Market Overview

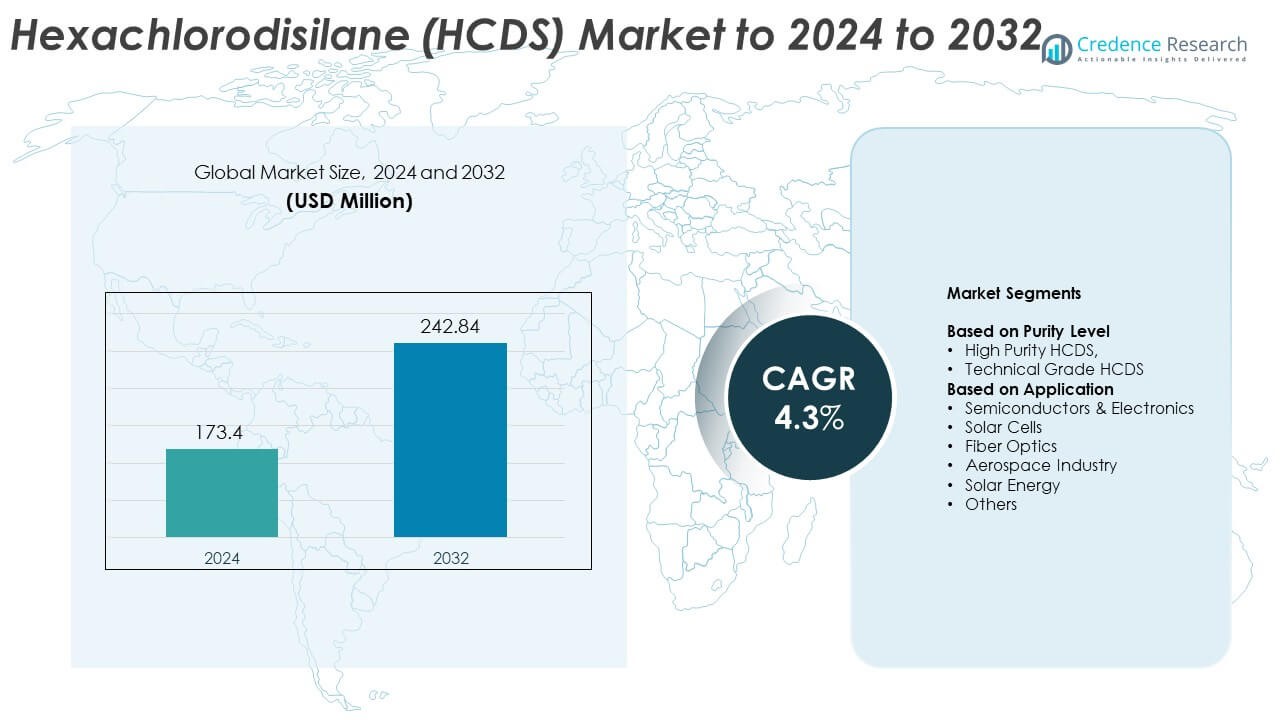

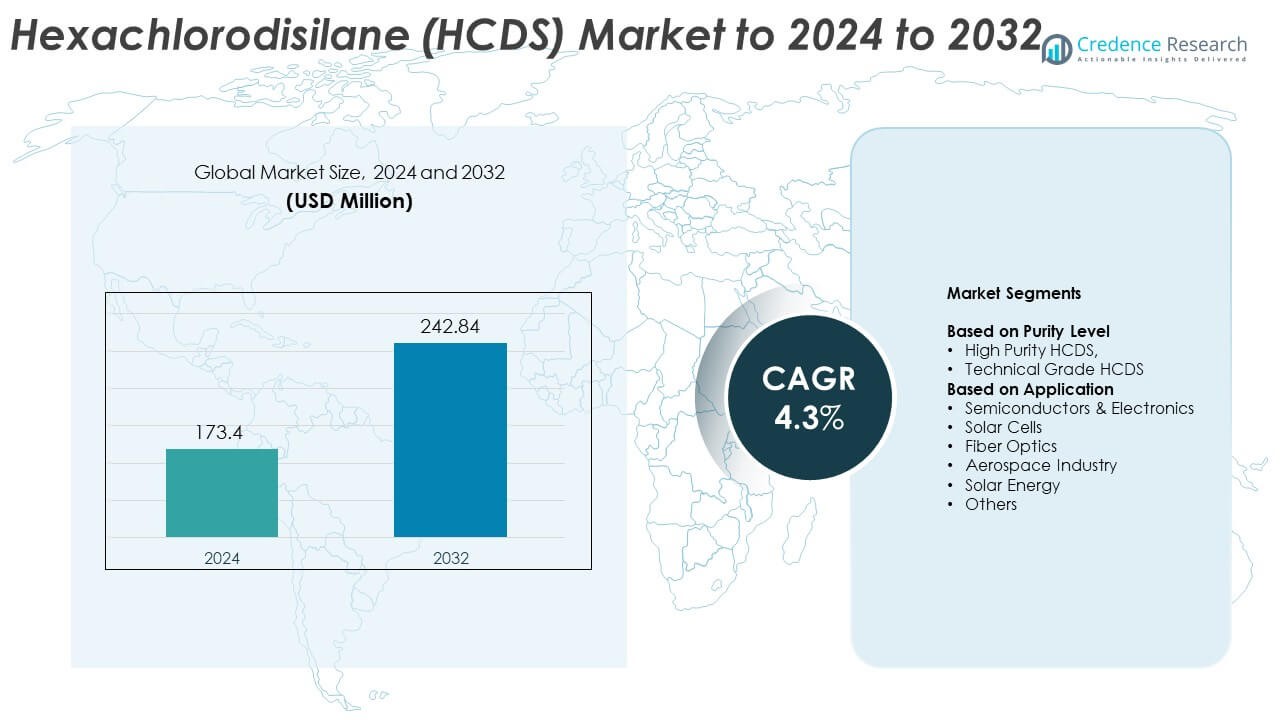

Hexachlorodisilane (HCDS) Market size was valued at USD 173.4 Million in 2024 and is anticipated to reach USD 242.84 Million by 2032, at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hexachlorodisilane (HCDS) Market Size 2024 |

USD 173.4 Million |

| Hexachlorodisilane (HCDS) Market, CAGR |

4.3% |

| Hexachlorodisilane (HCDS) Market Size 2032 |

USD 242.84 Million |

The Hexachlorodisilane market is shaped by major suppliers such as Hansol Chemical, Yoke Chem, Evonik, Toagosei, Altogen Chemicals, DNF, Asteran, Dow Corning, Nata, Air Liquide, Engtegris, DS Techopia, and Wonik Materials, each competing through high-purity production capabilities and strong semiconductor partnerships. Asia Pacific leads the market with about 38% share, driven by extensive wafer fabrication and large solar manufacturing capacity. North America follows with nearly 32% share due to strong investment in advanced logic and memory nodes, while Europe holds around 21% share supported by specialty electronics and renewable technology development. Latin America and Middle East & Africa represent smaller shares at about 5% and 4%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Hexachlorodisilane market was valued at USD 173.4 Million in 2024 and is projected to reach USD 242.84 Million by 2032, growing at a CAGR of 4.3%.

- Market growth is driven by rising semiconductor fabrication, increasing wafer starts, and strong adoption of high-purity precursors in advanced logic and memory production, giving high-purity HCDS about 68% segment share.

- Key trends include expansion of 3 nm and below technologies, rising demand from high-efficiency solar cell manufacturing, and growing use in fiber optics and advanced deposition processes.

- Competition intensifies as major producers enhance purification capabilities, strengthen supply chains, and expand regional footprints while restraints arise from strict environmental regulations and dependence on limited high-purity production sources.

- Asia Pacific leads regional demand with 38% share, followed by North America at 32% and Europe at 21%, while Latin America holds 5% and Middle East & Africa account for 4%.

Market Segmentation Analysis:

By Purity Level

High Purity HCDS leads this segment with about 68% share in 2024 due to its essential role in advanced semiconductor manufacturing, where tight contamination control is required for next-generation node production. Demand rises as chipmakers expand 5 nm and below processes, which rely on ultra-clean precursors for high yield. Technical Grade HCDS records steady use in less sensitive industrial applications, but growth remains slower because most new fabs prioritize high-purity materials to support improved device performance and tighter process windows.

- For instance, Applied Materials disclosed that it had over 52,000 semiconductor, display, and other manufacturing systems installed worldwide as of their 2023 Form 10-K filing (dated December 13, 2024), each system requiring high-purity precursor chemicals for advanced semiconductor production.

By Application

Semiconductors and Electronics dominate this segment with nearly 54% share in 2024 as HCDS remains a key precursor for epitaxial silicon layers and dielectric deposition. Strong demand comes from rising wafer starts, capacity expansion across Asia, and growing investment in advanced logic and memory technologies. Solar cells and fiber optics show consistent uptake, while aerospace and other industrial uses grow steadily but remain smaller contributors due to limited volume requirements.

- For instance, GlobalFoundries disclosed shipments of about 2.2 million 300-millimeter equivalent wafers in 2023, reflecting strong demand for semiconductor materials across electronics, power devices, and communications chips.

Key Growth Drivers

Rising Semiconductor Fabrication Expansion

Global fab expansions drive strong HCDS demand as manufacturers scale advanced logic and memory production. High-purity grades support low-defect deposition at 5 nm and below. Rising wafer starts in major regions and growing power electronics needs strengthen consumption. This makes semiconductor manufacturing the key growth driver for the Hexachlorodisilane market.

- For instance, UMC’s Fab 12A in Taiwan reached a monthly design capacity of about 130,000 wafers after its P5 and P6 expansion, directly increasing requirements for deposition precursors in foundry operations, by the year 2012.

Growing Use in Solar Cell Manufacturing

HCDS demand rises in high-efficiency solar technologies used in heterojunction and thin-film structures. The precursor enables high-quality silicon layers that improve conversion rates and long-term reliability. Rapid solar deployment and stronger clean-energy policies fuel adoption. This trend positions solar manufacturing as a major driver of Hexachlorodisilane demand.

- For instance, LONGi’s 2023 results show shipments of 125.42 gigawatts of monocrystalline wafers and 67.52 gigawatts of monocrystalline modules, highlighting rapid uptake of high-efficiency solar technologies that rely on high-quality silicon layers.

Rising Need for High-Purity Materials

Device miniaturization and tighter process control elevate the need for ultra-pure precursors. HCDS enables stable deposition, uniform layers, and reduced contamination during electronics production. As chip architectures grow more complex, manufacturers depend on consistent purity levels. This sustained shift toward ultra-clean materials remains a core market driver.

Key Trends & Opportunities

Shift Toward Advanced Node Technologies

Advanced processes at 3 nm and below increase reliance on high-purity HCDS for precise deposition. These technologies require superior uniformity and contamination control, creating strong opportunities for suppliers. Ongoing investment in global fabrication upgrades boosts potential across major semiconductor hubs.

- For instance, IBM’s 2-nanometer test chip technology demonstration fits about 50 billion transistors on a fingernail-sized die, showing how scaling drives tighter contamination control and more precise deposition chemistries.

Expansion of Renewable and Solar Applications

The global shift toward renewable energy expands HCDS use in high-efficiency solar cell designs. Manufacturers adopt advanced deposition techniques that depend on stable silicon precursors to enhance performance. Growing solar installation capacity and stricter clean-energy targets further support market opportunity.

- For instance, Trina Solar reported shipping about 65.21 gigawatts of solar modules in 2023 and achieving roughly 95 gigawatts of annual module production capacity by year-end, illustrating how large-scale renewable manufacturing expands demand for stable silicon precursor supply.

Rising Interest in Fiber Optics and Aerospace Uses

Upgrades in fiber optic networks and advanced aerospace components increase demand for specialty coatings. HCDS enables controlled silicon-based layers needed for high-performance communication and structural applications. Expanding use of advanced materials in both sectors creates new growth avenues.

Key Challenges

Regulatory and Environmental Compliance Pressure

Strict chemical handling and emission requirements raise compliance costs for manufacturers. Companies must upgrade purification, storage, and waste-management systems to meet global safety standards. These obligations slow capacity expansion and increase production complexity.

Supply Chain Vulnerability in High-Purity Materials

High-purity HCDS relies on specialized production systems and a limited supplier base. Any disruption in raw materials or logistics can delay supply for semiconductor and solar producers. This vulnerability creates long lead times and exposes the market to periodic shortages.

Regional Analysis

North America

North America holds about 32% share of the Hexachlorodisilane market in 2024, driven by strong semiconductor manufacturing activity in the United States. Growth comes from expansions in advanced logic and memory production, supported by rising investment in high-purity precursor supply chains. The region benefits from domestic fabrication incentives and increasing demand for specialty chemicals used in deposition and etching steps. Solar manufacturing and fiber optic applications add steady consumption, while ongoing infrastructure upgrades sustain material needs. The strong focus on supply security further supports long-term demand.

Europe

Europe accounts for nearly 21% share of the Hexachlorodisilane market, supported by advanced electronics manufacturing and growing interest in renewable technologies. Demand strengthens as countries invest in semiconductor autonomy, power electronics, and high-efficiency solar solutions. Stringent purity standards also elevate the use of high-grade precursors across research and specialty manufacturing hubs. Fiber optics expansion across digital infrastructure projects boosts additional uptake. Although production scale is smaller than Asia or North America, Europe’s focus on quality, sustainability, and innovation drives steady market growth.

Asia pacific

Asia Pacific leads the Hexachlorodisilane market with about 38% share in 2024, supported by large-scale semiconductor fabrication across China, Taiwan, South Korea, and Japan. Expanding wafer capacity, strong investments in advanced node technologies, and rapid solar cell manufacturing growth drive significant demand. High adoption of HCDS in thin-film deposition and epitaxy strengthens regional dominance. The region also benefits from strong fiber optic network expansion and rising electronics production. Its concentration of major fabs ensures long-term leadership in consumption and material sourcing.

Latin America

Latin America holds around 5% share of the Hexachlorodisilane market, driven mainly by growing electronics assembly activities and increasing adoption of solar energy technologies. The region shows moderate but steady consumption as countries expand renewable capacity and upgrade communication infrastructure. Demand from fiber optics and industrial applications supports niche use of HCDS. Although regional semiconductor production remains limited, rising investment in clean-energy projects and modern manufacturing improves opportunities for specialty materials. Market growth remains gradual due to limited high-purity chemical production capabilities.

Middle East & Africa

Middle East & Africa represent close to 4% share of the Hexachlorodisilane market, supported by expanding solar energy deployment and rising interest in advanced materials. Growth comes from increasing investment in renewable power projects across Gulf nations and South Africa. Adoption in fiber optics strengthens as digital infrastructure expands. While semiconductor manufacturing capacity remains low, ongoing industrial modernization creates small but steady demand for high-purity chemical precursors. The region’s gradual shift toward energy diversification supports future market growth.

Market Segmentations:

By Purity Level

- High Purity HCDS,

- Technical Grade HCDS

By Application

- Semiconductors & Electronics

- Solar Cells

- Fiber Optics

- Aerospace Industry

- Solar Energy

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Hexachlorodisilane market includes leading suppliers such as Hansol Chemical, Yoke Chem, Evonik, Toagosei, Altogen Chemicals, DNF, Asteran, Dow Corning, Nata, Air Liquide, Engtegris, DS Techopia, and Wonik Materials. The market features strong competition driven by high-purity material requirements, advanced purification capabilities, and close partnerships with semiconductor and solar manufacturers. Companies compete by expanding production capacity, improving quality consistency, and enhancing distribution networks to support global fabrication hubs. Increasing demand from advanced logic, memory, and solar cell manufacturing pushes suppliers to invest in scalable, contamination-controlled processes. Firms also focus on developing stable supply chains and regional manufacturing footprints to reduce dependence on single-source production. Rising technological demands at sub-5 nm nodes further intensify competition, encouraging suppliers to innovate in precursor stability, packaging, and material delivery systems. The market remains dynamic as emerging applications in fiber optics and aerospace create additional avenues for differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hansol Chemical

- Yoke Chem

- Evonik

- Toagosei

- Altogen Chemicals

- DNF

- Asteran

- Dow Corning

- Nata

- Air Liquide

- Engtegris

- DS Techopia

- Wonik Materials

Recent Developments

- In 2023, Soulbrain announced plans to acquire DNF, citing its strength in high-value ALD and CVD precursors used at advanced nodes, which include high-purity chlorosilane chemistries such as HCDS.

- In 2023, Evonik focused on leveraging its R&D capabilities and global distribution networks to serve demanding semiconductor and photovoltaic industries, which are primary consumers of HCDS.

- In 2022, DS Techopia was reported in Korean trade coverage to be expanding its hexachlorodisilane (HCDS) production capacity to meet the growing demand from advanced semiconductor fabs.

Report Coverage

The research report offers an in-depth analysis based on Purity Level, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Hexachlorodisilane market will grow as advanced semiconductor nodes expand worldwide.

- Demand will rise with increasing wafer starts across major fabrication hubs.

- High-purity HCDS consumption will accelerate due to stricter contamination control needs.

- Solar cell manufacturers will adopt more HCDS for high-efficiency deposition processes.

- Fiber optic network upgrades will support steady material demand.

- Regional supply chains will expand to reduce dependence on limited global producers.

- New purification technologies will improve consistency and production scalability.

- Increased investments in power electronics will enhance long-term HCDS usage.

- Aerospace applications will create niche opportunities for specialty coatings.

- Market growth will strengthen as governments support semiconductor and renewable energy sectors.