Market Overview

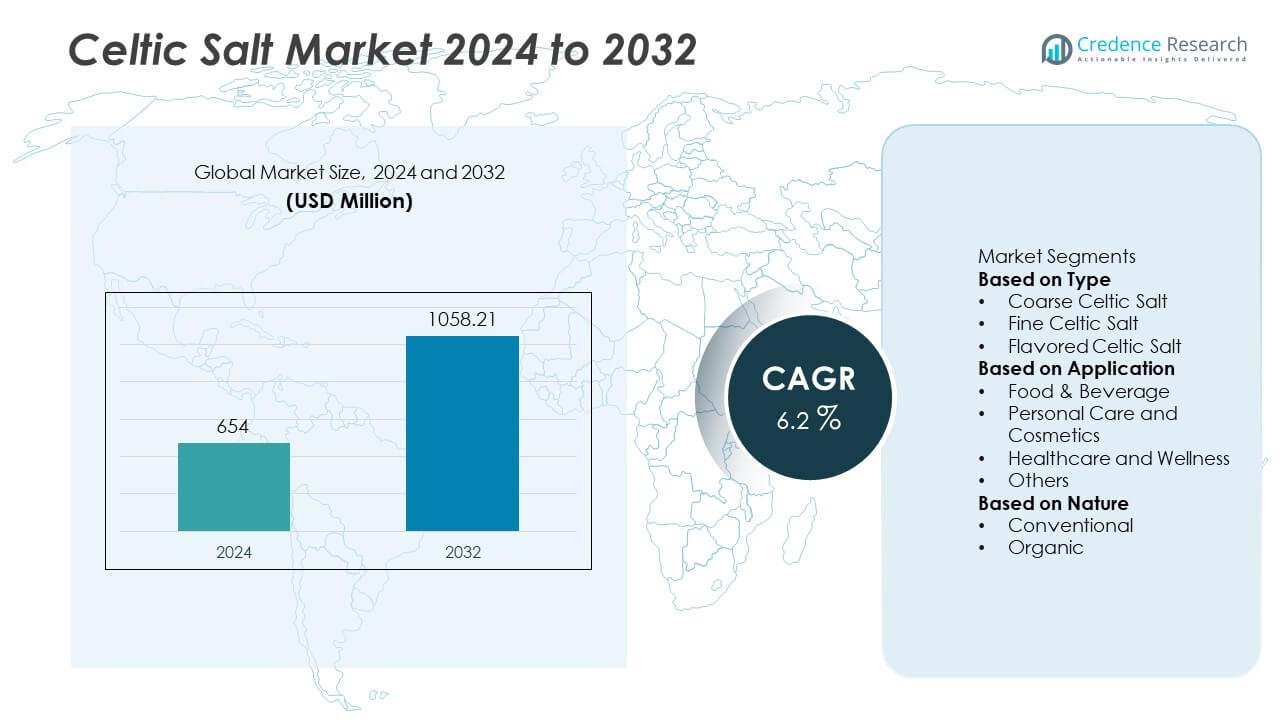

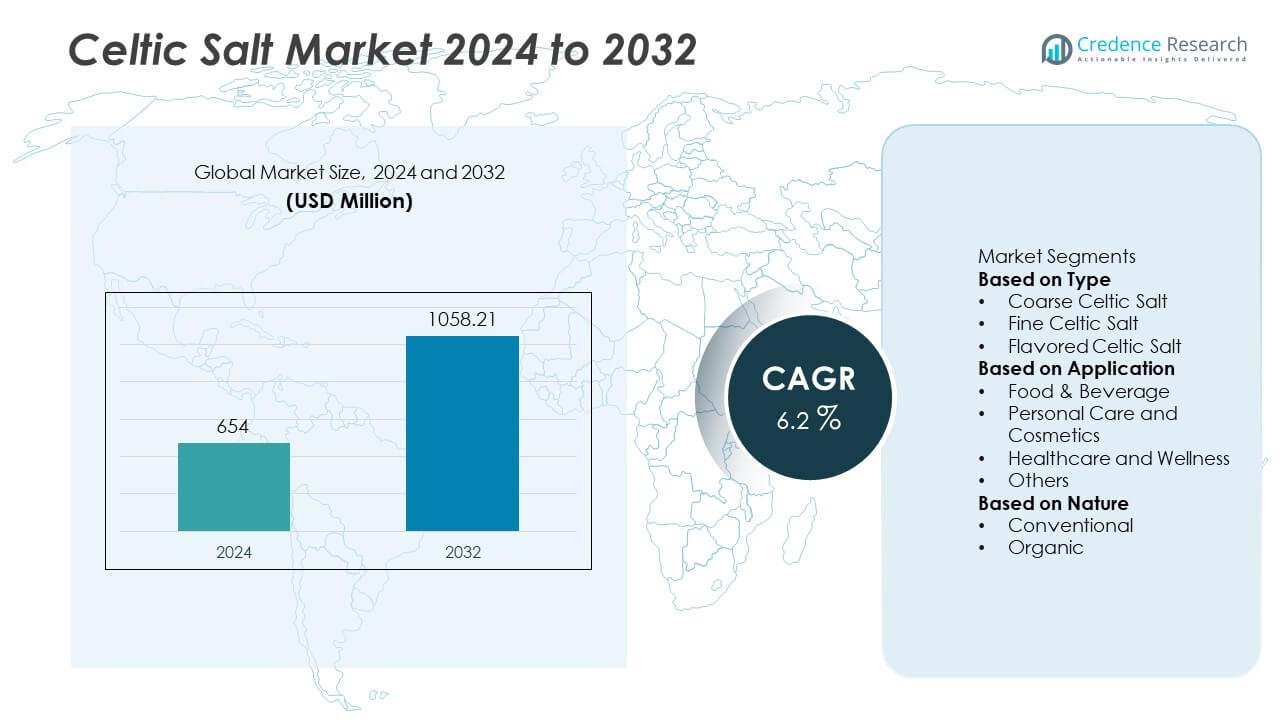

The Celtic Salt Market was valued at USD 654 million in 2024 and is expected to reach USD 1,058.21 million by 2032, registering a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Celtic Salt Market Size 2024 |

USD 654 Million |

| Celtic Salt Market, CAGR |

6.2% |

| Celtic Salt Market Size 2032 |

USD 1,058.21 Million |

The top players in the Celtic Salt market include Selina Naturally, Celtic Sea Salt Brand, SaltWorks Inc., San Francisco Salt Company, Maine Sea Salt Company, Cornish Sea Salt Co., Maldon Crystal Salt Company, HimalaSalt, Baja Gold Sea Salt, and The Salt Company of Iceland, each focusing on mineral-rich salt harvesting and clean-label positioning. Europe leads the market with a 37% share, supported by strong consumer demand for artisanal and natural gourmet salts. North America follows with a 32% share, driven by rising use in premium food products, wellness supplements, and personal care formulations. Asia Pacific holds a 20% share, expanding due to growing interest in nutrient-dense specialty salts and natural seasoning alternatives across emerging health-focused markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Celtic Salt market reached USD 654 million in 2024 and is projected to reach USD 1,058.21 million by 2032, registering a CAGR of 6.2% during the forecast period.

- Rising demand for mineral-rich, unrefined gourmet salts drives market growth, with Coarse Celtic Salt holding a 48% segment share due to strong use in culinary seasoning and food processing.

- Key trends include rising preference for clean-label, trace-mineral salts and growing product expansion in flavored blends supporting functional health and premium food applications.

- Competitive landscape features Selina Naturally, SaltWorks Inc., San Francisco Salt Company, and Cornish Sea Salt Co., focusing on sustainable harvesting, wellness branding, and expanding retail distribution across organic and specialty food channels.

- Europe leads with a 37% share due to strong gourmet salt usage, followed by North America at 32% driven by food, wellness, and personal care adoption, while Asia Pacific holds 20% supported by rising natural ingredient consumption and premium seasoning demand.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Coarse Celtic salt holds the largest 48% share of the Celtic Salt market, driven by its high mineral content, traditional harvesting methods, and growing preference for artisanal culinary ingredients. Consumers and gourmet chefs use coarse crystals for seasoning, salt curing, meat preservation, and cooking applications that benefit from slow-dissolving salt structure. Fine Celtic salt continues to gain traction in bakery, snacks, and table-use applications due to its easier solubility, while flavored Celtic salt expands in premium seasoning blends. Rising demand for clean-label, unrefined, and mineral-rich salt varieties supports continued growth across all product types.

- For instance, SaltWorks Inc. operates a 100,000-square-foot production facility in Woodinville, Washington, where the company processes a large volume of specialty sea salt each year using proprietary Optically Clean® technology, a chemical-free process which uses high-definition cameras and air jets to inspect every crystal and remove foreign material.

By Application

Food and beverage applications dominate with a 61% share, supported by rising adoption in gourmet foods, bakery items, premium snacks, meat products, and artisanal cooking. Celtic salt is valued for its trace minerals, lower sodium perception, and moist crystalline texture, appealing to health-conscious consumers seeking natural alternatives to refined table salt. The personal care and cosmetics segment grows due to increasing use in bath salts, scrubs, and mineral-rich skin formulations, while healthcare and wellness applications benefit from demand for electrolyte balance and natural mineral supplements. Expansion of specialty retail and e-commerce platforms strengthens market penetration.

- For instance, Cornish Sea Salt Co. supplies mineral-rich sea salt to food manufacturers and skincare brands, and laboratory analysis confirms the presence of more than 60 naturally occurring trace minerals, including minerals like calcium, potassium, and magnesium.

By Nature

Conventional Celtic salt accounts for a leading 67% share, driven by wider production availability, strong commercial distribution, and competitive pricing in bulk supply for food manufacturers and retailers. Organic Celtic salt shows faster growth as consumers associate organic certification with purity, sustainable harvesting, and environmentally responsible practices. Increasing interest in natural functional ingredients and premium culinary salts supports growth potential for both formats. Manufacturers focus on transparent sourcing, eco-friendly packaging, and certification standards to strengthen brand value and expand presence in global health food markets.

Key Growth Drivers

Increasing Demand for Natural and Mineral-Rich Salt Alternatives

Consumers increasingly shift toward natural, unrefined, and mineral-rich salts, driving strong demand for Celtic salt. Its higher levels of magnesium, calcium, and trace electrolytes support positioning in health-focused diets and clean-label food formulations. The growing rejection of chemically processed table salt encourages food manufacturers and gourmet brands to incorporate Celtic salt into premium seasoning blends and packaged foods. Health-conscious consumers and culinary professionals value its mild flavor and moist texture, supporting broader adoption across retail and food service channels, which strengthens market expansion.

- For instance, Selina Naturally’s laboratory analysis shows that Celtic Sea Salt contains trace minerals, including magnesium and calcium. Celtic Sea Salt and other unrefined sea salts are known to contain a range of minerals and trace elements. Selina Naturally, a producer of Celtic Sea Salt, is a company that exports its products to distributors.

Rising Use in Functional Food, Wellness, and Nutraceutical Products

Celtic salt increasingly appears in electrolyte supplements, mineral tonics, wellness beverages, and herbal formulations aimed at restoring hydration and promoting metabolic balance. As consumers emphasize preventive health and holistic nutrition, naturally harvested salt varieties gain more credibility as functional ingredients. The wellness industry promotes Celtic salt for potential benefits in pH balance and improved digestion, expanding application beyond culinary uses. Partnerships with nutraceutical brands and growth of direct-to-consumer health products contribute to sustained demand across global nutritional markets.

- For instance, Baja Gold Sea Salt provides mineral-rich formulations that contain significantly more magnesium and potassium than standard table salt, validated through third-party mineral assays. The company supplies salt ingredients to nutraceutical manufacturers producing electrolyte powders and hydration supplements.

Expansion of Premium and Gourmet Culinary Applications

Celtic salt benefits from rising interest in artisan cooking, gourmet meal kits, and high-quality seasoning categories. Restaurants, craft food producers, and specialty spice companies use coarse and flavored Celtic salt in finishing blends, rubs, smoked salts, and fermented food products. The increasing popularity of global cuisine, home-chef culture, and culinary-focused social media amplifies demand for premium salt varieties. Retailers expand shelf space for gourmet salts as consumers pay more for unique flavor experiences and traceable origin, supporting robust market growth.

Key Trends & Opportunities

Growth of Organic and Sustainable Harvesting Practices

Demand for organic and responsibly harvested salts creates opportunities for producers using environmentally conscious extraction and solar evaporation methods. Brands highlight traceability, hand-harvesting, and low-impact production on packaging to attract eco-aware consumers. Certifications and sustainability messaging enhance premium positioning in natural grocery and online marketplaces. This trend supports differentiation against conventional sea salt and positions Celtic salt as a high-value culinary and wellness ingredient with strong brand storytelling potential.

- For instance, The Salt Company of Iceland produces 1,500 metric tons of geothermal-evaporated sea salt each year using renewable energy sourced from a 75-megawatt geothermal plant, enabling zero-fuel production and verified carbon-neutral salt harvesting through independent environmental audits.

Expansion of E-Commerce and Direct-to-Consumer Distribution

Online health retailers and specialty e-commerce platforms increase global consumer access to Celtic salt, allowing small-batch producers to scale distribution without traditional retail constraints. Subscription services and personalized nutrition programs incorporate Celtic salt into curated wellness boxes. Digital marketing, influencer-led food content, and recipe-based promotions encourage trial and repeat purchases. This shift supports strong demand growth, especially in regions where gourmet and natural foods continue to expand.

- For instance, the San Francisco Salt Company sells a variety of gourmet and mineral salts, including Himalayan salt and organic blends, for cooking and personal care purposes through online marketplaces such as Amazon and its DTC platform.

Key Challenges

Higher Pricing Compared to Conventional Table and Sea Salt

Celtic salt’s artisanal harvesting, lower production volumes, and premium positioning result in significantly higher retail pricing than refined table salt. This limits adoption among cost-sensitive consumers and challenges penetration into mass-market food processing. Price competition from Himalayan pink salt and other premium sea salts further intensifies pressure, requiring clear value communication related to mineral benefits and purity. Brands must balance quality, sourcing transparency, and affordability to broaden market appeal.

Limited Awareness and Inconsistent Quality Standardization

In some markets, consumer familiarity with Celtic salt remains low, and confusion with other unrefined salts challenges brand recognition. Variations in mineral composition, moisture levels, and grain texture across suppliers can create inconsistency in product quality. Lack of strong global regulatory standards for specialty salts also impacts trust and labeling clarity. Manufacturers and associations must improve education and standardization to support widespread acceptance and long-term adoption.

Regional Analysis

North America

North America holds a 34% share of the Celtic Salt market, driven by strong consumer demand for natural, unrefined, and mineral-rich salt alternatives across the United States and Canada. Growth is supported by rising adoption in gourmet foods, premium seasoning blends, functional beverages, and wellness supplements. E-commerce channels, specialty health retailers, and direct-to-consumer brands drive higher product visibility and repeat purchases. The region benefits from strong marketing of clean-label and paleo, keto, and whole-food nutrition trends. Increased use in personal care and bath therapy products also strengthens market expansion, supported by well-developed distribution networks.

Europe

Europe accounts for a 28% share of the Celtic Salt market, supported by a long tradition of sea salt harvesting and strong consumer preference for artisanal and naturally sourced condiments. France, Germany, and the United Kingdom represent major demand hubs, driven by growth in gourmet culinary applications, organic food retail, and spa and wellness therapies. Premium food manufacturers use Celtic salt in craft bakery, fermented foods, and specialty seasoning categories. Sustainability, traceability, and organic certifications further support adoption across supermarkets and specialty food stores. Expanding gastronomic tourism and culinary education continue to reinforce long-term growth.

Asia Pacific

Asia Pacific holds a 22% share of the market, with demand rising in Japan, South Korea, China, and Australia. Growth is driven by the expanding health and wellness sector, increasing adoption of mineral-rich salts in functional foods, and a rising focus on clean-label ingredients. Culinary interest in Western and gourmet food preparation also contributes to higher household and restaurant usage. E-commerce platforms accelerate regional penetration, supported by health influencers and natural-living communities. The growing spa and mineral therapy industry supports use in bath salts and topical wellness formulations, helping strengthen market presence across the region.

Latin America

Latin America holds an 8% share, supported by growing interest in natural and traditional food ingredients. Brazil, Mexico, and Chile lead adoption, driven by increased health awareness and rising demand in premium culinary products and clean-label packaged foods. Celtic salt appears in specialty food stores, organic markets, and wellness-focused online retail channels. Limited domestic production and higher import dependence influence pricing, slowing broader consumption among cost-sensitive buyers. However, expanding middle-class spending and the popularity of gourmet cooking and fusion cuisines support continued market development across the region.

Middle East & Africa

Middle East and Africa represent an 8% share of the Celtic Salt market, driven by increasing preference for natural and minimally processed salt options across the United Arab Emirates, Saudi Arabia, and South Africa. Demand is supported by growth in high-end hospitality, specialty retail, and personal care formulations, including mineral bath salts and exfoliation products. Higher disposable income in Gulf countries and rising tourism-based culinary experiences help premium salt imports gain traction. Limited awareness in some countries and higher pricing constrain mass-market penetration, yet expanding wellness retail and spa industries support steady long-term growth.

Market Segmentations:

By Type

- Coarse Celtic Salt

- Fine Celtic Salt

- Flavored Celtic Salt

By Application

- Food & Beverage

- Personal Care and Cosmetics

- Healthcare and Wellness

- Others

By Nature

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Selina Naturally, Celtic Sea Salt Brand, SaltWorks Inc., San Francisco Salt Company, Maine Sea Salt Company, Cornish Sea Salt Co., Maldon Crystal Salt Company, HimalaSalt, Baja Gold Sea Salt, and The Salt Company of Iceland lead the competitive landscape of the Celtic Salt market. The competition centers on product purity, mineral-rich composition, sourcing transparency, and expanding distribution across retail, gourmet, and wellness channels. Companies focus on differentiating their offerings through artisan harvesting methods, low processing, and traceability from coastal salt beds. Leading brands strengthen market visibility through partnerships with natural food retailers, premium restaurants, and e-commerce platforms that support direct-to-consumer sales. Product innovation includes flavored blends, fine and coarse grain variants, and organic-certified salt targeted toward health-conscious consumers. Marketing emphasizes natural electrolytes, lower sodium content, and alignment with clean-label trends. As demand rises in food, personal care, and wellness formulations, key players continue investing in sustainable harvesting, brand storytelling, and regional expansion strategies.

Key Player Analysis

- Selina Naturally

- Celtic Sea Salt Brand

- SaltWorks Inc.

- San Francisco Salt Company

- Maine Sea Salt Company

- Cornish Sea Salt Co.

- Maldon Crystal Salt Company

- HimalaSalt (Sustainable Sourcing LLC)

- Baja Gold Sea Salt

- The Salt Company of Iceland

Recent Developments

- In 2025, SaltWorks Inc. announced the launch of a new portfolio of specialty salts developed exclusively for the food-industry and private-label markets.

- In November 2024, Cornish Sea Salt Co. introduced its “TekSalt” product in its food-manufacturing range, designed to allow lower sodium usage without sacrificing flavour.

- In July 2023, SeaAgri Solutions, LLC (maker of Baja Gold Sea Salt) launched the newly-branded Baja Gold Salt Co., with modern branding, expanded product portfolio including a liquid mineral tincture and bath soak, and a new Shopify e-commerce platform.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Nature and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for mineral-rich, natural salts will increase as consumers shift toward clean-label foods.

- Food manufacturers will expand use of Celtic salt in gourmet seasoning and premium snack products.

- Growth in wellness and holistic nutrition will support product demand in supplements and electrolyte blends.

- Personal care brands will integrate Celtic salt into exfoliation, bath, and skin-repair formulations.

- Flavored and smoked Celtic salt varieties will expand retail presence and attract culinary professionals.

- Online distribution and specialty e-commerce will strengthen global market reach for premium salt brands.

- Sustainable and ethical salt harvesting practices will become essential for brand differentiation.

- Restaurants and artisanal bakeries will increase adoption due to rising demand for authentic flavors.

- Innovation in packaging and traceability will improve product transparency and consumer trust.

- Strong growth potential will emerge in Asia Pacific as natural seasoning and health trends accelerate.

Market Segmentation Analysis:

Market Segmentation Analysis: