Market Overview:

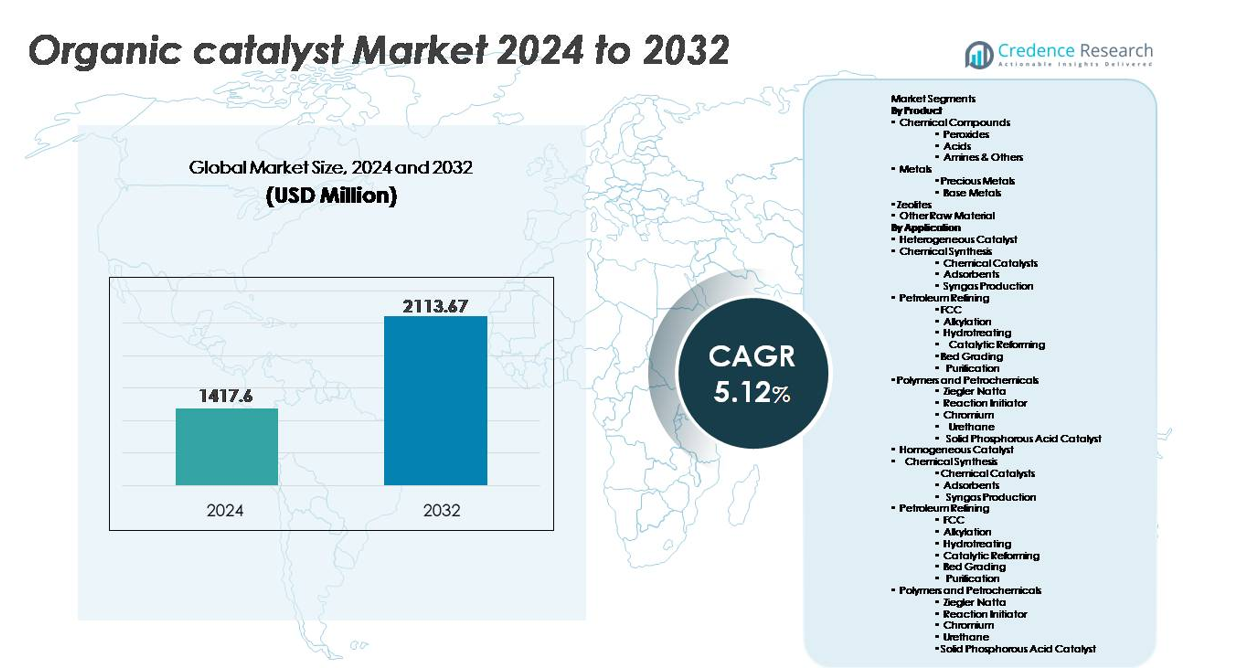

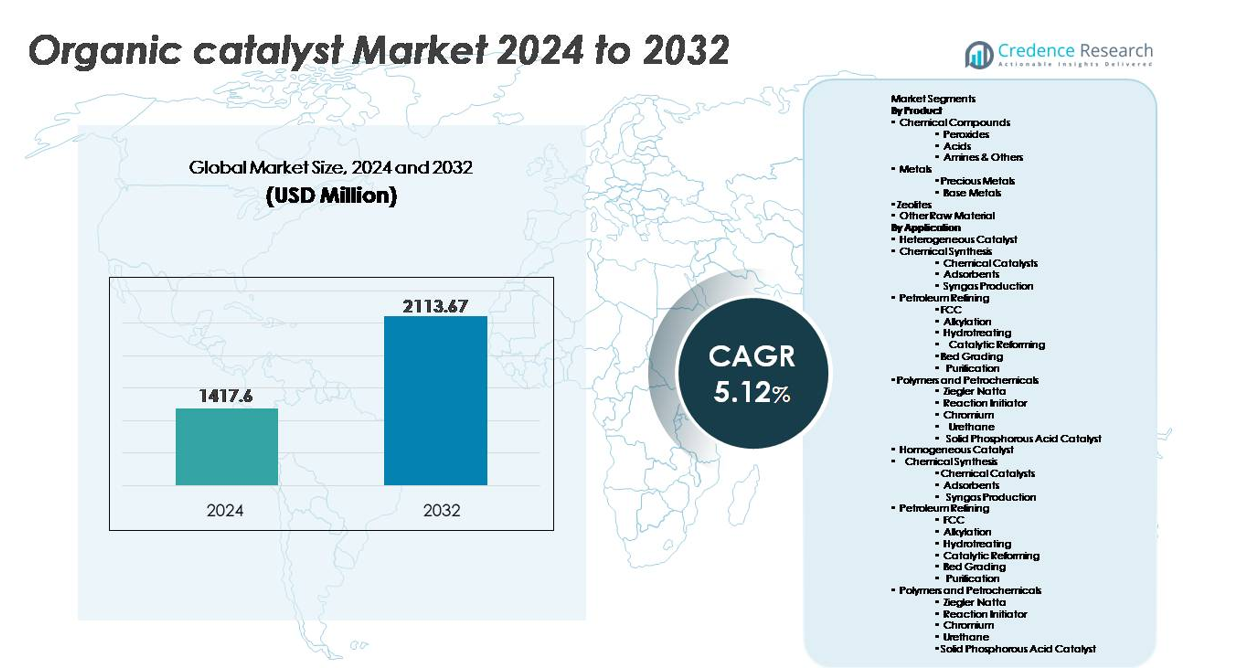

The global organic catalyst market was valued at USD 1,417.6 million in 2024 and is projected to reach USD 2,113.67 million by 2032, expanding at a compound annual growth rate (CAGR) of 5.12% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Organic Catalyst Market Size 2024 |

USD 1,417.6 million |

| Organic Catalyst Market, CAGR |

5.12% |

| Organic Catalyst Market Size 2032 |

USD 2,113.67 million |

The organic catalyst market is shaped by established chemical manufacturers and emerging innovators focused on sustainable and high-efficiency catalytic solutions. Key players include Arkema, Johnson Matthey, Evonik Industries AG, W. R. Grace & Co.-Conn., LyondellBasell Industries Holdings B.V., Albemarle Corporation, The Dow Chemical Company, BASF SE, and Haldor Topsoe A/S, each leveraging advancements in green chemistry, biocatalysis, and process intensification. Asia Pacific leads the global market with approximately 31% share, driven by large-scale chemical production and rapid industrialization, followed by North America at nearly 32% and Europe at around 28%, supported by regulatory mandates and strong pharmaceutical manufacturing ecosystems.

Market Insights:

- The global organic catalyst market was valued at USD 1,417.6 million in 2024 and is projected to reach USD 2,113.67 million by 2032, registering a CAGR of 5.12% during the forecast period.

- Market growth is primarily driven by the shift toward green chemistry, regulatory restrictions on heavy-metal catalysts, and rising demand for high-selectivity synthesis in pharmaceuticals, specialty chemicals, and advanced materials.

- Key trends include adoption of enzyme-based and bio-derived catalysis, increasing integration into continuous-flow processing, and expanding applications in biodegradable polymers and sustainable manufacturing.

- The competitive landscape is moderately consolidated, with BASF SE, The Dow Chemical Company, Arkema, Evonik Industries AG, and Johnson Matthey focusing on innovation, capacity expansion, and strategic partnerships to strengthen global presence.

- Asia Pacific leads with ~31% share, followed by North America at ~32% and Europe at ~28%; metals dominate product segments, while heterogeneous catalysts hold the largest application share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The metals segment dominates the organic catalyst market, driven by the widespread adoption of precious metal catalysts such as palladium, platinum, and rhodium for hydrogenation, oxidation, and reforming reactions requiring high selectivity and temperature resistance. Precious metals account for the largest share due to superior catalytic efficiency and integration into pharmaceuticals, polymers, and fine chemicals. Base metals continue to expand as cost-efficient substitutes in bulk chemical production, while peroxides and acids maintain demand in polymer curing, bleaching, and synthesis pathways. Zeolites gain momentum for ion-exchange and shape-selective applications aligned with sustainability goals.

- For instance, Johnson Matthey’s production infrastructure supports catalyst systems used in more than 100 million vehicles annually and delivers platinum-group-metal catalysts adapted for operating temperatures above 900°C, demonstrating industrial-scale deployment of metal-based catalytic technologies.

By Application

Heterogeneous catalysts represent the dominant application, holding the largest market share due to scalability, reusability, and compatibility with petroleum refining and polymer processing at industrial volumes. FCC, hydrotreating, and alkylation remain critical in refinery modernization to meet cleaner fuel mandates. Polymers and petrochemicals-particularly Ziegler Natta and chromium catalysts-accelerate capacity additions in polyethylene and polypropylene. Homogeneous catalysts sustain uptake in specialty chemical synthesis requiring precision molecular tailoring. Environmental applications continue expanding, supported by emission reduction norms across light-duty, commercial, and heavy-duty vehicle categories.

- For instance, W. R. Grace & Co.’s UNIPOL® technology supports production in more than 100 polypropylene reactor lines globally, enabling cumulative output exceeding 33 million tons per year, demonstrating the scale of heterogeneous catalyst implementation in polymer manufacturing.

Key Growth Drivers:

Growing Shift Toward Green and Sustainable Chemistry

The rising focus on reducing hazardous emissions, eliminating toxic intermediates, and optimizing atom economy is accelerating the adoption of organic catalysts across industrial synthesis. Governments and regulatory agencies promote low-VOC manufacturing and circular production pathways, pushing companies to replace heavy-metal catalysts with organic, recyclable, and enzymatic alternatives that support low-carbon footprints. Increased use in biodegradable materials, bio-based polymers, and eco-friendly coatings amplifies market demand as brands align product portfolios with ESG compliance. Pharmaceutical manufacturers benefit from enhanced selectivity and shorter process cycles, reducing waste generation and raw-material intensity. As sustainability becomes a commercial differentiator rather than a compliance mandate, organic catalysts gain wider penetration in industries seeking regulatory stability, green branding advantages, and reduced disposal liabilities, positioning them as a preferred choice in next-generation chemistry platforms.

- For instance, Evonik’s biotechnology-enabled catalysts have supported more than 400 commercial enzymatic processes, helping industrial producers reduce reaction temperatures by approximately 50°C, significantly cutting energy consumption and emissions during synthesis.

Increasing Demand for Efficiency, Selectivity, and Cost Optimization in Industrial Processes

Industries prioritize higher yields, minimized by-products, and lower purification costs, creating strong momentum for organic catalyst adoption in value-chain sensitive sectors such as pharmaceuticals, specialty chemicals, and agrochemicals. Organic catalysts enable precise control over reaction stereochemistry and functional group transformation, reducing energy consumption and enabling low-pressure or room-temperature operations. This operational efficiency increases throughput and supports continuous flow manufacturing, which is crucial for scaling personalized medicine, nutraceuticals, and specialty materials. Manufacturers also leverage organic catalysts to unlock novel formulations and reaction pathways unavailable to conventional metals. The ability to be regenerated and reused without significant activity degradation further enhances cost efficiency, extending lifecycle value. As markets prioritize productivity and innovation, organic catalysts become essential tools for next-generation synthesis.

- For instance, BASF’s catalyst technology enables numerous industrial reforming and synthesis unitsto operate with high-reaction selectivity and efficiency. These robust catalysts are designed for multi-cycle reuse and performance, including in demanding applications where operating temperatures can exceed 900°C, demonstrating significant industrial efficiency gains and reduced environmental impact.

Expanding Application Scope in Pharmaceutical and Advanced Material Development

The surge in biologics, high-potency APIs, and precision therapeutics drives the need for catalysts that deliver high selectivity, reduced impurity profiles, and biocompatibility. Organic catalysts enable stereoselective transformations critical in chiral drug development and peptide, oligonucleotide, and enzyme-linked reactions. Beyond healthcare, advancements in performance coatings, adhesive systems, and polymer modification broaden market adoption. Organic catalysts support lightweight material innovation in mobility, aerospace, and consumer electronics, combining durability with compliance to toxicity standards. Growth in printed electronics, smart packaging, and nanocomposite materials further increases demand for catalysts that enhance bonding, conductivity, and polymer cross-linking. Their expanding compatibility with renewable feedstocks reinforces integration across sustainable material science.

Key Trends & Opportunities:

Emergence of Bio-Based and Enzyme-Driven Catalysis

The evolution of biotechnology platforms and fermentation-derived enzymes has opened a new frontier in organic catalysis, creating opportunities in low-temperature, non-toxic, and carbon-neutral production lines. Enzyme catalysts drive growing interest in food-grade, pharmaceutical-grade, and medical-grade pathways where metal contamination is unacceptable. Breakthroughs in protein engineering, directed evolution, and AI-enabled molecule design enhance catalytic stability, pH tolerance, and substrate compatibility, shortening development cycles. This trend aligns with global mandates promoting bio-based feedstocks and green solvents, supporting decarbonization goals while enabling high-functional products. Strategic collaborations between chemical producers, biotech startups, and research institutions accelerate commercialization, positioning bio-catalysis as a transformative opportunity.

- For instance, Evonik’s biotechnology expertise supports customer projects using a diverse range of biocatalytic technologies and offers access to an enzymatic toolbox comprising approximately 20 different enzymes on a commercial scale.

Adoption of Continuous Flow and Modular Catalyst Systems

Continuous flow reactors and modular catalyst technologies represent a significant opportunity, enabling faster reaction times, improved thermal control, and enhanced process safety. Organic catalysts optimized for flow chemistry reduce batch variability, scale more efficiently, and support decentralized production models for fine chemicals and APIs. Small and mid-sized enterprises benefit from modular units that require lower capital investment and shorten commissioning timelines. Integration with automation, data analytics, and digital twins enables predictive optimization, reducing maintenance and operational risk. As industries transition toward flexible manufacturing with shorter product lifecycles, flow-compatible organic catalysts offer competitive advantages and commercial resilience.

- For instance, Evonik offers its Noblyst® F and certain Noblyst® P catalysts, such as the P1070 Pd/AC catalyst, which are specifically designed and optimized for seamless integration into continuous-flow systems, supporting efficient industrial hydrogenation processes with reduced residence time and high conversion consistency at various scales.

Key Challenges:

High Sensitivity to Reaction Conditions and Limited Stability

Organic catalysts often demonstrate higher sensitivity to moisture, temperature fluctuations, and oxidizing environments compared to inorganic or metal-based counterparts, which limits use in harsh production conditions. Some catalysts exhibit reduced reusability or degradation under repeated cycles, impacting lifecycle economics. Performance variability across feedstock grades complicates quality assurance in pharmaceuticals and specialty chemicals. Manufacturers adopt encapsulation and structural modification, but commercial scalability remains limited. Overcoming stability constraints requires substantial research and optimized process control, delaying wider industrial adoption.

Regulatory Complexity and Certification Barriers

Regulatory validation for organic catalysts used in pharmaceuticals, food-contact materials, and medical devices remains complex due to evolving compliance frameworks. Each catalyst formulation may require extensive toxicity, migration, and environmental impact assessments, adding documentation and time-to-market delays. Global certification discrepancies create approval redundancy for exporters, discouraging faster commercialization and increasing compliance costs. Companies must invest in standardized testing protocols, documentation systems, and cross-border regulatory expertise, creating challenges particularly for small and emerging catalyst developers.

Regional Analysis:

North America

North America holds approximately 32% of the organic catalyst market, supported by strong innovation in pharmaceutical synthesis, polymer modification, and bio-based chemical development. The United States drives demand through advanced manufacturing and strict environmental regulations that incentivize alternatives to heavy-metal catalysts. Increased R&D funding for green chemistry and expanding biologics pipelines accelerate adoption. Strategic collaborations between biotechnology firms and specialty chemical manufacturers further strengthen market penetration. Growth in catalytic applications for continuous flow production and precision drug formulation reinforces the region’s leadership and promotes wider commercialization of enzyme and organocatalyst technologies.

Europe

Europe accounts for nearly 28% of the global market, driven by long-standing sustainability mandates, carbon-neutral industrial policies, and rapid adoption of circular chemistry practices. The region benefits from strong pharmaceutical manufacturing hubs in Germany, Switzerland, and the UK, boosting demand for stereoselective organic catalysts. EU emission-reduction frameworks push refineries and chemical processors toward non-toxic, recyclable alternatives. Investments in biodegradable polymers, waste-to-value chemistries, and biocatalyst programs fuel industrial transition. Integration with bio-refineries and green hydrogen infrastructure presents further opportunities, positioning Europe as a frontrunner in regulatory-driven catalyst modernization.

Asia Pacific

The Asia Pacific region captures around 31% of the organic catalyst market, expanding rapidly due to large-scale chemical production, rising pharmaceutical exports, and capacity additions in China, India, and Southeast Asia. Government incentives for clean manufacturing, balanced by low-cost production ecosystems, support accelerated adoption. Local producers invest in enzyme-based and organocatalyst platforms to reduce dependence on imported metals and comply with emerging carbon policies. Growth in plastics, coatings, and adhesives manufacturing for automotive and electronics reshapes catalyst demand. The region’s cost advantages and expanding R&D capabilities strengthen its competitive position globally.

Latin America

Latin America holds approximately 5% market share, driven by emerging industrialization, petrochemical production growth, and increasing regulatory alignment with global environmental standards. Brazil and Mexico lead catalyst consumption through refining, polymer processing, and agrochemical production. Investments in bio-based feedstocks and sustainable materials create future opportunities, particularly in cellulose derivatives and biodegradable packaging. However, technology adoption remains slower due to capital constraints and infrastructure gaps. As multinational manufacturers expand regional footprints and knowledge transfer improves, organic catalyst penetration is expected to accelerate in specialized chemical and continuous processing applications.

Middle East & Africa

The Middle East & Africa region represents roughly 4% of the global market, primarily driven by refinery modernization, fuel quality upgrades, and selective adoption of green catalysts in petrochemical complexes. Countries such as Saudi Arabia and the UAE invest in downstream integration and specialty chemical diversification, opening opportunities for organocatalyst applications. However, adoption across other industries remains gradual due to limited local manufacturing and higher import reliance. Interest in polymer recycling, clean-fuel standards, and waste-to-energy projects is expected to support incremental demand as sustainability initiatives gather momentum.

Market Segmentations:

By Product

- Chemical Compounds

- Peroxides

- Acids

- Amines & Others

- Metals

- Precious Metals

- Base Metals

- Zeolites

- Other Raw Material

By Application

Heterogeneous Catalyst

- Chemical Synthesis

- Chemical Catalysts

- Adsorbents

- Syngas Production

- Petroleum Refining

- FCC

- Alkylation

- Hydrotreating

- Catalytic Reforming

- Bed Grading

- Purification

- Polymers and Petrochemicals

- Ziegler Natta

- Reaction Initiator

- Chromium

- Urethane

- Solid Phosphorous Acid Catalyst

Homogeneous Catalyst

- Chemical Synthesis

- Chemical Catalysts

- Adsorbents

- Syngas Production

- Petroleum Refining

- FCC

- Alkylation

- Hydrotreating

- Catalytic Reforming

- Bed Grading

- Purification

- Polymers and Petrochemicals

- Ziegler Natta

- Reaction Initiator

- Chromium

- Urethane

- Solid Phosphorous Acid Catalyst

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the organic catalyst market features a balanced mix of global catalyst manufacturers, biocatalyst innovators, and specialized organocatalyst developers targeting niche applications across pharmaceuticals, polymers, and clean manufacturing. Established companies focus on expanding production capacity, enhancing catalyst recyclability, and improving selectivity through advanced molecular engineering. Partnerships between chemical producers and biotech firms accelerate enzyme-driven and bio-based catalyst commercialization. Competitors increasingly adopt strategies such as patent portfolio expansion, forward integration, and licensing models to strengthen market positioning. Product differentiation reflects temperature tolerance, substrate compatibility, and lifecycle cost efficiency. Emerging players disrupt the market with modular catalyst technologies tailored for continuous-flow systems and decentralized production. Competitive intensity is expected to increase as sustainability regulations and circular chemistry frameworks shift demand from metal-based solutions to organic, low-toxicity alternatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Arkema

- Johnson Matthey

- Evonik Industries AG

- R. Grace & Co.-Conn.

- LyondellBasell Industries Holdings B.V.

- Albemarle Corporation

- The Dow Chemical Company

- BASF SE

- Haldor Topsoe A/S

- Haldor Topsoe A/S

Recent Developments:

- In October 2025, Evonik introduced its Noblyst® F catalyst portfolio for flow applications, offering precious metal catalysts in two particle sizes with a sample kit and application table, supporting pharma and fine-chemical customers shifting toward continuous processing with enhanced catalytic performance.

- In September 2025, BASF’s SYNSPIRE® G1-110 catalyst enabled Nan Ya Plastics’ 2-EH plant to cut annual steam use by 40,000 metric tons and reduce CO₂ emissions by 38,000 metric tons, delivering significant OPEX savings through improved methane-reforming efficiency.

- In February 2024, Grace signed an agreement with China Coal Shaanxi Energy & Chemical Group to license a second UNIPOL® polypropylene reactor, doubling the site’s PP capacity from 300 to 600 kilotons per annum (KTA) and adding to nearly 2.5 million tons of licensed PP capacity secured in 2023.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Organic catalysts will gain wider adoption as industries accelerate the transition to sustainable and non-toxic manufacturing.

- Enzyme-driven catalysis will expand in pharmaceutical and food-grade applications due to high selectivity and safety compliance.

- Continuous flow and modular catalyst systems will streamline production scalability and improve processing efficiency.

- Research investment will focus on enhancing catalyst stability and reusability under diverse industrial conditions.

- Bio-derived catalysts will support circular chemistry models using renewable feedstocks and low-carbon synthesis.

- Advanced polymers and specialty materials will create new demand for tailored organocatalysts.

- AI-driven molecular design will reduce development cycles and improve catalytic performance.

- Strategic collaborations between chemical and biotechnology firms will accelerate commercialization.

- Regulatory frameworks will further restrict heavy-metal catalyst usage, strengthening market alignment with green mandates.

- Emerging economies will play a larger role in production and adoption as clean-chemistry infrastructure expands.