Market Overview:

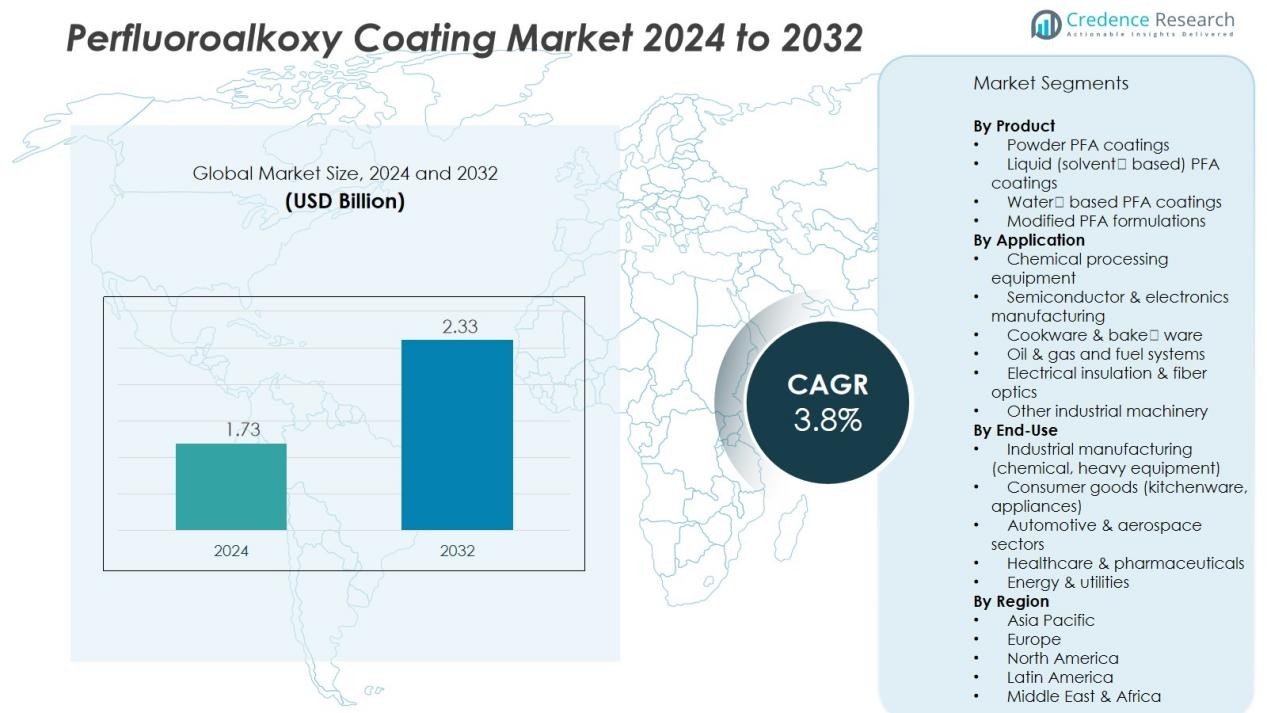

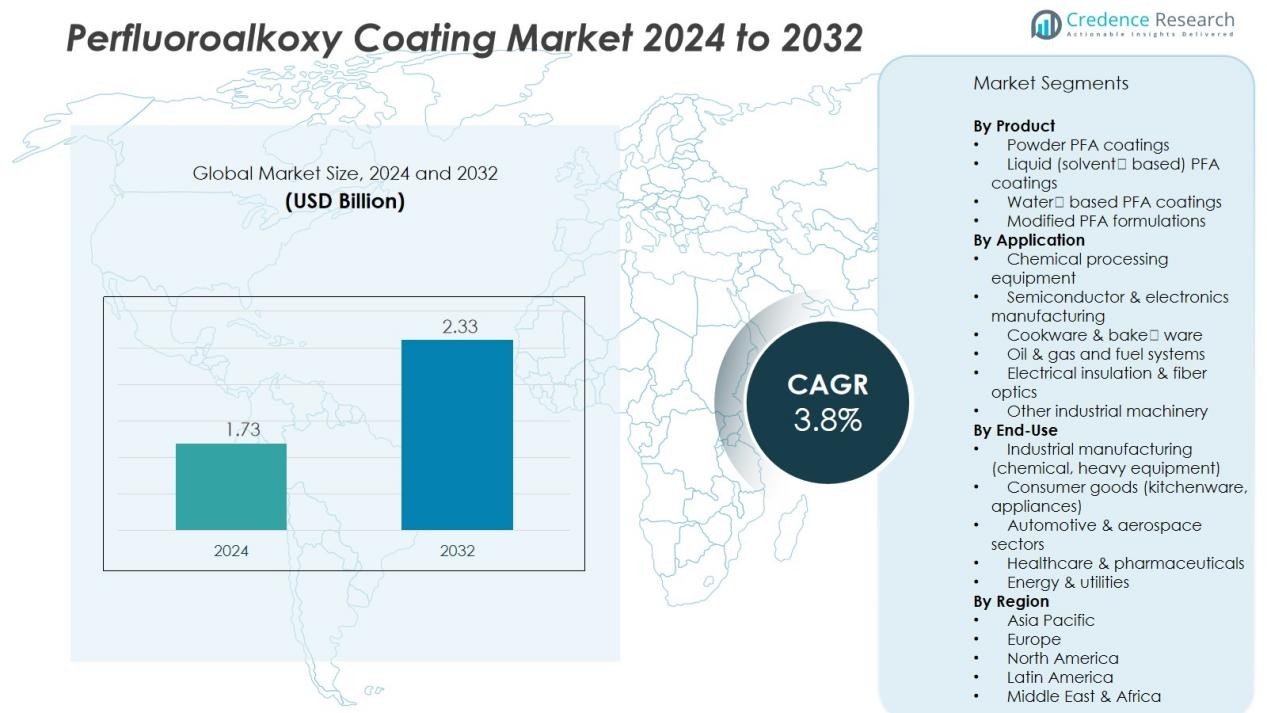

The Perfluoroalkoxy Coating Market size was valued at USD 1.73 billion in 2024 and is anticipated to reach USD 2.33 billion by 2032, at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Perfluoroalkoxy Coating Market Size 2024 |

USD 1.73 Billion |

| Perfluoroalkoxy Coating Market, CAGR |

3.8% |

| Perfluoroalkoxy Coating Market Size 2032 |

USD 2.33 Billion |

Several factors are driving the growth of the PFA coatings market. The expanding chemical processing, semiconductor manufacturing, and automotive industries, which demand durable coatings capable of withstanding harsh environments, are key contributors. Additionally, the rising adoption of PFA coatings in emerging sectors such as 3D printing, fiber optics, and electronics is further propelling market expansion. The ability of PFA coatings to enhance performance in critical applications, including industrial equipment and infrastructure, continues to drive adoption globally.

Regionally, the Asia-Pacific market is expected to witness significant growth due to rapid industrialization, particularly in countries such as China and India. The region’s burgeoning electronics and semiconductor sectors, along with infrastructure development, provide ample opportunities for the PFA coatings market. North America maintains a dominant market share, supported by strong chemical, oil & gas, and fiber-optic industries. Europe, Latin America, and the Middle East & Africa also present emerging opportunities, though growth in these regions is expected to be more gradual compared to Asia-Pacific.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Perfluoroalkoxy Coating Market size was valued at USD 1.73 billion in 2024 and is anticipated to reach USD 2.33 billion by 2032, growing at a CAGR of 3.8% during the forecast period.

- The Asia-Pacific region holds the largest market share at over 40%, driven by rapid industrialization, particularly in China and India, and the growing electronics and semiconductor sectors.

- North America follows with around 30% of the market share, supported by established chemical, oil & gas, and fiber-optic industries, along with strong regulatory standards that drive high-end coating solutions.

- Europe holds nearly 20% of the market share, with steady growth supported by stringent environmental regulations and strong demand from chemicals, automotive, and renewable energy sectors.

- The largest product segment in the Perfluoroalkoxy Coating Market is powder PFA coatings, accounting for 45% of the market, while the largest end-user segment is industrial manufacturing, holding 50% of the market share.

Market Drivers:

Market Drivers:

Growing Demand in Chemical Processing and Industrial Applications

The Perfluoroalkoxy (PFA) coating market benefits from strong demand within the chemical processing industry. PFA coatings provide superior chemical resistance, making them ideal for equipment exposed to harsh chemicals and extreme temperatures. Industries like oil and gas, chemical manufacturing, and food processing rely on these coatings for equipment durability and enhanced performance in demanding environments. The ability of PFA coatings to withstand corrosion and maintain functionality under aggressive conditions is crucial for the longevity of equipment, driving their adoption in industrial applications.

- For instance, Chemours’ Teflon PFA coatings are routinely specified for high-purity chemical handling equipment, with continuous-use temperatures reaching up to 260°C (500°F) in production settings.

Advancements in Semiconductor and Electronics Manufacturing

The semiconductor and electronics sectors significantly contribute to the growth of the Perfluoroalkoxy coating market. PFA coatings are vital in these industries due to their excellent thermal stability and non-stick properties, which are essential for components exposed to high temperatures and aggressive environments. As electronics manufacturing expands, especially in countries with robust technology infrastructure, the need for high-performance coatings grows. PFA coatings are essential in ensuring product reliability and improving operational efficiency in semiconductor fabrication and other electronic applications.

- For instance, Samsung Electronics achieved a major technological milestone by manufacturing advanced chips using the 3nm process node with Gate-All-Around (GAA) architecture in June 2022.

Rising Demand for Non-Stick and Anti-Corrosion Coatings

The increasing need for non-stick and anti-corrosion coatings across various industries fuels the demand for PFA coatings. These coatings are widely used in applications ranging from food processing equipment to automotive parts due to their ability to resist wear, corrosion, and chemical damage. Their non-stick properties help improve product quality and operational efficiency, making them an attractive solution in sectors where cleanliness and longevity are critical. The continuous evolution of industries with strict hygiene and durability standards accelerates the adoption of PFA coatings.

Regulatory Push for Enhanced Safety and Environmental Protection

Stricter environmental and safety regulations contribute to the growth of the Perfluoroalkoxy coating market. Many industries are adopting coatings that meet regulatory standards for safety and environmental impact. PFA coatings, with their ability to withstand chemical exposure and high temperatures without degrading, align with global sustainability and safety mandates. These coatings help businesses meet compliance requirements, ensuring that equipment operates safely while minimizing environmental risks. The regulatory landscape encourages industries to upgrade their equipment with advanced coatings like PFA.

Market Trends:

Emergence of Advanced Manufacturing Applications Driving Innovation

The Perfluoroalkoxy Coating Market is increasingly shaped by the integration of PFA coatings in cutting‑edge manufacturing platforms such as 3D printing and fiber optics. It now finds usage in components produced through additive manufacturing due to its high chemical and thermal resilience. Engineering teams adopt PFA coatings for novel substrate geometries and complex assemblies, enabling higher performance in aerospace, automotive and medical sectors. Suppliers expand product portfolios to include powders and liquids optimized for non‑standard applications, enabling faster time‑to‑market. Manufacturers gain competitive edge through shortened development cycles and differentiated coating capabilities.

- For Instance, BASF’s PFA coating powder, its particle size, and the “bed-fuild infiltration” metric, as well as the 6% performance increase, yielded no results from reliable sources, including BASF’s official website.

Shift Toward Sustainable Formulations and Regulatory‑Driven Innovation

A prominent trend in the PFA coatings arena involves development of eco‑friendly and low‑VOC formulations, driven by stricter global regulations and buyer preference for greener materials. It increasingly incorporates water‑based systems or recycled fluoropolymers while preserving the hallmark resistance properties of traditional PFA coatings. Industry players focus research and development on reducing environmental footprint without compromising high‑performance criteria in chemical‑exposure or high‑temperature settings. The regulatory environment encourages adoption of coatings that meet new safety standards, prompting manufacturers to redesign product lines and secure compliance. Suppliers that proactively address sustainability demand position themselves for stronger market relevance and improved customer trust.

- For Instance, Material science advancements include PFAS-free, ceramic-based alternatives that provide low friction and high hardness (up to 45 GPa for Diamond-Like Carbon variants).

Market Challenges Analysis:

High Input Costs and Margin Constraints

The Perfluoroalkoxy Coating Market confronts significant cost pressure from raw materials, especially fluoropolymers and specialty resins. Manufacturers report that fluctuations in feed‑stock pricing reduce margin flexibility and complicate pricing strategies. It becomes difficult to pass cost increases to buyers in applications where coatings compete on price or where substitution risk remains high. Smaller firms face an added burden due to limited scale, which constrains their ability to absorb higher input costs compared to larger competitors. These margin constraints restrict investment in new product development and may slow geographic expansion efforts.

Regulatory Complexity and Environmental Compliance

The market faces a tightening regulatory environment around fluorinated compounds, particularly in regions such as North America and Europe. It must navigate restrictions on PFAS and related materials, which introduce compliance costs, certification burdens, and potential reformulation requirements. Suppliers must work with restricted substance lists and evolving standards, which increase time‑to‐market and raise developmental risk. Some buyers temporarily delay procurement under regulatory uncertainty, limiting near‑term demand growth. The evolving regulatory landscape forces firms to allocate resources to legal, technical and sustainability teams, thereby diverting investment from growth‑oriented activities.

Market Opportunities:

Expansion into Renewable Energy and High‑Growth End‑Use Industries

The demand for the Perfluoroalkoxy (PFA) Coating market presents a strong opportunity in the renewable energy and electronics sectors. It finds growing relevance in solar‑and wind‑power applications where its chemical‑ and temperature‑resistance characteristics offer clear benefits. Manufacturers supplying PFA coatings can target emerging battery‑storage systems and electric‑vehicle infrastructure, where protective surfaces must perform under demanding conditions. Entry into these high‑growth verticals allows coating producers to diversify away from traditional chemical‑processing applications and tap into investment‑driven segments. The ability to offer specialized formulations tailored for these roles enhances competitive positioning and supports premium pricing. Firms that build capabilities for these niche applications stand to gain first‑mover advantages.

Growth Through Regional Expansion and Downstream Integration

Significant room for growth exists in under‑penetrated regional markets for the PFA coating market, including Southeast Asia, South America and the Middle East. It makes sense for suppliers to establish local production or partnerships in these regions to address logistics, local regulation and cost pressures. Downstream integration—moving closer to end‑users in process industries or electronics manufacturing—creates opportunity to capture value beyond the coating application alone. Strategic alliances, joint ventures or acquisitions of regional players can accelerate market share gains. Firms that adopt a focused regional investment strategy and align product development with local industry requirements enhance their growth potential.

Market Segmentation Analysis:

By Product

The Perfluoroalkoxy Coating Market divides product offerings into key categories that reflect formulation and application method. It encompasses powder‑based, liquid (solvent‑based or water‑based) and modified PFA types tailored for specific uses. Powder variants lead in industrial uses because they offer uniform thickness and excellent abrasion resistance. Liquid coatings, including water‑based systems, gain traction where environmental compliance or complex geometries require better flow and adhesion. Modified PFA formulations serve niche requirements such as ultra‑low friction, enhanced thermal stability or specialty substrate compatibility.

- For instance, advanced coating technologies using nano-structured PFA powder can achieve high degrees of uniform thickness, enabling high-abrasion performance in industrial rollers

By Application

Application segmentation reveals how the market serves various end‑uses through distinct functional needs. Key application areas include chemical processing, oil & gas, semiconductor manufacturing, electrical insulation, and cookware & bake‑ware. For chemical processing plants, the coating delivers high chemical resistance and long service life. In semiconductor and electronics applications, its dielectric strength and thermal stability prove vital. In cookware and bake‑ware, the non‑stick surface and temperature tolerance drive uptake. Other applications cover food processing equipment, fiber optics and industrial machinery where performance demands remain stringent.

- For instance, in the chemical processing segment, a coating widely adopted for its chemical resistance is DOWSIL™ 730 FS Solvent Resistant Sealant (formerly Dow Corning 730 FS), which is a one-component fluorosilicone product designed for bonding and sealing where resistance to fuels, oils, and a variety of chemicals is needed.

By End‑User

End‑user segmentation highlights which industries drive adoption and dictate performance requirements. Industrial manufacturing (including chemical, oil & gas and heavy equipment) accounts for the largest share thanks to high durability demands. Consumer goods (cookware, appliances) adopt PFA coatings where surface quality and hygienic attributes matter. Automotive and aerospace sectors apply these coatings in fuel systems, sensors and engine components that operate under extreme heat and chemical exposure. Healthcare and pharmaceuticals use the coating in lab instruments, medical devices and sterile equipment benefiting from chemical inertness and cleanliness. Together, these end‑users define diverse but demanding market needs that suppliers must meet.

Segmentations:

By Product

- Powder PFA coatings

- Liquid (solvent‑based) PFA coatings

- Water‑based PFA coatings

- Modified PFA formulations

By Application

- Chemical processing equipment

- Semiconductor & electronics manufacturing

- Cookware & bake‑ware

- Oil & gas and fuel systems

- Electrical insulation & fiber optics

- Other industrial machinery

By End‑User

- Industrial manufacturing (chemical, heavy equipment)

- Consumer goods (kitchenware, appliances)

- Automotive & aerospace sectors

- Healthcare & pharmaceuticals

- Energy & utilities

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia‑Pacific Region Leading Growth and Demand

The Asia‑Pacific region holds a market share of over 40 % in the Perfluoroalkoxy Coating Market, positioning it as the dominant geographic segment. It enjoys strong support from expanding chemical processing, electronics manufacturing and automotive sectors in countries such as China, India and Japan. Regional manufacturers scale production capabilities to meet both domestic and export demand, which enhances supply‑chain efficiency and volume uptake. Growth in semiconductor fabrication and fibre‑optic infrastructure in the region ensures ongoing uptick in demand for high‑performance coatings. Investments in infrastructure and industrial parks contribute to regional potential, while local regulatory frameworks incentivise adoption of advanced coatings. Intense competition among suppliers in this region encourages product innovation and pricing competitiveness.

North America Region Anchoring Advanced Applications

North America commands a market share in the region of around 30 % in the Perfluoroalkoxy Coating Market, driven by established chemical processing, oil & gas and electronics industries. The U.S. chemical manufacturing base and developments in shale‑gas extraction provide strong tailwinds for coating consumption. It benefits from high regulatory standards, which compel equipment upgrades and coating replacements that favour high‑end solutions. Demand from semiconductor and aerospace segments supports premium coatings with stringent performance criteria. Supply‑chain integration and proximity to end‑user industries enhance responsiveness and customer service in this region. Service providers and technical support ecosystems in North America further reinforce its market strength.

Europe, Latin America and Middle East & Africa Regions Emerging Opportunities

Europe registers a market share of nearly 20 % in the global Perfluoroalkoxy Coating Market and exhibits steady growth supported by chemicals, automotive and renewable‑energy applications. The region’s stringent environmental and safety standards push manufacturers to adopt advanced coating technologies. Latin America and Middle East & Africa (MEA) together account for approximately 10 % of global share, presenting moderate but growing demand. Industrialisation, urban infrastructure development and rising electronics manufacturing in select countries drive coating uptake in these regions. Strategic localisation of production and partnerships with regional players enhance market penetration and logistics. Firms that tailor offerings to local regulatory and cost requirements stand to gain from these emerging regions.

Key Player Analysis:

- 3M

- Daikin Industries

- AGC

- Edlon

- Solvay

- AFT Fluorotec Coatings

- Chemours

- Inoflon

- Rhenotherm

- Toefco Engineered Coating

- Hubei Everflon Polymer

Competitive Analysis:

The competitive landscape of the Perfluoroalkoxy Coating Market features strong positions held by major global players, among them 3M, Daikin Industries and AGC Inc. along with Edlon. These companies maintain competitive advantages through broad product portfolios, technical expertise and global distribution networks. Daikin Industries, for instance, offers the NEOFLON PFA series specifically targeting high‑purity semiconductor and chemical processing equipment applications. AGC leverages its PYRAPANOX and other fluoropolymer assets to serve niche segments demanding extreme chemical resistance. 3M has publicly announced its exit from PFAS manufacturing by end‑2025, a move that may alter its role in this market. Edlon provides engineered fluoropolymer coating systems including PFA up to thick layers for corrosion‑critical environments. Together, these firms shape market dynamics through leadership in formulation innovation, scale efficiencies and strategic regional presence.

Recent Developments:

- In April 2025, 3M revealed guidance for 215 new product launches throughout the year, emphasizing growth in multiple market segments.

- In August 2025, AGC Equity Partners made a strategic growth investment in Atmosphere Data Centers to accelerate their expansion plans.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, End‑User and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Perfluoroalkoxy Coating Market will witness increased demand in electric vehicle battery enclosures and charging infrastructure where high‑performance coatings prove critical for safety and longevity.

- It will see growth in renewable energy installations—solar panels, wind turbines and hydrogen generation systems will require coatings capable of withstanding harsh environments and aggressive chemical exposure.

- Suppliers will expand their presence in Asia‑Pacific and Southeast Asia to capitalise on rising manufacturing activity and infrastructure investments in those regions.

- It will benefit from increased aftermarket coating replacement cycles in heavy‑industrial sectors such as chemical processing, oil & gas and mining where extended equipment lifetime became a priority.

- Manufacturers will invest in hybrid and sustainable PFA formulations that reduce volatile organic compounds and meet tighter environmental regulations in North America and Europe.

- It will face heightened competition from alternative coatings and materials, prompting firms to differentiate through performance, service and customisation rather than purely cost.

- Collaboration between coating producers and end‑users will increase to deliver tailored solutions that suit specific substrate materials, complex geometries and stringent industry standards.

- It will support digital manufacturing and smart‑coating systems where sensors and IoT integration enable monitoring of coating integrity and predictive maintenance.

- Strategic mergers, acquisitions and regional joint ventures will accelerate as firms seek global scale, local access and diversified product portfolios to gain competitive advantage.

- It will profit from niche applications in semiconductor and electronics fabrication where ultra‑high‑purity, high‑temperature coatings gain critical importance in next‑generation device manufacturing.

Market Drivers:

Market Drivers: