Market Overview

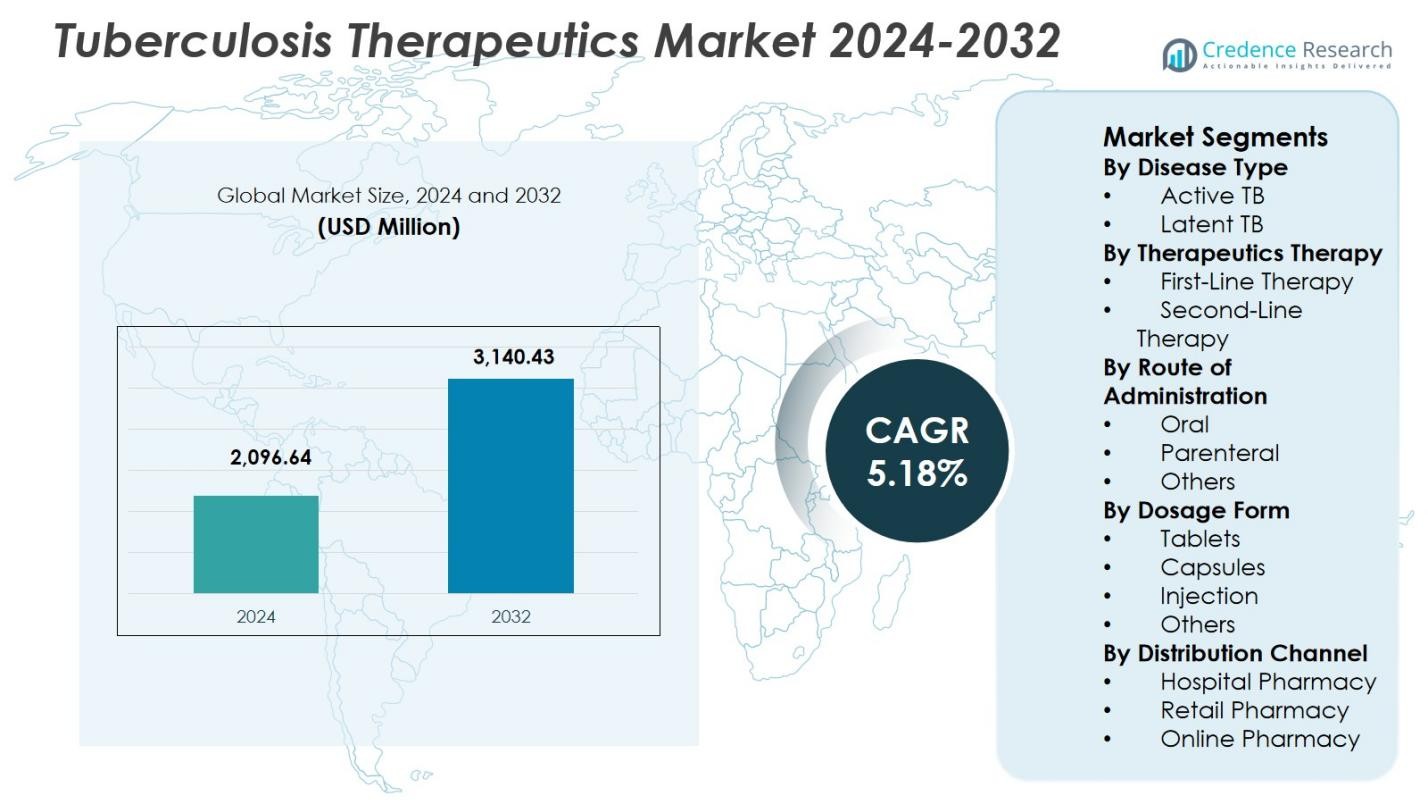

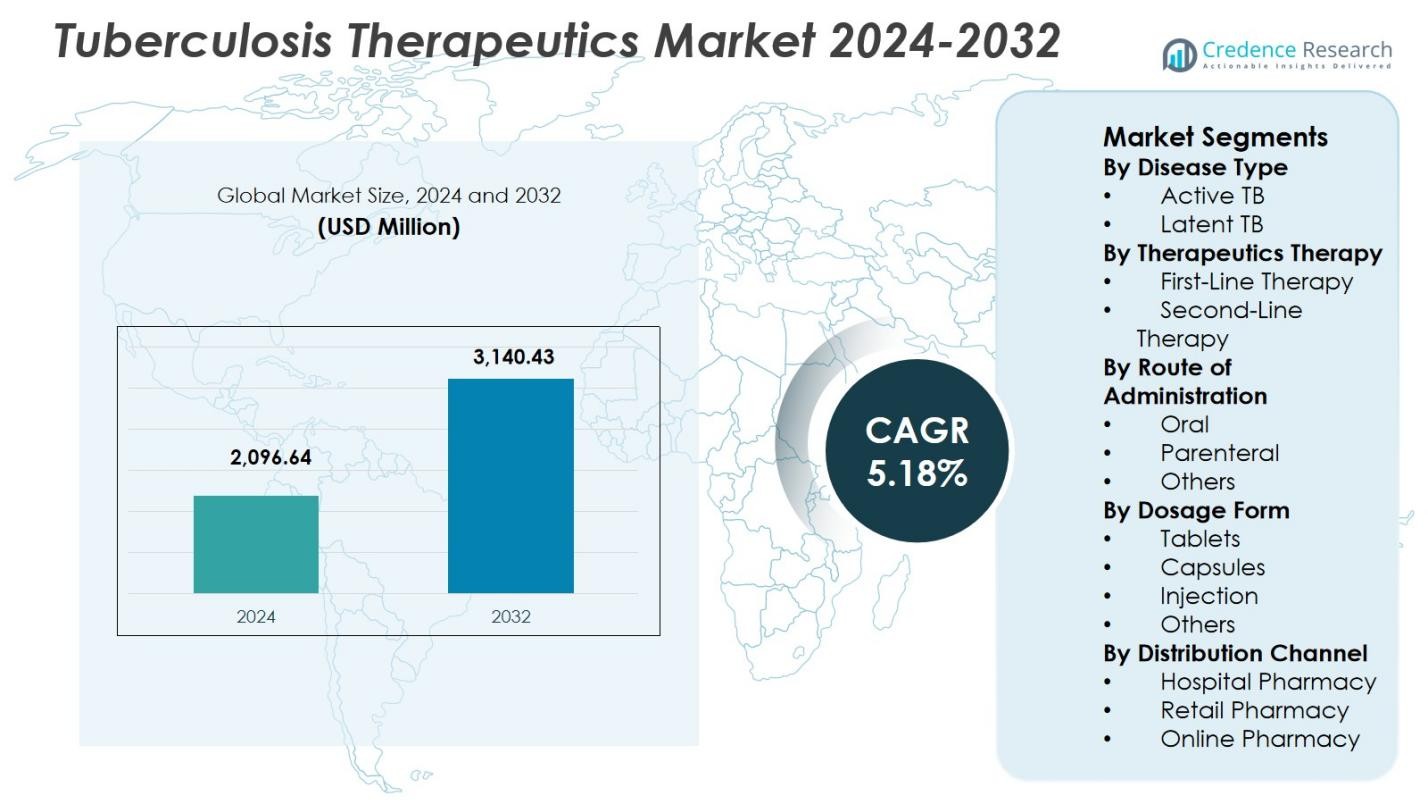

The Tuberculosis Therapeutics Market size was valued at USD 2,096.64 million in 2024 and is anticipated to reach USD 3,140.43 million by 2032, growing at a CAGR of 5.18% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tuberculosis Therapeutics Market Size 2024 |

USD 2,096.64 Million |

| Tuberculosis Therapeutics Market, CAGR |

5.18% |

| Tuberculosis Therapeutics Market Size 2032 |

USD 3,140.43 Million |

Tuberculosis Therapeutics Market features leading players such as Pfizer Inc., Sanofi, Johnson & Johnson Services Inc., Bayer Health Care, Otsuka Pharmaceutical Co., Ltd., Lupin, Macleods Pharmaceuticals Ltd., Mylan N.V., Eli Lilly and Company, and Aventis Pharmaceuticals Limited, all contributing to advancements in first-line and second-line treatment portfolios. These companies focus on improving drug efficacy, developing fixed-dose combinations, and expanding access through public health partnerships. Regionally, Asia-Pacific led the Tuberculosis Therapeutics Market with 42.7% share in 2024, driven by the highest global TB burden, strong government programs, and widespread availability of essential therapies across high-incidence countries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Tuberculosis Therapeutics Market reached USD 2,096.64 million in 2024 and is projected to grow at a CAGR of 5.18%, driven by rising treatment demand and expanding access programs.

- Market growth is supported by strong government-led TB elimination initiatives, high prevalence of active TB holding 74.6% share, and extensive use of first-line therapy with 68.9% share.

- Key trends include the rising focus on drug-resistant TB management, adoption of fixed-dose combinations, and the shift toward patient-centric and digitally supported treatment models.

- Major players such as Pfizer Inc., Sanofi, Johnson & Johnson Services Inc., Bayer Health Care, and Otsuka Pharmaceutical enhance market presence through improved formulations and broader distribution partnerships.

- Asia-Pacific led the market with 42.7% share in 2024, followed by Middle East & Africa at 21.3%; oral therapies dominated with 82.3% share owing to ease of administration and high adherence potential.

Market Segmentation Analysis:

By Disease Type:

The Tuberculosis Therapeutics Market by disease type is led by Active TB, which accounted for 74.6% market share in 2024. This dominance is driven by the high global burden of active tuberculosis, mandatory treatment protocols, and strong government-led TB control programs. Active TB requires immediate and prolonged pharmacological intervention to prevent transmission, supporting sustained drug demand. Higher diagnosis rates, wider access to first-line drug regimens, and funding support from public health agencies further reinforce segment leadership. In contrast, latent TB treatment adoption remains lower due to asymptomatic presentation and limited screening coverage.

- For instance, Lupin, the world’s largest supplier of first-line anti-TB drugs, partnered with TB Alliance in September 2021 to commercialize a new regimen for highly drug-resistant TB, targeting access in about 140 high-burden countries.

By Therapeutics Therapy:

By therapeutics therapy, First-Line Therapy dominated the Tuberculosis Therapeutics Market with a 68.9% market share in 2024. The segment benefits from established clinical guidelines recommending rifampicin-, isoniazid-, ethambutol-, and pyrazinamide-based regimens as standard care. Strong physician familiarity, lower treatment cost, and wide availability through national TB programs support high utilization. Fixed-dose combinations and improved adherence strategies further strengthen first-line therapy adoption. Second-line therapy remains limited to drug-resistant TB cases, constrained by higher toxicity, longer treatment duration, and increased monitoring requirements.

- For instance, Sandoz offers Rimstar 4FDC tablets containing rifampicin 150 mg, isoniazid 75 mg, pyrazinamide 400 mg, and ethambutol 275 mg hydrochloride, aligning with WHO-recommended dosing for the intensive phase.

By Route of Administration:

The Tuberculosis Therapeutics Market by route of administration is dominated by Oral therapy, holding 82.3% market share in 2024. Oral formulations remain the preferred option due to ease of administration, suitability for long-term treatment, and compatibility with outpatient care models. National TB elimination programs prioritize oral regimens to improve adherence and reduce hospitalization costs. Fixed-dose oral combinations also simplify dosing and enhance compliance. Parenteral therapies are mainly reserved for severe or drug-resistant cases, while other routes maintain limited use due to complexity and higher healthcare resource dependence.

Key Growth Driver

Rising Global Tuberculosis Burden

The Tuberculosis Therapeutics Market continues to expand due to the sustained global burden of tuberculosis, particularly in developing and high-population regions. High transmission rates, delayed diagnosis, and increased vulnerability among immunocompromised populations intensify treatment demand. Mandatory treatment of active TB cases under public health regulations ensures steady therapeutic consumption. Continuous screening initiatives and expanded access to care further strengthen drug utilization, positioning disease prevalence as a primary and long-term growth catalyst for the market.

- For instance, Johnson & Johnson received U.S. FDA traditional approval for SIRTURO (bedaquiline) in 2024 as part of combination therapy for pulmonary TB resistant to rifampicin and isoniazid in adults and pediatric patients aged 5 years and older weighing at least 15 kg.

Strong Government and NGO-Backed Treatment Programs

Extensive government and non-government organization involvement drives growth in the Tuberculosis Therapeutics Market. National TB elimination programs prioritize universal access to treatment through free or subsidized drug distribution. Centralized procurement and large-scale public funding improve availability of essential therapies across public healthcare systems. These initiatives also emphasize treatment adherence and monitoring, ensuring sustained demand for TB therapeutics and reinforcing long-term market stability.

- For instance, India’s National TB Elimination Programme (NTEP) provides free diagnostics and quality-assured drugs to all TB patients nationwide, alongside the Nikshay Poshan Yojana (NPY), which disburses financial support of ₹1,000 per month for nutrition during the course of treatment.

Advancements in TB Treatment Regimens

Ongoing improvements in tuberculosis treatment regimens significantly support the Tuberculosis Therapeutics Market. Shorter treatment durations, optimized dosing schedules, and fixed-dose combinations enhance patient compliance and therapeutic outcomes. Updated clinical guidelines reflecting improved drug efficacy and safety increase physician confidence in treatment protocols. These advancements reduce relapse rates and strengthen adoption across both drug-sensitive and resistant TB cases.

Key Trend & Opportunity

Increasing Focus on Drug-Resistant Tuberculosis

Rising cases of multidrug-resistant and extensively drug-resistant TB create major opportunities within the Tuberculosis Therapeutics Market. Healthcare systems are expanding resistance testing and prioritizing advanced treatment regimens for resistant strains. Inclusion of second-line and novel therapies in national guidelines supports higher adoption. This trend drives demand for specialized therapeutics and strengthens market potential in regions facing growing antimicrobial resistance.

- For instance, TB Alliance granted Lupin Limited a non-exclusive license in 2021 to manufacture pretomanid as part of the three-drug BPaL regimen for highly drug-resistant TB. Lupin aims to commercialize this in approximately 140 countries, including high-burden areas, to improve access to novel therapies.

Shift Toward Patient-Centric Treatment Models

The Tuberculosis Therapeutics Market is witnessing a shift toward patient-centric care approaches focused on improving adherence and treatment success. Simplified oral regimens, outpatient-based therapy, and digital adherence support systems enhance convenience for patients. Community-level treatment delivery reduces healthcare system burden while improving continuity of care. These models create opportunities for therapies aligned with ease of use and long-term compliance.

- For instance, Johnson & Johnson’s bedaquiline (SIRTURO) treatment for MDR-TB incorporated electronic dose monitoring like Wisepill devices, yielding median adherence of 97% over six months in HIV co-infected patients.

Key Challenge

Prolonged Treatment Duration and Adherence Issues

Long treatment duration remains a critical challenge in the Tuberculosis Therapeutics Market. Standard TB regimens require months of uninterrupted therapy, leading to adherence difficulties and increased dropout rates. Poor compliance contributes to treatment failure and resistance development. Healthcare systems face ongoing challenges in patient tracking and follow-up, particularly in resource-constrained settings, limiting overall treatment effectiveness. Extended treatment also increases healthcare costs and patient burden, exacerbating socioeconomic barriers and straining public health programs trying to achieve global TB elimination targets.

Drug-Related Toxicity and Safety Concerns

Adverse effects associated with TB drugs pose significant challenges for the Tuberculosis Therapeutics Market. Common side effects, including liver toxicity and neurological complications, can lead to dose modifications or therapy discontinuation. These safety concerns increase monitoring requirements and healthcare costs. Managing drug tolerability remains essential to ensuring sustained patient adherence and improving long-term therapeutic outcomes, particularly in vulnerable populations with comorbidities and limited access to specialized clinical supervision.

Regional Analysis

North America

North America accounted for 14.6% market share in 2024, driven by strong diagnostic infrastructure, high treatment adherence, and sustained public health funding. The U.S. leads the region with advanced surveillance programs and consistent investment in TB control initiatives targeting high-risk populations, including immigrants and immunocompromised individuals. Widespread availability of first-line and second-line regimens, coupled with active monitoring of drug-resistant cases, supports stable demand. Continued emphasis on preventive therapy adoption further strengthens the region’s contribution to the Tuberculosis Therapeutics Market.

Europe

Europe held 9.0% market share in 2024, supported by well-established healthcare systems and structured national TB elimination policies. Eastern Europe contributes significantly due to higher incidence of multidrug-resistant TB, driving increased use of specialized drug regimens. The region benefits from coordinated public health programs, mandatory reporting, and improved access to advanced therapeutics. Investments in rapid diagnostics and community-based treatment models enhance patient outcomes. Collaborative initiatives across EU member states promote surveillance harmonization and strengthen regional capabilities for TB management.

Asia-Pacific

Asia-Pacific dominated the Tuberculosis Therapeutics Market with 42.7% market share in 2024, driven by the world’s highest TB burden across countries such as India, China, Indonesia, and the Philippines. Large-scale government-led TB treatment programs, expanded screening coverage, and free drug distribution systems fuel therapeutic consumption. High prevalence of active TB and rising detection of drug-resistant strains further accelerate demand for diverse treatment regimens. International funding partnerships and broader access to fixed-dose combinations strengthen regional progress toward TB elimination targets.

Latin America

Latin America accounted for 12.4% market share in 2024, supported by expanding public health efforts and increased focus on improving treatment adherence. Countries such as Brazil and Peru lead regional TB control due to comprehensive national programs and enhanced diagnostic access. Growing urbanization and socioeconomic disparities continue to drive active TB incidence, sustaining therapeutic demand. Strengthening supply chains and adoption of WHO-recommended regimens improve treatment continuity. Gradual integration of digital adherence technologies is expected to enhance long-term treatment outcomes.

Middle East & Africa

The Middle East & Africa region held 21.3% market share in 2024, reflecting high disease prevalence, limited healthcare access in rural areas, and rising drug-resistant TB cases. Sub-Saharan Africa remains a key contributor due to TB–HIV co-infection rates and sustained dependence on donor-supported treatment initiatives. Expansion of community-level treatment programs and increased availability of first-line therapies support market growth. International health partnerships continue to enhance diagnostic capacity, although resource constraints and treatment interruptions remain critical challenges impacting therapeutic effectiveness.

Market Segmentations:

By Disease Type

By Therapeutics Therapy

- First-Line Therapy

- Second-Line Therapy

By Route of Administration

By Dosage Form

- Tablets

- Capsules

- Injection

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Tuberculosis Therapeutics Market features key players such as Sanofi, Pfizer Inc., Johnson & Johnson Services Inc., Bayer HealthCare, Otsuka Pharmaceutical, Mylan N.V., Lupin, Macleods Pharmaceuticals Ltd., Eli Lilly and Company, and Aventis Pharmaceuticals Limited. These companies actively strengthen their presence through continuous enhancement of first-line and second-line treatment portfolios, strategic collaborations with public health programs, and participation in global TB drug procurement initiatives. Leading manufacturers prioritize the development of fixed-dose combinations, improved oral formulations, and therapies addressing drug-resistant tuberculosis to meet evolving clinical needs. Partnerships with governmental agencies and non-profit organizations enable wide distribution of essential TB medications in high-burden regions. Additionally, ongoing investments in research targeting shorter treatment durations, improved safety profiles, and next-generation regimens reinforce players’ positions in the global market while supporting long-term tuberculosis elimination efforts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Lupin Limited received clearance from the Central Drugs Standard Control Organization (CDSCO) expert panel to launch its Isoniazid Dispersible Tablets for tuberculosis treatment.

- In November 2025, AN2 Therapeutics announced a research collaboration with GSK to advance boron-based LeuRS-inhibitors targeting tuberculosis, supported by additional funding from the Gates Foundation to accelerate development of novel TB therapies.

- In November 2025, Otsuka Pharmaceutical Co. Ltd. announced the first participants enrolled in the Phase 3 QUANTUM-TB clinical trial for its investigational compound quabodepistat targeting multidrug-resistant pulmonary tuberculosis.

Report Coverage

The research report offers an in-depth analysis based on Disease Type, Therapeutics Therapy, Route Of Administration, Dosage Form, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly shift toward shorter, more effective treatment regimens to improve patient adherence and outcomes.

- Adoption of fixed-dose combinations will continue to rise as healthcare systems prioritize simplified dosing and reduced pill burden.

- Drug-resistant TB management will gain greater focus, driving demand for advanced second-line and novel therapeutics.

- Governments will expand national TB elimination initiatives, strengthening screening, diagnosis, and treatment coverage.

- Digital adherence technologies will play a larger role in monitoring and supporting long-term therapy compliance.

- Public–private partnerships will intensify to ensure affordable access to essential TB medications in high-burden regions.

- Investment in research for new TB drug candidates will accelerate, targeting improved safety and reduced toxicity.

- Preventive therapy adoption will expand among high-risk populations, supporting long-term reduction in TB incidence.

- Integration of community-based treatment models will strengthen continuity of care and reduce treatment interruptions.

- Global funding and health policy alignment will remain critical to sustaining progress toward tuberculosis elimination goals.