Market Overview

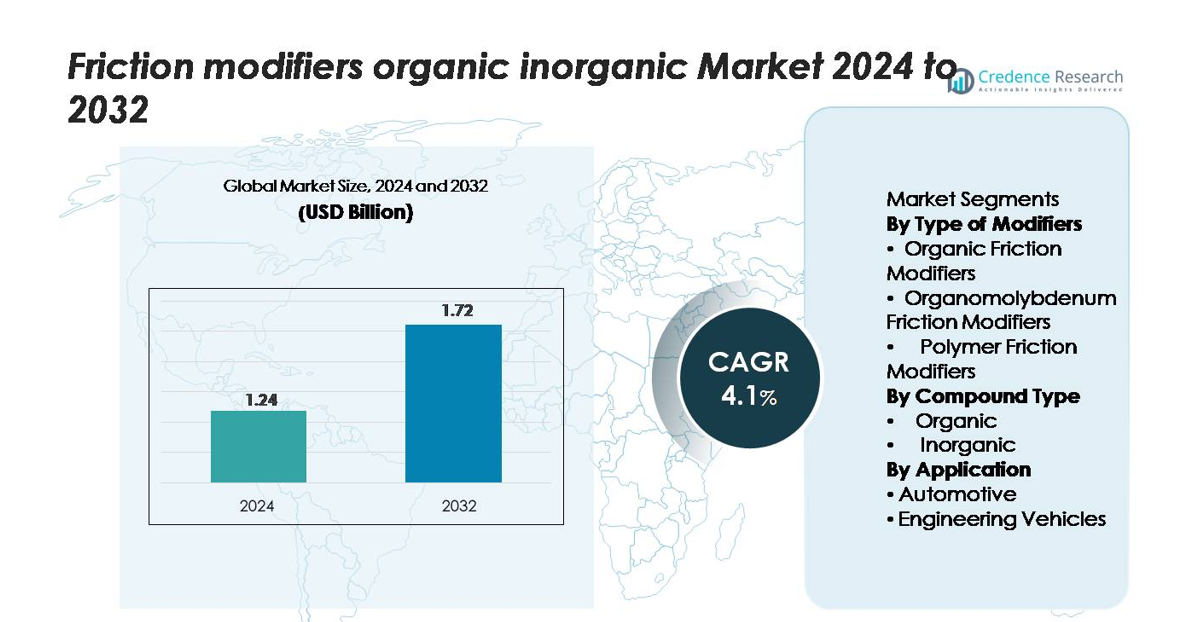

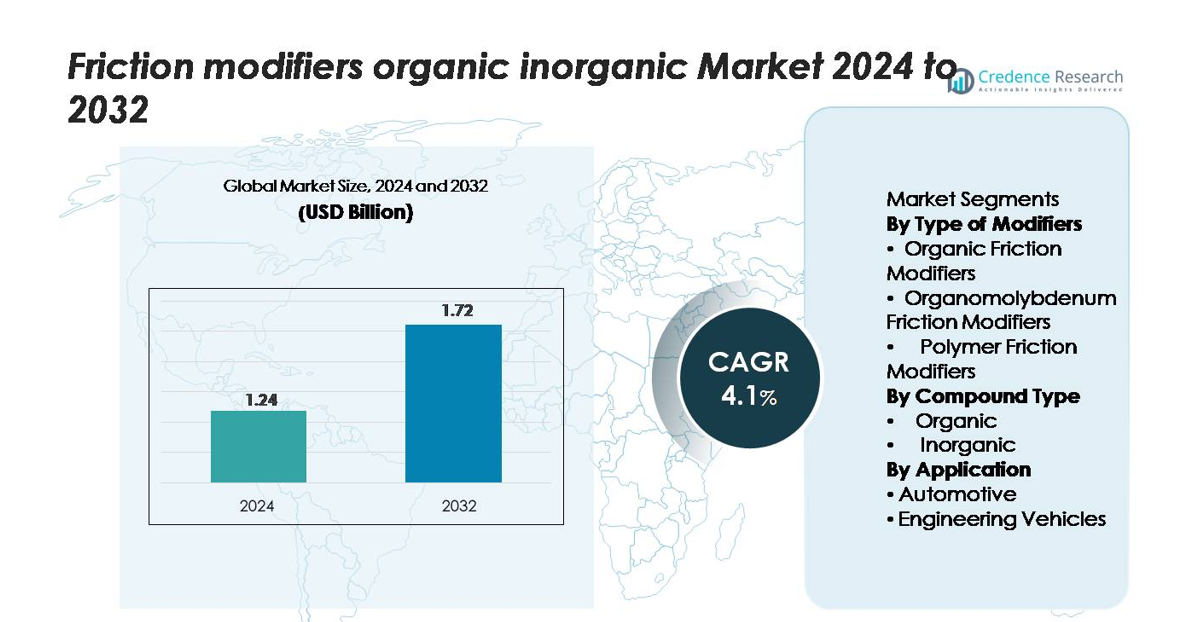

The global friction modifiers (organic & inorganic) market was valued at USD 1.24 billion in 2024 and is projected to reach USD 1.72 billion by 2032, registering a CAGR of 4.1% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Friction Modifiers Organic Inorganic Market Size 2024 |

USD 1.24 billion |

| Friction Modifiers Organic Inorganic Market, CAGR |

4.1% |

| Friction Modifiers Organic Inorganic Market Size 2032 |

USD 1.72 billion |

Leading players in the friction modifiers market—including Afton Chemical Corporation, BASF SE, Chevron Corporation, Croda International PLC, ADEKA Corporation, BRB International BV, CSW Industrials Inc., Kings Industries Inc., BITEC, and F.I.L.A. Group—compete through advanced additive chemistry, strong OEM partnerships, and global supply capabilities. North America leads the market with an estimated 35% share, driven by high adoption of premium automotive and industrial lubricants. Asia-Pacific follows with roughly 30%, supported by large-scale vehicle production and expanding industrial activity, while Europe holds about 25%, shaped by stringent emissions regulations and strong demand for low-ash, eco-friendly formulations. These regions collectively anchor the competitive landscape and influence global product development strategies.

Market Insights

- The global friction modifiers market was valued at USD 1.24 billion in 2024 and is projected to reach USD 1.72 billion by 2032, registering a CAGR of 4.1%, reflecting steady demand across automotive and industrial lubrication applications.

- Growing emphasis on fuel efficiency, lower emissions, and high-performance lubricants drives market expansion, with organic friction modifiers dominating the product segment due to their compatibility with low-ash and eco-friendly formulations.

- Market trends highlight increasing adoption of multifunctional additive chemistries, rising use in EV and hybrid powertrain lubrication, and strong OEM–additive supplier collaborations for customized performance solutions.

- Competitive intensity is high as global players focus on R&D, sustainability-driven formulations, and expansion into emerging markets, while restraints include raw material price volatility and regulatory pressures on metallic or inorganic additive components.

- Regionally, North America leads with about 35% share, followed by Asia-Pacific at roughly 30% and Europe at 25%, reflecting strong automotive demand, industrial activity, and evolving emission standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type of Modifiers:

Organic friction modifiers account for the largest share of the market, driven by their strong compatibility with modern lubricant formulations and their ability to reduce boundary friction without introducing metallic residues. Their dominance is supported by rising adoption in passenger cars and light commercial vehicles, where OEMs prioritize fuel-efficiency improvements and smoother engine performance. Organomolybdenum modifiers gain traction in heavy-duty lubricants due to superior anti-wear characteristics, while polymer friction modifiers expand in synthetic oils as formulators seek enhanced viscosity stability and long-drain performance.

- For instance, ADEKA Corporation’s “SAKURA-LUBE” organic molybdenum additive claims to improve fuel consumption in passenger-car engine oils by up to 1.7 %.

By Compound Type:

Organic compounds represent the dominant segment, holding the majority share owing to their biodegradability, formulation flexibility, and widespread usage across automotive engine oils and industrial lubricants. Growth is driven by regulatory pressure to reduce metallic additives and the demand for cleaner lubricant chemistries. Inorganic compounds continue to serve niche applications requiring high thermal stability and extreme-pressure performance, but their adoption remains relatively limited due to environmental concerns and the shift toward low-ash lubricant formulations.

- For instance, Afton Chemical reports that its organic friction modifiers (OFMs) are designed to reduce friction and improve fuel efficiency in modern low-viscosity oils, demonstrating measurable boundary-friction reduction in standard engine tests like the Sequence VI-D.

By Application:

The automotive segment leads the market with the highest share, supported by continuous advancements in engine design, stringent fuel-efficiency targets, and rising global vehicle production. Automakers increasingly incorporate high-performance lubricants containing friction modifiers to meet emission norms and improve drivetrain efficiency. Engineering vehicles also show steady demand, especially in construction and mining equipment where lubricants must withstand high loads and harsh operating conditions. However, automotive applications remain the dominant growth engine due to large-scale consumption and constant lubricant formulation upgrades.

Key Growth Drivers

Rising Demand for Fuel Efficiency and Lower Emissions

The global shift toward fuel-efficient mobility strongly drives the adoption of friction modifiers across automotive lubricants, transmission fluids, and gear oils. As governments enforce stricter emission norms, OEMs and lubricant formulators increasingly incorporate friction-reducing additives to minimize energy losses within engines and drivetrains. Organic and polymer-based friction modifiers help achieve smoother boundary lubrication, lowering fuel consumption and CO₂ output without compromising engine durability. Hybrid and start–stop vehicles further amplify this demand, as these platforms require optimized lubrication during frequent engine restarts. With automakers targeting measurable efficiency gains and sustainability improvements across vehicle fleets, friction modifiers continue to play a central role in meeting performance benchmarks and regulatory compliance.

- For instance, Afton Chemical’s gasoline friction-modifier product HiTEC® 6457 demonstrated an instantaneous fuel economy improvement equivalent to a reduction in brake‐specific fuel consumption (BSFC) of 1.2 g/kWh in a gasoline engine test when treated at 180 ppmv

Expansion of High-Performance Lubricants in Industrial Equipment

Industrial sectors, including manufacturing, mining, construction, and heavy engineering, increasingly adopt high-performance lubricants formulated with friction modifiers to enhance equipment uptime and operational reliability. Machinery operating under high loads, variable speeds, and elevated temperatures benefits from additives that reduce surface contact wear, improve film strength, and support longer maintenance intervals. As companies prioritize productivity and cost reduction, the demand for lubricants that deliver extended drain cycles and reduced component failure grows. The rapid digitalization of industrial operations also drives adoption of advanced lubricants compatible with sensors and predictive maintenance platforms. Friction modifiers—especially organomolybdenum and hybrid compounds—gain relevance in this environment by ensuring stable performance under severe service conditions.

- For instance, Lubrizol’s industrial friction modifier technology integrated into a hydraulic fluid formulation demonstrated a wear-scar diameter of 0.38 mm in a 40 kg, 75 °C Four-Ball Wear Test, compared to 0.63 mm for a reference oil, confirming significant protection in high-load industrial environments.

Shift Toward Eco-Friendly and Low-Ash Lubricant Formulations

The transition toward environmentally responsible lubricant formulations acts as a major driver for organic friction modifiers, which offer biodegradability, reduced toxicity, and compliance with global eco-label requirements. Regulatory bodies increasingly limit the use of metallic additives and ash-forming compounds, prompting formulators to replace traditional inorganic materials with organic and polymer-based alternatives. This shift is particularly strong in applications involving sensitive environments, such as marine engines, agriculture, forestry, and food-grade machinery. Furthermore, the rise of bio-based base oils has created demand for friction modifiers that deliver compatibility with plant-derived formulations while maintaining high oxidative stability. As sustainability commitments grow across industries, eco-friendly friction modifiers see accelerated adoption.

Key Trends & Opportunities

Advancements in Additive Chemistry and Multifunctional Formulations

A major trend shaping the market is the development of multifunctional friction modifiers that combine friction reduction with anti-wear, deposit-control, and oxidation-resistance properties. Additive manufacturers are investing in next-generation organic molecules, nano-engineered materials, and hybrid chemistries to enhance performance at varying temperatures and lubricant viscosities. These innovations support modern engines with tighter tolerances and advanced materials, as well as industrial machinery demanding longer service life. The opportunity lies in supplying high-performance formulations tailored for electric and hybrid powertrains, where reduced mechanical loss and thermal efficiency play an increasing role in overall system optimization. Companies that offer precision-engineered friction modifiers are positioned to capture premium demand.

- For instance, BASF’s Irgafluid® series demonstrated a Four-Ball Wear Test scar diameter of 0.42 mm at 392 N load for 60 minutes, compared with 0.63 mm for the untreated base oil showing simultaneous friction and wear reduction enabled through multifunctional organic chemistry.

Growing Adoption in Electrified and Hybrid Vehicle Lubrication

Electrification creates new opportunities for specialized friction modifiers as e-axles, electric drivetrains, and hybrid engines require fluids with unique thermal and tribological characteristics. Although electric vehicles have fewer moving components than internal combustion engines, they operate under conditions where lubrication challenges persist—such as high-speed bearings, integrated reduction gears, and cooling requirements for e-motors. Friction modifiers optimized for low conductivity, material compatibility, and thermal stability are increasingly incorporated into dedicated EV transmission fluids. Hybrid vehicles, which frequently switch between electric and combustion modes, represent another high-growth application, as they demand advanced lubricants that manage friction during rapid start-stop cycles and mixed-power operation.

- For instance, Afton Chemical’s e-Drive Lubricant Technology demonstrated a coefficient of friction of 0.065 in a high-sliding bench test at 120 °C, compared with 0.092 for a conventional driveline formulation, indicating the ability of tailored friction modifiers to reduce mechanical losses in electric drivetrains.

Opportunity in Emerging Markets and Heavy-Duty Fleets

Rapid industrialization, infrastructure development, and rising vehicle ownership in emerging regions create significant expansion opportunities for friction modifier suppliers. Heavy-duty fleets—including commercial trucks, mining vehicles, and construction machinery—are increasingly upgrading to premium lubricants to reduce downtime and fuel consumption. Government-led emission control programs in Asia-Pacific, the Middle East, and Latin America further accelerate the transition toward advanced friction-reducing additives. As supply chains digitize and fleet operators prioritize operational efficiency, demand strengthens for lubricant solutions that deliver quantifiable improvements in engine life and cost-per-kilometer performance. This opens growth avenues for both organic and hybrid friction modifier technologies.

Key Challenge

Fluctuating Raw Material Costs and Supply Chain Constraints

Volatility in raw material pricing, especially for specialty chemicals used in organic and organomolybdenum friction modifiers, poses a significant challenge for manufacturers. Global supply chain disruptions, geopolitical uncertainties, and transportation bottlenecks contribute to inconsistent availability of key inputs, increasing production costs and impacting profit margins. Lubricant formulators face additional hurdles in maintaining consistent additive quality across regions due to varying regulatory and environmental compliance requirements. These constraints force companies to explore backward integration, diversification of global supply sources, and strategic partnerships—yet managing stability in pricing and inventory remains a persistent challenge.

Regulatory Restrictions on Metallic and Environmentally Hazardous Additives

Increasingly stringent global regulations on chemical toxicity, ash-forming components, and environmental hazards challenge producers of inorganic and metal-based friction modifiers. Restrictions on molybdenum compounds, phosphorus, sulfur, and other metallic additives create barriers to their continued use, especially in automotive applications where emission control technologies are sensitive to lubricant chemistry. Manufacturers must reformulate products to comply with evolving standards, which requires significant R&D investment and potential performance trade-offs. Although organic friction modifiers present an alternative, ensuring comparable durability and thermal stability remains a technological challenge. Navigating these regulatory shifts while maintaining product performance is a key constraint for the industry.

Regional Analysis

North America

North America holds the largest share of the friction modifiers market, accounting for approximately 35%, supported by strong demand for high-performance automotive and industrial lubricants. The region benefits from a well-established automotive sector, advanced engine technologies, and stringent fuel-efficiency regulations that accelerate the adoption of organic and polymer-based friction modifiers. The United States leads consumption due to a large vehicle parc and consistent use of premium engine oils and transmission fluids. Continued investments in synthetic lubricants, coupled with a mature aftermarket service network, reinforce North America’s position as the dominant regional market.

Europe

Europe represents around 25% of the global market, driven by strict emission norms, robust OEM presence, and rapid uptake of low-ash, environmentally compatible lubricant additives. Countries such as Germany, France, and the UK lead demand due to advanced automotive manufacturing and strong industrial activity. The region’s emphasis on sustainability accelerates the transition toward organic friction modifiers while reducing reliance on metallic compounds. Europe’s growing hybrid and electric vehicle fleet also creates demand for specialized lubricants, supporting steady market growth and maintaining the region’s significant global share.

Asia-Pacific

Asia-Pacific accounts for approximately 30% of the market and stands as the fastest-growing region, driven by expanding vehicle production, industrialization, and rising adoption of high-performance lubricants. China, India, Japan, and South Korea contribute heavily due to increasing automotive ownership and strong manufacturing ecosystems. Growing demand for fuel-efficient vehicles and rapid development in construction and mining support widespread use of friction modifiers in both engine oils and heavy-duty lubricants. Cost-competitive production capabilities and rising regulatory focus on emissions further solidify Asia-Pacific as a major growth engine for the market.

Latin America

Latin America holds a smaller but steadily expanding share of around 6–8%, supported by rising vehicle maintenance needs, growing adoption of premium engine oils, and increased industrial activities. Brazil and Mexico dominate regional demand thanks to established automotive assembly operations and large commercial vehicle fleets. The region’s diverse climatic and operational conditions drive the need for lubricants with enhanced friction-reducing capabilities. Growth in mining, construction, and agriculture also supports the consumption of heavy-duty lubricants formulated with friction modifiers, contributing to the region’s gradual market expansion.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5–7% of the global market, driven by strong requirements from oil & gas operations, heavy machinery, and commercial transportation fleets. Countries such as Saudi Arabia, the UAE, and South Africa lead adoption due to large industrial bases and demanding operating environments that require high-performance lubricants. Elevated temperatures and heavy-load applications increase the need for friction modifiers to enhance wear resistance and thermal stability. Growing investments in infrastructure and aftermarket services support the region’s moderate yet consistent market growth.

Market Segmentations:

By Type of Modifiers

- Organic Friction Modifiers

- Organomolybdenum Friction Modifiers

- Polymer Friction Modifiers

By Compound Type

By Application

- Automotive

- Engineering Vehicles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the friction modifiers market is characterized by a mix of global additive manufacturers, specialty chemical companies, and integrated lubricant suppliers that compete through innovation, performance consistency, and formulation compatibility. Leading players invest heavily in R&D to develop advanced organic, polymer-based, and hybrid friction modifiers that meet evolving emission norms and deliver measurable gains in fuel efficiency, wear reduction, and thermal stability. Companies such as Afton Chemical, BASF SE, ADEKA, Chevron, Croda International, BRB International, BITEC, CSW Industrials, Kings Industries, and F.I.L.A. Group differentiate through customized additive packages, global supply capabilities, and partnerships with OEMs and lubricant blenders. The market also sees growing emphasis on eco-friendly, low-ash, and biodegradable chemistries, compelling manufacturers to adjust product portfolios in line with regulatory shifts. Competitive intensity remains high as players pursue technological upgrades, regional expansion, and strategic collaborations to strengthen their presence in automotive, industrial, and heavy-duty lubricant applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In Sep 2025, ADEKA reported participation in the “K 2025” plastics and rubber trade fair, and although the announcement concerns a clarifier product (“TRANSPAREX™”), it signals the company’s active materials-additive segment.

- In Sep 2024, BRB Lube Oil Additives & Chemicals launched Petrolad® 133LS, a new gear-oil additive booster for limited-slip differentials, designed to reduce friction inside the differential.

Report Coverage

The research report offers an in-depth analysis based on Type of modifiers, Compound type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as demand for high-performance automotive and industrial lubricants continues to rise.

- Adoption of organic and polymer-based modifiers will increase as industries shift toward eco-friendly and low-ash formulations.

- Regulatory pressure on emissions will drive wider use of friction modifiers in fuel-efficient and low-viscosity engine oils.

- Electric and hybrid vehicles will create new opportunities for advanced additives optimized for thermal stability and drivetrain efficiency.

- Industrial sectors will expand usage to enhance equipment reliability, reduce energy losses, and support extended maintenance cycles.

- Technological innovation in nano-engineered and multifunctional additives will strengthen product performance and differentiation.

- Partnerships between lubricant manufacturers and OEMs will intensify to meet customized performance targets.

- Emerging markets will become high-growth regions due to accelerating motorization and industrialization.

- Increasing digitalization of maintenance systems will boost demand for friction modifiers compatible with smart lubrication technologies.

- Competition will shift toward sustainable chemistry, pushing companies to expand bio-based and non-metallic additive portfolios.