Market Overview

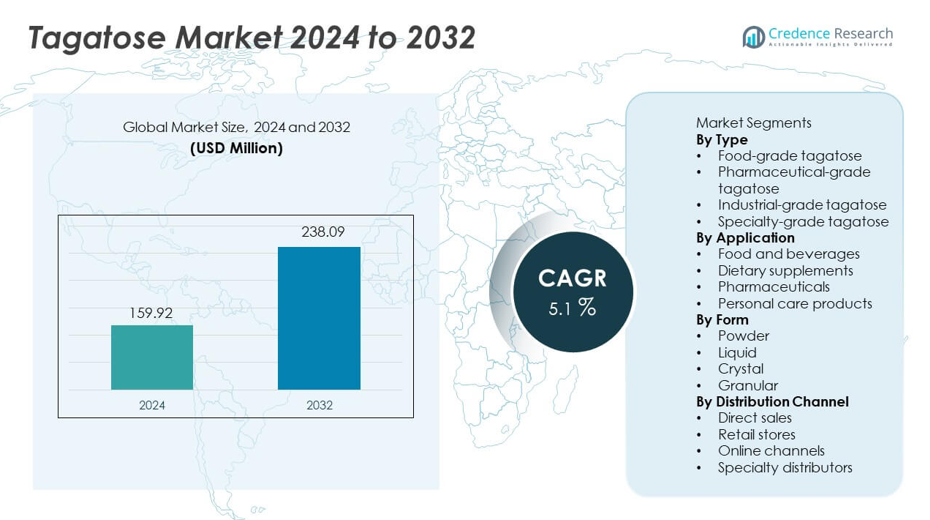

Tagatose market size was valued at USD 159.92 million in 2024 and is projected to reach USD 238.09 million by 2032, registering a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tagatose market Size 2024 |

USD 159.92 million |

| Tagatose market, CAGR |

5.1% |

| Tagatose market Size 2032 |

USD 238.09 million |

The top players in the Tagatose market include Bonumose Inc., CJ CheilJedang Corporation, Nutrilab NV, Ingredion Incorporated, Manus Bio, Südzucker AG, Tate & Lyle PLC, FrieslandCampina Ingredients, Arla Foods Ingredients, and Sigma Aldrich (Merck Group). These companies strengthen the market through innovations in enzymatic production, expanded commercial-scale manufacturing, and partnerships with food and nutraceutical brands seeking natural, low-calorie sweeteners. North America leads the market with a 36% share, driven by strong demand for clean-label and diabetic-friendly products. Europe follows with a 32% share, supported by strict sugar-reduction regulations, while Asia Pacific holds a 24% share, driven by rising health awareness and rapid growth in functional food applications.

Market Insights

- The Tagatose market reached USD 159.92 million in 2024 and will grow at a CAGR of 5.1 percent through 2032.

- Rising demand for low-calorie and low-glycemic sweeteners drives adoption, with food-grade tagatose holding a 58 percent share due to its use in bakery, beverages, and confectionery.

- Clean-label and natural ingredient trends support wider use of tagatose in functional foods, dietary supplements, and personal care products.

- Leading players enhance competitiveness by improving production efficiency, scaling fermentation technologies, and expanding partnerships with major food manufacturers.

- North America leads with a 36 percent share, followed by Europe at 32 percent and Asia Pacific at 24 percent, supported by strong sugar-reduction initiatives, rising health awareness, and growing demand for natural sweetener alternatives across key consumer markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Food-grade tagatose dominates this segment with a 58% share, driven by rising demand for low-calorie sweeteners in bakery, dairy, and confectionery products. Manufacturers adopt food-grade tagatose as a sugar alternative due to its low glycemic index and favorable taste profile. Pharmaceutical-grade variants expand steadily as tagatose supports prebiotic formulations and diabetic-friendly products. Industrial-grade and specialty-grade tagatose grow as niche sectors explore its use in fermentation processes and functional ingredient development. Increasing consumer shift toward healthier sugar substitutes strengthens overall segment demand.

- For instance, Bonumose operates a continuous bioprocessing platform producing food-grade tagatose from abundant, plant-based feedstocks. The company has a patented process that is a cost-effective and scalable enzymatic method, which yields high purity.

By Application

Food and beverages lead with a 62% share, supported by growing adoption of tagatose in chocolates, beverages, ice creams, and baked goods due to its similar sweetness profile to sucrose and reduced caloric content. Dietary supplements also grow as tagatose supports gut health and weight management formulations. Pharmaceutical applications increase with its benefits in diabetic-friendly products and low-impact glucose regulation. Personal care products use tagatose in moisturizing and skin-conditioning formulations. Rising preference for natural sweeteners fuels expansion across applications.

- For instance, Ingredion tested tagatose in chocolate and dairy systems, achieving sweetness equivalence at 0.92 sweetness intensity versus sucrose. FrieslandCampina Ingredients validated tagatose stability across pH 3.5 to 7.0 in liquid nutrition and beverage prototypes.

By Form

Powder form holds a 49% share, driven by its wide use in food manufacturing, easy blending properties, and strong stability in dry formulations. Powdered tagatose is preferred in bakery mixes, supplements, and confectionery products due to consistent performance. Liquid form grows steadily as beverage producers adopt tagatose for low-calorie drink formulations. Crystal and granular forms gain traction in tabletop sweeteners and functional food products. Increasing use of tagatose in processed foods and specialty nutrition supports growth across all formats.

Key Growth Drivers

Rising Demand for Low-Calorie and Low-Glycemic Sweeteners

Consumers seek healthier sugar alternatives, driving strong demand for tagatose due to its low-calorie content and minimal impact on blood glucose levels. Food manufacturers incorporate tagatose into bakery items, beverages, and confectionery products to meet growing interest in diabetes-friendly and weight-management diets. Increased awareness of metabolic health encourages adoption across global markets. Regulatory support for natural sweeteners further boosts usage in packaged foods. This shift toward health-focused consumption plays a key role in expanding tagatose adoption.

- For instance, Tate & Lyle validated tagatose in baked goods with a measured glycemic response of 3 on standardized glucose testing. CJ CheilJedang demonstrated tagatose stability at baking temperatures up to 180°C across multiple product trials.

Growing Use in Functional and Nutraceutical Products

Tagatose gains traction in dietary supplements and functional foods due to its prebiotic properties and gut-health benefits. Manufacturers integrate tagatose into fiber blends, probiotic formulations, and digestive wellness products. Its compatibility with nutraceutical ingredients supports product diversification in wellness categories. Rising consumer interest in digestive health and immunity drives new formulation development. The expanding nutraceutical industry strengthens long-term demand for high-quality sweetener alternatives like tagatose.

- For instance, Nutrilab NV incorporated tagatose into synbiotic formulations supporting over 1×10⁹ CFU probiotic viability after 24 months of shelf testing. Arla Foods Ingredients confirmed tagatose solubility above 600 g/L in liquid nutrition blends used for digestive health applications.

Expansion Across Pharmaceutical and Personal Care Applications

Pharmaceutical companies use tagatose in diabetic-friendly formulations and oral care products due to its low cariogenic effect and favorable sweetness profile. It also supports controlled-release compositions and therapeutic blends. Personal care brands adopt tagatose for moisturizing and skin-conditioning benefits. Growing research exploring new biomedical uses expands application potential. Rising investment in sugar alternatives across pharma and cosmetics sectors reinforces market growth.

Key Trends & Opportunities

Shift Toward Natural and Clean-Label Sweetener Solutions

Consumers show strong preference for natural, non-artificial sweeteners, creating opportunities for tagatose due to its natural origin and clean-label acceptance. Food and beverage companies reformulate products to replace synthetic sweeteners with plant-derived alternatives. This trend expands opportunities in premium, organic, and health-focused categories. Rising demand for natural ingredients in beverages, snacks, and lifestyle nutrition products supports broader adoption. Clean-label positioning strengthens market penetration across global regions.

- For instance, the general production of tagatose is achieved through enzymatic conversion. Reputable chemical suppliers provide analytical-grade tagatose for research purposes, confirming its established molecular weight.

Increasing Adoption in Low-Calorie Product Innovation

Growing interest in low-calorie and sugar-reduced foods drives innovation in formulations that incorporate tagatose for improved taste and functionality. Manufacturers explore tagatose in energy bars, dairy alternatives, frozen desserts, and ready-to-drink beverages. Opportunities expand as companies seek sweeteners with better stability, browning performance, and mouthfeel. Advancements in production technology reduce costs and support wider product development. Rising demand for premium low-sugar products fuels new market opportunities.

- For instance, Manus Bio developed a fermentation-based process for tagatose intermediates used in low-sugar formulations. Tagatose has been shown to be stable across typical thermal processing conditions, with minimal degradation during storage at typical refrigerated and ambient temperatures in beverages, including milk and dairy-alternative prototypes.

Key Challenges

High Production Costs and Limited Commercial-Scale Manufacturing

Tagatose production remains cost-intensive due to complex processing steps and reliance on advanced enzymatic technologies. Limited manufacturing capacity restricts large-scale availability and affects pricing stability. High production costs hinder adoption in price-sensitive markets, slowing penetration into mass-market food categories. Companies face challenges in scaling up efficient production to meet rising global demand. Investment in new technologies is required to improve yield and reduce costs.

Regulatory and Formulation Challenges in Certain Applications

Although tagatose is approved in many regions, regulatory variations affect its adoption in global markets. Formulation challenges arise due to its unique melting and browning characteristics, which may require adjustments in baking and confectionery processes. Some manufacturers face compatibility issues with specific ingredients in beverages or supplements. These hurdles slow product development timelines and increase reformulation costs. Overcoming regulatory and technical barriers remains essential for broader market expansion.

Regional Analysis

North America

North America holds a 36% share, driven by strong demand for low-calorie sweeteners and rising adoption of clean-label ingredients in food and beverage products. The region benefits from high consumer awareness of metabolic health, increasing interest in diabetic-friendly foods, and rapid growth of functional nutrition brands. Manufacturers integrate tagatose into snacks, beverages, and dietary supplements as they reformulate products to reduce sugar levels. Supportive regulatory frameworks and innovations in sweetener technology further strengthen market expansion. Widespread acceptance of natural alternatives continues to drive steady growth across the region.

Europe

Europe accounts for a 32% share, supported by strict regulations on sugar reduction, rising health consciousness, and strong demand for natural sweeteners. Food companies widely adopt tagatose in confectionery, bakery, and dairy categories to meet lower-sugar formulation requirements. The region’s mature functional food market encourages the use of tagatose in nutraceuticals and digestive wellness products. Growing consumer preference for clean-label and plant-derived ingredients strengthens adoption. Ongoing product innovation and sustainability-focused manufacturing practices further support market development across major European economies.

Asia Pacific

Asia Pacific holds a 24% share, fueled by rising incidences of diabetes and obesity, increasing consumer focus on healthier diets, and rapid growth of the packaged food industry. Demand for tagatose rises in beverages, dairy alternatives, and functional snacks as manufacturers seek natural sweeteners with low glycemic impact. Expanding middle-class populations and growing awareness of nutritional benefits contribute to wider acceptance. The region also benefits from expanding nutraceutical production and greater investment in sugar-reduction technologies. Urbanization and lifestyle shifts continue to strengthen long-term demand.

Latin America

Latin America captures a 5% share, driven by gradual adoption of reduced-sugar foods and beverages and rising awareness of healthier sweetener alternatives. Countries experience growing demand for low-calorie products due to increasing obesity and diabetes rates. Food manufacturers introduce tagatose-based formulations in confectionery and bakery categories to align with shifting consumer preferences. However, high production costs and limited local manufacturing capacity restrain faster adoption. Partnerships with international suppliers and expanding health-focused product lines support moderate market growth across the region.

Middle East & Africa

The Middle East & Africa region holds a 3% share, supported by rising interest in functional foods, increasing prevalence of lifestyle diseases, and growing demand for natural sweeteners in premium product categories. Adoption expands mainly in urban markets where consumers favor low-sugar and diabetic-friendly options. Food and beverage brands use tagatose in energy bars, dairy drinks, and confectionery products. Limited manufacturing infrastructure and higher import dependency slow broader market penetration. Nonetheless, expanding health awareness and rising investments in food innovation create steady long-term opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Type

- Food-grade tagatose

- Pharmaceutical-grade tagatose

- Industrial-grade tagatose

- Specialty-grade tagatose

By Application

- Food and beverages

- Dietary supplements

- Pharmaceuticals

- Personal care products

By Form

- Powder

- Liquid

- Crystal

- Granular

By Distribution Channel

- Direct sales

- Retail stores

- Online channels

- Specialty distributors

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Tagatose market is shaped by key players such as Bonumose Inc., CJ CheilJedang Corporation, Nutrilab NV, Ingredion Incorporated, Manus Bio, Südzucker AG, Tate & Lyle PLC, FrieslandCampina Ingredients, Arla Foods Ingredients, and Sigma Aldrich (Merck Group). These companies compete by advancing production technologies, improving fermentation efficiency, and expanding supply capabilities to meet rising demand for low-calorie sweeteners. Many players focus on scaling up cost-effective manufacturing to address high production barriers associated with tagatose. Strategic partnerships with food and beverage companies support broader adoption in confectionery, dairy, and functional food applications. Firms also invest in R&D to enhance purity, stability, and performance in various formulations. Expansion into nutraceuticals and clean-label product categories further strengthens competitive positioning. As health-conscious consumers seek natural sugar alternatives, companies emphasize sustainable production, regulatory compliance, and global distribution to capture growing market opportunities.

Key Player Analysis

Recent Developments

- In 2025, CJ CheilJedang remained a major industrial producer of D-tagatose with annual capacity exceeding 3000 tons.

- In August 2024, the U.S. District Court for the District of Columbia issued a significant preliminary court victory for Bonumose in its legal challenge against the FDA’s tagatose labeling rules.

- In March 2024, Bonumose Inc. tagatose earned the NutraStrong™ Prebiotic Verified certification.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Form, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural low-calorie sweeteners will rise as consumers reduce sugar intake.

- Food and beverage manufacturers will expand tagatose use in bakery, dairy, and confectionery products.

- Functional food brands will adopt tagatose for its prebiotic and gut-health benefits.

- Advances in fermentation and enzymatic production will lower manufacturing costs.

- Clean-label trends will strengthen adoption across premium and organic product categories.

- Pharmaceutical applications will grow as tagatose supports diabetic-friendly formulations.

- Personal care brands will use tagatose for moisturizing and skin-conditioning properties.

- Partnerships between ingredient suppliers and food producers will accelerate global availability.

- Regulatory approvals in additional countries will expand market reach.

- Rising interest in sugar-reduction strategies will drive new product innovation across sectors.