Market Overview

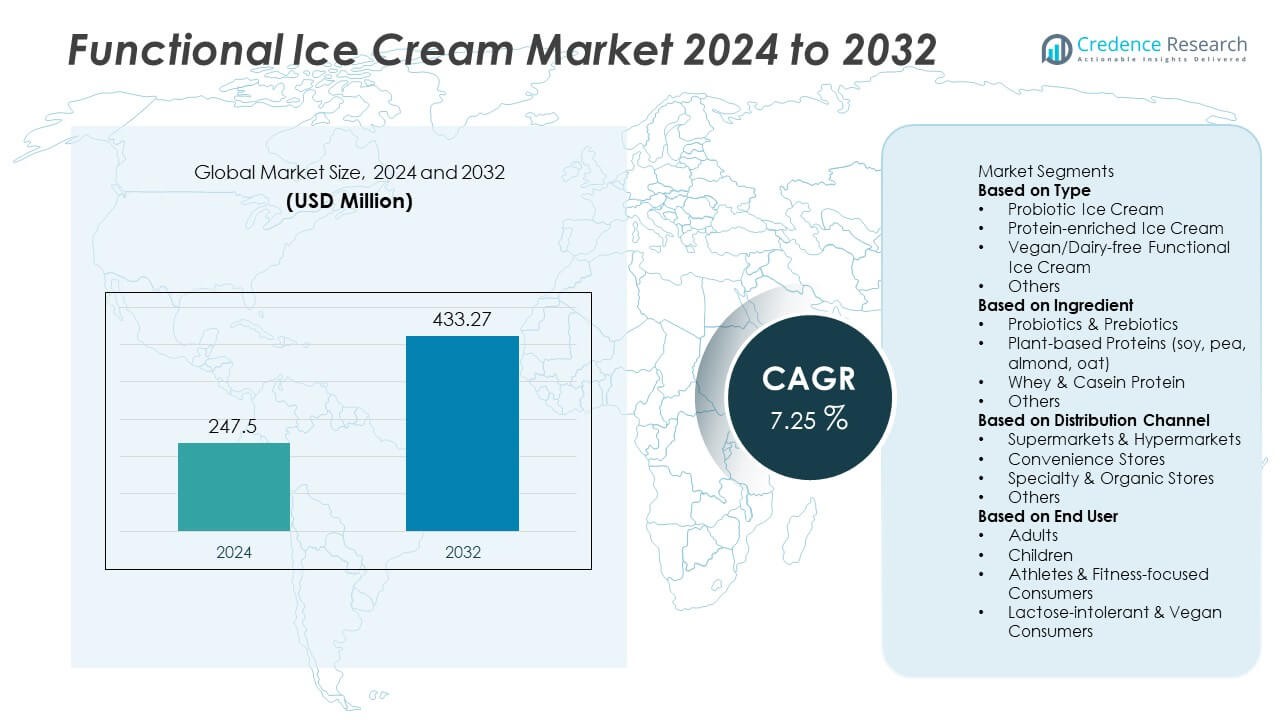

The Functional Ice Cream market was valued at USD 247.5 million in 2024. It is projected to grow steadily and reach USD 433.27 million by 2032, expanding at a CAGR of 7.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Functional Ice Cream Market Size 2024 |

USD 247.5 Million |

| Functional Ice Cream Market, CAGR |

7.25% |

| Functional Ice Cream Market Size 2032 |

USD 433.27 Million |

The Functional Ice Cream market features top players such as Halo Top Creamery, Unilever, Nestlé, Yasso Inc., Enlightened, My/Mochi Ice Cream, Perfect Day, Arctic Zero, Wheyhey Ice Cream, and Rebel Creamery, all focusing on high-protein, low-sugar, and probiotic formulations to meet rising demand for healthier frozen desserts. North America leads the market with a 37% share, supported by a strong fitness and clean-label consumer base and wide retail availability. Europe holds a 29% share, driven by demand for vegan and lactose-free frozen products. Asia Pacific accounts for a 23% share, expanding rapidly due to growing urban wellness trends and increasing adoption of protein-enhanced and digestive-health ice cream variants.

Market Insights

Market Insights

- The Functional Ice Cream market reached USD 247.5 million in 2024 and is projected to reach USD 433.27 million by 2032, expanding at a CAGR of 7.25%, driven by rising consumer interest in healthier frozen dessert alternatives.

- Demand for high-protein dessert options supports growth, with Protein-enriched Functional Ice Cream holding a 41% share, supported by strong adoption among fitness-focused and weight-management consumers seeking better nutritional value in indulgent foods.

- Key trends include low-sugar and keto-friendly product launches, probiotic-infused digestive wellness variants, and expansion of plant-based formulations, enabling brands to target lactose-intolerant and vegan buyers across retail and online platforms.

- Competition intensifies as companies focus on flavor innovation, creamy texture enhancements, and clean-label ingredients, while premium pricing and formulation complexity restrain adoption in cost-sensitive segments, especially among first-time and traditional ice cream buyers.

- Regionally, North America leads with a 37% share, followed by Europe at 29% and Asia Pacific at 23%, while Latin America and Middle East & Africa represent 6% and 5%, driven by developing health awareness and expanding specialty frozen dessert retail networks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The Protein-enriched Functional Ice Cream segment leads the market with a 41% share, driven by strong demand among fitness-conscious consumers seeking high-protein dessert alternatives. These products appeal to individuals focused on muscle recovery, weight management, and sports nutrition. Probiotic ice cream gains momentum as gut-health awareness rises, while vegan or dairy-free ice cream attracts lactose-intolerant and plant-based consumers. Although other functional variants, including collagen and vitamin-fortified ice creams, continue to expand, protein-enriched formulations remain dominant due to wider retail placement, strong product positioning in gym-centric categories, and enhanced consumer willingness to pay premium prices for nutritional benefits.

- For instance, Halo Top Creamery offers pints containing 20 grams of protein per 473 ml, supported by a recipe that uses ultrafiltered skim milk to maintain higher protein concentration.

By Ingredient:

The Whey and Casein Protein segment holds a 38% share, driven by broad availability, established nutritional credibility, and strong adoption in sports and active lifestyle consumer groups. These ingredients support muscle repair and satiety, increasing their use in high-protein ice cream lines. Probiotics and prebiotics grow as digestive wellness trends strengthen, while plant-based proteins such as soy and pea attract vegan and allergen-sensitive buyers. Other nutrient blends, including omega-3, antioxidants, and adaptogens, emerge in specialty launches. However, whey and casein remain dominant due to consistent supply, superior texture performance, and robust consumer trust in dairy-derived protein sources.

- For instance, Rebel Creamery formulates keto ice cream with cream and milk protein isolate, delivering 2 grams of protein in a 118 ml serving, and uses sugar alcohols to support low-carbohydrate nutrition goals.

By Distribution Channel:

Supermarkets and Hypermarkets dominate sales with a 54% share, supported by extensive product visibility, in-store sampling, and strong placement in premium frozen dessert sections. These retail chains offer wide brand variety, value packs, and promotional bundles that influence high-volume consumer purchases. Convenience stores show steady growth for single-serve formats, while specialty and organic stores attract buyers seeking clean-label and allergen-free functional ice cream options. Online sales accelerate as health-focused consumers shift toward subscription-based delivery of diet-specific frozen foods. Despite expanding e-commerce channels, supermarkets retain leadership due to established cold-chain logistics and impulse-driven retail purchasing behavior.

Key Growth Drivers

Rising Demand for Healthier and Protein-Rich Frozen Desserts

The market grows as consumers seek healthier indulgence without giving up familiar dessert formats. Functional ice cream appeals to fitness-focused individuals, weight-management users, and consumers seeking better nutritional value from treats. High-protein variants support muscle recovery and satiety, boosting adoption among gym-goers and sports nutrition buyers. Brands incorporate whey, casein, or plant-based proteins to strengthen product positioning. Rising awareness of macronutrient balance and interest in fortified foods also encourage demand. As lifestyle shifts continue and functional snacking gains popularity, protein-enriched ice cream remains a leading growth catalyst across retail and online platforms.

- For instance, Wheyhey Ice Cream in the UK previously offered tubs containing 22 grams of whey protein per 150 ml, supporting targeted distribution in sports nutrition stores.

Growing Popularity of Digestive Wellness and Probiotic Fortification

Digestive health trends fuel strong interest in probiotic functional ice cream, particularly among consumers seeking gut-friendly desserts. Probiotics and prebiotics help support microbiome balance, making these formulations attractive to health-conscious families and older consumers. Rising attention to immune system support further increases adoption, especially after heightened focus on wellness and disease prevention. Brands diversify offerings with clinically supported probiotic strains and low-lactose bases to enhance benefits and reduce digestive discomfort. This driver gains strength through product launches in supermarkets and specialty organic channels, reinforcing market expansion.

- For instance, Coconut Cult produces plant-based probiotic coconut yogurts (not frozen blends) that deliver 50 billion CFU per ounce (approx. 30 ml), and their products generally contain 400 billion CFU per 8 oz (237 ml) jar, supporting demand in premium wellness retail formats.

Expansion of Vegan and Lactose-Free Lifestyle Consumption

Demand rises for plant-based functional ice cream driven by lactose intolerance, dairy sensitivity, and ethical dietary preferences. Consumers adopt dairy-free alternatives made with almond, oat, coconut, or pea protein bases that deliver creamy texture and nutritional enhancement. Vegan functional ice cream also aligns with sustainability-driven purchasing and the clean-label movement. The segment benefits from strong placement in natural food stores and premium retail chains. Younger demographics adopting flexitarian diets accelerate expansion. As plant-based innovation improves taste, stability, and protein content, vegan functional ice cream becomes a key catalyst for long-term market growth.

Key Trends & Opportunities

Clean Label, Low-Sugar, and Keto-Friendly Innovation

A major trend shaping the market is the shift toward low-sugar and keto-focused formulations with natural sweeteners such as stevia and monk fruit. Clean label claims, short ingredient lists, and elimination of artificial stabilizers appeal to ingredient-conscious consumers. Companies introduce products that support weight control and blood sugar management. This creates opportunities for collaboration with fitness and nutrition brands and drives growth through online wellness communities. As retailers expand freezer shelf space for low-carb desserts, demand for healthier frozen treats continues to rise.

- For instance, Enlightened markets a collection of keto-friendly pints containing 1 gram of sugar per 85 gram serving, produced using allulose and chicory root fiber to maintain taste and texture.

Omnichannel Retail Growth and E-commerce Subscription Models

E-commerce platforms and direct-to-consumer delivery models support broader access, especially for niche and refrigerated health brands. Subscription ice cream plans and curated wellness dessert boxes help retain customers and boost recurring revenue. Digital marketing and influencer collaborations increase brand discovery among younger buyers. Cold-chain advancements improve shipment reliability and product quality, allowing premium functional ice cream brands to scale distribution. This trend creates strong expansion potential in emerging markets adopting rapid grocery delivery and frozen food e-commerce.

- For instance, Jeni’s Splendid Ice Creams uses an insulated shipping box packed with dry ice, which maintains temperatures around –78.5°C (–109.3°F), ensuring the product arrives perfectly frozen across nationwide home delivery.

Key Challenges

High Production Costs and Complex Formulation Requirements

Functional ice cream requires high-quality proteins, probiotics, and nutrient additives that increase production costs. Maintaining taste, texture, and freeze-thaw stability adds formulation complexity. Cold-chain storage and specialty packaging further elevate expenses, limiting price competitiveness with conventional ice cream. Smaller brands face manufacturing scale challenges, while premium pricing restricts adoption in cost-sensitive consumer segments. These constraints slow broader market penetration.

Limited Consumer Awareness and Flavor Acceptance Barriers

Some consumers remain unfamiliar with functional benefits or skeptical of nutrition claims in frozen desserts. Flavor and mouthfeel differences in high-protein or plant-based products may reduce repeat purchases if not well executed. Education and taste-led product development are essential to overcome perception barriers. Brands must invest in sensory improvements and clear communication of benefits to increase mainstream acceptance and drive frequency of consumption.

Regional Analysis

North America

North America holds a 37% share of the Functional Ice Cream market, driven by strong demand for high-protein, low-sugar, and probiotic frozen desserts. The United States leads consumption, supported by a mature sports nutrition sector and wide retail placement in supermarkets, health stores, and online delivery platforms. Fitness-focused consumers adopt protein-enriched varieties for post-workout recovery, while digestive wellness trends fuel demand for probiotic formulations. Product innovation featuring clean-label, lactose-free, and keto-friendly options strengthens brand competitiveness. Canada shows rising adoption through plant-based launches and premium organic frozen dessert offerings, reinforcing regional market growth.

Europe

Europe accounts for a 29% share of the market, supported by strong demand for vegan and lactose-free functional ice creams, particularly in Germany, the United Kingdom, and the Nordics. Consumers prioritize clean ingredients, reduced sugar, and sustainable packaging, encouraging growth in organic and probiotic variants. Retail expansion through specialty natural food chains boosts product visibility, while regional dairy innovation strengthens high-protein product development. Mediterranean markets also show rising demand for fortified frozen desserts as wellness tourism and functional food adoption increase. Regulatory support for reduced sugar formulations further enhances market expansion across the region.

Asia Pacific

Asia Pacific holds a 23% share and represents the fastest-growing region, driven by rising disposable incomes, urban lifestyle changes, and expansion of modern retail channels. China and Japan lead adoption of probiotic and digestive-health ice creams, supported by strong consumer familiarity with functional dairy products. India, South Korea, and Australia show increasing demand for protein-enriched and plant-based frozen desserts as fitness participation and lactose intolerance awareness rise. E-commerce and quick-commerce grocery platforms accelerate distribution, while new product launches featuring regional flavors attract younger consumers.

Latin America

Latin America holds a 6% share, supported by growing interest in healthier dessert alternatives and increasing adoption of fortified and lactose-free frozen products. Brazil and Mexico lead consumption as supermarkets expand premium and wellness-oriented frozen food assortments. Rising gym memberships and nutritional awareness promote demand for protein-enhanced functional ice cream. Economic sensitivity influences pricing strategies, pushing brands to introduce smaller pack sizes and value formats. Marketing focused on digestive health and low-sugar lifestyles drives gradual consumer shift toward functional alternatives.

Middle East and Africa

The Middle East and Africa account for a 5% share of the market, driven by rising health awareness and increased availability of premium frozen desserts in urban retail settings. The United Arab Emirates and Saudi Arabia lead adoption, as consumers show strong interest in high-protein, low-calorie, and dairy-free ice creams. Growth in fitness centers and sports nutrition channels expands product use among younger, wellness-oriented buyers. South Africa and other African markets experience gradual adoption supported by modern retail growth and e-commerce penetration. Climate conditions and demand for refreshing nutritious products create long-term opportunities for functional ice cream brands.

Market Segmentations:

By Type

- Probiotic Ice Cream

- Protein-enriched Ice Cream

- Vegan/Dairy-free Functional Ice Cream

- Others

By Ingredient

- Probiotics & Prebiotics

- Plant-based Proteins (soy, pea, almond, oat)

- Whey & Casein Protein

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty & Organic Stores

- Others

By End User

- Adults

- Children

- Athletes & Fitness-focused Consumers

- Lactose-intolerant & Vegan Consumers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis in the Functional Ice Cream market includes key players such as Halo Top Creamery, Unilever, Nestlé, Yasso Inc., Enlightened (Beyond Better Foods), My/Mochi Ice Cream, Perfect Day, Arctic Zero, Wheyhey Ice Cream, and Rebel Creamery. Companies compete by developing high-protein, low-sugar, and probiotic ice cream variants that appeal to fitness-focused and health-conscious consumers. Leading brands invest in clean-label formulations, plant-based proteins, and dairy-free alternatives to address lactose intolerance and vegan dietary shifts. Product differentiation focuses on flavor innovation, creamy texture, and functional ingredients such as collagen, fiber, or adaptogens. E-commerce growth and subscription-based delivery models expand market reach, while partnerships with gyms, nutrition retailers, and wellness influencers strengthen brand visibility. Price-sensitive markets drive demand for smaller pack sizes and value-based offerings. Continuous product reformulation, improved sensory profiles, and sustainable packaging investments help brands maintain competitive positioning as the functional frozen dessert category grows across global retail channels.

Key Player Analysis

- Halo Top Creamery

- Unilever (Magnum, Ben & Jerry’s, Breyers)

- Nestlé (Healthy Choice, High-Protein Variants)

- Yasso Inc.

- Enlightened (Beyond Better Foods)

- My/Mochi Ice Cream

- Perfect Day (Animal-free Dairy Protein)

- Arctic Zero

- Wheyhey Ice Cream

- Rebel Creamery

Recent Developments

- In October 2025, Yasso expanded its better-for-you frozen Greek yogurt portfolio with a new 14-oz tub format, making a stronger push into higher-protein frozen snacks.

- In March 2025, Halo Top launched a national advertising campaign emphasising its lower-sugar, lower-calorie, high-protein positioning via a new agency.

- In 2024, Unilever (via its ice-cream arm including Magnum) released the Magnum Bon Bons format, which was the brand’s first-ever dedicated bite-sized product, responding to growing snacking and wellness trends.

Report Coverage

The research report offers an in-depth analysis based on Type, Ingredient, Distribution Channel, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Functional ice cream will gain broader acceptance as consumers seek healthier indulgence options.

- High-protein and probiotic formulations will strengthen adoption among fitness and gut-health focused buyers.

- Plant-based and lactose-free product lines will expand to serve vegan and dairy-sensitive consumers.

- Low-sugar, keto-friendly, and diabetic-support frozen desserts will grow across retail channels.

- Premium brands will adopt clean-label ingredients and natural flavor systems to improve taste perception.

- E-commerce and subscription-based frozen dessert delivery models will boost direct-to-consumer sales.

- Partnerships with gyms, health influencers, and nutrition programs will enhance market visibility.

- Advances in dairy-free proteins and alternative fats will improve texture and creaminess.

- Sustainable packaging and reduced-waste cold chain logistics will gain importance for brand differentiation.

- Expansion in Asia Pacific and Latin America will accelerate as health-focused dessert consumption increases.

Market Insights

Market Insights