Market Overview:

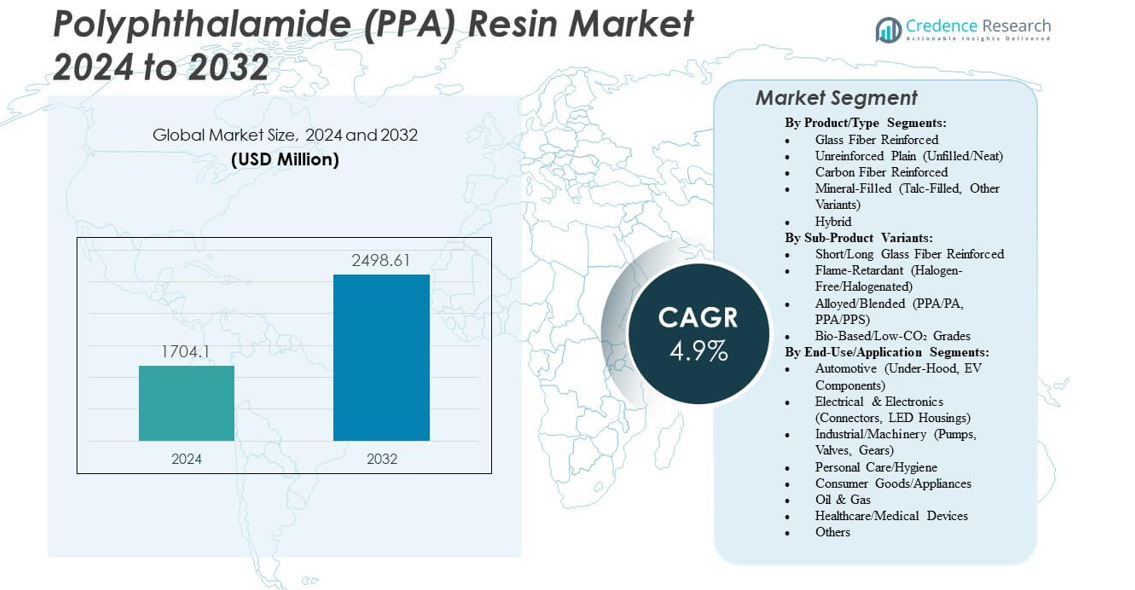

The Polyphthalamide (PPA) Resin Market is projected to grow from USD 1704.1 million in 2024 to an estimated USD 2498.61 million by 2032, with a compound annual growth rate (CAGR) of 4.9% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyphthalamide (PPA) Resin Market Size 2024 |

USD 1704.1 million |

| Polyphthalamide (PPA) Resin Market, CAGR |

4.9% |

| Polyphthalamide (PPA) Resin Market Size 2032 |

USD 2498.61 million |

Growth in this market is driven by increasing demand for lightweight and heat-resistant materials in the automotive, electrical, and electronics industries. Automakers use PPA resin for under-the-hood components to improve fuel efficiency and meet emission norms. Electronics manufacturers adopt it for compact devices that require thermal stability. The material’s mechanical strength, chemical resistance, and ability to replace metals in complex parts make it highly valuable across industries. Continuous innovation in polymer compounding further expands its use in EV systems and precision connectors.

Asia-Pacific dominates the Polyphthalamide (PPA) Resin Market due to strong industrial growth and the presence of major automotive and electronics manufacturers. China, Japan, South Korea, and India lead consumption through expanding production capacity and R&D investments. Europe follows with high demand from advanced automotive and engineering sectors emphasizing sustainability and performance. North America maintains steady adoption through innovation in EV and industrial automation. Emerging regions such as Latin America and the Middle East show growing potential as industrial infrastructure expands and manufacturers seek advanced materials for high-temperature applications.\

Market Insights:

- The Polyphthalamide (PPA) Resin Market is projected to grow from USD 1704.1 million in 2024 to USD 2498.61 million by 2032, registering a CAGR of 4.9%.

- Rising demand for lightweight, durable, and heat-resistant materials in automotive and electronics industries drives market expansion.

- High production costs and complex processing requirements restrain wider adoption across cost-sensitive sectors.

- Asia-Pacific leads global consumption due to strong automotive and electronics manufacturing in China, Japan, South Korea, and India.

- Europe and North America maintain steady growth through advanced engineering applications and electric vehicle component development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Lightweight and High-Performance Materials in Automotive Manufacturing

The Polyphthalamide (PPA) Resin Market benefits from automakers shifting toward lightweight materials to enhance fuel efficiency. Vehicle designs now include advanced polymers that replace metal in structural components. PPA resin offers heat stability and chemical resistance ideal for under-the-hood systems. Automakers use it in fuel lines, turbocharger housings, and electrical connectors. It supports lower emissions by reducing overall vehicle weight. Electric vehicle platforms expand this adoption trend due to thermal reliability needs. The resin’s durability ensures long service life under mechanical stress. Global regulatory norms on emission reduction further push automakers toward broader PPA resin integration.

- For instance, a high-voltage connector for Bosch e-motors, molded by Furnel Inc. using Syensqo’s Amodel PPA, achieves exceptional electrical performance, enhanced flame resistance, and a 50% reduction in production cycle time.

Rising Utilization in Electrical and Electronics Applications

Electronics manufacturers rely on PPA resin for compact parts that require insulation and high mechanical strength. It maintains stable performance under heat stress from high-density circuits. Producers of connectors, switches, and sensors value its dimensional stability. The Polyphthalamide (PPA) Resin Market strengthens through increasing use in smartphones and 5G infrastructure. It supports micro-molding processes in miniaturized electronic devices. Consumer preferences for lightweight and durable products accelerate industry growth. It also enables better resistance to chemicals used in device assembly lines. PPA resin’s adaptability aligns well with the trend toward smaller yet powerful electronic systems.

- For instance, Syensqo’s Amodel PPA AS-4133 HS grade, a 33% glass reinforced PPA, delivers fast molding cycles with low moisture absorption of 0.29% after 24 hours and density of 1.45 g/cm³ for high-density circuits.

Expanding Penetration in Industrial and Machinery Components

Industrial manufacturers use PPA resin for gears, bearings, and compressor parts exposed to friction. Its thermal endurance allows operation in continuous high-temperature settings. The material’s stiffness and wear resistance ensure reliability in rotating equipment. It lowers maintenance cycles in chemical plants and industrial compressors. The Polyphthalamide (PPA) Resin Market gains from industries seeking to replace metal with high-performance plastics. PPA resin extends the lifespan of machine parts under vibration and pressure. Industrial automation and robotics further expand material demand. It provides the durability and stability that critical process equipment requires.

Sustainability and Shift Toward Bio-Based PPA Grades

Rising environmental awareness drives manufacturers to develop eco-friendly PPA alternatives. Bio-based resins reduce carbon footprints while maintaining similar mechanical strength. Producers focus on renewable feedstock sources to meet sustainability goals. The Polyphthalamide (PPA) Resin Market evolves through innovation in green polymer chemistry. Manufacturers test recyclable blends compatible with modern molding processes. It supports circular economy models within automotive and electronics supply chains. Global policies encouraging sustainable material use increase bio-based adoption. The move toward greener resin options enhances brand reputation and long-term market growth potential.

Market Trends

Increased Adoption of Long-Fiber Reinforced PPA Compounds

Manufacturers increasingly prefer long-fiber reinforced PPA grades for structural performance. These compounds deliver improved tensile strength and dimensional stability under mechanical stress. Automotive OEMs apply them in engine brackets, housings, and under-body structures. The Polyphthalamide (PPA) Resin Market expands through engineered composites with higher fatigue resistance. It supports part integration and thickness reduction without performance loss. These grades also resist creep under high loads, ideal for electric motor assemblies. Industrial users benefit from the enhanced rigidity of long-fiber materials. Product diversification strengthens the competitive landscape among material suppliers.

- For instance, Xiamen LFT Composite Plastic Co. offers PPA reinforced with long glass fiber, achieving bending strength of 175-208 MPa and flexural modulus of 8-9 GPa for automotive applications.

Advancement in Processing Technology and 3D Printing Compatibility

Improved injection molding and additive manufacturing techniques raise PPA resin usability. New formulations allow better flow control and reduced warpage in complex molds. The Polyphthalamide (PPA) Resin Market aligns with 3D printing for prototyping and small-batch production. It enables manufacturers to produce intricate geometries with consistent strength. Enhanced thermal resistance supports high-temperature printing operations. Automation-driven industries benefit from faster design-to-part timelines. PPA’s adaptability to hybrid manufacturing broadens its reach in aerospace and industrial segments. The growing integration of digital manufacturing systems increases process efficiency.

Rising Focus on High-Temperature Electrical Components in EVs

Electric vehicle platforms demand components capable of tolerating extreme heat. PPA resin meets these conditions through superior insulation and heat distortion resistance. The Polyphthalamide (PPA) Resin Market benefits from EV production growth and battery advancements. It supports connectors, bus bars, and housing applications in high-voltage systems. Thermal management plays a vital role in ensuring component longevity. OEMs favor PPA compounds that sustain performance beyond 150°C operating temperatures. It promotes long-term safety and reliability within EV architecture. High adoption across e-mobility ecosystems reinforces the resin’s strategic importance.

- For instance, PPA/30SCF composites achieve ultimate tensile strength of 142.7 ± 12.5 MPa and elastic modulus of 12.9 ± 0.6 GPa, supporting high-temperature EV structural uses.

Integration of Flame-Retardant and Glass-Filled PPA Grades

Manufacturers introduce flame-retardant and glass-filled PPA variants to meet safety norms. These materials serve industries that need both high strength and compliance with fire regulations. The Polyphthalamide (PPA) Resin Market strengthens through growth in aerospace, electronics, and public transit sectors. It ensures electrical insulation while maintaining impact resistance. Flame-retardant PPA compounds reduce risks in densely packed systems. Glass fiber content enhances structural rigidity and temperature control. It improves dimensional stability across extended operating cycles. The availability of diverse formulations positions PPA resin as a critical engineering polymer.

Market Challenges Analysis

High Production Cost and Complex Processing Requirements

The Polyphthalamide (PPA) Resin Market faces cost challenges from raw materials and complex synthesis. Producing aromatic polyamides demands precise control and energy-intensive processing. It increases overall pricing compared to conventional polymers like nylon-6 or nylon-66. Complex melt behavior also limits adoption in small and medium manufacturing setups. Processing needs higher mold temperatures, raising operational expenses. Equipment wear from abrasive fillers adds to cost barriers. Manufacturers need expertise in handling resin shrinkage and moisture absorption. These challenges restrain PPA resin’s expansion in low-cost applications across emerging economies.

Competition from Alternative Engineering Plastics

Alternative materials such as polyether ether ketone (PEEK), polybutylene terephthalate (PBT), and polyamide-imide (PAI) create strong competition. These substitutes offer similar or superior thermal and mechanical properties at competitive prices. The Polyphthalamide (PPA) Resin Market faces pressure in cost-sensitive segments. Some industries opt for cheaper nylon blends for moderate temperature performance. Limited recyclability further reduces its attractiveness for sustainable applications. Manufacturers must differentiate through material innovation and customized grades. Market success depends on strategic partnerships with OEMs to secure long-term use cases. Continuous R&D investments remain critical for maintaining relevance against competing polymers.

Market Opportunities

Expanding Role of PPA in Electric Mobility and Autonomous Systems

Electric and autonomous vehicles create new demand for high-precision engineering plastics. The Polyphthalamide (PPA) Resin Market gains scope through increased EV battery, motor, and inverter production. PPA resin supports lightweight integration of sensors and safety components. Its electrical insulation helps improve vehicle safety under high-voltage conditions. OEMs explore PPA-based solutions for thermal shielding in control modules. It aligns with the shift toward more compact and high-density automotive designs. Advanced material engineering opens new potential across ADAS and electronic control units. Growing e-mobility infrastructure fuels consistent global expansion opportunities.

Growing Opportunities in Sustainable and Circular Material Development

Manufacturers focus on bio-based and recyclable PPA formulations that align with global sustainability goals. The Polyphthalamide (PPA) Resin Market benefits from initiatives promoting lower environmental footprints. R&D teams explore renewable monomers derived from biomass and waste sources. It supports closed-loop production systems with reduced dependency on petrochemical inputs. Collaborations between resin producers and automotive OEMs foster eco-efficient value chains. Sustainable PPA blends improve lifecycle performance and carbon reduction metrics. Market leaders invest in greener chemistry to gain competitive advantage. Regulatory incentives further strengthen the case for circular polymer adoption worldwide.

Market Segmentation Analysis:

By Product/Type Segments

The Polyphthalamide (PPA) Resin Market demonstrates clear dominance of glass fiber reinforced grades due to their superior strength and dimensional stability. These variants serve in automotive and industrial components that demand heat resistance and rigidity. Unreinforced PPA types find usage in precision-molded parts where flexibility and smooth surface finish matter. Carbon fiber reinforced grades gain traction for lightweight performance in high-stress environments. Mineral-filled variants improve stiffness and cost efficiency for moderate temperature use. Hybrid compositions integrate multiple fillers to achieve tailored performance across demanding sectors, expanding PPA’s functional scope.

- For instance, BASF’s Ultramid Advanced N (PA9T) grades maintain constant mechanics up to 100°C with a glass transition temperature of 125°C, offering low water uptake for high dimensional stability.

By Sub-Product Variants

Short and long glass fiber reinforced types deliver strong mechanical endurance for complex molded structures. Flame-retardant PPA resins meet safety standards for electrical and electronic assemblies. Alloyed blends such as PPA/PA and PPA/PPS provide balanced chemical and thermal performance for industrial uses. Bio-based and low-CO₂ variants emerge as sustainable alternatives, reflecting environmental awareness across production chains. The Polyphthalamide (PPA) Resin Market strengthens with innovation in resin blending and fiber integration that enhances part durability and recyclability.

By End-Use/Application Segments

Automotive applications lead overall consumption due to wide use in under-hood and EV parts requiring thermal endurance. Electrical and electronics segments adopt PPA for connectors, LED housings, and compact assemblies. Industrial and machinery segments use it in pumps, valves, and gears where long-term wear resistance is essential. Personal care, consumer goods, and oil & gas industries employ PPA for durability in chemical and mechanical environments. Healthcare and medical device makers explore PPA for sterilizable and biocompatible parts. The market continues broad adoption across sectors requiring performance stability and reduced weight.

- For instance, BASF’s carbon fiber reinforced Ultramid Advanced N grades (20%, 30%, 40% loadings) enable structural parts in body, chassis, and powertrain with 25-30% weight reduction versus metals.

Segmentation:

By Product/Type Segments:

- Glass Fiber Reinforced

- Unreinforced Plain (Unfilled/Neat)

- Carbon Fiber Reinforced

- Mineral-Filled (Talc-Filled, Other Variants)

- Hybrid

By Sub-Product Variants:

- Short/Long Glass Fiber Reinforced

- Flame-Retardant (Halogen-Free/Halogenated)

- Alloyed/Blended (PPA/PA, PPA/PPS)

- Bio-Based/Low-CO₂ Grades

By End-Use/Application Segments:

- Automotive (Under-Hood, EV Components)

- Electrical & Electronics (Connectors, LED Housings)

- Industrial/Machinery (Pumps, Valves, Gears)

- Personal Care/Hygiene

- Consumer Goods/Appliances

- Oil & Gas

- Healthcare/Medical Devices

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The Polyphthalamide (PPA) Resin Market demonstrates distinct regional dynamics with Asia-Pacific leading at 43.9% of the global share. Strong demand from automotive, electrical, and industrial applications drives regional growth. China, Japan, South Korea, and India anchor production through large electronics and automotive supply chains. The region benefits from rapid industrialization, lower manufacturing costs, and expansion of electric vehicle output. It remains the key production hub for both reinforced and flame-retardant PPA grades. Rising exports of precision components also strengthen Asia-Pacific’s long-term dominance. Manufacturers continue to invest heavily in localized compounding and processing facilities.

Europe follows with a 27.8% share, supported by high regulatory standards and a strong engineering base. Germany, France, and Italy remain central to PPA consumption in high-performance automotive systems. The region’s demand aligns with its push for lighter, low-emission vehicle components. PPA’s role in thermal and structural stability reinforces its importance in European production lines. Electronics and industrial sectors also sustain steady resin adoption across EU countries. It benefits from long-term partnerships between resin producers and Tier-1 suppliers that ensure quality and compliance with sustainability targets.

North America contributes about 12.3% of the Polyphthalamide (PPA) Resin Market. It maintains steady growth through ongoing vehicle electrification and industrial modernization. The United States and Canada see consistent adoption in electrical connectors, EV modules, and mechanical systems. Latin America holds around 7.5%, led by Mexico and Brazil’s automotive expansion. The Middle East & Africa account for 8.5%, supported by growing industrial projects and infrastructure investment. Each emerging region presents opportunities for capacity expansion as manufacturers diversify sourcing and supply networks to meet rising global demand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- DuPont de Nemours

- Solvay S.A.

- Arkema S.A.

- Evonik Industries AG

- EMS‑Chemie Holding AG

- Akro‑Plastic GmbH

- DSM Engineering Plastics B.V.

- Saudi Basic Industries Corporation (SABIC)

- Toray Industries Inc.

- Polyplastics Co. Ltd.

- LG Chem Ltd.

- Lotte Advanced Materials Co. Ltd.

- RTP Company Inc.

- Kingfa SCI & TECH CO. LTD.

Competitive Analysis:

The Polyphthalamide (PPA) Resin Market remains moderately consolidated. Leading firms include Solvay S.A., Arkema, Evonik Industries AG, Ems‑Chemie Holding AG, Akro‑Plastic GmbH and DuPont de Nemours, Inc.. These companies compete through product innovation, offering reinforced, flame-retardant, alloyed and bio-based PPA grades. They tailor resins for automotive, electronics, industrial and sustainable applications. Large players wield strength through global supply chains, R&D capabilities and broad customer reach. Mid-size firms focus on niche segments with specialized formulations. The competitive edge arises from ability to supply high-performance resins at scale while meeting environmental and regulatory demands. Entry barriers remain high due to production complexity and capital requirements. Market success depends on continuous innovation, cost optimization, and alignment with OEM demands across regions.

Recent Developments:

- In October 2025, BASF also announced a strategic collaboration with International Flavors & Fragrances Inc. (IFF) to co-develop sustainable solutions that include biobased polymers and enzyme systems, aimed at improving performance while reducing environmental impacts, marking a significant move toward innovation and sustainability in polymer technologies

- In June 2025, BASF further enhanced its PPA portfolio with the launch of Ultramid® Advanced N3U42G6, a polyamide 9T featuring a non-halogenated flame-retardant technology, responding to evolving market demands for high-performance polymers with improved safety profiles.

Report Coverage:

The research report offers an in-depth analysis based on Product/Type, Sub-Product Variants and End-Use/Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Polyphthalamide (PPA) Resin Market will expand through rising adoption in electric vehicles and lightweight automotive components.

- Demand from electrical and electronics manufacturing will increase due to high thermal stability and compact design needs.

- Industrial automation and robotics will support greater use of PPA in mechanical systems requiring heat resistance.

- Technological progress in compounding and long-fiber reinforcement will enhance structural performance and application range.

- The shift toward bio-based and low-CO₂ resin grades will accelerate under sustainability mandates.

- Asia-Pacific will remain the production hub, driven by manufacturing growth in China, Japan, and South Korea.

- Europe will continue favoring PPA for precision-engineered automotive and industrial uses under strict emission rules.

- New opportunities will arise from aerospace and defense sectors seeking high-strength, lightweight materials.

- Partnerships between OEMs and resin manufacturers will foster tailored solutions for advanced applications.

- Ongoing investment in R&D and recycling technologies will improve PPA’s circular economy potential and market longevity.