Market Overview:

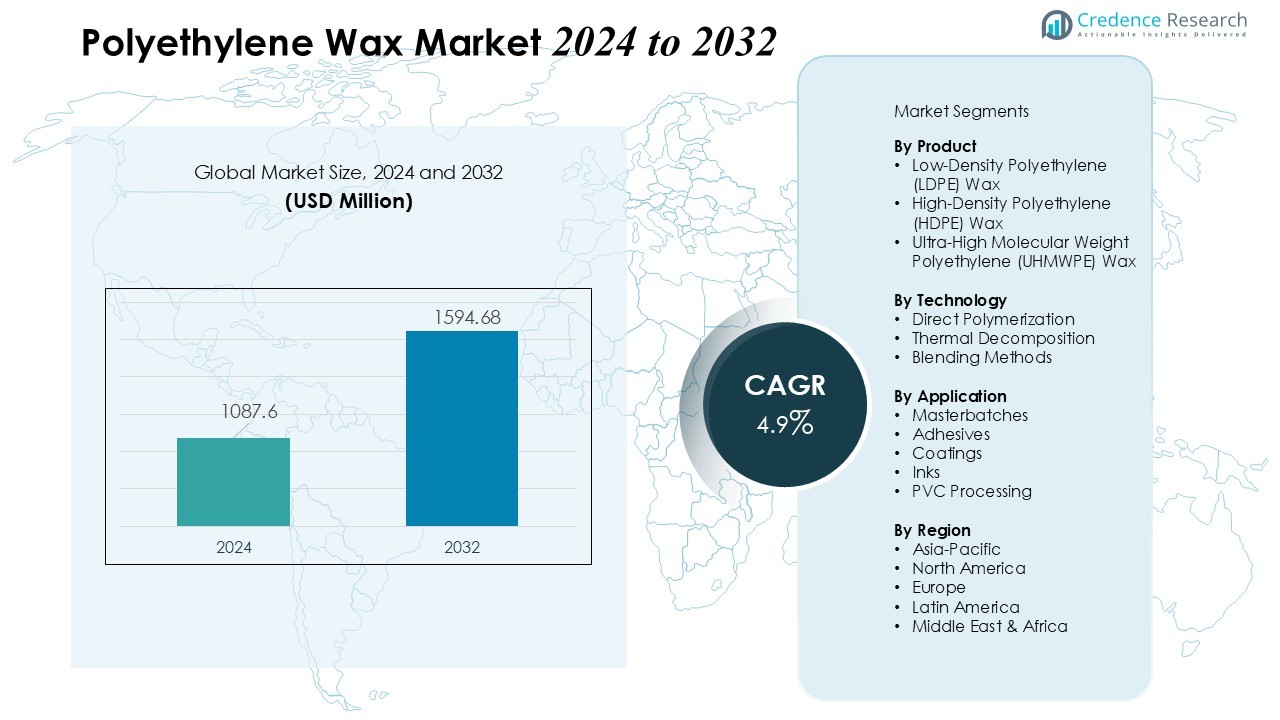

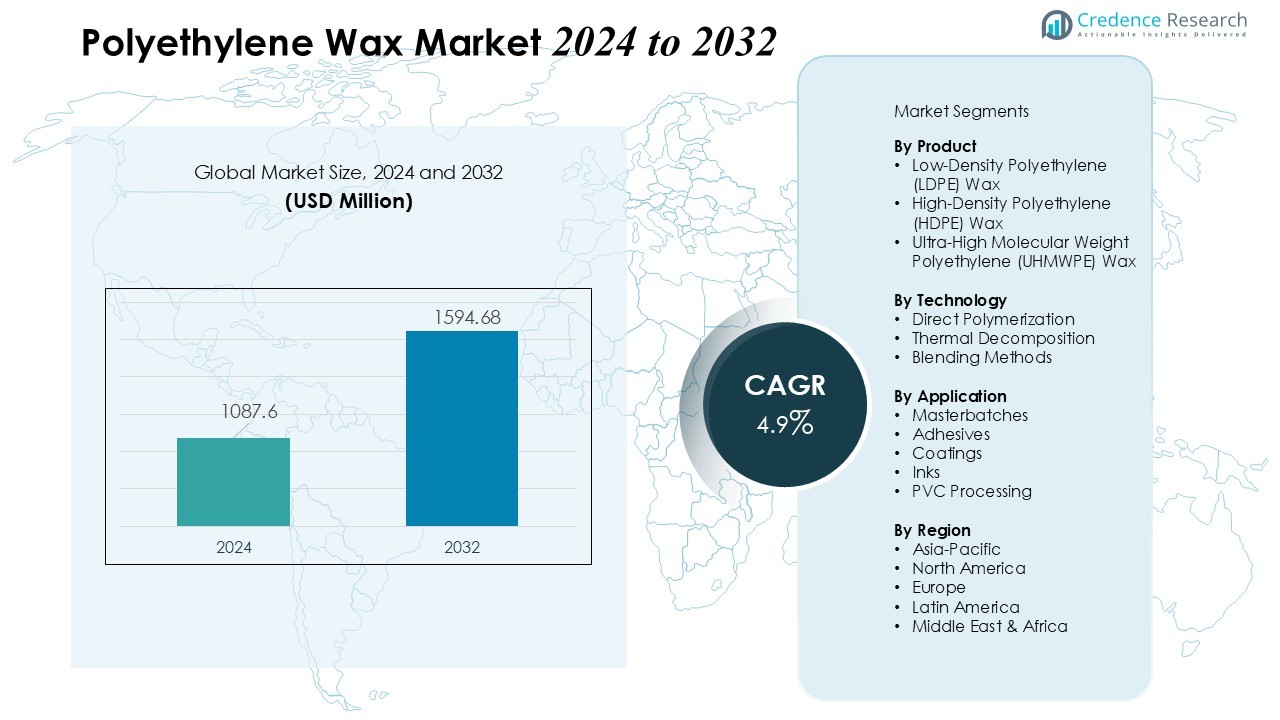

The Polyethylene Wax Market size was valued at USD 1087.6 million in 2024 and is anticipated to reach USD 1594.68 million by 2032, at a CAGR of 4.9% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyethylene Wax Market Size 2024 |

USD 1087.6 Million |

| Polyethylene Wax Market, CAGR |

4.9% |

| Polyethylene Wax Market Size 2032 |

USD 1594.68 Million |

Key market drivers include the expanding use of PE wax in masterbatches, hot-melt adhesives, and PVC processing, driven by the rising need for improved dispersion, scratch resistance, and processing performance. Rapid advancements in polymer modification and the growing trend toward high-performance, cost-effective additives further support market expansion. Additionally, the shift toward environmentally friendly and energy-efficient manufacturing practices fuels demand for engineered PE wax grades with superior compatibility and reduced emissions.

Regionally, Asia-Pacific dominates the global market, supported by its strong manufacturing base, expanding plastics industry, and rising industrial output in China, India, and Southeast Asia. North America and Europe represent mature yet stable markets, with demand driven by technological innovation and increased adoption of specialty waxes across packaging, automotive, and coatings sectors. Emerging markets in Latin America and the Middle East also show promising growth due to expanding industrial infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Polyethylene Wax Market was valued at USD 1087.6 million in 2024 and is projected to reach USD 1594.68 million by 2032, growing at a CAGR of 4.9% during the forecast period. Rising industrial demand, especially in masterbatches, adhesives, and PVC processing, drives steady expansion.

- High-performance plastics and coatings fuel market growth, as polyethylene wax enhances scratch resistance, gloss, and lubrication in PVC, polyethylene, and polypropylene. Its role in improving process efficiency and product quality strengthens adoption across automotive, packaging, and construction sectors.

- Expanding applications in adhesives, sealants, and masterbatches support consistent demand. It improves dispersion, thermal stability, and flow properties, enabling manufacturers to maintain uniform quality. Growing end-use industries and hot-melt adhesive consumption reinforce market potential.

- Asia-Pacific dominates consumption with 45% of global demand, driven by industrial expansion in China, India, and Japan. North America contributes 30% with strong adoption in specialty applications, while Europe and Latin America collectively hold 25%, supported by automotive, packaging, and construction demand.

- Challenges include raw material price volatility and regulatory compliance pressures, which affect production costs and operational efficiency. It requires strategic sourcing, sustainable production, and innovation to balance performance, cost, and environmental standards while capitalizing on industrial growth in developing regions.

Market Drivers:

Market Drivers:

Rising Demand for High-Performance Plastics and Coatings

The demand for high-performance plastics and coatings significantly drives the Polyethylene Wax Market. It enhances the surface properties of plastics, providing improved scratch resistance, gloss, and lubrication during processing. Manufacturers incorporate it into PVC, polyethylene, and polypropylene formulations to achieve superior durability and process efficiency. Increasing adoption of advanced coatings in automotive, packaging, and construction industries strengthens its market penetration. Its role in reducing processing defects and improving product quality remains critical for manufacturers.

- For instance, Envalior’s Tepex Dynalite glass fiber-reinforced polypropylene laminates in a roof cap design for a premium German automotive convertible achieved low weight and enhanced safety through sandwich architecture.

Expanding Applications in Adhesives and Masterbatches

Polyethylene wax finds extensive use in adhesives, sealants, and polymer masterbatches, supporting steady market growth. It improves dispersion, thermal stability, and flow properties of compounds, enabling manufacturers to produce consistent high-quality products. Rising demand for hot-melt adhesives in packaging and construction fuels its application. It also assists in modifying the surface properties of pigments and fillers in masterbatches. Growing end-use industries benefit from its multifunctional performance, promoting broader adoption.

- For instance, in the hot-melt adhesive segment, the wax acts as a key viscosity modifier and performance enhancer, contributing to an estimated market consumption of around 500 million units, underscoring its crucial role in adhesive efficiency and reliability.

Focus on Industrial Efficiency and Cost Reduction

Industrial manufacturers increasingly utilize polyethylene wax to optimize production efficiency and reduce operational costs. It lowers energy consumption during polymer processing by reducing friction and improving flow. The additive helps minimize waste and processing time while enhancing output quality. It is widely applied in extrusion, molding, and calendaring processes to maintain consistent performance. Companies prioritize its use to improve profitability and maintain competitive advantage.

Emerging Demand from Developing Economies

Rapid industrialization and urbanization in developing economies drive regional growth of polyethylene wax. Rising automotive production, packaging demand, and construction activities increase the need for high-performance additives. It supports manufacturers in producing durable and reliable products that meet quality standards. Expanding industrial infrastructure in Asia-Pacific, Latin America, and the Middle East creates new opportunities. Increased investment in manufacturing capacity ensures sustainable market expansion.

Market Trends:

Shift Towards Specialty and Functional Polyethylene Waxes for Advanced Applications

The Polyethylene Wax Market is witnessing a notable trend toward the development and adoption of specialty and functional wax grades. It offers tailored properties such as controlled melt viscosity, enhanced thermal stability, and improved compatibility with polymers and additives. Manufacturers focus on creating high-performance waxes for use in adhesives, masterbatches, coatings, and inks to meet stringent industry requirements. The shift supports end-users in producing durable, high-quality products while optimizing process efficiency. Growing demand from automotive, electronics, and packaging sectors accelerates the need for customized solutions. Suppliers invest in research and development to introduce innovative wax formulations that deliver multifunctional benefits.

- For instance, polyethylene waxes improve pigment dispersion and wear resistance in coatings and inks, contributing to strong growth in specialized formulations used specifically for automotive and industrial protective coatings.

Integration of Sustainable and Eco-Friendly Polyethylene Wax Solutions

Sustainability trends strongly influence the Polyethylene Wax Market, driving the adoption of environmentally friendly and low-emission waxes. It includes the introduction of bio-based polyethylene wax and recycled polymer-derived waxes that reduce environmental impact. Manufacturers implement energy-efficient production techniques to lower carbon footprint and comply with regulatory standards. Increasing consumer preference for sustainable packaging and products encourages its use across multiple industries. Companies emphasize product innovation to combine performance with ecological responsibility. Growing environmental awareness and government policies promoting green manufacturing continue to shape market dynamics.

- For instance, Clariant introduced a bio-based polyethylene wax derived from renewable sources, achieving 100% renewability while maintaining performance standards equivalent to conventional waxes.

Market Challenges Analysis:

Volatility in Raw Material Prices Affecting Production Costs

The Polyethylene Wax Market faces challenges due to fluctuations in raw material prices, particularly petroleum-based feedstocks. It directly impacts production costs and profit margins for manufacturers. Sudden price increases create uncertainty in supply contracts and can slow market growth. Smaller producers struggle to maintain competitive pricing while ensuring consistent product quality. High dependency on petrochemical derivatives limits flexibility in cost management. Companies must adopt strategic sourcing and efficient production methods to mitigate financial risks. Market players invest in supply chain optimization to maintain stability amid price volatility.

Regulatory Compliance and Environmental Concerns Limiting Adoption

Stringent environmental regulations and compliance requirements pose significant hurdles for the Polyethylene Wax Market. It must meet strict emission and safety standards in manufacturing and end-use applications. Regulatory pressure increases operational complexity and compliance costs for producers. Manufacturers face challenges in developing high-performance waxes that align with sustainability mandates. Limited availability of eco-friendly alternatives can restrict adoption in certain sectors. Companies must innovate to balance performance, cost, and environmental responsibility. Regulatory alignment remains a critical factor influencing market expansion.

Market Opportunities:

Expansion of Applications in Emerging Industrial Sectors

The Polyethylene Wax Market presents significant opportunities through its expanding use in emerging industrial sectors. It supports performance enhancement in adhesives, coatings, masterbatches, and inks, enabling manufacturers to meet evolving industry demands. Growth in automotive, packaging, and electronics industries drives increased adoption of high-performance waxes. Rising infrastructure development and industrialization in Asia-Pacific, Latin America, and the Middle East create new avenues for market expansion. Companies can leverage these trends by offering tailored wax solutions for specialized applications. Innovation in product formulation enhances versatility and widens end-use potential.

Development of Sustainable and Bio-Based Wax Alternatives

Sustainability initiatives offer considerable growth prospects for the Polyethylene Wax Market. It enables manufacturers to produce bio-based and recycled waxes that align with environmental regulations and consumer demand for eco-friendly products. Investment in green manufacturing techniques and low-emission production strengthens market credibility. Eco-conscious end-users increasingly prefer sustainable wax alternatives across packaging, plastics, and coatings industries. Suppliers focusing on research and development of functional, environmentally responsible waxes gain a competitive edge. Expanding awareness of environmental impact encourages wider adoption and long-term market growth.

Market Segmentation Analysis:

By Product

The Polyethylene Wax Market is categorized into low-density polyethylene (LDPE) wax, high-density polyethylene (HDPE) wax, and ultra-high molecular weight polyethylene (UHMWPE) wax. LDPE wax dominates due to its excellent dispersibility, lubrication properties, and compatibility with PVC, coatings, and adhesives. HDPE wax gains traction in applications requiring higher thermal stability and hardness, including masterbatches and molding compounds. UHMWPE wax serves specialized applications requiring superior wear resistance and low friction. Product segmentation enables manufacturers to tailor wax grades to specific performance requirements, optimizing application efficiency.

- For instance, Clariant’s Licolub PED 1316 enables higher recycled PVC loadings with balanced acid-number ranges for improved adhesion and surface finish.

By Technology

Production technologies in the Polyethylene Wax Market include direct polymerization, thermal decomposition, and blending methods. Direct polymerization provides consistent quality with controlled molecular weight, supporting high-performance applications. Thermal decomposition techniques offer tailored viscosity and melting characteristics suitable for coatings and adhesives. Blending methods combine different wax grades to enhance functional properties such as dispersion, lubrication, and scratch resistance. Technological choice impacts product quality, process efficiency, and end-use performance, driving adoption across industries.

- For instance, a patented process (e.g., US Patent 4,260,548 A) used in equipment by Parr Instrument Co. uses incremental free radical catalyst addition at high pressures (e.g., 2000 psi) and temperatures of 130-150°C to yield polyethylene wax with a typical melting point range of 100-130°C and a density of approximately 0.91 to 0.94 g/cm³

By Application

The market applications include masterbatches, adhesives, coatings, inks, and PVC processing. Masterbatches and PVC processing represent significant consumption due to demand for improved dispersion, gloss, and processing performance. Adhesives and coatings benefit from enhanced thermal stability, flow properties, and scratch resistance. Inks utilize polyethylene wax to improve surface smoothness and printability. Expanding industrial demand in automotive, packaging, and construction supports broader adoption across applications. It plays a critical role in improving product quality and operational efficiency across diverse sectors.

Segmentations:

By Product

- Low-Density Polyethylene (LDPE) Wax

- High-Density Polyethylene (HDPE) Wax

- Ultra-High Molecular Weight Polyethylene (UHMWPE) Wax

By Technology

- Direct Polymerization

- Thermal Decomposition

- Blending Methods

By Application

- Masterbatches

- Adhesives

- Coatings

- Inks

- PVC Processing

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Leads Global Consumption

Asia-Pacific commands the largest portion of the Polyethylene Wax Market, representing 45% of global demand. High industrial and manufacturing activity in automotive, packaging, electronics, and construction sectors drives this dominance. Countries like China, India, and Japan contribute significantly through extensive production of plastics and coatings. Rising urbanization and infrastructure development further boost growth. Regional manufacturers focus on introducing innovative wax grades to meet diverse end-use requirements. Investments in advanced production facilities strengthen the region’s competitive position.

North America Holds a Key Position

North America captures 30% of the global Polyethylene Wax Market, driven by strong adoption in adhesives, coatings, masterbatches, and PVC processing. The United States and Canada lead consumption due to established industrial bases and stringent regulatory frameworks. Manufacturers prioritize quality and compliance to satisfy environmental and safety standards. Research and development efforts enhance product performance for specialized applications. Companies leverage these capabilities to maintain steady regional growth.

Growth Opportunities in Europe and Latin America

Europe and Latin America together account for 25% of the global Polyethylene Wax Market. Demand expands in automotive, packaging, and construction industries, supported by innovation and compliance with regulatory standards. Germany, France, and Italy drive European consumption, while Brazil and Mexico lead in Latin America. Manufacturers focus on sustainable wax solutions to meet environmental requirements and consumer preferences. Expanding industrial infrastructure and adoption of high-performance additives provide opportunities for long-term growth.

Key Player Analysis:

- Clariant AG

- Eastman Chemical Company

- Honeywell International Inc.

- LyondellBasell Industries N.V.

- BASF SE

- Sinopec Shanghai Petrochemical Co., Ltd.

- Mitsui Chemicals, Inc.

- Adeka Corporation

- Japan Polychem Corporation

- Paramelt N.V.

- Michem Ltd.

- BYK-Chemie GmbH

Competitive Analysis:

The Polyethylene Wax Market features a competitive landscape with a mix of global chemical giants and specialized regional manufacturers. Leading players focus on product innovation, high-performance wax grades, and sustainable solutions to differentiate in the market. It emphasizes research and development to develop waxes with improved thermal stability, dispersion, and compatibility for diverse applications such as adhesives, coatings, and masterbatches. Strategic partnerships, mergers, and expansions enable companies to strengthen regional presence and supply chain efficiency. Companies also invest in eco-friendly and bio-based wax alternatives to align with regulatory standards and growing sustainability demand. Competitive pricing, consistent quality, and customized solutions remain critical factors for maintaining market leadership. Market players leverage advanced production technologies and tailored applications to address evolving industry requirements and sustain growth in dynamic regional and global markets.

Recent Developments:

- In November 2025, Clariant announced a joint venture with FUHUA to develop novel flame retardants, advancing safer, halogen-free flame-retardant systems in partnership with companies like Schneider Electric.

- In October 2025, ADEKA announced plans to expand global sales of TRANSPAREX™, targeting a market size increase to over 50 billion yen by fiscal 2030 and a market share exceeding 60%, up from 14% in 2024.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product, Technology, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Polyethylene Wax Market will experience sustained growth driven by expanding applications in adhesives, coatings, masterbatches, and PVC processing.

- It will benefit from increasing demand for high-performance plastics with enhanced surface properties, scratch resistance, and thermal stability.

- Emerging industrial sectors in Asia-Pacific, Latin America, and the Middle East will provide significant growth opportunities.

- Innovation in specialty and functional wax grades will support adoption in automotive, packaging, electronics, and construction industries.

- Sustainable and bio-based polyethylene wax solutions will gain traction due to environmental regulations and consumer preference for eco-friendly products.

- It will play a key role in improving manufacturing efficiency, reducing energy consumption, and optimizing production processes.

- Growing industrialization and infrastructure development in developing economies will create new demand for high-performance wax additives.

- Manufacturers will increasingly focus on R&D to enhance product performance, compatibility, and multifunctional properties.

- Market players will expand production capacities and strategic partnerships to strengthen regional presence and supply chain resilience.

- It will continue to evolve with technological advancements, regulatory alignment, and the adoption of innovative, application-specific wax solutions across multiple industries.

Market Drivers:

Market Drivers: