Market Overview

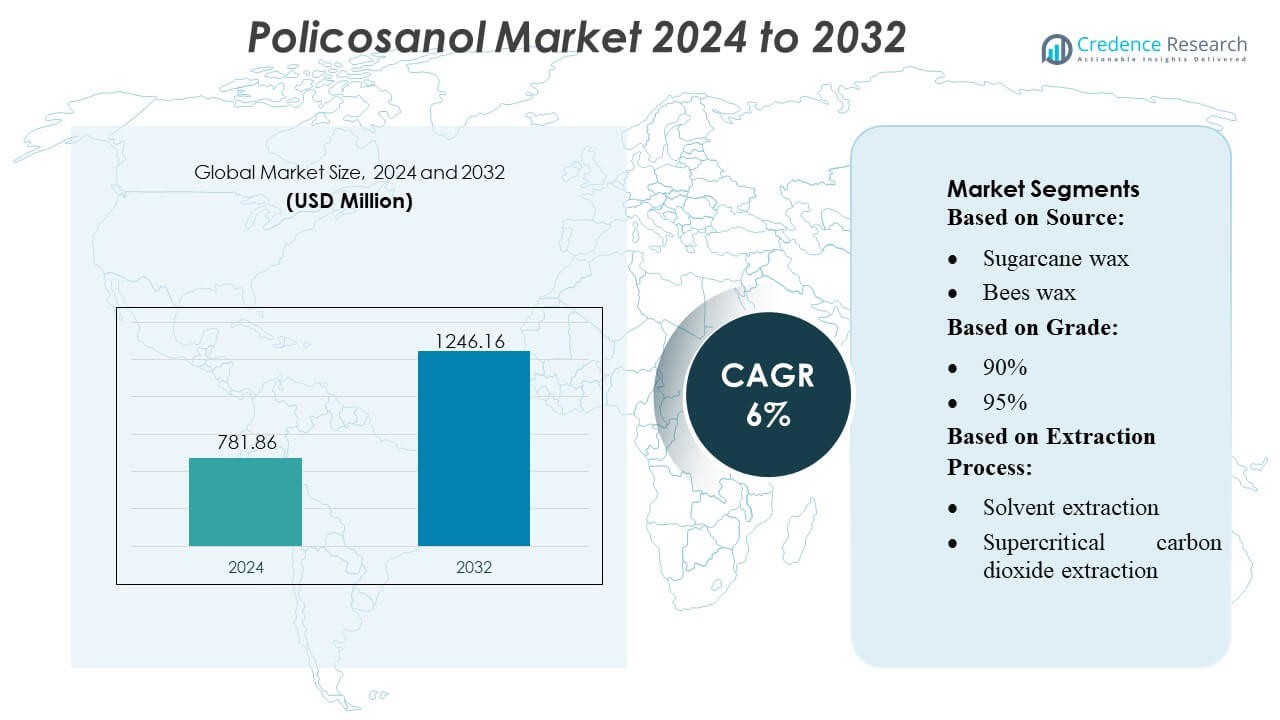

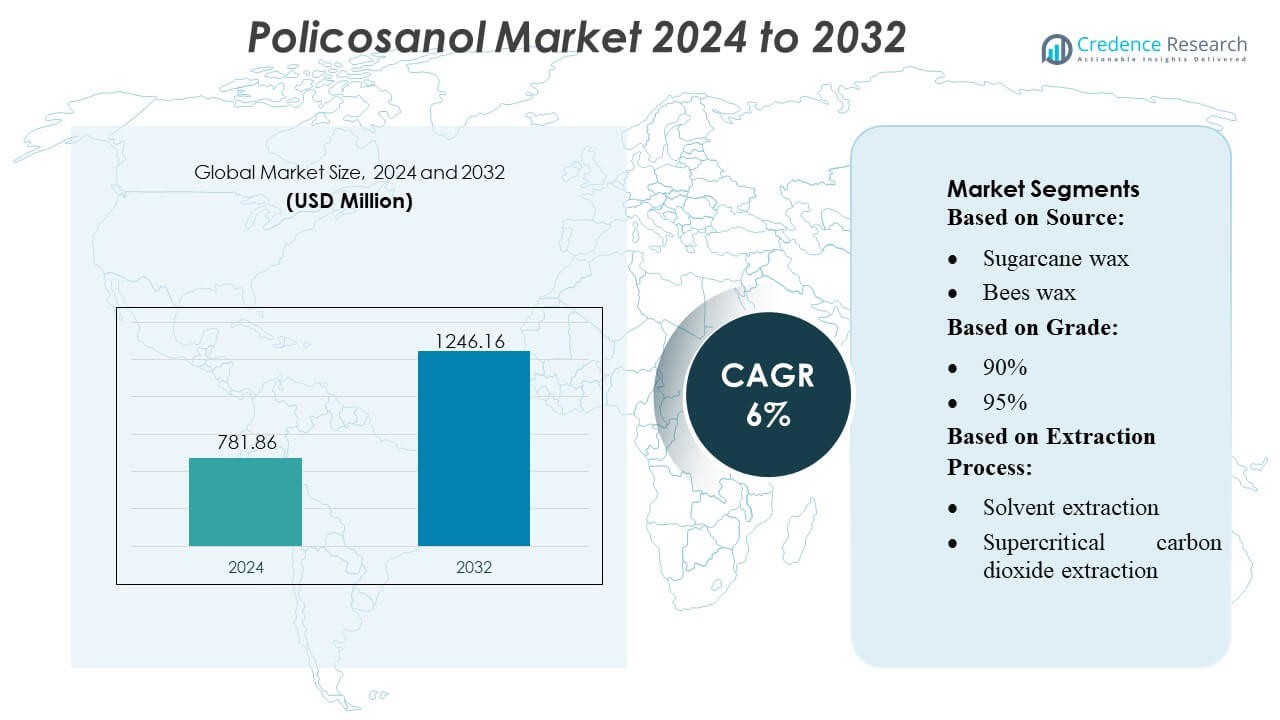

Policosanol Market size was valued USD 781.86 million in 2024 and is anticipated to reach USD 1246.16 million by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Policosanol Market Size 2024 |

USD 781.86 Million |

| Policosanol Market, CAGR |

6% |

| Policosanol Market Size 2032 |

USD 1246.16 Million |

The Policosanol Market is shaped by a mix of global ingredient manufacturers that continue to advance extraction technologies, purity enhancement, and formulation capabilities to strengthen their competitive position. Leading players focus on high-efficiency refining systems, sustainable sourcing, and consistent nutraceutical-grade output to meet rising global demand for cholesterol-management supplements. Competitive strategies emphasize expanding distribution partnerships, developing high-bioavailability variants, and integrating automated quality-control systems to maintain product performance across diverse applications. North America leads the global market with an exact 38% share, supported by strong consumer adoption of dietary supplements, well-established regulatory frameworks, and robust demand for plant-derived functional ingredients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Policosanol Market reached USD 781.86 million in 2024 and is projected to attain USD 1246.16 million by 2032 at a 6% CAGR, reflecting steady global demand growth.

- Rising consumer focus on natural lipid-management ingredients drives strong adoption across dietary supplements, with high-purity formulations gaining preference due to better efficacy and safety alignment.

- Product innovation accelerates as manufacturers invest in enzymatic extraction, bioavailability enhancement, and cleaner-label formulations, while competitive intensity increases through distribution expansion and private-label partnerships.

- Market growth faces restraints from raw-material fluctuations, strict regulatory validation requirements, and variability in clinical evidence across regions, creating challenges for faster product approvals and scaling.

- North America leads with 38% share, followed by Europe and Asia-Pacific, while nutraceutical supplements represent the dominant segment with the highest share, supported by expanding retail penetration and rising preventive-health spending.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Source

Sugarcane wax dominates the Policosanol Market with an estimated 42% share, supported by its high commercial yield, consistent long-chain alcohol profile, and strong acceptance in nutraceutical formulations. Manufacturers prioritize sugarcane-derived policosanol because it delivers superior purity levels and stable bioactive concentrations, enabling standardized dosage forms for functional foods and supplements. Beeswax and rice bran gain steady adoption in specialized health products, while wheat germ oil and other botanical sources expand niche demand. Growing consumer preference for plant-based lipid regulators and advancements in purification technologies strengthen the leadership of sugarcane wax across global supply chains.

- For instance, Qatar Solar Technologies (QSTec) previously utilized a high-precision chemical vapor deposition (CVD) system that operated with reactor rod temperatures typically ranging from 1,100°C to 1,250°C to enable the production of high-purity solar-grade polysilicon.

By Grade

The 90% grade leads the market with an approximate 46% share, driven by its optimal balance between purity, cost-efficiency, and compatibility with large-volume supplement manufacturing. Producers favor this grade because it supports scalable tablet and capsule production without requiring extensive refinement steps, reducing formulation costs for nutraceutical brands. The 95% and >95% grades find increasing demand in premium cardiovascular and metabolic health products, where higher purity is essential for targeted efficacy claims. Expanding clinical validation and R&D investments in high-purity long-chain alcohol fractions further enhance opportunities across specialized therapeutic segments.

- For instance, LG Chem’s random-copolymer grade R3450 for CPP-film exhibits a Melt Flow Index of 8 g/10 min (230 °C, 2.16 kg load), tensile yield strength of 260 kgf/cm², elongation at break > 500 % and a Vicat softening temperature of 134 °C.

By Extraction Process

Solvent extraction remains the dominant process with nearly 58% market share, supported by its high extraction efficiency, lower operational cost, and strong suitability for commercial-scale production across sugarcane and beeswax sources. The method’s ability to deliver consistent yield and purity levels enables manufacturers to meet rising demand from supplement and functional food industries. Supercritical CO₂ extraction grows rapidly as a cleaner and solvent-free alternative, appealing to premium brands targeting organic and natural product categories. Its higher capital cost limits widespread adoption, yet its superior selectivity and environmental benefits continue to accelerate interest in sustainable extraction pathways.

Key Growth Drivers

Rising Demand for Natural Lipid-Lowering Ingredients

The market grows steadily as consumers and healthcare providers shift toward natural, plant-derived compounds that support cholesterol regulation without synthetic additives. Policosanol, especially from sugarcane wax, gains traction due to its favorable safety profile, standardized purity levels, and documented benefits in lipid modulation. Supplement manufacturers integrate it into cardiovascular health formulations to meet rising demand for preventive wellness solutions. Expanding awareness campaigns, aging populations, and growing retail availability of nutraceuticals further accelerate adoption across global markets.

- For instance, PolyPacific’s PP-GF30 (polypropylene reinforced with 30 % glass fiber) used in instrument panels and structural trim parts offers a tensile strength of 110 MPa, a heat deflection temperature of 155 °C at 1.8 MPa, and a specific gravity of 1.16, making the material significantly lighter than steel components while maintaining durability under prolonged thermal load.

Expansion of Nutraceutical and Functional Food Applications

Broader use of policosanol in tablets, capsules, soft gels, and fortified foods strengthens market momentum as manufacturers diversify dosage formats to improve consumer convenience. Its compatibility with multivitamin blends and heart-health formulations drives higher product differentiation in competitive nutraceutical portfolios. Growing investments in formulation science enable better bioavailability and stability, encouraging integration into gummies, beverages, and health snacks. Increasing retail penetration across pharmacies, e-commerce channels, and specialty nutrition stores further boosts segment growth worldwide.

- For instance, SABIC’s grade PP 526P for cast film applications features a Melt Flow Rate of 8 g/10 min (at 230 °C, 2.16 kg) and a density of 905 kg/m³. The same grade exhibits a Vicat softening temperature of 152 °C and a notched Izod impact strength of 25 J/m at 23 °C.

Technological Advancements in Extraction and Purification

Improved extraction technologies support market expansion by delivering higher purity levels, consistent long-chain alcohol profiles, and lower production costs. Advancements in solvent optimization, membrane filtration, and CO₂-based extraction enhance yield efficiency while reducing environmental impact. These innovations enable manufacturers to scale output and meet rising global demand for high-quality policosanol in clinical-grade and commercial products. Enhanced R&D capabilities also encourage development of specialized blends with improved functionality, driving stronger adoption across nutraceutical and pharmaceutical applications.

Key Trends & Opportunities

Shift Toward High-Purity Grades for Cardiovascular Formulations

Manufacturers increasingly focus on producing 95% and >95% purity grades to target premium heart-health supplements with stronger evidence-based positioning. This trend opens opportunities for brands to differentiate products by offering enhanced potency and improved lipid-altering effects. Growing clinical research on high-purity long-chain alcohol fractions encourages adoption in specialized therapeutic categories. Premium positioning supports higher margins and attracts consumers seeking effective natural cholesterol management solutions.

- For instance, Arkema’s OREVAC® 18751 maleic-anhydride modified polypropylene resin exhibits a density of 0.910 g/cm³, a melt index of 35 g/10 min (230 °C, 2.16 kg load), a tensile yield strength of 24.0 MPa, elongation at break of 500 %, and a Vicat softening point of 138 °C.

Emergence of Clean-Label and Sustainable Extraction Practices

Sustainability becomes a key market opportunity as producers adopt greener extraction methods such as supercritical CO₂ to reduce solvent dependency and environmental footprint. Clean-label consumer preferences drive demand for minimally processed, organically sourced policosanol with transparent supply chains. Companies investing in renewable raw materials, eco-friendly processing plants, and traceability systems strengthen brand trust and tap into growing ethical consumer segments. This shift expands opportunities for premium-certified nutraceutical offerings globally.

- For instance, PetroChina’s K9928H high-impact copolymer polypropylene used in appliance parts delivers a typical Melt Flow Rate of approximately 24 g/10 min (at 230 °C, 2.16 kg load), a notched Izod impact strength of approximately 113 J/m (or 11.3 kJ/m²) at 23 °C, and a tensile yield strength of approximately 24 MPa, according to typical product data documentation.

Growth of Online Retail and Personalized Nutrition Channels

E-commerce expansion and personalized supplement platforms create new opportunities for market penetration by enabling tailored cardiovascular health solutions. Direct-to-consumer brands leverage digital marketing to highlight clinical benefits, purity specifications, and source transparency. Subscription-based models and AI-driven wellness assessments further support repeat purchases and higher customer retention. This trend helps smaller brands enter the market while encouraging established manufacturers to strengthen digital distribution strategies.

Key Challenges

Raw Material Supply Constraints and Price Volatility

Dependence on sugarcane wax, beeswax, and other natural sources exposes manufacturers to fluctuations in agricultural output, climate conditions, and regional production cycles. These supply uncertainties create cost instability, affecting pricing strategies for nutraceutical brands. Limited availability of high-purity raw materials can constrain production schedules and delay new product development. Companies must adopt diversified sourcing models and invest in resilient supply chains to mitigate these risks and maintain consistent quality standards.

Regulatory Variability Across International Markets

Regulatory differences related to nutraceutical ingredients, purity grades, safety labeling, and health claims pose challenges for global commercialization. Manufacturers must navigate varying approval processes, documentation requirements, and compliance standards across North America, Europe, and Asia. These complexities increase product development timelines and add cost burdens for clinical validation and quality certification. Inconsistent regulations also limit the ability of brands to standardize global marketing strategies, requiring region-specific formulations and claims management.

Regional Analysis

North America

North America holds an estimated 37% share of the Policosanol Market, supported by strong demand for natural cholesterol-management supplements and widespread consumer adoption of nutraceutical products. The region benefits from advanced retail distribution, high purchasing power, and strong preference for clinically supported cardiovascular health ingredients. Manufacturers leverage well-established regulatory frameworks and partnerships with supplement brands to introduce high-purity grades with standardized formulation profiles. Rising lifestyle-related disorders and greater awareness of preventive wellness continue to drive uptake across pharmacies, online channels, and specialty nutrition outlets, strengthening the region’s long-term growth potential.

Europe

Europe accounts for nearly 31% market share, driven by rising adoption of plant-derived lipid-lowering compounds and strong regulatory emphasis on clean-label, high-purity nutraceutical ingredients. Demand grows steadily across Germany, the U.K., France, and Italy as consumers seek natural cardiovascular health solutions with proven safety. Manufacturers benefit from stringent quality standards that support premium positioning of rice bran and sugarcane-derived policosanol. Expanding functional food applications, combined with increasing investments in sustainable extraction and traceable sourcing, enhance market development. E-commerce growth and private-label supplement offerings further strengthen Europe’s competitive standing.

Asia-Pacific

Asia-Pacific captures approximately 26% share, making it one of the fastest-growing markets due to rising health awareness, expanding middle-class populations, and increasing demand for plant-based supplements. Countries such as China, India, Japan, and South Korea show strong adoption driven by lifestyle changes and growing prevalence of cardiovascular conditions. Manufacturers capitalize on abundant raw material availability, particularly sugarcane and rice bran, enabling cost-efficient production. The region also benefits from active nutraceutical manufacturing hubs and expanding retail penetration across pharmacies, supermarkets, and digital platforms, positioning Asia-Pacific as a major contributor to global market expansion.

Latin America

Latin America holds close to 4% market share, supported by its strong heritage in sugarcane cultivation, which provides an accessible raw material base for policosanol production. Countries like Brazil, Mexico, and Colombia experience rising demand for natural wellness ingredients as consumers shift toward preventive healthcare. Local manufacturers increasingly explore export opportunities by offering competitively priced policosanol to global nutraceutical brands. Expanding supplement usage, improving retail infrastructure, and government initiatives promoting healthier lifestyles contribute to steady market growth. However, regulatory variability and import-dependent premium product segments limit faster regional expansion.

Middle East & Africa

The Middle East & Africa region accounts for an estimated 2% share, characterized by emerging demand for natural lipid-lowering supplements and increasing consumer interest in preventive cardiovascular health. Growth is concentrated in urban markets across the UAE, Saudi Arabia, and South Africa, where rising disposable incomes support uptake of premium nutraceuticals. Manufacturers rely heavily on imports due to limited local production capabilities, creating opportunities for international suppliers. Expanding e-commerce access, rising awareness of lifestyle-related health risks, and growing investments in pharmacy retail chains gradually strengthen regional adoption, although market penetration remains at an early stage.

Market Segmentations:

By Source:

By Grade:

By Extraction Process:

- Solvent extraction

- Supercritical carbon dioxide extraction

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Policosanol Market features a competitive landscape led by Qatar Solar Technologies, Wacker Chemie AG, Xinte Energy Co., Ltd, DAQO NEW ENERGY CO., LTD., Tokuyama Corporation, GCL-TECH, Tongwei Group Co., Ltd, REC Silicon ASA, OCI COMPANY Ltd., and High-Purity Silicon America Corporation. The Policosanol Market reflects a competitive environment shaped by continual advancements in extraction efficiency, purity enhancement, and formulation innovation. Leading manufacturers invest in high-precision refining systems, enzymatic processing, and sustainable raw-material sourcing to strengthen product consistency and regulatory compliance. Market participants emphasize expanding nutraceutical-grade portfolios, improving bioavailability, and integrating automated quality-control systems to meet rising global demand from dietary supplement and cardiovascular-health segments. Companies also prioritize strategic collaborations with contract manufacturers, ingredient distributors, and wellness brands to accelerate market penetration. R&D efforts increasingly focus on developing cleaner, high-efficacy formulations and optimizing production scalability, supporting stronger differentiation in a market driven by performance, safety, and evidence-based product claims.

Key Player Analysis

- Qatar Solar Technologies

- Wacker Chemie AG

- Xinte Energy Co., Ltd

- DAQO NEW ENERGY CO., LTD.

- Tokuyama Corporation

- GCL-TECH

- Tongwei Group Co., Ltd

- REC Silicon ASA

- OCI COMPANY Ltd.

- High-Purity Silicon America Corporation

Recent Developments

- In July 2025, Tokuyama formed a joint venture with OCI Holdings subsidiary OCI TerraSus to build a semiconductor-grade polysilicon factory at the Samalaju Industrial Park in Sarawak, Malaysia.

- In June 2023, Wacker Chemie AG, a Munich-based company, declared its plan to build a new production line to double the amount of semiconductor-grade polysilicon it can clean.

- In June 2023, Daqo New Energy confirmed its new 100,000 MT Phase 5A polysilicon plant in Baotou, Inner Mongolia, reached full capacity, boosting its total nameplate capacity to 205,000 MT annually, making it fully compatible with next-gen n-type solar cells.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Source, Grade, Extraction Process and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as consumers increasingly prefer plant-derived functional ingredients for cardiovascular and metabolic health.

- Manufacturers will strengthen R&D on high-purity and high-bioavailability formulations to support stronger clinical positioning.

- Global supplement brands will integrate policosanol into multi-ingredient blends targeting cholesterol management and healthy aging.

- Production facilities will adopt advanced extraction and refining technologies to improve yield consistency and scalability.

- Regulatory approvals across emerging economies will accelerate market penetration and increase product standardization.

- Partnerships between ingredient producers and nutraceutical companies will grow to support customized formulations and private-label portfolios.

- E-commerce channels will drive wider access to policosanol-based supplements among health-conscious consumers.

- Sustainability initiatives will influence sourcing strategies, encouraging producers to adopt eco-efficient processing methods.

- Clinical research will expand to validate broader therapeutic benefits and strengthen evidence-based marketing claims.

- Competitive intensity will rise as new entrants introduce value-added variants and innovative delivery formats.

Market Segmentation Analysis:

Market Segmentation Analysis: