Market Overview

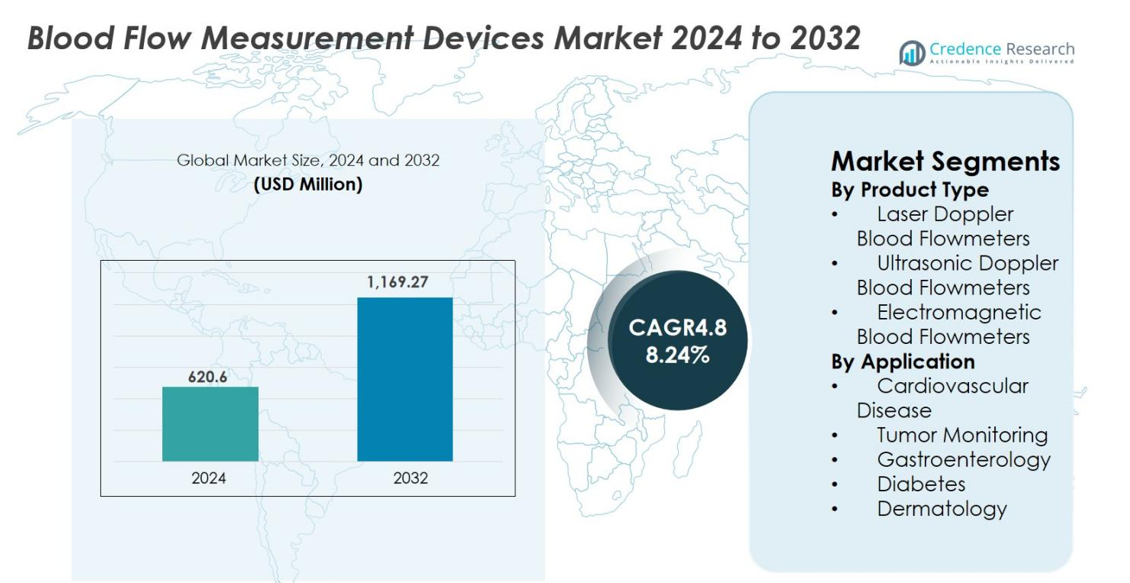

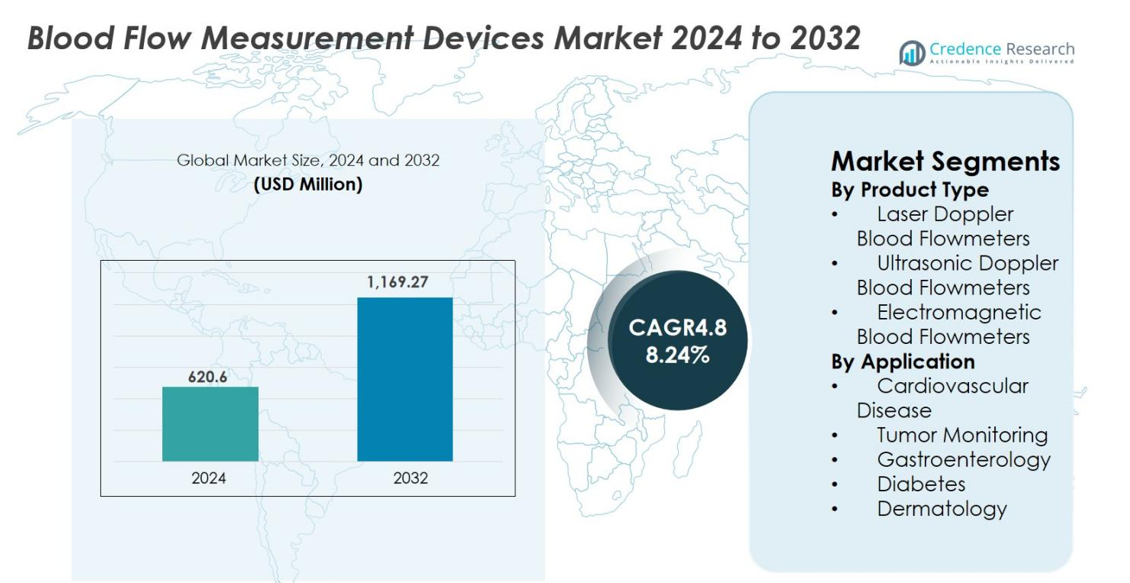

Blood Flow Measurement Devices Market size was valued at USD 620.6 Million in 2024 and is anticipated to reach USD 1,169.27 Million by 2032, at a CAGR of 8.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Blood Flow Measurement Devices Market Size 2024 |

USD 620.6 Million |

| Blood Flow Measurement Devices Market , CAGR |

8.24% |

| Blood Flow Measurement Devices Market Size 2032 |

USD 1,169.27 Million |

Blood Flow Measurement Devices Market features strong participation from leading manufacturers focused on precision diagnostics and microvascular monitoring technologies. Key players include Cook Medical Inc., Medistim ASA, Transonic Systems Inc., Deltex Medical Group PLC, Atys Medical, Getinge Group, Perimed AB, Compumedics, ADInstruments, and Moor Instruments Ltd., each expanding their portfolios through advanced Doppler and Laser-based systems. North America led the market in 2024 with a 37.6% share, supported by high diagnostic adoption and strong surgical infrastructure, while Europe followed with a 29.4% share due to rising demand for intraoperative perfusion assessment and chronic disease management.

Market Insights

- The Blood Flow Measurement Devices Market was valued at USD 620.6 million in 2024 and is projected to reach USD 1,169.27 million by 2032, registering a CAGR of 8.24% during the forecast period.

- Growing cases of cardiovascular disease and diabetes significantly drive demand, with cardiovascular applications accounting for a 38.4% share in 2024 as hospitals adopt Doppler and Laser-based systems for early diagnosis and surgical monitoring.

- A key trend includes the rising integration of AI-enabled analytics and portable Laser Doppler devices, expanding adoption in oncology, dermatology, and advanced wound care.

- Leading players such as Cook Medical Inc., Medistim ASA, Transonic Systems Inc., and Getinge Group enhance market momentum through product innovation and expanding intraoperative perfusion assessment technologies.

- North America led the market with a 37.6% share, followed by Europe at 29.4%, while Asia-Pacific held 23.1% driven by rising surgical volumes and increasing adoption of noninvasive microvascular monitoring tools.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product Type

Laser Doppler Blood Flowmeters dominated the Blood Flow Measurement Devices Market in 2024 with a 42.7% share, driven by their high sensitivity in detecting microvascular perfusion and suitability for continuous monitoring. Their adoption increases in dermatology, wound care, and peripheral vascular assessments, where real-time capillary blood flow measurement is essential. Ultrasonic Doppler systems gain traction due to expanding use in cardiovascular diagnostics and surgical settings, while electromagnetic flowmeters serve niche intraoperative applications. The demand for minimally invasive monitoring technologies further accelerates product innovation across all sub-categories.

- For Instance, In wound care settings, LDF has been used to monitor blood flow around post-surgical incisions: one study tracked cutaneous blood flow on day 1 versus day 5 after abdominal surgery and found a significant flow increase shortly after surgery, indicating active perfusion for healing.

By Application

Cardiovascular Disease remained the leading application segment with a 38.4% share in 2024, driven by the growing burden of coronary artery disease, higher use of Doppler systems for vascular assessments, and increasing adoption of intraoperative flow measurement during bypass surgeries. Tumor monitoring expands as oncology centers incorporate microcirculatory evaluation to assess therapy response. Gastroenterology and dermatology benefit from Laser Doppler tools for mucosal perfusion and skin microvascular studies, while diabetes applications rise due to the need for early detection of neuropathy and ulcer progression.

- For instance, the GE Vivid platform has documented clinical use in real-time Doppler evaluation of coronary and peripheral vessels, enabling clinicians to measure flow velocities and detect stenosis during cardiovascular procedures.

Key Growth Drivers

Rising Global Burden of Cardiovascular and Chronic Diseases

The growing prevalence of cardiovascular disorders, diabetes, peripheral vascular disease, and chronic wounds significantly drives the Blood Flow Measurement Devices market. Clinicians increasingly use Doppler and Laser-based technologies to assess tissue perfusion, detect circulatory abnormalities, and support early diagnosis. As aging populations expand, hospitals rely on these devices to improve surgical outcomes, reduce complications, and enhance patient monitoring. Their role in preventive care, chronic disease management, and intraoperative assessment strengthens adoption across cardiology, oncology, endocrinology, and dermatology. Integration with digital platforms further boosts clinical efficiency and demand.

- For instance, Perimed’s PeriFlux Laser Doppler systems have been used in diabetic foot evaluations to quantify microvascular perfusion, helping clinicians identify early stages of ulcer risk and guide treatment.

Advancements in Noninvasive and Microvascular Monitoring Technologies

Rapid advancements in Laser Doppler and Ultrasound Doppler technologies continue to enhance precision, portability, and real-time analysis of microvascular blood flow. Innovations enable clinicians to detect subtle perfusion changes and guide personalized treatment strategies. Wearable and miniaturized devices expand usage into outpatient and remote-care environments, supporting continuous monitoring for chronic conditions. AI-driven analytics improve measurement interpretation and streamline clinical workflows. These advancements broaden the clinical utility of blood flow measurement devices and strengthen their adoption across diverse medical specialties.

- For instance, Perimed’s PeriFlux 6000 system introduced advanced signal processing that improves microcirculation detection sensitivity, enabling clinicians to identify subtle perfusion abnormalities during vascular and wound-care evaluations.

Growth of Surgical Procedures and Intraoperative Perfusion Assessment

Increasing volumes of cardiovascular, transplant, reconstructive, and oncology surgeries significantly expand demand for intraoperative blood flow measurement. Surgeons depend on real-time Doppler and electromagnetic technologies to assess vessel patency, graft integrity, and tissue viability, reducing postoperative risks. Immediate perfusion insights support timely intervention during complex procedures, improving surgical accuracy and patient recovery. Hospitals adopt these systems to minimize revision surgeries and optimize outcomes across cardiac, microvascular, and reconstructive operations. Expanding surgical infrastructure and rising procedural complexity globally further accelerate market uptake.

Key Trends & Opportunities

Integration of AI, Digital Platforms, and Remote Monitoring

A major trend transforming the market is the integration of AI-enabled analytics and cloud-based platforms that enhance interpretation and allow predictive assessment of tissue perfusion. Smart devices equipped with automated waveform analysis and digital reporting support precision medicine and personalized therapy planning. Remote monitoring presents strong opportunities in diabetes care, wound management, and chronic vascular disorders, enabling early detection of perfusion issues. As telehealth expands, AI-driven blood flow technologies provide clinicians with continuous insights, improving outcomes and increasing adoption across home-care and ambulatory settings.

- For instance, Philips’ EPIQ ultrasound systems use AI-driven algorithms such as AI MicroFlow Imaging to improve visualization of low-velocity blood flow, enabling earlier identification of perfusion abnormalities.

Expanding Use in Oncology, Wound Care, and Dermatology

The market experiences strong opportunities as applications broaden beyond cardiovascular care into oncology, dermatology, and advanced wound management. Blood flow assessment supports tumor perfusion evaluation and therapy monitoring, helping clinicians optimize treatment strategies. Laser Doppler systems are increasingly used to assess microcirculation in burns, ulcers, grafts, and cosmetic procedures. Rising diabetes prevalence amplifies demand for perfusion monitoring in diabetic foot management. As early intervention and personalized care become priorities, advanced, real-time monitoring tools gain greater adoption across specialized clinical fields.

- For instance, Perimed’s Laser Doppler systems have been used in oncology research to quantify tumor perfusion changes during anti-angiogenic therapy, providing clinicians with early indicators of treatment response.

Key Challenges

High Device Costs and Limited Accessibility in Developing Regions

The high cost of Laser Doppler and electromagnetic blood flow measurement devices remains a major barrier to adoption, especially in developing regions. Many hospitals and clinics face budget constraints that limit procurement and maintenance of advanced technology. Limited reimbursement structures and inadequate insurance coverage for microvascular perfusion assessments further restrict clinical adoption. These factors reduce accessibility in regions where chronic disease burdens are growing rapidly, slowing market expansion. The financial barriers particularly affect smaller facilities that struggle to justify investment despite increasing clinical need.

Technical Limitations, Calibration Complexity, and User Dependency

Despite advancements, technical challenges persist, including susceptibility to motion artifacts, environmental influences, and variability across tissue types. Accurate measurement often requires skilled operation, precise calibration, and controlled conditions, creating inconsistencies in data quality. Devices may produce fluctuating readings in microvascular applications, complicating interpretation for less experienced users. Limited standardization across systems further increases training requirements and reduces seamless integration into clinical routines. These complexities affect clinician confidence, making some care settings hesitant to fully adopt advanced blood flow measurement technologies.

Regional Analysis

North America

North America held the largest share of 37.6% in the Blood Flow Measurement Devices market in 2024, driven by advanced healthcare infrastructure, high adoption of minimally invasive diagnostics, and strong clinical integration of Doppler and Laser-based systems. The region benefits from a high prevalence of cardiovascular diseases and diabetes, increasing demand for perfusion monitoring in hospitals and specialty clinics. Significant R&D investments, early adoption of AI-enabled technologies, and strong presence of leading manufacturers further support growth. Rising surgical volumes and favorable reimbursement systems reinforce North America’s continued market dominance.

Europe

Europe accounted for 29.4% of the market in 2024, supported by growing emphasis on early diagnosis, widespread use of microvascular imaging in dermatology, and rising demand for intraoperative perfusion assessment. An expanding elderly population increases adoption across cardiology, wound care, and oncology segments. Strong regulatory standards and robust healthcare systems enhance acceptance of high-precision Doppler and Laser Doppler devices. Increasing prevalence of chronic vascular disorders and diabetic complications further boosts usage. Ongoing investments in surgical innovation and clinical research sustain the region’s strong market position.

Asia-Pacific

Asia-Pacific captured 23.1% of the market in 2024 and remains the fastest-growing region due to expanding healthcare infrastructure and rising awareness about early detection of vascular and metabolic diseases. Increasing volumes of cardiovascular, oncology, and reconstructive surgeries drive demand for advanced perfusion monitoring tools. Countries such as China, India, and Japan invest heavily in digital health technologies, accelerating the adoption of Doppler and Laser-based systems. Rising diabetic complications, hospital modernization, and growing medical tourism further enhance market expansion across the region.

Latin America

Latin America held a 6.1% share of the market in 2024, driven by improving healthcare systems and rising cases of cardiovascular and metabolic disorders. Adoption grows as hospitals integrate Doppler-based technologies for vascular assessments, wound care, and surgical applications. However, budget limitations and uneven access to advanced devices constrain wider deployment. Brazil and Mexico lead demand as private healthcare facilities expand and invest in modern diagnostic tools. Increased awareness of chronic disease complications and gradual upgrades in medical technology infrastructure support steady regional growth.

Middle East & Africa

The Middle East & Africa region accounted for 3.8% of the market in 2024, supported by a rising burden of diabetes, peripheral artery disease, and chronic wounds. Adoption increases in advanced hospitals across the UAE, Saudi Arabia, and South Africa, where investments in specialized care and surgical infrastructure are accelerating. High device costs and limited accessibility in several African nations continue to restrict broader market penetration. Nonetheless, expanding private healthcare networks, medical tourism, and initiatives to strengthen diagnostic capabilities contribute to gradual market expansion in the region.

Market Segmentations

By Product Type

- Laser Doppler Blood Flowmeters

- Ultrasonic Doppler Blood Flowmeters

- Electromagnetic Blood Flowmeters

By Application

- Cardiovascular Disease

- Tumor Monitoring

- Gastroenterology

- Diabetes

- Dermatology

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Blood Flow Measurement Devices market features a diverse landscape of established medical technology manufacturers and specialized diagnostic companies focused on advancing perfusion assessment and vascular monitoring. Key players such as Cook Medical Inc., Medistim ASA, Transonic Systems Inc., Deltex Medical Group PLC, Atys Medical, Getinge Group, Perimed AB, Compumedics, ADInstruments, and Moor Instruments Ltd. actively expand their portfolios through innovations in Laser Doppler, ultrasonic Doppler, and electromagnetic measurement technologies. Companies prioritize accuracy, portability, and real-time analytics to meet rising clinical demand across cardiovascular, oncology, dermatology, and wound care applications. Strategic initiatives including product launches, AI integration, and collaborations with hospitals and research institutions strengthen their market presence. Increasing focus on digital health platforms, wearable monitoring solutions, and intraoperative perfusion technologies further intensifies competition as manufacturers target growth across both developed and emerging healthcare markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Perimed AB

- Moor Instruments Ltd.

- Getinge Group

- ADInstruments

- Cook Medical Inc.

- Compumedics

- Atys Medical

- Deltex Medical Group PLC

- Transonic Systems Inc.

- Medistim ASA

Recent Developments

- In July 2025, the global Blood Flow Measurement Devices Market saw a major update as leading device firms began launching AI-enabled Doppler and transit-time flow meters that automatically interpret flow data and flag anomalies in real time.

- In July 2025, Medtronic and Philips announced a renewed multi-year strategic partnership to expand access to advanced patient-monitoring technologies a move relevant for blood-flow measurement and related diagnostic devices.

- In April 2025, researchers published work on a novel imaging method: “pulse-coded vector Doppler (PC-UVD) imaging,” which significantly improves measurement precision of cerebral blood flow velocity a technical advance that could impact future blood-flow measurement devices

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness rising adoption of noninvasive Doppler and Laser-based systems across cardiology, oncology, and wound care.

- AI-enabled analytics will enhance interpretation accuracy and support real-time perfusion monitoring in diverse clinical settings.

- Miniaturized and wearable blood flow devices will gain traction for outpatient and remote patient monitoring applications.

- Intraoperative perfusion assessment will become standard in cardiovascular, transplant, and reconstructive surgeries.

- Increasing focus on early diagnosis will drive broader integration of microvascular monitoring in routine clinical workflows.

- Emerging markets will experience accelerated adoption as healthcare infrastructure modernizes and surgical volumes rise.

- Device manufacturers will expand digital connectivity features to support telehealth and cloud-based reporting.

- Research advancements in tumor perfusion and regenerative medicine will create new application opportunities.

- Hybrid imaging and perfusion technologies will evolve to deliver more comprehensive vascular assessments.

- Strategic collaborations between medical device firms and hospitals will strengthen product innovation and clinical adoption.