Market Overview:

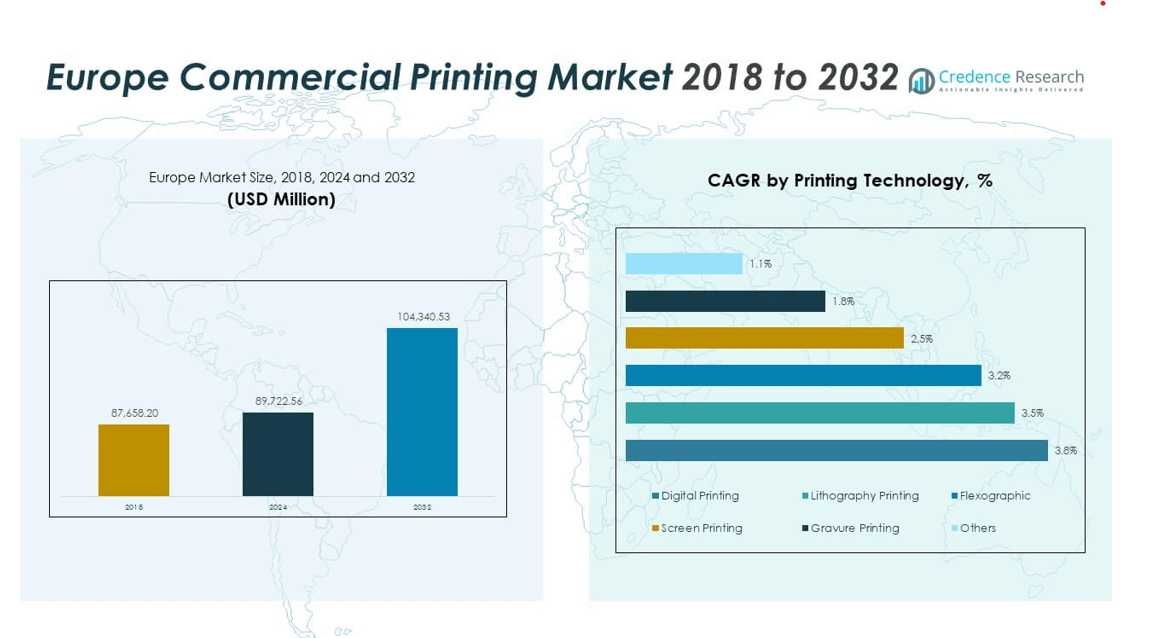

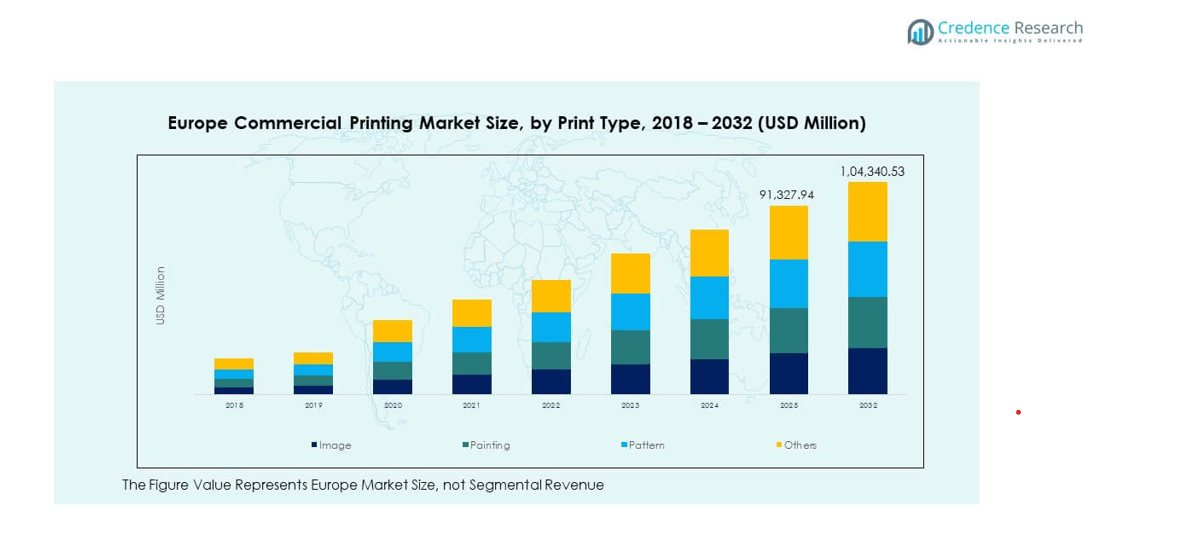

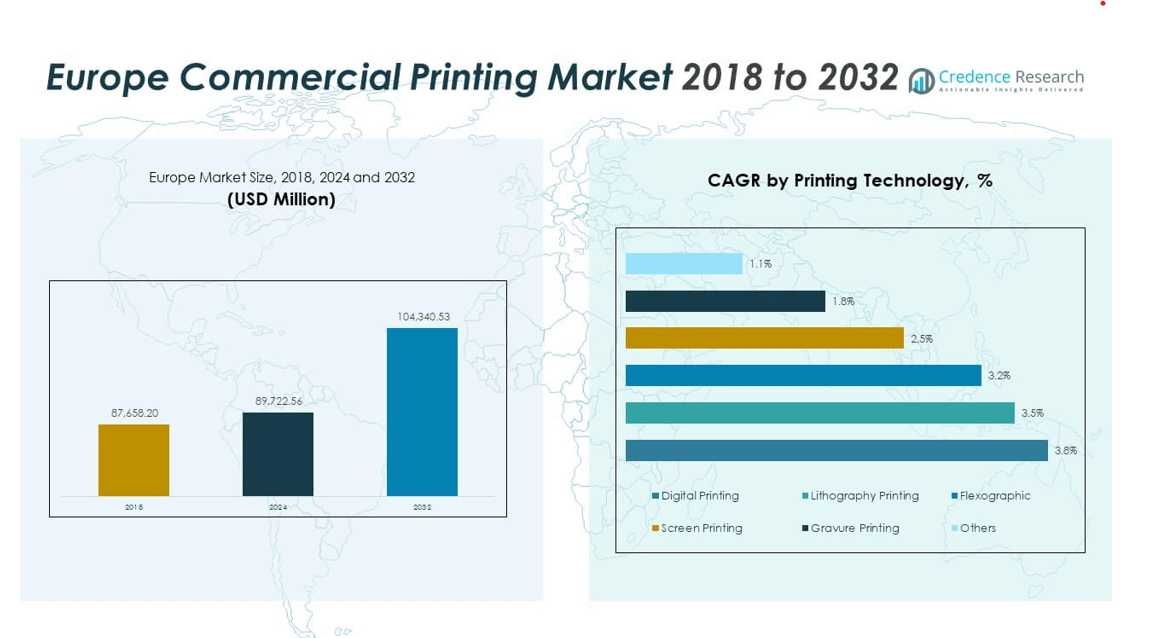

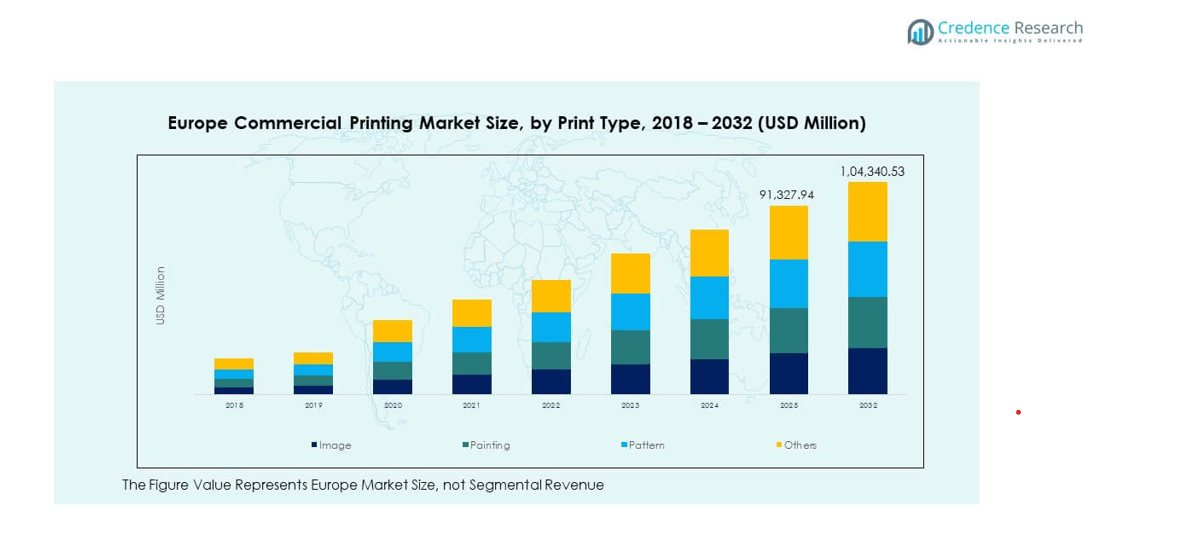

The Europe Commercial Printing Market size was valued at USD 87,658.20 million in 2018, reaching USD 89,722.56 million in 2024, and is anticipated to reach USD 1,04,340.53 million by 2032, at a CAGR of 1.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Commercial Printing Market Size 2024 |

USD 89,722.56 million |

| Europe Commercial Printing Market, CAGR |

1.90% |

| Europe Commercial Printing Market Size 2032 |

USD 1,04,340.53 million |

Growth in the market is supported by rising demand from packaging, publishing, and advertising sectors. The expansion of digital and hybrid printing systems enhances flexibility and print speed, enabling cost-efficient production for shorter runs. Increasing sustainability focus drives the adoption of eco-friendly inks and recyclable substrates. Automation in workflow management and advanced color calibration tools enhance operational precision. The steady shift toward personalized and on-demand printing formats strengthens commercial adoption across industries.

Western Europe dominates the market due to mature infrastructure, high consumer spending, and advanced digital printing adoption. Germany, France, and the U.K. lead the regional landscape with strong investments in industrial and packaging print technologies. Central and Eastern Europe show rapid growth driven by cost-effective production and expanding manufacturing bases. The Nordic region demonstrates high adoption of sustainable printing practices, while Southern Europe benefits from growing retail and tourism-based print demand. This regional diversity sustains long-term market stability and expansion potential.

Market Insights

- The Europe Commercial Printing Market was valued at USD 87,658.20 million in 2018, reached USD 89,722.56 million in 2024, and is expected to attain USD 1,04,340.53 million by 2032, registering a CAGR of 1.90% during the forecast period.

- Western Europe holds the largest share at 45–50%, driven by mature infrastructure, advanced print technologies, and strong demand from packaging and retail industries. Central and Eastern Europe follow with 20–25%, benefiting from cost efficiency and expanding industrial printing capacity.

- Nordic and Southern Europe collectively contribute 25–30%, supported by sustainability-led practices in the Nordic region and steady growth from tourism and publishing sectors in Southern Europe.

- By printing technology, Gravure Printing (3.8%), Flexographic (3.5%), and Digital Printing (3.2%) exhibit the highest CAGRs, reflecting growing adoption of sustainable materials and short-run, high-quality printing needs.

- By print type, Image and Pattern printing together account for nearly 60% of the total share, driven by high visual quality demand in advertising, retail, and packaging applications across Europe.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Expanding Demand for High-Quality Commercial and Packaging Prints

Growth in the Europe Commercial Printing Market stems from rising expectations for superior image quality and color consistency. Businesses prioritize customized print campaigns for product packaging and advertising, boosting adoption of high-definition presses. Print service providers invest in advanced color management systems to ensure precision and brand uniformity. Packaging manufacturers prefer durable substrates that withstand logistics and maintain design integrity. Sustainability initiatives push companies toward eco-certified inks and recyclable materials. The shift toward shorter production runs supports agile, on-demand printing. Digital workflow automation helps reduce turnaround times and operational costs. The industry benefits from growing use of variable data printing in consumer-targeted packaging and promotions.

- For instance, CGS ORIS offers a proofing system called ORIS Color Tuner that delivers contract-grade proofs with accurate spot-color matching and multi-channel profile support. Its packaging-focused system FLEX PACK enables printing of color-accurate packaging prototypes with varnish, embossing, and foil effects on real substrates.

Strong Integration of Digital Printing Across End-User Industries

Rising integration of digital solutions supports faster printing cycles and creative flexibility. Businesses adopt print-on-demand and just-in-time production for cost control. The Europe Commercial Printing Market gains momentum from expanding e-commerce, where packaging acts as a marketing tool. Digital printing enables mass customization without high setup expenses. Print providers embrace inkjet and electrophotographic systems to meet dynamic design needs. Growth in marketing personalization strengthens adoption of short-run, high-impact visuals. Automation and IoT connectivity help streamline job scheduling and maintenance. Firms achieve energy efficiency through newer generation equipment and reduced material waste. Digital innovation ensures consistent print quality across variable orders.

- For instance, EFI’s digital printing platforms equipped with Fiery workflow technology streamline setup and job management by automating color calibration and file processing. These systems enable faster turnaround and high-quality variable data printing for e-commerce and retail packaging applications.

Growing Preference for Sustainable and Environmentally Responsible Solutions

Sustainability drives strategic investment across European print networks. Governments and clients demand eco-friendly inks and biodegradable substrates. The Europe Commercial Printing Market aligns with green procurement policies and extended producer responsibility frameworks. Manufacturers adopt water-based inks and solvent-free coatings to minimize emissions. Brands shift to recyclable paper grades to improve circularity. Waste reduction programs cut excess inventory through predictive production systems. Regulatory pressures from the EU Green Deal accelerate sustainability certification. Print houses integrate closed-loop recycling and renewable energy operations. Such efforts enhance brand reputation and meet corporate sustainability targets.

Rising Automation and Artificial Intelligence in Print Production

Automation defines the future of production efficiency in commercial printing. Artificial intelligence supports predictive maintenance and quality control. The Europe Commercial Printing Market evolves through robotics-driven workflow management and smart presses. Automated inspection systems detect defects and optimize print precision. Integration of machine learning aids in print calibration and color balance. Advanced scheduling software ensures optimal resource utilization and reduced downtime. Robotics enhance handling speed and minimize manual errors in large-scale operations. Hybrid setups combine offset and digital presses for flexible order management. Automation empowers firms to sustain consistent output and meet tight delivery timelines.

Market Trends

Shift Toward On-Demand and Personalized Printing Models

Personalization continues to reshape printing business models across Europe. Consumers prefer customized marketing materials that reflect brand engagement. The Europe Commercial Printing Market experiences steady growth in short-run and localized printing. On-demand production limits waste while improving supply chain agility. Retailers use print data analytics to tailor seasonal campaigns. SMEs adopt print automation for real-time customization. Advances in variable data technologies enhance campaign effectiveness. Packaging designs include localized languages and product variations. Personalization supports customer loyalty and higher brand retention.

Adoption of Hybrid Presses and Smart Workflow Platforms

The convergence of offset and digital technologies improves production flexibility. Print houses deploy hybrid presses to balance volume and quality needs. The Europe Commercial Printing Market benefits from connected print ecosystems. Smart workflow software integrates design, prepress, and finishing into unified operations. IoT monitoring systems optimize uptime and reduce equipment wear. Data-driven scheduling platforms automate job sequencing. Industry 4.0 technologies promote seamless data exchange across systems. Print providers adopt cloud-based platforms for real-time tracking. Hybrid technology ensures consistent results with minimal setup time.

- For instance, Koenig & Bauer’s Rapida 106 sheetfed offset press achieves speeds up to 18,000 sheets per hour and features automated plate changing, inline color control, and advanced makeready systems. It integrates Industry 4.0 connectivity through IoT-based monitoring and cloud job tracking, enabling efficient scheduling and maintenance in modern print plants.

Expansion of Value-Added Print Finishing and Specialty Effects

Value-added printing enhances product differentiation and consumer appeal. Firms invest in foil stamping, embossing, and UV varnishing to enrich visuals. The Europe Commercial Printing Market witnesses rising demand for tactile finishes in luxury packaging. Specialty inks, metallic coatings, and holographic laminations attract premium clients. Label converters introduce advanced embellishment techniques for branding impact. Variable texture printing enhances shelf visibility for consumer goods. Custom finishing solutions increase perceived product value. Automation in finishing ensures precise application of coatings and adhesives. The trend supports higher margins through premiumization.

- For instance, Scodix’s Ultra 1000 and Ultra 5000 digital-enhancement presses deliver foil, varnish, embossing and other finishing effects on commercial or packaging prints. The Ultra 1000 supports substrates from 135 to 675 gsm and runs up to 1,250 sheets per hour.

Growth of Sustainable Packaging and Recycled Substrates

Sustainability remains a defining market theme across print applications. The Europe Commercial Printing Market focuses on renewable and low-carbon materials. Brands favor FSC-certified paper and post-consumer recycled substrates. Water-based inks dominate due to their reduced environmental footprint. Packaging manufacturers highlight biodegradable laminates for eco-label compliance. Green printing certifications strengthen supplier credibility. Corporate buyers prioritize sustainability metrics in vendor selection. Carbon-neutral production initiatives gain traction across major markets. The adoption of renewable energy and waste management practices reinforces eco-leadership.

Market Challenges Analysis

Rising Raw Material Costs and Supply Chain Pressure

Volatility in raw material prices limits operational margins for many print providers. Paper shortages and transport disruptions increase procurement uncertainty. The Europe Commercial Printing Market faces cost escalation for inks, substrates, and energy. Import dependency heightens exposure to global logistics instability. Small and mid-sized firms struggle to absorb rising production costs. Extended delivery timelines affect client commitments and profitability. Currency fluctuations further complicate budget forecasts for material sourcing. Companies adopt inventory pooling and supplier diversification to stabilize operations. Cost management remains critical for maintaining competitiveness.

Impact of Digital Substitution and Decline in Traditional Print Media

The digital shift continues to challenge print volumes in magazines and newspapers. Readers migrate toward online platforms, reducing print advertising budgets. The Europe Commercial Printing Market adapts by focusing on packaging and marketing segments. Advertising agencies reallocate spending to digital formats and social media. The market faces declining offset press utilization and idle capacity issues. Consolidation among smaller print firms accelerates due to shrinking demand. Publishers seek hybrid models combining print and digital outreach. Innovation in personalized print helps offset long-term volume erosion.

Market Opportunities

Emerging Demand from E-Commerce and Branding Applications

Growth in online retail expands demand for printed packaging and promotional inserts. The Europe Commercial Printing Market benefits from rising custom labeling for logistics and branding. E-commerce firms rely on high-impact visuals to enhance customer experience. Corrugated packaging integrates digital designs for differentiation. Print-on-demand packaging reduces waste in low-volume orders. Rapid turnaround capacity strengthens supplier-client relationships. Variable print codes support inventory tracking and traceability. The shift to direct-to-consumer delivery models increases printed communication needs. These factors unlock strong opportunities for innovative print providers.

Expansion in Industrial and Specialty Printing Applications

Industrial sectors adopt printed materials for signage, décor, and electronics. The Europe Commercial Printing Market evolves with applications in textiles, ceramics, and 3D substrates. Technical printing supports industrial labeling and component marking. Advancements in UV-curable inks enable durable surface printing. Architectural and interior design industries embrace wide-format printing. High-resolution graphics drive growth in exhibition and event branding. Manufacturers explore digital textile printing for short-batch production. Diversification into specialty segments offers high-margin opportunities for established printers.

Market Segmentation Analysis

By Printing Technology

Digital printing leads growth through flexibility and cost-effective short runs. The Europe Commercial Printing Market witnesses strong uptake of inkjet and electrophotographic technologies. Lithography printing retains importance for high-volume, high-quality jobs. Flexographic printing supports packaging and label manufacturing due to speed and adaptability. Screen printing continues serving textiles and decorative segments. Gravure printing remains preferred for long-run packaging and magazines. Other niche technologies address industrial and specialty applications with precision outputs.

- For instance, Heidelberg’s Jetfire 50 B3 sheetfed inkjet press, launched in 2024, achieves up to 9,120 SRA3 sheets per hour at 1,200 × 1,200 dpi. It supports paper weights between 60 and 350 g/m² and integrates with Heidelberg’s Prinect workflow for hybrid digital-offset production, ensuring high precision and automation.

By Application

Packaging dominates due to growing consumer goods and e-commerce sectors. The Europe Commercial Printing Market sees publishing stabilize in niche magazines and educational prints. Advertising and marketing remain vital for corporate promotions. Retail and e-commerce utilize printed materials for branding and logistics labeling. Corporate communication drives demand for business reports and brochures. Educational and government printing continues under regulated frameworks. Each application segment contributes to diversified revenue streams.

By Service Type

Printing services form the foundation for commercial operations. The Europe Commercial Printing Market includes packaging printing as the fastest-expanding category. Large-format printing supports outdoor advertising and event graphics. Transactional and direct mail printing sustain customer outreach strategies. Promotional printing integrates variable data for personalized campaigns. Value-added services such as design and finishing strengthen client retention. The service mix evolves toward integrated print marketing solutions.

- For instance, EFI’s VUTEk Q3h XP hybrid flatbed and roll-fed printer represents advanced large-format production technology, achieving up to 9,741 ft² per hour at 1200 dpi. It supports rigid and flexible media for signage, event graphics, and packaging applications, and integrates EFI’s Fiery ProServer and variable data printing tools to enable fast, personalized, and high-impact visual output across commercial and promotional segments.

By Print Type

Image printing dominates across advertising, signage, and packaging sectors. The Europe Commercial Printing Market sees painting and pattern printing rise in creative and decorative fields. Pattern applications support textile and wallpaper industries. Other print types include industrial markings and technical documentation. Each type supports unique end-user requirements and design specifications. Advancements in substrate compatibility improve durability and finish quality. Diverse print types enable product differentiation across industries.

Segmentation

By Printing Technology:

- Digital Printing

- Lithography Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

By Application:

- Packaging

- Publishing

- Advertising & Marketing

- Retail & E-commerce

- Corporate / Enterprise Communication

- Education & Government Documents

By Service Type:

- Printing Services

- Packaging Printing

- Large Format Printing

- Transactional & Direct Mail Printing

- Promotional Printing

- Value-Added Services

By Print Type:

- Image

- Painting

- Pattern

- Others

Regional Analysis

Western Europe Leads Market Share

Western Europe accounts for about 45–50% of the Europe Commercial Printing Market. The region benefits from mature printing infrastructure and high demand from retail, packaging, and publishing sectors. Countries such as Germany, France, and the U.K. support strong volumes of print jobs. Germany leads due to its robust manufacturing base and advanced print technologies. High consumer spending on packaged goods and advertising materials drive consistent demand. Western European firms maintain high standards, helping preserve this region’s market position. The presence of major print-service providers and equipment suppliers also consolidates Western Europe’s dominance.

Central & Eastern Europe Rising With Cost-Efficiency

Central and Eastern Europe capture roughly 20–25% of the market. Lower labor and production costs attract outsourcing of commercial printing jobs. Emerging manufacturing and retail sectors in countries like Poland, Czechia, and Hungary create growing demand for labels, packaging, and promotional prints. Firms in this region often compete on price while offering competitive quality. Investments in newer digital and hybrid printing presses help upgrade capabilities. The region draws demand from Western Europe companies seeking cost-effective production. Growing consumption within these countries further supports expansion.

Nordic, Southern And Rest-Of-Europe Show Steady Growth

Nordic, Southern Europe and other smaller European markets collectively hold around 25–30% share. The Nordic region emphasizes sustainable printing solutions and eco-friendly materials, which appeal to environmentally conscious clients. Southern European markets see steady demand from tourism, publishing, and regional retail sectors. Rest-of-Europe including smaller economies and emerging markets witness gradual uptake in digital printing and packaging services. Many operators in these areas focus on niche segments, such as boutique publishing, specialized packaging, and local retail support. Combined, these regions offer diversified growth and help balance against saturation in larger markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cewe Stiftung & Co.

- Flyeralarm GmbH

- Gutenberg Gruppe

- HH Global (Europe Presence)

- Colorgraf

- Paragon Group Ltd.

- Saica Group

- Smurfit Kappa Group plc

- DS Smith plc

- Mondi Group

- Ardagh Group S.A.

- Grafica Veneta S.p.A.

- IGEPA Group

- Friesens Corporation

- Eurodruck GmbH

- Aldridge Print Group (APG)

- Hubert & Co.

Competitive Analysis

The Europe Commercial Printing Market features a mix of legacy equipment suppliers and modern print-service providers. Historic print-press manufacturers based in Germany maintain strong influence by supplying heavy-duty offset and flexographic machines. These firms serve large publishers and packaging producers needing high volume, high-quality output. On the other hand, digital printing equipment vendors from Western Europe and Japan offer flexible presses suited for short-run, high-mix jobs. Smaller to mid-size print houses across Central and Eastern Europe adopt these solutions to win price-sensitive contracts while keeping quality aligned to client expectations. Service providers in major Western European countries differentiate through value-added services such as design support, finishing, and logistics integration. This approach helps integrate print production with clients’ supply chains and marketing workflows. Smaller providers emphasize speed and cost efficiency, often targeting packaging, promotional, or direct-mail segments. Companies competing on cost leverage lower overheads and local sourcing of consumables. Competition remains strong between firms offering high-volume offset printing and those pushing digital and hybrid printing—each appealing to different customer needs. The market rewards agility, sustainability credentials, and ability to support variable data printing.

Recent Developments

- In November 2025, Mondi launched an extended corrugated and solid board packaging portfolio for the food industry. The expansion follows its acquisition of Schumacher Packaging and includes digital printing capabilities to better serve European food-packaging customers.

- In April 2025, Mondi completed the acquisition of Schumacher Packaging’s Western Europe operations. This added over 1 billion square metres of additional packaging capacity and strengthened Mondi’s ability to offer sustainable, large-scale packaging solutions for e-commerce and FMCG clients across Europe

- In January 2025, International Paper secured regulatory approval from the European Commission to acquire DS Smith, a major European packaging and printing services firm. The decision followed commitments by International Paper to divest certain European assets to satisfy competition requirements.

Report Coverage

The research report offers an in-depth analysis based on Printing Technology, Application, Service Type and Print Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe Commercial Printing Market will advance through the growing integration of digital and hybrid press systems across print houses.

- Sustainability adoption will accelerate, driving the use of recyclable materials, low-emission inks, and circular packaging formats.

- Automation and AI-supported workflow systems will redefine production speed, consistency, and operational efficiency across large and mid-sized facilities.

- On-demand and personalized printing models will expand further due to strong marketing, e-commerce, and packaging personalization trends.

- Hybrid printing combining offset precision with digital flexibility will become a major productivity enabler across varied applications.

- Value-added services such as finishing, embossing, and 3D texture printing will help providers boost profit margins and client retention.

- Demand for wide-format printing will strengthen through signage, décor, and event branding activities across Europe’s retail and hospitality sectors.

- The transition toward cloud-based print management systems will enhance visibility, reduce waste, and improve collaboration with clients.

- Regional firms will focus on automation and green compliance to compete with Western Europe’s technologically advanced players.

- Continuous innovation in ink formulations and substrate compatibility will ensure the Europe Commercial Printing Market remains resilient and diversified.