Market Overview

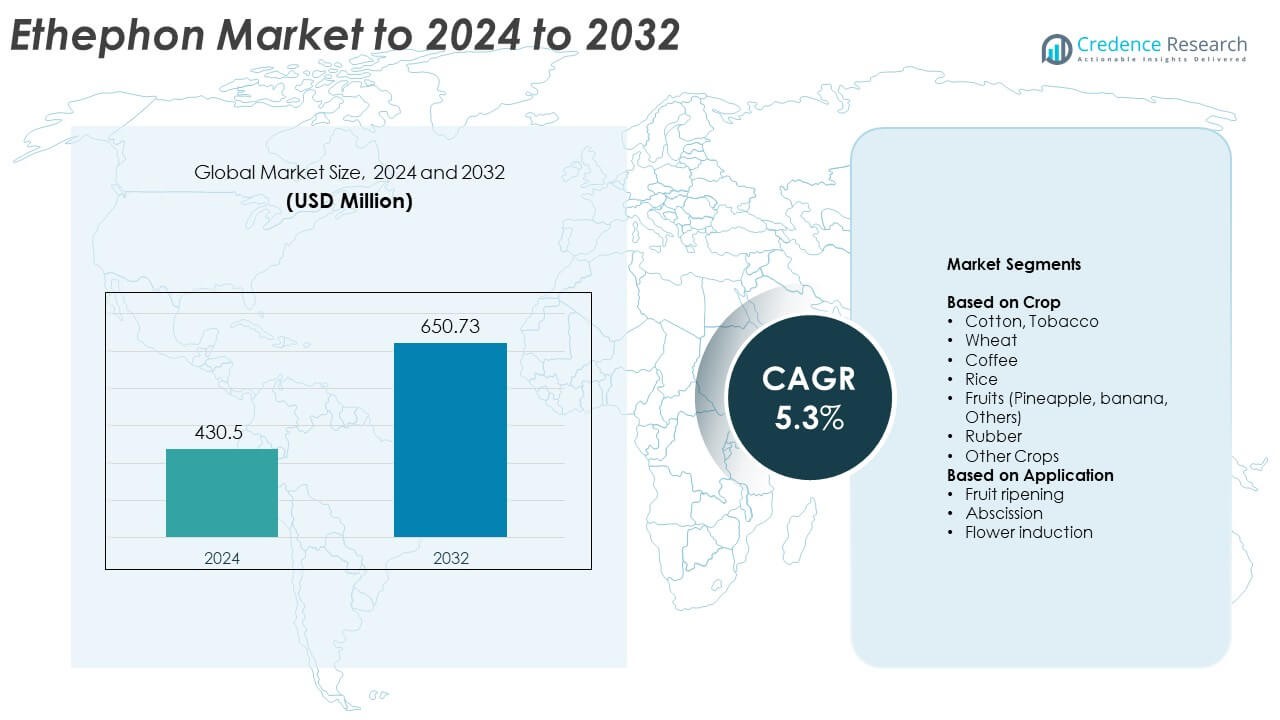

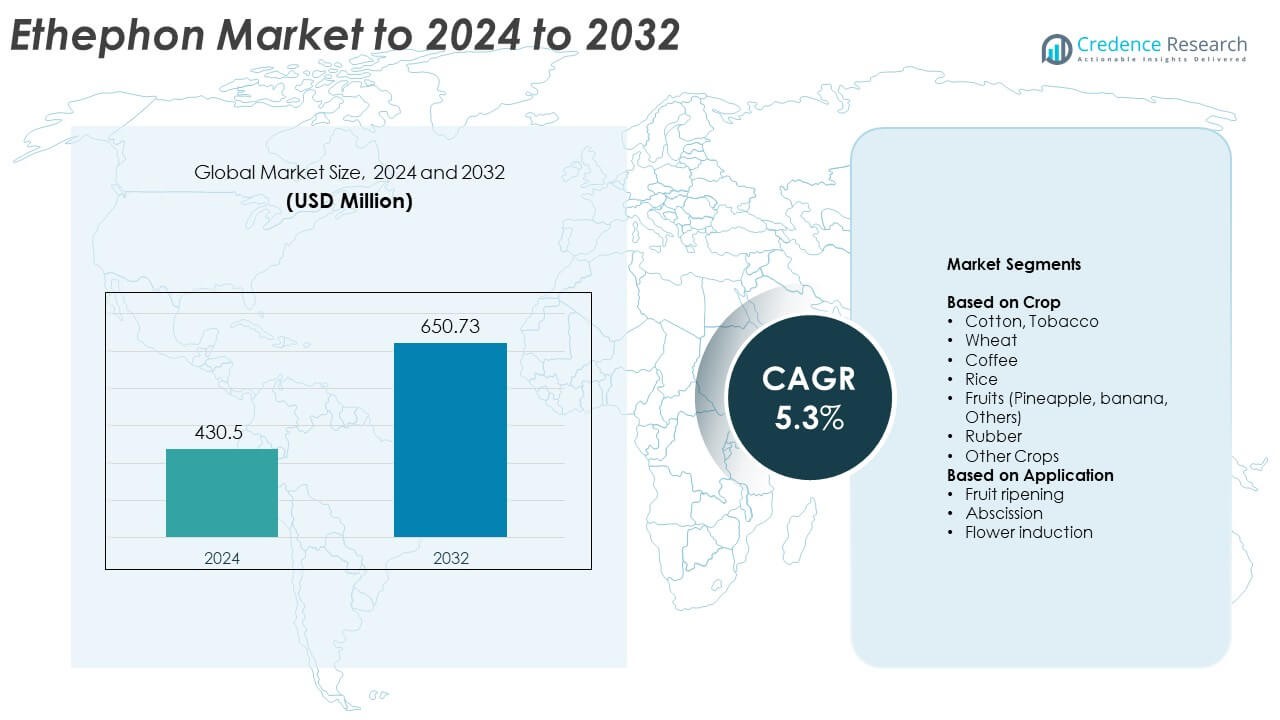

Ethephon Market size was valued at USD 430.5 million in 2024 and is anticipated to reach USD 650.73 million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ethephon Market Size 2024 |

USD 430.5 Million |

| Ethephon Market, CAGR |

5.3% |

| Ethephon Market Size 2032 |

USD 650.73 Million |

Top players in the ethephon market include UPL, BASF, Bayer, Cheminova, Dow, Sumitomo Chemical, ADAMA, Mitsui Chemicals, Syngenta, FMC, DuPont, Monsanto, Nufarm, and Arysta. These companies compete through advanced formulations, broad crop portfolios, and strong distribution networks in high-demand agricultural regions. Asia Pacific leads the market with about 36% share due to extensive use in cotton, fruits, rice, and plantation crops. North America follows with nearly 32% share, driven by mechanized cotton farming and established post-harvest systems. Europe holds around 24% share, supported by structured horticulture and regulated application practices.

Market Insights

- The ethephon market reached USD 430.5 million in 2024 and is projected to hit USD 650.73 million by 2032, growing at a CAGR of 5.3%.

- Growth is driven by high usage in cotton, which held about 41% share in 2024, and strong demand from fruit-ripening operations in major producing countries.

- Key trends include rising adoption in rubber and plantation crops, along with growing use of regulated ripening systems supported by expanding cold-chain networks across emerging markets.

- The market is competitive, with global agrochemical companies expanding formulation stability, distribution strength, and digital advisory tools to support accurate farm application.

- Asia Pacific led the market with nearly 36% share in 2024, followed by North America at about 32% and Europe at roughly 24%, while fruit ripening remained the dominant application segment with around 48% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Crop

Cotton held the dominant share in 2024 with about 41% of total demand. Farmers used ethephon widely in cotton because the chemical supports early and uniform boll opening, which improves harvesting efficiency. Adoption stayed strong in major cotton-producing countries where mechanized harvesting needs consistent maturity. Fruits such as pineapple and banana showed steady uptake as growers used ethephon for controlled ripening, but cotton remained the leading crop segment due to large cultivation area, predictable application cycles, and higher reliance on growth regulators for yield management.

- For instance, generic boll opener products available in Australia, such as Titan Ethephon 720, Apparent Ethephon 720, and Kenso Ethephon 720, contain 720 g/L of ethephon for cotton. Australian labels state these are used to accelerate the opening of mature bolls and enhance defoliation before harvest.

By Application

Fruit ripening led the application segment in 2024 with nearly 48% market share. Food supply chains used ethephon to support uniform color development and faster ripening for banana, pineapple, and other climacteric fruits. Demand grew as wholesale markets and distributors relied on regulated ripening to reduce spoilage during transport. Abscission and flower induction applications expanded gradually in rubber plantations and horticulture, but fruit ripening stayed dominant due to higher consumption volumes, consistent seasonal use, and strong demand from tropical fruit markets.

- For instance, Shandong Aoweite Biotechnology recommends one sachet of its ethephon-based banana ripener for every 12 to 18 kilograms of fruit. The company describes use in rooms held near 16 to 18 degrees Celsius to support uniform ripening.

Key Growth Drivers

Rising use in cotton and fruit production

Growing use of ethephon in cotton and major fruit crops acted as a primary growth driver. Cotton growers adopted ethephon to support faster boll opening and improve harvesting efficiency, especially in large mechanized farms. Fruit producers in banana and pineapple supply chains used controlled ripening to reduce losses and maintain uniform quality. Wider use across different climates supported steady expansion as growers sought predictable yield outcomes and better post-harvest handling performance.

- For instance, ethephon is widely used as a plant growth regulator on cotton, cereals, and various fruit crops, with application rates varying by region and specific crop needs. For cotton, application rates can reach over 2.5 kilograms per hectare, depending on the specific product concentration and local recommendations, as noted in various agricultural research reports.

Expansion of regulated ripening facilities

Growth accelerated as modern ripening chambers expanded across Asia, Africa, and Latin America. These facilities used ethephon to maintain consistency in color, texture, and shelf-life of fruits moving through long supply routes. Retailers and distributors emphasized freshness, which increased demand for reliable ripening agents. Strong urban consumption and higher fruit transport volumes reinforced adoption, making ripening infrastructure a key driver for market growth.

- For instance, POMAIS Agriculture recommends banana dipping rates of 500 to 1000 ppm ethephon in commercial operations. The same guide suggests mango dipping at 500 to 1000 ppm inside controlled packhouse ripening systems.

Higher focus on efficient crop management

Farmers used ethephon to manage crop cycles, regulate maturity timing, and support uniform flowering in high-value crops. Rubber plantations adopted ethephon for latex yield improvement through controlled stimulation. Wheat and rice growers also increased use for lodging control and consistent maturation. Broader farm mechanization and rising pressure to improve productivity encouraged growers to adopt growth regulators, positioning efficient crop management as a major growth catalyst.

Key Trends and Opportunities

Growing shift toward precision agriculture

Use of ethephon aligned with rising adoption of precision agriculture practices where growers adjust application timing based on crop physiology and climate data. This shift improved treatment accuracy and reduced waste, making growth regulators more effective. Digital advisory tools helped farmers time applications for ripening, abscission, and flowering. The movement toward precision-based application created new opportunities for regulated growth solutions.

- For instance, Imtrade Australia’s Ethephon 720 label lists rates up to 3 litres per hectare. The instructions also require minimum spray volumes of 20 litres of water per hectare, reinforcing calibrated and precise field application.

Rising demand in rubber and plantation crops

Ethephon usage expanded in rubber plantations as growers sought better latex flow and more predictable tapping cycles. Plantation operators adopted controlled stimulation schedules to maintain productivity, especially in Southeast Asia. This trend also spread across coffee and tobacco farms where growers explored growth regulation for improved crop handling. The expanding plantation sector strengthened long-term demand opportunities for ethephon.

- For instance, Zhengzhou Delong Chemical Co., Ltd. offers Ethephon 5% PA (paste) and 40% SL (soluble concentrate) formulations as high-efficacy plant growth stimulants to increase latex flow in rubber trees.

Adoption in post-harvest quality programs

Retail chains emphasized consistent fruit appearance and reduced spoilage, increasing interest in regulated ripening programs. Ethephon allowed uniform color development in bananas, pineapples, and other fruits, supporting large-scale distribution. Expanding cold-chain capacity and stricter quality standards created new openings for ethephon across export-oriented markets. This trend further improved adoption in both developed and emerging economies.

Key Challenges

Concerns over residue and regulatory compliance

Regulators increased scrutiny over residue limits in food crops, creating operational challenges for growers and distributors. Meeting strict safety standards required precise dosing, supervised ripening conditions, and strong monitoring practices. Any deviation could affect export acceptability and raise compliance costs. These factors slowed adoption among small producers who lacked advanced handling infrastructure.

Availability of natural and alternative ripening methods

Competition from natural ripening solutions and ethylene-based systems created challenges for ethephon adoption. Some markets favored non-chemical methods to meet consumer preferences for clean-label fruit handling. Improved ethylene generators and biological agents gained traction in premium supply chains. This shift pushed growers and distributors to evaluate alternatives, reducing growth potential in certain regions.

Regional Analysis

North America

North America held about 32% share of the ethephon market in 2024, supported by strong demand from cotton, fruit, and nursery crop production. The United States used ethephon widely for cotton boll opening and for uniform ripening of apples, grapes, and tropical fruits moved through distribution hubs. Canada contributed steady demand through greenhouse and horticulture operations focused on flower induction and growth control. The region benefited from advanced crop-management practices, high mechanization, and established post-harvest infrastructure, which maintained consistent use across regulated ripening and abscission applications.

Europe

Europe accounted for nearly 24% share of the global ethephon market in 2024, driven by strong adoption in grapes, apples, cereals, and greenhouse crops. Countries such as Spain, Italy, and France used ethephon for uniform ripening, abscission control, and improved harvesting cycles in vineyards and fruit orchards. Northern Europe showed moderate demand through controlled flowering in horticulture systems. Strict regulatory standards shaped application patterns, leading growers to adopt precise, low-dose treatments supported by digital advisory tools. Demand stayed stable due to highly structured farming systems and strong post-harvest quality programs.

Asia Pacific

Asia Pacific dominated the ethephon market with around 36% share in 2024, anchored by extensive use across cotton, rice, fruits, rubber, and plantation crops. India and China recorded high consumption for fruit ripening, crop maturation, and latex stimulation in rubber plantations. Southeast Asian nations expanded adoption through pineapple, banana, and coffee supply chains. Rapid growth came from expanding cold-chain networks and rising fruit exports. Large agricultural acreage, strong reliance on growth regulators, and expanding plantation economies kept Asia Pacific the leading and fastest-growing regional market.

Latin America

Latin America captured nearly 5% share in 2024, led by strong agricultural bases in Brazil, Mexico, and Colombia. Growers used ethephon for fruit ripening in bananas, pineapples, and tropical produce shipped to global markets. Coffee producers adopted flower-induction applications to support synchronized flowering and improved harvesting cycles. Cotton cultivation in selected areas also contributed to demand. Growth remained steady as regional supply chains improved post-harvest handling practices and adopted more consistent ripening protocols for export-oriented crops.

Middle East and Africa

Middle East and Africa held about 3% share of the ethephon market in 2024, with rising use in fruits, vegetables, and plantation crops. African countries increased adoption for banana and pineapple ripening and for cotton management in key producing nations. Rubber-growing regions showed moderate uptake for latex stimulation. The Middle East contributed through controlled horticulture systems that used ethephon for flower regulation and growth control. Market growth improved as cold-chain access expanded and farmers adopted more structured crop-management practices across emerging agricultural economies.

Market Segmentations:

By Crop

- Cotton, Tobacco

- Wheat

- Coffee

- Rice

- Fruits (Pineapple, banana, Others)

- Rubber

- Other Crops

By Application

- Fruit ripening

- Abscission

- Flower induction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the ethephon market is shaped by leading agrochemical companies such as UPL, BASF, Bayer, Cheminova, Dow, Sumitomo Chemical, ADAMA, Mitsui Chemicals, Syngenta, FMC, DuPont, Monsanto, Nufarm, and Arysta. Competition centers on product purity, formulation stability, and regulatory compliance across global markets. Companies focus on improving application efficiency for cotton, fruits, and plantation crops while expanding distribution networks in high-growth regions. Research efforts aim to refine controlled-release technologies, reduce residue levels, and align products with evolving safety standards. Market participants also enhance farmer outreach programs and digital advisory tools to support precise application timing. Strategic expansions, partnerships with regional distributors, and adoption of sustainable production practices continue to strengthen market positioning while ensuring competitiveness in diverse agricultural systems.

Key Player Analysis

Recent Developments

- In 2025, Bayer continues to promote its Ethrel product containing Ethephon 39% SL, a plant growth regulator used to enhance fruit ripening, flowering induction, and latex stimulation in crops like cotton, tomatoes, sugarcane, mango, pineapple, and rubber trees.

- In 2025, ADAMA updated the PADAWAN growth-regulator page in the UK; PADAWAN contains 480 g/L ethephon for height reduction and lodging control in cereals, with freshly revised label

- In 2024, Arysta LifeScience offers an Ethephon 39% SL plant growth regulator as of December 2024. The product is used to accelerate uniform ripening, improve fruit coloration, and promote profuse flowering in crops such as pineapple, mango, tomato, coffee, and rubber.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Crop, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as farmers expand use in cotton, fruits, and plantation crops.

- Demand will rise with wider adoption of regulated ripening across developing regions.

- Digital advisory tools will support more precise and efficient application schedules.

- Plantation sectors such as rubber and coffee will strengthen long-term consumption.

- Supply chains will adopt ethephon more as cold-chain networks expand in emerging markets.

- Growth regulators will gain importance as growers target higher productivity and uniform yields.

- Regulatory clarity will shape adoption patterns and encourage standardized application practices.

- Alternative ripening systems will drive innovation pressure but maintain balanced competition.

- Climate-driven production shifts will increase reliance on growth regulators for maturity control.

- Export-focused fruit markets will continue using ethephon to maintain consistent post-harvest quality.