Market Overview

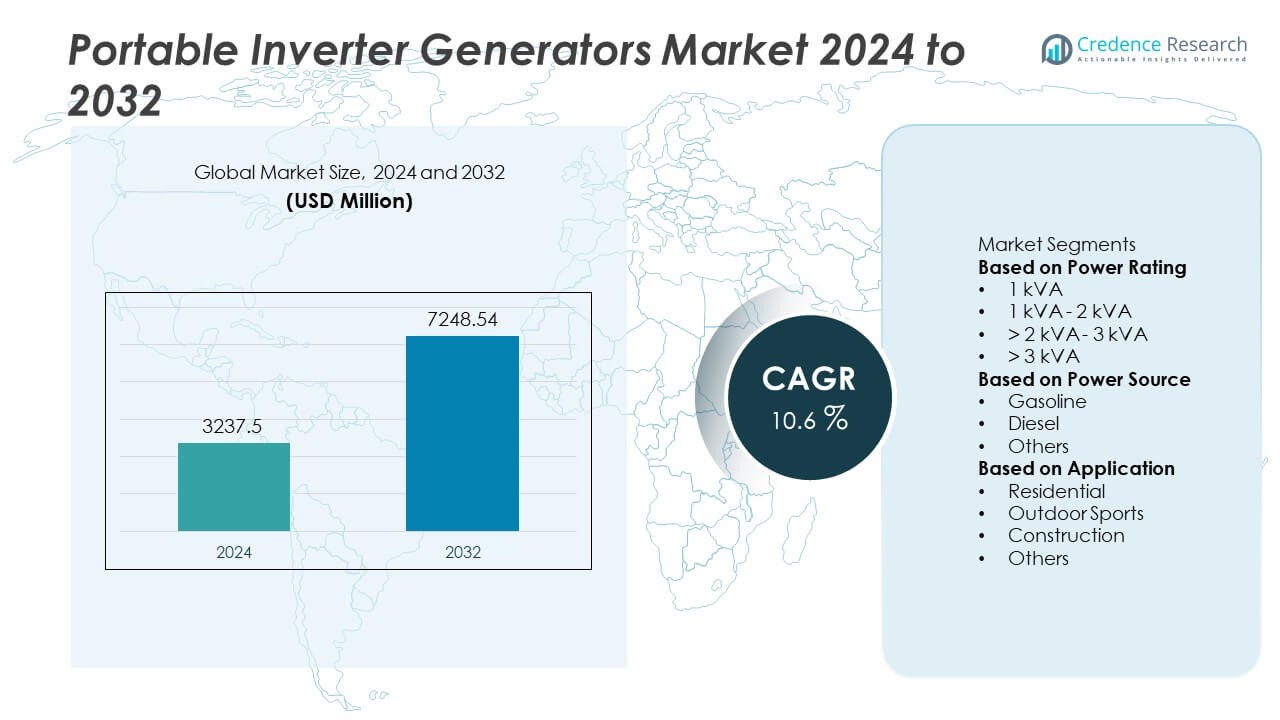

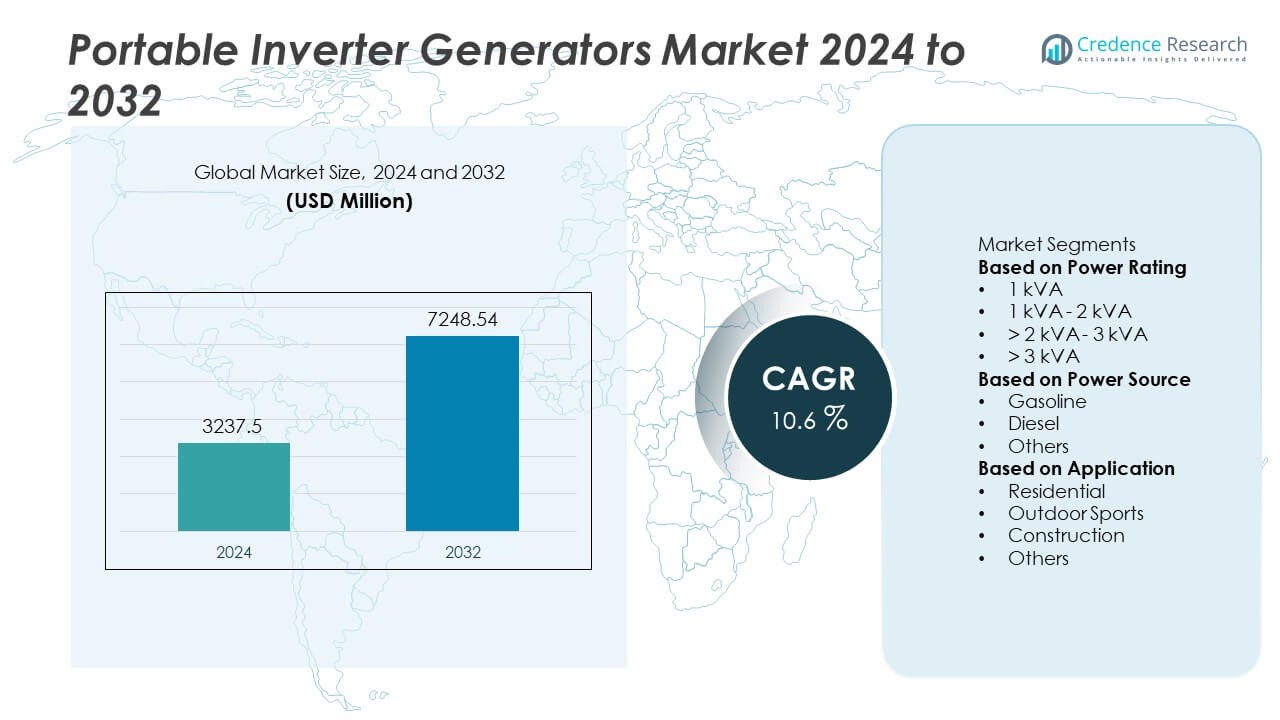

The Portable Inverter Generators market reached USD 3,237.5 million in 2024 and is projected to grow to USD 7,248.54 million by 2032, registering a strong CAGR of 10.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portable Inverter Generators Market Size 2024 |

USD 3,237.5 Million |

| Portable Inverter Generators Market, CAGR |

10.6% |

| Portable Inverter Generators Market Size 2032 |

USD 7,248.54 Million |

The Portable Inverter Generators market features leading companies such as Champion Power Equipment, Himoinsa, A-iPower, Cummins, Generac Power Systems, Atlas Copco, DuroMax Power Equipment, Deere & Company, Briggs & Stratton, and Caterpillar. These manufacturers focus on fuel-efficient engines, low-noise operation, and compact designs to support residential backup, outdoor recreation, and light commercial applications. Product portfolios continue to expand with dual-fuel options, smart monitoring, and parallel-ready functionality to meet growing user demand. North America leads the market with a 37% share, driven by strong adoption for home backup and recreational vehicle use. Europe follows at 26%, supported by stricter emission standards and outdoor leisure activities, while Asia Pacific holds 24% due to rising camping, construction, and remote power requirements across emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Portable Inverter Generators market reached USD 3,237.5 million in 2024 and is projected to grow at a 10.6% CAGR through 2032, supported by increasing demand for reliable portable power solutions.

- Rising power outages, growing remote work needs, and expanding outdoor recreation activities drive generator usage, with the 1 kVA – 2 kVA range holding a 46% segment share due to strong adoption in camping, RV use, and household backup.

- Key trends include advancements in fuel efficiency, hybrid battery-inverter systems, and smart connectivity for remote monitoring, enhancing safety, runtime optimization, and user convenience across residential and commercial applications.

- Competitive strategies focus on quieter operation, longer runtime, and dual-fuel technology, with major players expanding e-commerce distribution and rental partnerships; pricing pressure and higher cost versus conventional generators remain key restraints.

- North America leads with 37% regional share, followed by Europe at 26% driven by stricter emission standards, and Asia Pacific at 24% due to growing outdoor tourism, construction needs, and increased grid instability; Latin America holds 7% and Middle East & Africa 6%.

Market Segmentation Analysis:

By Power Rating:

The 1 kVA – 2 kVA segment leads with a 46% share in the Portable Inverter Generators market. This power range supports camping, RV use, tailgating, and backup power for small household electronics, making it highly attractive for residential and outdoor consumers. These generators offer quiet operation, longer fuel efficiency, and stable power output suitable for laptops, mobile devices, and small appliances. The > 2 kVA – 3 kVA range gains traction for small business and emergency backup needs, while > 3 kVA units serve heavier power loads. The 1 kVA category remains useful for lighting and basic device charging but holds a smaller share due to limited capacity.

- For instance, Honda’s EU2200i model delivers 2,200 watts of peak power and operates at 48 to 57 dB, enabling reliable charging of over 10 electronic devices during continuous outdoor use. The > 2 kVA – 3 kVA range gains traction for small business and emergency backup needs, while > 3 kVA units serve heavier power loads.

By Power Source:

Gasoline-powered inverter generators hold a 62% share, making them the dominant power source due to easy fuel availability, lower upfront cost, and higher adoption in recreational and residential backup applications. Gasoline variants offer quieter operation and lightweight design, attracting campers and RV users. Diesel inverter generators serve commercial and construction users who require longer runtime and higher durability but hold a smaller share because of higher emissions and cost. The Others segment, including propane and hybrid battery-inverter systems, is expanding as consumers seek cleaner, low-maintenance energy options for sustainable outdoor and emergency use.

- For instance, Champion Power Equipment’s 2000-watt ultra-light model weighs 39 pounds and produces 53 dB noise at 23 feet, allowing safe use in campsites with noise restrictions.

By Application:

The residential segment leads with a 48% share driven by rising demand for home backup power during outages, grid instability, and remote working power needs. Consumers choose portable inverter generators for smooth power output to run sensitive electronics such as routers, refrigerators, and medical devices. The outdoor sports segment continues to grow, supported by increasing camping, tailgating, and RV travel. Construction applications require higher output power for tools and site lighting, contributing steady demand. Other uses include mobile food services, outdoor markets, and emergency support, reflecting expanding generator utility across diverse user groups.

Key Growth Drivers

Rising Demand for Backup Power and Grid Resilience

Growing frequency of power outages and grid instability increases demand for portable inverter generators as reliable backup power solutions. Residential users adopt these units to support critical appliances, remote work setups, and home medical equipment. Small businesses rely on inverter generators to maintain operational continuity during service interruptions. Their fuel efficiency, cleaner output, and lower noise levels accelerate preference over conventional portable generators. Increased urbanization and dependence on electronic devices further support market expansion across both developed and emerging regions.

- For instance, Generac’s GP3000i supplies 3,000 starting watts and supports approximately 5.8 hours of operation at 25% load or 4.5 hours at 50% load, helping small offices maintain essential work during grid failures.

Growth in Outdoor Recreation and Mobile Lifestyle Activities

Camping, RV travel, tailgating, and outdoor entertainment activities have seen strong growth, driving portable inverter generator adoption. Lightweight design, quiet operation, and compatibility with sensitive electronics make inverter models ideal for outdoor use. Rising interest in off-grid travel and remote tourism strengthens market penetration. Outdoor event organizers and mobile food vendors also rely on inverter generators for stable power supply. The trend supports higher sales in 1 kVA to 2 kVA power ratings catered to recreational users.

- For instance, Yamaha’s EF2400iSHC weighs 34 kilograms (75 lbs) and is designed with high-current technology to power most 13,500 BTU RV air conditioners, supporting long-distance motorhome travel.

Advancements in Fuel Efficiency and Low-Emission Technologies

Manufacturers introduce improved engine technology, smart throttle controls, and reduced-emission designs to meet environmental standards. Fuel-efficient inverter generators lower operating costs and extend runtime, enhancing value for cost-conscious buyers. Hybrid fuel systems, including propane-compatible models, gain interest among users seeking cleaner power options. Technology integration such as Bluetooth monitoring and automatic load adjustment increases performance and user convenience. Innovation in noise reduction and compact form factors further boosts adoption across residential and commercial markets.

Key Trends & Opportunities

Growth of Hybrid and Battery-Integrated Inverter Generator Systems

Integration of inverter generators with battery storage systems presents a strong opportunity, allowing quieter operation and reduced fuel use. These hybrid models support residential energy resilience and off-grid living segments. Increased adoption of solar-charging compatibility and fast-start battery modes enhances convenience. Rental and fleet operators also evaluate hybrid systems to meet low-noise regulations at construction and event sites. As sustainability expectations rise, hybrid solutions position the market for long-term growth.

- For instance, EcoFlow’s Dual-Fuel Smart Generator integrates a 1,800-watt inverter and charges portable power stations at up to 1,800 watts, supporting reduced generator runtime during night operations.

Expansion of Smart Connectivity and Remote Monitoring Features

Smartphone connectivity enables users to track fuel levels, load capacity, and maintenance alerts in real time. Remote start/stop functions and automated power management improve user control and safety. Connected inverter generators appeal to tech-oriented consumers and commercial operators managing multiple units. Integration with IoT platforms creates opportunities for predictive service and long-term power planning. This trend supports premium segment growth and recurring service revenue for manufacturers.

- For instance, some generator fleet management solutions record engine runtime and fault codes across a fleet of units, enabling rental firms to schedule maintenance and reduce downtime.

Key Challenges

Stringent Emission Regulations and Compliance Costs

Governments implement strict emission standards for small engines, increasing manufacturing costs and design complexity. Compliance requires investment in cleaner combustion technologies, catalytic systems, and advanced filtration. Smaller manufacturers face difficulty meeting evolving regulatory requirements, affecting competitive positioning. Delays in certification and regional policy variations also impact product launches. While regulation drives innovation, it challenges cost-sensitive markets and may limit availability of low-cost models.

High Initial Cost Compared to Conventional Generators

Portable inverter generators cost more than traditional portable units, limiting adoption in price-sensitive markets. Advanced electronics, noise insulation, and efficient fuel systems contribute to higher production costs. Some consumers still choose standard generators for basic power needs despite higher noise and unstable output. Rental access and financing options help offset price barriers, but affordability remains a constraint for widespread adoption. As technology scales, cost reductions will be essential to expand market penetration.

Regional Analysis

North America

North America holds a 37% share of the Portable Inverter Generators market, supported by high demand for home backup power and strong adoption of RV and outdoor leisure activities. The United States leads regional consumption due to frequent weather-related outages, remote work power needs, and higher spending on recreational equipment. Canada contributes steady growth, driven by camping tourism and off-grid cabin use. Advanced emission-compliant models and smart connectivity features gain strong traction. Manufacturers benefit from established retail and e-commerce distribution networks, while rental services and disaster-preparedness programs continue to drive recurring equipment demand across residential and small commercial users.

Europe

Europe accounts for a 26% share, driven by rising energy resilience requirements and adoption of low-emission portable power systems. Germany, the United Kingdom, France, and Nordic countries lead consumption due to outdoor travel habits, caravan tourism, and stricter environmental standards encouraging cleaner inverter technology. Construction and events sectors rely on low-noise generators to comply with urban operating regulations. The region also benefits from higher penetration of hybrid and propane-compatible units among eco-conscious users. Growing grid instability concerns and renewable energy integration projects further support adoption, particularly in Southern European markets experiencing heatwaves and peak-load disruptions.

Asia Pacific

Asia Pacific holds a 24% share and represents the fastest-growing region due to expanding outdoor recreation, growing residential backup needs, and rising small business reliance on portable power. China, Japan, India, and Australia lead demand, driven by frequent grid fluctuations, typhoon seasons, and off-grid travel. Rapid growth in camping, overlanding, and mobile food services accelerates market expansion. Affordable gasoline-based inverter generators remain widely used, while hybrid solar-charging models gain momentum. Increasing retail and online availability, along with competitive local manufacturing, strengthens market penetration across both urban and rural areas with unstable power supply infrastructure.

Latin America

Latin America holds a 7% share, supported by demand for portable power in residential, agricultural, and outdoor work settings. Brazil and Mexico lead adoption due to periodic grid disruptions, storms, and the need for mobile power for street vendors and small enterprises. Recreational generator use grows with rising tourism and outdoor events, while construction and remote infrastructure projects contribute additional market support. Economic sensitivity drives preference for gasoline-powered units, although interest in more fuel-efficient and low-noise options increases. Distribution expansion through importers and hardware retail channels strengthens market accessibility across emerging urban and semi-rural zones.

Middle East & Africa

The Middle East & Africa region holds a 6% share, driven by remote site power requirements, tourism expansion, and reliance on portable power for desert, mining, and oilfield operations. GCC countries, particularly the United Arab Emirates and Saudi Arabia, see higher adoption for outdoor events and residential backup needs. In Africa, portable inverter generators support off-grid communities, small workshops, and agricultural operations where grid coverage remains limited. Demand grows for fuel-efficient systems to reduce operational costs in remote areas. Market expansion benefits from government-led rural electrification efforts and increased availability of portable power equipment through regional distributors and e-commerce platforms.

Market Segmentations:

By Power Rating

- 1 kVA

- 1 kVA – 2 kVA

- > 2 kVA – 3 kVA

- > 3 kVA

By Power Source

By Application

- Residential

- Outdoor Sports

- Construction

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis of the Portable Inverter Generators market includes key players such as Champion Power Equipment, Himoinsa, A-iPower, Cummins, Generac Power Systems, Atlas Copco, DuroMax Power Equipment, Deere & Company, Briggs & Stratton, and Caterpillar. These companies compete by offering fuel-efficient, low-noise, and compact inverter generator models designed for residential backup, outdoor recreation, and light commercial use. Leading brands focus on advanced engine technology, longer runtime, and stable power output suitable for sensitive electronics. Manufacturers enhance product differentiation through Bluetooth monitoring, parallel connection capability, and hybrid battery-inverter integration. Expansion of e-commerce distribution, rental fleet partnerships, and disaster-preparedness programs strengthens market reach. Firms also invest in emission-compliant designs to meet environmental standards across North America and Europe, while cost-effective gasoline and dual-fuel options support growth in Asia Pacific and Latin America. Continuous innovation and reliability remain central to competitive positioning as outdoor mobile lifestyles and home backup needs increase.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Champion Power Equipment

- Himoinsa

- A-iPower

- Cummins

- Generac Power Systems

- Atlas Copco

- DuroMax Power Equipment

- Deere & Company

- Briggs & Stratton

- Caterpillar

Recent Developments

- In October 2024, Cummins announced an original equipment manufacturer (OEM) partnership with GenTent Safety Canopies, LLC to introduce a Cummins-branded, weatherproof GenTent system.

- In 2024, Honda donated 40 EU3200i portable generators to the American Red Cross to aid in hurricane relief efforts for North Carolina residents affected by Hurricane Helene.

- In May 2023, Generac Power Systems introduced the GP15500EFI and GP18000EFI portable generator models with G-FORCE 816 cc EFI engines.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Power Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for portable inverter generators will rise as power outage events increase.

- Outdoor recreation and RV travel growth will continue to support strong product adoption.

- Hybrid battery-inverter and solar-compatible models will gain wider market preference.

- Smart connectivity and remote monitoring features will improve user control and safety.

- Low-noise and fuel-efficient engines will remain key purchase decision factors.

- Dual-fuel and propane-ready generators will expand in regions with cleaner fuel shifts.

- Rental fleets and emergency management programs will increase procurement volumes.

- Compact and lightweight designs will boost adoption for camping and mobile work sites.

- Emission regulations will push manufacturers to invest in cleaner engine technologies.

- Partnerships with outdoor, hardware, and e-commerce retailers will strengthen market reach.