Market Overview

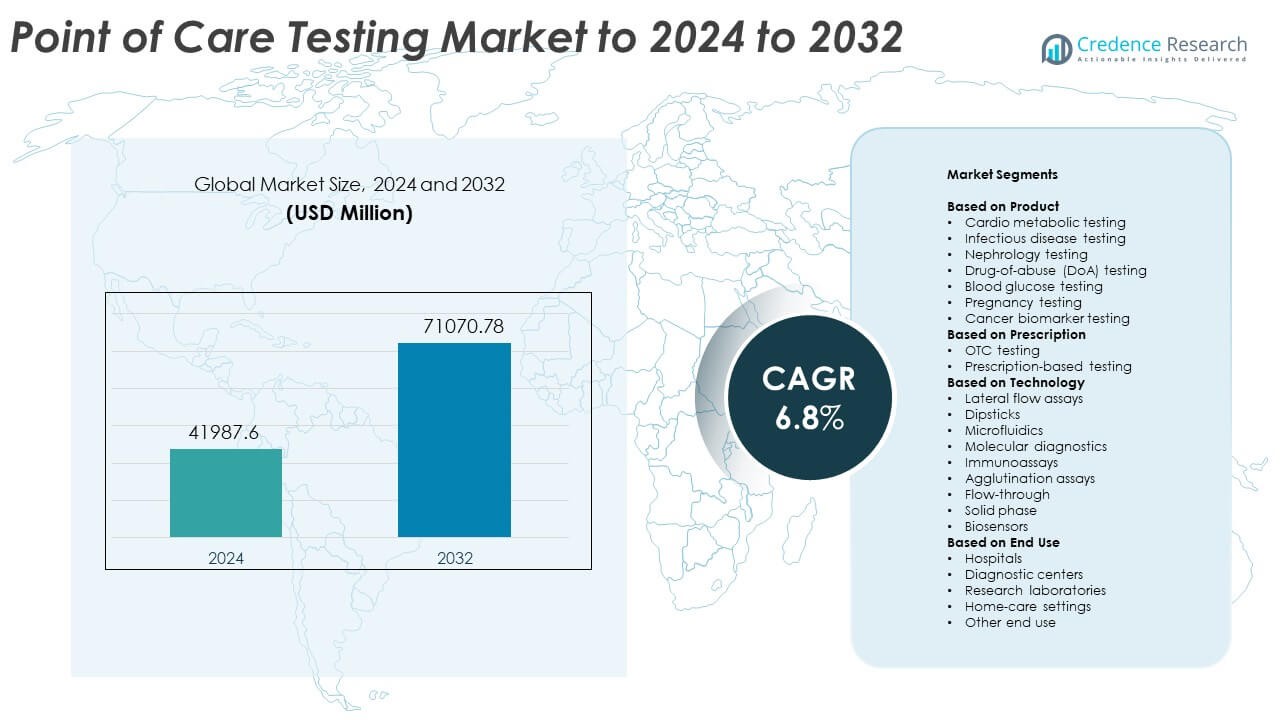

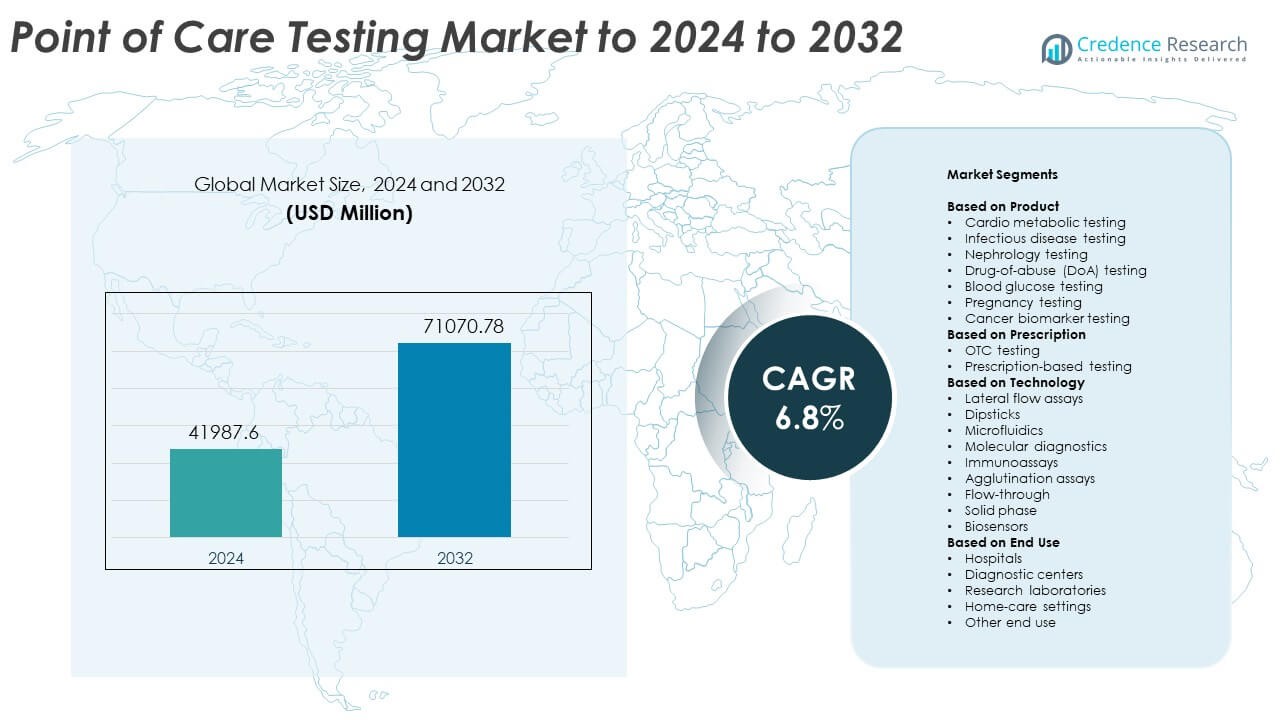

Point of Care Testing Market size was valued USD 41987.6 million in 2024 and is anticipated to reach USD 71070.78 million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Point of Care Testing Market Size 2024 |

USD 41987.6 Million |

| Point of Care Testing Market, CAGR |

6.8% |

| Point of Care Testing Market Size 2032 |

USD 71070.78 Million |

The Point of Care Testing Market is shaped by major players including Abbott Laboratories, F. Hoffmann-La Roche Ltd., Medtronic Plc, Sysmex Corporation, Nova Biomedical, LifeScan IP Holdings, LLC, Drägerwerk AG & Co. KGaA, and Meridian Bioscience, Inc. These companies strengthen their presence through advanced rapid testing systems, expanded home-use products, and improved molecular and immunoassay platforms. North America remained the leading region in 2024 with about 38% share, supported by strong adoption in hospitals, urgent care centers, and retail clinics. Europe followed with nearly 29% share, driven by expanding screening programs and rising demand for decentralized diagnostics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Point of Care Testing Market reached USD 41987.6 million in 2024 and is projected to hit USD 71070.78 million by 2032, growing at a CAGR of 6.8%.

- Strong market growth comes from rising demand for rapid diagnostic tools for chronic and infectious diseases, with cardio metabolic testing holding about 29% share in 2024.

- Key trends include digital connectivity, expansion of home-based testing, and advances in molecular platforms that improve accuracy and reduce turnaround time.

- Competition intensifies as major companies focus on portable systems, workflow automation, and improved assay sensitivity, while cost and reimbursement limitations restrain broader adoption.

- North America led the market with about 38% share in 2024, followed by Europe at nearly 29% and Asia-Pacific at around 24%, reflecting strong adoption of decentralized and home-based diagnostic solutions across major regions.

Market Segmentation Analysis:

By Product

Cardio metabolic testing held the dominant share in 2024 with about 29% of the Point of Care Testing Market. Demand increased due to rising cases of cardiovascular disorders and the need for rapid biomarker screening in emergency and primary care. Infectious disease testing also expanded as clinics adopted faster assays for respiratory and sexually transmitted infections. Nephrology and drug-of-abuse testing grew through wider use in outpatient settings. Blood glucose and pregnancy testing showed steady demand because of strong home-use adoption. Cancer biomarker testing advanced with improved early-detection tools.

- For instance, Abbott’s i-STAT cTnI test delivers cardiac troponin I results in 10 minutes at the point of care.

By Prescription

OTC testing led this segment in 2024 with nearly 57% share. Growth came from rising consumer adoption of self-testing kits for glucose, pregnancy, cholesterol, and infectious diseases. Wider retail availability and easier digital support boosted use across home settings. Prescription-based testing remained essential in hospitals and specialty centers for complex diagnostics that require clinician oversight. Its share improved as molecular and immunoassay-based point of care systems supported more accurate clinical decision-making. Demand for rapid triage in urgent care also strengthened its uptake.

- For instance, OraSure’s OraQuick HIV Self-Test gives an at-home HIV result in 20 minutes using an oral swab.

By Technology

Lateral flow assays dominated the technology segment in 2024 with around 41% share. This method gained traction due to low cost, simple workflows, and quick results for infectious disease, pregnancy, and drug-screening applications. Molecular diagnostics grew fast as advanced platforms enabled near-PCR accuracy at the bedside. Immunoassays expanded with higher sensitivity for cardiac and metabolic markers. Dipsticks, microfluidics, and biosensors also advanced through portable designs and improved analytical performance. Agglutination, flow-through, and solid-phase formats supported niche testing needs in decentralized labs.

Key Growth Drivers

Rising demand for rapid diagnostic solutions

Growing need for quick clinical decisions in emergency rooms, primary care centers, and home settings drives strong demand for point of care systems. Faster turnaround supports early treatment and reduces hospital burden. Rising cases of chronic and infectious diseases also increase testing volume. Wider use of decentralized care models and digital connectivity enhances adoption across both developed and emerging regions.

- For instance, Cepheid’s Xpert Xpress Strep A molecular test reports positive Group A Strep results in as little as 18 minutes, with full run time 24 minutes.

Expansion of home-based and OTC testing

Consumers now prefer self-testing for glucose, fertility, infectious diseases, and wellness parameters. Easy-to-use kits and wider pharmacy availability strengthen this shift. Digital apps help users track results and improve adherence. Growing awareness of preventive health encourages routine monitoring, while aging populations increase demand for convenient diagnostic tools. This trend supports sustained growth in OTC-focused point of care platforms.

- For instance, Cue Health’s at-home COVID-19 molecular test produces app-based results in about 20 minutes on its cartridge reader.

Advances in molecular and immunoassay technologies

Modern platforms now deliver near-laboratory accuracy at the bedside. Molecular assays enable rapid detection of complex infections, while improved immunoassays support sensitive cardiac and metabolic testing. Miniaturization, automation, and AI-driven analysis enhance precision. These upgrades help clinicians diagnose conditions faster, expand use cases, and drive replacement of older testing systems with advanced instruments.

Key Trends and Opportunities

Integration of digital health and connectivity

Smart meters and connected point of care devices allow seamless data transfer to clinicians and electronic records. Remote monitoring supports telehealth workflows and improves chronic disease management. Cloud platforms enhance analytics and patient engagement. This trend creates opportunities for AI-enabled decision support and real-time triage, strengthening long-term adoption of digitally integrated testing systems.

- For instance, Dexcom G6 continuous glucose monitoring sends real-time glucose readings to a connected smart device every 5 minutes.

Growth of decentralized and portable testing models

Healthcare shifts toward near-patient and community-based testing continue to rise. Portable platforms support use in pharmacies, mobile clinics, workplaces, and rural care programs. Rising investment in decentralized diagnostics creates opportunities for companies to expand product portfolios and reach underserved markets. These models reduce testing delays and improve screening coverage for high-risk groups.

- For instance, the LumiraDx CRP test on the portable LumiraDx platform uses a 20 microliter capillary blood sample and returns C-reactive protein results in 4 minutes.

Emerging biosensor and microfluidic innovations

Next-generation biosensors and microfluidic chips enable faster sample processing and compact device formats. These technologies reduce reagent use and improve sensitivity across metabolic, infectious, and oncology panels. Their scalability offers strong potential for low-cost mass production. This innovation wave opens opportunities for new product launches that target both clinical and consumer markets.

Key Challenges

Regulatory and quality compliance complexity

Point of care devices must meet strict accuracy, safety, and performance standards. Frequent updates to global regulatory frameworks complicate approval timelines. Maintaining consistent quality across diverse testing environments adds further challenges. These requirements increase development costs and delay commercialization, especially for companies launching advanced molecular solutions.

Cost pressures and reimbursement limitations

Limited reimbursement for several point of care tests restricts adoption in smaller clinics and low-resource settings. Equipment upgrades and consumable prices add financial strain for providers. Budget constraints in public health systems make it harder to scale advanced platforms. Cost–benefit concerns continue to hinder broader implementation, despite clinical advantages.

Regional Analysis

North America

North America held the largest share of the Point of Care Testing Market in 2024 with about 38%. Growth came from strong adoption of rapid diagnostic tools in hospitals, urgent care centers, and retail clinics. High prevalence of chronic diseases and widespread use of self-testing devices supported steady demand. Favorable reimbursement structures and ongoing technological upgrades also strengthened regional uptake. Expanding digital health ecosystems and strong industry presence further pushed innovation across molecular and immunoassay-based point of care platforms.

Europe

Europe accounted for nearly 29% of the market share in 2024. Demand rose due to rising screening programs for infectious and metabolic diseases. Hospitals and primary care facilities increasingly adopted rapid diagnostic tools to reduce testing delays and improve patient flow. Regulatory support for decentralized testing and strong uptake of home-based kits also contributed to market expansion. Growing aging populations and investment in advanced molecular point of care platforms helped sustain steady regional growth.

Asia-Pacific

Asia-Pacific held around 24% share in 2024, driven by large patient populations and rising awareness of early diagnosis. Expanding healthcare infrastructure and growing adoption of home-based monitoring boosted regional demand. Investments in molecular point of care systems accelerated in major countries such as China, Japan, and India. Increased burden of diabetes and infectious diseases supported broad testing needs. Wider availability of affordable devices and improving digital health access strengthened growth across urban and rural areas.

Latin America

Latin America captured roughly 6% of the market share in 2024. Growth was supported by rising use of rapid diagnostics for infectious diseases, especially in community clinics and mobile care units. Countries focused on expanding decentralized testing models to improve access in remote areas. Adoption of glucose, pregnancy, and basic metabolic tests increased through pharmacy-based channels. Investment constraints remained a challenge, yet rising partnerships with global manufacturers helped improve technology availability.

Middle East and Africa

Middle East and Africa accounted for about 3% of the market share in 2024. Demand grew as health systems increased screening for metabolic and infectious diseases. Adoption of point of care solutions expanded in private hospitals and urban clinics, while outreach programs supported testing in underserved areas. Limited laboratory infrastructure in several countries encouraged greater reliance on portable diagnostics. Despite budget limitations, growing interest in digital connectivity and rapid testing platforms continued to strengthen regional adoption.

Market Segmentations:

By Product

- Cardio metabolic testing

- Infectious disease testing

- Nephrology testing

- Drug-of-abuse (DoA) testing

- Blood glucose testing

- Pregnancy testing

- Cancer biomarker testing

By Prescription

- OTC testing

- Prescription-based testing

By Technology

- Lateral flow assays

- Dipsticks

- Microfluidics

- Molecular diagnostics

- Immunoassays

- Agglutination assays

- Flow-through

- Solid phase

- Biosensors

By End Use

- Hospitals

- Diagnostic centers

- Research laboratories

- Home-care settings

- Other end use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Point of Care Testing Market features key players such as Nova Biomedical, Medtronic Plc, Sysmex Corporation, LifeScan IP Holdings, LLC, Abbott Laboratories, F. Hoffmann-La Roche Ltd., Drägerwerk AG & Co. KGaA, and Meridian Bioscience, Inc. Competition focuses on expanding rapid diagnostic portfolios, improving accuracy, and enhancing connectivity across clinical and home-use platforms. Companies invest in advanced molecular and immunoassay systems to deliver faster results and support decentralized testing. Many firms strengthen their position through partnerships with hospitals, retail clinics, and digital health providers. Continuous innovation in biosensors, microfluidics, and integration with mobile applications shapes product development strategies. Firms also work to improve affordability and accessibility in emerging markets, where demand for portable and easy-to-use testing solutions continues to grow. Regulatory approvals, workflow automation, and increased emphasis on quality standards further define competitive strategies across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Nova Biomedical announced the U.S. launch of its FDA 510(k)-cleared next-generation StatStrip Glucose Hospital Meter System, a point-of-care glucose meter with enhanced cybersecurity, RFID data entry, and wireless charging for use in critical-care and hospital settings.

- In 2024, Abbott received FDA clearance for its i-STAT TBI cartridge to be used with whole blood on the handheld i-STAT Alinity system, enabling 15-minute concussion assessment at the bedside and in urgent-care point-of-care settings.

- In 2023, Sysmex introduced a rapid antimicrobial susceptibility testing system for urinary tract infections in Europe, based on technology from its Astrego acquisition, aimed at delivering fast, near-patient guidance on antibiotic selection in point-of-care settings.

Report Coverage

The research report offers an in-depth analysis based on Product, Prescription, Technology, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Point of care testing will expand across home, clinic, and retail settings.

- Digital connectivity will improve real-time data sharing and clinical decisions.

- Molecular point of care platforms will gain wider adoption for complex infections.

- AI-driven analytics will enhance accuracy and reduce diagnostic errors.

- Portable testing devices will support greater use in rural and remote areas.

- Demand for chronic disease monitoring tools will rise with aging populations.

- Biosensor and microfluidic innovations will create faster and smaller devices.

- Decentralized testing models will reduce pressure on traditional laboratories.

- Adoption will increase as healthcare systems prioritize rapid triage and screening.

- Growing investments in research will support next-generation point of care solutions.