Market Overview:

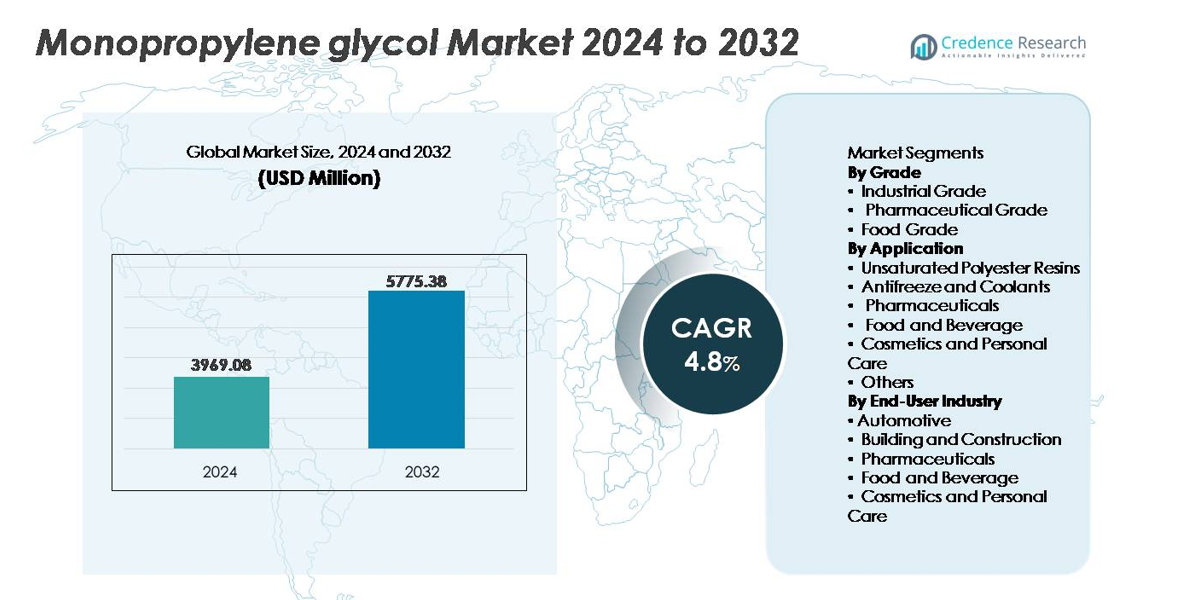

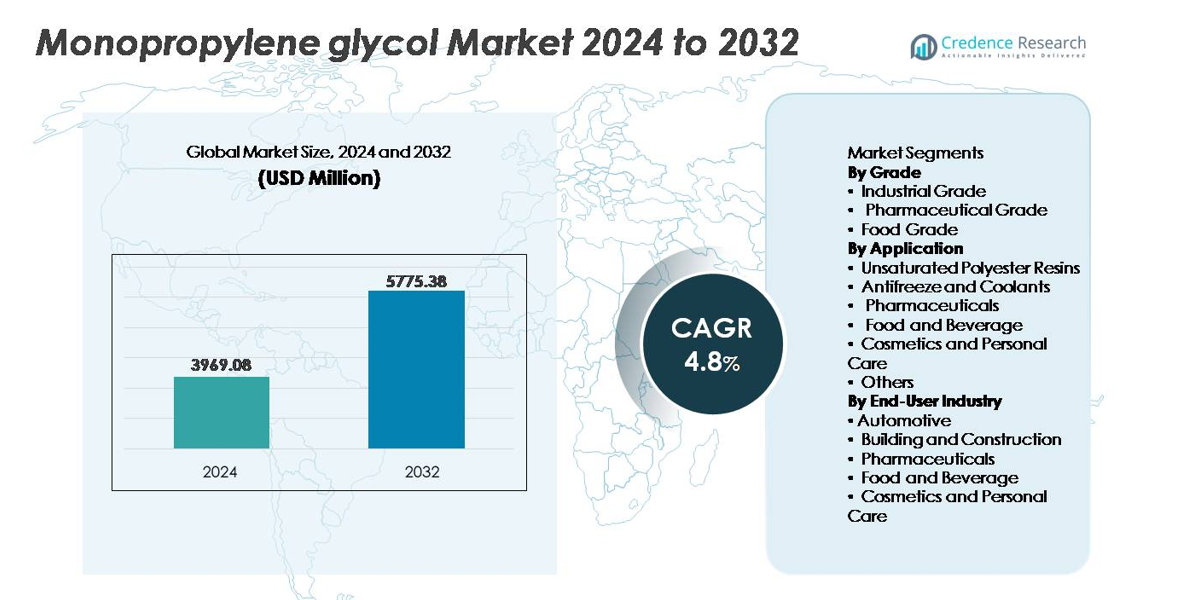

The global monopropylene glycol (MPG) market was valued at USD 3,969.08 million in 2024 and is projected to reach USD 5,775.38 million by 2032, expanding at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Monopropylene Glycol Market Size 2024 |

USD 3,969.08 million |

| Monopropylene Glycol Market, CAGR |

4.8% |

| Monopropylene Glycol Market Size 2032 |

USD 5,775.38 million |

The monopropylene glycol market is shaped by the strategic presence of global chemical producers including Huntsman Corporation, SKC Co., Ltd., BASF SE, ADEKA Corporation, LyondellBasell Industries N.V., Repsol S.A., INEOS Oxide, Sumitomo Chemical Co., Ltd., Dow Chemical Company, and Royal Dutch Shell Plc, each competing through quality compliance, cost-optimized manufacturing, and diversified product portfolios across industrial, pharmaceutical, and food-grade applications. Asia-Pacific leads the global market with approximately 38% share, supported by large-scale resin production, expanding consumer manufacturing, and cost-efficient chemical infrastructure. Europe and North America follow as key contributors, driven by regulated pharmaceutical, cosmetics, and high-performance material industries.

Market Insights:

- The global monopropylene glycol market was valued at USD 3,969.08 million in 2024 and is projected to reach USD 5,775.38 million by 2032, reflecting a CAGR of 4.8% during the forecast period.

- Market growth is driven by the rising consumption of unsaturated polyester resins, accounting for the largest application share, supported by demand for lightweight composites in automotive, marine, and construction sectors.

- Key trends include expanding usage in pharmaceuticals and personal care due to low toxicity, along with increasing adoption of bio-based MPG, driven by sustainability regulations and circular feedstock sourcing.

- Competitive dynamics are influenced by capacity expansion, purity specification differentiation, and long-term supply contracts executed by major international producers and specialty glycol manufacturers.

- Asia-Pacific leads with 38% market share, followed by North America (28%) and Europe (26%), while the automotive sector remains the dominant end-use industry, driven by antifreeze and coolant consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

Industrial grade monopropylene glycol represents the dominant grade segment, accounting for the largest share due to its extensive use in unsaturated polyester resins, de-icing fluids, hydraulic systems, and chemical processing. Strong demand from composite material manufacturing, automotive coolants, and industrial solvents reinforces revenue growth. Pharmaceutical grade MPG is gaining traction as regulations strengthen around purity standards for drug formulations. Food grade glycol expands steadily, supported by applications as a humectant, preservative carrier, and emulsifying agent. The surge in processed food manufacturing and safer additive demand continues to drive uptake across global markets.

- For instance, LyondellBasell Industries operates propylene oxide facilities with an annual output exceeding 1,000,000 metric tons, supporting large-volume MPG and derivative production capacity for industrial applications.

By Application

Unsaturated polyester resins remain the leading application segment, holding the highest market share driven by large-scale production of fiberglass-reinforced plastics, marine structures, and automotive body panels. Antifreeze and coolants form the second major segment propelled by increasing vehicle parc, temperature-sensitive machinery, and aviation de-icing requirements. Pharmaceutical and cosmetics applications experience strong growth due to MPG’s low toxicity and compatibility with active ingredients. Food and beverage applications advance with the rising focus on moisture retention and color stabilization. Other niche uses include inks, detergents, and chemical intermediates.

- For instance,”AOC is a leading global supplier of specialty resins and solutions that serves a wide range of composite applications in transportation, industrial equipment, construction, and marine sectors, with a global manufacturing presence”.

By End-User Industry

The automotive industry is the dominant end-user, driven by the widespread use of glycol-based coolants, lubricants, and resin-derived lightweight components. Building and construction demand is reinforced by composite panels, adhesives, sealants, and insulation materials. Pharmaceuticals continue scaling due to the role of MPG in oral, topical, and injectable formulations. Food and beverage manufacturers adopt MPG for texturizing, solvent functions, and stabilization. The cosmetics and personal care sector relies on MPG for its humectant and emollient attributes, supporting increasing product innovation across skincare, haircare, and hygiene categories.

Key Growth Drivers:

Expanding Use of MPG in Unsaturated Polyester Resin and Composite Manufacturing

The increasing consumption of unsaturated polyester resins in automotive, marine, wind energy, and construction sectors serves as a major growth driver for monopropylene glycol demand. Composite fiberglass structures, corrosion-resistant tanks, and lightweight molded components are widely replacing steel and traditional metal due to durability advantages and lower lifecycle costs. Infrastructure modernization, wind blade manufacturing, and prefabricated building systems continue to rely on resin systems where MPG acts as a critical raw material. As industries prioritize lighter vehicle components, sustainable marine equipment, and energy-efficient building materials, MPG consumption rises alongside composite applications. Ongoing investment in renewable infrastructure and advanced construction technologies further reinforces demand, solidifying its position in industrial chemical value chains.

- For instance, AOC Aliancysprovides a range of high-performance resins, including bisphenol-A epoxy-based vinyl esters and isophthalic polyesters, that are used in the fabrication of large wind turbine blades, which can exceed 70 meters in length.

Growing Demand from Pharmaceuticals, Cosmetics, and Personal Care Formulations

The pharmaceutical and personal care industries increasingly adopt monopropylene glycol for its low toxicity, solvent compatibility, humectant properties, and ability to enhance active ingredient stability. Its growing utilization in oral medications, topical creams, injectables, fragrances, and skincare products reflects the expanding regulated global healthcare and beauty markets. Rising consumer preference for moisture-focused skincare solutions and dermatologist-tested formulations supports MPG incorporation. In pharmaceuticals, high standards of drug purity and safer excipient requirements create recurring procurement cycles. Expanding healthcare infrastructures, aging populations, chronic disease prevalence, and prescription drug production fuel long-term MPG use. The convergence of medical-grade manufacturing and premium cosmetic innovation strengthens value-added applications across developed and emerging markets.

- For instance, Dow’s PuraGuard™ Propylene Glycol USP/EP (referred to as MPG) is validated to meet USP, EP, and JP excipient standards with a specified purity of at least 99.8%. This high purity enables its use as a pharmaceutical excipient in various applications, including oral syrups, injectables, and ophthalmic solutions. The compliance and detailed specifications are outlined in product data sheets and related documentation provided by Dow.

Increasing Adoption of Bio-Based MPG and Circular Chemical Production

The shift toward carbon reduction strategies and sustainable feedstocks accelerates the development and commercialization of bio-based monopropylene glycol derived from glycerin and renewable biomass. Bio-MPG offers lifecycle emission reductions and addresses consumer preference for environmentally aligned chemical sourcing. Chemical producers expand bio-based production capacities to meet regulatory incentives, corporate environmental targets, and sustainable product labeling standards. Circular production models allow conversion of biodiesel byproducts into MPG, supporting waste valorization and alternative feedstock security. As industries seek renewable intermediates for personal care, food-grade, and pharmaceutical applications, bio-MPG positions itself as a competitive replacement for petroleum-derived glycols. Policy-driven adoption and green procurement frameworks continue to grow future opportunities.

Key Trends & Opportunities:

Rising Penetration of MPG in Electric Vehicle Thermal Management Systems

The proliferation of electric vehicles generates new opportunities for MPG-based coolants and heat transfer fluids. Advanced battery chemistries require stable thermal control to maximize performance, safety, and charging efficiency, favoring glycols with low volatility and high stability. EV platforms utilize glycol fluids across battery packs, power electronics, and onboard charging systems. As vehicle manufacturers invest in larger cooling architectures and fast-charging infrastructure, the volume of thermal management fluids per vehicle increases. The trend supports ongoing innovation in additive packages and specialized coolant formulations tailored to electric mobility requirements.

- For instance, BASF’s GLYSANTIN® G64® coolant employs a PSi-OAT (phosphate and silicate fortified Organic Acid Technology) blend, which is suitable for both modern internal combustion engines and indirectly cooled electric vehicle and hybrid technologies. It offers excellent corrosion protection and thermal stability for engine systems.

Emergence of MPG in Food-Processing, Flavoring, and Packaging Applications

The food and beverage sector presents expanding opportunities as manufacturers rely on MPG for moisture retention, solvent use in flavor concentrates, and food-safe processing aids. Growth of processed food categories, cold chain distribution, and sustainable packaging unlocks new industrial use cases. The increasing global focus on additive transparency, freshness preservation, and food-grade chemical safety aligns with MPG’s favorable regulatory status. Rising demand for ready-to-cook meals, frozen goods, and functional beverages contributes to recurring supply requirements. Food packaging films, coatings, and laminates further enhance its role in modern food ecosystems.

- For instance, Dow’s Food Grade Propylene Glycol meets FCC and E1520 standards with purity documented at ≥99.5%, and water content controlled below 0.2%, supporting use in flavor extracts, emulsions, and carbonation-stable beverage concentrates as confirmed in its 2024 technical data sheet.

Process Efficiency Improvements Through Digitalization and Advanced Manufacturing

Chemical producers leverage digital plant controls, AI-driven predictive maintenance, and optimized feedstock strategies to maximize MPG production efficiency. Advanced catalyst technology and continuous processing improve yield, reduce waste, and minimize energy intensity. Integration of automation enhances monitoring accuracy, regulatory reporting, and batch consistency for pharmaceutical and food-grade products. Upgrading legacy facilities to smart manufacturing operations creates competitive differentiation and scalable profitability. The trend supports the reshaping of chemical production into more resilient, higher-quality supply ecosystems.

Key Challenges:

Volatility of Raw Material Prices and Feedstock Dependence

Fluctuations in crude oil derivatives and the variable supply of glycerin-based feedstocks represent a significant challenge for MPG manufacturers. Cost instability directly affects production margins and disrupts pricing strategies across industrial and consumer-grade markets. Feedstock competition from biodiesel, acrylics, and other glycols intensifies supply imbalance risks. Producers must navigate geopolitical tensions, refinery output variations, and agricultural commodity swings. As global supply chains experience unpredictable logistics cycles, companies must focus on diversification, long-term contracting, and optimized inventory strategies to sustain cost stability.

Stringent Regulatory Approvals and Quality Compliance Requirements

Regulatory frameworks governing pharmaceutical excipients, food additives, and personal care ingredients impose strict requirements for purity, toxicity profiling, and documentation. Compliance with differing national certifications and labeling standards raises operational complexity, particularly for cross-border trade. Testing, traceability, and batch validation increase cost burdens for chemical manufacturers scaling into regulated markets. Delays in approval cycles restrict time-to-market for new formulations and constrain strategic flexibility. As consumer safety expectations grow, producers must invest in robust quality processes, analytical technologies, and transparent supply chain governance.

Regional Analysis:

North America

North America holds approximately 28% market share, driven by strong demand from pharmaceuticals, cosmetics, and automotive coolant production. The United States leads consumption owing to advanced chemical manufacturing, established composite industries, and high output of processed food and beverage products that utilize food-grade MPG. The region benefits from early adoption of high-purity excipients in drug formulations and evolving bio-based glycol production initiatives. Increased investments in EV battery thermal management and lightweight material applications reinforce long-term demand. Regulatory support for sustainable manufacturing practices continues to accelerate the adoption of renewable feedstock-derived MPG.

Europe

Europe represents nearly 26% share of the global market, supported by its mature automotive sector, robust construction activity, and strict regulatory oversight favoring safer chemical ingredients. Germany, France, and the Nordic countries drive consumption through antifreeze, coolants, adhesives, and composite resin requirements in energy-efficient infrastructure and electric mobility advancement. Pharmaceutical-grade MPG benefits from stringent excipient compliance and rising biologics production. The European Green Deal and carbon-reduction frameworks promote growth in bio-based MPG manufacturing. Increased adoption of lightweight composites in marine and wind blade production further strengthens demand across industrial segments.

Asia-Pacific

Asia-Pacific dominates the global market with an estimated 38% market share, driven by rapid industrialization, capacity expansion in chemicals, and growing consumer product manufacturing in China, India, South Korea, and Southeast Asia. The region’s large-scale production of unsaturated polyester resins for building materials and automotive parts significantly boosts MPG consumption. Expanding pharmaceutical formulation hubs and processed food industries contribute to steady demand for high-purity MPG grades. Cost-competitive manufacturing, supportive public infrastructure spending, and rising EV production accelerate usage across coolant and composite applications, positioning Asia-Pacific as the fastest-growing regional contributor.

Latin America

Latin America accounts for approximately 5% of global share, led by automotive coolant needs, food processing, and growing construction activities in Brazil, Mexico, and Argentina. Increasing industrial investments and consumer market expansion support adoption of MPG in personal care formulations and pharmaceutical excipients. The region experiences rising demand for sustainable chemical inputs, opening opportunities for renewable glycerin-based glycol production. However, dependency on imported raw materials and economic fluctuations may constrain supply consistency. Growth of regional packaging and beverage manufacturing remains a key demand catalyst for food-grade and industrial MPG segments.

Middle East & Africa

The Middle East & Africa segment holds around 3% market share, driven mainly by applications in building materials, antifreeze fluids for energy facilities, and polymer resin consumption in infrastructure development. Gulf nations invest heavily in chemical diversification programs, supporting long-term consumption of industrial and construction-grade MPG. Africa’s expanding pharmaceutical packaging and food preservation industries contribute incremental demand. Limited local manufacturing capacity results in reliance on imports, influencing pricing structures and supply stability. As renewable energy projects scale and manufacturing ecosystems mature, opportunities emerge for MPG in composite structures and thermal fluid applications.

Market Segmentations:

By Grade

- Industrial Grade

- Pharmaceutical Grade

- Food Grade

By Application

- Unsaturated Polyester Resins

- Antifreeze and Coolants

- Pharmaceuticals

- Food and Beverage

- Cosmetics and Personal Care

- Others

By End-User Industry

- Automotive

- Building and Construction

- Pharmaceuticals

- Food and Beverage

- Cosmetics and Personal Care

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the monopropylene glycol market is characterized by the presence of global chemical producers, specialty glycol manufacturers, and emerging bio-based solution providers, with competition driven by pricing strategies, product purity levels, and supply chain reliability. Market leaders expand vertically across value chains to secure feedstock access and enhance distribution efficiencies, while mid-sized companies differentiate through pharmaceutical and food-grade certifications. Growing investment in bio-MPG production reflects the industry’s transition toward sustainability-aligned portfolios, creating new competitive dynamics as renewable glycerin-based glycol facilities scale. Strategic partnerships, long-term supply agreements with consumer goods and automotive manufacturers, and technological advancements in continuous production processes shape market positioning. Additionally, players prioritize capacity expansions near high-growth Asia-Pacific markets to reduce logistics costs and improve responsiveness. Regulatory compliance, ESG commitments, and end-user customization remain pivotal components of competitive advantage in the global monopropylene glycol ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Huntsman Corporation

- SKC Co., Ltd.

- BASF SE

- ADEKA Corporation

- LyondellBasell Industries N.V.

- Repsol S.A.

- INEOS Oxide

- Sumitomo Chemical Co., Ltd.

- Dow Chemical Company

- Royal Dutch Shell Plc

Recent Developments:

- In May 2025, BASF SE added a new product – Pluriol® A 2400 I -to its raw-material portfolio for use in concrete superplasticizers for the European construction industry.

- In May 1, 2024, INEOS Oxide completed acquisition of the EO & derivatives business from LyondellBasell Industries N.V. this included a site with integrated ethylene oxide, ethylene glycols, and glycol ethers capacity.

Report Coverage:

The research report offers an in-depth analysis based on Grade, Application, End-User industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for monopropylene glycol will increase with rising adoption of lightweight composite materials.

- Bio-based MPG production will expand as industries shift toward low-carbon and renewable feedstocks.

- Growth in EV manufacturing will strengthen the need for MPG-based thermal management fluids.

- Pharmaceutical and personal care applications will benefit from stricter purity standards.

- Construction sector demand will rise with energy-efficient and prefabricated building solutions.

- Digitalization in chemical manufacturing will improve process efficiency and output consistency.

- Regulatory reforms will accelerate transitions toward environmentally compliant formulations.

- Emerging markets will contribute higher consumption through industrialization and packaged food growth.

- Competitive differentiation will focus on supply reliability and product customization.

- Integration across the glycol value chain will shape market consolidation and strategic partnerships.