Market Overview:

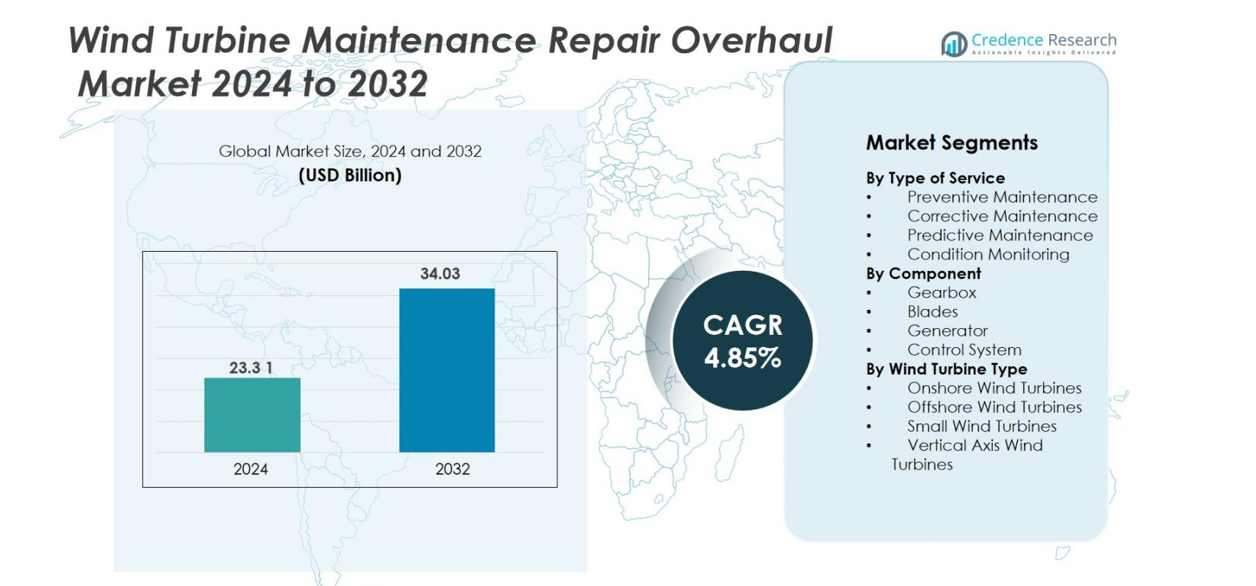

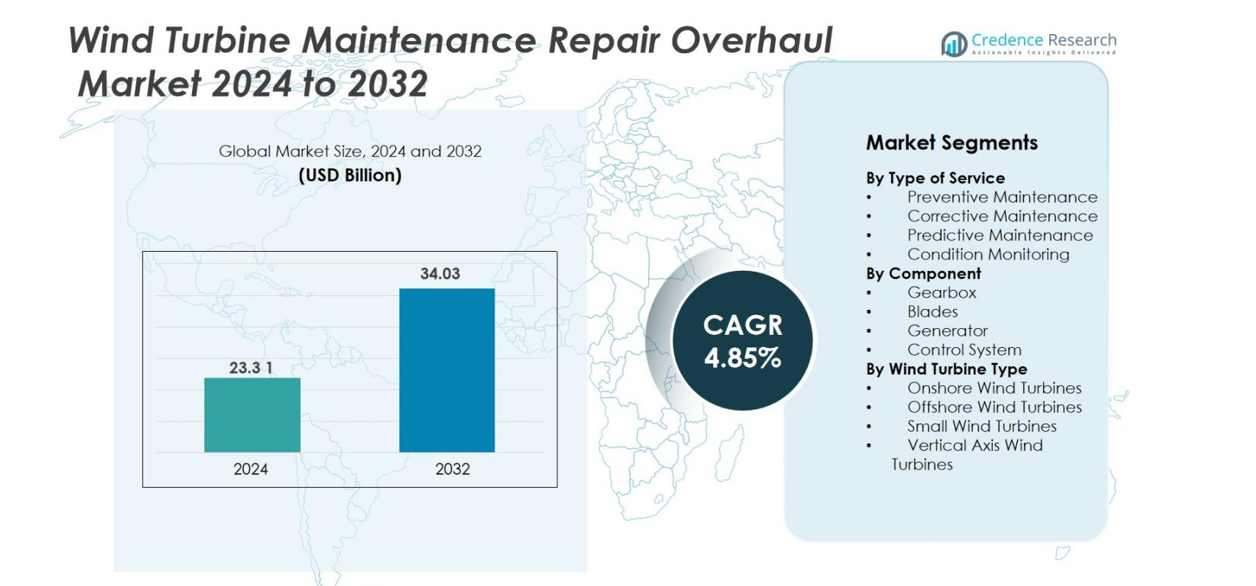

Wind Turbine Maintenance Repair Overhaul market size was valued USD 23.3 Billion in 2024 and is anticipated to reach USD 34.03 Billion by 2032, at a CAGR of 4.85% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wind Turbine Maintenance Repair Overhaul Market Size 2024 |

USD 23.3 Billion |

| Wind Turbine Maintenance Repair Overhaul Market, CAGR |

4.85% |

| Wind Turbine Maintenance Repair Overhaul Market Size 2032 |

USD 34.03 Billion |

Leading players in the Wind Turbine Maintenance, Repair, and Overhaul market include Vestas, Siemens Gamesa, GE Renewable Energy, Nordex, Acciona Energy, RWE Renewables, Enel Green Power, Vattenfall, EDP Renewables, Gestamp Wind, Innergex Renewable Energy, Senvion, Boralex, and MHI Vestas. These companies offer long-term service contracts, predictive analytics, blade refurbishment, gearbox overhaul, and digital monitoring platforms to maximize turbine uptime. Europe leads the market with a 31% share, driven by a large installed base, offshore expansion, and strict performance standards. North America follows with 28%, supported by aging fleets and repowering programs, while Asia Pacific holds 27% due to rapid capacity additions and rising service partnerships.

Market Insights

- The Wind Turbine Maintenance, Repair, and Overhaul market was valued at USD 23.3 Billion in 2024 and is expected to reach USD 34.03 Billion by 2032, growing at a CAGR of 4.85% during the forecast period.

- Market growth is driven by an expanding global wind fleet, with preventive maintenance holding the largest share due to scheduled servicing, lubrication, and part replacements that reduce downtime and protect revenue.

- Digital and predictive solutions, including vibration monitoring, drones, and thermal imaging, are key trends that support early fault detection and remote diagnostics, lowering technician risk and operational cost.

- Major players such as Vestas, Siemens Gamesa, GE Renewable Energy, and Nordex compete through service contracts, digital monitoring platforms, and component refurbishment, while independent service providers gain traction with low-cost blade and gearbox repair solutions.

- Europe leads with 31% market share, followed by North America at 28% and Asia Pacific at 27%, and onshore turbines dominate the turbine-type segment due to easy accessibility and large installed capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type of Service

Preventive maintenance held the largest share of around 46%, driven by scheduled inspections, lubrication cycles, and timely part replacements that reduce costly downtime. Utility-scale projects rely on structured service contracts to meet performance guarantees. Digital monitoring tools enable early fault detection and reduce onsite intervention. Predictive and condition-based programs are expanding as operators use vibration analysis and thermal imaging. Corrective maintenance continues to serve aging fleets facing gearbox and blade failures. However, preventive maintenance remains dominant due to long-term reliability needs and warranty compliance for multi-MW turbines.

- For instance, Siemens Energy uses its GenAdvisor™ platform for continuous vibration and partial discharge monitoring on generators, enabling early fault detection and optimized service planning.

By Component

Gearbox maintenance accounted for the leading 42% share because high torque loads and mechanical stress make it the most failure-prone turbine part. Operators invest in oil quality analysis, alignment checks, and torque inspections to extend service life. Blade repair demand is also increasing due to erosion and lightning damage. Generator servicing supports power quality in grid-connected units, while control system upgrades improve automation and safety. Still, the gearbox segment leads due to costly repairs, extended downtime risk, and the need for specialized technicians and diagnostic tools.

- For instance, Famur Gearo in Katowice specializes in precise gearbox repairs including dismantling, micrometer-accurate machining, and dynamometer testing to ensure reliability before reinstallation.

By Wind Turbine Type

Onshore wind turbines captured about 72% of the market, supported by the world’s largest installed capacity and easier access for repairs. Lower logistics cost, quicker technician deployment, and dense wind farm clusters enable frequent service schedules. Offshore turbines show faster growth, driven by harsh marine conditions and the adoption of remote inspection, robotics, and high-capacity service vessels. Small and vertical-axis units serve niche commercial applications. Onshore units remain dominant as mature projects, aging fleets, and widespread penetration create consistent demand for maintenance, repair, and overhaul services.

Key Growth Drivers

Growing Installed Wind Capacity and Aging Turbine Fleet

Global wind installations continue to rise across utility and commercial sectors. Each new turbine brings a long-term service need. Thousands of early-generation machines are now past their design life and require frequent inspections. Aging blades, bearings, and control systems fail more often and demand scheduled part replacement. Turbine owners sign long service contracts to secure uptime and protect revenue. Independent service providers enter the market with cheaper repair options. Governments extend renewable targets, which increases turbine density and service volume. Larger rotor diameters also push higher stress on components, especially gearboxes and generators.

- For instance, Ørsted has partnered with independent service providers for gearbox replacements and generator refurbishments on its UK offshore wind farms, responding to component failures that rise as turbines pass the 20-year mark.

Shift Toward Digital, Predictive, and Condition-Based Maintenance

Operators invest in predictive tools to avoid sudden failures and protect output. Vibration monitoring, thermal cameras, and oil analysis detect faults before downtime occurs. Digital twins create virtual turbine models and simulate wear patterns. Remote monitoring centers control hundreds of units from a single platform. Predictive alerts reduce field visits and safety risks for technicians. AI analytics schedule repairs at the best possible time. Utilities cut travel cost and increase component life. Operators also use drones and robots for tower inspection and blade repair. Predictive maintenance supports higher energy yield and stable grid supply. The shift from manual checks to data-driven service strengthens long-term reliability.

- For instance, Iberdrola has employed drones to inspect over 1,200 wind turbine blades across Spain and Mexico, substantially reducing inspection costs and improving safety by detecting structural faults early.

Growing Demand for Offshore Wind Service Solutions

Offshore projects expand in Europe, Asia, and North America. Harsh marine conditions speed up part failures, corrosion, and blade damage. Operators require specialized vessels, cranes, and robotics for service. Offshore turbines are larger, so tasks need trained technicians and advanced tools. Remote inspection through drones reduces human risk. Predictive platforms monitor vibration, temperature, and weather impact in real time. Floating turbines add new technical challenges for maintenance teams. Governments support offshore wind with long purchase agreements. Private developers invest in dedicated offshore repair hubs and logistics bases. Growing offshore capacity guarantees continuous service revenue for OEMs and third-party companies.

Key Trends and Opportunities

Adoption of Robotics, Drones, and Automated Repair Platforms

Robotics and drones change how operators inspect blades and towers. Drones capture high-resolution images and thermal scans in minutes. Robotic crawlers repair cracks and sand blades without stopping turbine operation. These tools cut downtime and technician risk. Autonomous systems reach heights and angles that human crews struggle to access. Companies deploy automated corrosion removal and surface coating robots at offshore sites. This trend lowers labor cost and increases accuracy. Start-ups enter the market with AI-based crack detection software. Robotics create new revenue streams for service companies and open opportunities for innovation.

- For instance, GE Aerospace has developed the “Sensiworm,” a soft robotic crawler equipped with sensors that can navigate complex turbine engine parts to detect defects and perform on-wing inspections, expanding coverage beyond traditional tools.

Growth of Long-Term Service Contracts and Independent Service Providers

Fleet owners prefer long-term contracts to guarantee uptime and reduce uncertainty. OEMs bundle maintenance, monitoring, and spare parts in multi-year agreements. Independent service providers offer cheaper solutions for aging turbines. Competition lowers repair cost and improves turnaround time. Small wind farms choose modular service plans to control expenses. Turbine owners benefit from flexible coverage and remote diagnostics. Contract-based service reduces emergency repairs and increases turbine life. This trend encourages market consolidation and fresh investment in skilled labor and tooling.

- For instance, GE Renewable Energy secured a 10-year full-service agreement for 122 GE 1.56-82.5 turbines at Idaho Wind Partners’ farms, achieving 99+% availability through digital monitoring and field service tools.

Key Challenges

High Cost of Offshore Maintenance and Shortage of Technicians

Offshore maintenance remains expensive due to vessels, cranes, and weather delays. Bad sea conditions pause service for days, reducing energy output and efficiency. Technicians require special training for offshore safety, rope access, and turbine-specific certifications. Skilled labor shortages affect repair timelines and cost, especially in remote wind farms. Moving heavy parts from ports to turbines demands planning, advanced lifting systems, and high logistics spending. Smaller operators struggle to finance such tasks, often relying on third-party contractors. These issues slow offshore growth, increase operational risk, and raise long-term maintenance budgets for wind energy operators.

Supply Chain Bottlenecks and Spare Part Availability Issues

Gearboxes, blades, transformers, and control systems face long lead times due to manufacturing constraints. Delays in shipping and sourcing raise downtime risk, lowering overall project profitability. Older turbines need custom parts that manufacturers no longer produce or support. Operators struggle to stock large or costly spares, especially for offshore locations. Supply chain disruptions impact revenue, extend repair windows, and strain service timelines. Companies respond with local repair hubs, additive manufacturing, and part refurbishment centers, but bottlenecks still affect reliability and increase pressure on maintenance planning and inventory control systems.

Regional Analysis

North America

North America held nearly 28% of the market due to a mature onshore fleet and rising repowering projects across the U.S. and Canada. Many early-installed turbines have crossed 15–20 years of operation, creating strong demand for blade repair, gearbox servicing, and control system upgrades. Service companies deploy predictive maintenance tools, remote monitoring centers, and drones to reduce downtime and labor costs. Offshore activity along the U.S. East Coast adds new requirements for heavy-lift vessels and corrosion management. Supportive renewable targets and utility-scale contracts ensure steady long-term service demand for OEMs and independent providers.

Europe

Europe captured the largest 31% share because the region hosts the world’s most advanced onshore and offshore wind infrastructure. Ageing fleets in Germany, Spain, and Denmark require frequent overhaul, repowering, and component replacement. Offshore hubs in the U.K., Netherlands, and France drive high-value maintenance projects using vessels, cranes, and robotics. Strict performance standards and grid balancing regulations push operators toward predictive analytics and condition monitoring. Service firms expand blade refurbishment and nacelle repair facilities near major ports. Government investment in offshore wind and carbon-neutral targets ensures continuous service revenue across the region.

Asia Pacific

Asia Pacific accounted for around 27% of the market, supported by rapid wind farm expansion in China, India, Japan, South Korea, and Australia. China has the world’s largest installed capacity, creating long-term service opportunities for gearbox repairs, generator maintenance, and tower inspection. Harsh climatic conditions in coastal zones increase corrosion and blade erosion, driving demand for specialized refurbishments. Governments promote renewable targets and long-term service contracts to reduce downtime in utility-scale farms. Local manufacturers partner with service companies to supply spare parts faster and reduce import dependency, strengthening the region’s long-term MRO ecosystem.

Latin America

Latin America held a 7% share, driven by wind development in Brazil, Mexico, Chile, and Argentina. Onshore turbines dominate and require periodic blade repair, lubrication services, and control system upgrades. Remote farm locations create logistical challenges, pushing operators toward predictive monitoring and remote diagnostics. International OEMs expand service stations and component warehouses to reduce part delays. Policy support and rising private investment strengthen long-term service demand. As installed capacity increases, independent service providers enter the market with cost-effective repair contracts for small and medium wind farm operators.

Middle East & Africa

Middle East & Africa accounted for roughly 7% of the market, supported by wind expansion in Egypt, Morocco, South Africa, Saudi Arabia, and UAE. High-temperature and desert environments accelerate component wear, especially blades and gearboxes. Operators adopt condition monitoring tools and IoT sensors to prevent unplanned outages. Governments invest in grid-connected projects and hybrid renewable systems, driving new maintenance demand. OEMs establish regional service hubs to supply parts without long shipping delays. Although the market is smaller than other regions, growing installations and carbon-neutral policies create strong long-term MRO opportunities.

Market Segmentations

By Type of Service

- Preventive Maintenance

- Corrective Maintenance

- Predictive Maintenance

- Condition Monitoring

By Component

- Gearbox

- Blades

- Generator

- Control System

By Wind Turbine Type

- Onshore Wind Turbines

- Offshore Wind Turbines

- Small Wind Turbines

- Vertical Axis Wind Turbines

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Wind Turbine Maintenance, Repair, and Overhaul market features strong competition between OEMs, independent service providers, and specialized component refurbishers. Leading turbine manufacturers such as Vestas, Siemens Gamesa, GE Renewable Energy, and Nordex offer long-term service contracts, digital monitoring platforms, and spare part programs to secure multi-year revenue. Independent service providers gain traction by offering lower-cost repairs, blade refurbishment, and field technician support for aging fleets. Companies invest in predictive analytics, SCADA integration, and remote inspection tools to reduce downtime and extend asset life. Robotics, drones, and automated blade repair systems create differentiation among technology-driven service firms. Offshore expansion drives partnerships with maritime logistics companies for crane vessels, crew transfer boats, and corrosion-resistant solutions. Market consolidation continues as OEMs and service firms acquire smaller operators to increase geographic reach and component availability. Growing installed wind capacity, aging turbines, and digital maintenance technologies ensure a highly competitive and innovation-focused landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- RWE Renewables

- Acciona Energy

- GE Renewable Energy

- Gestamp Wind

- Innergex Renewable Energy

- Vestas

- Siemens Gamesa

- Enel Green Power

- Boralex

- MHI Vestas

Recent Developments

- In June 2023, Enercon partnered with Kalyon Enerji, a renewable energy investor, for a 260 MW wind project in Turkey, under which it will supply and install 64 E-138 EP3 wind turbines for Kalyon’s Yeka Res-3 initiative.

- In May 2023, General Electric launched an upgraded online marketplace designed for onshore wind components, streamlining procurement and component availability for wind energy operators.

- In April 2023, Siemens Gamesa Renewable Energy, S.A. signed a contract with ArcelorMittal’s Indian subsidiary to supply 46 SG 3.6-145 wind turbines for a 166 MW project in Andhra Pradesh, India.

- In April 2023, ENERCON GmbH entered a memorandum of understanding with Enerjisa Üretim Santralleri A.Ş. to deliver two advanced ENERCON E-175 EP5 wind energy converters.

Report Coverage

The research report offers an in-depth analysis based on Service, Compound, Wind Turbine and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Aging wind fleets will increase demand for blade refurbishment, gearbox overhaul, and control system upgrades.

- Predictive maintenance platforms will replace manual inspections and reduce unplanned downtime.

- Drones and robotics will expand in tower, blade, and nacelle inspection to improve safety and accuracy.

- Service contracts will grow as operators seek fixed maintenance costs and guaranteed turbine availability.

- Offshore maintenance requirements will rise with larger turbines and harsh marine environments.

- Remote monitoring centers will manage multiple wind farms and optimize repair schedules.

- Component recycling and refurbishment will gain importance to reduce replacement cost and supply chain delays.

- Independent service providers will expand in markets with aging onshore turbines and limited OEM support.

- Local service hubs will grow in emerging wind regions to shorten part delivery timelines.

- Digital twins and AI-based diagnostics will improve fault prediction and extend turbine life.