Market Overview

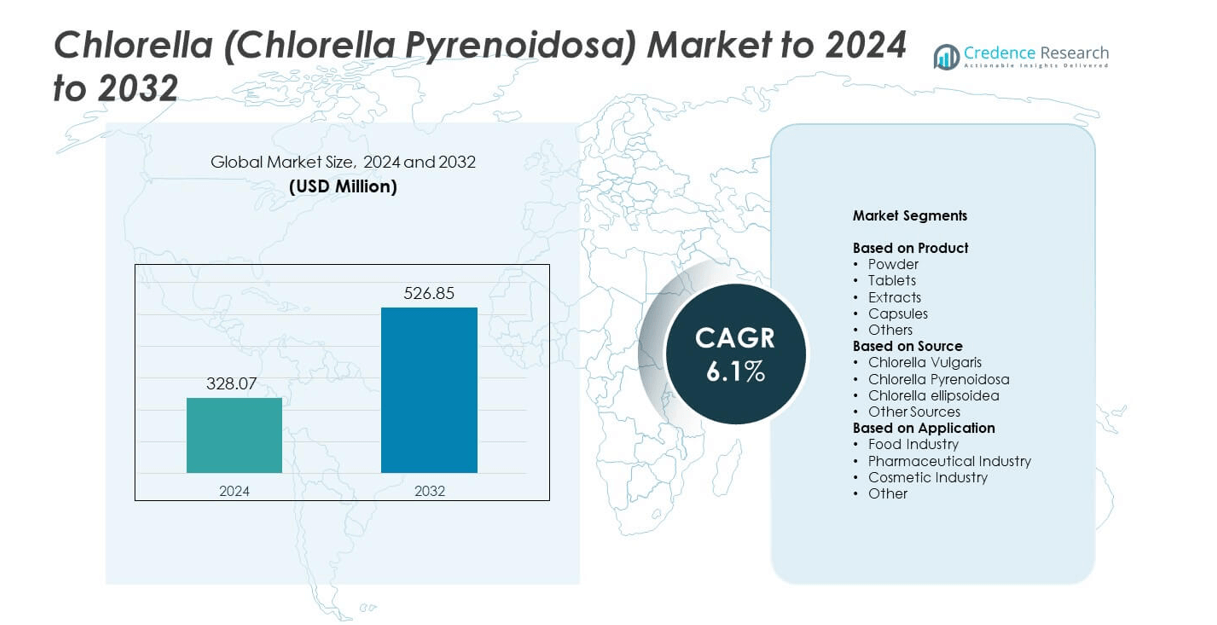

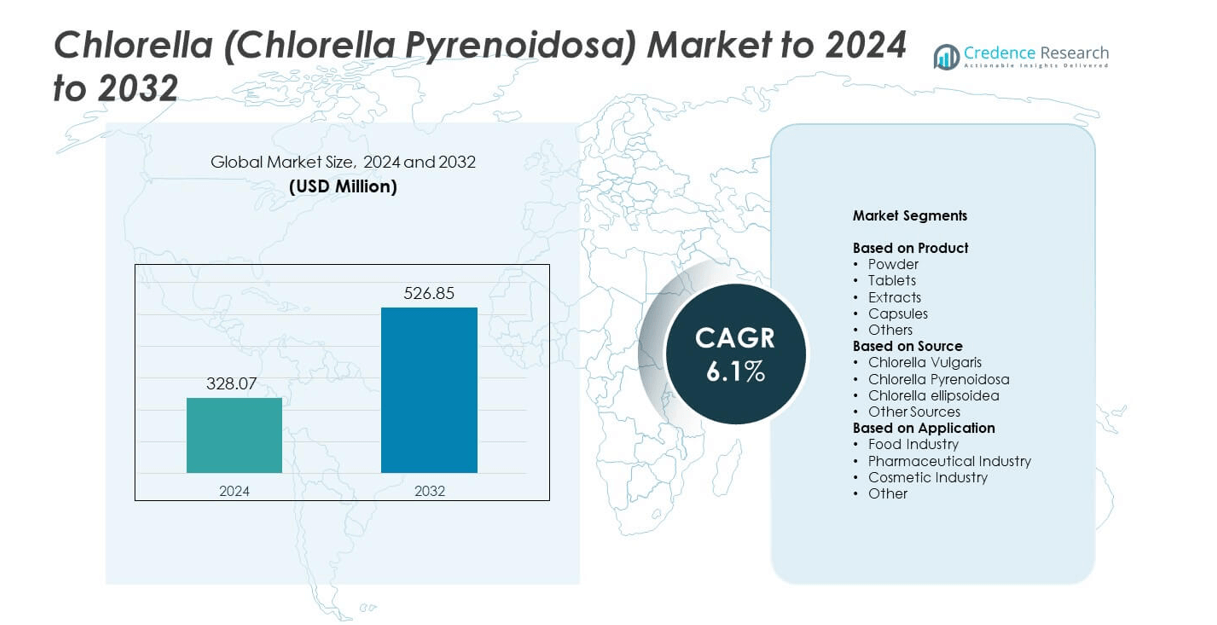

Chlorella (Chlorella Pyrenoidosa) Market size was valued at USD 328.07 million in 2024 and is anticipated to reach USD 526.85 million by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Chlorella (Chlorella Pyrenoidosa) Market Size 2024 |

USD 328.07 million |

| Chlorella (Chlorella Pyrenoidosa) Market, CAGR |

6.1% |

| Chlorella (Chlorella Pyrenoidosa) Market Size 2032 |

USD 526.85 million |

The Chlorella (Chlorella Pyrenoidosa) Market features strong competition among Fuqing King Dnarmsa Spirulina Co. Ltd., Yaeyama Shokusan Co. Ltd., Green Source Organics, E.I.D. – Parry (India) Limited, Sure Chemical Co. Ltd., SUN CHLORELLA CORP, GONG BIH ENTERPRISE CO. L.T.D., STAUBER Ingredients For Innovation, Tianjin Norland Biotech Co. Ltd., and Far East Bio-Tec Co. Ltd. These players focus on high-purity cultivation, advanced processing, and broader application development across supplements, functional foods, and cosmetics. Asia Pacific leads the market with about 34% share due to large-scale production and long-standing algae consumption patterns, while North America holds around 33% driven by strong demand for plant-based nutrition and premium wellness products.

Market Insights

- The Chlorella (Chlorella Pyrenoidosa) Market reached USD 328.07 million in 2024 and is projected to hit USD 526.85 million by 2032, growing at a CAGR of 6.1%.

• Rising demand for plant-based protein and detox supplements drives strong adoption of powder formats, which hold about 47% share due to wide use in functional foods and nutrition blends.

• Trends include expanding applications in fortified foods, clean-label products, and algae-based cosmetics, supported by improved cultivation and extraction technologies.

• Competition intensifies as companies focus on high-purity production, wider product portfolios, and premium nutraceutical formulations to strengthen global presence.

• Asia Pacific leads with nearly 34% share due to extensive production capacity, while North America holds about 33% with strong supplement demand, and the food industry contributes roughly 45% share as the dominant application segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Powder leads this segment with about 47% share in 2024 due to strong demand from functional food producers and supplement brands seeking easy-to-mix, nutrient-dense chlorella formats. Powder form gains preference because manufacturers use it in smoothies, energy bars, beverages, and nutritional blends without altering product texture. Tablets and capsules grow steadily as consumers prefer convenient daily dosing, while extracts expand within premium formulations. Rising use of powder in sports nutrition and fortified foods keeps this category dominant across global markets.

- For instance, Roquette’s chlorella plant near Lille can produce around 4,000–5,000 tonnes of chlorella powders each year.

By Source

Chlorella Pyrenoidosa dominates this segment with nearly 52% share in 2024 driven by its higher chlorophyll, protein, and detoxification properties compared to other species. Producers rely on this strain because it supports immunity-focused supplements and heavy-metal cleansing products. Chlorella Vulgaris remains widely used in food-grade applications due to its milder taste, while Chlorella ellipsoidea gains traction in cosmetic and antioxidant-rich formulations. Strong therapeutic value and rich nutrient density maintain Pyrenoidosa’s leadership worldwide.

- For instance, Duplaco’s facility in Oldenzaal, Netherlands, was acquired by Aliga Microalgae in August 2022. Under its previous ownership, Duplaco had a production capacity of 200 to 300 tons of Chlorella yearly and aimed to increase production to 1,500 tons per year.

By Application

The food industry leads this segment with about 45% share in 2024 fueled by growing demand for natural colorants, plant-based protein enhancers, and clean-label ingredients. Food manufacturers adopt chlorella to improve nutritional value in beverages, snacks, pasta, and bakery items. The pharmaceutical industry expands as companies study chlorella for immune modulation and detox support, while cosmetics gain adoption due to rising interest in algae-based antioxidants. Strong integration of chlorella in fortified and health-focused foods keeps the food industry dominant.

Key Growth Drivers

Rising demand for plant-based nutrition

Growing preference for plant-based foods boosts the use of chlorella as a natural protein and micronutrient source. Many consumers shift toward algae-based supplements to support immunity, detoxification, and overall wellness. Food and beverage companies add chlorella to snacks, drinks, and fortified products to meet clean-label expectations. Increased fitness awareness and higher protein consumption across global markets further strengthen demand. This driver remains one of the strongest forces shaping the Chlorella (Chlorella Pyrenoidosa) Market.

- For instance, Allmicroalgae in Portugal plans its integrated fermentation and photosynthetic platform to deliver a nominal capacity of about 120 tons of algae-based raw material per year.

Expanding application in pharmaceuticals and detox products

Pharmaceutical companies adopt chlorella due to its antioxidant, anti-inflammatory, and detoxification properties. Growing research on heavy-metal binding capacity increases its use in detox formulations and liver-support blends. Rising consumer focus on immune health accelerates product development, especially in capsules, tablets, and extracts. Regulatory approvals for algae-based nutraceutical ingredients support market penetration. This factor continues to act as a major driver for the Chlorella (Chlorella Pyrenoidosa) Market.

- For instance, Taiwan Chlorella Manufacturing Company in Taipei produces over 400 tons of dried chlorella biomass each year for health products and supplements.

Growing use in the food and cosmetic industries

Food manufacturers use chlorella as a natural green colorant and nutrient booster in bakery, beverages, and plant-based foods. The cosmetic industry increases adoption due to chlorella’s skin-repair, hydration, and antioxidant effects. Rising demand for algae-based clean beauty encourages new formulations in creams and masks. Producers invest in high-purity extracts and controlled cultivation systems to meet rising quality standards. This is a key growth driver supporting long-term industry expansion.

Key Trends & Opportunities

Rising adoption of microalgae farming and closed-system cultivation

Companies shift toward controlled photobioreactor systems to improve purity, yield, and nutrient density. This trend opens opportunities for large-scale, contamination-free chlorella production. Controlled systems reduce environmental risk and allow consistent output for food, pharmaceuticals, and cosmetics. Growing investment in sustainable algae farming increases supply stability and supports premium-grade chlorella development. This remains one of the most important trends in the Chlorella (Chlorella Pyrenoidosa) Market.

- For instance, Aliga Microalgae reports that its facilities in Denmark and the Netherlands, together with a partner site in France, currently provide about 400 tonnes of chlorella powder per year, with the Dutch plant engineered to scale production toward roughly 1,000 tonnes annually using precision fermenters

Growth of fortified and functional foods with algae ingredients

Food producers integrate chlorella into energy bars, plant proteins, noodles, and beverages as consumers seek nutrient-rich, natural, and minimally processed ingredients. Demand for vegan, gluten-free, and low-allergen foods creates new product development opportunities. Chlorella’s rich chlorophyll and vitamin profile supports expansion in functional health categories. This trend provides strong opportunities for new brand launches and cross-industry innovation. It is a key trend and opportunity in the Chlorella (Chlorella Pyrenoidosa) Market.

- For instance, Brevel and Kibbutz Yotvata have agreed to build a microalgae fermentation facility in Israel designed to reach 900,000 liters of fermenter volume and about 3,000 tons of dry microalgae product per year, targeting plant-based dairy and other functional foods using chlorella-family strains.

Advancements in extraction technologies and product diversification

Producers invest in gentle extraction, cell-wall cracking, and high-purity processing to improve bioavailability. These advancements help companies develop premium capsules, powders, and cosmetic ingredients for targeted health and skincare needs. Technology upgrades also reduce production costs and expand application potential. Growing focus on value-added formulations offers major opportunities for market expansion. This is an emerging trend and opportunity shaping future growth.

Key Challenges

High production cost and complex cultivation requirements

Chlorella production requires controlled light, temperature, and nutrient conditions. These systems increase costs for growers, especially in large-scale settings. Harvesting, drying, and purification also add significant expenses. Many producers face competitive pressure from lower-cost plant proteins, which slows price-sensitive market expansion. This is a major challenge affecting the Chlorella (Chlorella Pyrenoidosa) Market.

Limited consumer awareness in developing regions

Many consumers in emerging markets are unfamiliar with chlorella’s nutritional value and benefits. Low awareness limits supplement adoption and slows growth in functional food applications. Limited distribution networks and higher pricing reduce market penetration outside major urban centers. Companies must invest in education and marketing to expand acceptance. This remains a key challenge restricting broader market reach.

Regional Analysis

North America

North America holds about 33% share of the Chlorella (Chlorella Pyrenoidosa) Market in 2024 due to strong demand for plant-based supplements, functional foods, and detox products. The United States leads regional sales as consumers adopt algae-based nutrition for immunity, wellness, and clean-label diets. Food and beverage manufacturers also integrate chlorella into fortified products, supporting wider use across retail channels. Expanding vegan lifestyles and strong nutraceutical innovation keep North America a key contributor to global growth.

Europe

Europe accounts for nearly 28% share as the region embraces algae-based ingredients driven by strict clean-label, sustainability, and organic standards. Countries such as Germany, France, and the United Kingdom show high demand for chlorella powders, tablets, and food-grade additives. Growing interest in natural colorants and plant-based proteins increases adoption across both the food and cosmetic industries. Strong regulatory support for microalgae products and rising consumer awareness reinforce Europe’s position in the global market.

Asia Pacific

Asia Pacific leads with about 34% share in 2024, driven by long-standing consumption of algae supplements and large-scale chlorella production in China, Japan, Taiwan, and South Korea. The region benefits from established cultivation facilities and strong demand for immunity-enhancing and detoxifying supplements. Food manufacturers add chlorella to beverages, noodles, snacks, and nutritional blends, expanding its role in daily diets. Rising health awareness and expanding middle-income groups make Asia Pacific the fastest-growing regional market.

Latin America

Latin America holds around 3% share of the global market, supported by increasing interest in natural supplements and expanding health-focused product lines. Brazil and Mexico lead regional demand as consumers shift toward plant-based detox and immune-support supplements. Growth remains steady as local brands introduce chlorella powders and capsules across retail chains. Although market penetration is still developing, rising urban health trends create favorable long-term prospects.

Middle East & Africa

Middle East & Africa represent nearly 2% share, driven by rising awareness of algae-based nutrition and expanding availability of imported chlorella products. Urban centers in the UAE, South Africa, and Saudi Arabia experience growing interest in wellness supplements and functional foods. Limited local production slows volume expansion, but premium retail and online platforms support steady demand. Increasing focus on preventive health and natural ingredients gradually enhances the region’s presence in the global market

Market Segmentations:

By Product

- Powder

- Tablets

- Extracts

- Capsules

- Others

By Source

- Chlorella Vulgaris

- Chlorella Pyrenoidosa

- Chlorella ellipsoidea

- Other Sources

By Application

- Food Industry

- Pharmaceutical Industry

- Cosmetic Industry

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Chlorella (Chlorella Pyrenoidosa) Market is shaped by strong competition among leading companies such as Fuqing King Dnarmsa Spirulina Co. Ltd., Yaeyama Shokusan Co. Ltd., Green Source Organics, E.I.D. – Parry (India) Limited, Sure Chemical Co. Ltd., SUN CHLORELLA CORP, GONG BIH ENTERPRISE CO. L.T.D., STAUBER Ingredients For Innovation, Tianjin Norland Biotech Co. Ltd., and Far East Bio-Tec Co. Ltd. Market participants focus on expanding production capacity, improving cultivation efficiency, and maintaining high-quality nutrient profiles to meet rising global demand. Many companies invest in advanced photobioreactor technology and refined cell-wall cracking methods to enhance product purity and bioavailability. Strategic partnerships with food, nutraceutical, and cosmetic brands help widen application areas, while strong distribution networks support global reach. Firms also emphasize sustainability by adopting controlled microalgae farming practices, which improve consistency and reduce environmental impact. Continuous product innovation and certification compliance further strengthen competitiveness across major markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fuqing King Dnarmsa Spirulina Co. Ltd. (China)

- Yaeyama Shokusan Co. Ltd. (Japan)

- Green Source Organics (U.S.)

- E.I.D. – Parry (India) Limited (India)

- Sure Chemical Co. Ltd. (China)

- SUN CHLORELLA CORP (U.S.)

- GONG BIH ENTERPRISE CO. L.T.D. (Taiwan)

- STAUBER Ingredients For Innovation (U.S.)

- Tianjin Norland Biotech Co. Ltd. (China)

- Far East Bio-Tec Co. Ltd. (Taiwan)

Recent Developments

- In 2025, Fuqing King Dnarmsa Spirulina Co. Ltd. (China) continues to advance in Chlorella production and research. It operates several cultivation farms and a specialized algae research institute founded in 2011, emphasizing scientific research, quality control with advanced instrumentation, and product innovation in Chlorella powder and tablets.

- In 2025, Sure Chemical continues to emphasize Chlorella as a high-protein, nutrient-rich green algae used mainly as a food additive and flavor modifier in baking and fermentation industries.

- In 2023, FEBICO participated in Vitafoods Asia 2023, promoting its organic chlorella and spirulina product lines, including tablet and powder formats aimed at nutraceutical and functional food brands, underscoring its role as a premium microalgae supplier.

Report Coverage

The research report offers an in-depth analysis based on Product, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as consumers seek natural and plant-based nutrition.

- Demand for chlorella powders and extracts will increase across global supplement brands.

- Food manufacturers will expand use of chlorella in fortified and clean-label products.

- Pharmaceutical applications will rise as research supports detox and immune benefits.

- Cosmetic companies will adopt more algae-based formulas for skin-repair and anti-aging lines.

- Controlled photobioreactor farming will improve product purity and supply stability.

- Product diversification will expand with new blends, flavored powders, and concentrated extracts.

- Asia Pacific will strengthen its leadership due to large-scale production advantages.

- E-commerce channels will drive higher adoption of premium chlorella supplements.

- Growing sustainability focus will support wider acceptance of algae-based ingredients.