Market Overview

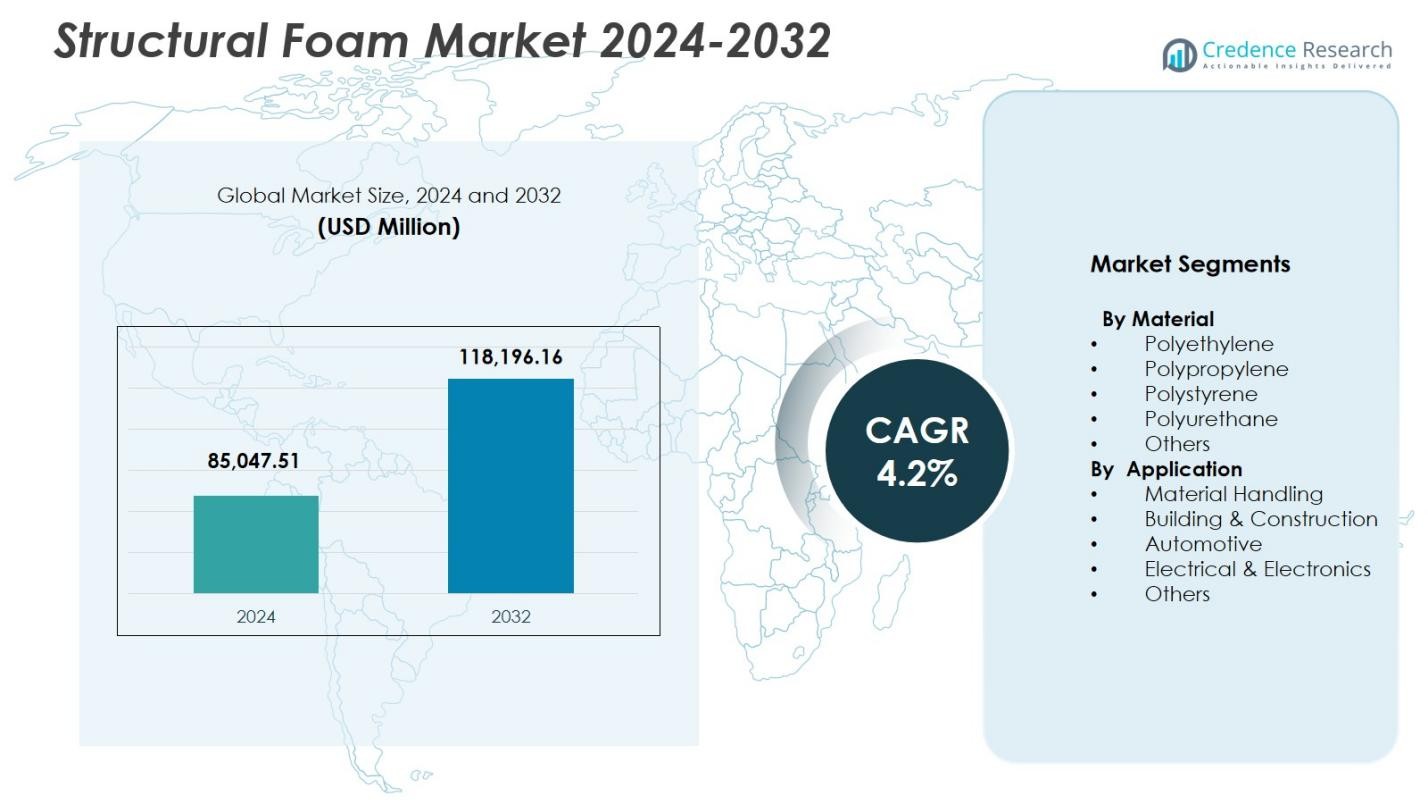

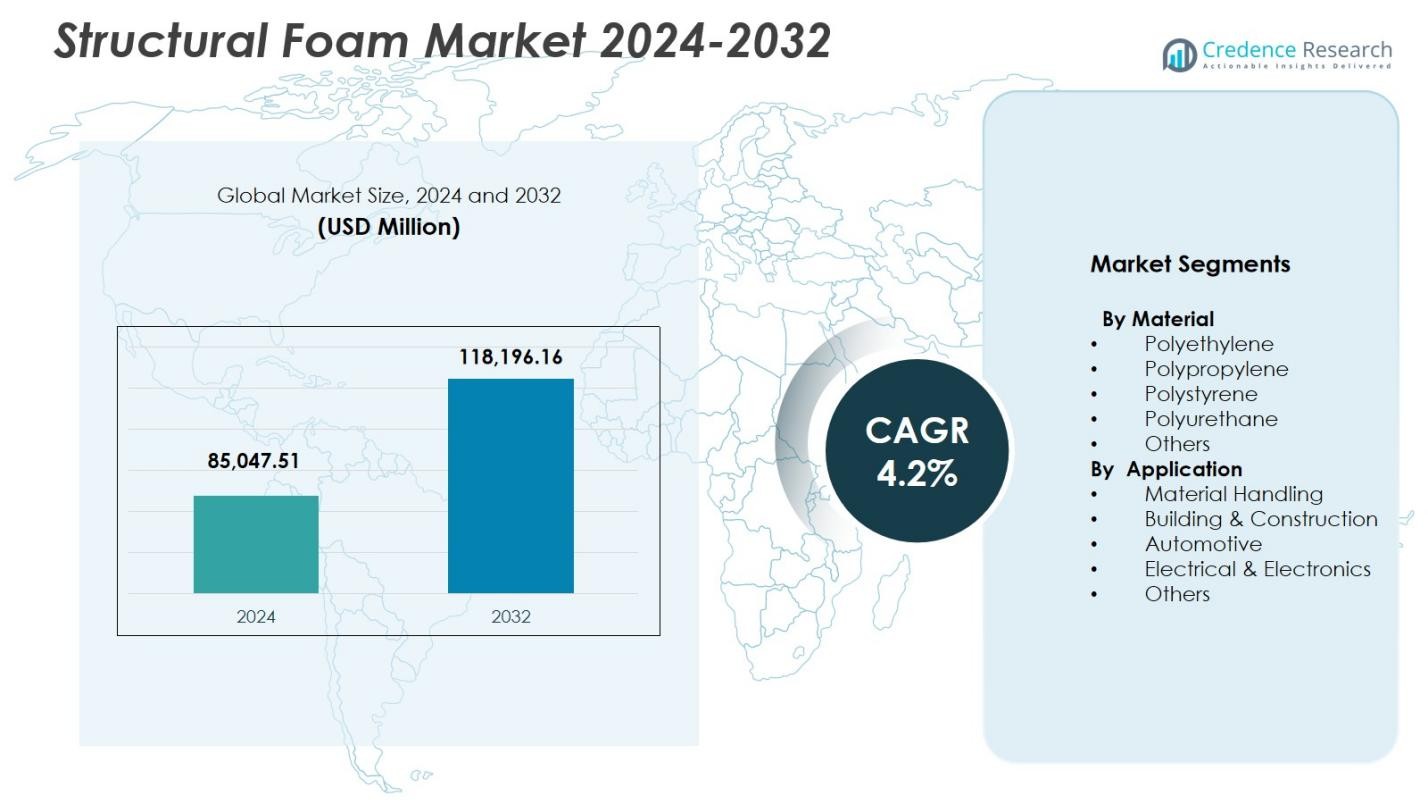

Structural Foam Market size was valued at USD 85,047.51 million in 2024 and is anticipated to reach USD 118,196.16 million by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Structural Foam Market Size 2024 |

USD 85,047.51 Million |

| Structural Foam Market, CAGR |

4.2% |

| Structural Foam Market Size 2032 |

USD 118,196.16 Million |

Structural Foam Market features major players such as BASF SE, Covestro AG, The Dow Chemical Company, Huntsman Corporation, Evonik Industries AG, SABIC, Armacell International S.A., Recticel NV/SA, Rogers Corporation, and Arkema, all advancing product innovation, sustainable formulations, and high-performance foam solutions for automotive, construction, material handling, and electronics applications. These companies strengthen their global presence through capacity expansion, partnerships, and technology upgrades that support lightweighting and durability requirements across industries. Regionally, North America leads the market with a 32.6% share in 2024, driven by strong manufacturing infrastructure, rising EV production, and growing demand for advanced material-handling solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Structural Foam Market was valued at USD 85,047.51 million in 2024 and will grow at a CAGR of 4.2% through 2032.

- Growing demand for lightweight and durable materials in automotive, material handling, and construction drives adoption, with material handling leading applications at 31.7% share.

- Key trends include rising use of recyclable polyethylene and polypropylene foams and increasing integration of digital molding technologies that enhance precision and reduce waste.

- Major players such as BASF SE, Covestro AG, Dow, Huntsman, Evonik, SABIC, and Armacell focus on sustainable formulations, capacity expansion, and partnerships to strengthen market presence

- Regionally, North America holds 32.6% share, followed by Europe at 28.4% and Asia-Pacific at 30.1%, reflecting strong industrial bases and expanding construction and logistics sectors supporting structural foam demand.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Material

The Structural Foam Market by material is led by Polyethylene, which accounted for 36.4% share in 2024, driven by its superior impact resistance, chemical stability, and suitability for high-load industrial applications. Polypropylene follows as a strong performer due to its lightweight characteristics and recyclability, supporting sustainability-focused industries. Polystyrene and polyurethane continue to gain traction in insulation, packaging, and automotive components, while the “Others” category grows with emerging engineered polymers. The dominance of polyethylene is supported by its cost efficiency, versatility across molding technologies, and expanding demand in logistics, automotive housings, and protective structures.

- For instance, Marko Foam Products produces expanded polyethylene foams used in medical packaging and automotive components, offering impact resistance for sensitive shipments and device protection.

By Application

By application, the Structural Foam Market is dominated by Material Handling, which captured 31.7% share in 2024, driven by rising demand for durable pallets, crates, and customized industrial containers. The segment benefits from the material’s high strength-to-weight ratio and long service life, supporting efficient warehouse operations. Building & construction remains a major contributor with increasing use in façade elements and structural panels, while automotive applications advance due to lightweighting initiatives. Electrical & electronics leverage structural foams for enclosures and thermal management. The “Others” category expands with applications in furniture, packaging, and recreational equipment.

- For instance, Robinson Industries produces reusable structural foam pallets, including their Gen2 design with a 45×48 inch footprint that supports heavy loads while prioritizing durability in automotive and industrial supply chains.

Key Growth Drivers

Expansion of Lightweight Structural Applications

The Structural Foam Market grows significantly as industries prioritize lightweight yet high-strength materials to improve product durability and reduce overall system weight. Structural foam provides exceptional rigidity and dimensional stability, making it ideal for automotive components, industrial housings, material-handling systems, and construction panels. Its ability to withstand mechanical stress while remaining lighter than solid plastics supports efficiency and fuel-saving goals across sectors. Increasing adoption in electric vehicles, warehouse automation systems, and modular building solutions further accelerates demand for advanced lightweight structural materials.

- For instance, Knauf Industries uses expanded polypropylene (EPP) foam molding to produce dashboard parts, door panels, and trunk elements that enhance shock absorption and passenger safety in vehicles.

Rising Demand in Material Handling and Logistics

Global expansion in warehousing, e-commerce, and automated logistics systems fuels substantial demand for structural foam products, particularly pallets, crates, containers, and protective packaging. Structural foam offers an extended service life, superior load-bearing capacity, and resistance to moisture and chemicals, making it a preferred choice over traditional materials like wood and metal. Companies increasingly adopt reusable and customized structural foam solutions to optimize supply chains, reduce maintenance costs, and enhance operational safety. This shift aligns with modern logistics requirements for durability, hygiene, and sustainability.

- For instance, Robinson Industries produces injection-molded structural foam pallets engineered for heavy loads in warehouse environments. These pallets feature custom designs that support rigorous demands while reducing logistics costs through reusability.

Growing Adoption in Building and Construction

The construction sector increasingly incorporates structural foam into insulation systems, façade elements, formwork, and structural panels due to its excellent energy efficiency, moisture resistance, and thermal performance. As global construction activities rise, particularly in urban infrastructure, modular buildings, and green-certified projects, structural foam delivers cost-effective and sustainable solutions. Its lightweight nature simplifies on-site handling and installation, reducing labor time and transportation expenses. Demand is further strengthened by building codes that emphasize thermal regulation, fire resistance, and long-term structural stability.

Key Trends & Opportunities

Advancements in Sustainable and Recyclable Foam Materials

A major trend shaping the Structural Foam Market is the development of eco-friendly formulations derived from recycled polymers and bio-based materials. Manufacturers are investing in circular production models to reduce carbon footprints and meet regulatory expectations. Recyclable polyethylene and polypropylene foams gain traction as industries transition toward greener packaging, automotive interiors, and construction components. This shift presents opportunities for companies offering high-performance sustainable materials that meet both environmental and functional standards, positioning them strongly within global sustainability initiatives.

- For instance, BASF worked with Ford and IAC to integrate a castor-oil-based Thin-Light foam under the instrument panel of the 2018 Ford Fusion, achieving up to 30% weight reduction versus conventional foam-backed panels while maintaining safety and long-term durability, directly supporting OEM lightweighting and CO₂ reduction strategies.

Increasing Integration of Automation and Industry 4.0

The adoption of automation, digital tooling, and precision molding technologies creates new opportunities in structural foam manufacturing. Advanced molding systems enable consistent cell structure, improved mechanical properties, and reduced material waste. Industry 4.0 capabilities such as real-time process monitoring, predictive maintenance, and digital twins enhance production efficiency and scalability. These innovations open pathways for customized, high-strength foam components across automotive, electronics, and industrial goods. Companies leveraging automation gain competitive advantages through reduced cycle time, enhanced quality control, and flexible product design.

- For instance, ENGEL introduced e-foam XL multi central gas supply units based on Trexel MuCell technology, allowing multiple injection molding machines to share highly compressed nitrogen.

Key Challenges

Fluctuations in Raw Material Prices

The Structural Foam Market faces pressure from volatile prices of key raw materials such as polyethylene, polypropylene, and polyurethane feedstocks. Price fluctuations directly impact manufacturing costs, especially for producers operating with high-volume, low-margin product lines. Dependence on petrochemical supply chains exposes the industry to disruptions caused by geopolitical tensions, refinery outages, and shifts in crude oil pricing. These uncertainties compel manufacturers to optimize sourcing strategies, explore recycled or bio-based alternatives, and adopt cost-management initiatives to safeguard profitability.

Technical Limitations in High-Performance Applications

Despite structural foam’s advantages, challenges arise in applications requiring extremely high load-bearing capacity, heat resistance, or precision tolerances. In some sectors, such as advanced automotive structures and aerospace components, engineers may prefer metals or engineered composites for superior performance. Structural foam’s susceptibility to deformation under extreme temperatures and its limited suitability for ultra-high-stress environments restrict broader adoption. Manufacturers must continuously innovate through advanced formulations, hybrid materials, and improved molding technologies to overcome performance constraints and expand market penetration.

Regional Analysis

North America

North America leads the Structural Foam Market with a 32.6% share in 2024, supported by strong demand across automotive, material handling, and construction industries. The region benefits from advanced manufacturing capabilities, high adoption of lightweight materials, and continuous innovation in foam molding technologies. Growing investment in warehouse automation and sustainable building solutions further propels market expansion. The United States remains the primary contributor due to its large industrial base and emphasis on durable, energy-efficient materials. Increased use of structural foam in EV components and logistics equipment continues to reinforce North America’s dominant position.

Europe

Europe accounted for a 28.4% share in 2024, driven by stringent sustainability regulations, widespread adoption of recyclable polymers, and strong demand in automotive lightweighting initiatives. Countries such as Germany, France, and the U.K. lead consumption due to established automotive, electronics, and construction sectors. Structural foam use in thermal insulation, façade systems, and industrial packaging continues to expand under EU energy-efficiency directives. The region’s focus on circular economy practices accelerates the adoption of recycled polyethylene and polypropylene materials. Rising investments in modern molding technologies further strengthen Europe’s position as a key market for high-performance structural foams.

Asia-Pacific

Asia-Pacific captured a 30.1% share in 2024, emerging as the fastest-growing region due to rapid industrialization, expanding construction activities, and surging demand for material handling solutions. China, India, Japan, and South Korea drive consumption across automotive parts, electronics housings, and logistics containers. Growing e-commerce and large-scale warehousing significantly boost the demand for durable pallets and crates made from structural foam. The region benefits from cost-effective manufacturing, abundant raw material availability, and government initiatives supporting infrastructure and industrial development. Asia-Pacific’s expanding automotive production and rising preference for lightweight materials continue to accelerate market growth.

Latin America

Latin America held a 5.4% share in 2024, supported by increasing adoption of structural foam in packaging, automotive components, and building applications. Brazil and Mexico lead the regional market due to their expanding industrial bases and growing need for durable, cost-efficient material handling products. Structural foam’s resistance to moisture and chemicals makes it suitable for agricultural logistics and outdoor construction materials. Rising investments in manufacturing modernization and warehouse infrastructure further stimulate demand. Although market growth is steady, the region’s dependence on imported raw materials creates cost pressures, prompting gradual exploration of local recycling and polymer production opportunities.

Middle East & Africa

The Middle East & Africa accounted for a 3.5% share in 2024, driven by growing construction activities, industrial development, and demand for lightweight, corrosion-resistant materials. Countries such as Saudi Arabia, the UAE, and South Africa increasingly adopt structural foam for insulation boards, industrial housings, and handling equipment. The region benefits from rising infrastructure projects and diversification initiatives that promote manufacturing and logistics growth. Structural foam’s durability in harsh climates supports its use across outdoor and industrial environments. However, limited local polymer production and slower technological adoption moderate the market’s overall expansion, although long-term opportunities remain strong.

Market Segmentations:

By Material

- Polyethylene

- Polypropylene

- Polystyrene

- Polyurethane

- Others

By Application

- Material Handling

- Building & Construction

- Automotive

- Electrical & Electronics

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Structural Foam Market features leading companies such as BASF SE, Covestro AG, The Dow Chemical Company, Huntsman Corporation, Evonik Industries AG, SABIC, Armacell International S.A., Recticel NV/SA, Rogers Corporation, and Arkema, each strengthening their global presence through product innovation and capacity expansion. These players focus on developing high-performance polyethylene, polypropylene, and polyurethane structural foams tailored for automotive, construction, material handling, and electronics applications. Strategic investments in advanced molding technologies, sustainable formulations, and recycled polymer integration continue to shape market evolution. Companies increasingly pursue partnerships with OEMs to deliver customized, lightweight solutions that enhance durability and operational efficiency. Additionally, strong emphasis on sustainability drives initiatives centered on bio-based materials, closed-loop recycling, and carbon-reduction programs. Regional expansion, targeted acquisitions, and enhancements in R&D capabilities enable key players to diversify product portfolios and meet rising demand across emerging industrial sectors worldwide.

Key Player Analysis

- Rogers Corporation (USA)

- Evonik Industries AG (Germany)

- Huntsman Corporation (USA)

- Arkema (France)

- BASF SE (Germany)

- Recticel NV/SA (Belgium)

- Armacell International S.A. (Luxembourg)

- Covestro AG (Germany)

- SABIC (Saudi Arabia)

- The Dow Chemical Company (USA)

Recent Developments

- In July 2025, BASF acquired the remaining 49% stake in its Alsachimie S.A.S. joint venture, enhancing its control over polyamide precursor production relevant to foam and polymer materials.

- In April 2025, Covestro launched Desmopan® FLY, an advanced thermoplastic polyurethane (TPU) series engineered for supercritical fluid (SCF) foaming technology to support lightweight and sustainable foam applications.

- In March 2025, BASF unveiled biomass balance grades of its Elastoflex® polyurethane foam, expanding offerings for furniture applications relevant to structural foam uses.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Structural Foam Market will experience steady growth as industries prioritize lightweight and durable materials across automotive, construction, and logistics.

- Adoption of recyclable and bio-based structural foam materials will rise as sustainability regulations strengthen worldwide.

- Advanced molding technologies will enhance product precision, reduce waste, and support large-scale customized manufacturing.

- Demand for structural foam in EV components and battery housings will expand due to lightweighting requirements.

- Material handling applications will continue to dominate as warehousing and e-commerce operations scale globally.

- Integration of Industry 4.0 and automation will increase production efficiency and improve quality consistency.

- Construction sectors will adopt more structural foam for insulation systems and modular building components.

- Growth in electronics manufacturing will support higher use of structural foam for enclosures and thermal management.

- Manufacturers will invest in recycling infrastructure to reduce dependency on virgin polymers and stabilize material costs.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will create new opportunities through infrastructure expansion and industrial development.

Market Segmentation Analysis:

Market Segmentation Analysis: