Market Overview:

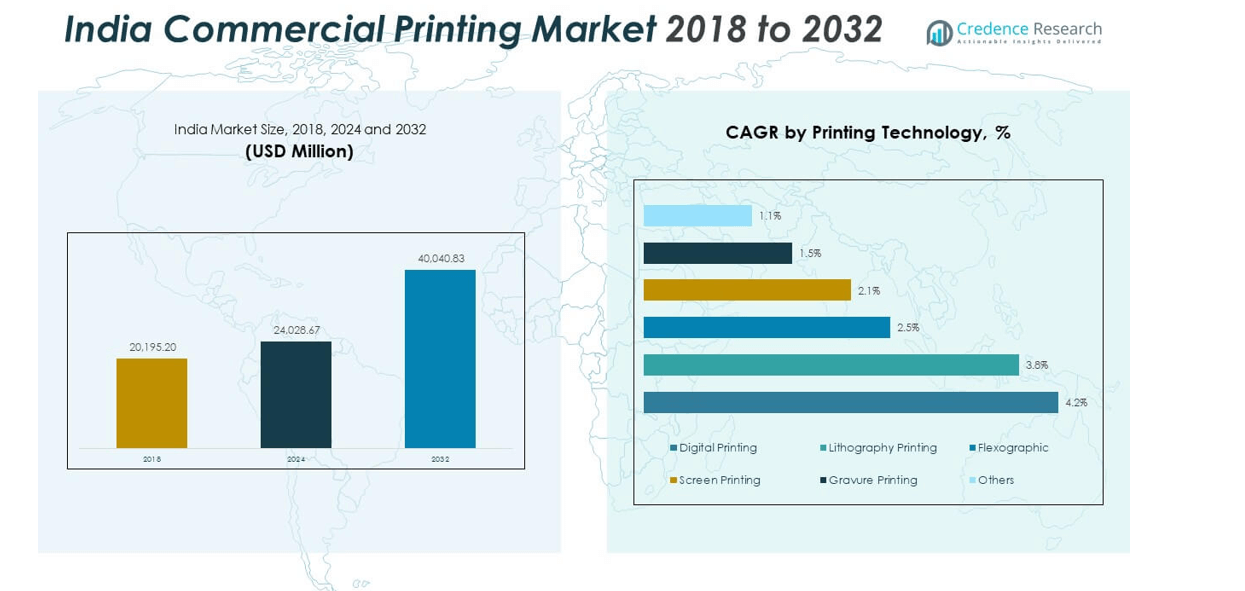

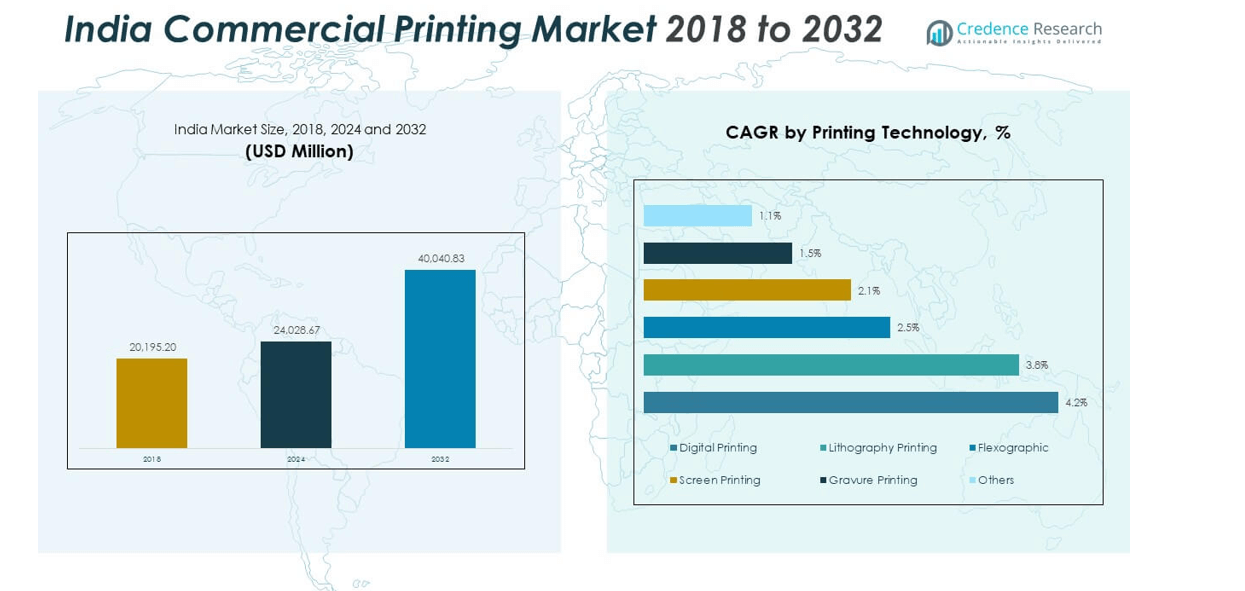

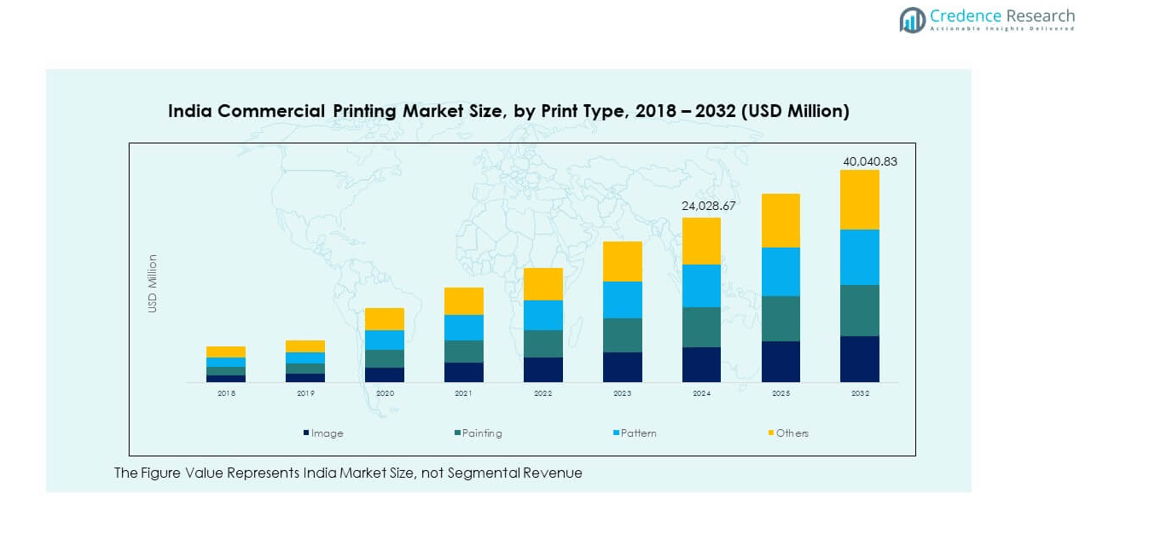

The India Commercial Printing Market size was valued at USD 20,195.20 million in 2018, reached USD 24,028.67 million in 2024, and is anticipated to attain USD 40,040.83 million by 2032, at a CAGR of 6.59% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Commercial Printing Market Size 2024 |

USD 24,028.67 million |

| India Commercial Printing Market, CAGR |

6.59% |

| India Commercial Printing Market Size 2032 |

USD 40,040.83 million |

Growth in advertising, retail, and packaging sectors drives consistent demand for commercial printing. Expanding e-commerce activities and rising brand promotions push businesses toward high-quality printed materials. The adoption of digital printing technology enhances speed, flexibility, and customization. Corporate demand for brochures, catalogs, and marketing collateral continues to rise. Sustainability trends promote the use of eco-friendly inks and recyclable substrates. These factors collectively strengthen market performance across urban and semi-urban zones.

South India leads the market due to strong demand from packaging and IT-related industries in cities such as Bengaluru, Chennai, and Hyderabad. Western India follows with a robust presence in commercial advertising and FMCG packaging across Mumbai and Pune. Northern India contributes significantly through educational publishing and government documentation. Eastern and northeastern regions are emerging with growing e-commerce and retail networks. Central India shows gradual expansion supported by small-scale enterprises and improved infrastructure. Each subregion’s contribution enhances the market’s overall growth momentum across the country.

Market Insights

- The India Commercial Printing Market was valued at USD 20,195.20 million in 2018, reached USD 24,028.67 million in 2024, and is projected to attain USD 40,040.83 million by 2032, expanding at a CAGR of 6.59% during 2024–2032.

- South India holds the highest market share at 30%, led by advanced packaging, IT, and retail printing in cities like Bengaluru, Chennai, and Hyderabad. Western India follows with 27%, driven by FMCG and advertising sectors in Mumbai and Pune.

- Northern India captures 25% share, sustained by strong educational publishing and public sector printing activities across Delhi and Uttar Pradesh.

- Eastern and Northeastern regions collectively hold 15% share but are the fastest-growing territories, supported by rising e-commerce penetration and regional retail investments.

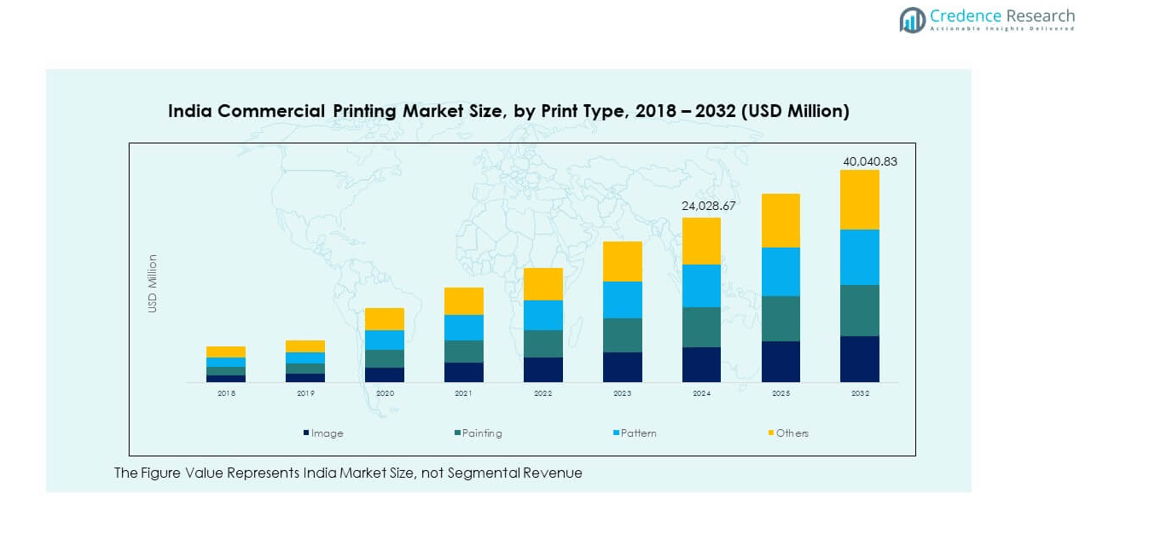

- In segment share distribution, image printing accounts for the largest portion at around 35%, followed by pattern printing near 28%, reflecting rising demand for advertising visuals and packaging design applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Expanding Packaging and E-Commerce Demand Drives Print Volumes

The India Commercial Printing Market benefits from rising packaging consumption across retail and e-commerce sectors. Online marketplaces use printed boxes, labels, and inserts to boost brand recall. FMCG companies invest in high-quality flexible and corrugated packaging to meet growing consumer expectations. It gains traction from packaging converters that integrate short-run digital printing to manage seasonal demand. Variable data technology supports custom designs and localized campaigns. The rapid rise in online retail accelerates print orders for secondary and tertiary packaging. SMEs adopt cost-effective print solutions for promotional packaging. Increased use of recyclable substrates drives sustainable print growth.

Corporate Branding and Marketing Investments Bolster Print Demand

Corporate organizations spend more on visual branding across brochures, catalogues, and event materials. The India Commercial Printing Market sees steady demand from enterprises using print for trade shows and direct mail campaigns. Companies value tangible print materials to enhance client engagement and recall. It gains momentum from hybrid marketing that blends print and digital outreach. Offset and digital printers benefit from steady corporate contracts that ensure consistent revenue. Banks and insurance firms rely on secure transactional printing for statements and policy documents. Strong demand from brand identity projects fuels business expansion for mid-sized printing firms. The trend enhances long-term partnerships between service providers and enterprises.

Technological Advancements Improve Print Quality and Turnaround

The adoption of digital and hybrid presses transforms printing speed, precision, and cost-efficiency. The India Commercial Printing Market leverages inkjet and electrophotographic systems to meet short-run, on-demand jobs. Automated workflows enable real-time monitoring and minimize setup delays. It benefits from new color management tools that ensure consistent output across media. Print providers deploy software for variable data handling to serve personalized campaigns. Energy-efficient printing machines reduce operational expenses and carbon footprint. Integration of UV-curable inks boosts durability across signage and packaging. These developments enhance service differentiation in a highly competitive market.

- For instance, Canon India’s imagePRESS V1000 digital press introduced in 2025 at Print Expo Chennai supports up to 10,000-sheet feeding and handles thick coated papers, enhancing uptime and media versatility for commercial printers.

Government Initiatives and Urbanization Strengthen Industry Expansion

Public infrastructure projects, smart city programs, and educational drives increase print requirements nationwide. The India Commercial Printing Market experiences rising orders from educational publishing and government documentation. Urbanization boosts demand for advertising materials and outdoor signage. It benefits from skill development initiatives that strengthen the workforce in printing clusters. Government procurement of printed forms, manuals, and communication materials sustains consistent contracts. Public campaigns on health and social awareness expand large-format printing demand. Regional policies promoting MSME development encourage investment in new print facilities. This ecosystem reinforces the long-term resilience of the industry.

- For instance, the National Skill Development Corporation (NSDC) supports training programs in printing and packaging through its allied skill councils under initiatives like Pradhan Mantri Kaushal Vikas Yojana (PMKVY), helping enhance technical capabilities and workforce readiness across India’s commercial printing sector.

Market Trends

Rising Adoption of Digital Printing for On-Demand Production

The India Commercial Printing Market witnesses a rapid shift toward digital presses driven by low setup time and flexibility. Digital printing enables customized short runs with reduced waste. It supports fast-changing marketing cycles and localized promotions. Print firms adopt cloud-based job management for streamlined workflows. Integration of digital front-end systems ensures color consistency across multiple print media. The shift reduces material inventory needs while improving cost control. Businesses also prefer digital platforms for variable content marketing. These factors strengthen the dominance of digital printing in urban centers.

Integration of Sustainable and Eco-Friendly Print Practices

Growing environmental awareness drives adoption of green printing processes. The India Commercial Printing Market benefits from investments in water-based and soy-based inks. Print houses use recycled paper, energy-efficient presses, and low-VOC materials. Clients prioritize sustainability certification in vendor selection. It pushes printers to upgrade facilities for waste management and carbon reduction. Demand for biodegradable packaging materials continues to grow. Brands use eco-labels and minimalistic designs to align with green values. Sustainability becomes a key differentiator in competitive bids for large accounts.

- For instance, ITC’s Printing and Packaging Division (PSPD) operates FSC-certified manufacturing units and has adopted water-based and low-VOC inks, aligning with its corporate sustainability strategy to reduce environmental impact across packaging and print operations.

Growth of Print Automation and Cloud-Based Production Management

Automation reshapes print production through AI-driven scheduling and predictive maintenance. The India Commercial Printing Market integrates cloud solutions that centralize file management and proofing. Real-time monitoring enhances accuracy and turnaround times. It improves collaboration across multiple print sites. Robotic material handling reduces manual intervention and boosts safety. Workflow software enables seamless order tracking and billing. These tools allow printers to scale operations efficiently. The shift toward smart production lines improves margins and reliability for large print networks.

Expansion of Hybrid and Specialty Printing for Niche Segments

The demand for specialty finishes such as embossing, foiling, and 3D effects rises across premium print categories. The India Commercial Printing Market gains traction from luxury packaging and high-end marketing materials. Print providers combine offset and digital capabilities for hybrid print jobs. It helps brands create eye-catching materials for limited-edition campaigns. Growth in décor and textile printing adds new revenue channels. Industrial inkjet applications extend across ceramics and signage. This diversification supports higher margins and long-term growth opportunities for advanced print shops.

- For instance, Fujifilm India unveiled its Revoria Press series at PrintPack 2025, offering specialty color management and metallic finish options, enabling luxury packaging printers to achieve over 2,400 dpi quality and advanced embellishment control.

Market Challenges Analysis

Rising Raw Material Prices and Supply Chain Constraints Impact Profitability

The India Commercial Printing Market faces pressure from fluctuating costs of paper, ink, and chemicals. Import dependence for specialty substrates adds risk during currency fluctuations. It struggles with inconsistent supply of coated papers and polymers. High logistics costs increase production expenses for regional printers. SMEs find it hard to absorb cost increases without raising client prices. Power supply fluctuations and fuel costs add to operational challenges. Global pulp shortages cause longer lead times for raw material procurement. Maintaining price competitiveness while ensuring quality becomes a key challenge for market players.

Digital Substitution and Shifting Media Preferences Reduce Print Volumes

The rise of digital advertising and online media continues to challenge traditional printing segments. The India Commercial Printing Market experiences volume decline in magazines, newspapers, and office documents. Clients move toward digital communication to reduce environmental impact and costs. It compels printers to reposition services toward value-added solutions. Educational institutions adopt e-learning platforms reducing textbook printing. Corporate clients favor online brochures and digital signatures. Maintaining relevance in a digital-first landscape requires continuous innovation. Balancing print relevance with new media integration remains a long-term industry challenge.

Market Opportunities

Expanding Scope for Value-Added and Personalized Printing Services

Growing demand for customized promotional materials creates opportunities for service differentiation. The India Commercial Printing Market can capitalize on variable-data, short-run, and personalized printing. Retail brands invest in event-specific campaigns that need high design flexibility. It allows printers to offer packaging prototypes and personalized marketing kits. Integration of AR and QR technologies enhances interactivity. Enterprises seek print solutions linked to digital engagement platforms. Rising luxury packaging and premium labeling markets open space for niche high-margin segments.

Strong Growth Potential Across Tier-II and Tier-III Cities

Emerging cities represent the next wave of print industry expansion. The India Commercial Printing Market gains traction from retail growth and rising disposable incomes in smaller urban clusters. It supports regional packaging hubs and localized print distribution. Educational institutions and government programs in these areas boost publishing demand. Better logistics and industrial parks enable cost-effective setup of new print facilities. The market expansion toward these cities improves competitiveness and nationwide coverage for large print service networks.

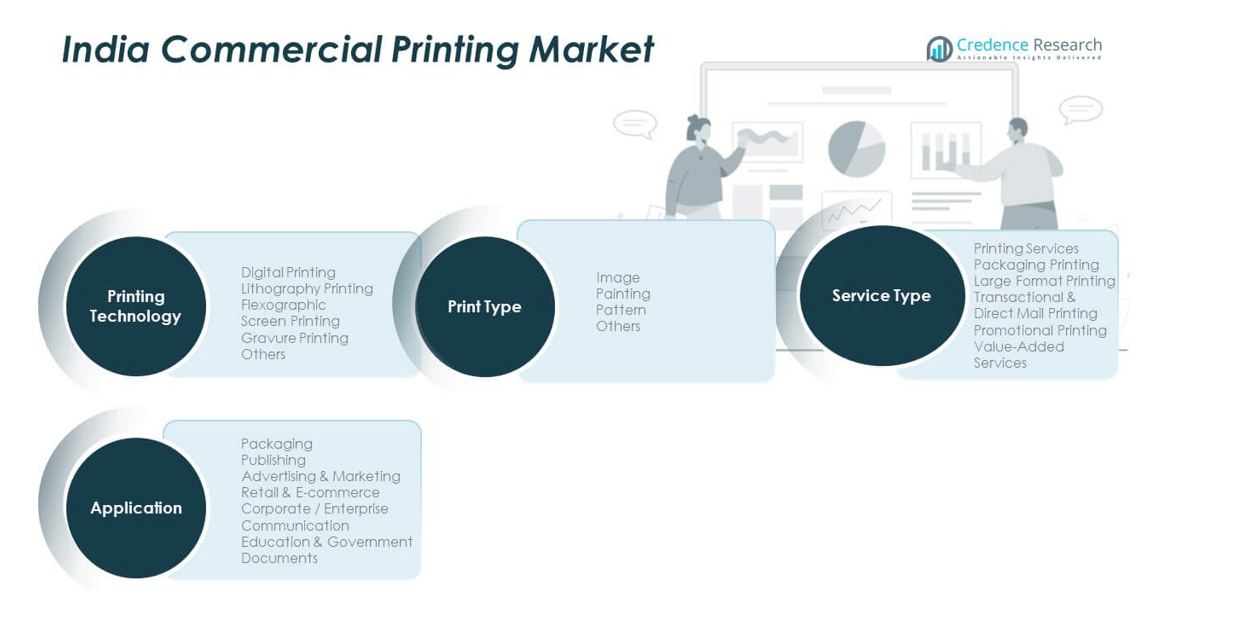

Market Segmentation Analysis

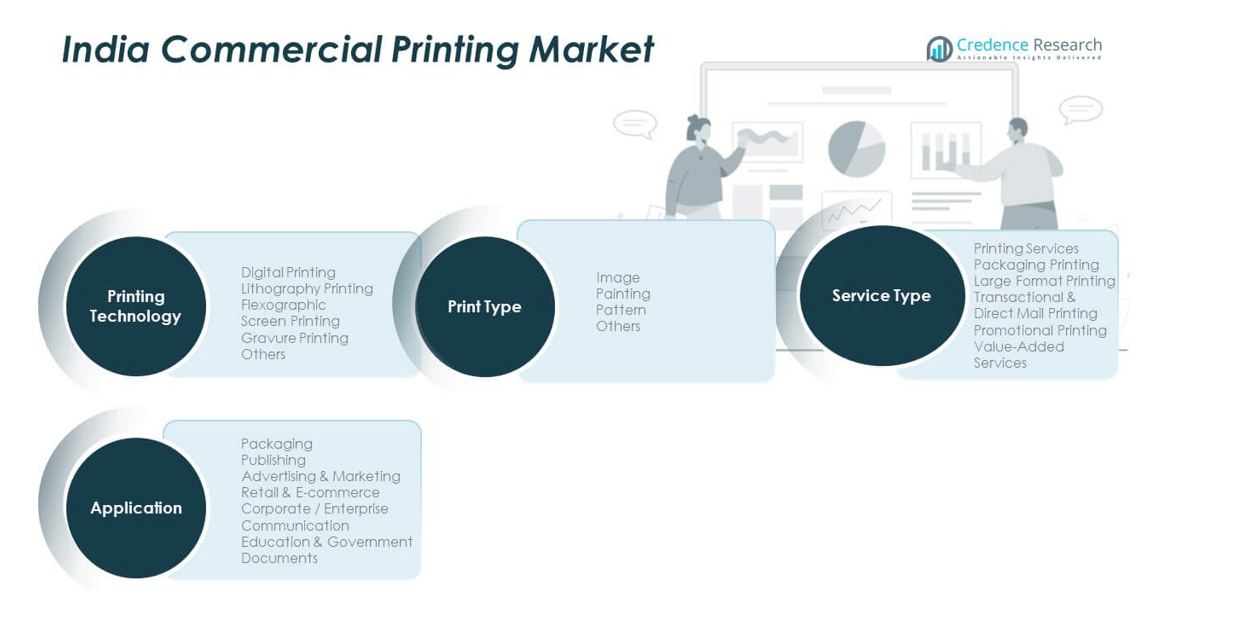

By Printing Technology

The India Commercial Printing Market covers digital, lithography, flexographic, screen, gravure, and other printing methods. Digital printing dominates due to short-run flexibility and fast turnaround. Lithography maintains relevance in bulk commercial applications. Flexographic and gravure printing lead in packaging due to high-quality color output. Screen printing remains key in textiles and signage. Each technology caters to specific production needs, driving diverse investment patterns.

By Application

Key applications include packaging, publishing, advertising, retail, corporate communication, and education. The India Commercial Printing Market sees packaging as the largest segment driven by FMCG and e-commerce. Publishing sustains steady demand from educational institutions. Advertising and retail sectors push short-run jobs and promotional prints. Corporate clients depend on transactional and marketing materials for branding.

- For instance, Parksons Packaging operates eight advanced print facilities across India with multi-process offset and flexographic lines, supporting major FMCG and personal care brands through customized folding carton and label printing solutions.

By Service Type

Printing services range from packaging and large format to transactional, promotional, and value-added services. The India Commercial Printing Market benefits from increased demand for packaging printing with brand differentiation. Large format and promotional printing grow through outdoor advertising and events. Transactional printing remains relevant in finance and telecom sectors. Value-added services like finishing and personalization provide competitive advantages.

By Print Type

Print types include image, painting, pattern, and others. The India Commercial Printing Market uses image and pattern printing widely in advertising and décor. Artistic and creative print jobs find demand in customized gifting and retail. Pattern printing supports textile and interior applications. This diversity strengthens the sector’s adaptability to new consumer trends.

- For instance, HP India’s Latex 700 and 800 printer series support high-resolution fabric and wallpaper printing up to 1,200 dpi, helping design studios and décor firms expand into pattern-based interior applications with eco-certified water-based inks.

Segmentation

By Printing Technology:

- Digital Printing

- Lithography Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

By Application:

- Packaging

- Publishing

- Advertising & Marketing

- Retail & E-commerce

- Corporate / Enterprise Communication

- Education & Government Documents

By Service Type:

- Printing Services

- Packaging Printing

- Large Format Printing

- Transactional & Direct Mail Printing

- Promotional Printing

- Value-Added Services

By Print Type:

- Image

- Painting

- Pattern

- Others

Regional Analysis

The India Commercial Printing Market shows distinct regional concentration across India. The South region accounts for roughly 30 % of total market share. The West region holds close to 27 %. The North region contributes about 25 %. The East and North-East region share near 15 %, while Central India covers around 3 %. These shares reflect established industrial zones and urban demand centres.

South India leads due to strong retail growth, expanding e-commerce, and thriving IT and packaging sectors in cities like Bengaluru, Hyderabad and Chennai. Printers in this region benefit from consistent demand for packaging, labels and corporate materials. It draws large printing houses owing to available infrastructure and stable power supply. The West region records robust demand from Mumbai and Pune, driven by advertising, film-industry print collateral, and FMCG packaging needs. It attracts investment because of logistics networks and proximity to ports.

The North region sees steady demand from educational publishing houses and government documentation projects. Printers there rely on demand from populous states and institutional printing jobs. It faces competition from digital media but retains strength through textbooks and legal document printing. The East and North-East record gradual growth led by regional retail expansion and rising e-commerce penetration. It shows potential for future growth once infrastructure improves. Central India remains under-penetrated but slowly gains ground via regional retail and governmental contracts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thomson Press

- Parksons Graphics

- Hindustan Press

- Multivista Global

- Nutech Print Services

- Printech India

- Manipal Technologies

- ITC Print & Packaging (ITC PSPD)

- MPS Limited

Competitive Analysis

The India Commercial Printing Market features a mix of large national players and mid-size regional firms that compete on quality, turnaround time and service breadth. Major firms leverage state-of-the-art digital, flexographic and hybrid presses to offer packaging, corporate, and large-format printing. These players operate multiple facilities across regions to meet diverse demand quickly. It allows them to achieve economies of scale and cross-region delivery capabilities. Regional printers focus on rapid service for nearby clients. They offer personalized services, short-run digital jobs and competitive pricing to capture small and medium enterprises. Some specialise in niche services such as security printing, variable data printing or eco-friendly substrate procurement. These niches help them differentiate from larger rivals. Pricing pressure from regional competitors forces national players to improve efficiency and adopt automation. Some printers form alliances with packaging converters or logistics firms to broaden their service scope. Competition drives continuous equipment upgrades and process optimisation industry-wide.

Recent Developments

- In July 2025, Canon India launched an upgraded version of its imagePRESS V1000 digital press featuring a new vacuum paper feeding deck at Print Expo Chennai, enhancing efficiency for high-volume commercial printing with support for up to 10,000 sheets and thick coated papers.

- In February 2025, Print Plus signed a deal with Bindwel Technologies to acquire the advanced Bindline bookbinding system at PrintPack 2025, incorporating features like the Signa Gatherer and Freedom 5K perfect binder to boost production capabilities for book printing and exports.

- In February 2025, FUJIFILM India unveiled next-generation printing solutions, including the Revoria series, in its graphic communications portfolio at PrintPack India 2025, targeting advancements in commercial and packaging print applications.

Report Coverage

The research report offers an in-depth analysis based on Printing Technology, Application, Service Type and Print Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market

Future Outlook

- The India Commercial Printing Market will expand through sustained demand in packaging, retail, and corporate sectors.

- Digital printing will continue to dominate due to fast turnaround and personalization capabilities.

- Hybrid presses combining offset and digital functions will gain traction for short-run premium work.

- Automation and workflow integration will enhance operational efficiency for print houses nationwide.

- Sustainability will remain a strategic focus with greater use of recyclable substrates and green inks.

- E-commerce growth will elevate demand for printed packaging and logistics materials.

- Tier-II and Tier-III cities will emerge as new growth centers driven by retail and education sectors.

- Corporate branding and variable-data print campaigns will strengthen enterprise-driven print volumes.

- Technological advancements in color management and UV-curable systems will elevate print quality.

- Industry consolidation through mergers and partnerships will help firms expand service capacity and geographic reach.