Market Overview

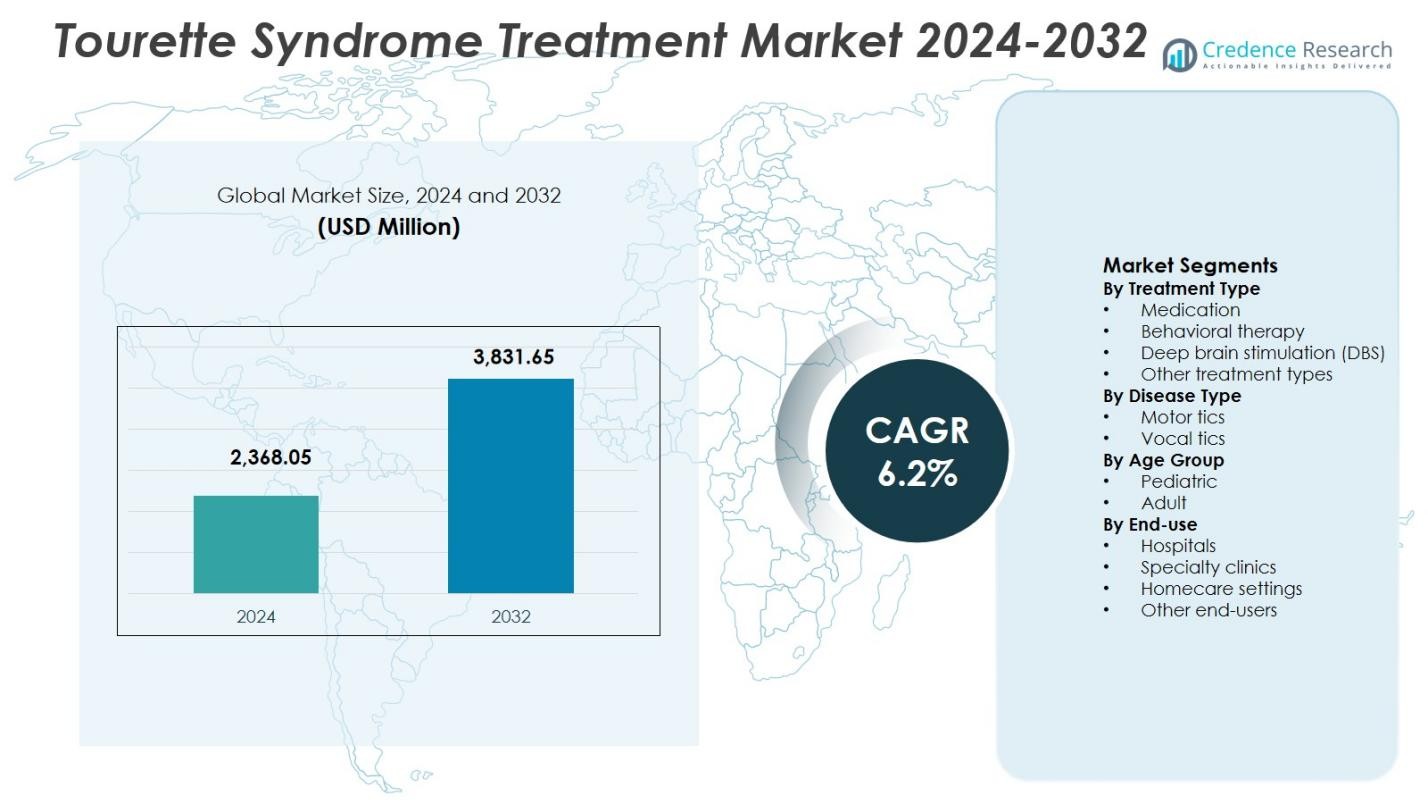

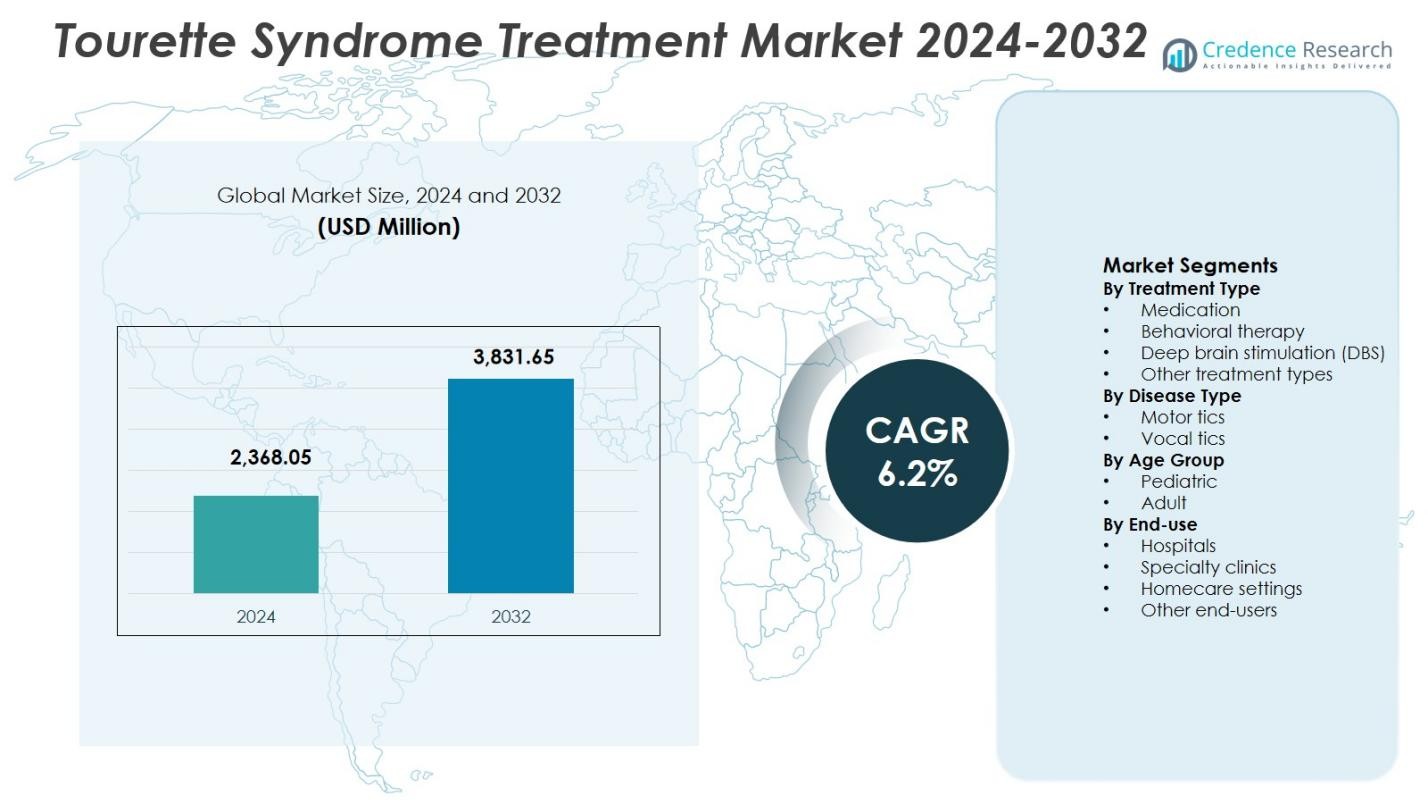

The Tourette Syndrome Treatment Market size was valued at USD 2,368.05 million in 2024 and is anticipated to reach USD 3,831.65 million by 2032, growing at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tourette Syndrome Treatment Market Size 2024 |

USD 2,368.05 Million |

| Tourette Syndrome Treatment Market, CAGR |

6.2% |

| Tourette Syndrome Treatment Market Size 2032 |

USD 3,831.65 Million |

Tourette Syndrome Treatment Market is shaped by the presence of established pharmaceutical and biotechnology companies such as AbbVie Inc., Teva Pharmaceutical Industries Ltd., Neurocrine Biosciences, Inc., Otsuka Pharmaceutical Co., Ltd., Eli Lilly and Company, Pfizer Inc., Johnson & Johnson, GlaxoSmithKline plc, UCB S.A., and Lundbeck A/S, which focus on pharmacological innovation and expanded therapeutic portfolios for tic management. These players emphasize VMAT2 inhibitors, next-generation antipsychotics, and supportive treatment solutions to improve patient outcomes. North America leads the market with a 38.6% share, driven by high diagnosis rates, advanced healthcare infrastructure, and strong reimbursement support, followed by Europe with 29.4% share supported by public healthcare systems, while Asia-Pacific holds 22.1% share supported by rising awareness and expanding access to neurological care.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Tourette Syndrome Treatment Market was valued at USD 2,368.05 million in 2024 and is projected to grow at a CAGR of 6.2% during the forecast period, supported by rising diagnosis rates and expanding treatment adoption.

- Increasing clinical awareness, early diagnosis in pediatric populations, and advancements in pharmacological therapies such as VMAT2 inhibitors strongly drive market growth.

- Growing adoption of behavioral therapies and continued innovation by key pharmaceutical players strengthen product portfolios and treatment outcomes across the market.

- High treatment costs, variable patient response, and medication-related side effects restrain broader adoption, particularly in cost-sensitive regions.

- North America leads with 38.6% market share, followed by Europe at 29.4% and Asia-Pacific at 22.1%, while the medication segment dominates with 56.4% share and motor tics account for 62.7% of total demand.

Market Segmentation Analysis:

By Treatment Type:

The Tourette Syndrome Treatment Market by treatment type is led by Medication, which accounted for 56.4% market share in 2024. Medications such as antipsychotics, alpha-adrenergic agonists, and VMAT2 inhibitors remain the first-line treatment due to their proven efficacy in reducing tic severity and improving daily functioning. Strong physician preference, wider reimbursement coverage, and increasing diagnosis rates support medication dominance. Behavioral therapy continues to expand with growing awareness of non-pharmacological interventions, while Deep Brain Stimulation (DBS) adoption remains limited to severe, treatment-resistant cases due to high cost and surgical complexity.

By Disease Type:

By disease type, Motor tics dominated the Tourette Syndrome Treatment Market with a 62.7% market share in 2024. Motor tics are more prevalent, clinically visible, and frequently impair physical coordination, prompting earlier diagnosis and treatment initiation. Higher treatment-seeking behavior among patients and caregivers accelerates demand for pharmacological and behavioral interventions targeting motor symptoms. Vocal tics represent a smaller share due to comparatively lower clinical severity and episodic presentation. Increased clinical focus on early motor symptom management and standardized diagnostic criteria continue to reinforce the dominance of the motor tics segment.

- For instance, Emalex Biosciences’ ecopipam, a selective dopamine D1 receptor antagonist, maintained tic reductions in a phase 3 trial where 41.9% of pediatric patients relapsed after open-label treatment versus 68.1% on placebo, targeting motor and vocal symptoms.

By Age Group:

Based on age group, the Pediatric segment held the leading position with a 68.9% market share in 2024. Tourette syndrome typically manifests during childhood, leading to earlier diagnosis and prolonged treatment duration in pediatric patients. Rising parental awareness, school-based screening programs, and improved access to child neurologists drive higher treatment uptake in this segment. Pediatric patients also show better responsiveness to behavioral therapies and early pharmacological intervention. Although adult cases persist, symptom stabilization or reduction with age limits treatment intensity, maintaining pediatric dominance in overall market demand.

- For instance, Aripiprazole, FDA-approved for tic treatment in children as young as 6, showed efficacy in a phase 3 trial by Sallee et al. for pediatric Tourette patients.

Key Growth Drivers

Rising Diagnosis Rates and Improved Clinical Awareness

The Tourette Syndrome Treatment Market benefits significantly from rising diagnosis rates driven by improved clinical awareness and standardized diagnostic guidelines. Greater recognition of tic disorders among pediatricians, neurologists, and mental health professionals enables earlier identification and treatment initiation. Public health campaigns, school-based screenings, and growing acceptance of neurodevelopmental disorders reduce underdiagnosis. Earlier diagnosis increases long-term treatment demand, particularly for pharmacological and behavioral therapies. Improved diagnostic accuracy also supports targeted treatment selection, enhancing patient outcomes and expanding the treated patient pool across both pediatric and adult populations.

- For instance, the Tourette Association of America launched a national billboard campaign in Times Square and Downtown Los Angeles starting February 26, 2025, featuring community members to highlight tics and target parents of young children.

Expanding Pharmacological Advancements and Drug Approvals

Continuous advancements in pharmacological therapies strongly drive growth in the Tourette Syndrome Treatment Market. The development of VMAT2 inhibitors, novel antipsychotics with improved safety profiles, and symptom-specific drug formulations enhances treatment efficacy while reducing adverse effects. Regulatory approvals for newer therapies improve physician confidence and accelerate adoption. Pharmaceutical companies are increasingly investing in clinical trials to address unmet needs such as refractory tics and comorbid conditions. These innovations expand therapeutic options and sustain long-term market expansion.

- For instance, Otsuka Pharmaceutical’s aripiprazole (Abilify) received FDA approval in December 2014 for treating tics in pediatric patients aged 7-17 with Tourette’s Disorder, based on an 8-week study demonstrating significant tic suppression.

Increasing Healthcare Access and Reimbursement Coverage

Improved access to neurological and mental health services supports sustained growth in the Tourette Syndrome Treatment Market. Expansion of healthcare infrastructure, rising insurance coverage for neuropsychiatric disorders, and favorable reimbursement policies increase treatment affordability. Government initiatives focused on mental health inclusion further strengthen access to both pharmacological and behavioral interventions. Enhanced availability of specialist care in developed and emerging economies drives treatment penetration. Broader reimbursement support also encourages long-term therapy adherence, contributing to stable revenue growth.

Key Trends & Opportunities

Growing Adoption of Behavioral and Non-Pharmacological Therapies

The increasing adoption of behavioral therapies presents a major trend and opportunity in the Tourette Syndrome Treatment Market. Comprehensive Behavioral Intervention for Tics (CBIT) and habit reversal training gain traction due to their non-invasive nature and long-term symptom management benefits. Growing patient and caregiver preference for drug-free options supports this trend. Integration of behavioral therapy into standard treatment protocols expands service-based revenue opportunities and reduces dependency on long-term medication use.

- For instance, NYU Langone’s Child Study Center applies habit reversal therapy in eight to 16 weekly outpatient sessions for children and adolescents with mild to moderate Tourette disorder.

Technological Advancements in Deep Brain Stimulation

Technological innovation in Deep Brain Stimulation creates emerging opportunities within the Tourette Syndrome Treatment Market. Advances in precision targeting, device miniaturization, and programmable stimulation improve outcomes for severe, treatment-resistant patients. Ongoing clinical research enhances safety and efficacy, encouraging selective adoption. As procedural expertise expands and costs gradually decline, DBS offers long-term growth potential, particularly in specialized neurological centers and developed healthcare markets.

- For instance, the NCT02056873 trial evaluates responsive brain stimulation as an alternative to continuous DBS at the centromedian nucleus for medication-refractory Tourette Syndrome. This approach tests intra-operative physiological changes and safety in reducing tics through triggered electrical trains.

Key Challenges

High Treatment Costs and Limited Accessibility

High treatment costs remain a significant challenge in the Tourette Syndrome Treatment Market. Long-term medication use, behavioral therapy sessions, and advanced interventions such as Deep Brain Stimulation impose financial burdens on patients and healthcare systems. Limited insurance coverage in certain regions restricts access to comprehensive care. Cost-related barriers reduce treatment adherence and delay intervention, particularly in low- and middle-income economies, constraining overall market penetration.

Variability in Treatment Response and Side Effects

Inconsistent treatment response poses a major challenge in the Tourette Syndrome Treatment Market. Patients exhibit variable reactions to pharmacological therapies, often requiring frequent dose adjustments or therapy switching. Side effects such as sedation, weight gain, and cognitive impairment limit long-term medication compliance. This variability complicates treatment planning and increases clinical burden. The lack of universally effective therapies highlights the need for personalized treatment approaches and continued therapeutic innovation.

Regional Analysis

North America

North America led the Tourette Syndrome Treatment Market with a 38.6% market share in 2024, supported by high diagnosis rates, strong clinical awareness, and advanced healthcare infrastructure. The region benefits from widespread access to neurologists, availability of FDA-approved pharmacological therapies, and early adoption of behavioral interventions such as CBIT. Favorable reimbursement policies and significant investment in neuropsychiatric research further strengthen treatment uptake. The presence of leading pharmaceutical companies and ongoing clinical trials continues to drive innovation, sustaining North America’s dominant position across both pediatric and adult patient populations.

Europe

Europe accounted for a 29.4% market share in 2024 in the Tourette Syndrome Treatment Market, driven by robust public healthcare systems and strong emphasis on mental health inclusion. Countries such as Germany, the United Kingdom, and France demonstrate high treatment penetration due to standardized diagnostic frameworks and access to multidisciplinary care. Increasing adoption of behavioral therapies and rising availability of specialty clinics support market expansion. Government-backed reimbursement programs and growing awareness initiatives reduce treatment gaps. Continued research collaboration and expanding DBS capabilities further reinforce Europe’s strong regional presence.

Asia-Pacific

Asia-Pacific captured a 22.1% market share in 2024, reflecting rapid growth potential in the Tourette Syndrome Treatment Market. Improving healthcare infrastructure, expanding access to neurological care, and rising awareness of neurodevelopmental disorders drive regional demand. Countries including Japan, China, South Korea, and Australia show increasing diagnosis rates supported by urban healthcare expansion. Growing investments in mental health services and gradual inclusion of tic disorder treatments in insurance coverage improve treatment accessibility. The large pediatric population base and expanding specialist networks position Asia-Pacific as a key growth region.

Latin America

Latin America held a 6.1% market share in 2024 in the Tourette Syndrome Treatment Market, supported by gradual improvements in neurological care access. Brazil and Mexico lead regional demand due to expanding healthcare coverage and increasing awareness among healthcare professionals. Growth is driven by improved availability of pharmacological treatments and rising referrals to behavioral therapy programs. However, limited specialist availability and uneven reimbursement structures constrain faster adoption. Ongoing healthcare reforms and public mental health initiatives are expected to enhance diagnosis rates and treatment penetration across the region.

Middle East & Africa

The Middle East & Africa accounted for a 3.8% market share in 2024, reflecting emerging adoption within the Tourette Syndrome Treatment Market. Growth is primarily concentrated in countries such as the UAE, Saudi Arabia, and South Africa, where healthcare investments and access to specialized neurological services are improving. Increasing recognition of neuropsychiatric disorders and gradual expansion of insurance coverage support market development. Despite challenges related to limited specialist availability and diagnostic gaps, rising government focus on mental health infrastructure continues to strengthen long-term regional growth potential.

Market Segmentations:

By Treatment Type

- Medication

- Behavioral therapy

- Deep brain stimulation (DBS)

- Other treatment types

By Disease Type

By Age Group

By End-use

- Hospitals

- Specialty clinics

- Homecare settings

- Other end-users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Tourette Syndrome Treatment Market includes key players such as AbbVie Inc., Teva Pharmaceutical Industries Ltd., Pfizer Inc., Otsuka Pharmaceutical Co., Ltd., Neurocrine Biosciences, Inc., Eli Lilly and Company, GlaxoSmithKline plc, and Johnson & Johnson. The market is characterized by strong focus on pharmacological innovation, particularly in VMAT2 inhibitors and next-generation antipsychotics with improved safety and tolerability profiles. Leading companies prioritize clinical trials targeting refractory tics and comorbid neuropsychiatric conditions to strengthen therapeutic differentiation. Strategic partnerships with research institutions and licensing agreements support pipeline expansion and accelerate product development. Companies also emphasize geographic expansion and regulatory approvals to enhance market reach. Increasing investment in behavioral therapy integration and digital treatment support tools further shapes competition, enabling firms to address evolving patient needs while maintaining long-term market positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In February 2025, Relmada Therapeutics completed the acquisition of Sepranolone from Asarina Pharma AB, a Phase 2b–ready neurosteroid being developed as a potential treatment for Tourette syndrome and other compulsion-related conditions.

- In October 2025, Emalex Biosciences received FDA authorization for an Expanded Access Program for its investigational Tourette syndrome therapy ecopipam, allowing physicians to treat eligible patients ahead of NDA submission.

- In October 2025, the U.S. Food and Drug Administration (FDA) authorized an Expanded Access Program for ecopipam, developed by Emalex Biosciences, providing investigational access for pediatric Tourette syndrome patients outside of clinical trials; ecopipam also holds Orphan Drug and Fast Track designations.

Report Coverage

The research report offers an in-depth analysis based on Treatment Type, Disease Type, Age Group, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Tourette Syndrome Treatment Market will expand steadily due to rising diagnosis rates and improved clinical awareness worldwide.

- Ongoing development of targeted pharmacological therapies will enhance treatment efficacy and patient safety.

- Behavioral interventions will gain wider adoption as first-line or adjunct treatment options.

- Personalized treatment approaches will increase, driven by variability in patient response and symptom severity.

- Integration of digital health tools will support therapy monitoring and long-term disease management.

- Deep brain stimulation will see selective growth for severe, treatment-resistant cases.

- Pediatric treatment demand will remain strong due to early onset of the disorder.

- Expansion of mental health infrastructure in emerging economies will improve treatment access.

- Regulatory support for neuropsychiatric therapies will accelerate product approvals and market entry.

- Strategic collaborations between pharmaceutical companies and research institutions will strengthen innovation pipelines.