Market Overview

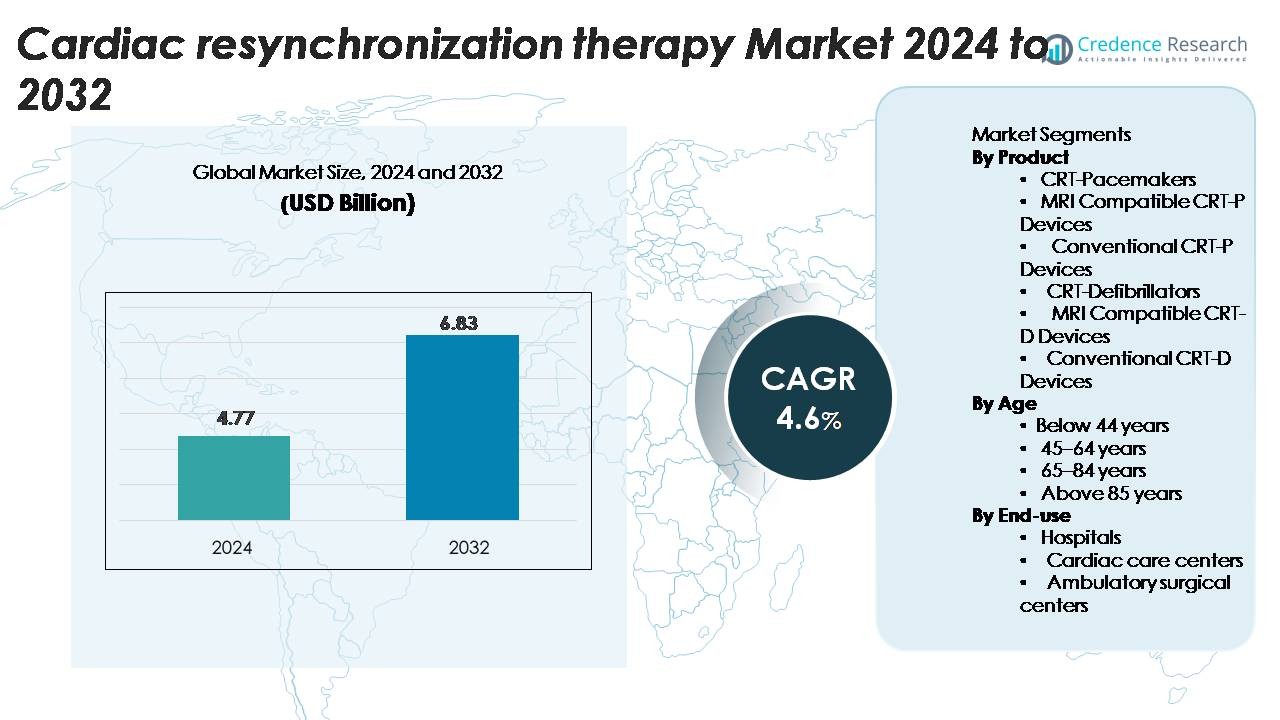

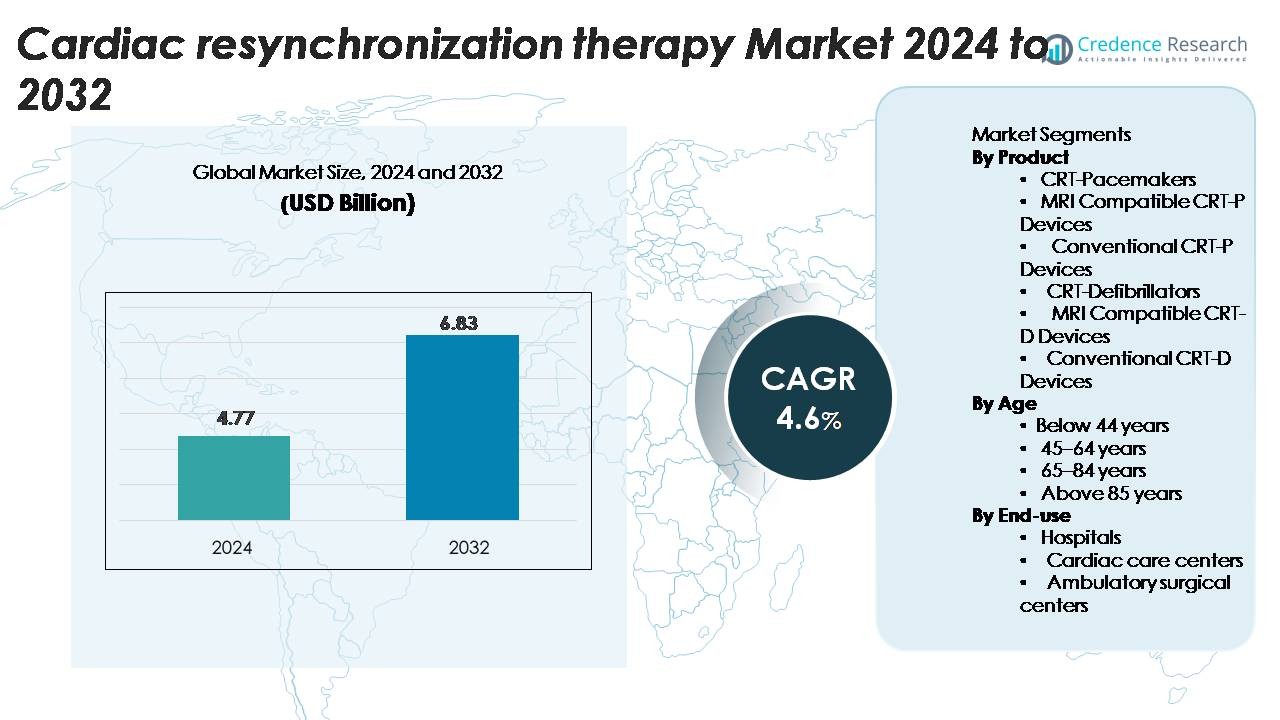

The Cardiac Resynchronization Therapy market size was valued at USD 4.77 billion in 2024 and is projected to reach USD 6.83 billion by 2032, growing at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cardiac Resynchronization Therapy Market Size 2024 |

USD 4.77 Billion |

| Cardiac Resynchronization Therapy Market, CAGR |

4.6% |

| Cardiac Resynchronization Therapy Market Size 2032 |

USD 6.83 Billion |

The Cardiac Resynchronization Therapy market is shaped by strong participation from global device manufacturers that focus on advanced CRT-D and MRI-compatible pacing systems. Companies with broad electrophysiology portfolios lead adoption across major hospitals and cardiac centers by offering reliable devices and strong post-implant support. North America remains the leading region with 41% market share, supported by high diagnosis rates, strong reimbursement, and early uptake of next-generation systems. Europe follows with significant demand driven by structured care pathways and aging populations. Asia-Pacific grows rapidly as cardiac centers expand and more patients gain access to advanced pacing therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market size reached USD 4.77 billion in 2024 and will hit USD 6.83 billion by 2032 at a 4.6% CAGR.

- Rising heart failure cases drive higher demand for CRT-D devices, which hold the 61% share as providers prefer dual therapy for high-risk patients.

- MRI-compatible systems gain traction as hospitals adopt safer imaging-friendly devices and remote monitoring becomes a key trend in long-term care.

- Competition remains strong among global electrophysiology device makers that expand innovation pipelines, but high device cost and lead-related complications restrain wider adoption.

- North America leads with 41%, followed by Europe at 32%, while Asia-Pacific at 19% grows fastest; by age, the 65–84 group dominates with 54% share, and hospitals lead end-use with 68% share.

Market Segmentation Analysis:

By Product:

CRT-Defibrillators lead this segment with an estimated 61% share in 2024 due to strong adoption among high-risk cardiac patients. These devices support both pacing and defibrillation, which enhances survival in advanced heart failure. MRI-compatible CRT-D devices continue to gain traction because patients often require MRI scans during long-term care. CRT-Pacemakers hold steady demand due to their suitability for moderate heart failure cases. MRI-compatible CRT-P devices also expand as providers shift toward safer imaging options. Growth across all product groups is driven by rising heart failure prevalence and improved device reliability.

- For instance, a large CRT-D study reported that among 320 patients treated, the primary endpoint (death, heart transplantation, or LV-assist device) was reached by 37% in the CRT-D group at a median follow-up of 4.3 years.

By Age:

The 65–84 years group dominates the market with nearly 54% share, reflecting the high incidence of heart failure in older adults. Advancing age increases the need for synchronized cardiac pacing, which boosts demand across this demographic. Patients aged 45–64 years account for a growing share as early diagnosis rates improve due to broader use of cardiac screening. Individuals above 85 years show stable device adoption, supported by better post-implant survival. The below-44 group remains the smallest segment, driven mainly by genetic or congenital cardiac conditions.

- For instance, data from one study showed that individuals aged 80–84 years had a heart failure prevalence of 5.2% in that age band.

By End-use:

Hospitals lead the segment with an estimated 68% share, driven by the availability of advanced electrophysiology labs and skilled cardiac surgeons. These facilities manage complex CRT-D and CRT-P implantation procedures, which require continuous monitoring and post-operative care. Cardiac care centers show strong growth as they provide dedicated rhythm management services and faster intervention for heart failure cases. Ambulatory surgical centers hold a smaller share but expand steadily as minimally invasive implantation techniques reduce recovery time and support outpatient procedures.

Key Growth Drivers

Rising Burden of Heart Failure

Growing heart failure cases drive strong demand for cardiac resynchronization therapy. The rising burden among older adults increases the need for advanced pacing solutions. More patients now receive earlier diagnosis, which boosts therapy adoption across hospitals and cardiac centers. Better awareness programs help people understand treatment benefits and lower their fear of implants. Wider access to screening tools supports timely referral for CRT. This steady flow of new patients creates a large base for repeat follow-ups and long-term device use.

·For instance, prevalence data show that the self-reported, diagnosed overall rate of specific severe cardiovascular diseases (heart attack, chronic heart disease, and stroke) among adults aged 45 years and older in India was 5.2% according to one analysis of the Longitudinal Ageing Study in India (2017–2019).

Shift Toward Advanced CRT-D and MRI-Compatible Systems

The shift toward safer and more advanced devices raises adoption across clinical settings. MRI-compatible systems attract strong demand due to the higher number of patients needing imaging during long-term care. CRT-D devices offer more protection by combining pacing and defibrillation, which improves survival in high-risk groups. This dual function strengthens market preference for premium models. Faster regulatory approvals for new designs also support growth. Doctors trust these devices because they reduce imaging limits while improving safety.

- For instance, Medtronic’s Cobalt XT™ MRI CRT-D system lists a device volume of 35 cc and a mass of 82 g, making it suitable for full-body MRI scans at both 1.5 T and 3 T field strengths.

Improved Clinical Outcomes and Expanding Reimbursement Support

Better clinical outcomes encourage wider use of CRT in heart failure treatment. Studies show improved heart function, reduced hospital stays, and higher quality of life after implantation. These gains raise confidence among both doctors and patients. Strong reimbursement policies make therapy more affordable in major markets. Insurance coverage for device placement and follow-up care reduces the financial burden for families. Supportive guidelines from medical bodies also drive higher adoption. These combined factors help the therapy reach more patients each year.

Key Trends & Opportunities

Rising Use of Remote Monitoring and Connected CRT Devices

Connected CRT systems create new growth opportunities as care shifts toward remote monitoring. These tools help doctors track heart rhythm and device function with higher accuracy. Real-time data improves early detection of clinical issues and reduces emergency visits. Many hospitals adopt these systems to support home-based care. This trend improves patient comfort and encourages long-term device use. Higher investment in digital healthcare tools will strengthen this shift.

- For instance, BIOTRONIK’s Home Monitoring® platform demonstrated the ability to detect clinically relevant events a median of 47 days earlier than traditional in-office follow-ups, according to the TRUST clinical study.

Growing Preference for Minimally Invasive Procedures

Minimally invasive CRT implantation attracts interest due to shorter recovery time and lower risk. Hospitals prefer these methods because they help reduce bed occupancy and speed up patient discharge. Patients also choose these procedures because they experience less pain and faster return to normal activity. Better technology and skilled teams support safer and more precise lead placement. This trend will continue to open new opportunities for device makers.

- For instance, Medtronic’s SelectSecure™ 3830 lead—used in conduction system pacing during CRT implantation—has a 4.1-French diameter, enabling implantation through smaller sheaths and contributing to reduced tissue trauma during lead placement.

Expansion of CRT Programs in Developing Regions

Developing markets show rising opportunity as hospitals upgrade cardiac care units. More centers now offer electrophysiology services that support CRT implantation. Governments and private groups invest in training programs to address device shortages. Growing insurance penetration helps patients afford treatment. These combined changes help expand therapy access across wider populations.

Key Challenges

High Device Cost and Limited Access in Low-Resource Settings

High device prices remain a major barrier in many regions. The total cost includes the device, surgery, follow-up visits, and periodic replacement. Many hospitals in low-income areas lack trained specialists or electrophysiology labs. This reduces access for large patient groups. Even with partial reimbursement, families struggle to manage long-term expenses. These gaps slow adoption in developing markets with high disease burden.

Complications Linked to Lead Placement and Device Management

Lead-related issues create challenges for both surgeons and patients. Problems such as lead displacement, infection, or poor electrical contact require repeat procedures. These events increase healthcare costs and patient stress. Device management becomes harder in older adults with multiple health conditions. Some people also fear surgery and delay treatment. These clinical and psychological barriers limit the full reach of CRT therapy.

Regional Analysis

North America

North America holds the largest share at 41% in 2024 due to strong access to advanced cardiac care. Hospitals use CRT-D and MRI-safe devices at high rates. The region benefits from early diagnosis programs and high awareness among older adults. Wide insurance coverage supports steady demand. Many patients receive remote monitoring, which improves long-term care. Large device makers also operate major research units in the United States. This support drives faster adoption of new CRT models. Canada shows stable growth due to rising heart failure cases and improved access to specialty centers.

Europe

Europe captures 32% of the market share, supported by structured cardiac care networks. The region benefits from strong clinical guidelines and early patient referral systems. Germany, France, and the UK lead due to high installation of CRT-D units. Aging populations increase demand for pacing therapy. Reimbursement policies improve patient access and reduce treatment delays. Many hospitals use MRI-compatible systems, which raise safety levels and device preference. Research groups also support clinical trials that validate long-term outcomes. Eastern Europe shows steady growth as cardiac centers upgrade facilities.

Asia-Pacific

Asia-Pacific accounts for 19% of the market, driven by rising heart failure cases and fast healthcare expansion. China and Japan lead due to large patient bases and strong hospital capacity. India shows rapid growth as more cardiac centers adopt electrophysiology services. Awareness programs help patients understand pacing benefits. A growing middle-aged population increases long-term demand. Device makers expand training programs to support skilled teams. New private hospitals also add CRT implantation units. These changes drive stronger adoption across the region.

Latin America

Latin America holds 5% of the market and shows steady expansion as hospitals improve cardiac care. Brazil and Mexico lead due to large populations and rising diagnosis rates. Public and private hospitals add CRT-D and CRT-P services in major cities. Cost remains a barrier in rural areas, but insurance coverage improves access. Training programs support better device management. Growing investment in heart failure treatment raises adoption. The region benefits from partnerships with global device makers. These efforts help more patients receive advanced pacing therapy.

Middle East & Africa

The Middle East & Africa region holds 3% of the market, driven by gradual improvement in specialized cardiac centers. Gulf countries lead due to high investment in advanced hospitals. Awareness programs support higher diagnosis of heart failure. Access improves in urban areas, but rural regions face device shortages. South Africa shows steady growth with expanding electrophysiology services. Partnerships with global firms help train specialists. Rising chronic disease rates support long-term demand. Expansion of private hospitals strengthens adoption of CRT-D and MRI-safe devices.

Market Segmentations:

By Product

- CRT-Pacemakers

- MRI Compatible CRT-P Devices

- Conventional CRT-P Devices

- CRT-Defibrillators

- MRI Compatible CRT-D Devices

- Conventional CRT-D Devices

By Age

- Below 44 years

- 45–64 years

- 65–84 years

- Above 85 years

By End-use

- Hospitals

- Cardiac care centers

- Ambulatory surgical centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Cardiac Resynchronization Therapy market features strong participation from global medical device companies that focus on advanced pacing and defibrillation technologies. Leading players compete through innovation in MRI-compatible CRT-D and CRT-P systems, improved battery life, and enhanced lead performance. Many companies strengthen their market position through continuous product upgrades, clinical evidence, and strong physician training programs. Strategic partnerships with hospitals support wider device adoption and long-term follow-up programs. Firms also invest in remote monitoring platforms that improve patient management and reduce hospital visits. Competition intensifies as manufacturers introduce smaller, more efficient devices aimed at improving implant precision and patient comfort. Expanding geographic reach, particularly in Asia-Pacific and Latin America, remains a key priority for most companies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Boston Scientific Corporation

- Medico S.p.A

- Abbott Laboratories

- Microport Scientific Corporation

- LivaNova PLC

- Medtronic PLC

- Biotronik

Recent Developments

- In November 2024, Boston Scientific also entered into a definitive agreement to acquire Cortex, Inc. (an Ajax Health company) to strengthen its electrophysiology portfolio.

- In February 2024, MicroPort also announced the launch of its GALI™ SonR® CRT-D device with NAVIGO 4LV pacing leads in Japan.

Report Coverage

The research report offers an in-depth analysis based on Product, Age, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for CRT-D devices will rise as more high-risk patients get early diagnosis.

- MRI-compatible CRT systems will gain wider use due to increased imaging needs.

- Remote monitoring will expand as hospitals adopt connected care platforms.

- Minimally invasive implantation methods will improve patient recovery times.

- Device makers will focus on longer battery life and improved lead durability.

- Adoption will grow in Asia-Pacific as cardiac centers expand electrophysiology capacity.

- Training programs will increase to support skilled CRT implantation teams.

- Reimbursement support will strengthen access in both developed and developing regions.

- Integration of AI-driven rhythm monitoring will improve long-term outcomes.

- Smaller and more ergonomic devices will enhance patient comfort and acceptance.