Market Overview

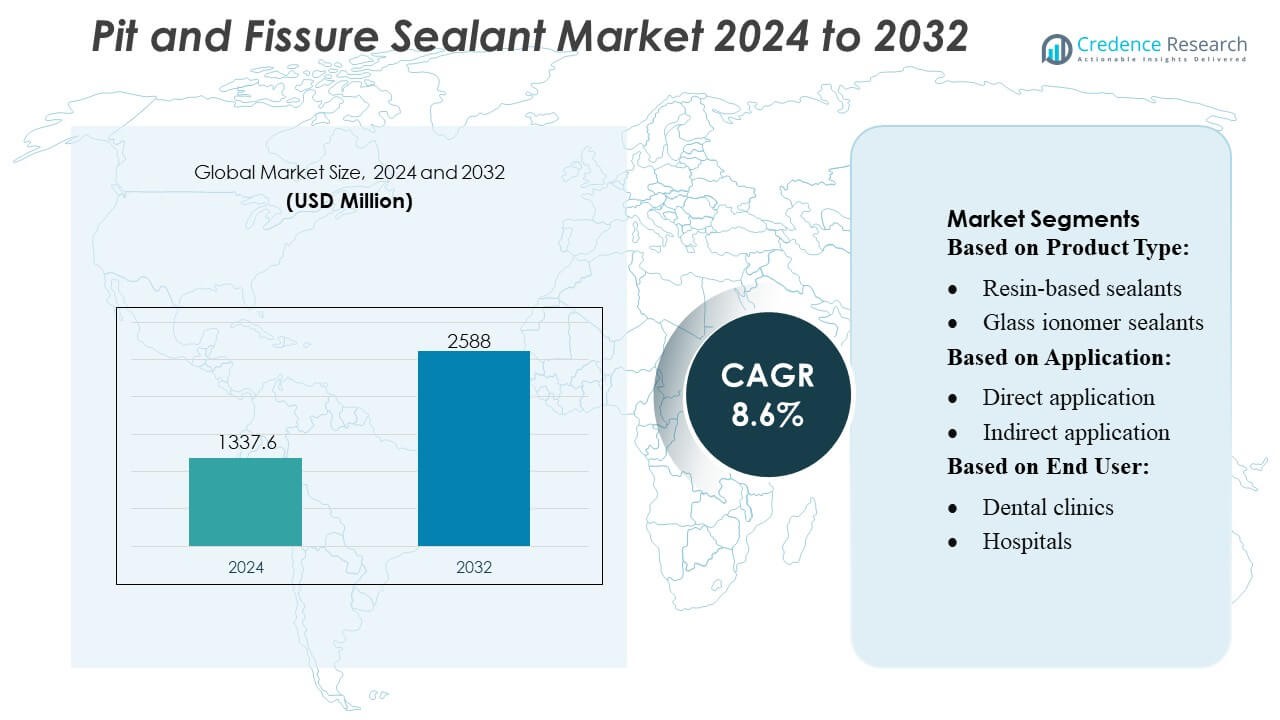

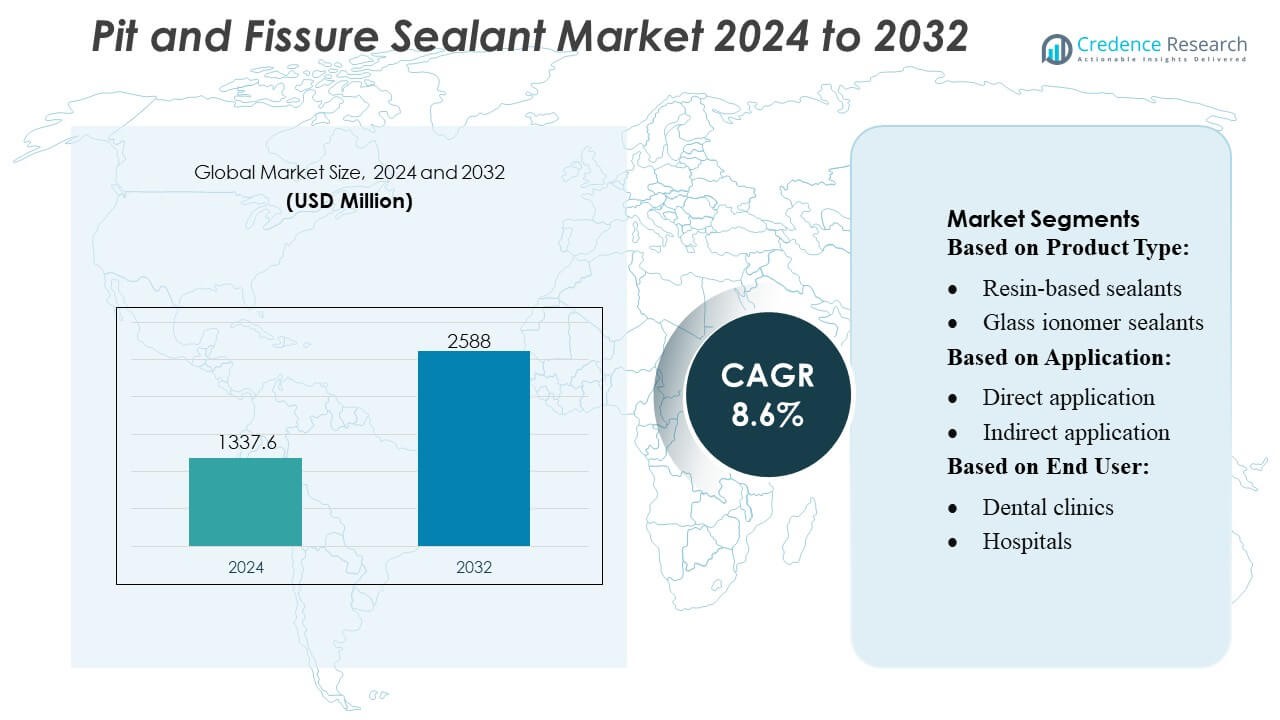

Pit and Fissure Sealant Market size was valued USD 1337.6 million in 2024 and is anticipated to reach USD 2588 million by 2032, at a CAGR of 8.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pit and Fissure Sealant Market Size 2024 |

USD 1337.6 Million |

| Pit and Fissure Sealant Market, CAGR |

8.6% |

| Pit and Fissure Sealant Market Size 2032 |

USD 2588 Million |

The Pit and Fissure Sealant Market is supported by a competitive mix of global manufacturers that continue to advance resin technologies, fluoride-releasing systems, and moisture-tolerant formulations to strengthen preventive dentistry outcomes. Leading companies focus on enhancing product retention, improving biocompatibility, and expanding distribution networks to meet rising demand from dental clinics and public health programs. Innovation in light-cured sealants and bioactive materials further intensifies competition as providers target higher durability and easier chairside application. North America leads the global market with an exact 38% share, driven by strong preventive care adoption, advanced dental infrastructure, and widespread school-based sealant initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Pit and Fissure Sealant Market reached USD 1337.6 million in 2024 and is projected to hit USD 2588 million by 2032 at a CAGR of 8.6%, reflecting strong global demand for preventive dental solutions.

- Market growth is driven by rising pediatric caries prevalence, increasing preventive dentistry adoption, and the expanding use of advanced resin-based sealants, which hold the largest segment share due to their high retention and durability.

- Trends focus on bioactive, fluoride-releasing, and moisture-tolerant formulations that enhance remineralization and support clinical efficiency, with manufacturers accelerating R&D to improve flowability and long-term performance.

- Competitive intensity grows as companies strengthen distribution networks, expand product portfolios, and promote evidence-based outcomes, while cost barriers and limited awareness in low-income regions restrain broader adoption.

- North America leads with 38% market share, supported by robust dental infrastructure and school-based sealant programs, while Asia-Pacific shows fast growth driven by rising clinic penetration and expanding public oral health initiatives.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

Resin-based sealants hold the dominant position in the Pit and Fissure Sealant Market with an estimated over 45% share, driven by their strong adhesion, long-term retention, and widespread clinical adoption for preventive dentistry. Their superior mechanical strength and adaptability across tooth surfaces strengthen their preference among practitioners. Glass ionomer sealants gain traction in moisture-sensitive cases due to chemical bonding and fluoride release, while polyacid-modified resin (compomer) sealants serve niche needs where flexibility and aesthetics matter. Fluoride-releasing sealants expand in pediatric dentistry, and other emerging formulations support specialized preventive protocols.

- For instance, Huntsman improved the performance of dental resin systems by integrating its JEFFAMINE® polyetheramines, which deliver controlled crosslink density and achieve tensile strengths exceeding 80 MPa in polymerized systems, enabling higher durability and longer intraoral retention.

By Application

Direct application accounts for the largest share, exceeding 60%, supported by its procedural efficiency, chairside convenience, and strong suitability for pediatric and adult preventive care. It offers immediate placement, reduced treatment time, and cost-effectiveness, making it the primary choice in routine dental practice. Indirect application remains relevant for high-precision preventive restorations and complex occlusal surfaces, although it holds a smaller share due to higher procedural steps and laboratory involvement. The market continues to shift toward advanced light-cured direct sealants that enhance flowability, retention, and long-term cavity protection.

- For instance, Avery Dennison Corporation improved dental and medical device adhesive performance through its medical-grade pressure-sensitive adhesive platforms (such as the MED 1815 or MED 5740 series).

By End User

Dental clinics dominate the market with over 55% share, driven by high patient footfall, routine preventive checkups, and rapid adoption of advanced sealant materials. Clinics benefit from flexible appointment systems and strong utilization of resin-based and fluoride-releasing sealants in preventive programs. Hospitals maintain a steady share due to their role in treating complex dental conditions, pediatric cases requiring sedation, or special-needs patients. Other end users, including community dental programs and public health centers, expand their adoption as governments intensify early childhood caries prevention and school-based oral health initiatives.

Key Growth Drivers

Rising Pediatric Caries Prevalence

Growing incidence of dental caries among children acts as a major driver in the Pit and Fissure Sealant Market, pushing demand for early preventive interventions. Rising focus on school-based oral health programs and national preventive dentistry campaigns strengthens adoption of resin-based and fluoride-releasing sealants. Governments and dental associations promote routine sealing of high-risk molars to reduce future restorative costs. The trend accelerates in developing regions where untreated caries rates remain high. Expanding awareness among parents and increased insurance coverage for preventive care further reinforce market growth.

- For instance, RPM subsidiaries demonstrate the capability to achieve compressive strengths reaching 80 MPa or higher and Shore D hardness values around 80 upon full cure, validating the company’s capability to engineer durable, high-retention resin matrices relevant to various coating and adhesive formulations.

Expanding Adoption of Minimally Invasive Dentistry

The shift toward minimally invasive dentistry significantly boosts market demand, as sealants provide a non-invasive protective barrier against occlusal caries without requiring tooth reduction. Clinicians increasingly prioritize retention efficiency, biocompatibility, and fluoride release to extend tooth longevity. Technological enhancements in flowable resins and moisture-tolerant formulations improve application outcomes. This driver aligns with global recommendations encouraging preventive rather than restorative interventions. It also promotes wider use of sealants across adults and adolescents, not just children, expanding the overall treatment base.

- For instance, 3M Company enhanced minimally invasive workflows through its 3M™ Clinpro™ Sealant, which incorporates a color-change Smart Color Technology (goes on pink, cures white) and achieves a tested shear bond strength to enamel of approximately 20 to 30 MPa, according to 3M’s technical product bulletin.

Growth in Dental Clinics and Preventive Care Visits

Increasing dental clinic penetration and rising annual preventive care visits contribute strongly to market expansion. Patients increasingly seek routine checkups driven by better oral health awareness, digital appointment systems, and improved accessibility to private dental care. Clinics rapidly adopt advanced light-cured and hydrophilic sealants that enhance workflow efficiency and retention performance. The growing preference for chairside preventive treatments supports higher sealant placement rates. This driver is reinforced by targeted promotions from manufacturers and clinical guidelines emphasizing periodic sealing of vulnerable pits and fissures.

Key Trends & Opportunities

Adoption of Fluoride-Releasing and Bioactive Sealants

A key market trend involves rising interest in fluoride-releasing and bioactive sealants that provide dual benefits of sealing and remineralization. These materials gain recognition for their role in inhibiting early enamel demineralization and strengthening high-risk tooth surfaces. Manufacturers invest in advanced chemistries that offer sustained ion release and improved hydrophilicity for use in moisture-compromised conditions. The trend aligns with evidence-based preventive dentistry and expands usage in pediatric populations. It also supports broader adoption in community health programs focusing on long-term caries prevention.

- For instance, Pidilite Industries company’s R&D documentation for certain high-performance polymer systems reports typical material properties such as tensile shear strengths in the range of 15-20 MPa and controlled water absorption values below typical industry benchmarks for specific applications, demonstrating material stability and capabilities relevant to the development of specialized adhesive and sealant formulations.

Technological Advancements in Sealant Materials and Application Methods

Innovation in resin chemistry, filler technology, and curing systems shapes major opportunities in the market. Newer sealants provide enhanced flow characteristics, higher wear resistance, and better bonding to etched enamel, improving long-term retention. Light-curing technologies and improved applicator designs streamline chairside workflow and reduce application time. Digital caries-risk assessment tools also encourage more targeted and timely sealant placement. This trend creates opportunities for manufacturers to differentiate through performance-focused formulations and easier clinical handling.

- For instance, Wacker Chemie AG advanced polymer performance through its ELASTOSIL® and VINNAPAS® material platforms; ELASTOSIL® R plus silicone grades demonstrate tear-propagation resistance up to 30 N/mm and tensile strengths reaching 9 MPa, while VINNAPAS® polymer.

Expansion of Public Health and School-Based Sealant Programs

Governments increasingly emphasize preventive dental care through school-based sealant programs, creating significant opportunities for market expansion. These initiatives prioritize sealing of permanent molars in children from underserved populations, reducing long-term restorative burdens. Partnerships between public health agencies, NGOs, and dental professionals enhance accessibility and funding support. This opportunity grows in regions with high untreated caries prevalence and expanding preventive dentistry budgets. Increased procurement of cost-effective fluoride-releasing and glass ionomer sealants strengthens adoption across large-scale public programs.

Key Challenges

Limited Awareness and Access in Low-Income Regions

One of the key challenges involves inadequate awareness of preventive dentistry and limited access to dental services in low-income regions. Many populations prioritize curative rather than preventive care due to cost constraints or lack of education on long-term benefits. Shortages of dental professionals and limited penetration of clinics further restrict sealant uptake. Public health programs face funding limitations, slowing large-scale adoption. This challenge continues to create regional disparities in sealant utilization and hinders the overall market’s growth potential.

Sealant Retention Issues in Moisture-Compromised Conditions

Achieving optimal retention remains a clinical challenge, especially in environments where moisture control is difficult, such as pediatric or uncooperative patients. Glass ionomer and moisture-tolerant formulations address part of the issue, but resin-based sealants still require stringent isolation for long-term success. Premature sealant loss leads to additional appointments and reduced preventive efficacy, discouraging consistent use among some practitioners. Enhancing hydrophilicity, flowability, and bonding performance remains critical for overcoming this limitation and improving clinical outcomes.

Regional Analysis

North America

North America holds the largest share at approximately 38% of the Pit and Fissure Sealant Market, supported by strong preventive dentistry adoption, high dental insurance penetration, and widespread implementation of school-based sealant programs. The region benefits from advanced clinical infrastructure, early uptake of resin-based sealants, and strong participation from dental associations promoting evidence-based preventive protocols. Increased awareness among parents, frequent dental visits, and broad integration of fluoride-releasing sealants further strengthen market demand. Government-funded community oral health initiatives continue to elevate sealant placement rates across underserved populations, reinforcing the region’s sustained leadership.

Europe

Europe accounts for around 27% of the global market, driven by well-established dental care systems, strong practitioner focus on preventive treatment, and supportive reimbursement frameworks in several countries. The region shows high adoption of glass ionomer and resin-based sealants in pediatric dentistry, supported by stringent oral health guidelines issued by national dental bodies. Public-funded preventive programs and increased emphasis on early childhood caries reduction contribute to consistent demand. Growing preference for minimally invasive dentistry and rising awareness of enamel preservation strengthen market momentum across Western and Northern Europe.

Asia-Pacific

Asia-Pacific captures approximately 24% of the market, fueled by rapid growth in dental clinics, rising disposable incomes, and expanding awareness of preventive oral care. High caries prevalence among children in countries such as India, China, and Southeast Asia drives increased sealant usage, especially in school-based and government-supported oral health campaigns. Adoption of affordable fluoride-releasing and glass ionomer sealants continues to rise in developing markets. Strengthening healthcare infrastructure, higher dental workforce density in urban centers, and growing private dental insurance coverage further support market expansion across the region.

Latin America

Latin America holds close to 7% of the market, influenced by growing implementation of caries-prevention initiatives and rising access to private dental services. Countries such as Brazil, Mexico, and Chile lead regional adoption due to expanding dental education programs and increased uptake of pediatric preventive care. The market benefits from gradual improvements in public healthcare funding and targeted oral health campaigns in schools. However, economic disparities and uneven distribution of dental professionals continue to limit widespread penetration. Expanding urban dental clinics and rising awareness among young parents contribute to incremental market growth.

Middle East & Africa

The Middle East & Africa region accounts for around 4% of the global market, driven by growing investments in dental care infrastructure and increasing demand for preventive treatments in urban centers. Gulf countries demonstrate faster adoption supported by higher healthcare spending and expanding private dental networks. Public health initiatives in Africa encourage sealant use, though accessibility challenges and low awareness continue to restrict broader penetration. The market gradually benefits from training programs for dental professionals and partnerships aimed at improving pediatric oral health outcomes across both public and private sectors.

Market Segmentations:

By Product Type:

- Resin-based sealants

- Glass ionomer sealants

By Application:

- Direct application

- Indirect application

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Pit and Fissure Sealant Market features a competitive landscape shaped by global materials and chemical manufacturers, including Huntsman, Avery Denison Corporation, RPM International Inc., 3M Company, Pidilite Industries, Wacker Chemie AG, H B Fuller, Henkel AG, Sika AG, and Ashland Inc. the Pit and Fissure Sealant Market is defined by continuous innovation in material science, growing emphasis on preventive dentistry, and strong participation from global manufacturers specializing in dental consumables and advanced resin technologies. Companies focus on developing high-retention, moisture-tolerant, and fluoride-releasing formulations that support long-term caries prevention across diverse patient groups. Product differentiation increasingly revolves around biocompatibility, enhanced flow characteristics, and improved enamel bonding performance. Market players expand distribution networks, strengthen collaborations with dental professionals, and invest in clinical research to validate product efficacy. Rising demand from dental clinics, school-based programs, and public health initiatives intensifies competition, encouraging manufacturers to adopt performance-driven and cost-effective strategies.

Key Player Analysis

Recent Developments

- In June 2025, Sika announced a strategic investment in Giatec Scientific Inc., a Canadian leader in digital concrete technology. Giatec focuses on AI sensors, software, and data analytics that enhance concrete quality, durability, and sustainability. With this partnership, Sika’s digital strategy is furthered with the integration of AI-driven concrete mix optimization with Sika’s admixture technologies to reduce material use, cost, and CO2 emissions.

- In March 2025, H.B. Fuller announced the launch of industry-grade commercial roofing adhesive with first-of-its-kind canister propellent technology. The H.B. Fuller Millennium PG-1 EF ECO 2 is a high-performance roofing adhesive that eliminates the need for chemical blowing agents by using naturally occurring atmospheric gases.

- In March 2025, VOCO GmbH is preparing for the launch of eight novel products during the International Dental Show (IDS). Among this quad is GrandioSO Unlimited, a universal composite applicable in 4 mm-high layers and with a simplified shade system covering all 16 VITA classical shades, emphasizing the commitment of the company under continuous innovation in dental materials.

- In February 2025, Power Adhesives launched Tecbond 110B-PR a biodegradable, low-viscosity bulk hot melt for high-speed case sealing, offering energy savings and fast open times while expanding their eco-friendly range alongside the existing Tecbond 214B, providing certified sustainable options (ASTM D6400/EN13432) that break down naturally for industrial packaging needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising global emphasis on preventive dentistry and early caries management.

- Adoption of fluoride-releasing and bioactive sealants will grow as clinicians prioritize remineralization benefits.

- School-based oral health programs will increase sealant placement rates, especially in developing regions.

- Technological advances will improve sealant retention, moisture tolerance, and long-term durability.

- Minimally invasive dentistry trends will drive higher use of resin-based sealants in routine care.

- Government-funded preventive initiatives will strengthen accessibility for underserved populations.

- Digital caries-risk assessment tools will support more targeted sealant application.

- Private dental clinics will continue to drive demand with higher adoption of advanced light-cured formulations.

- Training programs for dental professionals will expand, improving application quality and outcomes.

- Manufacturers will prioritize sustainable, biocompatible materials to meet evolving clinical and regulatory expectations.

Market Segmentation Analysis:

Market Segmentation Analysis: