Market Overview

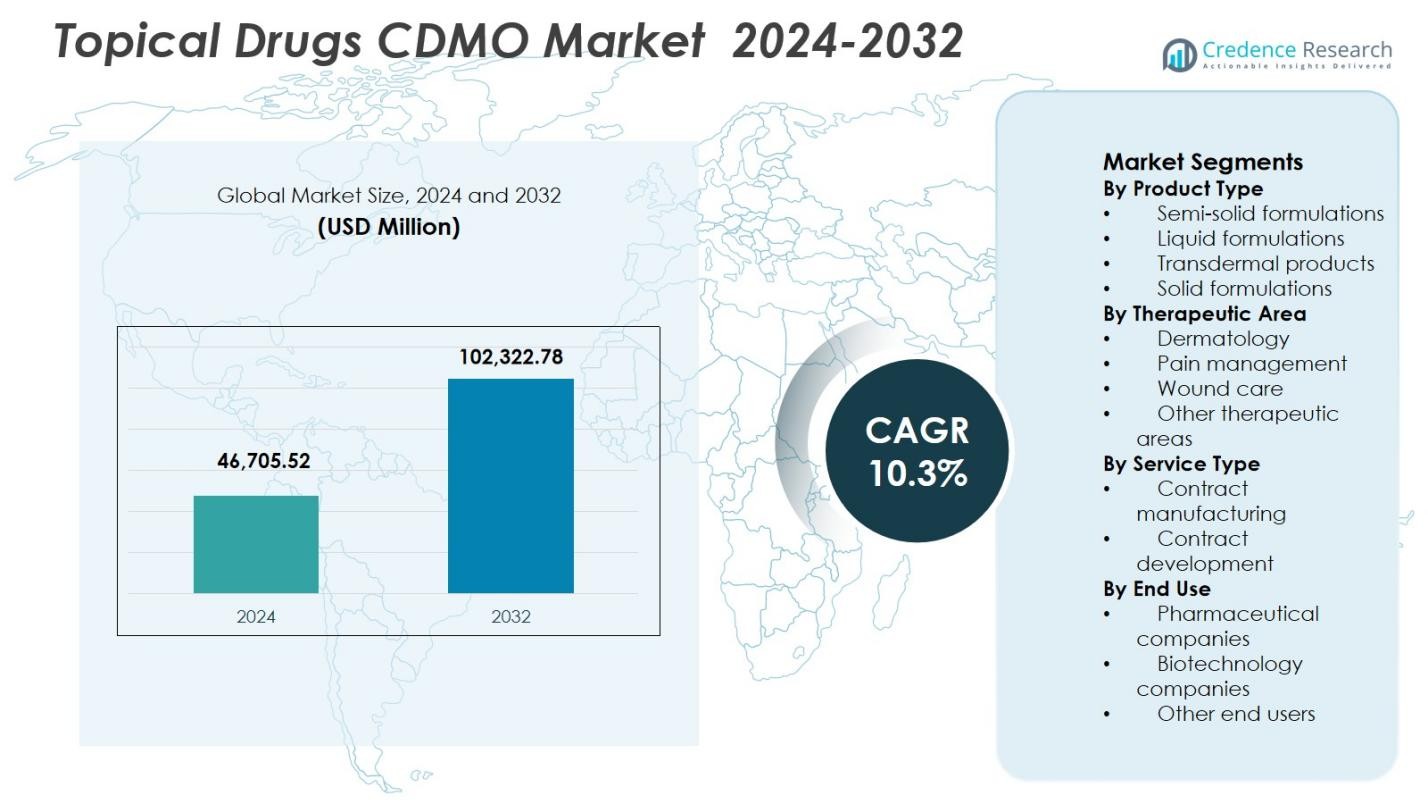

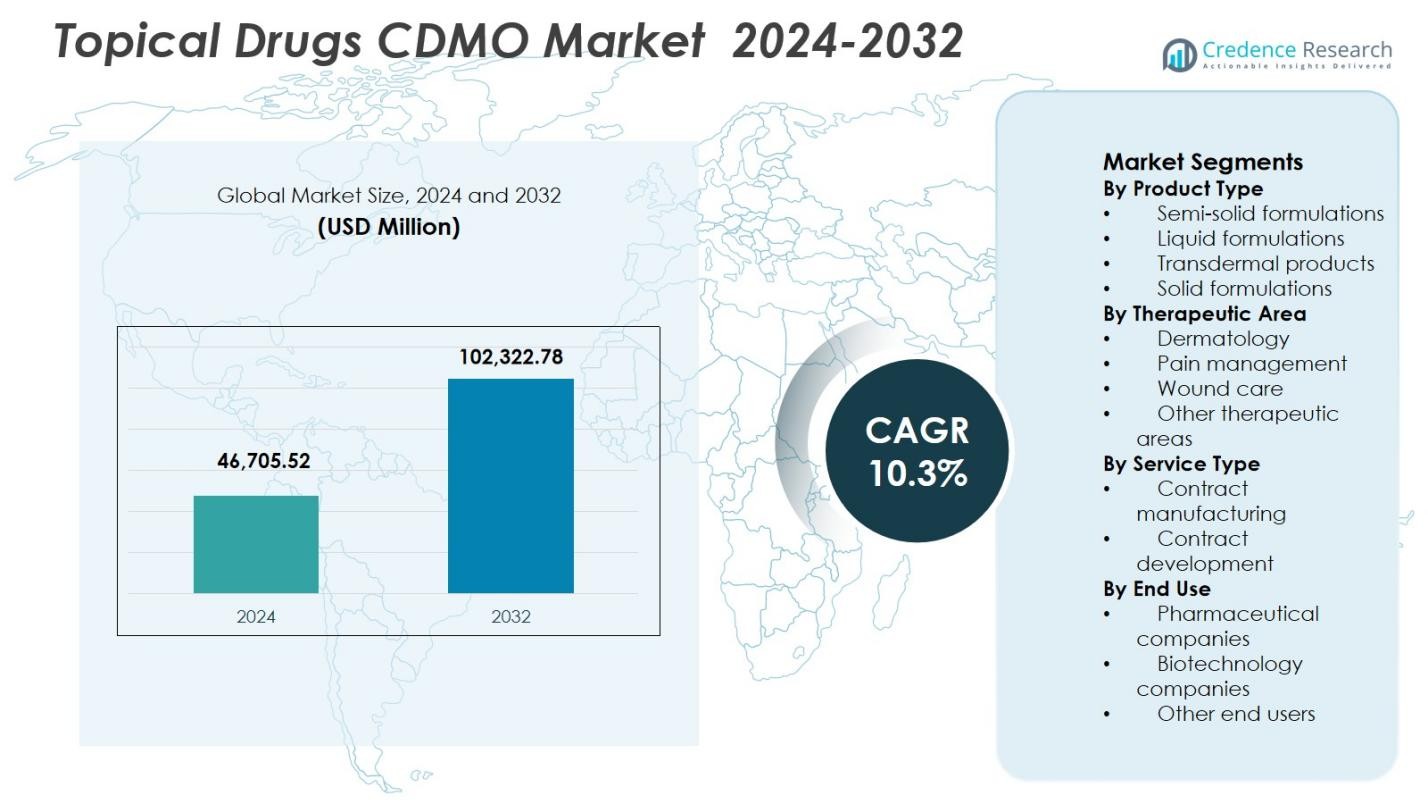

The Topical Drugs CDMO Market size was valued at USD 46,705.52 million in 2024 and is anticipated to reach USD 102,322.78 million by 2032, expanding at a CAGR of 10.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Topical Drugs CDMO Market Size 2024 |

USD 46,705.52 Million |

| Topical Drugs CDMO Market , CAGR |

10.3% |

| Topical Drugs CDMO Market Size 2032 |

USD 102,322.78 Million |

Topical Drugs CDMO Market is supported by a strong presence of established outsourcing providers including Piramal Pharma Solutions, PCI Pharma Services, Cambrex, Bora Pharmaceuticals, Ascendia Pharmaceuticals, MedPharm, Contract Pharmaceuticals, DPT Laboratories, Pierre Fabre Group, and The Lubrizol Corporation. These companies focus on integrated formulation development, scalable manufacturing, and regulatory-compliant supply of semi-solid, liquid, and transdermal topical products. Investments in advanced formulation technologies, bioequivalence testing, and lifecycle management capabilities strengthen their service offerings and client retention. North America leads the market with a 38.6% share, driven by high outsourcing adoption, strong dermatology and pain management drug pipelines, and the presence of mature CDMO infrastructure supporting both branded and generic topical drug development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Topical Drugs CDMO Market was valued at USD 46,705.52 million in 2024 and is projected to grow at a CAGR of 10.3% through 2032, supported by rising outsourcing of formulation development and large-scale manufacturing by pharmaceutical companies.

- Increasing demand for complex topical formulations acts as a key driver, with semi-solid formulations holding a 46.8% segment share, driven by high usage in dermatology and pain management therapies requiring specialized manufacturing expertise.

- Market trends highlight growing adoption of transdermal systems and integrated CDMO service models, while leading players strengthen positions through advanced formulation technologies, bioequivalence support, and end-to-end development capabilities.

- Regulatory complexity and capacity constraints remain restraints, as stringent approval requirements and rising operational costs increase development timelines and pressure CDMO margins, particularly for complex generics.

- Regionally, North America leads with a 38.6% market share, followed by Europe at 29.4% and Asia Pacific at 21.8%, reflecting strong outsourcing adoption, mature pharmaceutical infrastructure, and expanding generic pipelines.

Market Segmentation Analysis:

By Product Type:

The Topical Drugs CDMO Market by product type is led by semi-solid formulations, which account for 46.8% market share in 2024. Creams, ointments, gels, and lotions dominate outsourcing demand due to their widespread use in dermatology and pain-related therapies, coupled with complex formulation and stability requirements. CDMOs with advanced rheology control, emulsification expertise, and scalable filling capabilities gain preference from pharmaceutical sponsors. Liquid formulations hold 27.4% share, supported by sprays and solutions, while transdermal products at 15.6% benefit from sustained-release demand. Solid topical formats represent 10.2%, driven by niche dermatological applications.

- For instance, Mission CDMO offers contract development and manufacturing for topical liquids such as solutions alongside semi-solids. LGM Pharma supports formulation development of non-sterile topical liquids in forms like solutions.

By Therapeutic Area:

By therapeutic area, dermatology remains the dominant sub-segment with a 52.3% market share, supported by high prescription volumes for acne, eczema, psoriasis, and fungal infections. Rising skin disorder prevalence and continuous product reformulations drive sustained outsourcing to CDMOs. Pain management holds 21.8% share, led by topical NSAIDs and analgesic patches requiring controlled drug delivery expertise. Wound care accounts for 16.1%, benefiting from increased use of antimicrobial and healing-enhanced formulations. Other therapeutic areas contribute 9.8%, supported by niche indications and customized topical delivery solutions requiring specialized development capabilities.

- For instance, LEO Pharma partnered with a dedicated dermatology CDMO to develop and manufacture a new foam formulation of calcipotriol/betamethasone for psoriasis, using the CDMO’s ex vivo skin models and formulation analytics to optimize drug retention and patient compliance.

By Service Type:

The service type segment is dominated by contract manufacturing, capturing 63.7% market share, as pharmaceutical companies increasingly outsource large-scale production, packaging, and regulatory-compliant supply of topical drugs. Cost efficiency, capacity flexibility, and reduced capital expenditure remain key growth drivers. Contract development holds 36.3% share, driven by growing demand for formulation optimization, bioequivalence support, and lifecycle management of topical products. Increasing complexity of topical delivery systems and stricter regulatory requirements encourage early-stage collaboration with CDMOs, strengthening development-focused service demand across both branded and generic pharmaceutical pipelines.

Key Growth Drivers

Rising Outsourcing of Complex Topical Formulations

The Topical Drugs CDMO Market benefits strongly from increasing outsourcing of complex topical formulations by pharmaceutical and biotechnology companies. Semi-solid, transdermal, and combination topical products require specialized formulation know-how, stability testing, and scale-up capabilities that many sponsors lack in-house. CDMOs offer advanced development platforms, validated manufacturing lines, and regulatory expertise, enabling faster time-to-market. Growing pressure to optimize costs, reduce capital investments, and maintain compliance with evolving quality standards continues to drive long-term outsourcing partnerships across branded and generic topical drug portfolios.

- For instance, Ascendia Pharmaceuticals provides CDMO services for topical semi-solid dosage forms like creams and ointments, supporting pharmaceutical clients in overcoming solubility challenges through nano-technology approaches for dermatological applications.

Expanding Prevalence of Dermatological and Pain Disorders

Rising incidence of chronic skin conditions and musculoskeletal pain significantly drives demand for topical drug development and manufacturing services. Increasing diagnosis rates of eczema, psoriasis, acne, and localized pain conditions support sustained product launches and reformulations. Pharmaceutical companies increasingly favor topical delivery to minimize systemic side effects and improve patient adherence. This trend strengthens CDMO engagement for formulation optimization, bioequivalence support, and commercial-scale production, particularly for dermatology and pain management therapies with high prescription volumes and recurring demand cycles.

- For instance, Dermavant Sciences launched VTAMA (tapinarof) cream 1%, a non-steroidal aryl hydrocarbon receptor agonist approved by the FDA in May 2022 for topical treatment of plaque psoriasis in adults, applicable to sensitive areas like face and skin folds without duration restrictions.

Growing Generic and Lifecycle Management Activities

The expansion of generic topical drugs and lifecycle management strategies acts as a major growth catalyst for the Topical Drugs CDMO Market. Patent expirations and pricing pressures encourage pharmaceutical companies to reformulate, rebrand, and extend product lifecycles through improved delivery systems and differentiated topical formats. CDMOs play a critical role in supporting these strategies by providing formulation redevelopment, scale-up, and regulatory submission support. Increasing focus on abbreviated approval pathways further accelerates outsourcing of development and manufacturing activities.

Key Trends & Opportunities

Increasing Demand for Transdermal and Advanced Delivery Systems

A notable trend in the Topical Drugs CDMO Market is the growing adoption of transdermal patches and advanced topical delivery platforms. Controlled drug release, improved bioavailability, and enhanced patient compliance make these systems attractive for both chronic and acute therapies. CDMOs investing in permeation enhancement technologies, adhesive science, and clinical performance testing gain competitive advantage. This shift creates new opportunities for long-term development partnerships, particularly for pain management and hormone-based therapies requiring consistent dosing and regulatory precision.

- For instance, AdhexPharma specializes in drug-in-adhesive transdermal patches that release active ingredients gradually through an adhesive layer in direct skin contact, supporting applications like chronic pain management with fentanyl for consistent plasma levels.

Strategic Partnerships and Integrated Service Models

Pharmaceutical companies increasingly prefer CDMOs offering integrated development-to-commercialization services. End-to-end solutions covering formulation development, clinical supply, scale-up, packaging, and regulatory support reduce coordination complexity and development timelines. This trend presents strong growth opportunities for CDMOs expanding capabilities through strategic partnerships, acquisitions, and technology investments. Integrated service models enhance customer retention, improve project continuity, and position CDMOs as long-term collaborators rather than transactional suppliers in topical drug pipelines.

- For instance, Gilead worked with WuXi AppTec on its oncology pipeline, leveraging WuXi’s combined discovery, clinical trials, manufacturing, and scale-up services to advance therapies efficiently while ensuring quality and compliance.

Key Challenges

Regulatory Complexity and Approval Uncertainty

Regulatory scrutiny poses a significant challenge in the Topical Drugs CDMO Market, particularly for complex generics and transdermal products. Demonstrating bioequivalence, in vitro release testing consistency, and product performance equivalence remains technically demanding and time-consuming. Evolving regulatory expectations across regions increase development costs and extend approval timelines. CDMOs must continuously invest in compliance systems, analytical capabilities, and documentation to mitigate risks, placing pressure on operational margins and resource allocation.

Capacity Constraints and Cost Pressures

Capacity limitations and rising operational costs present ongoing challenges for CDMOs supporting topical drug manufacturing. Increasing demand for specialized equipment, cleanroom environments, and skilled formulation scientists intensifies competition for resources. Inflationary pressures on raw materials, energy, and labor further impact profitability. CDMOs must balance capacity expansion with cost control while maintaining stringent quality standards. Failure to scale efficiently may limit the ability to support large-volume commercial contracts and emerging client requirements.

Regional Analysis

North America

North America holds a 38.6% market share in the Topical Drugs CDMO Market, driven by a strong pharmaceutical base, high outsourcing adoption, and advanced regulatory infrastructure. The region benefits from a large volume of dermatology and pain management drug approvals, supporting continuous demand for formulation development and commercial manufacturing. Presence of established CDMOs with integrated development-to-packaging capabilities accelerates sponsor reliance on external partners. High R&D spending, strong generic drug pipelines, and frequent lifecycle management initiatives further strengthen outsourcing activity. The United States remains the primary contributor due to its mature topical drug market and innovation-driven pharmaceutical ecosystem.

Europe

Europe accounts for a 29.4% market share in the Topical Drugs CDMO Market, supported by robust dermatology drug consumption and strong regulatory harmonization across the region. Countries such as Germany, France, and the United Kingdom drive outsourcing demand due to active generic manufacturing and increasing reformulation efforts. Stringent quality and compliance standards encourage pharmaceutical companies to collaborate with specialized CDMOs offering validated manufacturing and regulatory expertise. Growing focus on sustainable manufacturing practices and advanced topical delivery systems also enhances CDMO engagement. The region’s emphasis on high-quality generics and branded topical therapies sustains steady market expansion.

Asia Pacific

Asia Pacific represents a 21.8% market share in the Topical Drugs CDMO Market, driven by rapid pharmaceutical manufacturing expansion and cost-efficient outsourcing models. Increasing prevalence of skin disorders, rising healthcare access, and expanding generic drug production support strong demand for topical drug development services. Countries such as India, China, and South Korea attract global sponsors seeking scalable manufacturing and formulation expertise. Improving regulatory frameworks and growing investments in advanced manufacturing infrastructure further strengthen regional capabilities. The region also benefits from increasing domestic pharmaceutical pipelines and rising exports of topical formulations to regulated markets.

Latin America

Latin America holds a 6.1% market share in the Topical Drugs CDMO Market, supported by expanding pharmaceutical manufacturing activity and growing demand for dermatology treatments. Brazil and Mexico serve as key contributors due to improving healthcare infrastructure and rising generic drug consumption. Pharmaceutical companies increasingly outsource formulation development and manufacturing to regional CDMOs to address local market needs and regulatory requirements. Growth in chronic skin conditions and localized pain therapies supports steady topical drug demand. Ongoing investments in quality compliance and capacity expansion gradually enhance the region’s attractiveness for both domestic and international sponsors.

Middle East & Africa

The Middle East & Africa region accounts for a 4.1% market share in the Topical Drugs CDMO Market, driven by improving healthcare access and rising demand for dermatology and wound care products. Growth is supported by increasing pharmaceutical manufacturing initiatives in countries such as Saudi Arabia, the UAE, and South Africa. Governments encourage local drug production through regulatory reforms and investment incentives, boosting CDMO participation. Expanding treatment coverage for skin infections and chronic wounds supports outsourcing needs. While still emerging, gradual infrastructure development and regulatory alignment continue to strengthen long-term market potential.

Market Segmentations:

By Product Type

- Semi-solid formulations

- Liquid formulations

- Transdermal products

- Solid formulations

By Therapeutic Area

- Dermatology

- Pain management

- Wound care

- Other therapeutic areas

By Service Type

- Contract manufacturing

- Contract development

By End Use

- Pharmaceutical companies

- Biotechnology companies

- Other end users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis: Piramal Pharma Solutions, PCI Pharma Services, Cambrex, Bora Pharmaceuticals, Ascendia Pharmaceuticals, MedPharm, Contract Pharmaceuticals, DPT Laboratories, Pierre Fabre Group, and The Lubrizol Corporation. The Topical Drugs CDMO Market features a mix of global CDMOs and specialized formulation-focused providers competing on technical expertise, regulatory strength, and end-to-end service capabilities. Leading players emphasize integrated development and manufacturing platforms to support complex semi-solid, liquid, and transdermal products. Strategic investments in advanced formulation technologies, bioequivalence testing, and scalable manufacturing infrastructure strengthen long-term client relationships. Partnerships with branded and generic pharmaceutical companies, along with selective acquisitions, expand geographic reach and service breadth. Compliance with stringent regulatory standards and the ability to accelerate time-to-market remain key differentiators, positioning established CDMOs as preferred outsourcing partners across dermatology, pain management, and wound care segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, Granules India completed its acquisition of Senn Chemicals AG, a Swiss CDMO with expertise in peptide-based therapeutics relevant to advanced topical formulations.

- In June 2024, Aterian Investment Partners completed the acquisition of Contract Pharmaceuticals Limited (CPL), expanding its footprint in non-sterile liquid and semi-solid dosage CDMO services.

- In July 2024, MedPharm and Tergus Pharma merged to form a stronger topical and transdermal CDMO entity with enhanced scientific, clinical, and commercial manufacturing capabilities.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Therapeutic Area, Service Type, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as pharmaceutical companies increase reliance on outsourced development and manufacturing for complex topical formulations.

- Demand will strengthen for CDMOs offering integrated services spanning formulation development, scale-up, and commercial manufacturing.

- Growth will accelerate with rising adoption of semi-solid and transdermal delivery systems across dermatology and pain management therapies.

- Regulatory expertise will become a critical differentiator as approval pathways for topical and complex generics evolve.

- Investment in advanced formulation technologies and analytical testing capabilities will shape long-term competitiveness.

- Strategic partnerships and acquisitions will increase as CDMOs seek to broaden geographic reach and service portfolios.

- Asia Pacific will gain prominence due to expanding pharmaceutical manufacturing capacity and cost-efficient outsourcing models.

- Sustainability initiatives and efficient manufacturing practices will influence client selection of CDMO partners.

- Increasing lifecycle management and reformulation activities will support steady project pipelines.

- Long-term growth will favor CDMOs capable of supporting both branded innovation and high-volume generic production.