Market Overview:

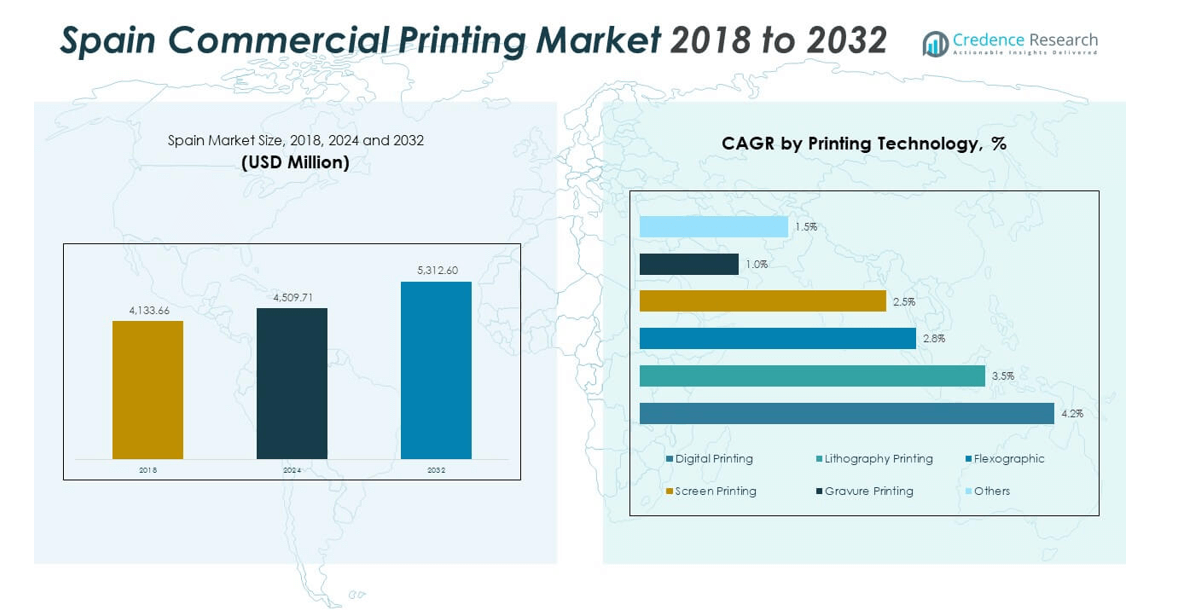

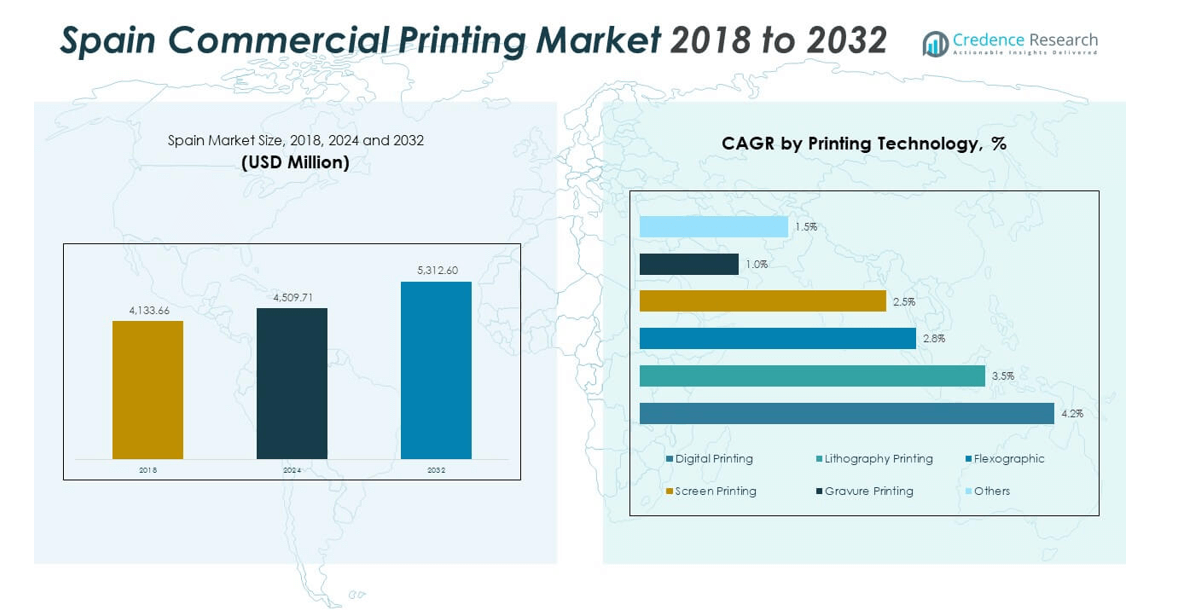

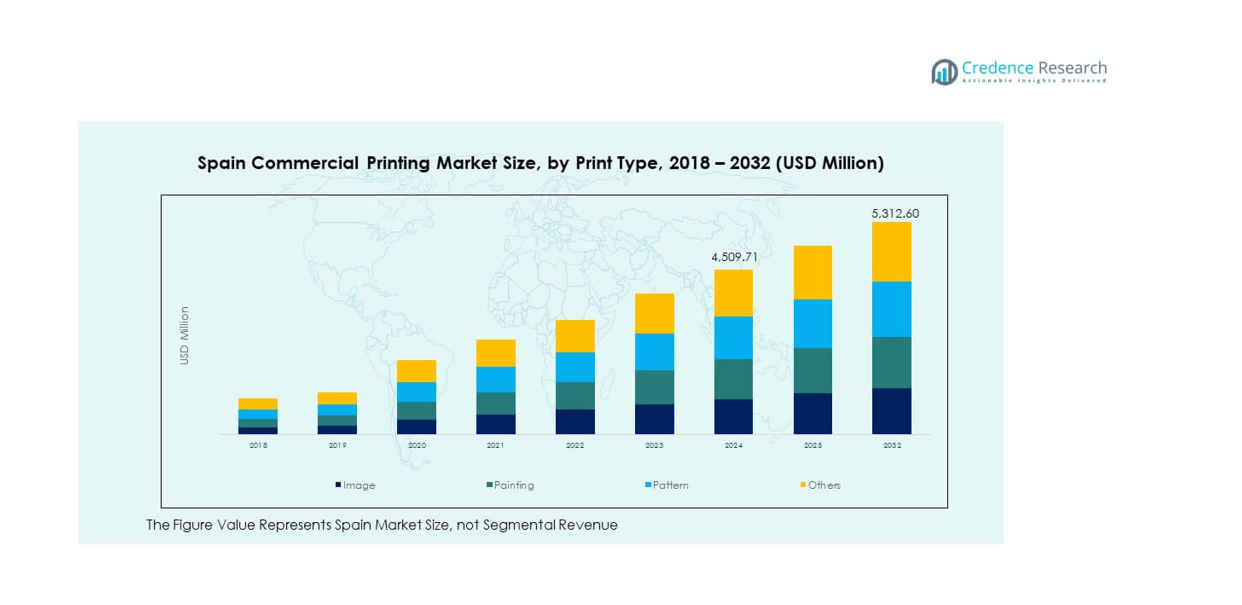

The Spain Commercial Printing Market size was valued at USD 4,133.66 million in 2018 to USD 4,509.71 million in 2024 and is anticipated to reach USD 5,312.60 million by 2032, at a CAGR of 2.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Commercial Printing Market Size 2024 |

USD 4,509.71 million |

| Spain Commercial Printing Market, CAGR |

2.07% |

| Spain Commercial Printing Market Size 2032 |

USD 5,312.60 million |

Growth in the market is driven by the rapid shift toward digital printing technologies that enable short-run, personalized, and sustainable print production. Businesses increasingly prefer digital presses for flexibility and cost efficiency across packaging, publishing, and marketing materials. Demand for eco-friendly inks, recyclable substrates, and advanced color management tools has surged, aligning with Spain’s sustainability commitments and the EU’s green production standards. The rise in customized packaging and on-demand promotional materials also supports market expansion.

Regionally, Catalonia, Madrid, and Valencia dominate due to strong industrial, retail, and logistics networks supporting large-scale print operations. These hubs benefit from dense concentrations of corporate offices, advertising agencies, and packaging converters. Northern Spain maintains steady growth through manufacturing-led demand, while southern regions are emerging with rising tourism-driven marketing print needs. The diverse regional dynamics ensure a balanced market landscape that reflects Spain’s economic and industrial diversity.

Market Insights

- The Spain Commercial Printing Market was valued at USD 4,133.66 million in 2018, increased to USD 4,509.71 million in 2024, and is projected to reach USD 5,312.60 million by 2032, expanding at a CAGR of 2.07% during the forecast period.

- Catalonia (30%), Madrid (25%), and Valencia (20%) hold the top three regional shares, supported by strong industrial networks, retail concentration, and logistics hubs that drive high packaging and advertising print demand.

- The southern region (15%) emerges as the fastest-growing area, driven by rising tourism, expanding local marketing activities, and the development of print services for hospitality and event industries.

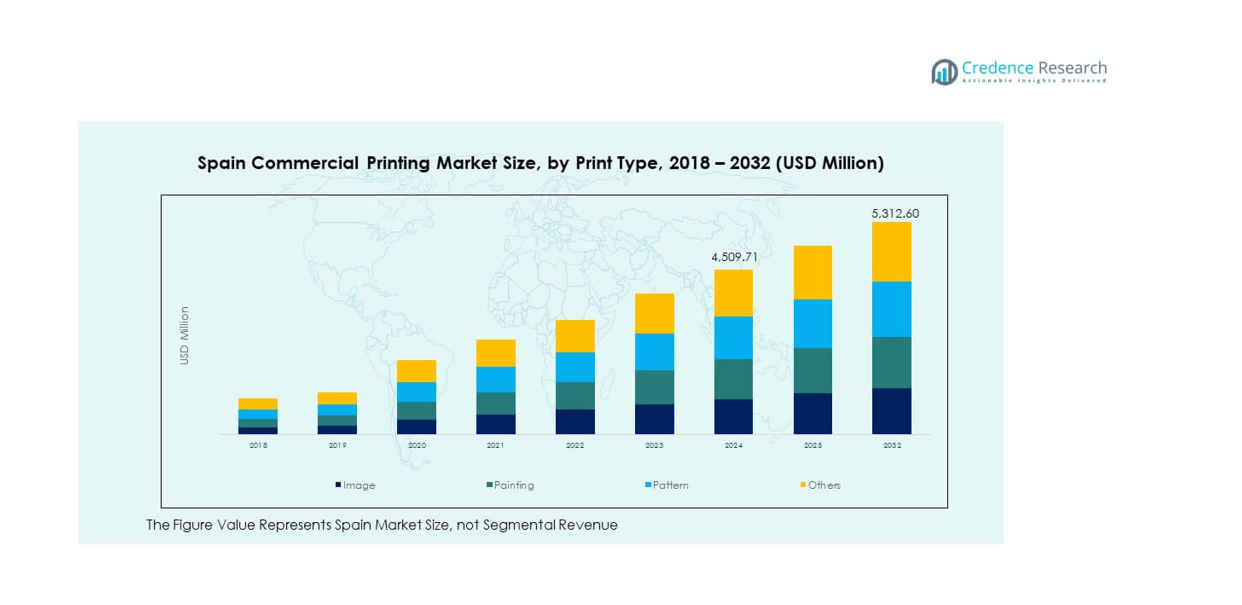

- By print type, image printing represents about 35% of total output, driven by its use in corporate branding, advertising, and promotional materials requiring high-quality visuals.

- Pattern printing accounts for nearly 28% share, supported by applications across textiles, décor, and customized product packaging, indicating growing diversification in commercial printing demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for On-Demand and Short-Run Printing Services

The Spain Commercial Printing Market grows due to strong demand for short-run and personalized printing. Businesses prefer digital presses that reduce setup time and waste while offering flexible production. Advertising agencies use short-run formats to deliver fast campaigns tailored to brand needs. Local printers upgrade digital capabilities to handle multiple small orders efficiently. E-commerce growth increases packaging print jobs that require variable designs. It benefits firms investing in automation and quick turnaround systems. Customers value customization, driving repeat orders. The shift toward on-demand models supports sustainable production and better cost efficiency.

Expansion of Packaging and Retail Branding Requirements

Packaging plays a major role in driving print service demand across Spain. FMCG and beverage firms use printed labels and boxes to enhance brand visibility. It creates stable revenue streams for printing houses offering diverse material options. Retailers require premium-quality packaging that combines design, durability, and compliance. Sustainability standards push converters toward recyclable and biodegradable substrates. Growing online retail adds demand for branded shipping and marketing inserts. It supports adoption of inkjet and flexographic presses for packaging jobs. Increasing competition in retail accelerates investments in visual branding.

- For instance, Hinojosa Packaging Group’s 2025 launch of BottleClip, a 100% recyclable cardboard carrier, reduced plastic use in beverage packaging by 70%, meeting EU eco-design targets for retail brands.

Rising Adoption of Digital and Hybrid Printing Technologies

Technological upgrades continue to reshape the Spain Commercial Printing Market. Digital and hybrid printing models reduce downtime and improve precision across print runs. It enhances operational agility, especially for marketing and publishing sectors. Automation in workflows boosts speed and consistency in complex jobs. Print service providers integrate cloud-based management for better control and analytics. Rising use of variable data printing supports personalization for marketing campaigns. The hybrid approach combining offset and digital offers flexibility in cost and volume. Businesses find these technologies vital for meeting evolving design requirements.

Sustainability and Circular Economy Initiatives Boost Market Evolution

Environmental priorities influence equipment selection and print material sourcing. Companies adopt water-based inks and energy-efficient presses to meet EU sustainability norms. It positions print service providers as compliant and eco-conscious partners. Clients demand transparency in sourcing and recycling, driving greener supply chains. Print-on-demand models help reduce excess inventory and material waste. The focus on sustainable packaging strengthens collaboration with FMCG and luxury brands. It encourages continuous innovation in substrates, coating, and finishing. The sustainability trend is now central to market competitiveness across printing segments.

- For instance, Saica Pack, part of the Saica Group, uses FSC®-certified paper and develops recyclable corrugated packaging aligned with EU circular economy goals. The company focuses on reducing environmental impact through sustainable materials and energy-efficient production across its Spanish facilities.

Market Trends

Growth in Variable Data and Personalization Capabilities

Personalized printing continues to reshape client expectations across industries. The Spain Commercial Printing Market benefits from rising demand for data-driven customization. Businesses use variable data printing to adjust visuals, names, or messages within a single run. It enhances engagement in direct mail, brochures, and promotional materials. Digital platforms simplify the execution of such campaigns at scale. Brands leverage personalization for higher conversion in advertising and loyalty programs. This trend integrates well with AI-based design automation. It transforms print communication into measurable marketing tools.

- For instance, Canon’s varioPRINT iX3200 supports variable data printing in document and transaction modes, achieving 320 A4 images per minute (ipm) with 1200 x 1200 dpi resolution and variable drop sizes of 2.4 and 5.7 pl for dynamic text and image adjustments.

Technological Integration Across Smart Printing Solutions

Automation, IoT, and analytics tools define the next phase of print innovation. Printers integrate predictive maintenance systems to improve uptime. It ensures reliable output and reduces unexpected breakdowns. Real-time tracking systems optimize scheduling and delivery. AI tools analyze color accuracy and material performance in real time. Digital workflow systems link design, proofing, and billing into one network. These innovations strengthen cost efficiency and client satisfaction. The adoption of smart printing reflects the sector’s movement toward Industry 4.0.

Evolving Print Applications in E-Commerce and Retail Sectors

E-commerce expansion drives new use cases for commercial printing. Sellers seek high-quality visuals for packaging inserts, flyers, and promotional kits. The Spain Commercial Printing Market supports these needs with rapid design-to-delivery models. Retail stores enhance in-store experience through vibrant point-of-sale graphics. Demand rises for product catalogs and promotional materials in digital and printed formats. Printers now offer integrated logistics to fulfill regional and online distribution. This shift broadens the customer base and improves revenue diversity.

- For instance, HP Indigo 200K digital press enables flexible short-run packaging with print speeds of 56 m/min and seamless workflow integration for retail promotional campaigns.

Shift Toward Eco-Friendly Materials and Circular Design Practices

Sustainability remains a defining trend across print operations. Firms prioritize recyclable substrates and reduce solvent-based ink use. It aligns with EU environmental goals and local green policies. Equipment manufacturers introduce low-emission printers suited for eco packaging. Clients demand certifications that validate environmental responsibility. Paper reuse and recycling programs are being expanded across print houses. The market moves toward closed-loop material cycles for better efficiency. These efforts strengthen brand image and client trust in environmentally conscious production.

Market Challenges Analysis

High Operational Costs and Price Competition Among Printers

Cost pressure remains a major concern for the Spain Commercial Printing Market. Raw material price fluctuations affect profit margins across paper, ink, and consumables. Small printers struggle to balance technology investments with competitive pricing. It limits their ability to expand service portfolios or maintain large inventories. The need for regular maintenance adds to overheads. Price wars in local markets lower margins, especially in promotional printing. Energy costs and inflation further stress operational efficiency. Firms are forced to streamline production and renegotiate supplier contracts.

Digital Substitution and Declining Demand for Traditional Print Media

Digital transformation continues to reshape the print landscape. Corporate communication and publishing gradually migrate to online platforms. It reduces large-volume offset print runs across books and magazines. The shift impacts traditional players dependent on print advertising. Younger audiences prefer digital media, reducing print subscriptions. Marketing budgets are diverted toward online channels, lowering print demand. Printers must innovate to stay relevant through hybrid models. The challenge lies in maintaining value while competing with instant digital alternatives.

Market Opportunities

Rising Potential in Sustainable and Specialty Printing Segments

Green printing opens new business prospects for service providers. The Spain Commercial Printing Market can capture growth in sustainable packaging and eco labeling. Brands seek recycled paper, biodegradable laminates, and non-toxic inks. Specialty printing such as metallic finishes and textured papers attracts luxury brands. Print houses investing in eco-material innovation can secure long-term contracts. Demand for certified sustainable prints continues to expand across Europe. It creates a premium market tier focused on environmental compliance.

Expanding Corporate Branding and E-Commerce Print Solutions

Corporate demand for marketing collaterals and packaging personalization grows steadily. Online retail firms require printed inserts and visual branding tools. It helps printers diversify offerings beyond traditional publishing work. Integration of design services, variable data, and fulfillment supports high-value projects. Local printers collaborate with digital platforms to meet cross-border demand. The opportunity lies in merging automation with creative services. Strong logistics and faster turnaround create an edge in B2B segments.

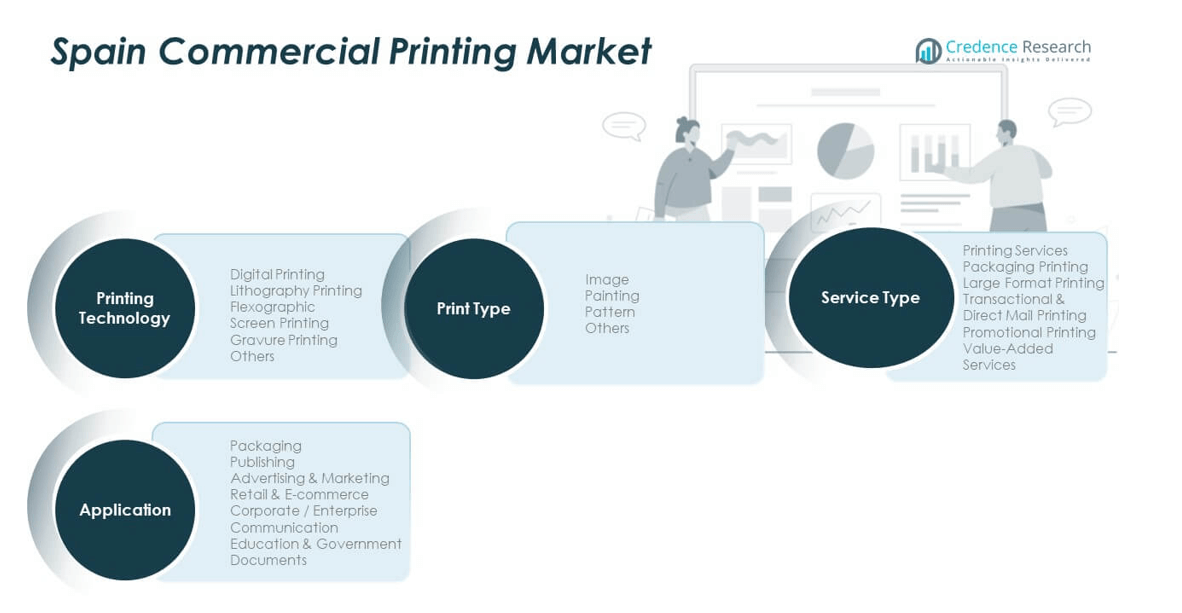

Market Segmentation Analysis

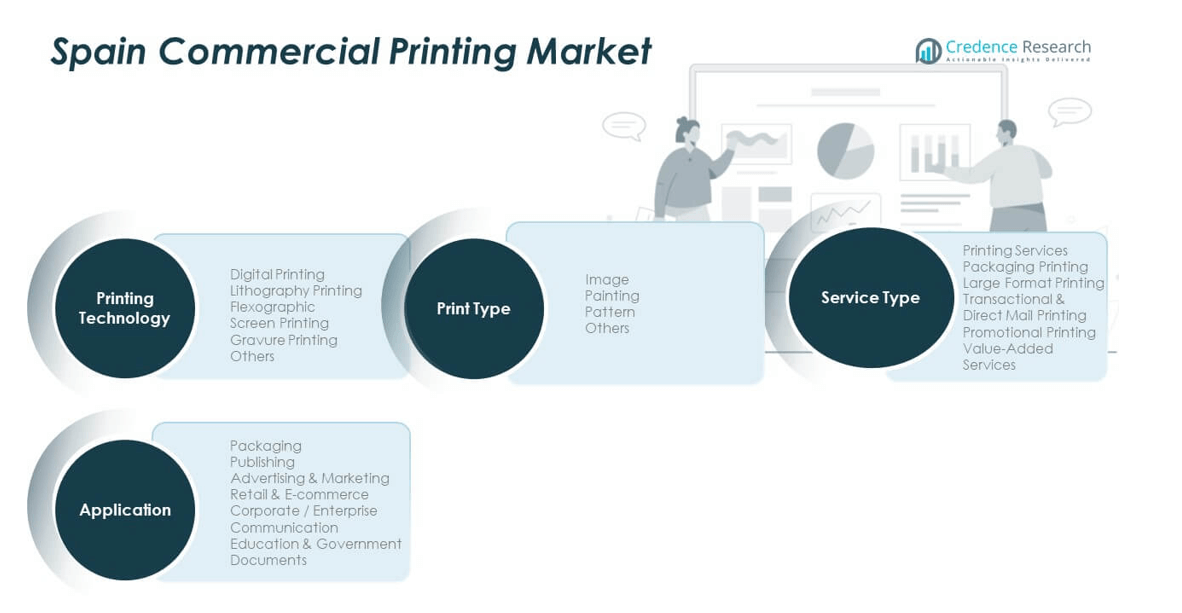

By Printing Technology

The Spain Commercial Printing Market covers digital, lithography, flexographic, screen, gravure, and other printing methods. Digital printing dominates due to its flexibility and low waste output. Lithography remains relevant for bulk orders requiring consistent color quality. Flexographic and gravure printing serve packaging and label production. Screen printing supports textile and promotional products. Emerging technologies aim to combine high speed and sustainable ink systems. Each method addresses specific customer requirements across sectors.

- For instance, Spanish commercial printers are increasingly investing in digital printing systems to improve efficiency and sustainability. These systems help reduce setup waste, shorten turnaround times, and enable high-quality short-run production, aligning with the industry’s shift toward eco-efficient printing practices.

By Application

Applications include packaging, publishing, advertising and marketing, retail and e-commerce, corporate communication, and education. Packaging and advertising lead due to brand-focused printing demand. Publishing sustains stable orders for educational and professional materials. Retail and e-commerce segments grow due to promotional packaging needs. Corporate clients require internal communication and event branding prints. Educational institutes rely on cost-efficient document production systems.

By Service Type

Key services include printing, packaging printing, large format, transactional, promotional, and value-added printing. Printing services lead due to broad application scope. Packaging printing supports FMCG and e-commerce growth. Large format printing caters to billboards and in-store displays. Transactional printing remains vital for invoices and communication. Promotional printing grows with brand marketing initiatives. Value-added services like design, logistics, and finishing enhance competitiveness.

- For instance, Graphispag, Spain’s leading printing and visual communication trade fair, showcases the latest digital, packaging, and industrial printing technologies adopted across Europe. It serves as a major innovation hub where Spanish printers explore automation, workflow integration, and sustainable material solutions for commercial applications.

By Print Type

Print types include image, painting, pattern, and others. Image-based prints dominate across advertising and corporate branding. Pattern printing gains use in textiles and décor. Painting and artistic prints find niche demand in creative industries. The segment diversification highlights how print houses adapt to diverse visual and functional needs. It reinforces the dynamic character of Spain’s evolving commercial printing landscape.

Segmentation

By Printing Technology:

- Digital Printing

- Lithography Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

By Application:

- Packaging

- Publishing

- Advertising & Marketing

- Retail & E-commerce

- Corporate / Enterprise Communication

- Education & Government Documents

By Service Type:

- Printing Services

- Packaging Printing

- Large Format Printing

- Transactional & Direct Mail Printing

- Promotional Printing

- Value-Added Services

By Print Type:

- Image

- Painting

- Pattern

- Others

Regional Analysis

The northern region including Catalonia (with its major city Barcelona) captures roughly 30% of total market share. Its strong manufacturing base and dense industrial clusters drive high demand for commercial printing, especially packaging and retail materials. Catalonia holds significant share because many factories and distribution centres concentrate there.

The central region anchored by Community of Madrid (including Madrid city) commands about 25% share. The region’s role as Spain’s administrative, cultural, and service hub fuels demand for corporate communications, advertising prints, and signage. Madrid’s logistic advantages and dense business activity support a robust printing ecosystem.

The eastern and southern regions—covering Comunidad Valenciana, Andalucía and adjacent areas—together account for around 20% of the market. Growth in manufacturing, packaging outputs, and export-oriented production lifts demand here. Smaller but growing clusters in industrial zones also contribute to commercial printing demand.

Remaining regions, including northern-industrial zones such as Basque Country and central inland areas, share the rest of the market (~25%). Their moderate industrial activity sustains steady but lower printing volumes compared with major hubs. Demand here often relates to niche manufacturing, labels, or local enterprise needs rather than mass-market printing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Major firms such as Cimpress, Grupo GRAFIL and Impresora Montalban lead the Spain Commercial Printing Market through broad service portfolios and capacity. Cimpress focuses on digital printing and personalized print products for retail and e-commerce. Grupo GRAFIL places emphasis on packaging and corrugated cardboard solutions, operating multiple plants across Spain. Impresora Montalban builds strength through sustainable printing solutions and specialized offerings. Competition centers on technology adoption, service breadth, and sustainability credentials. Firms that invest in digital presses, hybrid workflows, and eco-friendly inks deliver faster turnaround and flexible production that appeal to retail, packaging, and advertising clients. Companies offering integrated services from design to fulfillment gain advantage over those limited to traditional offset jobs. Smaller local printers struggle to match pricing and scale of larger players. Newer entrants attempt to capture niche segments such as short-run packaging, customized retail materials, and high-quality large-format prints. They often offer value-added services such as design consulting and supply-chain support to differentiate. Their agility pressures larger firms to innovate. Large players continue consolidating positions via facility expansion and technology upgrades.

Recent Developments

- In November 2025, Mondi launched an extended corrugated and solid board packaging portfolio for the food industry. The expansion follows its acquisition of Schumacher Packaging and includes digital printing capabilities to better serve European food-packaging customers.

- In September 2025, Gallus, a subsidiary of Heidelberger Druckmaschinen AG (HEIDELBERG), introduced two new printing presses at Labelexpo Europe 2025, including an all-digital press and a hybrid solution designed to meet the growing demand for efficient, high-quality label printing.

- In April 2025, Mondi completed the acquisition of Schumacher Packaging’s Western Europe operations. This added over 1 billion square metres of additional packaging capacity and strengthened Mondi’s ability to offer sustainable, large-scale packaging solutions for e-commerce and FMCG clients across Europe

Report Coverage

The research report offers an in-depth analysis based on Printing Technology, Application, Service Type and Print Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Spain Commercial Printing Market will advance through continued digital adoption across publishing, packaging, and retail sectors.

- Increased demand for sustainable printing materials will guide long-term investments and innovation.

- Packaging and e-commerce segments will create steady business for converters and print service providers.

- Hybrid printing systems will become standard, combining offset precision with digital flexibility.

- Automation and AI-driven maintenance will improve uptime and operational reliability in print facilities.

- On-demand printing will expand due to growing customization needs among retail and corporate clients.

- Environmental regulations will shape product development and influence technology upgrades.

- Localized printing networks will help reduce logistics costs and improve delivery turnaround.

- Collaborations between design studios and printing houses will increase value-added service offerings.

- The market will remain moderately consolidated, with regional players focusing on niche, high-quality outputs.