Market Overview

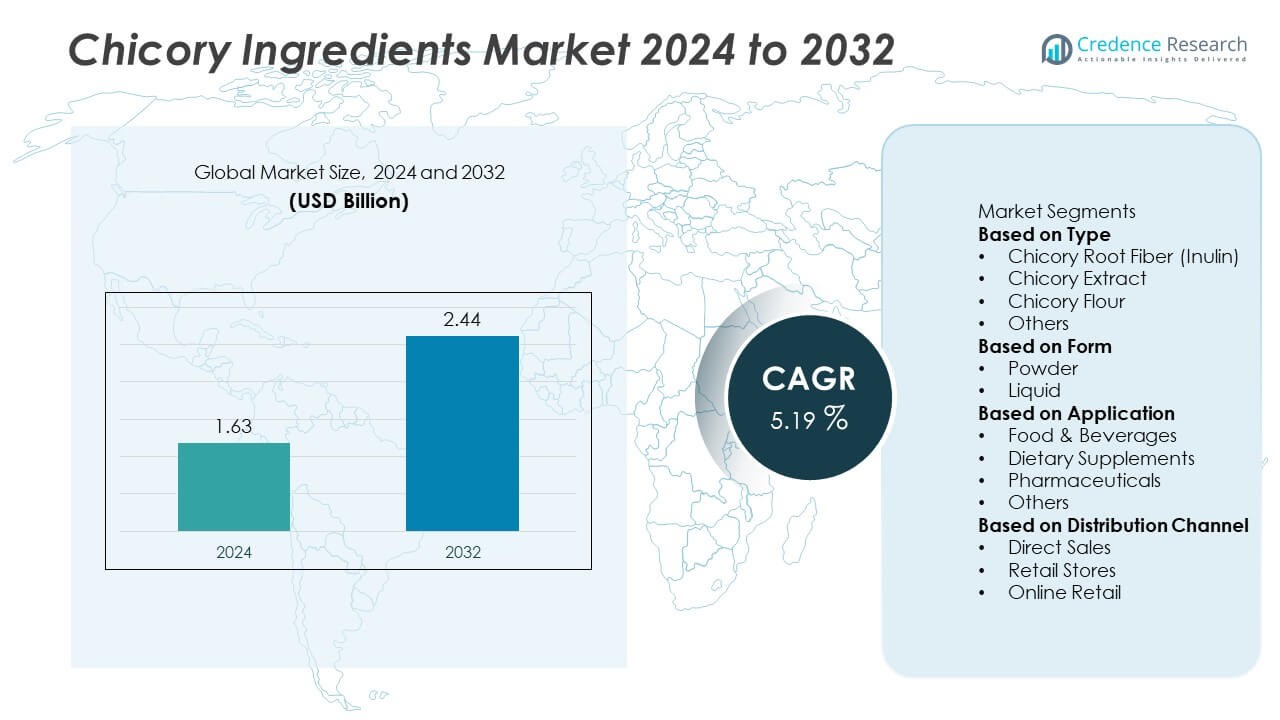

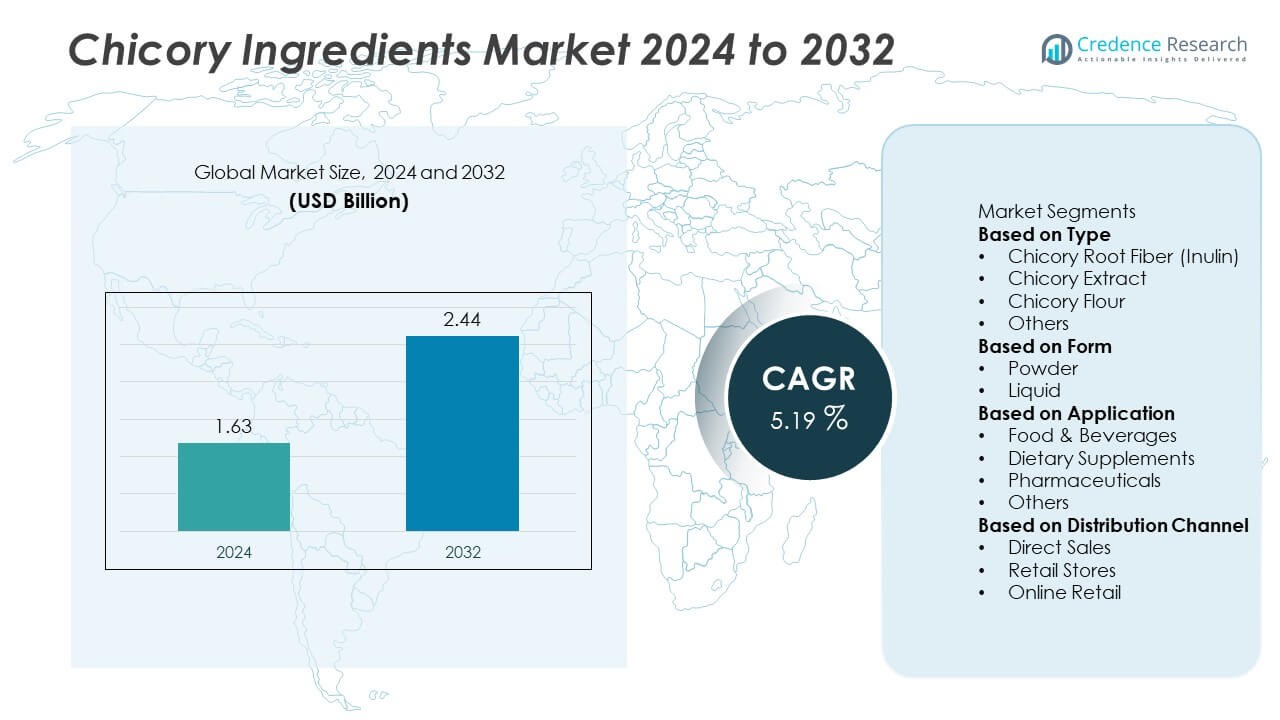

The Chicory Ingredients Market was valued at USD 1.63 billion in 2024 and is projected to reach USD 2.44 billion by 2032, registering a 5.19% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chicory Ingredients Market Size 2024 |

USD 1.63 Billion |

| Chicory Ingredients Market, CAGR |

5.19% |

| Chicory Ingredients Market Size 2032 |

USD 2.44 Billion |

Top players in the Chicory Ingredients market, including Cosucra Groupe Warcoing, Sensus, Beneo GmbH, Leroux, The Tierra Group, Pioneer Chicory, PMV Nutrient Products Pvt. Ltd., Murlikrishna Foods Pvt. Ltd., Farmvilla Food Industries Pvt. Ltd., and Nutraceutix Inc., strengthen their presence through high-quality inulin production, advanced extraction systems, and strong collaborations with food and nutraceutical brands. These companies focus on clean-label formulations, functional fiber innovation, and efficient supply chains to meet rising global demand. Europe leads the market with a 38% share due to strong cultivation and processing infrastructure, followed by Asia Pacific with a 32% share supported by growing use in food and beverage applications.

Market Insights

Market Insights

- The Chicory Ingredients market reached USD 1.63 billion in 2024 and will grow at a 5.19% CAGR through the forecast period.

- Demand grows as food and beverage brands adopt chicory root fiber and extract to meet rising needs for natural sweeteners and digestive health solutions.

- Key trends highlight strong expansion of inulin-fortified bakery, dairy, and nutrition products, with chicory root fiber holding a 42% segment share.

- Competition rises as major players enhance extraction technology and product purity, though seasonal cultivation limits supply stability.

- Europe leads with a 38% regional share, followed by Asia Pacific at 32% and North America at 21%, driven by high use in food and supplement applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Chicory root fiber (inulin) leads the type segment with a 42% market share, driven by its strong use as a natural prebiotic and sugar-reduction ingredient across food and beverage formulations. Demand grows as manufacturers replace synthetic additives with plant-based fibers to improve digestive health and product texture. Chicory extract and chicory flour expand steadily due to rising interest in herbal ingredients and caffeine-free beverage alternatives. The “others” category benefits from niche applications in flavor enhancement, snacks, and bakery mixes. Continuous innovation in clean-label products supports inulin’s strong dominance.

- For instance, Cosucra Groupe Warcoing’s inulin-based products are a key driver in the food and beverage sector, where they are used in sugar reduction and digestive health formulations.

By Form

The powder segment dominates the form category with a 67% market share, supported by its longer shelf life, easy handling, and broad compatibility with dry food blends, supplements, and bakery applications. Powdered chicory ingredients are widely adopted for prebiotic fortification, flavor addition, and sugar replacement. The liquid segment grows in beverage concentrates, syrups, and ready-to-drink formulations, driven by rising demand for natural flavoring agents. While both forms serve diverse applications, powder maintains a firm lead due to its processing advantages and widespread industrial use.

- For instance, Beneo GmbH leads the powdered chicory segment with its inulin-based products, such as Orafti® HP, which offer high fiber content and significant health benefits like improved digestive wellness.

By Application

Food and beverages hold the dominant position in the application segment with a 58% market share, supported by growing use of chicory-derived ingredients in bakery items, dairy alternatives, cereals, and coffee substitutes. Manufacturers leverage chicory root fiber for its prebiotic properties and clean-label appeal. The dietary supplements segment expands as consumers prioritize gut health and natural functional ingredients. Pharmaceuticals use chicory for digestive benefits, while the “others” category includes animal feed and personal care. Strong demand for functional foods continues to anchor the leadership of the food and beverage segment.

Key Growth Drivers

Rising Demand for Prebiotic and Gut-Health Ingredients

Growing consumer focus on digestive wellness drives strong demand for chicory-derived inulin, a widely recognized natural prebiotic. Food and beverage brands increasingly incorporate chicory fiber into cereals, dairy alternatives, bakery products, and nutritional drinks to enhance gut health benefits and support clean-label positioning. As awareness of microbiome health rises, manufacturers adopt inulin to reduce sugar, improve texture, and fortify products with functional fiber. This shift toward natural digestive-support ingredients continues to accelerate the adoption of chicory-based solutions across global markets.

- For instance, Sensus has made significant strides with its Frutafit® inulin, which is used by various food brands to enhance their product offerings in the growing digestive wellness category.

Increasing Use of Chicory as a Sugar and Fat Replacer

Chicory ingredients gain traction as manufacturers reformulate products to meet rising demand for low-sugar, low-fat, and calorie-reduced foods. Inulin provides natural sweetness, bulking properties, and fat-mimicking texture, making it a preferred replacement for synthetic additives. Food producers use chicory in chocolate, bakery items, dairy alternatives, and plant-based snacks to enhance mouthfeel without compromising nutrition. Regulatory support for clean-label ingredients and reformulation initiatives further strengthen the adoption of chicory-based fibers and extracts in mainstream food applications.

- For instance, the food industry uses agave-derived inulin as a fat replacer, enabling manufacturers to deliver creamy textures in reduced-fat products like ice creams without the added calories associated with full fat. Companies such as The Tierra Group supply agave inulin for these applications, leveraging its ability to form a particle gel that mimics the mouthfeel of fat.

Expanding Applications in Functional Foods and Nutraceuticals

The nutraceutical sector increasingly adopts chicory ingredients due to their digestive health benefits, natural origin, and compatibility with supplements and fortified foods. Dietary supplement brands incorporate chicory fiber into capsules, powders, and gummies targeting gut health and immunity. The functional food category benefits from rising consumer demand for plant-based, natural, and wellness-focused ingredients. As product developers expand formulations for immunity, weight management, and overall wellness, chicory continues to gain relevance across multiple health-driven categories.

Key Trends & Opportunities

Growing Preference for Clean-Label and Plant-Based Ingredients

A major trend shaping the market is the rising shift toward natural and plant-derived ingredients in food, beverages, and supplements. Chicory fiber aligns well with clean-label expectations, offering digestive benefits and natural sweetness without synthetic additives. Brands reformulate products to replace artificial fibers and chemical sweeteners with chicory-based alternatives. Expanding plant-based food categories—including dairy-free, vegan snacks, and meat alternatives—create strong opportunities for chicory in both texture improvement and nutritional enhancement.

- For instance, Ingredion Incorporated offers a range of clean-label ingredient solutions, including chicory root fiber (inulin), which functions as a prebiotic, bulking agent, and sugar reducer.

Expansion of Chicory in Coffee Substitutes and Specialty Beverages

Chicory extract and roasted chicory continue to gain popularity as caffeine-free coffee alternatives, driven by rising interest in healthier beverage options. Specialty beverage brands use chicory to enhance flavor depth, reduce acidity, and support functional drink formulations. Growth in herbal beverages, wellness drinks, and cold-brew substitutes creates new opportunities for chicory-based ingredients. As consumers explore novel flavors and caffeine-conscious choices, chicory enjoys expanding use in both premium and mainstream beverage categories.

- For instance, chicory has gained prominence as a popular ingredient for roasted, caffeine-free coffee alternatives, with a growing demand for such beverages. Its use in these drinks enhances flavor complexity while providing a healthier, caffeine-free option for consumers.

Increasing Industrial Adoption in Pharmaceuticals and Personal Care

Pharmaceutical and personal care companies integrate chicory ingredients for their anti-inflammatory, prebiotic, and soothing properties. Chicory extract appears in digestive health medicines, herbal formulations, and skincare products targeting hydration and microbiome balance. Rising interest in natural active ingredients supports further adoption across topical and ingestible applications. This trend opens new pathways for diversification beyond food and supplements.

Key Challenges

Supply Variability Due to Agricultural Dependence

Chicory production relies heavily on agricultural factors such as seasonal yields, soil quality, and climate conditions. Supply fluctuations affect raw material availability and price stability for ingredient manufacturers. Variability in crop output can disrupt production planning for food, nutraceutical, and beverage companies. Smaller processors struggle with inconsistent supply chains, increasing procurement challenges. Ensuring stable chicory sourcing remains a key constraint for market expansion.

Competition from Alternative Functional Ingredients

Chicory ingredients face strong competition from other prebiotic fibers, natural sweeteners, and plant-based functional materials such as fructooligosaccharides (FOS), resistant starches, and agave fibers. Some alternatives offer lower cost, different functional benefits, or broader compatibility with specific formulations. As manufacturers evaluate ingredient versatility and pricing, chicory must compete based on performance, clean-label appeal, and nutritional value. This competitive pressure poses a challenge to market share growth in both food and nutraceutical sectors.

Regional Analysis

North America

North America holds a market share of 32%, supported by rising demand for prebiotic fibers, clean-label ingredients, and plant-based food formulations. Food and beverage companies increasingly use chicory inulin for sugar reduction, digestive health claims, and texture enhancement. Strong consumer interest in functional foods and dietary supplements accelerates adoption across mainstream brands. The region benefits from advanced R&D capabilities and frequent product innovations in nutrition bars, beverages, and dairy alternatives. Expanding retail availability and high awareness of gut-health solutions further strengthen North America’s position in the chicory ingredients market.

Europe

Europe accounts for a market share of 38%, driven by strong chicory cultivation, established processing facilities, and long-standing use of chicory in food and beverage applications. The region leads in producing chicory root fiber due to favorable farming environments and advanced extraction technologies. Rising demand for natural sweeteners, functional fibers, and clean-label reformulations supports high consumption across bakery, confectionery, and dairy sectors. European consumers show strong preference for plant-based and digestive wellness products, further strengthening market growth. Regulatory support for natural ingredients enhances Europe’s leadership in the global chicory ingredients market.

Asia Pacific

Asia Pacific holds a market share of 22%, fueled by expanding food processing industries, rising health awareness, and growing adoption of chicory-based ingredients in functional foods and supplements. The region benefits from increasing consumption of prebiotic fibers in beverages, nutritional products, and fortified foods. Manufacturers integrate chicory fiber to support sugar reduction and improve digestive health claims. Rapid urbanization, rising disposable incomes, and growth in nutraceutical demand further contribute to market expansion. Strong interest in natural and plant-derived ingredients positions Asia Pacific as a fast-growing market for chicory ingredients.

Latin America

Latin America captures a market share of 5%, supported by rising interest in natural functional ingredients and steady adoption across food, beverage, and dietary supplement applications. Demand strengthens as manufacturers incorporate chicory fibers into bakery items, dairy substitutes, and wellness-focused products. Growth in herbal beverages and plant-based formulations also supports usage of chicory extracts. Although production capabilities remain limited, expanding imports and increasing awareness of digestive health trends drive market development. The region’s growing nutraceutical sector further supports adoption of chicory ingredients.

Middle East & Africa

The Middle East & Africa region holds a market share of 3%, driven by gradual adoption of chicory ingredients in health-oriented foods, beverages, and supplements. Rising prevalence of digestive health concerns increases consumer interest in natural prebiotic fibers. Food manufacturers incorporate chicory in low-sugar formulations and clean-label products to align with shifting dietary preferences. Although market penetration remains moderate due to limited processing facilities, rising imports and expanding retail distribution support demand. Growth in functional food and nutraceutical sectors strengthens the region’s long-term potential for chicory ingredient use.

Market Segmentations:

By Type

- Chicory Root Fiber (Inulin)

- Chicory Extract

- Chicory Flour

- Others

By Form

By Application

- Food & Beverages

- Dietary Supplements

- Pharmaceuticals

- Others

By Distribution Channel

- Direct Sales

- Retail Stores

- Online Retail

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Chicory Ingredients market highlights the presence of major players such as Cosucra Groupe Warcoing, Sensus, Beneo GmbH, Leroux, The Tierra Group, Pioneer Chicory, PMV Nutrient Products Pvt. Ltd., Murlikrishna Foods Pvt. Ltd., Farmvilla Food Industries Pvt. Ltd., and Nutraceutix Inc. These companies compete by expanding production capacity, improving extraction efficiency, and developing high-purity inulin and chicory-based functional ingredients. Many invest in advanced drying, filtration, and refining technologies to enhance product quality for use in dietary supplements, functional foods, and pharmaceutical formulations. Partnerships with food manufacturers support broader application development, while sustainability initiatives help strengthen brand positioning. Companies also emphasize R&D to introduce cleaner-label products and diversify chicory ingredient formats. Strong distribution networks and customized product solutions further reinforce competitive advantage in a market shaped by rising health awareness and growing preference for natural fiber ingredients.

Key Player Analysis

- Cosucra Groupe Warcoing

- Sensus

- Beneo GmbH

- Leroux

- The Tierra Group

- Pioneer Chicory

- PMV Nutrient Products Pvt. Ltd.

- Murlikrishna Foods Pvt. Ltd.

- Farmvilla Food Industries Pvt. Ltd.

- Nutraceutix Inc.

Recent Developments

- In September 2025, BENEO secured approval from the Thai FDA for an exclusive prebiotic claim for its chicory‑root fibre “Orafti® Inulin,” enabling manufacturers in Thailand to market this health benefit on pack.

- In June 2025, BENEO GmbH published research showing that combining its chicory‑derived inulin‑type fructans with human milk oligosaccharide (HMO) 2’‑fucosyllactose produced additive or synergistic benefits for toddler gut‑microbiota in a pre‑clinical study.

- In August 2024, DKSH extended its exclusive distribution agreement with Cosucra in Australia and New Zealand to promote Cosucra’s chicory‑root fibre ranges FIBRULINE™ and FIBRULOSE™.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Form, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for chicory root fiber will rise as consumers seek digestive health benefits.

- Adoption of chicory ingredients in clean-label foods will expand across global markets.

- Food and beverage companies will increase use of chicory as a natural sugar replacer.

- Growth in plant-based diets will boost demand for chicory-based functional ingredients.

- Dietary supplement makers will introduce more inulin-rich formulations for gut wellness.

- Advances in extraction technology will improve product purity and yield efficiency.

- Manufacturers will expand cultivation zones to reduce supply risks and seasonal shortages.

- Chicory flour will gain traction in gluten-free bakery and snack applications.

- Asia Pacific markets will grow faster due to rising health awareness and product diversification.

- Partnerships between farming cooperatives and ingredient companies will strengthen supply chains.

Market Insights

Market Insights