Market Overview

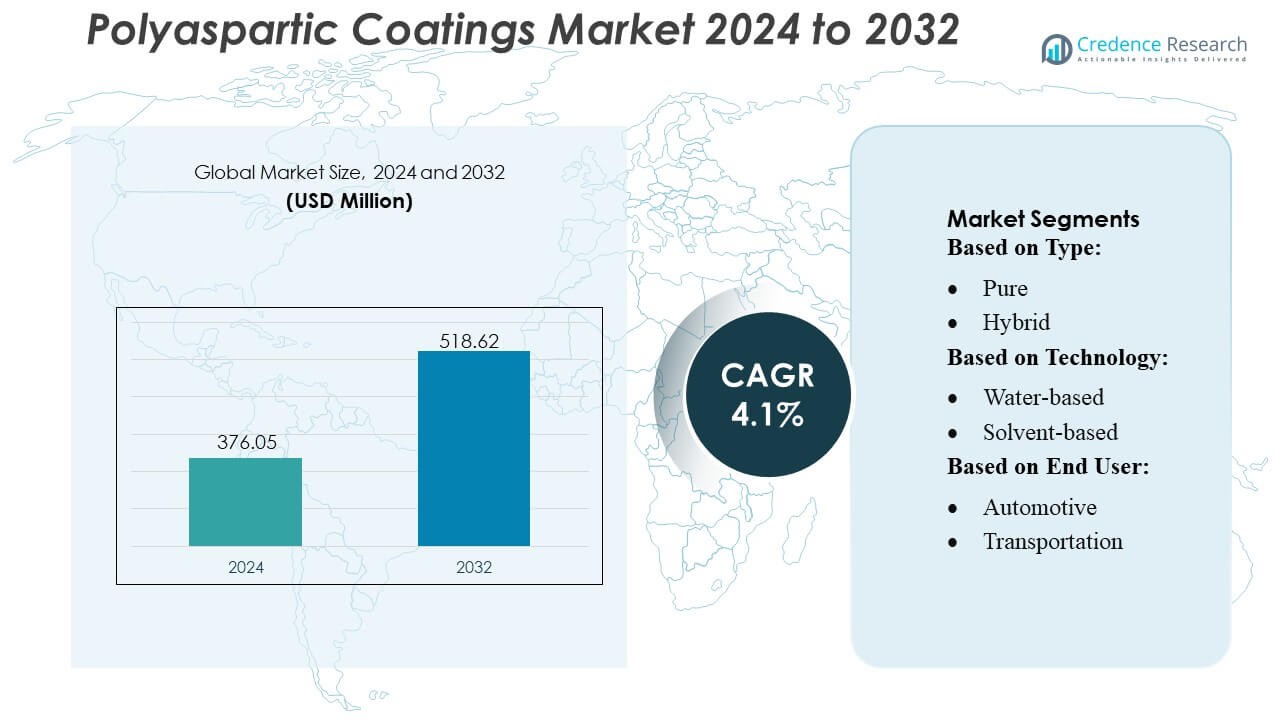

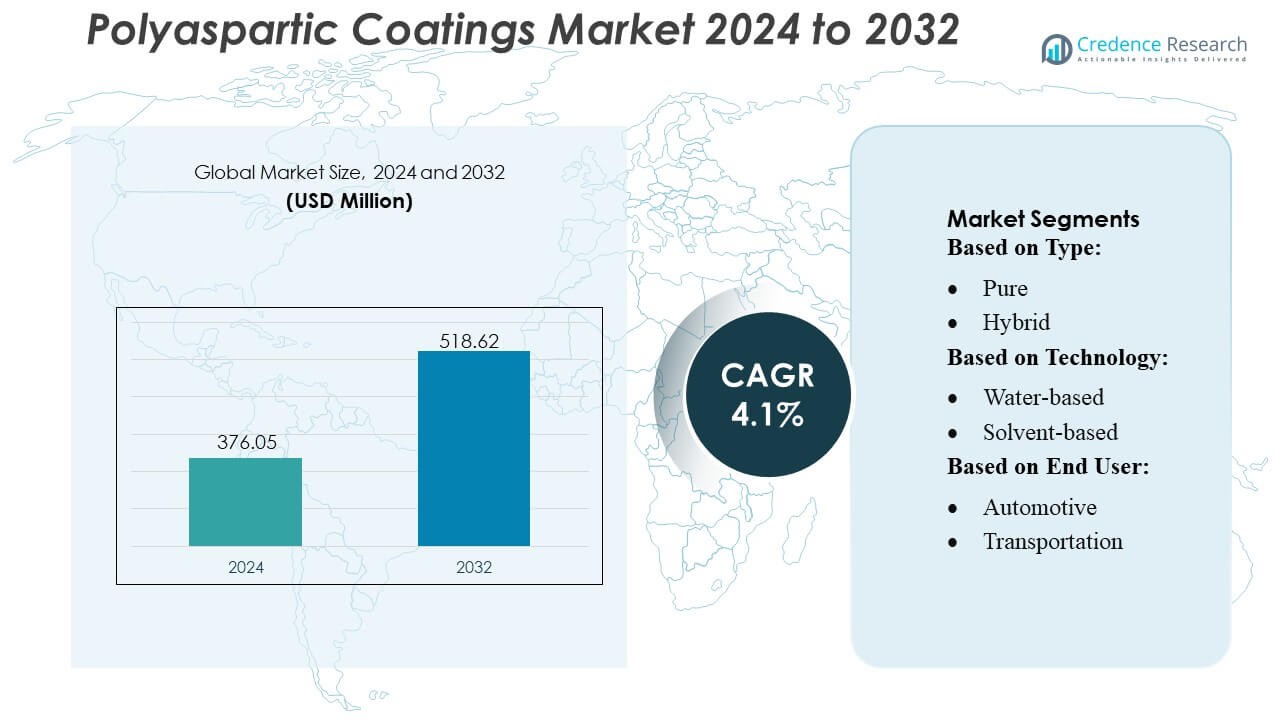

Polyaspartic Coatings Market size was valued USD 376.05 million in 2024 and is anticipated to reach USD 518.62 million by 2032, at a CAGR of 4.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyaspartic Coatings Market Size 2024 |

USD 376.05 Million |

| Polyaspartic Coatings Market, CAGR |

4.1% |

| Polyaspartic Coatings Market Size 2032 |

USD 518.62 Million |

The Polyaspartic Coatings Market is shaped by a mix of global coating manufacturers and specialized solution providers that compete through advanced resin technologies, durable formulations, and strong technical service capabilities. Companies focus on fast-curing, high-performance systems that support industrial flooring, infrastructure protection, and automotive applications, strengthening their presence through R&D investment, expanded distribution networks, and application-specific product portfolios. North America leads the global market with an exact 38% market share, supported by mature industrial infrastructure, high adoption of premium protective coatings, and strong demand from commercial construction and manufacturing facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Polyaspartic Coatings Market was valued at USD 376.05 million in 2024 and is projected to reach USD 518.62 million by 2032, registering a 4.1% CAGR during the forecast period.

- Demand rises due to the need for fast-curing, high-durability coatings that support industrial flooring, infrastructure protection, and automotive applications across diverse end-use sectors.

- Market trends highlight growing adoption of low-VOC and high-performance formulations, supported by continuous R&D and expansion of application-specific coating systems.

- Competitive intensity increases as global players strengthen distribution networks, enhance technical support, and develop advanced resin technologies, while cost sensitivity in emerging markets acts as a restraint.

- North America leads with 38% regional share, while pure polyaspartic coatings dominate the type segment with an estimated 56% share, supported by strong performance requirements in commercial and industrial environments.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Pure polyaspartic coatings lead the segment with an estimated 56% market share, supported by their fast curing profile, high film build, and superior UV stability that enables long-term protection across demanding environments. Their ability to deliver rapid return-to-service enhances contractor productivity and reduces downtime in commercial and industrial projects. Hybrid polyaspartic systems gain traction in cost-sensitive applications where balanced performance is sufficient, yet pure formulations maintain leadership because they meet high-performance specifications for corrosion resistance, abrasion strength, and durability in heavy-duty infrastructure and industrial assets.

- For instance, LATICRETE SPARTACOTE PURE Polyaspartic 85 (formerly HP Spartacote) exhibits a typical tack-free time of 1–3 hours, supports light foot traffic in 5–7 hours, and reaches full cure for heavy traffic in 24–48 hours, while delivering an exceptional abrasion resistance rating of 9 mg loss under ASTM D4060 testing (CS-17 wheel, 1000g load, 1000 cycles).

By Technology

Solvent-based polyaspartic coatings dominate the technology landscape with an approximate 48% share, driven by their strong adhesion, robust chemical resistance, and reliable performance in high-humidity or variable-temperature conditions. Their compatibility with thick-film applications and metal substrates strengthens their use in industrial floors, heavy machinery, and protective structures. Water-based systems grow due to environmental compliance, while powder-based coatings expand in OEM and high-volume manufacturing. Solvent-based solutions retain leadership because end users prioritize consistency, extended lifespan, and superior mechanical strength in mission-critical industrial and commercial environments.

- For instance, Citadel Floor Finishing Systems’ Poly-1 HD™ (Polyurea-One HD) delivers a tensile strength of 5,500 psi (ASTM D412), an elongation capacity of 75%, and an abrasion loss of 43 mg under ASTM D4060 testing (CS-17 wheel, 1000g, 1000 cycles), while maintaining a standard return-to-service window with a recoat time of 4–12 hours.

By End-User

Construction and infrastructure represent the dominant end-user segment with nearly 40% market share, supported by expanding demand for high-performance floor coatings, bridge protection systems, and exterior architectural finishes. Growing investment in commercial real estate, public infrastructure, and industrial facilities accelerates adoption because polyaspartic formulations deliver fast curing, weather resistance, and long-term surface durability. Automotive and transportation applications expand through OEM metal protection needs, while industrial and power-generation sectors adopt the technology for corrosion control. Construction retains its lead due to continuous global urbanization and stringent performance requirements in structural assets.

Key Growth Drivers

Rising Demand for High-Performance Protective Coatings

Demand for high-performance protective solutions drives strong adoption of polyaspartic coatings due to their fast curing, high abrasion resistance, and strong UV stability. Industries prioritize these formulations to extend asset lifespan, reduce maintenance cycles, and minimize downtime. Their ability to deliver thick-film applications in a single coat supports productivity gains across construction, industrial floors, and heavy equipment. Expanding investment in long-lasting infrastructure systems and performance-driven surface protection further strengthens the market outlook for polyaspartic technologies across commercial, industrial, and institutional environments.

- For instance, Line-X reports that its XS-350 pure polyurea system delivers a tensile strength of 3,432 psi (ASTM D412), elongation of 162% (ASTM D412), tear strength of 783 ppi (ASTM D624), and Shore D hardness of 60 (ASTM D2240), while achieving a full mechanical cure for rugged use within 24 hours.

Rapid Urbanization and Infrastructure Development

Global infrastructure development fuels sustained demand for polyaspartic coatings as contractors require durable, fast-curing solutions for high-traffic surfaces and exterior structures. Urban expansion increases the need for protective systems capable of withstanding weather fluctuations, chemical exposure, and structural stress. Polyaspartic coatings enable accelerated project timelines, meeting stringent construction deadlines while reducing labor costs. Their long-term performance benefits strengthen adoption in bridges, transportation hubs, industrial complexes, and commercial buildings. Growing government investment in smart infrastructure and resilient construction materials reinforces this driver across regions.

- For instance, Elite Crete Systems reports that its high-performance PE-Industrial Polyaspartic Floor Coating delivers a tensile strength of approximately 7,000–8,000 psi, an elongation rating of 100%, and a high mechanical durability demonstrated by strong performance under ASTM D4060 testing (CS-17 wheel, 1000g).

Shift Toward Low-Maintenance and Long-Lifespan Surface Solutions

Industries seek low-maintenance coating systems that reduce total cost of ownership, driving adoption of polyaspartic technologies capable of retaining gloss, resisting corrosion, and maintaining structural integrity for extended periods. Their superior mechanical strength supports use in demanding environments such as industrial floors, power-generation facilities, and transportation components. The need for coatings that withstand continuous operational stress and aggressive chemicals enhances preference for polyaspartic systems over conventional epoxies and polyurethanes. Rising emphasis on durability, lifecycle efficiency, and reduced reapplication frequency accelerates their market penetration.

Key Trends & Opportunities

Growth of Environmentally Compliant and Low-VOC Formulations

Environmental regulations accelerate development of low-VOC polyaspartic coatings, creating new opportunities for water-based and hybrid systems. Industries shift toward eco-friendly coatings to comply with sustainability standards without compromising performance. Advancements in resin chemistry improve workability, pot life, and film clarity, making low-emission formulations more versatile across construction, automotive, and industrial settings. Rising corporate sustainability commitments and tightening regulatory frameworks encourage broader commercialization of greener polyaspartic solutions across global markets.

- For instance, Akzo Nobel NV reports that its Intercure® 3240HG polyaspartic technology is a low VOC, high solids coating (around 152-250 g/L depending on specific formulation and test method), delivers a dry-to-handle time of 30 minutes at 25°C (77°F), and can be overcoated within 2 hours at that same temperature.

Expansion of Fast-Curing Technologies for High-Throughput Industries

Industries with time-critical operations create strong opportunities for fast-curing polyaspartic formulations that significantly reduce downtime. Growing adoption in manufacturing plants, logistics hubs, and automotive facilities strengthens demand for rapid-application coatings that enable same-day return-to-service. Material advancements enhance cure control, enabling uniform performance across varied temperatures and humidity levels. This trend supports operational efficiency, boosting adoption among users prioritizing productivity-driven coating solutions.

- For instance, ArmorPoxy documents that its Polyaspartic High-Performance Coating (80% Solids) achieves a dry-to-touch time of 2–4 hours, supports light foot traffic in 12–24 hours, and reaches full cure for vehicle use in 24–48 hours, depending on ambient conditions.

Rising Adoption in Automotive, Transportation, and Industrial OEM Segments

OEM sectors increasingly integrate polyaspartic coatings to improve corrosion resistance, UV durability, and long-term appearance retention on metal and composite components. The automotive industry utilizes these coatings for parts requiring mechanical stability, while transportation and heavy machinery manufacturers adopt them for enhanced surface resilience. Growth in EV manufacturing, rail modernization, and industrial machinery upgrades expands application potential. OEM-driven customization and large-volume production environments further create long-term opportunities.

Key Challenges

High Material and Application Costs Restrict Adoption

Higher material costs and specialized application requirements create barriers, especially in price-sensitive markets. Polyaspartic coatings involve advanced raw materials and require skilled applicators due to rapid curing, which increases overall project expenses. Small contractors and emerging economies often opt for lower-cost epoxy or polyurethane alternatives, limiting penetration. Cost-related constraints slow adoption across large-area public infrastructure and budget-sensitive industrial sectors. Manufacturers face ongoing pressure to balance high performance with cost efficiency to expand market accessibility.

Limited Pot Life and Application Sensitivity

Short pot life and sensitivity to environmental conditions challenge broader usage of polyaspartic coatings. Their rapid curing, while beneficial for fast project turnaround, demands precise application timing and suitable climatic conditions to prevent defects such as bubbling or improper adhesion. These constraints require experienced applicators and careful substrate preparation, increasing operational complexity. Inconsistent field conditions in outdoor construction projects further complicate deployment. These factors slow adoption among users unfamiliar with advanced coating chemistry or lacking technical expertise.

Regional Analysis

North America

North America leads the Polyaspartic Coatings Market with an estimated 38% market share, supported by strong construction activity, advanced industrial maintenance practices, and robust adoption across commercial flooring, automotive components, and heavy-duty equipment protection. Increased investments in warehouse infrastructure, public facilities, transportation networks, and industrial refurbishment accelerate the use of fast-curing, high-durability polyaspartic systems. The region benefits from early technological adoption, stringent performance standards, and a mature contractor ecosystem familiar with high-build protective coatings. Ongoing upgrades in manufacturing plants and distribution centers further strengthen market expansion across the United States and Canada.

Europe

Europe holds approximately 27% market share, driven by stringent environmental regulations, strong demand for long-lifespan coatings, and rising adoption in industrial flooring, automotive production, and infrastructure rehabilitation. Advancements in low-VOC and sustainable polyaspartic formulations align with EU emission directives, encouraging wider commercial and industrial use. Growth in public infrastructure modernization, including bridges, railway facilities, and logistics hubs, increases adoption of high-performance protective coatings. Automotive OEM expansion and refurbishing of aging industrial assets further support market development. The region’s push toward energy-efficient buildings and durable construction materials sustains long-term demand.

Asia-Pacific

Asia-Pacific accounts for an estimated 30% market share, making it the fastest-growing region due to rapid urbanization, strong infrastructure investment, and expanding manufacturing capacity. China, India, Japan, and Southeast Asian countries increasingly adopt polyaspartic coatings for industrial flooring, machinery protection, and large-scale construction projects requiring durable and fast-curing solutions. Growing automotive and transportation manufacturing enhances demand for high-strength, corrosion-resistant coatings. Rising foreign investment in industrial parks, logistics hubs, and commercial complexes further accelerates adoption. The region’s expanding contractor base, improving application expertise, and rising preference for performance-driven building materials strengthen long-term growth potential.

Latin America

Latin America contributes around 8% market share, supported by gradual growth in construction, industrial refurbishment, and automotive assembly activities. Countries such as Brazil, Mexico, and Colombia increasingly adopt polyaspartic systems for high-performance flooring, exterior structural protection, and corrosion control in manufacturing environments. The region benefits from rising investment in logistics facilities, retail infrastructure, and public utilities that require durable coating systems. However, adoption remains concentrated in premium commercial projects due to cost-sensitive market conditions. Growing awareness of lifecycle benefits and expansion of industrial plants provide steady opportunities for regional market development.

Middle East & Africa

The Middle East & Africa region holds roughly 7% market share, driven by large-scale infrastructure development, commercial construction, and industrial expansion across the Gulf countries and parts of Africa. High demand for UV-resistant and weather-durable coatings supports adoption in airports, metro systems, industrial zones, and real estate megaprojects. Oil and gas facilities, power generation assets, and heavy-duty equipment operators increasingly use polyaspartic coatings to enhance corrosion resistance and reduce maintenance cycles. Growth remains uneven across the region, yet strong investment in urban development and industrial diversification sustains long-term market potential.

Market Segmentations:

By Type:

By Technology:

- Water-based

- Solvent-based

By End User:

- Automotive

- Transportation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Polyaspartic Coatings Market players such as HP Spartacote, Citadel Floor Finishing Systems, Line-X, Elite Crete Systems, Flexmar Coatings, Akzo Nobel NV, ArmorPoxy, Abbott Laboratories, Key Resin Company, and Advacoat Concrete Solutions. the Polyaspartic Coatings Market reflects a mix of specialized coating manufacturers, advanced resin formulators, and solution providers that compete through high-performance technologies and rapid-application capabilities. Companies emphasize innovation in fast-curing systems, UV-resistant formulations, and durable protective coatings tailored for industrial floors, infrastructure assets, and automotive components. Strategic investments in R&D, low-VOC product lines, and enhanced adhesion technologies support stronger market differentiation. Expanding distribution networks, contractor certification programs, and OEM partnerships further reinforce competitive positioning. As end users prioritize lifecycle efficiency, corrosion resistance, and reduced downtime, market participants continue advancing product reliability and application versatility to secure long-term growth.

Key Player Analysis

- HP Spartacote

- Citadel Floor Finishing Systems

- Line-X

- Elite Crete Systems

- Flexmar Coatings

- Akzo Nobel NV

- ArmorPoxy

- Abbott Laboratories

- Key Resin Company

- Advacoat Concrete Solutions

Recent Developments

- In April 2025, Jotun and Thoresen Shipping Singapore Pte. Ltd. agreed to use Jotun’s Hull Skating Solutions (HSS) on the bulk carrier Thor Brave for proactive, robotic hull cleaning, aiming to reduce drag, fuel use, and emissions, highlighting a growing trend in maritime efficiency solutions.

- In November 2024, Covestro AG has increased production of its Desmophen CQ NH polyaspartic resins at its Foshan, China facility. These resins with at least 25% bio-based content lower carbon emissions and ensure durability with excellent chemical and weather resistance. This expansion is expected to boost polyaspartic coatings production.

- In February 2024, the Sherwin-Williams Company launched Repacor™ SW-1000, a 100% solids, VOC-free, glass flake polyaspartic repair coating system in a cartridge designed to simplify the maintenance and repair of steel structures, specifically for offshore wind and onshore industrial assets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as industries increase reliance on fast-curing, high-durability coatings for demanding environments.

- Adoption will rise across commercial and industrial flooring due to the need for long-lifespan, low-maintenance surface protection.

- Infrastructure development worldwide will drive greater use of polyaspartic systems in bridges, public facilities, and transportation structures.

- Manufacturers will expand low-VOC and eco-compliant formulations to meet tightening environmental regulations.

- Automotive and transportation sectors will integrate more polyaspartic coatings to enhance corrosion resistance and exterior durability.

- Industrial OEMs will adopt advanced systems to improve asset protection and reduce maintenance-related downtime.

- Product innovation will accelerate, with improved pot life, better application control, and enhanced UV stability.

- Market penetration will increase in emerging economies as contractor expertise and awareness improve.

- Direct-to-metal and high-build technologies will gain momentum in heavy-duty industrial applications.

- Competition will intensify as global players strengthen distribution networks and offer more customized application solutions.

Market Segmentation Analysis:

Market Segmentation Analysis: