Market Overview:

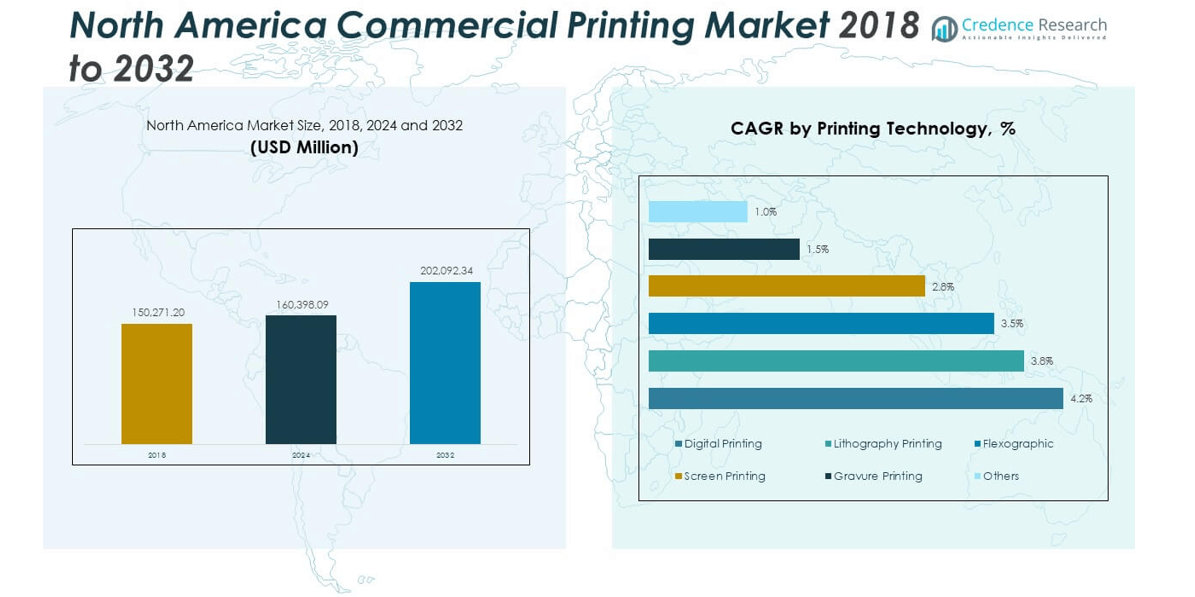

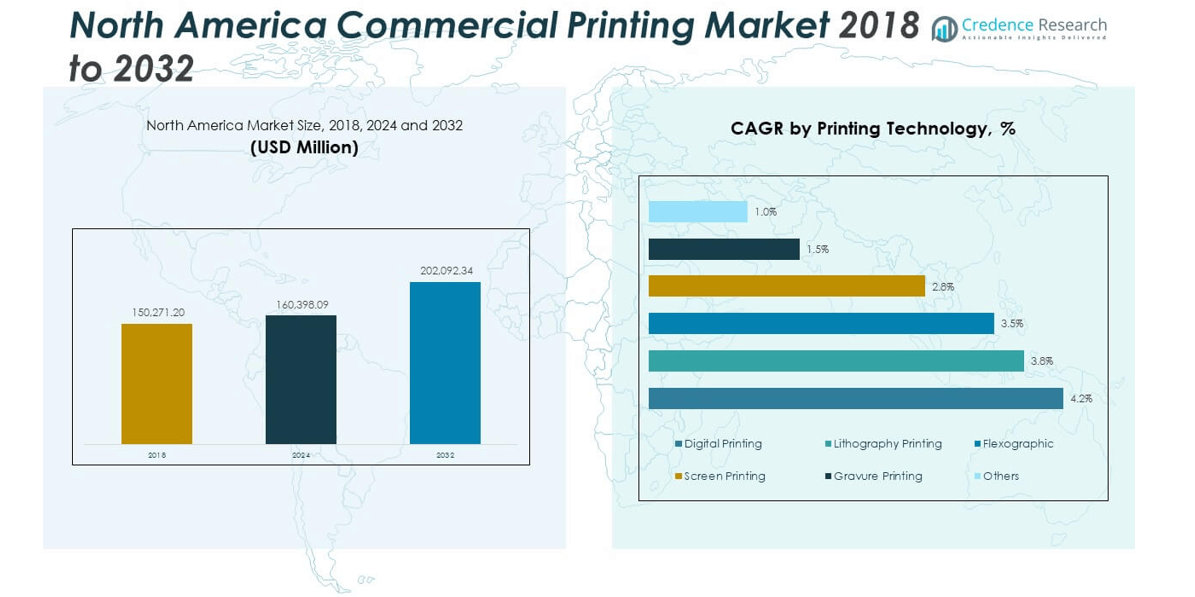

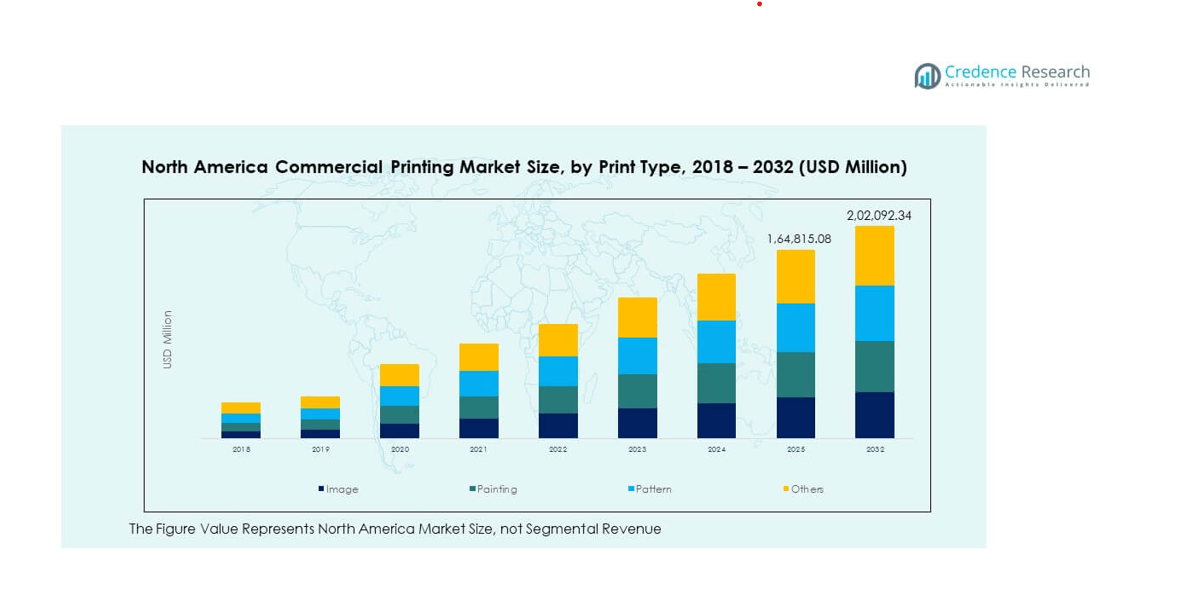

The North America Commercial Printing Market size was valued at USD 150,271.20 million in 2018, reached USD 160,398.09 million in 2024, and is anticipated to attain USD 202,092.34 million by 2032, growing at a CAGR of 2.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Commercial Printing Market Size 2024 |

USD 160,398.09 million |

| North America Commercial Printing Market, CAGR |

2.93% |

| North America Commercial Printing Market Size 2032 |

USD 202,092.34 million |

The market growth is driven by rising demand for high-quality packaging and promotional materials across consumer and industrial sectors. Digital printing technologies enable faster, cost-effective production for customized and short-run orders. Print service providers are modernizing with automated workflows and cloud-based management tools. The advertising and retail sectors continue to use printed media for targeted marketing campaigns. Investments in sustainable inks, eco-friendly substrates, and advanced presses reinforce long-term industry resilience.

The United States dominates the regional landscape, supported by a large industrial base and advanced printing infrastructure. Canada shows steady progress with growing demand for sustainable packaging and specialty printing. Mexico is emerging as a strong growth market, fueled by rapid industrialization, retail expansion, and rising adoption of digital printing solutions. The region benefits from a balanced mix of technological innovation, diverse applications, and increasing sustainability initiatives across printing operations.

Market Insights

- The North America Commercial Printing Market was valued at USD 150,271.20 million in 2018, reached USD 160,398.09 million in 2024, and is expected to attain USD 202,092.34 million by 2032, growing at a CAGR of 2.93%.

- The United States leads with approximately 78% market share, supported by advanced printing infrastructure, strong industrial capacity, and robust demand from packaging and marketing sectors.

- Canada follows with nearly 14% share, driven by sustainable packaging adoption and digital print expansion, while Mexico contributes around 8% as an emerging industrial and retail printing hub.

- Flexographic printing holds the fastest growth at 4.2% CAGR, followed by gravure at 3.8% and screen printing at 2.8%, indicating rapid technology adoption in packaging and specialty applications.

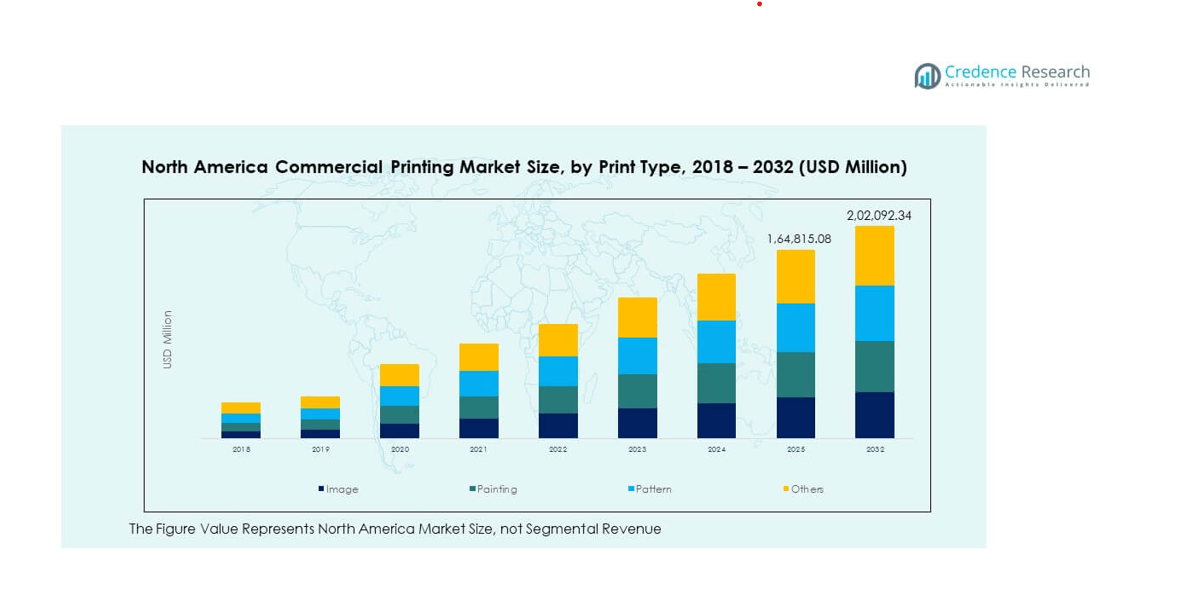

- By print type, image and pattern printing account for the largest combined share, with increasing use in packaging, advertising, and decorative segments across the region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for High-Quality Packaging and Promotional Materials

Strong growth in the packaging and promotional sectors drives expansion of the North America Commercial Printing Market. Businesses across food, beverage, and retail industries depend on high-quality printing to attract buyers. The rise in e-commerce has boosted the need for durable and visually appealing packaging. Companies prioritize customized labels and flexible packaging to improve product differentiation. It supports brand identity and enhances shelf visibility. Continuous product launches and short-run packaging orders promote faster adoption of digital printing systems. Brands adopt print-on-demand services to minimize waste and streamline inventory. Sustainability concerns encourage the use of recyclable inks and materials. These factors collectively strengthen the role of printing in consumer-focused marketing.

Adoption of Advanced Digital and Inkjet Technologies

Technological innovation fuels growth across print categories by improving precision and turnaround time. Digital and inkjet systems replace conventional methods in short-run and variable data printing. The North America Commercial Printing Market benefits from automation and cloud-based job management tools. Print service providers focus on hybrid production that merges offset quality with digital flexibility. Automated prepress and color management tools reduce errors and setup costs. The technology enables faster personalization for packaging and direct mail campaigns. It enhances workflow efficiency and ensures cost-effective output. High-resolution inkjet printers deliver superior image quality across wide substrates. These innovations support faster adoption among medium and small printers seeking productivity gains.

- For instance, Epson’s SurePress L-6534VW digital label press, commercially available and recognized for high-resolution output, delivers up to 1440 dpi across a range of substrates, enabling precise, short-run printing with variable data capabilities. This production-grade inkjet press helps mid-sized printers achieve faster turnaround and high customization for direct mail and packaging, thereby improving productivity and reducing setup costs.

Strong Corporate Communication and Marketing Requirements

Corporations in the region invest in high-impact marketing materials to enhance brand engagement. Brochures, catalogs, and event displays remain vital to communication strategies. The North America Commercial Printing Market supports these efforts by providing consistent print quality and large-scale production capabilities. Businesses seek integrated print solutions that complement digital campaigns. Print providers develop data-driven personalization services that increase response rates. Corporate rebranding projects sustain steady printing demand across annual reports and internal documents. Trade exhibitions and product launches rely on large-format and promotional prints. These developments create continuous opportunities for diversified print solutions. It ensures steady growth across corporate printing channels.

Sustainability and Eco-Friendly Printing Materials

Growing environmental awareness influences the regional printing landscape. Businesses switch to bio-based inks and recyclable substrates to align with sustainability goals. The North America Commercial Printing Market adapts to stricter emission regulations and green certification programs. Printers invest in energy-efficient presses and closed-loop systems to minimize waste. Waterless printing and soy-based inks gain wider adoption among packaging converters. Corporate clients demand proof of environmental compliance, driving innovation in eco-friendly solutions. Sustainable practices enhance reputation and attract new customers. Manufacturers of substrates and inks emphasize reduced carbon footprints. This shift toward greener printing methods supports long-term market competitiveness.

- For instance, Xeikon introduced its TITON toner technology in early 2024, offering a fully recyclable barrier paper solution for food packaging that complies with strict environmental standards. Additionally, Quad Graphics has publicly reported reducing its carbon footprint by over 20,000 tons annually through energy-efficient press upgrades and adoption of soy-based and bio-based inks, showcasing measurable environmental impact improvements aligned with green certification programs.

Market Trends

Rise of On-Demand and Short-Run Printing Models

On-demand printing transforms operational dynamics by allowing flexible, small-volume production. It helps companies manage inventory more efficiently and respond quickly to market shifts. The North America Commercial Printing Market experiences steady demand from businesses seeking agile fulfillment. The rise of personalized consumer goods reinforces this model’s relevance. Print-on-demand platforms integrate online ordering and just-in-time production to optimize resources. Smaller print batches help brands maintain creative flexibility without overstocking materials. Commercial printers gain profitability through reduced storage costs and improved throughput. Automation tools support these fast-paced production cycles effectively. The trend reflects evolving client preferences toward customization and sustainability.

- For instance, Cimpress (Vistaprint) signed a landmark deal with HP in 2025 to install 10-20 HP Indigo 120K and 18K digital presses globally. These presses are engineered for short-run, on-demand production, enabling Cimpress to print hundreds of small-batch jobs per day with faster turnaround times and high quality.

Integration of Artificial Intelligence and Data Analytics in Printing Workflows

Artificial intelligence reshapes how printers manage processes and analyze customer data. AI-enabled print management platforms enhance predictive maintenance and reduce downtime. The North America Commercial Printing Market embraces analytics to optimize resource usage and color accuracy. Machine learning aids quality control through real-time defect detection and calibration. Automated scheduling ensures faster turnaround and minimal waste. Predictive demand forecasting helps manage consumables efficiently. Print businesses apply AI insights to enhance campaign targeting and output performance. Data-driven decisions create consistent, measurable improvements in production. The integration of intelligent systems redefines competitiveness across print operations.

Expansion of Variable Data and Personalization Capabilities

Personalized printing continues to gain traction among marketers and retailers. Brands use customized packaging, catalogs, and promotional mailers to improve consumer engagement. The North America Commercial Printing Market leverages variable data technology to enable tailored messaging. Advances in digital presses allow each print to feature unique content. Consumer data integration helps create targeted marketing materials across sectors. The ability to combine personalization with high-quality output drives brand loyalty. Printers expand service portfolios to include customer data analytics and automation. The approach strengthens campaign effectiveness and response rates. Variable data printing continues to shape future print demand dynamics.

Growth in Sustainable and Energy-Efficient Printing Practices

Sustainability dominates investment decisions in modern print operations. The adoption of low-VOC inks and recyclable materials expands rapidly across North America. The North America Commercial Printing Market adapts to corporate and regulatory sustainability targets. Manufacturers invest in energy-efficient machinery and waste-reduction programs. Green certifications such as FSC and PEFC support credibility among eco-conscious clients. Water-based and UV-curable inks gain preference for reducing environmental impact. Packaging converters shift toward compostable materials to meet circular economy goals. The emphasis on sustainability aligns commercial printing with future consumer values. It promotes long-term growth and competitive differentiation in a maturing industry.

- For example, HP Indigo manufactures its digital presses under a certified carbon-neutral process and promotes lower waste and energy use compared to traditional analog printing. The company’s sustainability framework emphasizes reduced setup waste, efficient ink usage, and lifecycle assessments that demonstrate smaller environmental impacts across production and printing operations.

Market Challenges Analysis

Rising Operational Costs and Supply Chain Disruptions

Fluctuating raw material and energy costs create financial strain for industry participants. Ink, paper, and substrate prices experience volatility due to supply shortages and logistics disruptions. The North America Commercial Printing Market faces challenges maintaining profitability under these pressures. Smaller print shops struggle to balance equipment upgrades with rising labor expenses. Transportation delays impact delivery schedules and client satisfaction. Inflationary trends further tighten margins across the sector. It drives firms to re-evaluate supplier contracts and inventory strategies. Investments in automation and procurement efficiency aim to offset these challenges. However, sustaining consistent material availability remains a key concern for long-term operations.

Digital Media Substitution and Market Saturation

Rapid digitization across communication and advertising continues to challenge print-based channels. Businesses increasingly shift budgets toward digital platforms for cost efficiency and reach. The North America Commercial Printing Market experiences slower growth in traditional offset segments. Print providers must innovate through hybrid services combining digital integration and physical media. Declining newspaper and magazine circulation reduces bulk order volumes. Competition intensifies among local printers operating within niche categories. Firms that fail to diversify into digital or packaging applications risk revenue decline. The transition phase demands significant capital investment and workforce upskilling. Adaptability and strategic repositioning are vital for maintaining relevance in this evolving environment.

Market Opportunities

Emergence of Smart and Connected Printing Systems

The integration of IoT and cloud-based technologies creates strong opportunities for future growth. Printers equipped with sensors provide real-time monitoring and predictive maintenance. The North America Commercial Printing Market benefits from connected workflows that enhance efficiency. Businesses deploy remote print management tools to ensure seamless coordination. These solutions improve output accuracy while reducing equipment downtime. Smart automation supports better utilization of resources and labor. Data analytics integrated into connected systems deliver insight-driven productivity improvements. The evolution of smart printing helps providers meet dynamic client demands effectively. Such advancements open new pathways for digital transformation across printing operations.

Expanding Scope of Industrial and Textile Printing Applications

Diversification into industrial and textile segments creates new market potential. The North America Commercial Printing Market evolves with advancements in fabric printing and surface design. Demand for printed electronics, décor elements, and customized apparel increases steadily. High-speed inkjet technology enables broader application coverage and design flexibility. Print service providers explore industrial sectors such as automotive and home furnishings. It expands client portfolios beyond traditional commercial uses. Collaboration with textile producers and industrial manufacturers fosters innovation in specialty printing. This expansion enhances profitability and competitiveness in emerging niche categories.

Market Segmentation Analysis

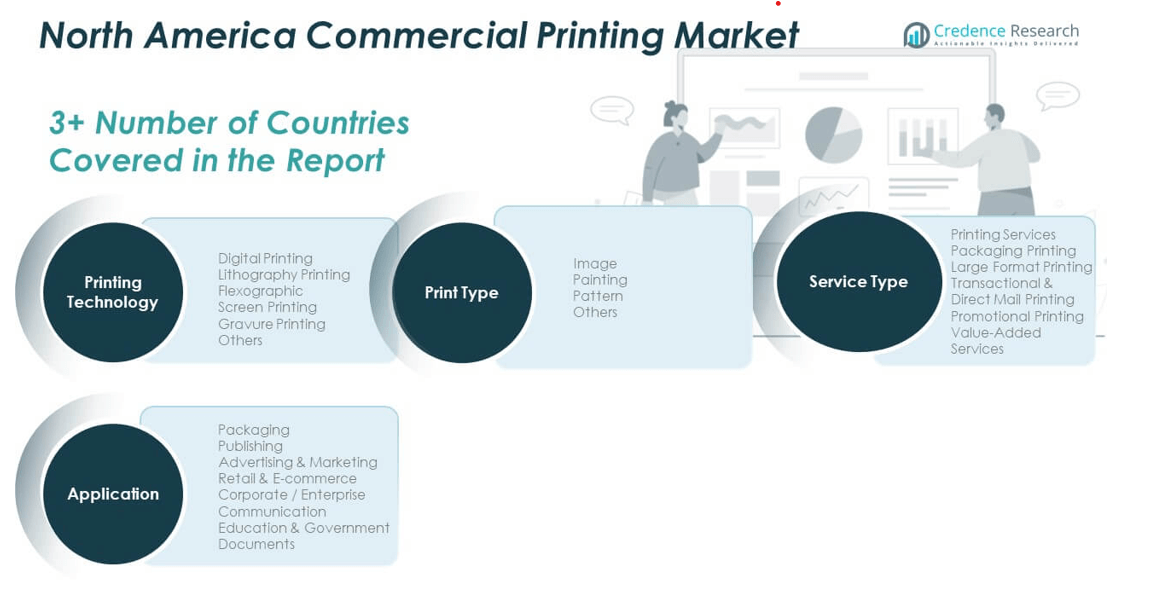

By Printing Technology

Digital printing dominates due to flexibility, variable data capability, and short-run efficiency. The North America Commercial Printing Market benefits from improved print quality and lower setup costs. Lithography remains essential for high-volume commercial and publishing jobs. Flexographic and gravure techniques retain importance in packaging and label production. Screen printing serves niche applications like textiles and signage. Hybrid systems integrating multiple technologies deliver superior workflow efficiency. Automation across print processes continues to increase system productivity. The rise of energy-efficient presses supports sustainability goals across the sector. This diversification across technologies enhances adaptability and cost competitiveness.

- For example, HP’s Indigo 120K Digital Press delivers offset-quality output at speeds of up to 6,000 B2-size sheets per hour. The system features an eco-mode that lowers energy consumption and supports reduced carbon impact. It also includes automated color calibration and maintenance tools that enhance production efficiency across commercial printing operations.

By Application

Packaging leads the market owing to strong demand from retail and consumer goods. The North America Commercial Printing Market supports publishing, advertising, and corporate communication needs. E-commerce expansion fuels greater demand for high-quality package printing. Education and government institutions maintain consistent need for documentation services. Retailers invest in personalized displays, labels, and seasonal promotional prints. Publishing adapts to hybrid formats where digital complements printed media. Corporate communication continues to rely on professionally printed reports and brochures. Each segment contributes distinct revenue streams and stability. Application diversity ensures balanced growth across multiple end-user sectors.

- For example, Avery Dennison’s digital labels division deploys the HP Indigo 6K Digital Press, which supports high-speed label printing at up to 130 feet per minute in enhanced productivity mode, with substrate flexibility ranging from pressure-sensitive label stock to unsupported films. This technology supports packaging demands from retail and consumer goods sectors by enabling rapid, precise, and short-run production.

By Service Type

Printing services form the core of commercial operations across regional providers. The North America Commercial Printing Market includes large-format, transactional, and packaging printing subsegments. Promotional printing remains vital to retail and event-based marketing activities. Value-added services such as design, finishing, and logistics strengthen client retention. Direct mail and transactional services integrate data personalization to improve engagement. Packaging printing gains traction through sustainable and flexible substrates. Companies adopt end-to-end printing solutions covering design to delivery. This integration boosts efficiency and service differentiation. The evolution of service portfolios enhances long-term competitiveness and growth potential.

By Print Type

Image and pattern printing hold the largest share due to strong consumer appeal. The North America Commercial Printing Market also encompasses painting and decorative print applications. Designers leverage advanced color management to achieve accurate visual reproduction. Pattern printing finds wide use in textiles, wallpapers, and promotional surfaces. Industrial clients prefer precision printing for branding and technical labeling. Emerging interest in customized art and design fuels creative printing services. Print service providers focus on durability and aesthetic precision. Digital solutions enable consistent reproduction across materials and formats. This broad scope of print types ensures continuous innovation and market relevance.

Segmentation

By Printing Technology:

- Digital Printing

- Lithography Printing

- Flexographic Printing

- Screen Printing

- Gravure Printing

- Others

By Application:

- Packaging

- Publishing

- Advertising & Marketing

- Retail & E-commerce

- Corporate / Enterprise Communication

- Education & Government Documents

By Service Type:

- Printing Services

- Packaging Printing

- Large Format Printing

- Transactional & Direct Mail Printing

- Promotional Printing

- Value-Added Services

By Print Type:

- Image

- Painting

- Pattern

- Others

Regional Analysis

United States – The Dominant Market with Advanced Printing Infrastructure

The United States holds nearly 78% share of the North America Commercial Printing Market, driven by strong industrial capability and broad service diversity. Its dominance stems from a large base of publishing, packaging, and corporate printing operations. The country’s advanced automation and digital press adoption have modernized traditional printing workflows. Demand for premium-quality packaging and direct mail marketing remains high among retailers and e-commerce firms. Large print service providers continue investing in AI-enabled and inkjet systems to improve turnaround and precision. Sustainability initiatives promote eco-friendly inks and recyclable substrates, aligning with national environmental goals. It remains the region’s innovation hub, supported by steady advertising and marketing expenditure.

Canada – Growing Focus on Sustainable Packaging and Niche Printing Segments

Canada contributes about 14% share to the North America Commercial Printing Market, supported by steady industrial expansion and green initiatives. The market benefits from demand for sustainable packaging, print advertising, and specialty publishing. Canadian printers emphasize recyclable materials and low-emission inks to align with environmental regulations. Regional growth in consumer goods, healthcare, and education boosts print demand across commercial and government sectors. Local printing companies focus on small-batch, high-quality production catering to niche markets. Trade collaborations with U.S. manufacturers strengthen technology transfer and operational efficiency. Continuous upgrades in digital printing equipment enhance quality and competitiveness across the Canadian industry.

Mexico – Emerging Market with Expanding Industrial and Retail Printing Demand

Mexico accounts for roughly 8% share of the North America Commercial Printing Market and continues to show promising growth. Expansion in manufacturing, logistics, and retail drives increasing demand for packaging and promotional prints. The country’s competitive labor and production costs attract global print providers to establish regional facilities. It is witnessing fast digitalization in printing services across automotive, consumer goods, and logistics applications. Local print companies adopt hybrid models combining offset and digital solutions to boost output. Growing export activity supports demand for labeling and branded packaging in industrial segments. The country’s rising consumer market ensures consistent long-term growth potential for the printing sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- R. Donnelley (RRD)

- Quad/Graphics Inc.

- Transcontinental Inc. (TC Transcontinental)

- Cimpress / Vistaprint

- Taylor Corporation

- Deluxe Corporation

- Cenveo Worldwide Limited

- LSC Communications

- Shutterfly LLC

- Quebecor (QG)

- 4Over Inc.

- Printful Inc.

- AlphaGraphics

- Minuteman Press International

Competitive Analysis

The North America Commercial Printing Market is moderately consolidated, with large players holding strong regional influence and smaller firms focusing on niche capabilities. Major companies such as Quad/Graphics Inc., RR Donnelley & Sons Company, Cenveo Worldwide Limited, and Transcontinental Inc. dominate through extensive service portfolios and digital transformation investments. It remains competitive due to growing technological advancements and sustainability demands. Players expand through mergers, acquisitions, and strategic alliances to enhance service integration and geographic coverage. Companies invest heavily in workflow automation, eco-friendly materials, and inkjet press technology to strengthen efficiency. Medium-sized providers target personalized printing and value-added design services to differentiate offerings. The entry of technology-driven print startups intensifies market dynamism and accelerates adoption of cloud-managed print ecosystems. Innovation, flexibility, and sustainability remain key competitive differentiators across the region’s printing landscape.

Recent Developments

- In October 2025, Taylor Corporation acquired Gooten, a print-on-demand order-management platform. This move expands Taylor Corporation’s on-demand printing and fulfilment capabilities, strengthening its position in e-commerce and variable-data printing.

- In December 2024, FUJIFILM North America Corporation’s Graphic Communication Division announced four new mid-range Revoria Press series production presses for North America, adding specialty color capabilities that enable commercial printers to offer value-added applications such as metallics and spot embellishments without separate finishing steps.

- In July 2024, R.R. Donnelley & Sons Company completed acquisition of certain digital and print marketing businesses from Vericast Corporation. The deal enhanced R.R. Donnelley’s marketing print and digital media capabilities, strengthening its marketing-solutions offering.

Report Coverage

The research report offers an in-depth analysis based on Printing Technology, Application, Service Type and Print Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital transformation will remain a major growth catalyst, driving adoption of high-speed inkjet and on-demand printing systems.

- Integration of artificial intelligence and data analytics will enhance color management, predictive maintenance, and workflow efficiency.

- Sustainable printing practices will expand as firms invest in bio-based inks, recyclable substrates, and low-emission technologies.

- Packaging and labeling applications will experience continued demand from retail, e-commerce, and fast-moving consumer goods industries.

- Hybrid production combining offset and digital capabilities will improve cost efficiency and customization potential for print service providers.

- Investments in cloud-managed printing and IoT-enabled devices will support remote operation and quality control.

- The corporate communication segment will sustain steady demand through branding, internal publishing, and marketing collateral.

- Personalized and variable data printing will reshape advertising effectiveness across direct mail and promotional segments.

- Small and medium print firms will gain competitiveness by adopting automation and flexible finishing solutions.

- The regional market will see strategic consolidations as companies strengthen capacity and technology integration to meet evolving client demands.