Market Overview

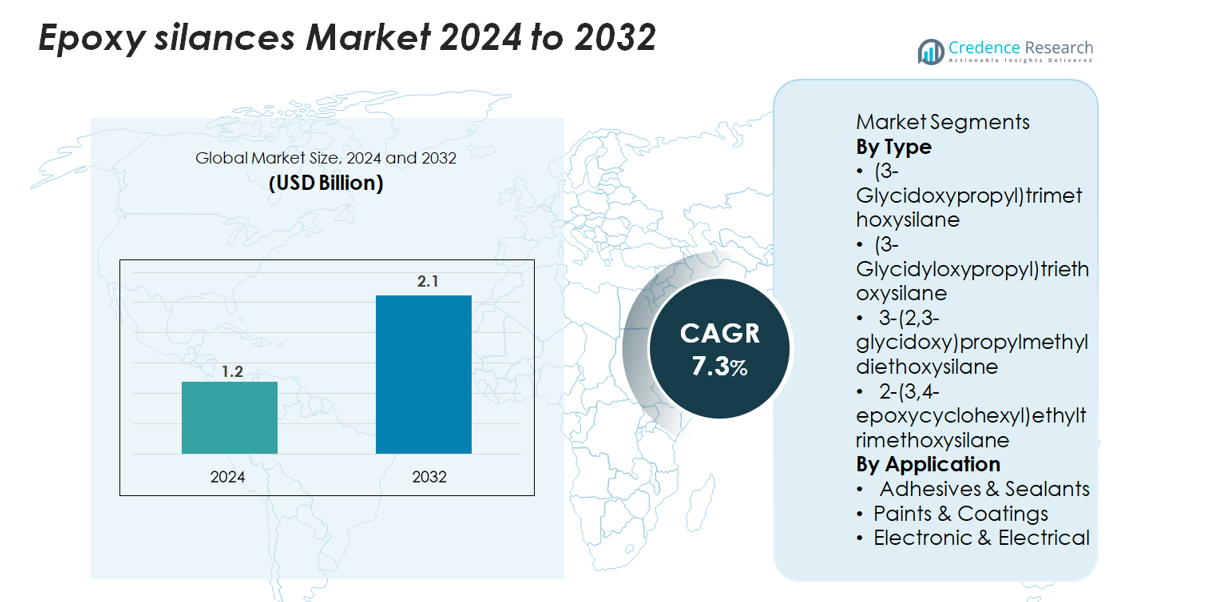

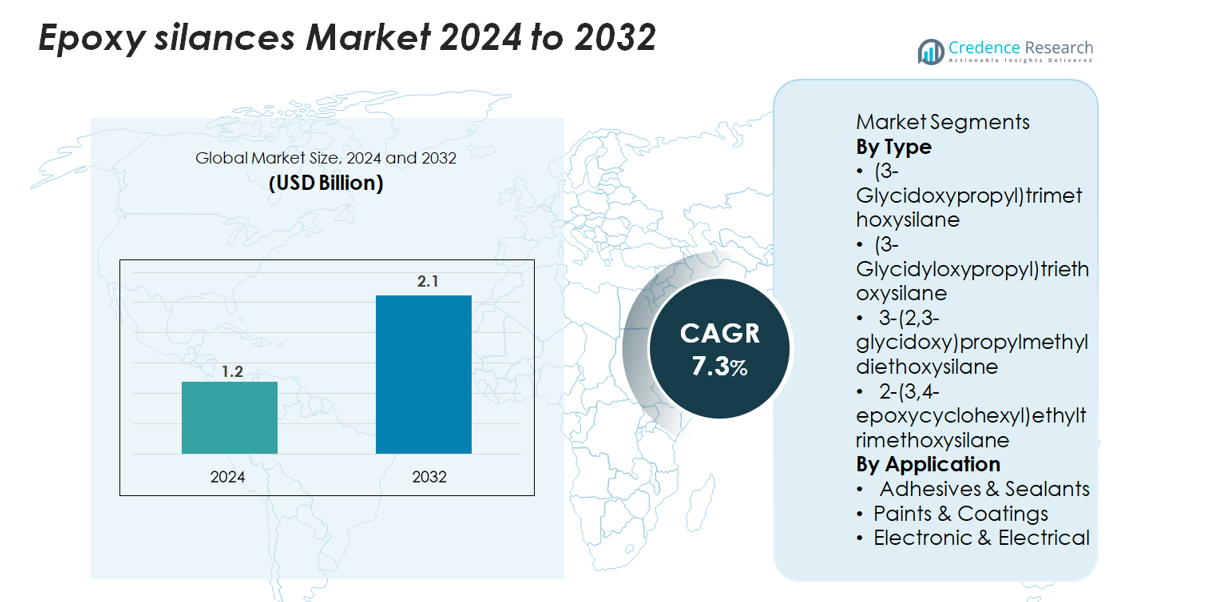

The epoxy silanes market was valued at USD 1.2 billion in 2024 and is projected to reach USD 2.1 billion by 2032, reflecting a CAGR of 7.3% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Epoxy Silanes Market Size 2024 |

USD 1.2 billion |

| Epoxy Silanes Market, CAGR |

7.3% |

| Epoxy Silanes Market Size 2032 |

USD 2.1 billion |

The epoxy silanes market is shaped by leading chemical manufacturers known for their advanced coupling agents, adhesion promoters, and surface-modification technologies. Major players—including Evonik Industries, Shin-Etsu Chemical, Dow, Wacker Chemie, Gelest Inc., Momentive Performance Materials, and Nanjing Union Silicon Chemical—compete through high-purity formulations, improved hydrolytic stability, and specialized grades for coatings, electronics, and high-performance composites. These companies leverage strong R&D capabilities and global distribution networks to meet demand across industrial and specialty applications. Asia Pacific leads the market with a 36% share, supported by large-scale electronics production and rapid industrialization, while North America and Europe follow as key high-value markets driven by advanced manufacturing and stringent performance standards.

Market Insights

- The epoxy silanes market reached USD 1.2 billion in 2024 and is projected to hit USD 2.1 billion by 2032, registering a 7.3% CAGR, driven by rising demand for high-performance coupling and adhesion-promoting agents.

- Increasing use in adhesives & sealants, the largest segment with 42% share, along with growing adoption in electronics and protective coatings, continues to accelerate market expansion across industrial applications.

- Key trends include the shift toward waterborne and eco-friendly formulations, advancements in high-purity silane grades, and expanding use in composites for EVs, aerospace, and construction.

- The competitive landscape features global players such as Evonik, Dow, Wacker, Shin-Etsu, Gelest, Momentive, and regional manufacturers, with competition driven by product innovation, purity levels, and performance stability; however, high production costs and raw material price fluctuations remain key restraints.

- Asia Pacific leads with 36% share, followed by North America at 32% and Europe at 28%, supported by strong manufacturing bases and growing industrial modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The epoxy silanes market is dominated by (3-Glycidoxypropyl) trimethoxysilane, which accounts for approximately 38% of total demand due to its broad compatibility with polymers, strong adhesion promotion, and widespread use in composites and coatings. Its superior hydrolytic stability and crosslinking performance drive adoption in industries requiring high mechanical strength and moisture resistance. Meanwhile, (3-Glycidyloxypropyl) triethoxysilane and 2-(3,4-epoxycyclohexyl) ethyltrimethoxysilane gain traction in specialty applications such as high-temperature electronics and advanced resin systems, supporting the shift toward durable, high-performance materials.

- For instance, Wacker Chemie produces high-quality silane-terminated polyethers with controlled viscosities such as 10,000 mPa·s and 30,000 mPa·s in its GENIOSIL® STP-E product line, supporting precise bonding performance in advanced formulations.

By Application

Adhesives & Sealants represent the largest application segment, holding around 42% market share, driven by expanding use in automotive assemblies, construction bonding systems, and industrial manufacturing. Epoxy silanes improve substrate adhesion, chemical resistance, and long-term durability, making them integral to premium adhesive formulations. Paints & Coatings follow as a fast-growing segment, benefiting from the demand for corrosion-resistant and weather-stable protective layers. In the Electronic & Electrical segment, the need for enhanced insulation, dielectric performance, and moisture-barrier properties further accelerates adoption across encapsulants, connectors, and circuit protection materials.

- For instance, Momentive’s NXT silane technology—supported by a newly expanded production facility commissioned in September 2018 in Leverkusen, Germany, that doubled its output capacity for Europe—demonstrates how advanced silane systems significantly strengthen bonding efficiency in demanding applications.

Key Growth Drivers

Rising Demand for High-Performance Adhesion and Surface Modification

The epoxy silanes market benefits significantly from the increasing demand for advanced adhesion promoters across automotive, construction, and industrial sectors. These compounds form strong covalent bonds between organic polymers and inorganic substrates, improving mechanical performance, water resistance, and long-term durability. Growing adoption of lightweight materials, such as composites, plastics, and hybrid structures, amplifies the need for effective coupling agents—especially in EV manufacturing, aerospace assemblies, insulation materials, and structural adhesives. Additionally, construction applications including sealants, concrete additives, and protective coatings increasingly rely on epoxy silanes to enhance surface compatibility and minimize delamination. As industries shift toward high-strength, corrosion-resistant, and weather-stable materials, epoxy silanes remain central to improving process efficiency and end-product performance. Their ability to enhance bonding under harsh environmental conditions continues to strengthen their role in advanced material engineering.

- For instance, Wacker Chemie’s GENIOSIL® STP-E series introduced in March 2025 includes binder grades with viscosities of 10,000 mPa·s and 30,000 mPa·s, enabling stronger and more flexible adhesion performance in advanced construction and industrial bonding systems.

Expansion of Electronic & Electrical Applications Requiring Enhanced Reliability

Rapid growth in electronic components, semiconductors, and electrical insulation systems fuels demand for epoxy silanes, which offer superior moisture-barrier properties, dielectric stability, and thermal resistance. These materials are widely incorporated into encapsulants, conformal coatings, connectors, and circuit board laminates to improve reliability under high-temperature or high-humidity conditions. With miniaturization trends accelerating, manufacturers seek coupling agents that deliver strong interfacial bonding and minimal performance drift over long service lifecycles. Epoxy silanes meet these requirements by reducing microcracking, inhibiting corrosion, and improving structural integrity in sensitive components. The expansion of EV power electronics, renewable energy inverters, and high-density data centers further drives their adoption. As device complexity rises, epoxy silanes become indispensable in ensuring electrical stability and extending component longevity, especially in mission-critical applications.

- For instance, Shin-Etsu Chemical introduced its KRW-6000 Series in March 2024, a water-based silicone resin capable of achieving full curing at 150 °C within 10 minutes, significantly improving thermal endurance and moisture stability in electronic insulation systems.

Increasing Use of Advanced Coating and Corrosion-Protection Technologies

Epoxy silanes gain traction as industries adopt high-performance coatings for metal protection, infrastructure durability, and chemical resistance. Their ability to create well-bonded, crosslinked networks enhances primer adhesion, reduces moisture penetration, and strengthens anti-corrosion coatings used in marine, industrial, and automotive applications. Regulations promoting eco-friendly coating systems also drive the shift toward silane-based solutions, as they support low-VOC and waterborne formulations. Growing investments in infrastructure maintenance, industrial equipment longevity, and pipeline protection significantly boost demand. The rise of smart coatings and nano-enhanced barrier technologies further expands opportunities, as epoxy silanes act as functional building blocks enhancing both protective and decorative properties. Their versatility across steel, concrete, and composite substrates ensures strong market relevance in corrosion-critical environments.

Key Trends & Opportunities

Growing Adoption of Eco-Friendly and Waterborne Formulations

A major trend shaping the market is the transition from solvent-based to environmentally friendly waterborne systems. Epoxy silanes support this shift by offering strong adhesion and crosslinking performance without relying on volatile or hazardous solvents. As global regulations tighten around emissions and workplace safety, industries increasingly prefer silane-modified waterborne coatings, adhesives, and sealants. Additionally, manufacturers are exploring bio-based or low-toxicity silane chemistries, presenting opportunities for sustainable product development. The trend toward greener construction materials, renewable energy structures, and low-emission industrial solutions further accelerates adoption. Companies investing in cleaner silane technologies gain a competitive edge as sustainability becomes a core purchasing criterion across markets.

- For instance, Shin-Etsu Chemical launched its KRW-6000 Series in March 2024, a fully water-based silicone resin system that cures at 150 °C in 10 minutes and contains zero emulsifiers and zero VOCs, demonstrating measurable progress toward greener, regulatory-compliant materials.

Advancements in Composite Materials and Lightweight Engineering

The growing use of composite materials in automotive, aerospace, wind energy, and industrial manufacturing presents significant opportunities for epoxy silanes. These materials require superior interfacial bonding between reinforcing fibers and polymer matrices, making epoxy silanes essential for achieving high structural integrity. As OEMs shift toward lightweight designs to improve energy efficiency and reduce emissions, demand for high-performance coupling agents continues to rise. Epoxy silanes also support advanced processing techniques such as resin transfer molding, 3D-printed composites, and high-temperature thermoset systems. The expansion of green mobility, including EV battery casings and lightweight chassis components, further opens long-term growth avenues.

- For instance, Gelest expanded its composite-focused materials capability in May 2025 by commissioning a 50,000-sq-ft production facility that includes a 3,000-sq-ft ISO Class 7 cleanroom, enhancing its capacity to supply precision-engineered silane intermediates used in high-performance composite manufacturing.

Increasing Innovation in Hybrid Silane Technologies

Emerging hybrid silane technologies—combining epoxy, amino, and ureido functionalities—create opportunities for improved adhesion, faster curing, and enhanced durability in demanding applications. These multifunctional silanes offer tailored performance for electronics, automotive coatings, and specialty adhesives. Innovation also extends to nano-functionalized silanes designed for enhanced barrier properties, scratch resistance, and self-healing surfaces. Manufacturers developing customizable or application-specific silane systems can tap into niche high-value segments, such as high-frequency electronics, anti-corrosion marine coatings, and long-life industrial assemblies. This trend reflects a broader shift toward precision material engineering driven by performance and reliability requirements.

Key Challenges

High Production Costs and Raw Material Price Sensitivity

One of the primary challenges for the epoxy silanes market is the high cost associated with manufacturing and sourcing key raw materials, including specialty alcohols, epoxides, and chlorosilanes. Price volatility in chemical feedstocks impacts production economics and reduces profit margins for manufacturers. Additionally, the synthesis of high-purity epoxy silanes requires stringent process controls, advanced equipment, and compliance with safety regulations—all of which elevate operational costs. End-use industries with cost-sensitive applications, such as construction or general-purpose adhesives, may hesitate to adopt premium silane formulations. Competitive pressure from alternative coupling agents, including titanates and zirconates, further intensifies pricing challenges, limiting broader penetration in low-cost markets.

Handling, Storage, and Environmental Safety Constraints

Epoxy silanes pose challenges related to handling sensitivity, moisture reactivity, storage stability, and environmental safety. Their tendency to hydrolyze prematurely complicates logistics and necessitates controlled packaging, which increases distribution costs. Adoption is also affected by strict environmental and occupational safety regulations governing reactive organosilanes, especially in regions prioritizing worker exposure limits and eco-friendly formulations. Manufacturers must invest in compliance, labeling, and hazard management, which can slow product development cycles. End users may require specialized training for safe application, limiting uptake in small or decentralized industries. These constraints increase overall adoption barriers despite the material’s performance advantages.

Regional Analysis

North America

North America holds approximately 32% of the global epoxy silanes market, driven by strong demand from the automotive, aerospace, construction, and electronics sectors. The region benefits from advanced manufacturing capabilities and widespread adoption of high-performance coatings, adhesives, and composite materials. Growth is further supported by rising investments in electric vehicles and infrastructure refurbishment, which require durable bonding and corrosion-resistant systems. The U.S. leads regional consumption due to its mature chemical industry and increasing technological innovation in surface modification and material enhancement. Regulatory focus on high-performance, low-VOC formulations continues to reinforce market expansion.

Europe

Europe accounts for roughly 28% of the epoxy silanes market, supported by stringent environmental regulations, strong emphasis on sustainable coating technologies, and high adoption in automotive lightweighting and industrial engineering applications. Countries such as Germany, France, and the U.K. anchor regional demand due to their advanced electronics and automotive manufacturing bases. The region’s shift toward waterborne coatings and eco-friendly adhesives enhances consumption of epoxy silanes as multifunctional coupling and crosslinking agents. Additionally, the robust composites industry—especially in aerospace and wind energy—strengthens long-term market prospects across the continent.

Asia Pacific

Asia Pacific dominates the global market with a market share of nearly 36%, driven by rapid industrialization, large-scale electronics production, and strong expansion in automotive manufacturing across China, Japan, South Korea, and India. The region’s growing construction activity and rising deployment of corrosion-resistant, high-durability coatings significantly support epoxy silane demand. Increasing investment in semiconductor fabrication and EV battery technologies further accelerates adoption in electrical and electronic applications. Favorable government policies promoting domestic chemical production and fast-growing composite material usage position Asia Pacific as the fastest-growing regional market.

Latin America

Latin America holds around 7% market share, with steady demand emerging from construction, automotive aftermarket, and industrial coatings applications. Brazil and Mexico lead regional consumption due to expanding manufacturing activities and increasing adoption of corrosion-protection solutions in coastal and industrialized zones. The region’s gradual shift toward advanced adhesives and sealants supports incremental growth in epoxy silane usage. However, reliance on imported specialty chemicals and economic fluctuations limit market acceleration. Despite this, investments in infrastructure modernization and renewable energy installations contribute to long-term demand stability.

Middle East & Africa (MEA)

The Middle East & Africa region accounts for approximately 5% of the global epoxy silanes market, primarily driven by growing infrastructure projects, oil & gas equipment maintenance, and demand for high-performance protective coatings. GCC countries lead consumption due to significant investment in construction and industrial facilities requiring advanced bonding and corrosion-resistant materials. Increasing urbanization in African nations contributes modest but steady growth in adhesives, sealants, and coatings applications. Market expansion is somewhat constrained by limited local production capacities, but continued growth in industrial development and architectural coatings supports future adoption.

Market Segmentations:

By Type

- (3-Glycidoxypropyl)trimethoxysilane

- (3-Glycidyloxypropyl)triethoxysilane

- 3-(2,3-glycidoxy)propylmethyldiethoxysilane

- 2-(3,4-epoxycyclohexyl)ethyltrimethoxysilane

By Application

- Adhesives & Sealants

- Paints & Coatings

- Electronic & Electrical

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the epoxy silanes market is characterized by a mix of global chemical leaders and specialized regional manufacturers competing through product innovation, purity enhancement, and application-specific formulations. Companies such as Evonik Industries, Dow, Shin-Etsu Chemical, Wacker Chemie, Gelest Inc., Momentive Performance Materials, and Nanjing Union Silicon Chemical dominate the market with broad portfolios covering high-performance adhesion promoters, surface modifiers, and crosslinking agents. Their strategies center on R&D investments to improve hydrolytic stability, bonding efficiency, and compatibility with advanced coating, adhesive, and electronic systems. Strategic expansions in Asia Pacific—where large-scale electronics and composites manufacturing drive demand—continue to strengthen their presence. Meanwhile, niche producers focus on cost-effective alternatives and customized silane chemistry to capture emerging opportunities in construction and industrial applications. Despite strong growth potential, competitive intensity remains high due to fluctuating raw material costs, stringent environmental regulations, and increasing customer demand for sustainable and high-purity silane technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Gelest

- Shin-Etsu Silicone

- PCC SE

- Nanjing Union Silicon Chemical

- Momentive

- WD Silicone

- Wacker Chemie

- Anhui Elite Industrial

- Evonik

- Dow Corning

Recent Developments

- In May 2025, the company Gelest, completed a new 50,000 sq ft production facility at its Morrisville, PA headquarters designed for high-volume specialty chemistries including silanes.

- In March 2025, the firm introduced its new silane-terminated binders GENIOSIL® STP-E 140 and STP-E 340 at the European Coatings Show; one binder has a viscosity of 10,000 mPa·s, the other 30,000 mPa·s, enabling tin-free adhesive and sealant formulations.

- In March 2024, the company Shin‑Etsu Chemical Co., Ltd. announced a new water-based, fast-curing silicone resin (the KRW-6000 Series) that is emulsifier-free and VOC-free, signalling advancement in silicone chemistry which closely aligns with silane / coupling agent trends.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for epoxy silanes will increase as industries adopt stronger and more durable adhesion solutions.

- Growth in electric vehicles will boost usage in high-performance coatings and electronic components.

- Waterborne and eco-friendly formulations will gain wider acceptance due to regulatory pressure.

- Adoption in advanced composites will rise as lightweight materials become more common in manufacturing.

- Manufacturers will invest more in high-purity and specialty-grade silane technologies.

- Expansion of semiconductor and electrical insulation applications will support long-term market growth.

- Infrastructure modernization will drive demand for corrosion-resistant coatings using epoxy silanes.

- Strategic partnerships and capacity expansions will intensify competition among major producers.

- Asia Pacific will continue to lead consumption as industrial production and electronics manufacturing expand.

- Increasing focus on sustainability will encourage development of low-VOC and green silane chemistries.