Market Overview:

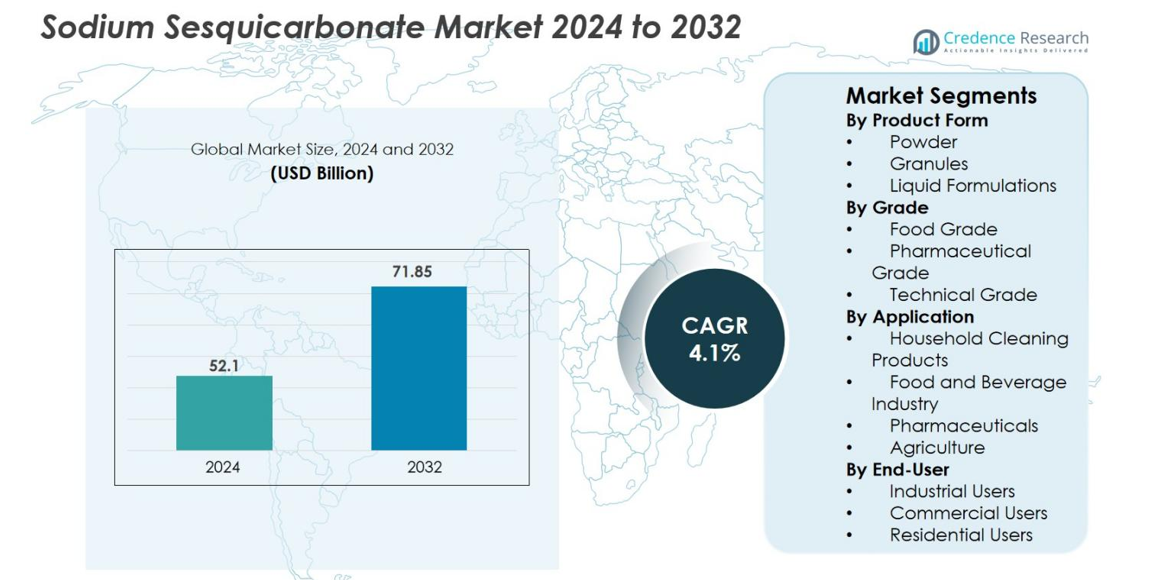

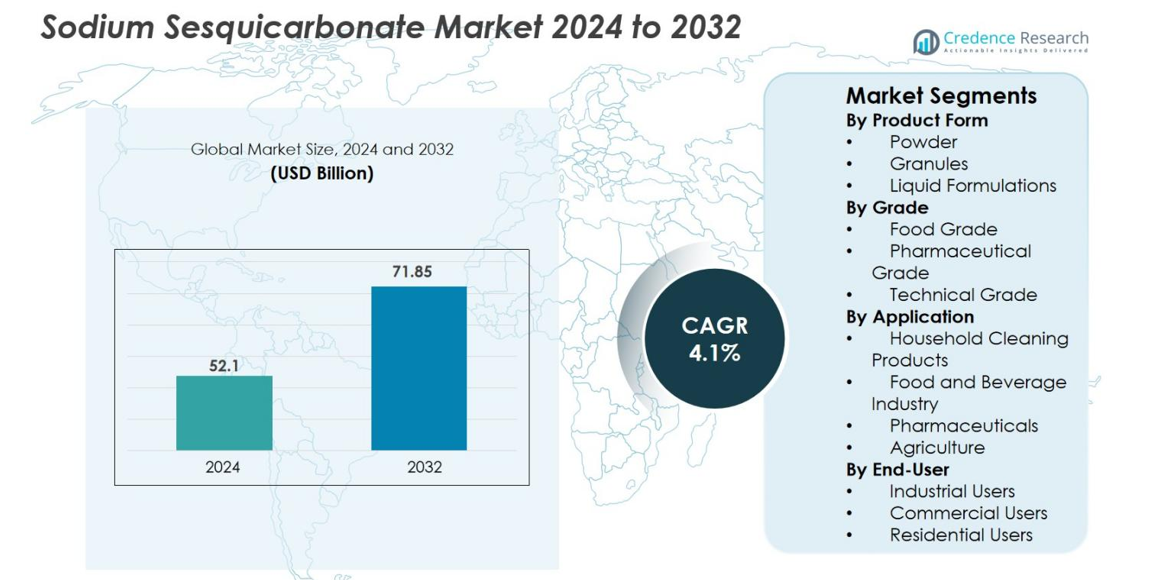

The Sodium Sesquicarbonate market size was valued at USD 52.1 billion in 2024 and is anticipated to reach USD 71.85 billion by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sodium Sesquicarbonate Market Size 2024 |

USD 52.1 billion |

| Sodium Sesquicarbonate Market, CAGR |

4.1% |

| Sodium Sesquicarbonate Market Size 2032 |

USD 71.85 billion |

The Sodium Sesquicarbonate market is characterized by key players such as Solvay, Tronox Limited, East Lancashire Chemical Co. Ltd., Destiny Chemicals, Ennore India Chemicals, and Akshar Exim Pvt. Ltd. These companies are primarily focused on expanding their production capacities, developing specialized product grades, and improving their global distribution networks. North America dominates the market with a share of approximately 36.3%, driven by a well-established industrial infrastructure and high demand from end-use sectors, including household cleaning, food and beverage, and pharmaceuticals. In addition, the market sees increasing adoption of eco-friendly and sustainable solutions, particularly in agriculture, which further drives demand. The growing focus on specialty applications and regional expansions by leading players is expected to support market growth throughout the forecast period.

Market Insights

- The global Sodium Sesquicarbonate market size was valued at USD 52.1 billion in 2025 and is projected to reach USD 71.85 billion by 2032, representing a CAGR of 4.1%.

- Rising demand in cleaning agents, water treatment, and industrial applications drives the market, with the industrial-grade segment accounting for about 69.0% share in 2025.

- A key trend involves the shift toward eco-friendly and clean-label ingredients, supporting growth in food and beverage and household cleaning applications, where the detergents & cleaners segment holds roughly 45.1% share in 2025.

- Competitive analysis shows several major regional and global producers expanding capacity and product grades to address competitive pressure and substitution risk, particularly as North America leads the market with about 36.3% share.

- Market restraints include raw material price volatility and stringent regulatory oversight, which could hamper margin stability and slow adoption of new end-use applications across regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product Form

The Sodium Sesquicarbonate market is segmented by product form into powder, granules, and liquid formulations. Among these, the powder form dominates the market, holding the largest share of 50%. This dominance is attributed to the powder’s versatility, cost-effectiveness, and efficient application in household cleaning products and industrial processes. The powder form is favored due to its ease of handling, storage, and its widespread use in various cleaning and chemical formulations, driving the growth of this sub-segment.

- For instance, Independent Chemical Corporation markets its Sesqui™ brand sodium sesquicarbonate as a free‑flowing crystal powder suitable for household and industrial cleaning—offering annual consumption quotations in units such as tons, kilograms, or ounces

By Grade

Sodium Sesquicarbonate is available in food grade, pharmaceutical grade, and technical grade forms. The food grade sub-segment leads the market with an estimated share of 45%. This is driven by the growing demand for food-safe ingredients in the food and beverage industry, where it is used as a leavening agent and pH regulator. As consumer preferences shift toward natural and safe ingredients, the food-grade segment continues to expand, further solidifying its dominant position within the overall market.

- For instance, Spectrum Chemical lists sodium sesquicarbonate with molecular weight 226.03 g/mol (CAS 533‑96‑0) and indicates that all its products “meet or exceed the grade requirements” for specified applications including food & beverage.

By Application

The major applications of Sodium Sesquicarbonate include household cleaning products, food and beverage industry, pharmaceuticals, and agriculture. The household cleaning products segment holds the largest share, 40%, fueled by the rising demand for eco-friendly and effective cleaning solutions. With increased awareness of environmental sustainability and hygiene practices, the household cleaning segment continues to grow, driven by consumer preferences for safe, non-toxic products in both residential and commercial sectors.

Key Growth Drivers

Increasing Demand for Eco-Friendly Cleaning Products

The growing preference for environmentally friendly cleaning products is one of the key drivers of the Sodium Sesquicarbonate market. As consumers become more conscious of the environmental impact of traditional chemical cleaners, there is a shift toward using safer, non-toxic alternatives. Sodium Sesquicarbonate, as a naturally derived compound, fits perfectly into this trend due to its effectiveness as a cleaner and deodorizer without harming the environment. The rising awareness of sustainability and the adoption of green cleaning products in both residential and commercial sectors are propelling the demand for Sodium Sesquicarbonate-based formulations. Moreover, the regulatory push for greener product formulations across various regions has spurred growth in the market. The compound’s increasing use in household cleaning items, industrial cleaners, and personal care products further reinforces its position as a preferred ingredient in eco-conscious product lines.

- For instance, Down Under Wash Co., an Australian laundry‑care brand, uses sodium sesquicarbonate as the “magic ingredient” in its stain‑remover powder. The brand highlights that the compound is mined from natural trona and that their packaging is home‑compostable.

Expansion of the Food and Beverage Industry

The growth of the global food and beverage industry is a significant driver for the Sodium Sesquicarbonate market. This compound is widely used as a leavening agent, pH regulator, and buffering agent in various food products. With increasing consumer demand for processed and convenience foods, the food-grade segment of Sodium Sesquicarbonate has witnessed notable growth. Additionally, the rising trend of health-conscious consumers has spurred the demand for food products with natural ingredients, thus driving the adoption of Sodium Sesquicarbonate in food formulations. As food manufacturers expand their product offerings globally and cater to changing dietary preferences, there is an increasing need for Sodium Sesquicarbonate to maintain food safety and quality. The rising popularity of plant-based and organic foods also contributes to this trend, as Sodium Sesquicarbonate is a preferred ingredient in clean-label formulations.

- For instance, distributor Independent Chemical Corporation lists their “Sesqui™” sodium sesquicarbonate product (CAS 533‑96‑0) and states it is supplied for food & beverage, meat & baking, and processed food applications—signalling this compound’s role in food processing formulations.

Growth of the Pharmaceutical Sector

The pharmaceutical industry is experiencing rapid growth, driven by advancements in healthcare and an aging population worldwide. Sodium Sesquicarbonate, known for its buffering and pH-regulating properties, plays an essential role in the production of pharmaceuticals, particularly in the formulation of effervescent tablets, antacids, and other drug delivery systems. The increasing demand for over-the-counter medications and the expansion of pharmaceutical manufacturing capacities globally are contributing to the growing need for high-quality Sodium Sesquicarbonate. The compound’s application in the pharmaceutical sector is further boosted by its non-toxic, safe nature, which makes it suitable for use in a wide range of pharmaceutical products. Additionally, the rise of personalized medicine and specialized formulations is expected to drive the continued demand for Sodium Sesquicarbonate in the healthcare and pharmaceutical markets.

Key Trends & Opportunities

Rising Preference for Natural and Clean Ingredients

One of the most prominent trends in the Sodium Sesquicarbonate market is the growing consumer preference for natural and clean ingredients, particularly in the food and beverage, cleaning, and pharmaceutical industries. As the trend toward organic, plant-based, and non-toxic products accelerates, there is a notable shift away from synthetic chemicals in favor of naturally sourced alternatives like Sodium Sesquicarbonate. This presents a significant opportunity for manufacturers to meet the increasing demand for green and sustainable products by incorporating Sodium Sesquicarbonate into their formulations. As regulatory standards tighten around ingredient transparency, the demand for clean-label products is expected to further grow, offering manufacturers the chance to innovate with eco-friendly and natural compounds. By leveraging Sodium Sesquicarbonate’s natural properties, companies can tap into the expanding market of environmentally conscious consumers and meet evolving market demands.

- For instance, Independent Chemical Corporation’s brand Sesqui™ (CAS 533‑96‑0) is described as a single‑crystalline sodium sesquicarbonate material “free‑flowing and dust‑free” used in household cleaning, personal care, and specialty cleaning formulations.

Development of Advanced Agricultural Applications

The growing interest in sustainable agriculture presents a significant opportunity for Sodium Sesquicarbonate. In agriculture, the compound is used for its ability to neutralize acidity in soils, making it an effective agent for maintaining soil health and enhancing crop yields. With the global push towards sustainable farming practices and the increasing adoption of organic farming methods, the demand for eco-friendly agricultural inputs like Sodium Sesquicarbonate is poised for growth. Additionally, the need for soil amendments to counteract the adverse effects of over-farming, acid rain, and high soil salinity further supports the compound’s use in agriculture. As governments worldwide push for more sustainable agricultural practices, the opportunity to use Sodium Sesquicarbonate as a natural, non-toxic solution in farming continues to expand.

- For instance, a study in the Indian Journal of Dairy Science added sodium sesquicarbonate up to 3 % (of substrate) in in‑vitro rumen fermentation tests (for livestock feed) and found no significant effect on in‑vitro dry matter (DM) digestibility or organic matter digestibility.

Key Challenges

Fluctuating Raw Material Prices

A key challenge facing the Sodium Sesquicarbonate market is the fluctuating prices of raw materials required for its production. The price of sodium carbonate and other essential ingredients can vary significantly depending on factors such as supply chain disruptions, geopolitical instability, and changes in raw material availability. These fluctuations can impact the overall production cost of Sodium Sesquicarbonate, which, in turn, affects the pricing of end products. Manufacturers may face difficulties in maintaining stable production costs, particularly when the cost of raw materials rises unexpectedly. To mitigate this challenge, companies may need to invest in supply chain diversification, long-term contracts, or even look into alternative raw material sources, though these strategies may add further complexities to production and pricing strategies.

Regulatory and Compliance Challenges

As Sodium Sesquicarbonate is used in various industries, including food, pharmaceuticals, and household products, manufacturers face increasing regulatory scrutiny across different regions. Compliance with varying local, national, and international regulations regarding ingredient transparency, safety standards, and environmental impact can be complex and costly. For instance, the food-grade Sodium Sesquicarbonate must adhere to strict guidelines set by regulatory bodies such as the FDA and EFSA, while its use in pharmaceuticals must meet the stringent standards established by health authorities. Navigating these regulations, along with the potential for sudden changes in policy, poses a significant challenge for manufacturers seeking to expand their market presence. Meeting these requirements often involves additional certification processes and investments in testing and quality assurance, impacting profitability and time-to-market for new products.

Regional Analysis

North America

North America holds a significant share of the Sodium Sesquicarbonate market, driven by its well-established food and beverage industry, as well as the growing demand for eco-friendly cleaning products. The region’s robust consumer preference for sustainable and natural ingredients in household and industrial products further fuels market growth. The U.S. dominates the market, accounting for over 40% of the region’s share, and the North American market overall represents 30% of the global market share in 2024. The pharmaceutical sector’s growth also contributes to the rise in demand, supported by increasing green product formulations.

Europe

Europe represents a key market for Sodium Sesquicarbonate, with significant demand across various applications such as food processing, cleaning products, and agriculture. The region’s strict regulatory framework and rising consumer awareness regarding sustainability have boosted the adoption of eco-friendly and natural ingredients. The European market holds 25% of the global share, with countries like Germany, France, and the UK driving demand. The increasing popularity of organic farming and clean-label food products is further accelerating market growth, particularly in Western Europe, where environmentally-conscious consumer trends are more prominent.

Asia-Pacific

The Asia-Pacific region is expected to witness the highest growth in the Sodium Sesquicarbonate market due to rapid industrialization, population growth, and rising disposable incomes. China, India, and Japan are the leading contributors to this growth, with expanding food and beverage sectors and increasing use of Sodium Sesquicarbonate in agriculture. The region’s market share is estimated to reach over 30% by 2032. The demand for sustainable and eco-friendly products is also gaining traction in countries like South Korea and Australia, further boosting market opportunities. Government support for sustainable farming practices is expected to drive continued growth.

Latin America

Latin America is experiencing steady growth in the Sodium Sesquicarbonate market, driven by an expanding food and beverage industry and increasing awareness of environmental sustainability. Brazil, Mexico, and Argentina are key contributors to the market’s expansion in the region. The growing adoption of eco-friendly cleaning solutions and the rising demand for natural food additives contribute to the regional market’s growth. Latin America is estimated to account for around 10% of the global market share, with prospects for further growth driven by increased consumer preference for green and sustainable products across the region.

Middle East & Africa

The Middle East and Africa (MEA) region shows a moderate but steady demand for Sodium Sesquicarbonate, with growth driven by agricultural applications, particularly in soil amendments and improving water quality. The region’s increasing focus on sustainability, as well as the expansion of food production, contributes to the rising demand. Saudi Arabia, the UAE, and South Africa are leading markets, with Sodium Sesquicarbonate used in both industrial and agricultural sectors. The MEA region is expected to capture around 5% of the global market share, with agricultural and environmental sustainability initiatives fueling its growth prospects.

Market Segmentations

By Product Form

- Powder

- Granules

- Liquid Formulations

By Grade

- Food Grade

- Pharmaceutical Grade

- Technical Grade

By Application

- Household Cleaning Products

- Food and Beverage Industry

- Pharmaceuticals

- Agriculture

By End-User

- Industrial Users

- Commercial Users

- Residential Users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

In the competitive landscape of the Sodium Sesquicarbonate market, leading players such as Solvay, Tronox Limited, East Lancashire Chemical Co. Ltd., Destiny Chemicals, Ennore India Chemicals and Akshar Exim Pvt. Ltd. are actively distinguishing themselves through strategic moves such as capacity expansion, product‑grade diversification, and geographic footprint enhancement. These firms are investing in R&D to develop advanced formulations with environmentally friendly profiles and improved performance, especially for cleaning, food and water‑treatment applications. They are also forging partnerships and acquisitions to secure raw‐material supply, optimise logistics and access underserved regional markets. Meanwhile, competitive pressure from regional and low‑cost producers is driving aggressive pricing strategies, which in turn compels the major players to emphasise operational efficiency and value‑added services to maintain margin and market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Solvay

- Tronox Limited

- East Lancashire Chemical Co. Ltd.

- Destiny Chemicals

- Ennore India Chemicals

- Akshar Exim Pvt. Ltd.

- Tata Chemicals Europe

- FMC Corporation

- Xingrui Industry Co., Ltd.

- CDH Fine Chemical

Recent Developments

- In March 2025, WE Soda Ltd (an affiliate of Ciner Enterprises Inc.) acquired Genesis Alkali, the largest US‑based natural soda ash producer, which increases WE Soda’s production capacity to ~9.5 million metric tonnes per year.

- In October 2024, WE Soda acquired a controlling interest in Iberian distributor SAISA Group to establish a new joint‑venture “Soda World Iberia” for distribution of soda ash & sodium bicarbonate across Spain and Portugal.

Report Coverage

The research report offers an in-depth analysis based on Product Form, Grade, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market for sodium sesquicarbonate is projected to grow steadily over the next decade as demand expands.

- Increased use in eco‑friendly cleaning formulations and water treatment applications will drive broad‑based adoption across industrial and consumer sectors.

- Rise in clean‑label food and beverage products will stimulate demand for food‑grade sodium sesquicarbonate as a pH regulator and leavening agent.

- Growth in pharmaceutical and specialty chemical applications will open higher‑value opportunities for premium grades of sodium sesquicarbonate.

- Rapid industrialisation and urbanisation in Asia‑Pacific will push regional demand, making Asia‑Pacific a key focus for expansion.

- Technological advancements in production and cost optimisation will enable manufacturers to improve margins and scale operations.

- Global supply‑chain diversification will become essential as manufacturers seek to hedge raw‑material volatility and minimise logistic risks.

- Stringent environmental regulations and increasing preference for non‑toxic chemistries will favour sodium sesquicarbonate over traditional alkaline agents.

- However, substitution risk from alternative chemicals and pricing pressure from low‑cost producers may curtail growth momentum.

- Strategic partnerships, mergers and acquisitions among leading players will shape future competitive dynamics and drive market consolidation.