Market Overview:

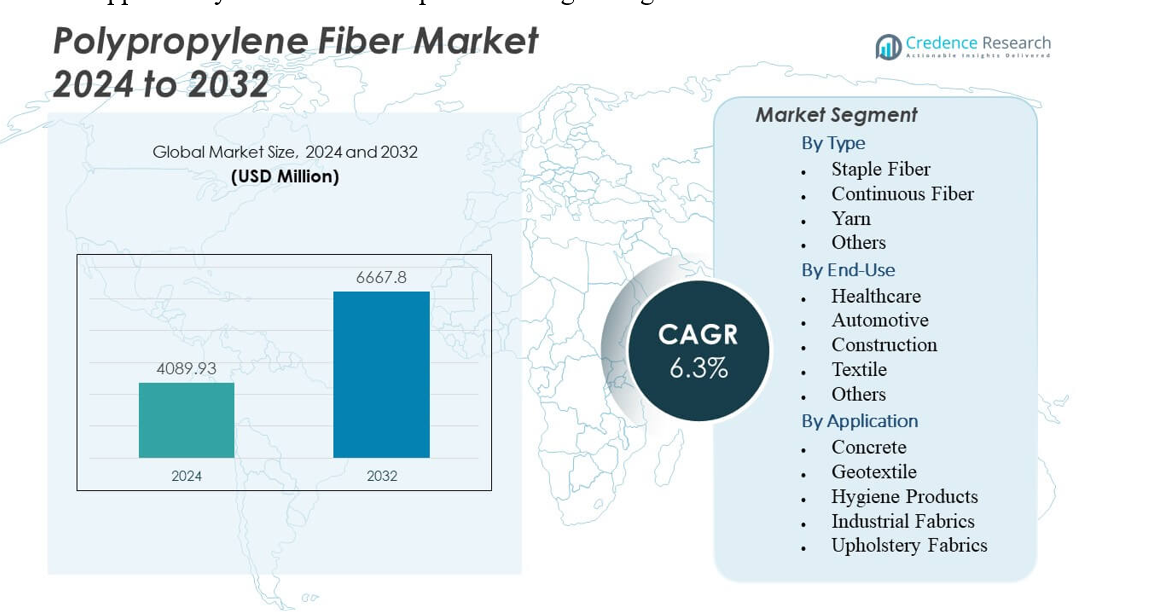

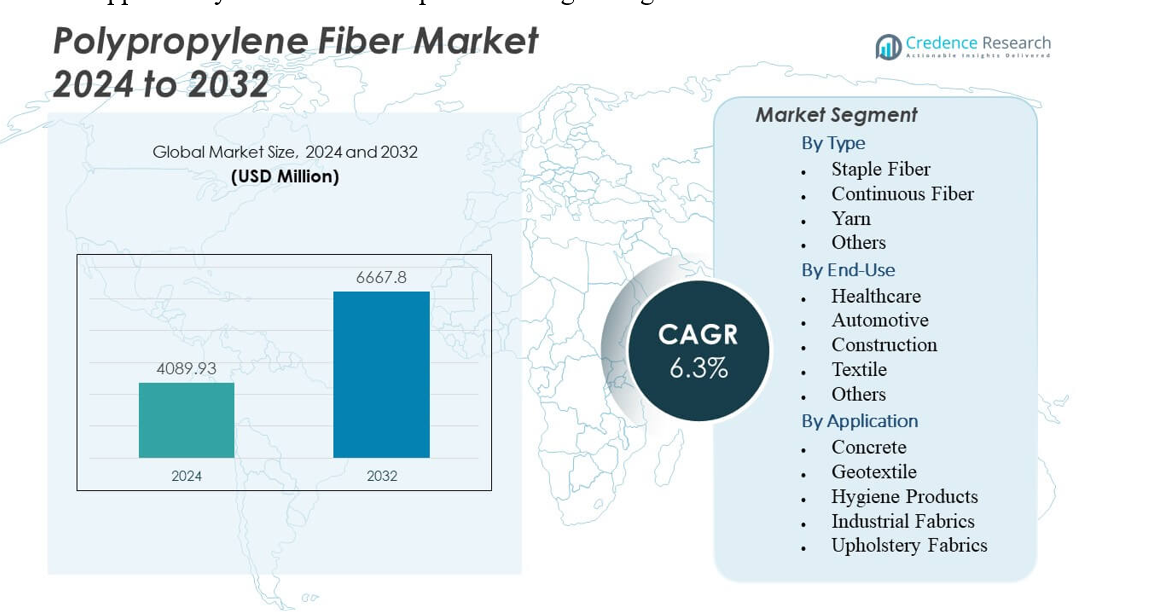

The Polypropylene Fiber Market is projected to grow from USD 4089.93 million in 2024 to an estimated USD 6667.8 million by 2032, with a compound annual growth rate (CAGR) of 6.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polypropylene Fiber Market Size 2024 |

USD 4089.93 million |

| Polypropylene Fiber Market, CAGR |

6.3% |

| Polypropylene Fiber Market Size 2032 |

USD 6667.8 million |

The market grows through rising construction upgrades, strong demand for hygiene goods, and wider industrial adoption. Builders prefer polypropylene fibers due to stable crack control and long-term durability in concrete mixes. Hygiene manufacturers use soft, safe fibers to support high-volume nonwoven output. Automotive suppliers adopt lightweight fibers to enhance interior structures and reduce load. Industrial units choose polypropylene due to chemical resistance and consistent filtration behavior. New product development improves tensile strength and processing efficiency. These factors shape strong forward momentum across many applications.

Asia Pacific leads due to large-scale infrastructure activity, strong nonwoven production, and expanding automotive demand. China anchors the region through wide manufacturing capacity and rising consumption across construction and hygiene sectors. India and Southeast Asia grow through rapid urban development and rising textile output. Europe maintains steady demand through premium-grade fibers used in automotive, filtration, and geotextile systems. North America shows consistent growth through industrial modernization and adoption of reinforced construction materials. Latin America and the Middle East & Africa emerge as developing markets supported by infrastructure expansion and growing technical textile use.

Market Insights:

- The Polypropylene Fiber Market is projected to grow from USD 4089.93 million in 2024 to USD 6667.8 million by 2032, supported by a 6.3% CAGR during the forecast period.

- Strong demand from construction, hygiene, automotive, and industrial applications drives wider use of polypropylene fibers across global supply chains.

- Market restraints include raw material volatility, rising quality expectations, and competition from alternative synthetic and natural fibers across key end-use sectors.

- Asia Pacific leads the market due to extensive infrastructure growth and strong nonwoven production, while Europe and North America maintain steady demand across technical and industrial applications.

- Emerging regions such as Latin America and the Middle East & Africa expand due to growing construction activity, broader adoption of technical textiles, and rising consumption of hygiene products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Strong Adoption In Construction Reinforcement Applications

Growing use of fibers in concrete boosts steady expansion across many projects. Users rely on polypropylene to improve crack control and extend structural life. Builders pick fiber mixes to handle stress loads in tunnels and pavements. It helps reduce repair cycles through stable reinforcement behavior. The Polypropylene Fiber Market gains strong traction across large-scale civil work. Contractors value consistent performance in wet and dry environments. Demand rises due to quick mixing and better dispersion behavior. Infrastructure upgrades in many regions keep long-term use steady.

- For instance, Singapore’s Land Transport Authority (LTA) used hybrid steel fiber reinforced concrete (SFRC) with 1 kg/m³ micro polypropylene fibers (Duomix Fire M6) in Downtown Line Stage 3 tunnel linings, alongside 30-40 kg/m³ steel fibers, to control crack widths and enhance durability.

Rising Penetration In Hygiene And Disposable Products

Producers widen supply toward hygiene goods such as wipes and diapers. Users prefer polypropylene for softness and stable barrier support. It handles moisture exposure while keeping product comfort intact. The Polypropylene Fiber Market benefits from consistent volume growth in hygiene lines. Nonwoven makers adopt fibers to improve strength without weight rise. Better fiber uniformity supports faster line speeds in major plants. Health-focused demand pushes producers to refine purity levels. Growing use in personal care formats strengthens market depth worldwide.

Growing Demand Across Industrial Filtration And Safety Products

Industrial plants adopt fibers to enhance filter durability during long cycles. Users trust polypropylene due to its chemical resistance in harsh zones. It supports clean flows across food, chemical, and metal plants. The Polypropylene Fiber Market expands through stronger reliance on high-strength media. Safety gear makers pick fibers for gloves, ropes, and protective nets. Better tensile output helps handle heavy industrial loads. Many producers design tailored grades to meet niche demands. Rising need for safe operations across factories sustains demand.

- For instance, KrampeHarex supplies polypropylene microfibers engineered for concrete reinforcement, providing improved crack control and fire-spalling resistance in tunnels and high-performance structures. These fibers help stabilize concrete behavior during thermal stress and support long-term structural durability.

Increased Use In Lightweight Automotive Components

Automakers shift toward fibers to cut part weight across many modules. Lightweight design helps reduce fuel use and improve overall performance. It enables efficient molding of trims, liners, and interior panels. The Polypropylene Fiber Market grows due to steady adoption in mobility programs. Producers test fibers for noise damping in cabin structures. Better impact support improves safety across new platforms. Many OEMs explore reinforced grades for long-term weight targets. Shifting mobility trends push interest in cost-friendly material choices.

Market Trends

Shift Toward High-Performance Fiber Modification Technologies

Producers refine fiber structures to improve thermal and tensile behavior. Advanced processing supports better bonding in composite formats. It helps users reach higher load performance in demanding zones. The Polypropylene Fiber Market reflects steady upgrades in modified grades. Many plants invest in advanced spinning controls for uniform output. Tailored fibers gain traction in technical textiles with strict quality norms. R&D teams work on fibers that fit multi-functional roles. Rising interest in engineered enhancements shapes future design efforts.

Growing Preference For Sustainable And Recycled Polypropylene Grades

Manufacturers adopt recycling streams to reduce waste across major plants. Buyers request fibers made from cleaner, traceable inputs. It supports environmental goals across construction, textile, and hygiene lines. The Polypropylene Fiber Market sees rising focus on low-impact production. Many firms invest in closed-loop systems to reduce material loss. Recycled fibers enter geotextiles and carpets due to stable strength. Strong sustainability goals drive new certification activity. Shifts in buyer preference strengthen demand for eco-focused options.

Expansion Of Technical Textile Use In Transportation And Defense

Technical textile demand rises across rail, aerospace, and defense units. Users seek fibers that resist heat, moisture, and impact stress. It supports new material layouts in lightweight composite structures. The Polypropylene Fiber Market gains traction across specialized textile lines. Many agencies pick fibers to improve durability in field-grade goods. Strong interest in mobile armor support systems expands material trials. Producers test blends for higher fatigue resistance under constant load. Growth in engineered textile domains broadens long-term adoption.

- For instance, Singapore’s Land Transport Authority incorporated 1 kg/m³ micro polypropylene fibers (Duomix Fire M6) in hybrid SFRC tunnel linings for the Downtown Line, enhancing crack control and spalling resistance in transportation infrastructure.

Rapid Automation And Efficiency Upgrades In Fiber Production

Automation improves output stability across large spinning facilities. Producers deploy smart controls to manage denier and uniformity. It supports consistent fiber flow during high-volume runs. The Polypropylene Fiber Market sees rising investment in automated inspection tools. Plants use sensors to reduce defects and enhance quality checks. Digital systems help monitor waste levels across each line. Many teams adopt predictive controls to stop shutdown risks. Efficiency targets drive wider adoption of data-enabled operations.

- For instance, leading nonwoven manufacturers report more stable production performance when using uniform polypropylene fibers, which support efficient web formation in hygiene product lines. Automated spinning and inspection systems help maintain consistent output across high-volume operations.

Market Challenges Analysis

Volatile Raw Material Supply And Rising Quality Expectations

Producers face stress due to shifting propylene feedstock behavior across regions. Plants must manage cost swings while meeting strict performance goals. It places pressure on producers to stabilize output during tight cycles. The Polypropylene Fiber Market must align quality targets with rapid demand shifts. Users request fibers with narrow tolerance levels for technical tasks. Strict hygiene rules demand stable purity in high-volume goods. Variations in polymer quality disrupt supply consistency. Producers invest in process upgrades to maintain contract reliability.

Strong Competition From Alternative Synthetic And Natural Fibers

Competing fibers gain attention due to specific strength or comfort traits. Users often compare polypropylene with polyester, nylon, and cotton lines. It creates a challenging landscape for producers targeting premium grades. The Polypropylene Fiber Market must address performance gaps across select areas. Some buyers pick alternatives for heat stability or dye acceptance. High competition limits price flexibility across key segments. Producers respond by improving fiber functionality to retain users. Market players refine positioning across industrial and consumer domains.

Market Opportunities

Rising Scope For Fiber Integration In Smart Construction Solutions

Growing use of smart construction systems builds new openings for advanced fibers. Engineers integrate polypropylene with digital monitoring tools in next-gen materials. It helps create stronger concrete blends for long-term infrastructure goals. The Polypropylene Fiber Market can expand through fibers tailored for structural sensing uses. Builders adopt hybrid mixes for tunnels, dams, and transport corridors. Better crack control supports extended lifecycle targets. Growth in megaproject plans drives material trials across many nations. Producers that offer specialty fibers gain early advantage.

Expansion Potential In Next-Generation Nonwoven And Composite Goods

Nonwoven development widens through demand for safer, cleaner, and stronger goods. Producers test polypropylene blends for high-efficiency filtration and medical formats. It enhances performance in wipes, protective textiles, and absorbent layers. The Polypropylene Fiber Market can enter advanced composites used in drones, cabins, and sports gear. Many designers seek lightweight layouts for mobility and safety devices. Strong interest in sustainable blends drives new research activity. Technical textile makers explore fibers that meet multi-functional targets. Wider use across consumer and industrial sectors opens new growth paths.

Market Segmentation Analysis:

By Type

Staple fiber leads due to strong use in nonwovens, geotextiles, and automotive products. Its balanced strength and cost structure support steady industrial demand. Continuous fiber gains share through rising use in technical textiles and ropes. Yarn grades find adoption in carpets, upholstery, and lightweight textiles. Others such as slit film and fibrillated types fill niche needs across packaging and agricultural lines. The Polypropylene Fiber Market benefits from this wide material mix across major supply chains. It expands through product upgrades that strengthen performance in each type group.

- For instance, polypropylene fibers are widely used in needle-punched nonwoven filters due to their chemical resistance and stability, supporting applications across water treatment, industrial fluids, and process filtration. Their balanced strength and cost efficiency help maintain steady industrial demand.

By End-Use

Healthcare holds strong influence due to rising need for hygiene goods and medical textiles. Its demand stays high across disposable wipes, masks, and protective layers. Automotive gains traction through wider use of lightweight interior components. Construction depends on polypropylene fibers for concrete reinforcement and soil stabilization. Textile producers adopt fibers for carpets, apparel, and sportswear. Others include packaging and consumer goods linked to durable fiber output. The Polypropylene Fiber Market aligns with each end-use group through steady production flexibility.

By Application

Concrete reinforcement remains a key application due to strong crack-control performance across infrastructure work. Geotextiles gain wide acceptance due to stability in soil and drainage layers. Hygiene products use soft fibers that support comfort and barrier strength. Industrial fabrics depend on polypropylene for chemical resistance and tensile stability. Upholstery fabrics adopt fibers for long wear life and color retention. The Polypropylene Fiber Market grows through rising interest in application-specific grades. It strengthens product reach across diverse technical and consumer environments.

- For instance, high-modulus polypropylene tapes produced through advanced drawing processes are used in woven geotextiles and geogrids to reinforce soil layers in road and pavement construction. These materials support stability in asphalt structures and improve drainage efficiency across large infrastructure projects.

Segmentation:

By Type

- Staple Fiber

- Continuous Fiber

- Yarn

- Others

By End-Use

- Healthcare

- Automotive

- Construction

- Textile

- Others

By Application

- Concrete

- Geotextile

- Hygiene Products

- Industrial Fabrics

- Upholstery Fabrics

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds nearly 21% share and benefits from stable demand in construction, automotive, and hygiene sectors. Producers supply advanced fiber grades that support strict quality norms across major industries. It gains momentum through rising infrastructure activity and steady adoption of nonwoven products. The Polypropylene Fiber Market expands in this region due to strong material performance and balanced pricing. Canada shows faster uptake in geotextiles, while the U.S. leads hygiene-grade consumption. Mexico strengthens regional supply networks through broader industrial output. Growth patterns align with national investment cycles and expanding consumer needs.

Europe accounts for about 26% share and maintains strong focus on sustainable and high-performance fibers. Manufacturers supply reinforced and modified grades that meet advanced filtration and automotive standards. It benefits from strict environmental rules that push demand for recyclable and lightweight materials. The Polypropylene Fiber Market gains support from mature nonwoven production hubs in Germany, Italy, and France. Eastern Europe widens its presence through expanding construction and textile activity. Regional buyers value stable tensile strength and long-term durability. Adoption spreads across specialized technical textile facilities with strong export reach.

Asia Pacific leads with nearly 41% share and remains the fastest-growing region due to wide industrial expansion. China anchors output with strong nonwoven, construction, and automotive demand. It benefits from large-scale production bases and competitive operating structures. The Polypropylene Fiber Market gains rapid scale through rising hygiene consumption in India and Southeast Asia. Japan and South Korea support premium-grade development across technical textiles. Strong consumer markets help broaden end-use patterns across urban centers. Latin America and the Middle East & Africa hold a combined 12% share and show steady growth through expanding infrastructure and industrial modernization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Polypropylene Fiber Market features a diverse competitive landscape shaped by global producers, regional specialists, and integrated nonwoven manufacturers. Major companies strengthen portfolios with fibers designed for hygiene, geotextiles, and industrial filtration. It moves toward advanced formulations that improve tensile strength, softness, and chemical resistance. Firms invest in automated spinning lines to increase efficiency and maintain uniform quality across high-volume output. Competitors differentiate through cost control, product customization, and faster delivery cycles that support large procurement programs. Sustainability commitments push producers to expand recycled and low-impact polypropylene grades for hygiene and construction sectors. Strategic partnerships help firms secure supply reliability across growing regions. Market leaders invest in R&D to upgrade thermal performance, bonding behavior, and fiber consistency, while emerging players target niche applications with tailored solutions that match the evolving needs of global industries.

Recent Developments:

- In March 2025, LyondellBasell Industries announced a capacity expansion project at its Channelview Complex. The investment will expand propylene production, supporting downstream polypropylene and related fiber manufacturing.

Report Coverage:

The research report offers an in-depth analysis based on Type, End-Use and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise through wider adoption in concrete reinforcement and geotextile layers.

- Hygiene producers will increase fiber use to meet higher cleanliness and comfort standards.

- Automotive suppliers will adopt lightweight fiber formats to support interior design changes.

- Nonwoven plants will expand output through automated lines that improve quality stability.

- Sustainable polypropylene grades will gain traction through stronger recycling commitments.

- Technical textile makers will test advanced blends for better mechanical and thermal behavior.

- Industrial filtration units will rely on stable polypropylene fibers for cleaner process flows.

- Infrastructure programs will create new openings for fiber-modified construction materials.

- Upholstery and furnishing producers will explore long-life polypropylene designs for global markets.

- The Polypropylene Fiber Market will grow through broader functional upgrades across every application group.