Market Overview

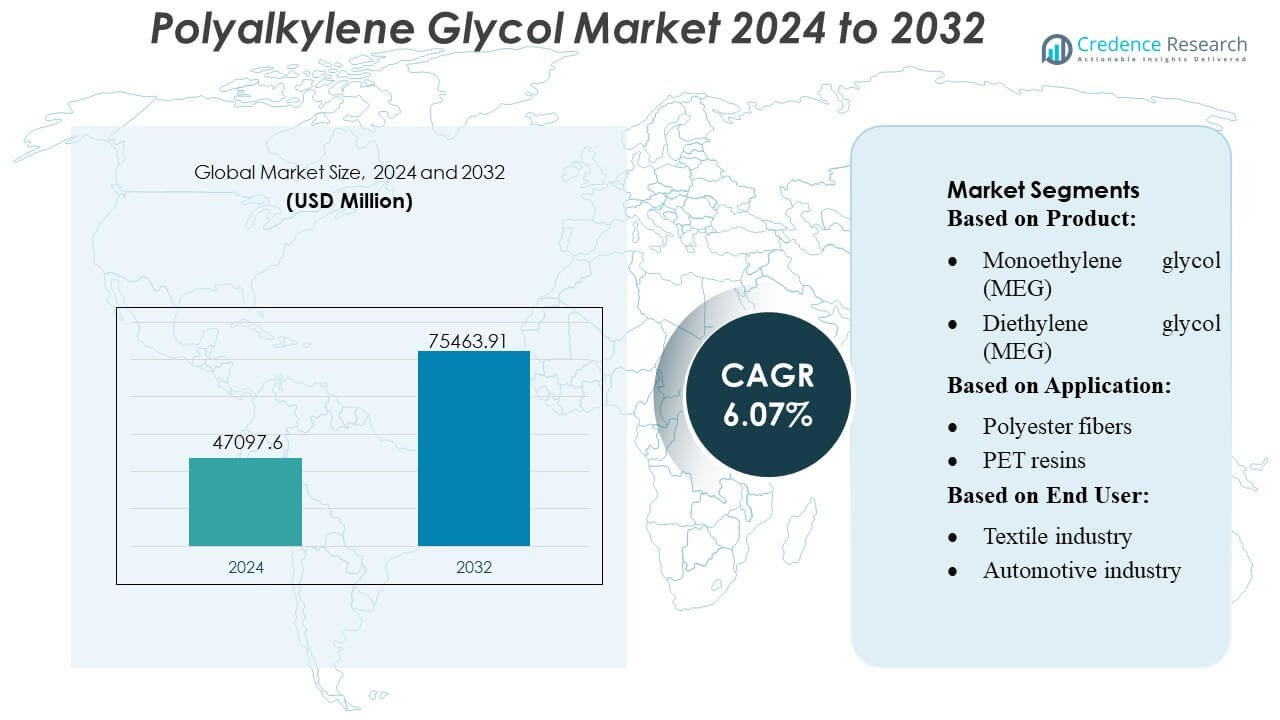

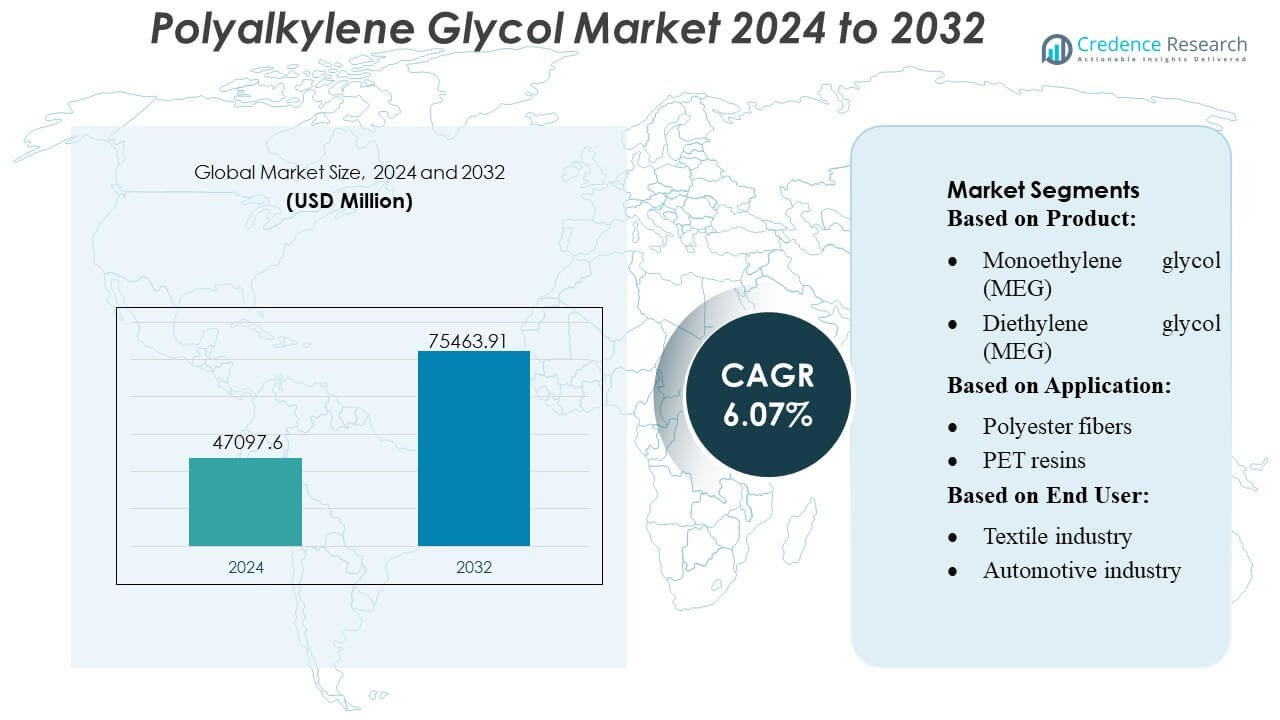

Polyalkylene Glycol Market size was valued USD 47097.6 million in 2024 and is anticipated to reach USD 75463.91 million by 2032, at a CAGR of 6.07% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyalkylene Glycol Market Size 2024 |

USD 47097.6 Million |

| Polyalkylene Glycol Market, CAGR |

6.07% |

| Polyalkylene Glycol Market Size 2032 |

USD 75463.91 Million |

The global polyalkylene glycol market is highly competitive, with leading players including Mitsubishi Chemical, LOTTE Chemical, Eastman Chemical, Dow Chemical, BASF SE, Indian Oil, LyondellBasell, LG Chem, Ineos Group, and Formosa Plastics. These companies maintain market leadership through extensive production capacities, diversified product portfolios, and continuous investment in research and development to enhance high-purity and specialty glycol offerings. Asia-Pacific emerges as the leading region, accounting for approximately 40% of global consumption, driven by strong demand from textile manufacturing, polyester fiber production, and PET resin-based packaging. Rapid industrialization, low production costs, and robust petrochemical infrastructure further strengthen the region’s dominance. Market players focus on capacity expansions, technological innovation, and sustainability initiatives to capture growth opportunities, meet evolving industrial requirements, and maintain a competitive edge across global and regional markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global polyalkylene glycol market size was valued at USD 47,097.6 million in 2024 and is projected to reach USD 75,463.91 million by 2032, growing at a CAGR of 6.07% during the forecast period.

- Asia-Pacific is the leading region with approximately 40% of global consumption, driven by strong demand from textile manufacturing, polyester fiber production, and PET resin-based packaging, followed by North America and Europe with significant industrial and automotive applications.

- Monoethylene glycol dominates the product segment due to its extensive use in polyester fibers and PET resin production, while polyester fibers and PET resins are the largest application segments.

- Key market players maintain leadership through high production capacities, diversified portfolios, R&D investment, technological innovation, and sustainability initiatives to enhance high-purity and specialty glycol offerings.

- Market growth is supported by industrialization and urbanization, but fluctuating raw material prices and regulatory compliance requirements pose challenges, requiring companies to optimize supply chains and adopt eco-friendly production methods.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product

The Monoethylene Glycol (MEG) segment dominates the polyalkylene glycol market, accounting for the largest share due to its extensive use as a feedstock for polyester fibers and PET resins. Its widespread adoption is driven by the growing global textile and packaging industries, where polyester fiber production requires substantial MEG quantities. MEG is also a key component in antifreeze, coolants, and heat transfer fluids, further reinforcing its dominance. Diethylene Glycol (DEG) holds a moderate market share and is primarily used in chemical intermediates, plasticizers, resins, and solvents. Meanwhile, Triethylene Glycol (TEG) occupies a smaller segment, mainly used in specialized applications such as natural gas dehydration, industrial solvents, and certain pharmaceutical formulations. The overall product segment growth is closely linked to MEG consumption in major industrial sectors, while DEG and TEG see steady but niche demand growth.

- For instance, Mitsubishi Chemical has developed a proprietary “OMEGA” catalytic MEG process that achieves a production selectivity exceeding 99 %, compared with about 90 % in conventional methods.

By Application

In the application segment, Polyester Fibers represent the leading sub-segment, capturing the largest share of the market. The surge in global demand for textile products, including apparel, home textiles, and industrial fabrics, drives this dominance. Polyester fibers produced from MEG are highly valued for durability, affordability, and versatility, making them the preferred choice in mass-market textiles. PET Resins constitute the second-largest sub-segment, extensively used in manufacturing beverage bottles, food packaging, films, and technical-grade materials. The demand for PET resins is fueled by the expanding packaging industry and increasing consumer preference for recyclable packaging solutions. Other applications such as Antifreeze & Coolants leverage glycol’s thermal stability and freeze protection, while niche industrial uses like heat transfer fluids and dehydrating agents continue to sustain steady demand. The application growth is strongly driven by rising industrial production and consumer product consumption across emerging and developed regions.

- For instance, LOTTE Chemical operates ethylene‑glycol (EG) production with an annual capacity of 1,830 kt per year, supplying the glycol feedstock needed for polyester fiber and PET‑resin production this capacity underpins its ability to meet large-scale fiber demand.

By End-User Industry

The Textile Industry dominates the end-user segment, consuming the majority of polyalkylene glycol primarily through polyester fiber production. Growth in apparel demand, technical textiles, and home furnishing products contributes to the high consumption levels. The Packaging Industry, primarily for PET bottles and containers, is rapidly growing due to increasing global consumption of packaged food, beverages, and other consumer goods. The Automotive Industry also consumes glycols, especially for antifreeze, coolants, and heat transfer fluids, while the Chemical Industry uses them as intermediates in various formulations. Other sectors such as Healthcare and Pharmaceuticals, Construction, and Industrial Applications contribute to steady demand, but their market share is relatively smaller. Overall, end-user growth is closely tied to industrial development, urbanization, and rising consumer demand across global markets, with textiles and packaging remaining the primary drivers.

Key Growth Drivers

- Rising Demand from Textile and Packaging Industries

The growth of the polyalkylene glycol market is largely driven by increasing demand in the textile and packaging sectors. Polyester fiber production consumes significant quantities of MEG, while PET resin manufacturing for bottles and films fuels glycol usage in packaging. Expanding global textile production, particularly in Asia-Pacific, and rising consumer preference for packaged goods contribute to consistent demand. This industrial adoption, combined with urbanization and population growth, ensures that polyalkylene glycol remains a core raw material, supporting steady volume growth and market expansion.

- For instance, Eastman Chemical Company has leveraged its advanced molecular‑recycling technology to support this trend: its facility at Kingsport, Tennessee processes 110,000 metric tons of polyester waste annually, converting it back into ethylene glycol and other monomers for reuse in polyester fiber and PET‑resin production.

- Expanding Automotive and Industrial Applications

Automotive and industrial sectors are significant contributors to polyalkylene glycol demand. Glycols serve as essential components in antifreeze, coolants, and heat transfer fluids, ensuring engine efficiency and temperature regulation. Industrial applications include chemical intermediates, dehydrating agents, and specialty solvents. Rising automotive production, particularly in emerging economies, coupled with increasing industrial activities, creates a robust demand base. Continuous technological improvements in engine and manufacturing processes enhance the efficiency of glycol-based fluids, further reinforcing their market presence and adoption across multiple sectors.

- For instance, DOWCAL™ 100 (a glycol‑based heat transfer fluid) remains effective from –50 °C up to 175 °C in industrial heating and cooling applications.

- Growth of PET Resin and Polyester Fiber Manufacturing

PET resin and polyester fiber manufacturing remain crucial drivers for polyalkylene glycol consumption. PET is widely used in beverage packaging, films, and technical-grade applications, while polyester fibers dominate textile production due to their durability and cost-effectiveness. The expansion of beverage consumption, fast-moving consumer goods, and fashion industries globally intensifies glycol demand. Additionally, initiatives promoting recycling and sustainable packaging indirectly boost MEG utilization, as recycled PET requires high-quality glycols for processing. This sustained production demand ensures continuous growth for the polyalkylene glycol market.

Key Trends & Opportunities

- Shift Towards Sustainable and Recycled PET Applications

Increasing focus on sustainability presents an opportunity for polyalkylene glycol producers. Recycled PET usage in packaging requires high-purity glycols for quality retention, driving demand for MEG in circular economy initiatives. Companies are investing in eco-friendly production methods and advanced recycling technologies, creating growth opportunities. The trend towards sustainable materials aligns with consumer preferences for recyclable packaging and environmentally conscious products, enabling glycol suppliers to expand market share and position themselves as partners in sustainability-driven supply chains.

- For instance, BASF SE successfully achieved ISCC+ certification at all major global sites for its portfolio of glycol‑related products, enabling it to offer more than 60 products with sustainability credentials.

- Technological Advancements in Glycol Derivatives

Innovation in glycol-based derivatives offers market expansion potential. Research and development focus on high-performance TEG and DEG variants for industrial solvents, pharmaceutical formulations, and specialty chemicals. Enhanced thermal stability, chemical resistance, and solubility properties of advanced glycol derivatives open new application areas. Adoption of these derivatives in niche industrial processes and specialty manufacturing provides incremental revenue streams. Companies investing in R&D to improve product efficiency and performance can capitalize on these trends, strengthening market presence and differentiating from competitors.

- For instance, Indian Oil revamped its MEG/DEG/TEG plant at its Panipat complex to a total capacity of 457,000 tons per annum (with MEG: 425,000 tpa; DEG: 31,000 tpa; TEG: 1,000 tpa) as of 2022.

- Growth in Emerging Markets

Emerging economies, particularly in Asia-Pacific, Africa, and Latin America, are witnessing rapid industrialization, urbanization, and rising disposable incomes. These factors increase demand for textiles, packaged goods, and automotive products, directly impacting polyalkylene glycol consumption. Expanding manufacturing facilities and government initiatives supporting industrial growth create opportunities for glycol producers to capture new market share. Regional growth trends suggest significant potential for long-term demand increases, particularly for MEG and other glycol variants used in polyester fiber and PET resin production.

Key Challenges

- Fluctuating Raw Material Prices

The polyalkylene glycol market faces challenges from volatility in raw material costs, primarily ethylene and other feedstocks. Price fluctuations affect production costs and profit margins, creating uncertainty for manufacturers. This can slow down expansion plans and lead to cautious pricing strategies. Companies need to implement cost management and supply chain optimization to mitigate the impact of price swings. Dependence on petroleum-based raw materials makes the market vulnerable to global crude oil price fluctuations, posing a significant challenge to stable growth and long-term planning.

- Environmental and Regulatory Constraints

Strict environmental regulations regarding chemical handling, emissions, and wastewater treatment impact polyalkylene glycol production. Compliance with these standards increases operational costs and may limit expansion, especially in regions with stringent environmental policies. The need for sustainable production methods and reduction of chemical pollutants adds pressure on manufacturers to invest in eco-friendly technologies. Non-compliance risks fines and reputational damage, making regulatory adherence a critical challenge that influences production decisions, market entry strategies, and overall competitiveness in the global glycol market.

Regional Analysis

North America

North America holds approximately 25 % of the global polyalkylene glycol market. The region’s demand is driven by mature automotive, chemical, and packaging industries. Glycols are widely used in antifreeze, coolants, heat-transfer fluids, and PET resin production. The presence of advanced manufacturing infrastructure and focus on high-performance and bio-based glycols further supports growth. Rising consumer preference for sustainable packaging and stricter regulatory standards encourages adoption of eco-friendly glycol variants. Key markets include the U.S. and Canada, where industrial development and technological advancements in automotive and chemical sectors maintain steady consumption and moderate market expansion.

Asia-Pacific

Asia-Pacific dominates the global market, accounting for roughly 40 % of total polyalkylene glycol consumption. Strong demand stems from expanding textile manufacturing, polyester fiber production, and PET-resin-based packaging, especially in China and India. Rapid industrialization, urbanization, and low production costs support large-scale glycol usage. The region benefits from robust petrochemical infrastructure, allowing competitive production and supply. Additionally, the growing automotive and industrial fluids market contributes significantly to demand. Investments in R&D, adoption of advanced glycol derivatives, and government initiatives promoting manufacturing further strengthen the market, making Asia-Pacific the fastest-growing and most influential region globally.

Europe

Europe accounts for about 20 % of the global polyalkylene glycol market, supported by well-established automotive, textile, chemical, and packaging industries. Demand is fueled by polyester fiber and PET resin production, as well as industrial applications like coatings, adhesives, and chemical intermediates. The region emphasizes sustainability and regulatory compliance, driving adoption of bio-based and high-purity glycol products. Western Europe, particularly Germany, France, and Italy, leads consumption due to industrial diversification and technological advancements. Overall, Europe shows stable growth supported by strong environmental standards, high-quality production capabilities, and growing demand for sustainable packaging and industrial applications.

Latin America

Latin America contributes roughly 5–7 % of the global polyalkylene glycol market. The region’s growth is driven by increasing automotive production, textile manufacturing, and packaging industries in countries such as Brazil and Mexico. Rising industrialization, expanding chemical processing, and development of consumer goods markets enhance glycol demand. Adoption of PET resins and polyester fibers is gradually increasing, creating new opportunities. However, growth is constrained by infrastructure limitations and slower industrial expansion compared to Asia-Pacific and North America. Latin America presents potential for future market expansion through investment in chemical manufacturing facilities and modernization of textile and packaging industries.

Middle East & Africa

The Middle East & Africa region holds approximately 8–10 % of the global market. Demand is driven by petrochemical and industrial fluid applications, including lubricants, antifreeze, and heat-transfer fluids. Key countries such as Saudi Arabia, UAE, and South Africa are investing in chemical production and infrastructure, supporting glycol consumption. Rapid urbanization, industrialization, and growing automotive and packaging sectors contribute to steady growth. The region also benefits from abundant raw materials, which enables cost-effective production. While growth is moderate, the combination of infrastructure development, industrial expansion, and increasing adoption of synthetic glycols presents significant long-term market potential.

Market Segmentations:

By Product:

- Monoethylene glycol (MEG)

- Diethylene glycol (MEG)

By Application:

- Polyester fibers

- PET resins

By End User:

- Textile industry

- Automotive industry

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the polyalkylene glycol market players such as Mitsubishi Chemical, LOTTE Chemical, Eastman Chemical, Dow Chemical, BASF SE, Indian Oil, LyondellBasell, LG Chem, Ineos Group, and Formosa Plastics. the polyalkylene glycol market is defined by strong global production capacities, technological innovation, and strategic expansion into high-growth regions. Companies focus on diversifying product portfolios, including high-purity and specialty glycols, to meet the evolving demands of textile, packaging, automotive, and industrial sectors. Investments in research and development drive process optimization, improved product performance, and sustainable production methods. Market competition is further intensified by initiatives such as capacity expansions, mergers and acquisitions, and entry into emerging markets. Firms leverage advanced supply chain management and operational efficiencies to reduce costs and ensure consistent delivery, while differentiation through innovation and sustainability initiatives remains a key factor shaping competitive dynamics and long-term market positioning.

Key Player Analysis

- Mitsubishi Chemical

- LOTTE Chemical

- Eastman Chemical

- Dow Chemical

- BASF SE

- Indian Oil

- LyondellBasell

- LG Chem

- Ineos Group

- Formosa Plastics

Recent Developments

- In July 2024, Sinopec, headquartered in China, announced plans to further reduce ethylene output, following a cut in June. The move was likely aimed at increasing fuel production, as the company shifted its focus to meet rising demand in the energy sector.

- In May 2024, Asahi Kasei, Mitsui Chemicals, and Mitsubishi Chemical agreed to conduct a joint feasibility study on feedstock and fuel conversion at their ethylene production facilities in Western Japan. This initiative aimed to promote carbon neutrality and advance the decarbonization of society through sustainable practices.

- In May 2024, Dow announced the completion of an 80,000-ton annual propylene glycol capacity expansion at its Map Ta Phut, Thailand facility, making it the largest PG plant in Asia Pacific at 250,000 tons/year.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for polyalkylene glycol will grow steadily due to increasing polyester fiber production.

- PET resin applications will continue to drive market expansion in the packaging sector.

- Automotive industry requirements for antifreeze and heat-transfer fluids will sustain glycol consumption.

- Emerging economies will see significant market growth due to industrialization and urbanization.

- Development of high-purity and specialty glycols will open new application areas.

- Sustainability trends will promote adoption of bio-based and recyclable glycol products.

- Expansion of textile and chemical manufacturing facilities will support long-term demand.

- Technological advancements in glycol derivatives will enhance product performance and efficiency.

- Regulatory emphasis on eco-friendly production will influence market strategies and investments.

- Integration of advanced supply chains and production optimization will strengthen global competitiveness.

Market Segmentation Analysis:

Market Segmentation Analysis: