Market Overview:

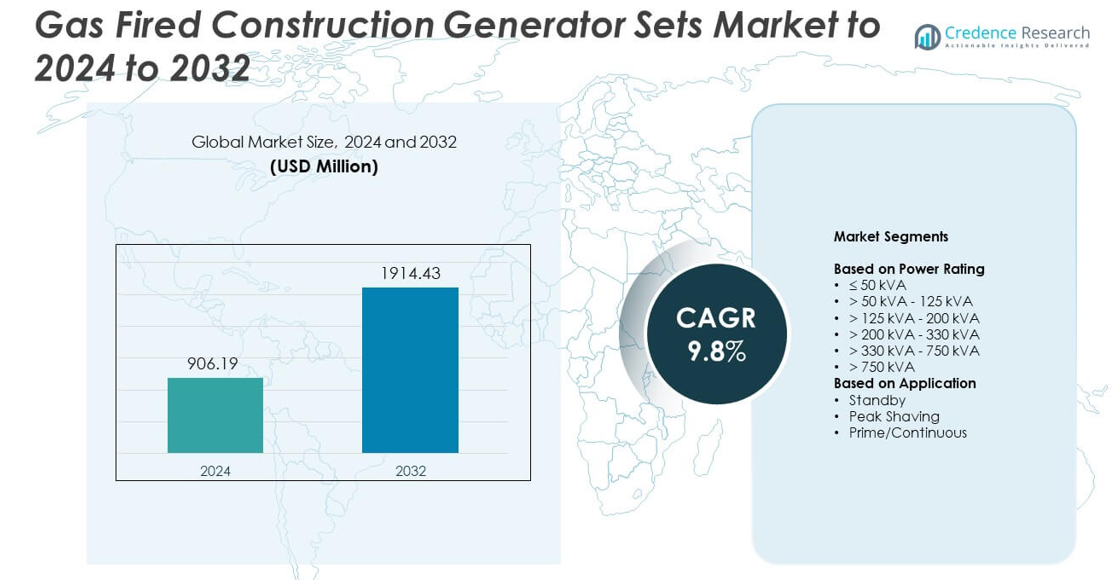

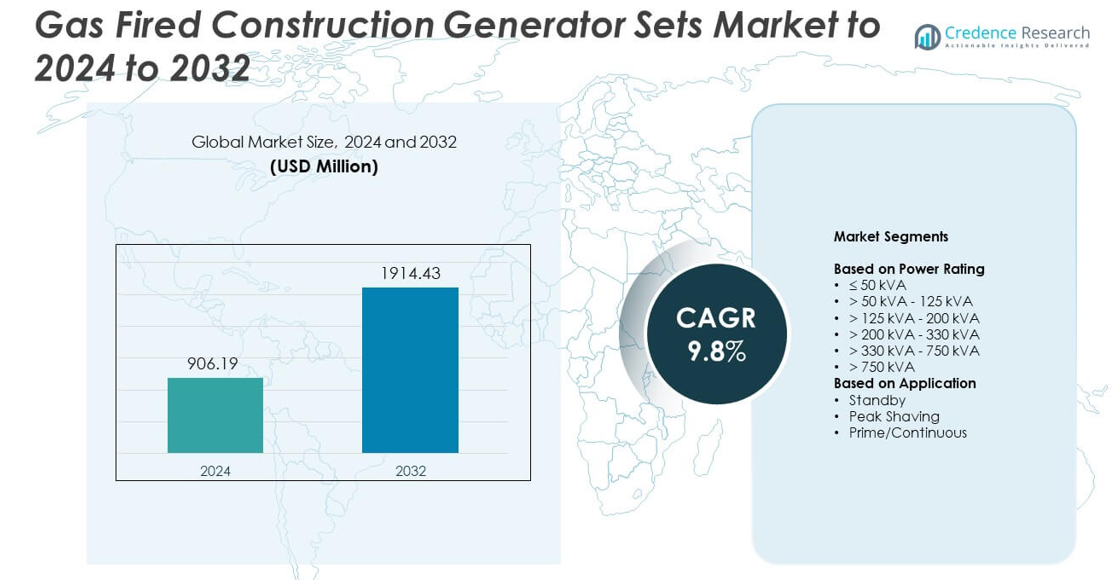

Gas Fired Construction Generator Sets Market size was valued at USD 906.19 Million in 2024 and is anticipated to reach USD 1914.43 Million by 2032, at a CAGR of 9.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gas Fired Construction Generator Sets Market Size 2024 |

USD 906.19 Million |

| Gas Fired Construction Generator Sets Market, CAGR |

9.8% |

| Gas Fired Construction Generator Sets Market Size 2032 |

USD 1914.43 Million |

The Gas Fired Construction Generator Sets Market is shaped by major players such as HIMOINSA, Greaves Cotton, Aggreko, Kirloskar, Caterpillar, Generac Power Systems, J C Bamford Excavators, Cooper, Atlas Copco, and Cummins. These companies compete through cleaner combustion systems, smart monitoring features, and strong rental fleet offerings that support evolving construction power needs. North America leads the market with about 38% share due to advanced gas infrastructure and strict emission norms. Asia Pacific follows with nearly 30% share, driven by rapid urban development and large infrastructure pipelines, while Europe holds close to 26% supported by strong sustainability regulations.

Market Insights

- The Gas Fired Construction Generator Sets Market reached USD 906.19 Million in 2024 and will rise to USD 1914.43 Million by 2032 at a CAGR of 9.8%.

• Cleaner emission requirements, wider gas availability, and strong construction activity drive demand, with the 50–125 kVA segment holding the largest share at about 34%.

• Key trends include rising use of hybrid power systems, remote monitoring features, and increased adoption of gas-based rental fleets across major construction zones.

• Competitive activity focuses on fuel-efficient engines, low-noise systems, and service-driven differentiation as manufacturers expand rental fleets and digital-enabled models.

• North America leads with nearly 38% share, followed by Asia Pacific at around 30% and Europe at close to 26%, supported by gas network expansion and strict sustainability norms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Power Rating

The power rating segment is led by the 50–125 kVA class with about 34% share in 2024. This range dominates because construction sites need compact generator sets for tools, lighting, and temporary office units. The segment grows as small and mid-size projects increase across urban zones. Demand rises due to stable fuel efficiency, easy mobility, and lower emission levels from modern gas-fired systems. Higher ranges such as 330–750 kVA serve heavy-duty loads, but the mid-capacity class remains the preferred choice for most contracting operations.

- For instance, the Cummins C1160N5C natural gas generator set has a manufacturer-stated NOx emission of approximately 500 mg/Nm³ at 50 Hz/1160 kW power output at 5% O₂.

By Application

The standby category holds the dominant share at nearly 47% in 2024. Standby generator sets lead because construction projects rely on backup power to avoid delays during grid outages. This dependence grows as builders adopt tighter project timelines and face rising power interruptions. Gas-fired models gain traction due to cleaner operation and lower running cost compared with diesel sets. Prime and continuous units support remote or long-duration work sites, while peak shaving units address cost control, but standby remains the preferred application across the sector.

- For instance, Generac produces gaseous generators like the industrial SG130 and residential RG13090 models, which offer a 130 kW standby rating and use a 9.0-liter, 8-cylinder engine.

Key Growth Drivers

Rising Demand for Cleaner On-Site Power

Construction firms prefer gas-fired generator sets because they emit fewer pollutants than diesel units. This shift accelerates as regulators push stricter emission norms for temporary power systems. Builders also adopt cleaner fuel options like natural gas to meet sustainability targets. Growing urban construction, where emission restrictions are tighter, further supports demand. The need for reliable and cleaner temporary power makes gas-fired systems a strong choice across commercial, residential, and infrastructure sites.

- For instance, Caterpillar documents that the G3512 gas generator set achieves NOx emissions as low as 0.5 g/bhp-hr under lean-burn operation, a certified figure published in its emissions specification sheets.

Expansion of Urban Infrastructure Projects

Large-scale urban development increases the requirement for stable on-site power. Projects such as metro systems, smart cities, bridges, and industrial parks rely on gas-fired generator sets for continuous or backup power. Contractors pick gas units because they offer lower operating cost and steady performance during long construction cycles. This expansion creates sustained demand as new public and private infrastructure pipelines grow across emerging and developed economies.

- For instance, JCB publicly lists the G125QI (which is a model variant in the QS range for some markets) as a diesel generator that delivers a prime output of 125 kVA and operates with a 1500 rpm engine speed for construction and general duties.

Improved Fuel Availability and Lower Operating Cost

Natural gas networks are expanding in many regions, making fuel supply more stable for construction sites. Better access reduces logistics issues linked with diesel transport and storage. Gas-fired generator sets also deliver lower running cost due to reduced fuel price volatility. Construction companies choose these systems to manage long project timelines and avoid cost overruns. This combination of fuel stability and cost efficiency drives broad adoption across medium and large construction projects.

Key Trends & Opportunities

Shift Toward Hybrid and Smart Generator Systems

Construction companies adopt hybrid systems that pair gas generator sets with battery storage or energy management tools. This shift increases efficiency by reducing idling time and optimizing load sharing. Smart monitoring features help track performance, predict maintenance needs, and improve fuel use. These upgrades create opportunities for manufacturers to offer advanced digital-enabled gas generator models and integrated power solutions tailored for construction workflows.

- For instance, Himoinsa specifies that its EHR 45/60 battery-hybrid module provides 56.8 kWh usable battery capacity and supports 600 A peak discharge, enabling hybridized generator-battery operation at construction sites.

Growth in Rental-Based Deployments

Rental power services gain traction as contractors avoid heavy upfront investment. Gas-fired construction generator sets are in demand within rental fleets because they deliver reliable output and meet emission norms. Short-term construction jobs, seasonal activities, and remote sites rely heavily on rental options. This trend offers strong opportunities for rental companies and manufacturers supplying lightweight, portable, and fuel-efficient gas-fired units.

- For instance, Aggreko lists a 1375 kVA gas generator in its rental fleet, which offers 1120 kW of continuous power at 50 Hz and is a high-output, rapid-deploy power module for temporary and remote power needs.

Key Challenges

High Initial Installation and Setup Cost

Gas-fired generator sets require higher upfront investment due to fuel system integration, ventilation needs, and specialized components. Smaller contractors may struggle to justify the cost compared with diesel models. The need for skilled technicians during installation adds further expense. These financial barriers slow adoption, especially in regions with limited capital availability for construction equipment upgrades.

Limited Gas Infrastructure in Remote Areas

Many construction zones, especially in developing regions, lack access to stable gas pipelines. Transporting compressed or liquefied gas increases operational complexity and cost. This infrastructure gap restricts deployment of gas-fired generator sets in off-grid or rural sites. As a result, diesel units remain the default choice in many remote areas despite higher emissions, making infrastructure limitations a major challenge for market expansion.

Regional Analysis

North America

North America holds the largest share at about 38% in 2024. The region leads due to strong construction spending, widespread gas infrastructure, and strict emission rules that encourage cleaner generator technologies. Contractors prefer gas-fired units for commercial, residential, and infrastructure work because running cost is lower than diesel. Growth in urban redevelopment and large infrastructure projects, including transport and utility upgrades, supports steady adoption. The presence of established generator manufacturers and rental fleet providers further strengthens the regional market position.

Europe

Europe accounts for nearly 26% share in 2024. The region benefits from advanced natural gas networks, strict environmental policies, and strong demand for low-emission temporary power systems. Construction companies adopt gas-fired generator sets to comply with sustainability targets and reduce operational emissions on regulated project sites. Growth in smart city development, industrial refurbishment, and green building projects supports wider deployment. Rising preference for hybrid and digital-enabled power solutions also enhances market expansion across key countries, including Germany, the UK, France, and the Nordic region.

Asia Pacific

Asia Pacific holds about 30% share in 2024, driven by rapid urbanization, expanding infrastructure pipelines, and rising investment in industrial projects. Countries like China, India, and Southeast Asian nations rely on gas-fired generator sets to support large construction zones where stable grid access is limited. Growth in metro networks, commercial complexes, and logistics hubs boosts demand. Improving natural gas distribution and expanding LNG import capacity enhance fuel availability. The region shows strong long-term potential as government-led infrastructure programs continue to expand.

Latin America

Latin America represents close to 4% share in 2024. Market growth is supported by construction activities in commercial buildings, mining areas, and public infrastructure upgrades. Gas-fired generator sets gain traction in countries where natural gas availability improves, particularly Brazil and Mexico. Construction firms adopt gas units to reduce operating cost and meet tightening emission guidelines in urban areas. However, slower expansion of gas pipeline networks restricts broader adoption. Rental demand remains notable in remote and industrial construction projects.

Middle East and Africa

Middle East and Africa account for nearly 2% share in 2024. The region sees steady use of gas-fired generator sets in large-scale construction linked to real estate, energy projects, and industrial zones. Countries with strong gas reserves, such as Qatar, UAE, and Saudi Arabia, support fuel availability, which encourages adoption. However, reliance on diesel remains high in remote construction areas due to easier accessibility. Growing investment in infrastructure diversification and sustainability programs is expected to gradually increase preference for gas-fired units.

Market Segmentations:

By Power Rating

- ≤ 50 kVA

- > 50 kVA – 125 kVA

- > 125 kVA – 200 kVA

- > 200 kVA – 330 kVA

- > 330 kVA – 750 kVA

- > 750 kVA

By Application

- Standby

- Peak Shaving

- Prime/Continuous

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Gas Fired Construction Generator Sets Market is shaped by leading companies such as HIMOINSA, Greaves Cotton, Aggreko, Kirloskar, Caterpillar, Generac Power Systems, J C Bamford Excavators, Cooper, Atlas Copco, and Cummins. The market shows strong competition as manufacturers focus on clean-burn technologies, compact generator design, and enhanced fuel efficiency to meet rising construction power needs. Many players invest in hybrid and digitally monitored generator systems that support load management and predictive maintenance. Rental fleet expansion remains a major competitive area because contractors prefer flexible power solutions with low upfront cost. Companies increase their market presence through regional distribution networks, after-sales service packages, and customizable power configurations. Continuous innovation in low-emission engines, noise-reduction systems, and long-runtime models strengthens competition as construction activities grow across urban, industrial, and infrastructure projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- HIMOINSA

- Greaves Cotton

- Aggreko

- Kirloskar

- Caterpillar

- Generac Power Systems

- J C Bamford Excavators

- Cooper

- Atlas Copco

- Cummins

Recent Developments

- In 2025, Aggreko introduced new natural gas generators including a 350 kW trailer-mounted rapid deploy unit and a robust 1500 kW generator, their largest gas model to date.

- In 2024, Cummins partnered with Liberty Energy to develop a variable speed, large displacement natural gas engine for hydraulic fracturing platforms.

- In 2024, Caterpillar Unveiled the new G3500K series of gas generator sets, offering improved reliability, higher efficiency, and faster response times.

Report Coverage

The research report offers an in-depth analysis based on Power Rating, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market demand will rise as construction firms shift to cleaner power solutions.

- Gas infrastructure expansion will support higher adoption across major construction zones.

- Hybrid generator models will gain traction due to energy efficiency needs.

- Digital monitoring systems will improve fleet management and uptime.

- Rental deployments will grow as contractors avoid high upfront equipment costs.

- Large infrastructure projects will continue to drive steady use of mid-capacity gas units.

- Emission regulations will push builders to phase out older diesel generator sets.

- LNG and CNG supply improvements will enhance usage in remote construction areas.

- Manufacturers will focus on low-noise and fuel-optimized generator designs.

- Demand will strengthen in Asia Pacific as industrial and urban development accelerates.