Market Overview

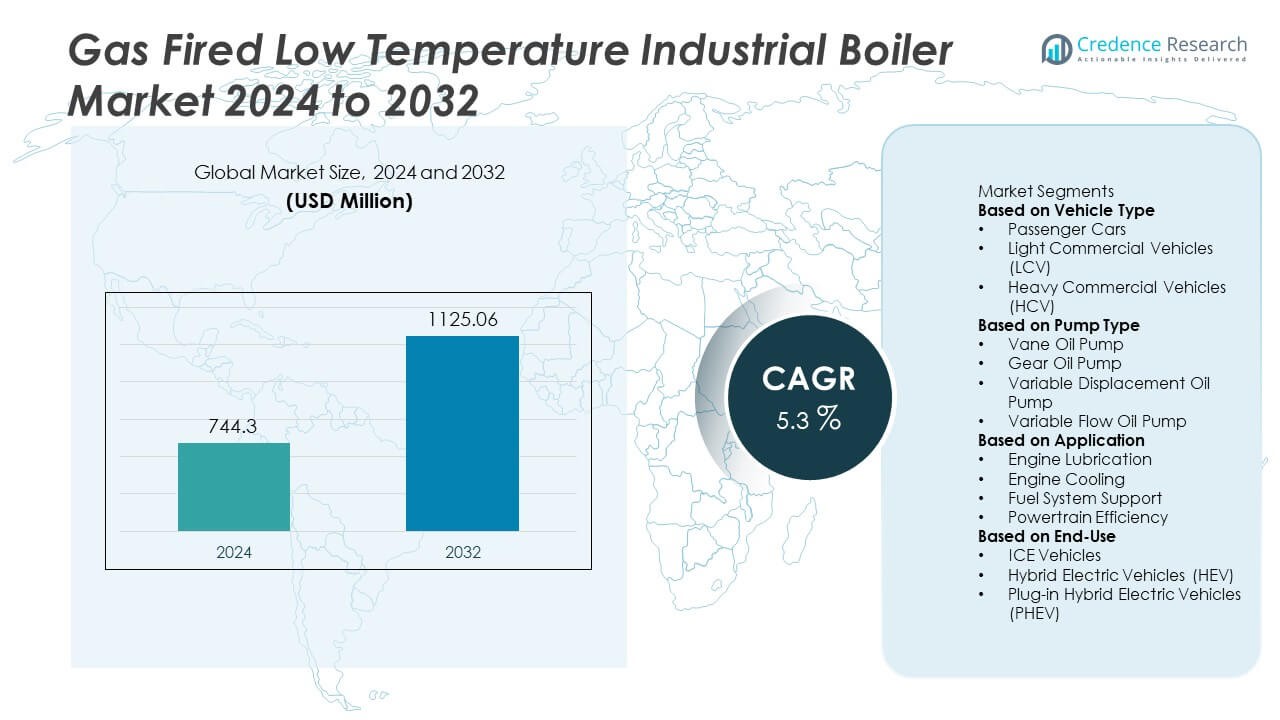

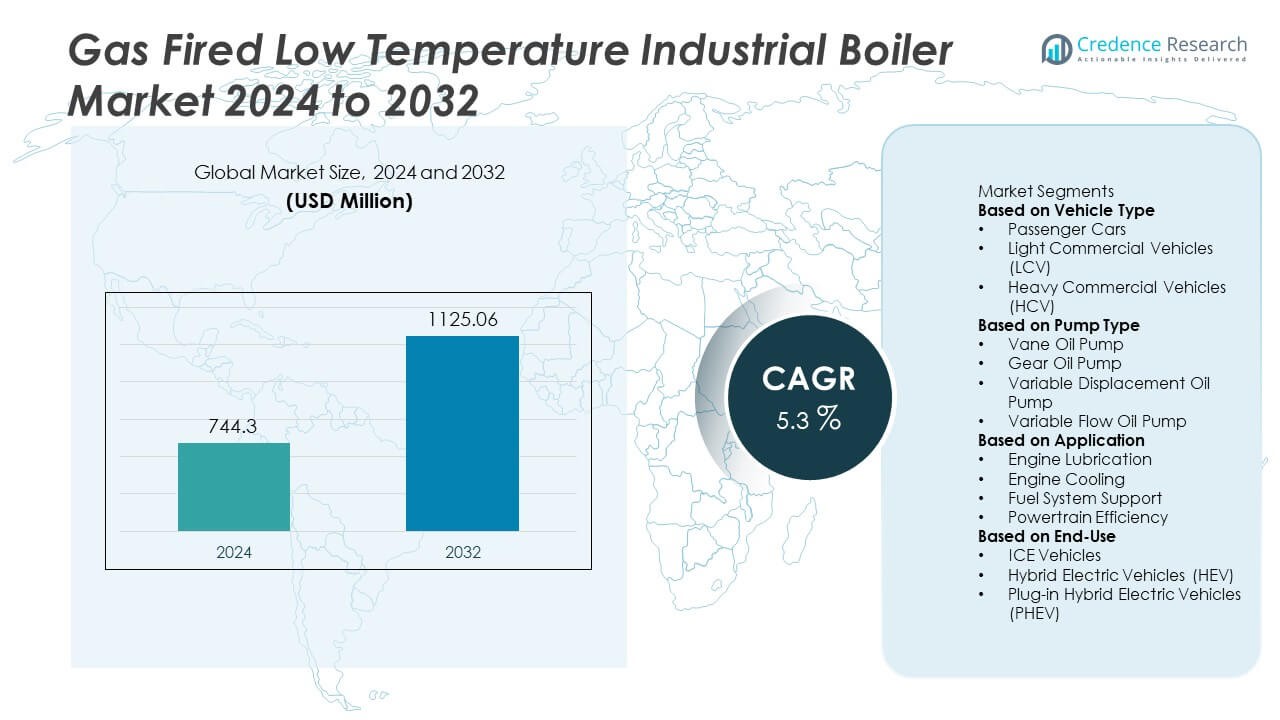

The Gas Fired Low Temperature Industrial Boiler Market reached USD 744.3 million in 2024. The market is projected to grow to USD 1,125.06 million by 2032, reflecting a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fired Low Temperature Industrial Boiler Market Size 2024 |

USD 744.3 Million |

| Gas Fired Low Temperature Industrial Boiler Market, CAGR |

5.3% |

| Gas Fired Low Temperature Industrial Boiler Market Size 2032 |

USD 1,125.06 Million |

The top players in the Gas Fired Low Temperature Industrial Boiler market include Cleaver-Brooks, Hoval, Clayton Industries, Fulton, Hurst Boiler & Welding, Babcock Wanson, Danstoker, Cochran, Bosch Industriekessel, and Ferroli, each focusing on high-efficiency, low-NOx, and heat recovery-enabled boiler technologies to support industrial heating and process applications. Asia Pacific leads the market with a 33% share, driven by rapid industrialization and the transition to cleaner natural gas systems across China, India, Japan, and South Korea. Europe follows with 28% due to strict decarbonization policies and strong adoption in food, beverage, and chemical sectors, while North America holds 26%, supported by modernization of legacy boiler systems and growth in pharmaceuticals, food processing, and district energy applications.

Market Insights

Market Insights

- The Gas Fired Low Temperature Industrial Boiler market reached USD 744.3 million in 2024 and is projected to reach USD 1,125.06 million by 2032, registering a CAGR of 5.3% during the forecast period.

- Growing demand for energy-efficient process heating in food processing, pharmaceuticals, and specialty chemicals drives adoption, with the 10–25 MMBTU/hr capacity segment holding the largest 42% share due to strong suitability for mid-scale industrial operations.

- Key trends include increasing deployment of low-NOx and condensing boiler technologies, along with rising integration of modular, package-ready systems that support faster installation and digital monitoring for enhanced operational reliability.

- Cleaver-Brooks, Hoval, Clayton Industries, Fulton, Hurst Boiler & Welding, Babcock Wanson, Danstoker, Cochran, Bosch Industriekessel, and Ferroli lead the competitive landscape, focusing on heat recovery designs, automation, and customized industrial boiler solutions.

- Asia Pacific leads regional demand with a 33% share, followed by Europe at 28% and North America at 26%, supported by industrial modernization, cleaner fuel transitions, and strong investment in food, textiles, and chemical processing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Temperature

The > 140°F – 160°F segment holds the dominant 39% share of the Gas Fired Low Temperature Industrial Boiler market. This temperature range supports efficient heat transfer for food processing, chemical production, and textile manufacturing, driving strong adoption. Industries prefer this range due to stable steam generation and reduced thermal stress on system components, improving equipment life and lowering maintenance costs. The ≤ 120°F segment also shows increasing demand across HVAC, district heating, and low-intensity processing. Growing focus on fuel efficiency and lower NOx emissions continues to support market growth across temperature segments.

- For instance, Cleaver-Brooks integrated a heat recovery system that can raise thermal efficiency to over 90% and capture significant waste heat, which improves fuel utilization in continuous steam processing.

By Capacity

The 10 – 25 MMBTU/hr segment accounts for the largest share of 42% of the market. This capacity range meets heating and process steam requirements across medium-scale operations in pharmaceuticals, packaged food, and small chemical plants. Automation-ready control systems and lower installation costs support strong adoption among industrial users shifting toward energy-efficient boiler operations. The > 50 MMBTU/hr category grows steadily in petrochemical and metals processing. Demand rises as industries modernize aging boiler units and prioritize reduced fuel consumption along with improved output reliability.

- For instance, Remforce provides a remote boiler monitoring solution that works with any system and monitors critical data like temperature and pressure, which can be adapted to Hurst boilers.

By Product

Fire-tube boilers hold the leading market share of 57% due to lower operating pressure requirements, simpler design, and easier maintenance. These systems remain preferred in food processing, commercial heating, and small-scale manufacturing. Water-tube boilers gain traction among high-demand users because of higher temperature tolerance, rapid steam generation, and better safety performance under fluctuating loads. Increasing adoption of advanced control systems and low-NOx burners strengthens both product categories. Technological innovation, including condensing designs and heat recovery solutions, further enhances efficiency and supports broader adoption across diverse industrial applications.

Key Growth Drivers

Rising Demand for Energy-Efficient Industrial Heating

Industries increase investment in energy-efficient heating technologies to reduce fuel consumption and operational costs, which supports the adoption of gas fired low temperature industrial boilers. These systems offer better thermal efficiency, quicker start-up capability, and reduced heat losses compared with conventional boilers. Growth in food processing, chemical production, and pharmaceutical sectors accelerates installation of optimized steam and hot-water systems. Strict emission standards and cost-saving measures encourage companies to replace older equipment with high-efficiency, low-temperature gas-fired units, creating sustained market growth across both existing and new industrial facilities.

- For instance, Cleaver-Brooks offers a line of ClearFire condensing boilers, such as the ClearFire-CE and ClearFire-LC models, which achieve up to 99% thermal efficiency under specific low-temperature return water operating conditions.

Expansion of Food Processing and Chemical Manufacturing

The expanding food and beverage industry, along with continuous growth in chemical and specialty chemical production, drives strong boiler demand. Low-temperature gas-fired boilers support precise heat control, ensuring product consistency and safe processing conditions. Their ability to maintain stable operation at controlled steam and water temperatures increases adoption for batch processing, pasteurization, and drying applications. Investment in modern processing infrastructure and the rise of automated production lines further accelerate adoption. Manufacturers aim to meet quality, hygiene, and efficiency requirements, strengthening market demand.

- For instance, Hoval supplied a boiler for an industrial application. Boilers are used across various processes in manufacturing plants, including cooking and sanitation. Boiler performance is measured by parameters such as steam flow rate (kg/hour) and temperature (°C), which are critical for monitoring efficiency and operational capabilities.

Industrial Modernization and Boiler Replacement Programs

Industrial modernization initiatives prompt companies to upgrade aging boiler systems to meet new sustainability and performance targets. Low-temperature gas boilers reduce greenhouse gas emissions and improve heat exchange efficiency, supporting carbon reduction strategies. Reliability improvements, remote monitoring, and integrated safety controls make these units attractive for replacement in manufacturing plants, textile mills, and district heating networks. Government incentives for cleaner industrial heating and growing awareness of lifecycle cost benefits encourage companies to transition from coal and oil-fired systems toward natural gas-based technology.

Key Trends & Opportunities

Integration of Low-NOx and Condensing Technologies

Manufacturers invest in low-NOx burner configurations and condensing heat recovery systems to reduce emissions and optimize fuel utilization. Condensing gas boilers recover latent heat from exhaust gases, improving operating efficiency and lowering fuel costs. Industries adopt these systems to meet regulatory limits and sustainability objectives. This trend creates opportunities for advanced boiler control automation, smart temperature management, and hybrid system integration. Continuous R&D activity supports performance improvements and broader adoption across medium and large industrial users.

- For instance, Bosch Industriekessel offers its highly efficient UL-S series steam boiler, designed with a three-pass flame-tube/smoke-tube system that can achieve very low emissions, with NOx levels potentially below 50 mg/Nm³, primarily due to its generously sized furnace.

Growth of Modular and Packaged Boiler Systems

Demand for modular and factory-assembled boiler systems rises as industries seek faster installation, shorter maintenance downtime, and flexible capacity expansion. Packaged gas-fired low temperature boilers enable efficient on-site deployment and integration with digital monitoring solutions. Growing adoption in food processing, pharmaceuticals, and district heating applications supports market expansion. Remote asset management and predictive maintenance models further improve operational reliability, creating long-term opportunities for manufacturers offering scalable and service-based boiler portfolios.

- For instance, Clayton Industries supplied a modular skid-mounted steam system to a food processing plant capable of reaching full output in under ten minutes, which helps minimize downtime associated with startup when compared to traditional boilers.

Key Challenges

Volatility in Natural Gas Prices and Supply Risks

Fluctuating natural gas prices affect operating costs and influence boiler purchasing decisions, particularly for cost-sensitive industries. Dependence on natural gas supply infrastructure creates risk in regions with limited pipeline networks or unstable import conditions. Price volatility may reduce the economic advantages of gas-fired systems over alternative heating fuels. Industries operating under long-term budgets may delay modernization or replacement decisions, affecting near-term market growth. Companies must evaluate fuel-switching strategies and efficiency optimization to manage cost uncertainty.

Compliance with Emission and Safety Regulations

Gas fired low temperature industrial boilers must meet strict emission and plant safety regulations, increasing design and certification requirements. Low-NOx and ultra-low-NOx compliance can raise equipment costs and require specialized burner technology. Industries with high regulatory oversight may require complex monitoring systems, increasing installation and maintenance expenses. Failure to maintain compliance risks operational penalties and shutdowns. Manufacturers must innovate materials, automation, and combustion control systems to satisfy safety, environmental, and performance standards in different regions.

Regional Analysis

North America

North America holds a market share of 26% driven by strong adoption of energy-efficient industrial heating systems across food processing, chemicals, and commercial infrastructure. U.S. manufacturers invest in low-NOx, condensing, and automation-ready boiler technologies to meet federal emission standards and reduce operational fuel costs. Growth in pharmaceutical production and expanding district heating networks further contributes to demand. Modernization of legacy coal and oil-fired systems continues as companies shift toward natural gas-based heating solutions. Increasing focus on industrial decarbonization and integration of remote monitoring systems supports ongoing market expansion across the United States and Canada.

Europe

Europe accounts for a 28% market share supported by strict carbon reduction targets, clean industrial heating policies, and rapid deployment of low-temperature gas boiler systems. Germany, France, Italy, and the United Kingdom lead adoption due to strong food processing and specialty chemical manufacturing. Industrial users prioritize high-efficiency, low-NOx, and condensing boiler units to comply with EU environmental directives. Growth in district heating and cogeneration further enhances demand. Replacement of outdated boilers accelerates as businesses align with energy performance standards, making Europe a key market for advanced automation-enabled gas-fired boiler technologies with smart control and heat recovery features.

Asia Pacific

Asia Pacific commands the largest share at 33% due to rapid industrialization and expanding processing industries across China, India, Japan, and South Korea. Demand rises in food processing, pharmaceuticals, textiles, and packaged goods manufacturing, driving installation of reliable low-temperature gas-fired boilers. Government initiatives promoting cleaner fuel transitions from coal to natural gas strengthen adoption. High investments in chemical and petrochemical plants also support market growth. Local and global boiler manufacturers expand production capacity and offer modular and high-efficiency condensing systems tailored for diverse industrial needs. Increasing infrastructure development and rising energy consumption reinforce Asia Pacific’s leading position.

Latin America

Latin America holds an 8% market share supported by growing use of gas-fired boilers in food production, beverages, and light manufacturing. Brazil and Mexico lead demand due to expanding industrial and commercial heating requirements. Companies gradually adopt low-NOx and automation-ready boiler systems to reduce fuel costs and improve process reliability. Natural gas infrastructure development supports long-term growth, although adoption varies across countries. Economic recovery and increasing investment in food exports and pharmaceutical production encourage modernization of steam and hot-water systems, strengthening opportunities for efficient low-temperature gas boiler technologies across the region.

Middle East and Africa

Middle East and Africa represent a 5% market share, with demand emerging from food processing, desalination-related industries, and commercial heating applications. Countries such as Saudi Arabia, the UAE, and South Africa modernize industrial heating systems and adopt cleaner natural gas-based solutions. Harsh climate conditions increase the need for operational reliability and efficient thermal control. Limited pipeline networks in some areas influence adoption, but LNG import capacity and infrastructure expansion improve long-term prospects. Growing industrial diversification, manufacturing investments, and government energy transition plans support continued adoption of low-temperature gas-fired boilers across the region.

Market Segmentations:

By Temperature

- ≤ 120°F

- > 120°F – 140°F

- > 140°F – 160°F

- > 160°F – 180°F

By Capacity

- 10 MMBTU/hr

- 10 – 25 MMBTU/hr

- 25 – 50 MMBTU/hr

- > 50 MMBTU/hr

By Product

By Application

- Food Processing

- Pulp & Paper

- Chemical

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Cleaver-Brooks, Hoval, Clayton Industries, Fulton, Hurst Boiler & Welding, Babcock Wanson, Danstoker, Cochran, Bosch Industriekessel, and Ferroli lead the competitive landscape of the Gas Fired Low Temperature Industrial Boiler market. Competition is shaped by efficiency-driven design enhancements, integration of low-NOx burner technologies, and the rising demand for condensing and modular boiler systems across industrial processing environments. Manufacturers focus on expanding product portfolios that support reduced fuel consumption and extended operational life, targeting food processing, pharmaceutical, textile, and district heating applications. Strategic collaborations with gas utilities, engineering firms, and industrial automation providers strengthen product deployment and service networks. Investments in digital monitoring, heat recovery solutions, and remote performance diagnostics further differentiate market offerings. Companies also expand manufacturing footprints and after-sales service capabilities in Asia Pacific and Europe to address growing replacement and modernization requirements. The competitive environment continues to shift toward cleaner combustion systems and automated control platforms aligned with industrial sustainability goals.

Key Player Analysis

- Cleaver-Brooks

- Hoval

- Clayton Industries

- Fulton

- Hurst Boiler & Welding

- Babcock Wanson

- Danstoker

- Cochran

- Bosch Industriekessel

- Ferroli

Recent Developments

- In 2024, Babcock Wanson launched its LV-Pack low-voltage industrial electric boiler, which offers steam outputs from 600 kg/h to 8,400 kg/h and includes integrated monitoring and remote-data logging via the Navinergy operating system.

- In July 2023, Fulton introduced two redesigned VSRT steam-boiler models with outputs of 1,565 kg/h and 1,956 kg/h, expanding its range.

- In February 2023, Babcock Wanson announced the successful installation of a BWD40 fire-tube boiler at the Meantime Brewing facility in London as part of a site refurbishment and capacity expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Temperature, Capacity, Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption will increase as industries shift toward cleaner and more efficient heating systems.

- Condensing and low-NOx technologies will gain wider acceptance across major industrial applications.

- Modular and packaged boiler solutions will expand due to faster installation and lower downtime.

- Integration of digital monitoring and predictive maintenance will enhance system reliability.

- Replacement demand will rise as companies phase out aging coal and oil-fired units.

- Food, beverage, pharmaceutical, and chemical sectors will remain strong demand contributors.

- Manufacturers will focus on advanced burner controls and optimized heat recovery solutions.

- Asia Pacific will remain the fastest-growing region due to rapid industrialization and gas infrastructure expansion.

- Government regulations promoting carbon reduction and fuel switching will accelerate technology upgrades.

- Aftermarket services and long-term maintenance contracts will become key revenue drivers for boiler suppliers.

Asia Pacific led the Gas Fired Low Temperature Industrial Boiler market with a 33% regional share.

Market Insights

Market Insights