Market Overview:

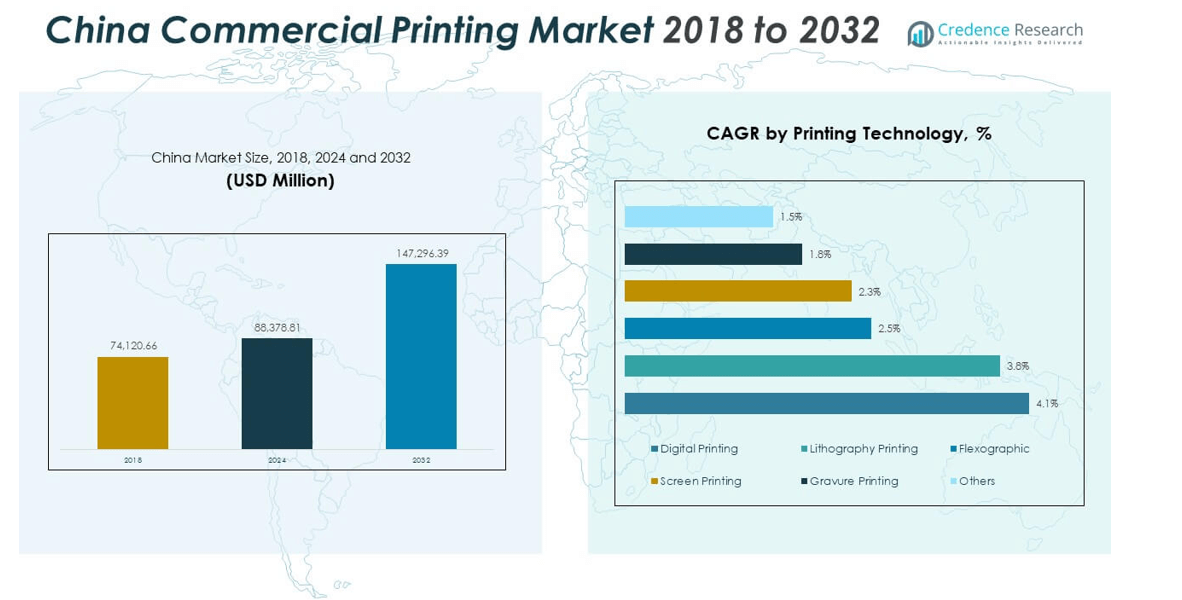

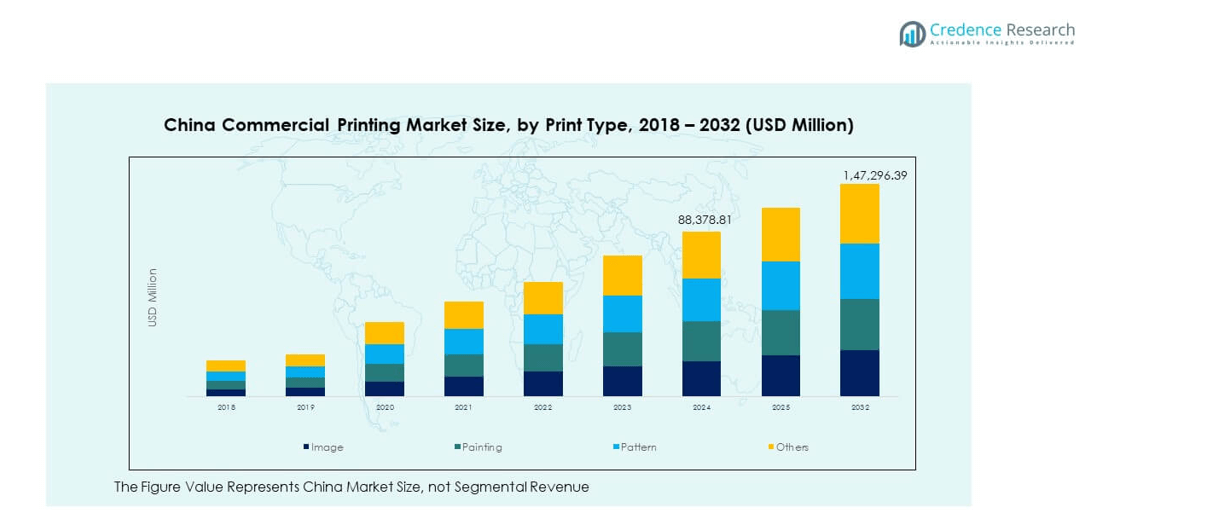

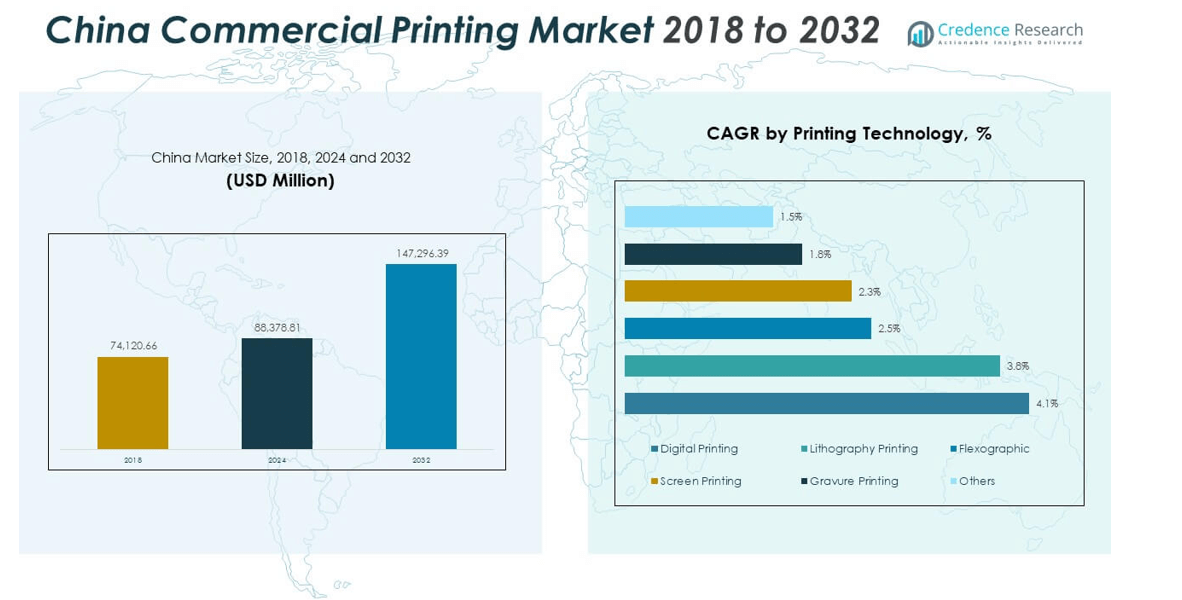

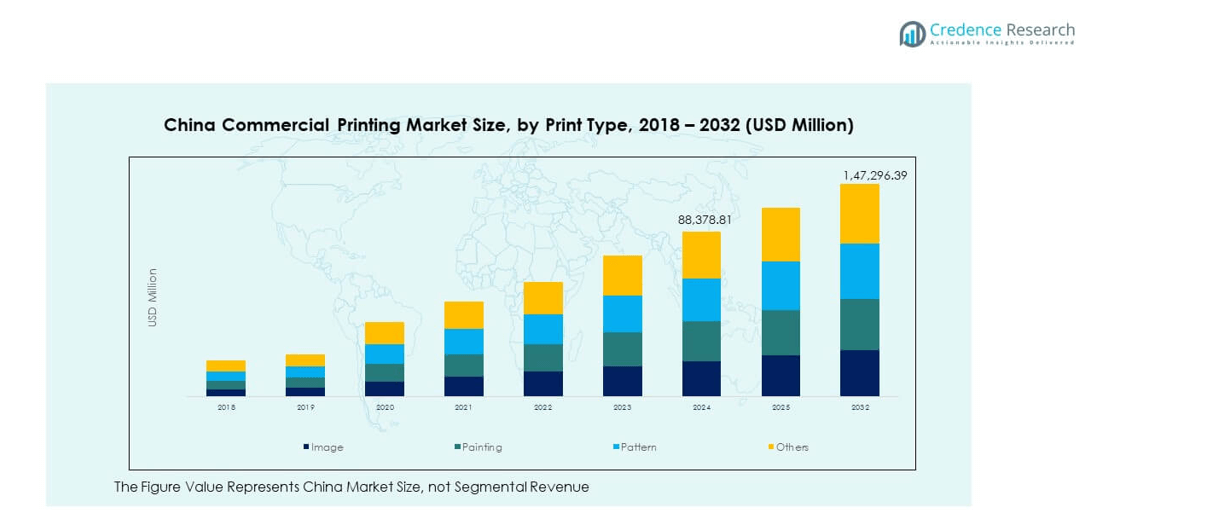

The China Commercial Printing Market size was valued at USD 74,120.66 million in 2018 to USD 88,378.81 million in 2024 and is anticipated to reach USD 147,296.39 million by 2032, at a CAGR of 6.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| China Commercial Printing Market Size 2024 |

USD 88,378.81 million |

| China Commercial Printing Market, CAGR |

6.59% |

| China Commercial Printing Market Size 2032 |

USD 147,296.39 million |

Growth in e-commerce, packaging, and advertising continues to drive strong momentum in the China Commercial Printing Market. Expanding retail channels increase the need for high-quality printed packaging and promotional materials. Printing companies invest in digital and hybrid presses to handle shorter runs and faster delivery cycles. Rising environmental awareness encourages the use of recyclable substrates and eco-friendly inks. Advancements in automation improve production efficiency and workflow control, boosting output quality and reducing operational costs. These combined forces sustain steady market growth across multiple applications.

East China dominates the China Commercial Printing Market due to its strong manufacturing infrastructure and dense commercial hubs like Shanghai and Jiangsu. The region benefits from high retail activity and extensive logistics networks that support packaging and advertising demand. Southern China, including Guangdong and the Pearl River Delta, follows closely with major export-driven printing capacity. Northern and central provinces such as Beijing, Tianjin, and Hubei show emerging potential with growing institutional and corporate printing needs. Western regions remain less developed but are gradually expanding due to industrial relocation and infrastructure development.

Market Insights

- The China Commercial Printing Market was valued at USD 74,120.66 million in 2018, reached USD 88,378.81 million in 2024, and is projected to attain USD 147,296.39 million by 2032, expanding at a CAGR of 6.59%.

- East China holds about 45–50% of the total market share, driven by manufacturing density, high consumer demand, and advanced logistics networks across Shanghai, Jiangsu, and Zhejiang.

- South China captures nearly 25–30% of the market, supported by strong export-oriented operations and modern packaging infrastructure across the Greater Bay Area and Guangdong.

- North and Central China together account for 20–25%, emerging rapidly due to industrial relocation, government projects, and rising retail activity that increase regional print volumes.

- In print technology segmentation, gravure printing (4.1%) and flexographic printing (3.8%) show the fastest CAGRs, while digital printing (1.5%) and lithography (1.8%) maintain stable demand, marking a clear technological transition toward sustainable, high-speed solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Expanding E-Commerce and Retail Packaging Demand

The China Commercial Printing Market gains strong momentum from rapid e-commerce growth. Rising online retail orders drive higher use of printed boxes, labels, and inserts. Companies invest in customized and visually appealing packaging to enhance brand recognition. The expansion of cross-border e-commerce platforms increases the need for multilingual and compliant print materials. It benefits printing firms that provide flexible short-run solutions. Demand for sustainable packaging fuels innovation in recyclable and biodegradable substrates. Printers adopt automated systems for fast order completion. The growing retail base continues to reinforce consistent printing volumes.

- For instance, YUTO Packaging Technology Co., Ltd., a leading Chinese packaging manufacturer, specializes in eco-friendly molded fiber solutions through its YUTOECO brand. The company operates smart manufacturing facilities featuring automated production lines and digital monitoring systems to enhance efficiency and support sustainable packaging for major consumer and e-commerce brands.

Growing Adoption of Digital and Hybrid Printing Technologies

Advances in digital technology reshape production efficiency in the China Commercial Printing Market. Printers implement high-speed inkjet and laser presses that cut waste and improve color accuracy. Variable data printing enables personalized marketing materials for consumer campaigns. Hybrid workflows integrating offset and digital systems help balance cost and flexibility. The shift supports faster turnaround across retail, advertising, and packaging applications. It encourages investments in software that optimizes print workflows. AI-driven calibration tools enhance color consistency and equipment uptime. This transition drives modernization across small and large printing houses alike.

- For instance, Konica Minolta China launched the AccurioJet 30000 and AccurioPress C14010 systems in 2025, featuring a fifth-color white toner and productivity improvements exceeding 20%, helping printers deliver higher-value commercial prints.

Sustainability and Green Production Practices

Environmental policy reforms influence operations in the China Commercial Printing Market. Firms focus on reducing emissions, chemical waste, and non-recyclable materials. Water-based and soy-based inks replace petroleum alternatives in mass production lines. Packaging clients prefer eco-certified substrates to align with brand responsibility goals. Printing equipment manufacturers develop energy-efficient presses to comply with new standards. It pushes the market toward renewable material sourcing and optimized energy use. National initiatives promoting circular economy practices encourage green certifications. The trend strengthens the competitive position of environmentally responsible providers.

Corporate Branding and Marketing Communication Expansion

Rapid business development enhances demand for marketing and promotional materials in the China Commercial Printing Market. Enterprises across manufacturing, retail, and finance sectors invest in high-quality brochures, catalogs, and promotional prints. Corporate events, exhibitions, and product launches sustain steady demand for branded materials. High competition encourages creative visual design and fast reprints. Print management platforms support consistent quality across multiple business units. The trend strengthens value for print vendors that combine design, data, and distribution. It helps brands maintain physical visibility in a digital-heavy marketing environment.

Market Trends

Integration of Automation and Smart Print Workflows

Automation tools transform production speed and accuracy in the China Commercial Printing Market. Printers deploy connected management systems to track output in real time. Workflow automation reduces manual setup time and ensures error-free print runs. Predictive maintenance minimizes downtime through sensor-based monitoring. Integration with ERP and cloud systems improves order tracking and client transparency. Data-driven analytics enhance scheduling and capacity planning. Automation tools also lower operational costs, strengthening margins for service providers. The trend continues to redefine competitiveness and production efficiency across print facilities.

Emergence of On-Demand and Short-Run Printing

The China Commercial Printing Market experiences a shift toward short-run and on-demand printing models. Businesses favor smaller quantities with quicker delivery to avoid excess inventory. Digital platforms simplify file submission and remote proofing, supporting faster job execution. Personalized marketing and variable data campaigns expand across multiple sectors. The flexibility of short-run printing supports seasonal and regional promotions. Print service providers leverage this to attract SMEs and start-ups. The move enables cost-efficient production without long-term material commitments. Growing customer preference for tailored designs supports its expansion.

Advancement in Ink and Substrate Technologies

Continuous innovation in inks and substrates boosts quality and sustainability in the China Commercial Printing Market. UV-curable and water-based inks dominate packaging and advertising applications. Advanced coatings improve print durability and vibrancy on varied materials. Paper manufacturers develop lightweight, recyclable substrates for greener packaging. Smart materials with embedded QR codes and NFC tags emerge in premium packaging. It expands the role of print in digital interactivity. Improvements in substrate compatibility reduce waste and enhance efficiency. These material innovations expand creative potential while maintaining compliance with eco-standards.

- For instance, Siegwerk China and Sun Chemical supply water-based, low-VOC ink systems for packaging and commercial printing applications, supporting China’s move toward cleaner production. Both companies promote sustainable ink formulations that reduce chemical emissions and enable recycling-friendly printing processes. Asia Pulp & Paper (APP) China also manufactures recyclable paper and board substrates, widely used in premium packaging and print materials across the region.

Growth of Digital Advertising Integration with Print Media

The blending of digital and print communication creates new opportunities in the China Commercial Printing Market. QR codes, AR features, and scannable content connect physical prints with digital campaigns. Brands use this hybrid strategy to boost customer engagement and data collection. The approach strengthens the measurable value of print in omnichannel marketing. Printers develop expertise in interactive formats and design integration. High-end catalogues and brochures incorporate embedded media links. It allows brands to track user behavior from print to digital purchase. The trend enhances cross-platform engagement and supports future marketing evolution.

- For instance, Artron Art Group, a leading high-end printing company in China, combines digital imaging and precision color management technologies to produce premium art books and luxury catalogs. The company integrates digital workflow systems to enhance print accuracy and visual quality, serving top cultural institutions and global luxury brands within the China Commercial Printing Market.

Market Challenges Analysis

Intense Price Competition and Margin Pressure

High competition among regional and local printers challenges profitability in the China Commercial Printing Market. Price-sensitive customers demand lower costs without compromising quality. Overcapacity in printing hubs drives undercutting in bids and contracts. Rising input costs for paper, ink, and energy further strain operational margins. Smaller firms struggle to sustain technology upgrades under cost pressure. Standardization limits product differentiation, reducing opportunities for premium pricing. It compels businesses to pursue service innovation and automation to stay competitive. The pricing challenge remains a primary constraint to sustainable growth.

Digital Shift and Decline in Traditional Print Volumes

The growing preference for digital media impacts demand for conventional printing in the China Commercial Printing Market. Online advertising and e-publications replace many print-based communication formats. Publishers and advertisers reduce print budgets to favor digital outreach. This shift weakens demand for magazines, books, and flyers. Printers dependent on offset and lithographic operations face declining orders. Workforce adaptation to digital workflows remains uneven, affecting productivity. Companies must restructure to handle mixed-media projects. It forces legacy players to reinvent service portfolios to remain relevant.

Market Opportunities

Expansion in Sustainable and Premium Packaging

Rising awareness of eco-friendly consumption drives opportunities in the China Commercial Printing Market. Brands adopt sustainable packaging to comply with national environmental targets. Print providers supplying FSC-certified materials gain preference among large clients. Premium sectors such as cosmetics and electronics demand high-end packaging finishes. The trend supports expansion into specialty substrates and embossing services. Sustainable innovation builds long-term client loyalty. It positions green-certified printers as strategic partners for major brands.

Growth in Smart and Interactive Print Solutions

Smart print technologies create growth potential in the China Commercial Printing Market. Brands integrate RFID tags, QR codes, and NFC chips to enhance consumer engagement. Interactive prints enable trackable marketing campaigns and real-time feedback. The adoption of these formats strengthens partnerships between print and tech industries. Service providers offering cross-media solutions gain competitive advantage. It opens revenue streams beyond traditional print output. Growing corporate digitization ensures steady adoption of intelligent print products.

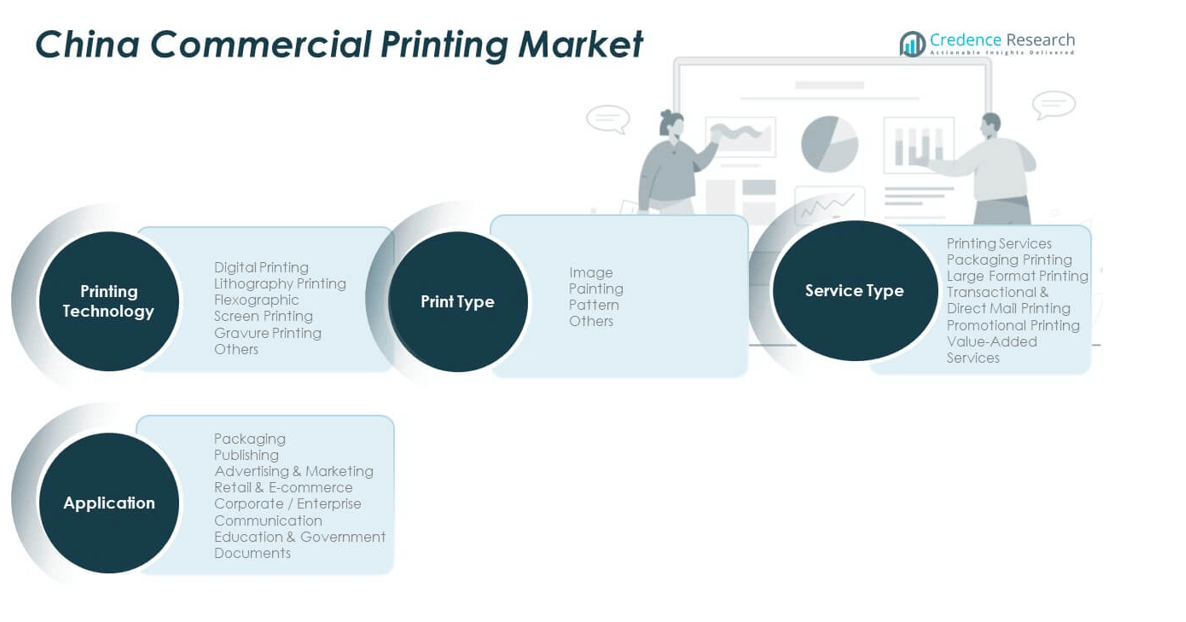

Market Segmentation Analysis

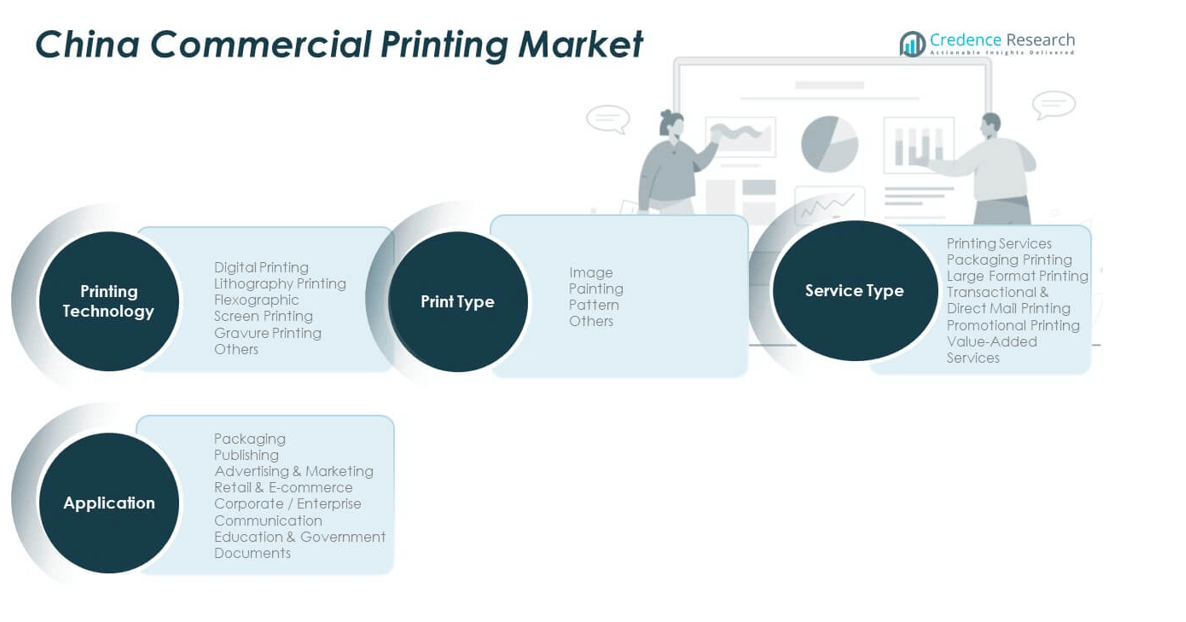

By Printing Technology

The China Commercial Printing Market features diverse technologies, including digital, lithography, flexographic, screen, and gravure printing. Digital printing gains traction for short runs and customized outputs. Lithography remains dominant for large-scale, high-volume operations. Flexographic systems are preferred for packaging due to versatility on varied materials. Screen and gravure processes serve niche applications such as decorative prints and labels. Other technologies, including 3D and UV printing, show steady adoption in premium segments.

- For instance, Koenig & Bauer’s Rapida 106 sheetfed offset press achieves production speeds up to 18,000 sheets per hour in medium format. Flexographic systems are preferred for packaging due to versatility on varied materials.

By Application

Applications span packaging, publishing, advertising, retail, and enterprise communication. Packaging leads due to rising demand from FMCG and e-commerce sectors. Publishing continues in educational and official documentation. Advertising and marketing drive creative design requirements, particularly for promotional print. Retail and e-commerce rely on printed materials for branding and unboxing experiences. Corporate communication supports consistent internal and external messaging.

- For instance, Zhengzhou Huaying Packaging Co. Ltd. deployed Koenig & Bauer’s six-color Rapida 164 (max sheet 1,205 x 1,640 mm) and seven-color Rapida 145 for large-format packaging. Corporate communication supports consistent internal and external messaging.

By Service Type

Services in the China Commercial Printing Market include printing, packaging, large format, transactional, promotional, and value-added services. Printing and packaging services dominate due to mass demand in consumer goods and logistics. Large-format and promotional printing cater to retail and exhibition branding. Transactional mail printing supports financial and utility sectors. Value-added services such as finishing, binding, and personalization create differentiation and customer loyalty.

By Print Type

Print types include image, painting, pattern, and others. Image printing dominates advertising and corporate branding segments. Pattern printing finds use in packaging and decorative applications. Painting and artistic prints support creative and cultural industries. Other print forms include technical diagrams and textile prints, reflecting diverse end-use adaptability within the China Commercial Printing Market.

Segmentation

By Printing Technology:

- Digital Printing

- Lithography Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

By Application:

- Packaging

- Publishing

- Advertising & Marketing

- Retail & E-commerce

- Corporate / Enterprise Communication

- Education & Government Documents

By Service Type:

- Printing Services

- Packaging Printing

- Large Format Printing

- Transactional & Direct Mail Printing

- Promotional Printing

- Value-Added Services

By Print Type:

- Image

- Painting

- Pattern

- Others

Regional Analysis

East-Coast Cluster Dominance (East China – Shanghai, Jiangsu, Zhejiang)

The East-Coast cluster holds approximately 45–50% of total commercial printing volume in China. The East region benefits from high industrial density, advanced logistics, and proximity to major manufacturers. The concentration of packaging, publishing, retail and advertisement sectors in this region drives heavy printing demand. Firms in East China exploit economies of scale, efficient supply chains and high consumer income to sustain consistent printing demand. Many international and domestic brands base their packaging and marketing operations in this zone. It keeps price stability and quick turnaround times for print orders. The region remains the backbone of printing output nationally.

Southern Cluster Leadership (Greater Bay Area – Guangdong, Pearl River Delta)

Southern China contributes roughly 25–30% of the commercial printing market share. The region features a well-developed supply-chain for printing and packaging materials, and hosts many manufacturing and export-oriented firms. Printing firms in Guangdong and surrounding areas produce packaging, labels, and printed materials for goods destined for domestic and international markets. The region benefits from port access and efficient freight logistics. High export volume sustains demand for packaging printing. This zone attracts investments in modern printing technologies. It supports both mass production and short-run requirements.

Northern and Inland Regions Emerging (North & Central China – Beijing/Tianjin, Inland Provinces)

Northern and inland provinces share around 20–25% of the market. Regions such as Beijing, Tianjin and central provinces show growth potential due to rising urbanization and corporate activity. Demand originates from corporate communication, domestic publishing, government documents, and regional retail expansion. Printing firms here cater to enterprises and institutions requiring high-volume or specialised print services. Lower saturation allows emerging printers to capture untapped customer bases. Logistics challenges and lower manufacturing density limit growth speed compared to coastal regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hucais Printing

- C&C Joint Printing (China/HK)

- Dinglong Group

- Hongbo Co. Ltd.

- Haimen Huanyu Printing

- Shanghai PrintYoung

- Zhongke Printing

- Artron Printing Group

- Toppan China

- Leo Paper Group

Competitive Analysis

The commercial printing sector in China features a mix of large-scale and regional players. Leading firms maintain wide service portfolios covering packaging, publishing, retail, and direct-mail printing. These providers leverage advanced printing technologies and extensive supply-chains to support high-volume orders and maintain cost efficiency. Smaller print houses often focus on niche segments such as customised packaging, short-run promotional materials, or value-added services like finishing and binding. They compete on flexibility, turnaround speed and personalized service. Pricing remains a critical competitive dimension. Firms with high automation and efficient workflows sustain lower per-unit costs and underbid less efficient players. Producers dependent on traditional offset or lithographic printing face pressure due to rising material costs and slower throughput. Those investing in digital printing and hybrid workflows gain advantage by serving short-run, variable-data and e-commerce packaging demands. Entry barriers remain moderate for small players, yet scale and technology investments favor established firms. Market consolidation appears gradually. Larger players strengthen market share through capacity expansion and technology upgrades. Smaller firms survive by differentiation—specialised services, sustainable substrates, interactive print formats. This segmentation reduces direct price competition and allows coexistence of varied business models. The competitive dynamic rewards agility, cost control, and technological adoption.

Recent Developments

- In October 2025, Shengda Printing Technology in China made a significant investment by acquiring ten additional Jetfire 50 inkjet systems from Heidelberg, expanding their printing technology capabilities, which underscores ongoing market activity in equipment acquisition to meet growing or changing commercial printing demands.

- In May 2025, Konica Minolta China launched two new major products at the CHINA PRINT 2025 exhibition: the HS-UV B2 high-speed UV inkjet printer AccurioJet 30000 and the heavy-duty color production digital printing system AccurioPress C14010 series, featuring innovations like a fifth color white toner to help printing companies create higher added value and new growth engines

Report Coverage

The research report offers an in-depth analysis based on Printing Technology, Application, Service Type and Print Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The China Commercial Printing Market is expected to advance steadily due to sustained growth in packaging and retail sectors.

- Widespread digital transformation will shift traditional print workflows toward automated and data-driven systems.

- On-demand and variable data printing will expand rapidly, driven by customization trends in e-commerce.

- Demand for sustainable materials and water-based inks will reshape procurement and compliance strategies.

- Hybrid print models combining offset and digital methods will dominate high-volume production.

- Smart packaging technologies, including NFC and QR-enabled prints, will create new revenue streams.

- Expansion of regional logistics and manufacturing zones will support rising print demand inland.

- Corporate and government digitalization will diversify print applications into secure and hybrid communication.

- Increased competition will push firms toward service diversification and advanced finishing capabilities.

- The market will remain innovation-driven, supported by strong domestic manufacturing and export activity.