Market Overview

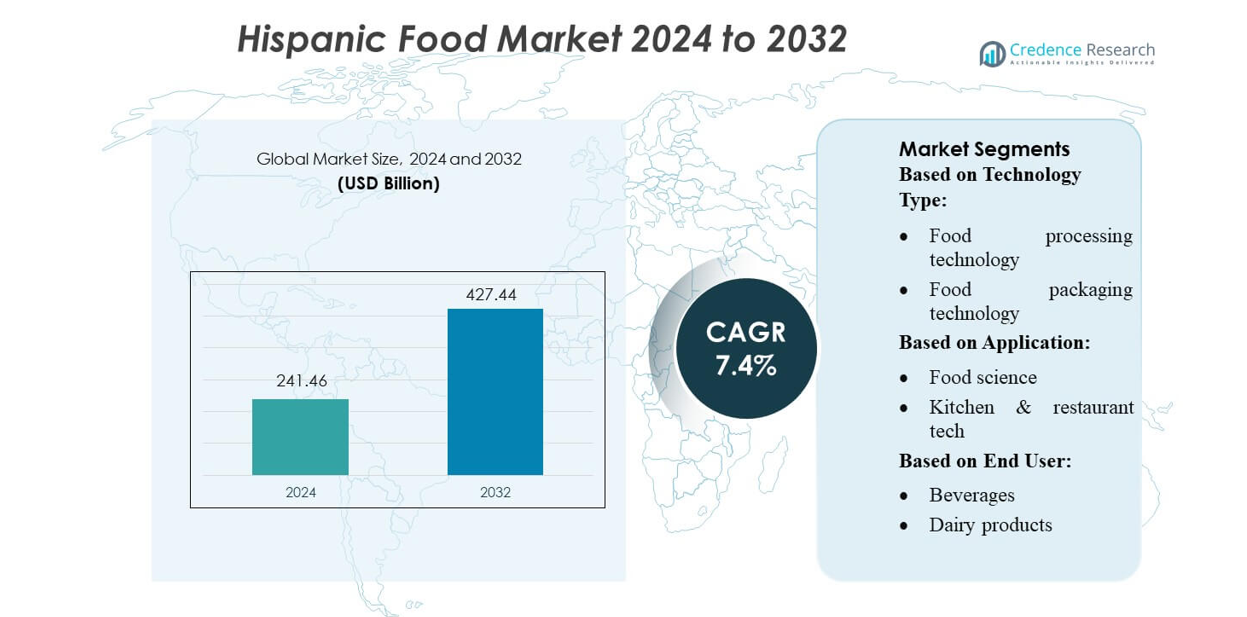

Hispanic Food Market size was valued USD 241.46 billion in 2024 and is anticipated to reach USD 427.44 billion by 2032, at a CAGR of 7.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hispanic Food Market Size 2024 |

USD 241.46 billion |

| Hispanic Food Market, CAGR |

7.4% |

| Hispanic Food Market Size 2032 |

USD 427.44 billion |

The Hispanic food market include Gruma, Bimbo, Goya Foods, Kraft Heinz, and Nestlé, all of which compete fiercely by leveraging their extensive distribution networks, strong brand heritage, and product innovation. Gruma and Bimbo dominate the tortilla and flatbread segments, while Goya Foods excels in beans, sauces, and frozen entrees. Kraft Heinz and Nestlé drive growth through convenient, value-added offerings tailored to Latino and mainstream consumers. North America leads the global Hispanic food market with an estimated 78.2 % share, thanks to a large Hispanic population, advanced retail infrastructure, and strong demand for authentic and convenience-driven Hispanic products.

Market Insights

- The Hispanic Food Market reached USD 241.46 billion in 2024 and is expected to grow to USD 427.44 billion by 2032 at a 7.4% CAGR, supported by rising global demand for authentic Hispanic cuisines.

- Growing multicultural populations, strong preference for convenient meal formats, and expanding retail penetration act as major market drivers, accelerating adoption of Hispanic sauces, tortillas, snacks, and ready meals across mainstream consumers.

- Key trends include increasing clean-label reformulations, premium regional specialties, and innovation in plant-based and low-sodium Hispanic product lines driven by evolving health preferences.

- Competitive intensity remains high as Gruma, Bimbo, Goya Foods, Kraft Heinz, and Nestlé expand product portfolios and leverage wide distribution, with tortillas, flatbreads, and beans among the most dominant segments.

- Regional analysis shows North America holding 78.2% of the market due to strong cultural integration and retail infrastructure, while Europe and Asia-Pacific gain momentum through growing international food demand and rising Hispanic food imports.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology Type:

Food processing technology dominates the Hispanic Food Market with an estimated 32–35% share, driven by the rising demand for automation, clean-label ingredient handling, and high-throughput processing systems that preserve authentic flavors while scaling production. Manufacturers increasingly adopt advanced thermal processing, extrusion, and high-pressure processing to maintain freshness and cultural authenticity. Packaging technology follows closely as brands integrate smart labels and extended-shelf-life materials to support long-distance distribution. Food safety technologies also gain traction due to stringent compliance requirements for imported Hispanic food products.

- For instance, Eurofins Scientific SE operates a network of over 900 food-testing labs across 62 countries and applies more than 200,000 validated analytical methods, enabling comprehensive high-pressure processing, extrusion, and thermal stability analyses with exceptional reliability.

By Application:

Food science represents the dominant application with 30–33% market share, driven by ongoing R&D investments in flavor stabilization, nutritional enhancement, and shelf-life extension tailored specifically for Hispanic food profiles. Kitchen and restaurant tech grows as commercial kitchens adopt automated prep tools and smart cooking systems to ensure menu consistency across multiple locations. Delivery and supply chain applications continue to scale due to the increasing reach of Hispanic food through e-commerce and meal-delivery platforms, supported by real-time logistics management, cold-chain monitoring, and integrated inventory technologies.

- For instance, AsureQuality Ltd recently upgraded its Auckland microbiology laboratory with an automated imaging system—an ultra-HD camera plus AI software—that scans and interprets over 35,000 petri dishes per year, eliminating manual colony counting.

By End User:

The Bakery segment leads the market with around 28–30% share, supported by strong consumer demand for Hispanic bakery staples such as tortillas, conchas, and specialty sweet breads. Growth is strengthened by innovations in mass-production ovens, dough-handling systems, and automated tortilla lines that maintain texture consistency. Meat & seafood and beverages also expand rapidly as Hispanic flavors gain mainstream adoption across retail and foodservice. Fruits & vegetables benefit from improved cold-chain systems that enhance freshness, while dairy products leverage upgraded fermentation and packaging systems to meet rising demand for cheeses and traditional beverages.

Key Growth Drivers

Rising Hispanic Population and Cultural Integration

The expanding Hispanic population and wider cultural integration significantly boost demand for authentic Hispanic cuisine. Consumers increasingly prefer diverse flavor profiles, enabling mainstream retailers and restaurants to broaden their Hispanic food portfolios. Product lines featuring spices, tortillas, sauces, and ready-to-eat Hispanic meals gain rapid acceptance due to growing familiarity. As multicultural households diversify their diets, manufacturers ramp up innovation and distribution of region-specific Hispanic foods. This rising consumer base strengthens long-term market potential and encourages investments in flavor authenticity, convenience, and high-quality ingredient sourcing.

- For instance, Bureau Veritas operated a global network of 34 food-testing laboratories staffed by over 1,900 technical experts, supporting microbiology, chemical, and molecular analysis across the supply chain.

Expansion of Retail Channels and Foodservice Adoption

Wider adoption of Hispanic foods across supermarkets, quick-service restaurants, and specialty stores drives consistent market growth. Large grocery chains allocate more shelf space to Hispanic staples and value-added products, improving product visibility. Meanwhile, foodservice operators integrate Hispanic-inspired menus to enhance customer engagement and differentiate offerings. Increased availability of frozen and packaged Hispanic meal solutions supports higher consumption. These expanded distribution networks improve accessibility, enabling brands to penetrate non-traditional markets. As omnichannel retail evolves, online grocery platforms further accelerate product reach across urban and semi-urban areas.

- For instance, NSF’s Shanghai laboratory spans 11,000 m² and has secured ISO/IEC 17065 accreditation for certification under NSF/ANSI 455 and 173 standards, greatly shortening turnaround times for ingredient conformity and food-equipment testing in Asia.

Product Innovation in Convenience and Health-Focused Offerings

Manufacturers increasingly innovate to meet rising demand for convenient, nutritious Hispanic food options. Companies launch ready-to–cook kits, plant-based adaptations of traditional dishes, low-sodium seasonings, and clean-label sauces. This shift toward health-driven reformulation appeals to fitness-conscious consumers seeking authentic tastes without compromising dietary goals. Innovations in packaging, such as resealable pouches and microwaveable trays, strengthen product usability. As busy lifestyles drive preference for quick meal solutions, brands invest in R&D and upscale processing technologies to elevate product quality, freshness, and shelf stability.

Key Trends & Opportunities

Premiumization and Authentic Regional Specialties

Consumers increasingly seek premium, region-specific Hispanic foods representing Mexican, Puerto Rican, Cuban, Peruvian, and Dominican culinary traditions. Brands leverage this trend by offering artisanal tortillas, specialty chilies, slow-cooked meats, and gourmet sauces. Growing interest in culinary exploration creates space for premium pricing and small-batch production. Restaurants and retail brands highlight regional authenticity to differentiate offerings. This trend opens opportunities for partnerships with local Hispanic suppliers, enabling companies to source high-quality ingredients and strengthen product authenticity narratives.

- For instance, TÜV SÜD invested €15 million in a new 70,000 ft² testing and training campus in Bengaluru to expand its capacity for electrical, electronic, and medical device services.

Growth of Digital Food Retail and Subscription Models

The rapid growth of online grocery channels and meal-kit subscriptions creates new opportunities for Hispanic food brands. Digital platforms enable targeted marketing toward multicultural consumers and streamline delivery of specialty ingredients not commonly found in local stores. Brands capitalize on subscription boxes featuring curated Hispanic spices, snacks, and ready-meal kits. Enhanced e-commerce logistics improve product accessibility in non-urban regions. This shift expands consumer reach and supports small Hispanic food producers entering the digital marketplace with minimal entry barriers.

- For instance, Intertek launched its Trace For Good SaaS platform in 2024, enabling full supply-chain mapping and verification of supplier risk for over 10,000 unique product batches.

Technological Adoption in Food Processing and Packaging

Advancements in food processing and packaging strengthen product quality, extend shelf life, and reduce operational costs. Companies invest in high-pressure processing, modified-atmosphere packaging, and automated production systems to maintain authenticity while scaling output. These technologies support broader distribution of perishable Hispanic products like fresh salsas, dairy-based desserts, and refrigerated meals. Technology adoption also enhances sustainability, reducing waste and improving material efficiency. As regulatory focus tightens around food safety, brands using advanced packaging technologies gain competitive positioning.

Key Challenges

Supply Chain Constraints and Ingredient Price Volatility

Fluctuating prices of key raw materials—such as corn, chilies, tomatoes, and spices—pose challenges for manufacturers. Many ingredients are imported from Latin America, increasing exposure to geopolitical risks, weather disruptions, and currency fluctuations. Logistics bottlenecks affect timely procurement of perishable goods, limiting production planning accuracy. Small and mid-sized producers often struggle to maintain stable margins. Managing supplier diversification, import dependencies, and freight costs remains a core operational challenge that directly impacts pricing strategies and product availability.

Competition from Mainstream and Private-Label Brands

As Hispanic foods gain popularity, mainstream brands and private-label lines rapidly expand their Hispanic product assortments, intensifying competitive pressure. These entrants benefit from strong distribution networks and price advantages, making it difficult for traditional Hispanic brands to sustain market share. Private labels often replicate popular products at lower prices, influencing consumer purchasing decisions. Authentic Hispanic brands must differentiate through quality, flavor authenticity, and niche innovation. Balancing cost competitiveness with brand identity becomes critical to retaining long-term positioning.

Regional Analysis

North America

North America holds the largest share of the Hispanic food market at around 78%, driven by a large Hispanic population and strong demand for authentic and convenient Hispanic meals. The United States leads consumption, supported by widespread retail availability, strong foodservice integration, and expanding online grocery channels. Product innovation in sauces, snacks, tortillas, and ready-to-eat meals further strengthens regional dominance. Major supermarkets continue increasing shelf space for Hispanic offerings, making the region the center of global market growth and the primary contributor to long-term industry expansion.

Europe

Europe accounts for about 13% of the Hispanic food market, supported by rising multicultural populations and increasing interest in Latin American flavors. Consumers in the UK, Spain, Germany, and France are adopting Hispanic sauces, tortillas, snacks, and frozen meals as part of broader international food exploration. Retailers have expanded international aisles, improving access to imported products. Growing tourism and exposure to Latin American cuisine also contribute to rising awareness. While smaller than North America, Europe offers strong growth potential for premium and specialty Hispanic products as consumer curiosity and ethnic diversity continue to rise.

Asia-Pacific

Asia-Pacific holds a smaller share of the Hispanic food market at around 5%, but it shows one of the fastest growth rates. Rising incomes, urbanization, and growing openness to global cuisines drive interest in Hispanic snacks, sauces, and ready meals. Countries such as Japan, South Korea, Australia, and Singapore are leading consumption, especially through international restaurants and modern retail channels. Online retailers also play a key role in making imported products accessible. Although still developing, APAC presents significant long-term opportunities as international flavor trends and fusion cuisines expand across urban markets.

Latin America

Latin America represents around 4–5% of the global Hispanic food market**, mainly driven by packaged and modernized versions of traditional foods. While Hispanic cuisine originates in this region, market growth focuses on processed, ready-to-cook, and branded food categories rather than basic staples. Urban consumers increasingly prefer convenient sauces, frozen meals, snacks, and value-added bakery products. Local manufacturers benefit from strong cultural familiarity and regional trade links. Growth remains stable, supported by rising middle-class buying power and increased interest in branded Hispanic foods adapted for modern lifestyles.

Middle East & Africa

The Middle East & Africa market holds around 2–3% of the global share, with early-stage but steadily growing demand for Hispanic foods. Growth is strongest in the UAE, Saudi Arabia, and South Africa, where international restaurants, tourism, and multicultural populations drive exposure to global cuisines. Retailers and foodservice operators are gradually introducing Hispanic sauces, tortillas, and snacks to meet rising demand. Online food delivery platforms also support experimentation with new flavors. Although small, this region offers emerging opportunities as international food trends and global consumer mobility expand.

Market Segmentations:

By Technology Type:

- Food processing technology

- Food packaging technology

By Application:

- Food science

- Kitchen & restaurant tech

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Hispanic food market reflects an expanding competitive landscape supported by global food-safety, quality-assurance, and testing leaders such as Eurofins Scientific SE, AsureQuality Ltd, Thermo Fisher Scientific Inc., Bureau Veritas, NSF International, UL LLC, TUV SUD, Intertek Group PLC, Merieux Nutrisciences, and SGS S.A. The Hispanic food market continues to strengthen as manufacturers expand product portfolios, improve distribution capabilities, and invest in advanced processing technologies. Companies increasingly focus on authentic flavor development, clean-label formulations, and convenient ready-to-eat or ready-to-cook formats to attract a broader consumer base. Retail partnerships, private-label expansion, and strong placement across supermarkets and online grocery platforms further intensify competition. Innovation in sauces, tortillas, snacks, and frozen meals enables brands to differentiate offerings while maintaining cost efficiency. As consumer interest in regional Hispanic cuisines grows, producers emphasize quality consistency, supply-chain reliability, and strategic marketing to secure long-term market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Bio-Rad launched the XP-Design Assay Salmonella Serotyping Solution to enable rapid and accurate identification of Salmonella serotypes in food and environmental samples. The assay uses real-time PCR technology with fluorescent probes to ensure high specificity.

- In November 2024, Eurofins DQCI and Eurofins Microbiology Laboratories, Inc. developed a new test for Avian Influenza A in raw milk to protect dairy herds and maintain milk production safety. The test provided dairy farmers and processors with the capabilities to detect and manage avian flu outbreaks.

- In November 2023, QIAGEN launched new QIAcuity digital PCR kits along with updated software to expand applications in biopharma and food safety. The new kits include solutions for mycoplasma detection, RNA/DNA quantification, and food testing, offering enhanced sensitivity and compliance with industry standards

Report Coverage

The research report offers an in-depth analysis based on Technology Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as multicultural consumer adoption of Hispanic flavors increases across mainstream retail.

- Manufacturers will focus more on authentic regional recipes to differentiate products and meet rising demand for diverse cuisine profiles.

- Ready-to-eat and ready-to-cook Hispanic meals will grow rapidly due to busy lifestyles and preference for convenient formats.

- Clean-label, low-sodium, and plant-based Hispanic product lines will gain traction among health-conscious consumers.

- Online grocery platforms will strengthen distribution of Hispanic foods, especially in non-urban regions.

- Foodservice chains will continue expanding Hispanic-inspired menu offerings to attract younger consumers.

- Investments in advanced processing and packaging technologies will enhance product shelf life and freshness.

- Private-label Hispanic offerings will rise as retailers seek cost-competitive differentiation.

- Export opportunities will increase as global interest in Latin American culinary culture strengthens.

- Brands will prioritize supply-chain stability to manage ingredient volatility and ensure consistent quality.