Market Overview:

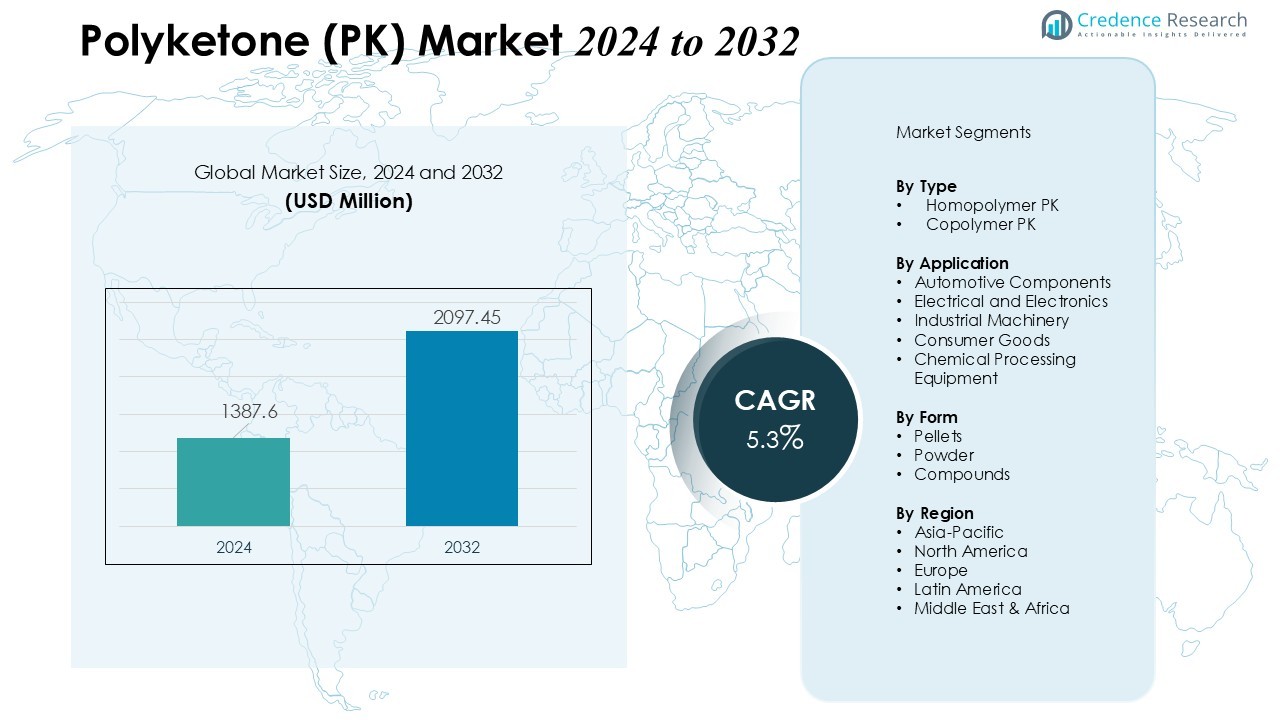

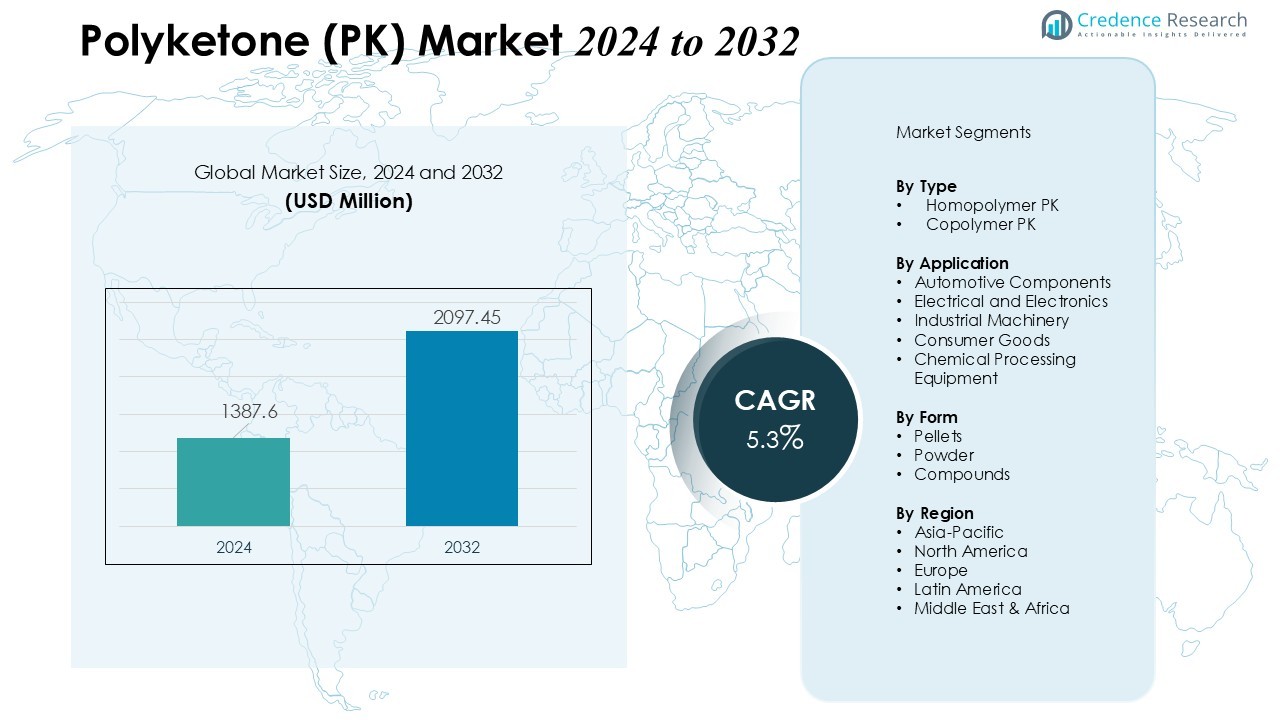

The Polyketone (PK) Market size was valued at USD 1387.6 million in 2024 and is anticipated to reach USD 2097.45 million by 2032, at a CAGR of 5.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyketone (PK) Market Size 2024 |

USD 1387.6 Million |

| Polyketone (PK) Market, CAGR |

5.3% |

| Polyketone (PK) Market Size 2032 |

USD 2097.45 Million |

Key drivers shaping market growth include increasing demand from the automotive sector, where PK enhances fuel system components, gears, and under-the-hood applications due to its durability and wear resistance. Expanding use in consumer electronics and industrial machinery further supports consumption, as manufacturers prioritize polymers that deliver high performance under demanding operating conditions. Additionally, its low environmental impact and recyclability align with global sustainability initiatives, strengthening its market penetration.

Regionally, Asia Pacific secures the largest share, supported by strong manufacturing bases, rising automotive production, and expanding electronics industries in China, Japan, and South Korea. Europe maintains significant adoption driven by stringent environmental regulations and a mature automotive sector. North America continues to grow steadily, supported by advanced industrial capabilities and increasing focus on high-performance polymer solutions.

Market Insights:

Market Insights:

- The Polyketone (PK) Market records USD 1387.6 million in 2024 and is forecast to reach USD 2097.45 million by 2032 at a CAGR of 5.3%, supported by rising adoption across high-performance end-use industries.

- Automotive manufacturers increase PK integration in fuel systems, gears, and under-the-hood components due to its wear resistance, dimensional stability, and contribution to lightweight vehicle designs.

- Electrical and electronics producers strengthen PK usage in connectors, circuit components, and precision housings because it offers strong dielectric properties and reliability under thermal and mechanical stress.

- Sustainability-driven industries prefer PK for its recyclability, low VOC profile, and reduced carbon footprint, supporting broader transition toward eco-efficient engineering polymers.

- Asia Pacific leads adoption, followed by Europe and North America, supported by established automotive, electronics, and machinery industries that rely on durable and high-performance polymer solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Adoption in Automotive and Transportation Applications

The Polyketone (PK) Market benefits from strong demand from the automotive and transportation sectors. Manufacturers prefer PK for components that require high wear resistance, dimensional stability, and chemical tolerance. It reduces component weight while maintaining performance standards, which supports fuel efficiency targets. Increasing use in fuel systems, gears, and under-the-hood parts reinforces its relevance in modern vehicle design.

- For Instance, Hyosung Polyketone developed POKETONE™ grades for automotive fuel system components and gears, leveraging superior low-friction performance and excellent chemical resistance. The company currently holds a dominant share of over 83% of the entire global polyketone market.

Growing Use in Electrical and Electronics Manufacturing

Demand strengthens due to rising production of electrical and electronic devices. PK delivers high dielectric strength and excellent resistance to moisture, which supports its use in connectors, circuit protection systems, and precision housings. It meets miniaturization requirements without compromising mechanical strength. Manufacturers in this sector value its reliability under continuous thermal and mechanical stress.

- For instance, Isola Group’s Tachyon 100G material demonstrates minimal moisture uptake in 24-hour DI water soaks, maintaining stable dielectric constant (Dk) even at elevated temperatures.

Expansion in Industrial and Mechanical Applications

Industrial machinery and mechanical equipment manufacturers adopt PK for parts exposed to friction, corrosive environments, and repeated stress. It performs well in pumps, valves, and conveyor components due to its toughness and chemical compatibility. Companies prefer PK over conventional engineering plastics when long service life is a priority. Its versatility contributes to growing adoption in process industries and heavy-duty applications.

Increasing Focus on Sustainable and Eco-Efficient Materials

Global sustainability targets encourage the shift toward polymers with lower environmental impact. PK supports these goals through its recyclability, low VOC emissions, and reduced carbon footprint during processing. Industries seeking compliance with environmental standards view it as a viable alternative to traditional engineering plastics. Market growth aligns with rising preference for materials that support circular manufacturing practices.

Market Trends:

Growing Shift Toward High-Performance and Lightweight Engineering Polymers

The Polyketone (PK) Market shows a strong shift toward materials that deliver high performance while supporting lightweight product design. Manufacturers seek polymers that reduce system weight without compromising durability, which strengthens PK adoption in automotive, industrial, and consumer sectors. It offers superior wear resistance, chemical stability, and low friction properties that meet evolving engineering requirements. Demand rises for materials that perform reliably under extreme temperature and mechanical stress conditions. Industries integrate PK in components that require long service life and precision. The trend aligns with global efforts to improve energy efficiency and operational reliability through advanced material engineering.

- For instance, PK maintains mechanical strength in high-stress industrial gears and structural parts under extreme conditions.

Increasing Preference for Sustainable and Eco-Efficient Polymer Solutions

Global industries strengthen their focus on sustainability, which supports wider use of PK in environmentally aligned production systems. The Polyketone (PK) Market benefits from heightened interest in polymers with lower emissions, recyclability, and reduced lifecycle impact. It responds well to regulatory pressures that encourage the shift toward cleaner and safer material choices. Manufacturers aim to reduce environmental footprints while maintaining high mechanical and functional performance. PK suits circular manufacturing initiatives that emphasize resource efficiency and material recovery. The trend promotes innovation in PK formulations tailored for greener industrial applications.

- For instance, Hyosung advanced PK formulations with superior chemical resistance and low moisture absorption for automotive fuel systems. Manufacturers aim to reduce environmental footprints while maintaining high mechanical and functional performance, demonstrated by Hyosung’s PK maintaining mechanical strength at 150°C exposure.

Market Challenges Analysis:

High Production Costs and Limited Raw Material Availability

The Polyketone (PK) Market faces challenges related to high production costs and dependence on specific monomer supply chains. It relies on carbon monoxide and olefins, which require controlled processing environments and specialized technologies. Production expenses restrict wider adoption in cost-sensitive industries that prefer lower-priced engineering plastics. Manufacturers evaluate cost-to-performance ratios carefully before integrating PK into large-volume applications. Limited availability of raw materials in certain regions influences pricing stability. The issue affects long-term procurement planning for end-use sectors seeking predictable material supply.

Competition from Established Engineering Polymers and Processing Constraints

Strong competition from polyamides, polyacetals, and other engineering plastics presents a significant barrier for PK adoption. The Polyketone (PK) Market must demonstrate clear performance advantages to justify substitution in existing applications. It encounters processing challenges in facilities not equipped for its specific thermal and mechanical requirements. Manufacturers may hesitate to modify infrastructure or invest in new tooling for PK-based product lines. Market penetration depends on increased awareness of PK’s unique benefits and improved compatibility with standard processing equipment. Competitive pressure continues to shape market strategies and innovation efforts.

Market Opportunities:

Expansion Potential in Automotive, Electronics, and Industrial Applications

The Polyketone (PK) Market offers strong opportunities across automotive, electronics, and industrial segments that seek durable and lightweight materials. Demand rises for polymers that support fuel efficiency, precision engineering, and improved component reliability. It meets requirements for high wear resistance and chemical stability, which encourages adoption in gears, connectors, fuel system components, and mechanical parts. Manufacturers explore PK to replace traditional engineering plastics where higher performance is necessary. Growth accelerates in electronic devices that need robust insulating materials with consistent thermal behavior. The opportunity strengthens as industries prioritize materials that enhance operational efficiency.

Advancements in Sustainable Materials and Circular Manufacturing Models

Sustainability trends create new pathways for PK integration into eco-efficient product systems. The Polyketone (PK) Market aligns well with global initiatives that prioritize polymers with recyclability and reduced environmental impact. It supports circular manufacturing models that rely on resource recovery and low-emission processing. Industries consider PK for applications that require compliance with environmental standards without sacrificing mechanical performance. Innovation in bio-based feedstocks and greener production methods enhances PK’s long-term market potential. These developments enable broader acceptance across sectors implementing sustainability-driven procurement strategies.Top of Form

Market Segmentation Analysis:

By Type

The Polyketone (PK) Market includes homopolymer PK and copolymer PK as the primary types. Homopolymer PK secures strong demand due to its high wear resistance and superior chemical stability, which suit automotive and industrial components. Copolymer PK gains traction where improved flexibility and balanced mechanical properties are required. It supports applications that need tailored performance for dynamic operating environments. Manufacturers evaluate both types based on durability, processing ease, and end-use requirements.

- For instance, Hyosung’s homopolymer PK grades deliver up to 50% lower wear rates than polyamide 66 in gear applications for automotive transmissions.

By Application

Key applications include automotive components, industrial machinery, electrical and electronics, consumer goods, and chemical processing equipment. The Polyketone (PK) Market records high adoption in automotive fuel systems, gears, and precision parts that rely on strength and friction resistance. Electrical and electronics producers integrate PK into connectors, switches, and insulating structures. It also supports industrial machinery where long service life and corrosion resistance are critical. Growing use in consumer goods reinforces its position across high-performance applications.

- For instance, Hyosung expanded production capacity for PK resins used in automotive fuel system components, achieving 50% lower fuel permeability compared to PA66.

By Form

The market includes pellet, powder, and customized compound forms. Pellets hold the largest share due to their suitability for large-scale injection molding and extrusion processes. Powder forms serve niche applications that require fine material dispersion or specialized surface treatments. The Polyketone (PK) Market benefits from growing demand for customized compounds engineered for specific performance criteria. It supports processing flexibility across diverse manufacturing environments.

Segmentations:

By Type

- Homopolymer PK

- Copolymer PK

By Application

- Automotive Components

- Electrical and Electronics

- Industrial Machinery

- Consumer Goods

- Chemical Processing Equipment

By Form

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific Leads Global Demand with 46% Market Share

Asia Pacific holds 46% of the Polyketone (PK) Market, driven by strong industrial expansion and robust production capacities. China, South Korea, and Japan sustain high consumption levels supported by established automotive, electronics, and machinery sectors. It gains traction in components that require durability, chemical resistance, and dimensional stability. The region increases PK integration through continuous investment in advanced polymer technologies. Rising focus on lightweight engineering materials strengthens adoption in transportation and industrial applications.

Europe Maintains 27% Share Supported by High-Performance Material Adoption

Europe accounts for 27% of the Polyketone (PK) Market, reflecting stable demand from automotive, electrical, and industrial users. Germany, France, and the United Kingdom drive consumption backed by rigorous regulatory standards promoting sustainable and high-performance materials. It aligns with the region’s emphasis on reliability, recyclability, and environmental compliance. Manufacturers adopt PK to enhance mechanical performance while meeting evolving industry requirements. Ongoing innovation in engineering design continues to reinforce its role in specialized applications.

North America Holds 19% Share Driven by Technological and Industrial Growth

North America secures 19% of the Polyketone (PK) Market, supported by strong industrial capabilities and rising demand for advanced polymer solutions. It gains importance in automotive, electronics, and industrial equipment applications that require long service life and chemical stability. The region benefits from investment in advanced processing technologies that expand PK’s usability. End-use industries prefer PK when seeking alternatives to traditional engineering plastics with higher performance potential. Growth continues as manufacturers prioritize efficiency, durability, and material innovation.

Key Player Analysis:

- Hyosung (Poketone)

- K.D. Feddersen

- Akro-Plastic

- Poly-Source

- BASF

- Chevron Phillips Chemical

- Evonik

- Mitsui Chemicals

Competitive Analysis:

The Polyketone (PK) Market features a consolidated competitive landscape dominated by established polymer manufacturers that focus on performance-driven material innovation. Leading companies invest in advanced production technologies to improve polymer quality, reduce processing costs, and expand application suitability. It benefits from strategic collaborations among material suppliers, automotive OEMs, and electronics manufacturers seeking long-term reliability and enhanced product functionality. Competitors strengthen their portfolios through the development of specialized PK grades tailored for demanding operating environments. Market players also prioritize sustainability by advancing recyclable formulations and energy-efficient manufacturing practices. Continuous research efforts support the introduction of PK materials that deliver improved chemical resistance, wear performance, and mechanical stability, reinforcing competitiveness across global markets.

Recent Developments:

- In January 2025, Evonik launched a new company called Smart Effects by merging its silica and silane business lines, employing 3,500 people globally.

- In October 2025, BASF launched a strategic partnership with IFF to develop next-generation enzyme and polymer innovations for cleaning and personal care products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Form and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Polyketone (PK) Market is set to experience increasing adoption in automotive systems that require high durability, low friction, and chemical resistance.

- Manufacturers will expand PK usage in electrical and electronic components to support miniaturization and long-term thermal stability.

- Demand will rise for PK grades tailored for industrial machinery that operates under high stress and corrosive environments.

- It will benefit from growing interest in lightweight materials that enhance energy efficiency across transportation and mechanical applications.

- Sustainability trends will drive development of recyclable PK formulations that align with circular manufacturing goals.

- Advancements in compounding technologies will improve PK compatibility with diverse processing methods and broaden end-use potential.

- Market participants will invest in regional production capabilities to strengthen supply stability and reduce dependence on limited raw material sources.

- New application opportunities will emerge in consumer goods where reliability and high mechanical performance are required.

- Collaborative innovation between polymer manufacturers and OEMs will accelerate product customization for niche industrial needs.

- Global demand will strengthen as industries seek alternatives to traditional engineering plastics with higher performance consistency and environmental benefits.

Market Insights:

Market Insights: