Market Overview

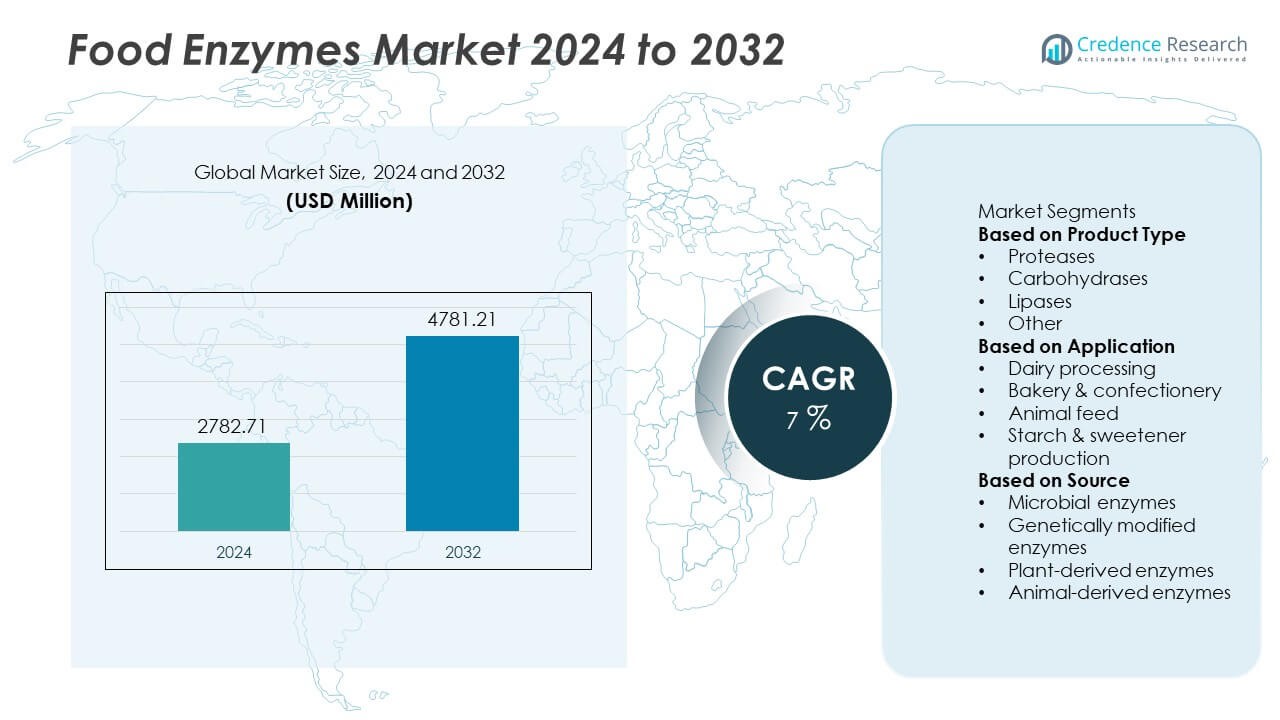

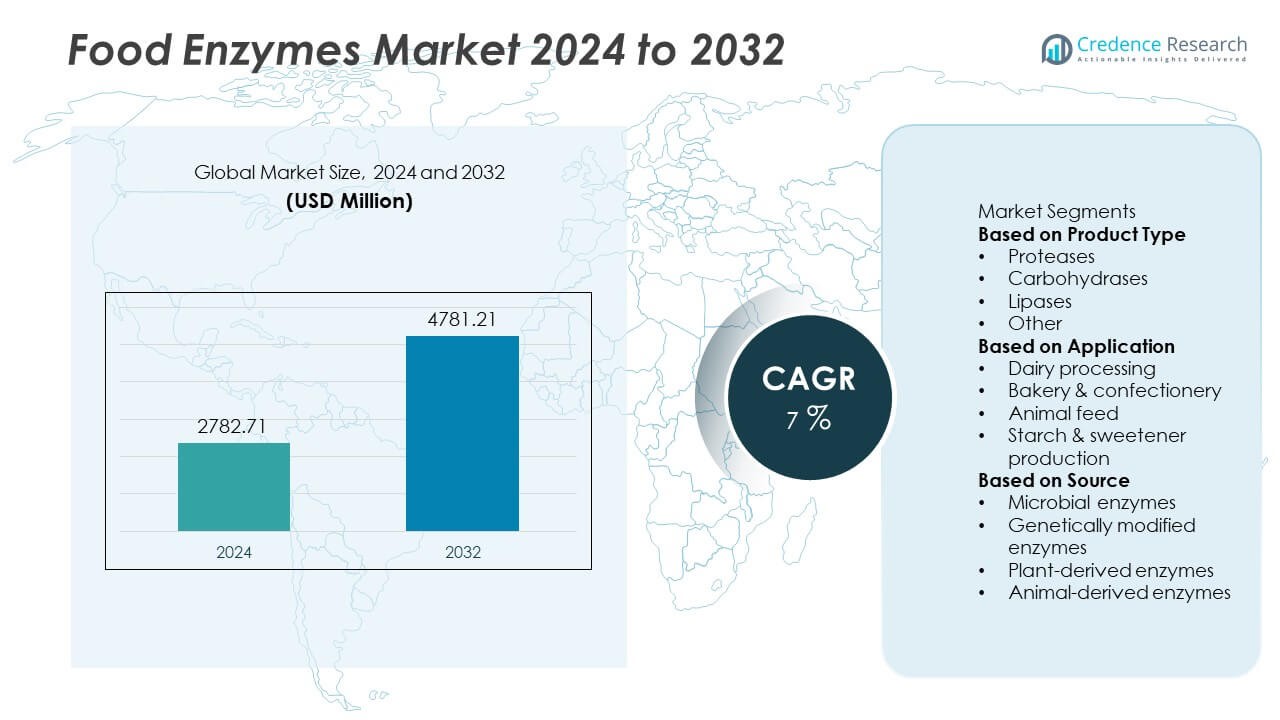

The Food Enzymes Market reached USD 2,782.71 million in 2024 and is projected to climb to USD 4,781.21 million by 2032, reflecting a steady 7% CAGR across the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Food Enzymes Market Size 2024 |

USD 2,782.71 Million |

| Food Enzymes Market, CAGR |

7% |

| Food Enzymes Market Size 2032 |

USD 4,781.21 Million |

The Food Enzymes market includes key players such as BASF SE, Advanced Enzyme Technologies Ltd, Novozymes A/S (now Novonesis), Chr. Hansen Holding A/S, Kerry Group plc, Kemin Industries Inc, Amano Enzyme Inc, International Flavors & Fragrances Inc. (IFF), Associated British Foods plc, and DSM-firmenich. These companies focus on expanding enzyme portfolios for bakery, dairy, brewing, and plant-based food applications. Strategic R&D investments enhance microbial and genetically engineered enzyme performance, supporting clean-label and reduced-sugar product development. North America leads the market with a 34% share, supported by strong adoption of enzyme-based processing in packaged foods, advanced fermentation capacity, and clear regulatory acceptance of food-grade enzyme formulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Food Enzymes market reached USD 2,782.71 million in 2024 and is expected to reach USD 4,781.21 million by 2032 at a 7% CAGR, driven by wider adoption in processed food production.

- Rising demand for clean-label bakery, dairy, and plant-based foods drives use of carbohydrases, which lead product type share at 46%, supporting texture, sweetness, and shelf-life improvement in packaged food categories.

- Trends include enzyme integration in sugar-reduced formulations, lactose-free dairy, and alternative protein processing, while rapid advancements in precision fermentation and strain engineering improve efficiency and cost control.

- The market remains competitive with strong innovation from global players focusing on tailored enzyme solutions, while regulatory approval complexity and cost sensitivity in emerging markets act as key restraints to faster penetration.

- North America holds 34%, Europe 28%, Asia Pacific 24%, Latin America 8%, and Middle East & Africa 6% of the market share, supported by strong bakery, dairy, and starch conversion industries across these regions.

Market Segmentation Analysis:

By Product Type:

Carbohydrases lead the Food Enzymes market with a 46% share due to strong demand in bakery, beverage, and sugar processing. Carbohydrases enhance texture, shelf life, and sweetness levels, supporting wider use in processed food categories. Proteases follow, driven by protein hydrolysis needs in dairy and meat tenderization. Lipases support flavor development in cheese and enzyme-modified dairy fats. The “Other” segment includes pectinases and lactases used for fruit juice clarification and lactose-free product manufacturing. Growth in carbohydrase use is driven by rising carbohydrate conversion efficiency, expanding enzymatic sweetener production, and increased investment in sugar reduction formulations across global markets.

- For instance, Novonesis expanded its baking enzyme line by adding a new solution called Novamyl® BestBite, a maltogenic alpha-amylase that helps maintain crumb softness, moistness, and elasticity in baked goods, ultimately improving shelf life and reducing food waste. It allows bread to remain fresh for much longer, with consumers liking bread that was 15 days old as much as fresh bread in a study.

By Application:

Bakery & confectionery remains the dominant application segment with a 39% share, supported by consistent demand for dough conditioning, volume improvement, and crumb structure enhancement. Enzymes help reduce additives and improve product softness and shelf stability. Dairy processing is the next major area due to enzyme roles in cheese ripening and lactose-free milk production. Starch and sweetener production benefits from enzymatic conversion for syrup and glucose manufacturing. Animal feed enzymes enhance nutrient absorption and digestion efficiency. Growth is driven by consumer preference for clean-label bakery products and steady industrial adoption of enzyme-based texture and flavor optimization.

- For instance, DSM-firmenich offers advanced bakery enzyme systems, such as the BakeZyme® portfolio, that are specifically designed to deliver precise, measurable improvements in dough quality and final product characteristics in commercial baking.

By Source:

Microbial enzymes hold the largest share at 52%, driven by high production efficiency, stability across pH and temperature variations, and ease of genetic enhancement. Genetically modified enzymes expand adoption by improving catalytic performance and enabling specialized food formulations. Plant-derived enzymes support clean-label and vegan positioning, while animal-derived enzymes serve niche applications such as rennet substitution in cheese manufacturing. Microbial sources dominate due to scalable fermentation, cost-effective downstream processing, and strong use in dairy, baking, brewing, and starch conversion. Their growth is further supported by rising investment in precision fermentation and increased regulatory approval for food-grade microbial enzyme strains.

Key Growth Drivers

Rising Demand for Processed and Functional Foods

Rising consumption of packaged, ready-to-eat, and functional foods drives higher adoption of food enzymes. Enzymes improve flavor, texture, shelf stability, and nutritional value, making them essential in bakery, dairy, beverage, and plant-based food categories. The shift toward protein-rich and fiber-enhanced diets also increases the use of specialty enzymes for hydrolysis and bioavailability improvement. Food manufacturers integrate enzymes to replace chemical additives and support clean-label product development. The demand surge remains aligned with urban lifestyles, expanding retail channels, and continuous product innovations across global markets.

- For instance, Advanced Enzyme Technologies produces a range of protein-hydrolyzing enzymes used in the food and beverage industry to increase the release of amino acids during controlled hydrolysis.

Expansion of Clean-Label and Natural Ingredient Formulations

Food enzymes support label simplification and removal of synthetic additives, enabling manufacturers to match clean-label purchasing behavior. Enzymes allow natural processing without compromising sensory attributes, making them ideal in dairy-free, gluten-free, and reduced-sugar products. Brands use enzymatic solutions to improve dough handling, lactose breakdown, protein modification, and flavor enhancement. Regulatory encouragement for reduced chemical usage further accelerates enzyme utilization. As consumer awareness of ingredient transparency strengthens, demand for enzymatic processing solutions increases across mainstream and premium food segments.

- For instance, Chr. Hansen, a major bioscience company now part of Novozymes, developed a lactase formulation called NOLA® Fit that enables the production of lactose-free or reduced-sugar dairy products without compromising the natural dairy taste.

Technological Advancements in Enzyme Engineering and Fermentation

Advances in enzyme engineering improve catalytic efficiency, substrate specificity, and temperature tolerance. Precision fermentation and genetically optimized microbial strains enhance enzyme yields and functionality for industrial-scale food production. Enhanced production methods reduce costs and allow development of application-specific enzymes for bakery, brewing, and nutritional manufacturing. Technologies supporting immobilized enzymes and controlled-release systems also unlock efficiency in continuous processing lines. Innovation in bioinformatics and protein modeling enables rapid enzyme customization, supporting wider commercialization across diverse food formulations.

Key Trends & Opportunities

Growth of Plant-Based and Alternative Protein Food Enzymes

Expansion of plant-based dairy and meat alternatives creates strong demand for specialized enzyme solutions. Enzymes improve texture, emulsification, and protein digestibility in soy, pea, and oat-based formulations. They also enable flavor development by reducing bitterness and enhancing fat simulation in vegan cheese and cultured products. As food manufacturers scale production of plant-based beverages and protein snacks, enzyme providers gain opportunities to deliver tailored solutions. Increasing investments in sustainable protein processing accelerate this trend and support long-term growth potential.

- For instance, Amano Enzyme offers a range of specialty proteases and protein-modifying enzymes, such as Protein Glutaminase “Amano” 500 (PG500) and Umamizyme™ Pulse, that improve the functionality and sensory properties of plant proteins, including pea isolates.

Increasing Use of Enzymes in Sugar Reduction and Nutritional Improvement

Food and beverage companies use enzymes to support sugar reduction, starch conversion, and functional carbohydrate development. Enzymatic processing helps create low-glycemic sweeteners and prebiotic fibers that meet nutritional labeling needs. Demand rises in bakery, confectionery, and beverages, where sweetness retention and calorie reduction remain key goals. Enzymes improve nutrient release and digestion benefits, enabling more nutritionally balanced product positioning. This trend strengthens opportunities in metabolic health and personalized nutrition-focused product portfolios.

- For instance, DuPont Nutrition & Biosciences offers various amylase solutions, such as Amylex 6T and SPEZYME ALPHA, which are highly effective for industrial starch processing, including brewing and ethanol production.

Key Challenges

Regulatory Compliance and Complex Approval Requirements

Stringent safety evaluation and approval procedures for enzyme-derived food ingredients challenge new product commercialization. Regional regulatory differences require extensive documentation, toxicology validation, and GRAS or novel-food certifications. Manufacturers must ensure allergen management and transparent labeling to meet compliance rules. Delays in clearance processes may restrict innovation cycles and market entry for emerging enzyme variants. This challenge raises development costs and increases the need for strong regulatory strategy across global food markets.

Price Sensitivity and Competition from Conventional Processing Methods

High enzyme development and production costs affect adoption in cost-sensitive food categories and emerging markets. Some manufacturers continue using traditional processing or chemical additives due to lower short-term costs, despite reduced sustainability benefits. Intense competition among enzyme suppliers and the presence of generic alternatives may pressure pricing strategies. Securing consistent fermentation inputs and managing supply chain disruptions also influence cost stability. These factors limit faster market penetration in lower-margin food manufacturing segments.

Regional Analysis

North America

North America holds a 34% market share driven by strong demand for processed bakery, dairy, and convenience food products. Large-scale adoption of microbial and genetically modified enzymes supports stable growth across the United States and Canada. Food manufacturers integrate enzymes to improve texture, shelf life, and nutritional quality while meeting clean-label standards. Advanced fermentation capabilities and a strong presence of enzyme technology developers further strengthen regional output. Regulatory support for reduced chemical additives and rising interest in sugar-reduced and lactose-free formulations continue to encourage enzyme adoption in commercial food processing operations.

Europe

Europe accounts for a 28% market share, supported by established bakery, confectionery, and specialty dairy processing industries. Enzyme utilization grows under strict labeling and sustainability regulations, reinforcing clean-label and natural ingredient development. Strong adoption of carbohydrases and proteases supports large industrial baking and brewing activities across Germany, France, the United Kingdom, and the Netherlands. The region benefits from leading research in precision fermentation and food biotechnology. Consumer demand for plant-based, gluten-free, and reduced-sugar foods accelerates the incorporation of specialty enzymes, enhancing product innovation across retail and foodservice channels.

Asia Pacific

Asia Pacific holds a 24% market share, driven by rapid expansion in processed food consumption across China, India, Japan, and Southeast Asia. Growing bakery and dairy production, along with rising demand for sweeteners and starch conversion, increases the use of carbohydrases and amylases. The region shows strong interest in enzyme-based texture modification, shelf-life enhancement, and flavor improvement for packaged food. Rising urbanization and investment in fermentation capacity strengthen enzyme supply capabilities. The growth of plant-based food and beverage manufacturers further boosts enzyme demand across diverse product categories.

Latin America

Latin America represents an 8% market share, supported by the expansion of bakery, beverage, and dairy production in Brazil, Mexico, Argentina, and Chile. Enzymes are increasingly used to improve dough stability, sweetness optimization, and lactose conversion, meeting changing consumer diets. Local producers adopt enzymes to reduce food waste and maintain product freshness during extended distribution cycles. Increasing investment in sugar processing and ethanol-related starch applications encourages carbohydrase and protease adoption. Growth opportunities strengthen as regional food processors align with global clean-label standards and enhance nutritional value in packaged food categories.

Middle East & Africa

The Middle East & Africa region holds a 6% market share, with growing demand for extended shelf-life bakery goods, dairy applications, and beverage processing. Enzymes support product consistency in hot-climate logistics, reducing spoilage and quality loss. Rising food manufacturing investment in the United Arab Emirates, Saudi Arabia, and South Africa drives interest in enzyme-enhanced processing. Expansion in halal and specialty nutrition products also increases demand for plant-derived and microbial enzyme solutions. Growth potential remains strong as countries enhance food security programs and encourage domestic production of enzyme-supported processed food products.

Market Segmentations:

By Product Type

- Proteases

- Carbohydrases

- Lipases

- Other

By Application

- Dairy processing

- Bakery & confectionery

- Animal feed

- Starch & sweetener production

By Source

- Microbial enzymes

- Genetically modified enzymes

- Plant-derived enzymes

- Animal-derived enzymes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape is characterized by major participants including BASF SE, Advanced Enzyme Technologies Ltd, Novozymes A/S (now Novonesis), Chr. Hansen Holding A/S, Kerry Group plc, Kemin Industries Inc, Amano Enzyme Inc, International Flavors & Fragrances Inc. (IFF), Associated British Foods plc, and DSM-firmenich. Companies strengthen their presence through enzyme engineering, precision fermentation, and application-specific formulation capabilities. Leading suppliers focus on expanding portfolios for bakery, dairy, brewing, starch conversion, and plant-based food processing to support cleaner formulations and texture optimization. Strategic partnerships with food manufacturers accelerate development of tailored solutions for reduced sugar, improved digestibility, and enhanced shelf-life stability. Investments in biotechnology and microbial strain improvement drive innovations in catalytic performance and cost-efficient production. Competitors also pursue acquisitions, joint ventures, and regional capacity expansion to enhance market reach, particularly in Asia Pacific and North America. Rising interest in sustainable and allergen-free enzyme sources encourages ongoing R&D initiatives and differentiated product positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Advanced Enzyme Technologies Ltd

- Novozymes A/S (now Novonesis)

- Hansen Holding A/S

- Kerry Group plc

- Kemin Industries Inc

- Amano Enzyme Inc

- International Flavors & Fragrances Inc. (IFF)

- Associated British Foods plc

- DSM-firmenich

Recent Developments

- In October 2025, BASF SE announced that it is evaluating strategic options for its feed enzymes business, aiming to find a partner focused on that segment.

- In October 2025, International Flavors & Fragrances Inc. (IFF) and BASF announced a strategic collaboration to develop next-generation enzyme and polymer technologies, including enzyme systems for industrial and cleaning applications.

- In September 2025, Kerry Group plc established a new Biotechnology Centre in Leipzig, Germany for enzyme and strain identification, engineering, fermentation and bioprocess development.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Source and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Food enzymes will gain wider adoption across bakery, dairy, beverage, and plant-based food processing.

- Enzyme engineering and precision fermentation will improve catalytic efficiency and reduce production costs.

- Clean-label and natural ingredient demand will accelerate enzymatic replacement of chemical additives.

- Sugar reduction and starch conversion enzymes will support healthier formulation strategies.

- Growth in lactose-free and digestive-friendly dairy products will increase demand for lactase and protease solutions.

- Enzyme use in plant-based meat and dairy alternatives will expand product texture and flavor optimization.

- Automation and digital monitoring will enhance enzyme dosing and processing accuracy in manufacturing lines.

- Mergers, acquisitions, and partnerships will strengthen global supply and innovation networks.

- Regional production capacity will grow, especially in Asia Pacific enzyme fermentation facilities.

- Sustainability goals will drive interest in enzyme-enabled waste reduction and improved resource efficiency in food production.