Market Overview

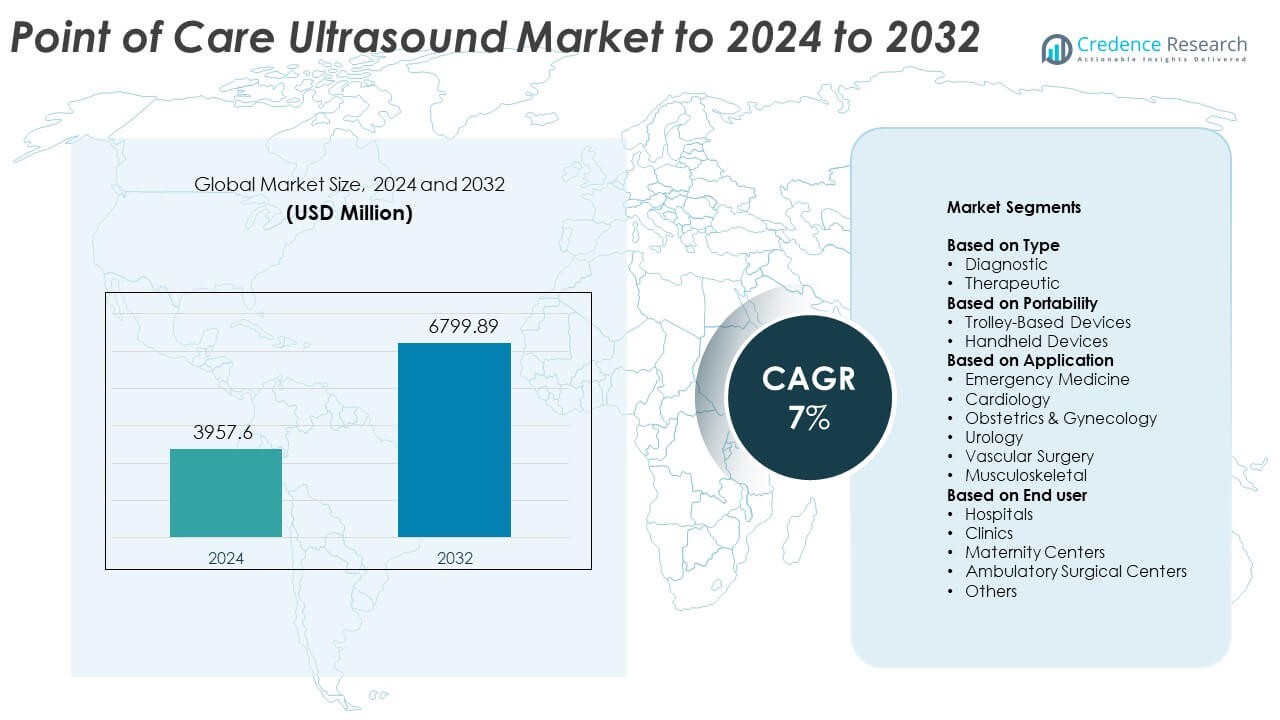

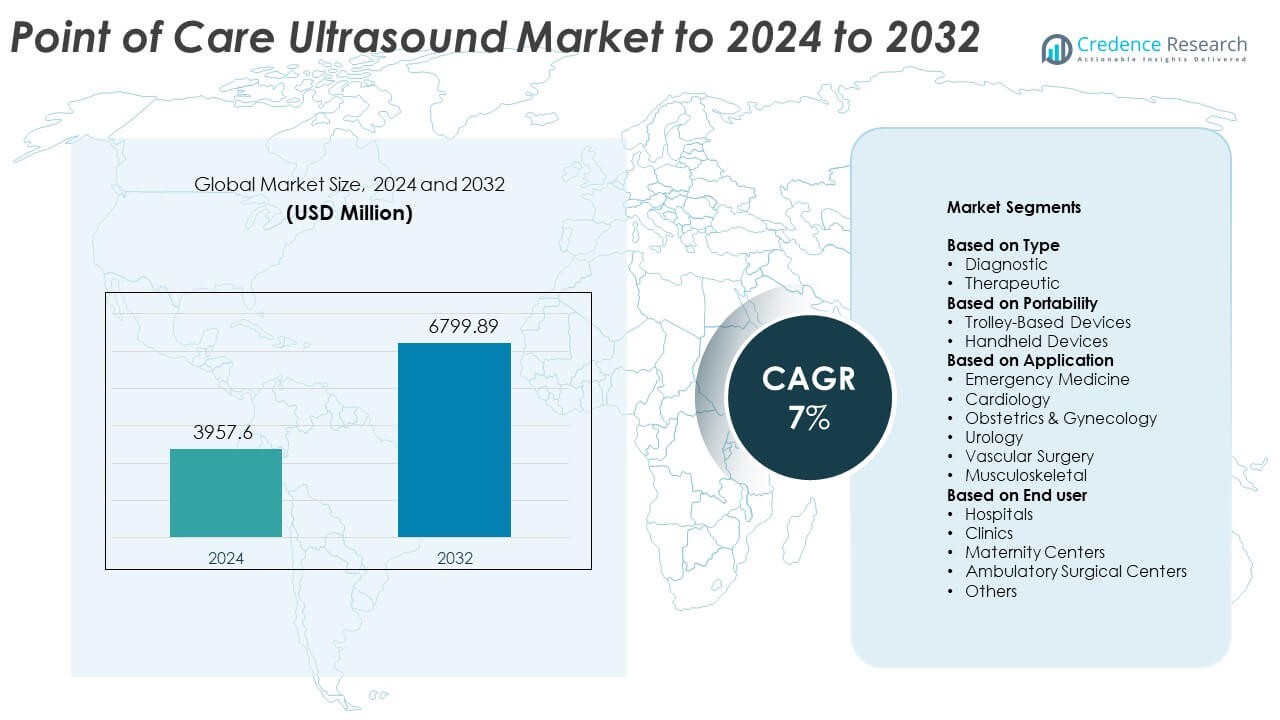

Point of Care Ultrasound Market size was valued USD 3957.6 million in 2024 and is anticipated to reach USD 6799.89 million by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Point of Care Ultrasound Market Size 2024 |

USD 3957.6 Million |

| Point of Care Ultrasound Market, CAGR |

7% |

| Point of Care Ultrasound Market Size 2032 |

USD 6799.89 Million |

The Point of Care Ultrasound Market is shaped by major players such as Koninklijke Philips N.V., GE Healthcare, FUJIFILM Sonosite, Inc., Shenzhen Mindray Bio-Medical Electronics Co. Ltd., and Butterfly Network Inc., which drive innovation through handheld, wireless, and AI-enhanced imaging systems. These companies focus on improving diagnostic speed, mobility, and workflow integration across emergency, primary, and specialty care. North America led the market in 2024 with about 38% share due to strong healthcare infrastructure and faster adoption of portable ultrasound devices. Europe followed with nearly 29% share, supported by expanded clinical applications and steady investment in diagnostic modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Point of Care Ultrasound Market was valued at USD 3957.6 million in 2024 and is projected to reach USD 6799.89 million by 2032, growing at a CAGR of 7%.

- Growth is driven by rising demand for rapid bedside diagnostics and wider adoption in emergency, cardiac, and maternal care.

- Key trends include the expansion of handheld and wireless systems, stronger AI integration, and increased use across outpatient and remote healthcare settings.

- The market remains competitive as global manufacturers advance portable designs, enhance image clarity, and expand clinical training programs; handheld devices held about 58% share in 2024.

- North America led the market with nearly 38% share in 2024, followed by Europe at around 29%, while Asia Pacific showed the fastest growth with about 24% share due to rising healthcare investments.

Market Segmentation Analysis:

By Type

Diagnostic ultrasound dominated this segment in 2024 with about 71% share. Strong adoption came from its use in rapid bedside imaging across emergency, cardiac, and maternal care units. Clinicians prefer diagnostic units because they deliver clear real-time views that support faster decisions in critical cases. Growth also relates to rising demand for non-invasive assessments in hospitals and clinics. Therapeutic ultrasound continued to expand in pain relief and physiotherapy, but its share remained smaller due to narrower clinical use and slower adoption across general practice settings.

- For instance, Butterfly iQ+ uses a 9000-element CMUT transducer. The system supports scan depths up to 30 cm with a 1–10 MHz frequency range.

By Portability

Handheld devices held the dominant position in 2024 with roughly 58% share. Demand grew as hospitals adopted compact scanners that support mobile use across wards, ambulances, and rural centers. These units offer strong ease of use, lower cost, and wireless connectivity, which help more clinicians perform bedside scans. Wider training programs also increased acceptance. Trolley-based devices still serve complex imaging needs with higher power and advanced probes, but their fixed setup and higher price limited growth compared to handheld technologies.

- For instance, Healcerion’s SONON 300C handheld scanner weighs 390 grams with battery installed and is specified for imaging depths up to 20 cm.

By Application

Emergency medicine led this segment in 2024 with nearly 34% share. The segment grew as point-of-care scans became essential for quick trauma checks, internal bleeding assessment, and rapid cardiac evaluations. Healthcare teams rely on immediate imaging to guide treatment within minutes, boosting device demand in emergency departments. Cardiology and obstetrics also expanded with wider use of portable units for routine and acute care. Other fields such as urology, vascular surgery, and musculoskeletal care continue to adopt POCUS to support faster diagnostic workflows.

Key Growth Drivers

Rising demand for rapid bedside diagnostics

Healthcare providers rely on quick imaging to guide treatment in emergency, critical care, and outpatient settings. Point-of-care ultrasound supports faster decisions during trauma checks, cardiac assessments, and maternal monitoring. Growing patient loads in emergency units and wider deployment of portable devices strengthen this trend. Many hospitals now prioritize real-time scanning to reduce delays and improve outcomes. These factors position bedside diagnostics as a major growth driver for the market.

- For instance, Mindray’s TE7 ACE ultrasound boots in less than 25 seconds from power-on, and the built-in battery supports about two hours of continuous scanning with up to 22 hours in standby.

Technological advances in handheld and wireless systems

New portable scanners provide better image quality, improved battery life, and seamless data transfer. Wireless probes support greater mobility for clinicians and expand use in ambulances, rural clinics, and home-based care. Integration with AI tools also boosts adoption by improving accuracy and reducing operator dependency. These advances make POCUS more accessible and efficient. As performance improves, adoption accelerates across specialties, making technology innovation a key growth driver.

- For instance, Clarius HD3 handheld scanners use 192 piezoelectric elements with eight beamformers and can reach frame rates up to 30 images per second.

Expanding clinical applications across specialties

POCUS adoption continues to grow in cardiology, obstetrics, musculoskeletal care, and vascular assessments. Clinicians use portable imaging for monitoring chronic disease, guiding procedures, and reducing reliance on large imaging systems. This broader clinical reach supports steady device demand. Training programs in hospitals and medical schools also raise comfort levels among new practitioners. The expanding scope of use is a key growth driver that strengthens market penetration.

Key Trends & Opportunities

AI-enabled image interpretation and workflow automation

AI tools enhance image clarity, automate measurements, and support clinicians with guided scanning. These features reduce operator variability and help new users perform accurate exams. Automated workflows shorten examination times and improve diagnostic reliability in busy care settings. As AI capabilities advance, more providers adopt POCUS for routine tasks, opening new opportunities in primary care, telemedicine, and home health environments. This shift represents a major trend shaping the future of POCUS.

- For instance, Caption Health’s Caption Guidance was tested in a multicenter study where eight nurses without previous ultrasound experience each scanned 30 patients, producing AI-guided echocardiography studies on 240 patients.

Growing adoption in home care and remote healthcare settings

Portable ultrasound devices support remote monitoring in telehealth programs and community care models. Care teams use handheld systems to evaluate cardiac function, maternal health, and chronic conditions without requiring hospital visits. This trend creates strong opportunities in developing regions where imaging access remains limited. Broader reimbursement support and lower-cost device launches enhance market expansion. Remote care adoption remains one of the most promising trends and opportunities.

- For instance, all of Philips’ current generation Lumify transducers, including the linear array (L12-4), the curved-array (C5-2), and the phased-array (S4-1), are specified to weigh less than 136 grams (around 4.8 ounces) each, supporting lightweight mobile or home-care use with compatible smart devices.

Integration with mobile platforms and cloud ecosystems

Modern POCUS systems connect seamlessly with smartphones and cloud dashboards, supporting easier data sharing and patient management. Cloud-based storage enables multi-site access and faster specialist reviews. This integration boosts collaboration and supports value-based care models. As healthcare providers prioritize digital ecosystems, POCUS gains more relevance in both large hospitals and small clinics. This digital shift strengthens long-term opportunities.

Key Challenges

Training gaps and operator-dependent accuracy

Image quality and diagnostic reliability depend heavily on user skill, which challenges adoption in busy or resource-limited settings. Many clinicians lack structured POCUS training, leading to inconsistent results. Hospitals face the need to expand education programs and maintain competency standards. Limited expertise slows integration into routine workflows. This remains a key challenge that affects market growth and clinical confidence.

High initial investment and cost barriers

Advanced handheld and cart-based systems often remain expensive for small clinics and developing regions. Budget constraints limit replacement cycles and delay technology upgrades. Additional costs for software, probes, and maintenance add further pressure. These financial hurdles restrict broader adoption despite clear clinical benefits. Cost-related limitations therefore continue to be a key challenge within the market.

Regional Analysis

North America

North America held the largest share in 2024 with about 38%. The region benefited from strong adoption of handheld ultrasound devices across emergency care, primary clinics, and advanced hospital networks. Demand grew as providers increased use of bedside imaging to improve diagnostic speed and reduce pressure on radiology departments. Supportive reimbursement structures and high investments in digital health strengthened market penetration. Continuous upgrades in wireless probes and AI imaging tools also enhanced clinical efficiency. Broad training programs in the United States and Canada supported wider use, helping the region maintain its leading position.

Europe

Europe accounted for nearly 29% share in 2024. Growth came from increased deployment of portable ultrasound units in public hospitals, maternity centers, and emergency medicine departments. Many countries expanded point-of-care imaging as part of diagnostic modernization programs, improving access to rapid assessments. Rising focus on early disease detection and wider use in cardiac and musculoskeletal care also supported uptake. Technological enhancements and integration with digital platforms attracted both large hospitals and smaller practices. Strong government support for training and standardized protocols further strengthened regional demand.

Asia Pacific

Asia Pacific held about 24% share in 2024 and recorded the fastest growth. Expansion came from rising healthcare investments, especially in China, India, and Southeast Asia, where portable devices improve access to imaging in remote areas. Growing maternal care needs and wider use in emergency units increased adoption across public and private hospitals. Local manufacturing capabilities lowered costs and made handheld devices more accessible. Digital health expansion also encouraged use of POCUS for community and telehealth programs. These factors positioned Asia Pacific as a rapidly developing regional market.

Latin America

Latin America captured roughly 6% share in 2024. Adoption increased as healthcare systems enhanced diagnostic capacity in emergency rooms and primary care centers. Portable ultrasound devices supported faster assessments in underserved regions, where large imaging systems remain limited. Brazil and Mexico led regional demand due to wider hospital modernization and greater acceptance of handheld units. Training initiatives improved clinician familiarity, supporting higher usage across specialties. Economic constraints slowed full-scale adoption, but expanding telemedicine programs continued to open new opportunities for market growth.

Middle East & Africa

Middle East and Africa held nearly 3% share in 2024. Growth emerged from expanding diagnostic infrastructure and increased reliance on portable imaging for maternal health, emergency care, and rural outreach. Countries in the Gulf region adopted advanced handheld systems to improve care quality in hospitals and clinics. African nations focused on portable and battery-powered units to address limited imaging access. International health programs supported training initiatives, improving operator capability. Despite budget limitations, rising demand for rapid point-of-care diagnostics continued to push steady adoption across the region.

Market Segmentations:

By Type

By Portability

- Trolley-Based Devices

- Handheld Devices

By Application

- Emergency Medicine

- Cardiology

- Obstetrics & Gynecology

- Urology

- Vascular Surgery

- Musculoskeletal

By End user

- Hospitals

- Clinics

- Maternity Centers

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Point of Care Ultrasound Market features leading players such as EDAN Instruments, FUJIFILM Sonosite, Inc., GE Healthcare, Butterfly Network Inc., Terason Corporation, Hitachi Ltd., Esaote S.p.A, Shenzhen Mindray Bio-Medical Electronics Co. Ltd., ALPINION MEDICAL SYSTEMS Co., Ltd, and Koninklijke Philips N.V. Companies focus on advancing handheld and wireless ultrasound technologies that support faster diagnostics and improved mobility across clinical settings. Many firms invest in AI-driven imaging tools that enhance accuracy and reduce operator variability. Product portfolios continue to expand with compact designs, longer battery life, and integration with mobile devices. Manufacturers also emphasize affordability to increase adoption in emerging markets. Strategic collaborations with hospitals and training programs strengthen product visibility and clinician familiarity. Continuous innovation, broader clinical applications, and digital ecosystem integration remain key factors shaping competitive positioning across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- EDAN Instruments

- FUJIFILM Sonosite, Inc.

- GE Healthcare

- Butterfly Network Inc.

- Terason Corporation

- Hitachi Ltd.

- Esaote S.p.A

- Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

- ALPINION MEDICAL SYSTEMS Co., Ltd

- Koninklijke Philips N.V.

Recent Developments

- In 2025, Fujifilm Sonosite introduced the Sonosite MT portable platform, optimised for emergency and point-of-care scanning.

- In 2024, GE HealthCare gained FDA clearance extending Caption AI to Vscan Air SL handheld scanner. This supports easier cardiac point-of-care ultrasound exams for clinicians.

- In 2023, Alpinion launched the X-CUBE i9 cart-based system, focused on mobile and emergency ultrasound workflows.

Report Coverage

The research report offers an in-depth analysis based on Type, Portability, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as handheld ultrasound devices gain wider clinical acceptance.

- AI-driven image guidance will enhance diagnostic accuracy and reduce operator dependency.

- Portable systems will see stronger demand in emergency, primary, and remote care settings.

- Integration with mobile platforms and cloud systems will streamline data sharing and workflows.

- Training programs will grow, improving clinician skill levels and boosting adoption rates.

- Broader applications in cardiology, obstetrics, and musculoskeletal care will drive steady use.

- Rising investments in telehealth will increase deployment of portable ultrasound tools.

- Battery-efficient and wireless designs will support wider use in low-resource regions.

- Hospitals will adopt more POCUS units to reduce pressure on central imaging departments.

- Cost reductions and local manufacturing will help expand adoption in emerging markets.