Market Overview

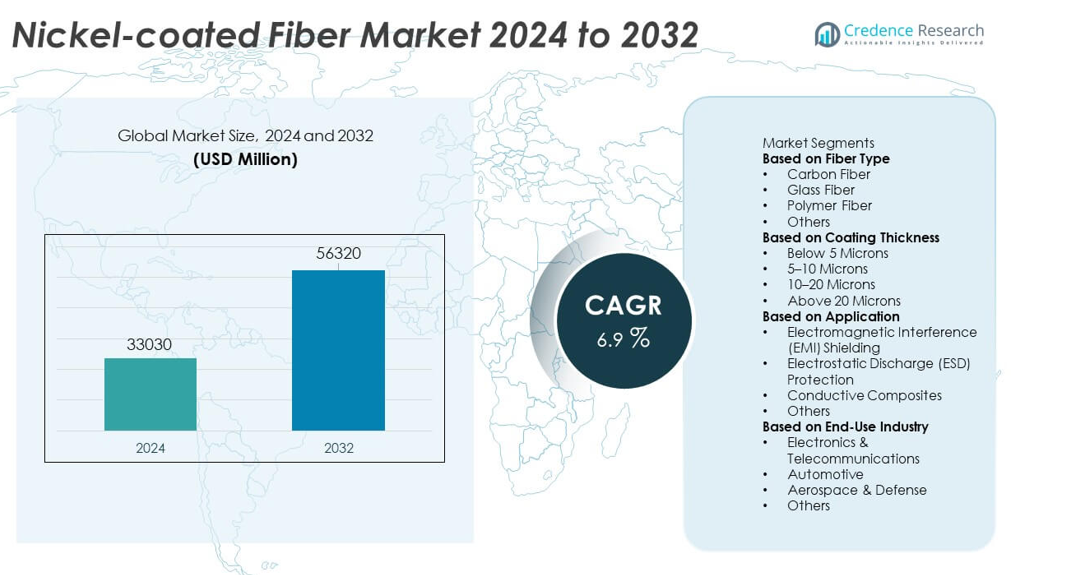

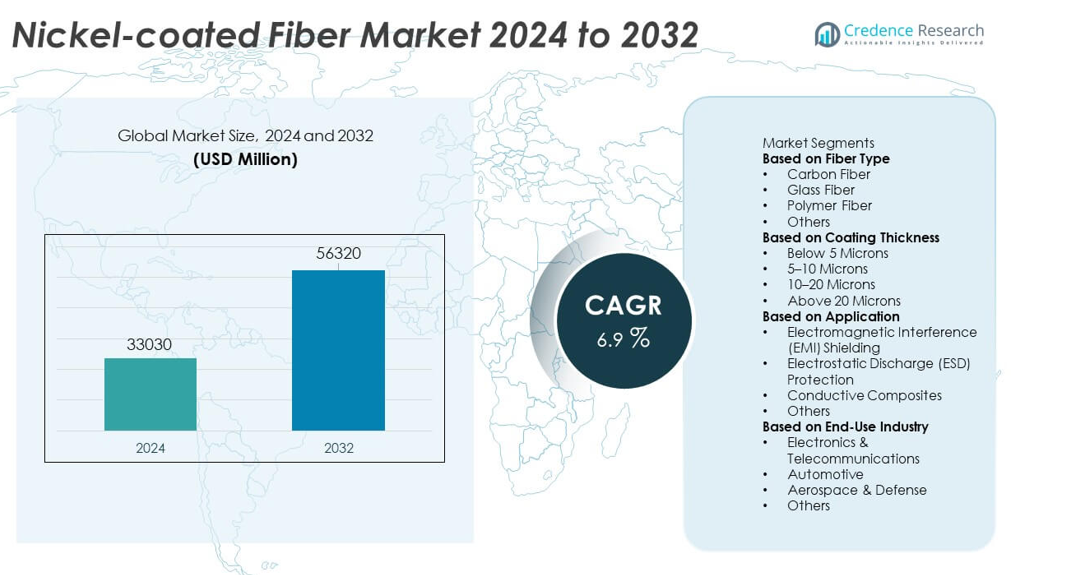

The Nickel-Coated Fiber market was valued at USD 33,030 million in 2024 and is projected to reach USD 56,320 million by 2032, registering a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nickel-coated Fiber Market Size 2024 |

USD 33,030 million |

| Nickel-coated Fiber Market, CAGR |

6.9% |

| Nickel-coated Fiber Market Size 2032 |

USD 56,320 million |

The top players in the Nickel-Coated Fiber market—3M Company, TOHO Tenax Co., Ltd., Mitsui Mining & Smelting Co., Ltd., Conductive Composites Inc., Nippon Carbon Co., Ltd., Specialty Materials, Inc., Hollingsworth & Vose Company, Bekaert, Jiangsu Tianniao High Technology Co., Ltd., and Qingdao Advanced Carbon Materials Co., Ltd.—drive growth through advanced coating technologies, high-conductivity materials, and expanding applications in EMI shielding, conductive composites, and aerospace systems. These companies strengthen their portfolios with precision plating methods and high-performance fiber solutions for electronics, EV components, and telecommunications. Asia Pacific leads the market with a 32% share, supported by large-scale electronics manufacturing and strong industrial expansion. North America follows with 34%, driven by aerospace and defense adoption, while Europe holds 27%, supported by advanced automotive and electronics production.

Market Insights

- The Nickel-Coated Fiber market reached USD 33,030 million in 2024 and is projected to reach USD 56,320 million by 2032 at a CAGR of 6.9%, reflecting rising global demand.

- Market growth strengthens as industries expand EMI shielding and ESD protection applications, with Carbon Fiber holding a 47% segment share due to its high conductivity and structural performance.

- Key trends include increased use of nickel-coated fibers in EV components, conductive composites, telecommunications equipment, and next-generation electronics driven by 5G and IoT expansion.

- Competition intensifies as leading players like 3M, TOHO Tenax, Mitsui Mining & Smelting, Bekaert, and Conductive Composites invest in advanced coating technologies, corrosion-resistant materials, and customized high-conductivity fiber solutions.

- Regional performance is led by North America at 34%, Asia Pacific at 32%, and Europe at 27%, supported by strong aerospace, electronics, automotive, and industrial manufacturing activities across these markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fiber Type

Carbon Fiber leads this segment with a market share of 47%, driven by its high conductivity, strength, and compatibility with advanced composite materials. It is widely used in EMI shielding, aerospace structures, and high-performance electronics due to superior electrical and mechanical properties. Glass Fiber follows with strong adoption in cost-sensitive applications requiring moderate conductivity and lightweight reinforcement. Polymer Fiber supports flexible electronic components and wearable systems, while other specialty fibers serve niche applications. The segment grows as industries demand enhanced conductivity, durability, and thermal stability across next-generation electronic and structural systems.

- For instance, Teijin Limited developed a high-modulus carbon fiber grade used in aerospace EMI shielding panels with a tensile strength of 7,000 MPa and a modulus of 350 GPa.

By Coating Thickness

The 5–10 Microns category dominates with a market share of 42%, offering an optimal balance between conductivity, weight, and material cost. This thickness is widely adopted in EMI shielding, conductive plastics, and composite reinforcement where stable electrical performance is required. Below 5 Microns coatings support lightweight structures and flexible components, while 10–20 Microns coatings serve high-strength and high-conductivity applications in aerospace and automotive systems. Coatings above 20 Microns provide superior durability and corrosion resistance. Growth strengthens as manufacturers optimize coating thickness for efficiency, electrical output, and long-term performance.

- For instance, Bekaert produces nickel-coated wire (known as Bekanickel®) with a coating thickness ranging from 0.5 to 45 microns for applications like household appliances and lamp leads.

By Application

Electromagnetic Interference (EMI) Shielding holds the largest market share of 44%, driven by rising demand from electronics, telecommunications, and automotive sectors that require robust protection against signal disruption. Nickel-coated fibers enhance shielding effectiveness in housings, cables, circuit protection layers, and advanced communication equipment. Electrostatic Discharge (ESD) protection sees strong growth in semiconductor handling, cleanrooms, and electronics packaging. Conductive Composites gain traction in aerospace, defense, and EV components requiring lightweight and high-performance materials. Other applications include heating elements and sensors. Market expansion is fueled by miniaturization, 5G growth, and increasing electronic content across industries.

Key Growth Drivers

Growing Demand for EMI and ESD Protection

Rising electronic content across automotive, aerospace, telecommunications, and consumer electronics drives strong demand for materials that offer superior EMI and ESD protection. Nickel-coated fiber provides high conductivity, durability, and reliable shielding performance, making it essential in safeguarding sensitive circuits. The shift toward advanced communication systems, 5G infrastructure, and high-frequency devices further strengthens adoption. Industries rely on these fibers to improve equipment safety, reduce signal interference, and meet strict regulatory standards, positioning EMI and ESD protection as a key market growth driver.

- For instance, Conductive Composites developed nickel-coated fibers used in EMI shielding gaskets, which offer high strength and electrical conductivity for advanced composite material applications.

Expansion of High-Performance Composites

High-performance composites used in aerospace structures, electric vehicles, and industrial machinery require strong, conductive, and lightweight reinforcement materials. Nickel-coated fiber enhances mechanical strength, thermal stability, and conductivity in composite formulations, enabling superior performance in demanding environments. The increasing use of carbon fiber composites in structural applications accelerates demand for nickel-coated variants. As industries focus on weight reduction, energy efficiency, and improved material performance, nickel-coated fiber becomes a critical additive supporting next-generation composite technologies.

- For instance, Sumitomo Metal Mining Co., Ltd. is a major Japanese metals company that has expertise in nickel production and is a leader in developing HPAL (High Pressure Acid Leach) technology for extracting nickel from low-grade ore, as well as recycling processes for used batteries.

Advancements in Electronics and Smart Devices

The rapid expansion of smart devices, IoT systems, and miniaturized electronics fuels demand for conductive materials that support stable electrical performance. Nickel-coated fibers enable reliable signal transmission, grounding, and circuit protection in compact electronic assemblies. Their flexibility and compatibility with conductive plastics and coatings enhance design possibilities for modern devices. Growth accelerates as manufacturers seek materials that ensure durability, thermal management, and consistent conductivity in high-density electronics, strengthening their role in next-generation electronic components.

Key Trends & Opportunities

Rising Adoption in Electric Vehicles and Energy Storage

Electric vehicles and energy storage systems require high-conductivity materials for battery components, thermal management, electromagnetic shielding, and lightweight structural parts. Nickel-coated fiber supports reliable current transfer and enhances safety in high-voltage environments. The shift toward EV manufacturing and advanced battery technologies creates strong opportunities for its integration. As automakers invest in safer, lighter, and more efficient components, demand for nickel-coated fiber in EV modules, charging systems, and sensor housings continues to rise.

- For instance, Bekaert developed a conductive stainless steel fiber (Bekinox®) used in EV battery shielding panels that provides high conductivity and excellent heat resistance, with electrical resistance values in textiles typically measured at < 1 Ohm/square.

Development of Advanced Coating Technologies

Manufacturers invest in improved nickel-coating processes to enhance adhesion, uniformity, corrosion resistance, and conductivity. Innovations such as precision electroplating and nano-scale coating techniques boost material performance across aerospace, defense, and electronics. These advancements open opportunities for customized fiber grades that meet specific electrical, mechanical, and thermal requirements. As industries demand higher durability and improved efficiency, enhanced coating technologies support wider adoption of nickel-coated fiber in high-value applications.

- For instance, controlled electroless nickel systems can produce a uniform film thickness with a typical tolerance of ±2 µm (micrometers) for specific thickness ranges, such as 5-20 µm, or tolerances as tight as ±0.0001 inches (approximately ±2.5 µm), regardless of the part’s geometry.

Key Challenges

High Production Costs and Complex Manufacturing

Producing nickel-coated fiber requires precise coating processes, high-purity materials, and controlled manufacturing environments, leading to elevated production costs. Complex coating procedures increase operational expenses and limit scalability. This cost challenge affects adoption in price-sensitive industries, pushing manufacturers to balance performance benefits with economic feasibility. Companies must invest in process optimization and material efficiency to reduce manufacturing costs while maintaining quality.

Environmental and Sustainability Concerns

Nickel extraction and electroplating processes raise environmental concerns due to energy consumption, chemical handling, and waste generation. Strict environmental regulations influence production practices and increase compliance costs for manufacturers. Industries also seek sustainable alternatives, pressuring suppliers to improve recycling methods and adopt eco-friendly production technologies. The need to reduce environmental impact while maintaining high-performance standards poses a significant challenge for the nickel-coated fiber market.

Regional Analysis

North America

North America holds a market share of 34% in the Nickel-Coated Fiber market, driven by strong demand from aerospace, defense, automotive electronics, and advanced manufacturing sectors. The region benefits from extensive R&D investment, high adoption of EMI shielding materials, and rapid integration of conductive composites in next-generation aircraft and electric vehicles. The U.S. leads consumption due to growth in high-frequency communication systems and expanding semiconductor production. Increasing focus on lightweight materials and high-performance reinforcement solutions further boosts demand. Ongoing technological advancements and stringent performance standards strengthen the region’s position in the global market.

Europe

Europe accounts for a market share of 27%, supported by robust aerospace engineering, automotive manufacturing, and electronics production. Countries such as Germany, France, and the U.K. drive adoption of nickel-coated fiber for EMI protection, composite reinforcement, and conductive material applications. Strict regulatory requirements for electromagnetic compatibility and safety enhance market growth. The region’s strong presence in renewable energy, electric mobility, and industrial automation strengthens demand for high-conductivity reinforcement materials. Manufacturers focus on sustainable production methods and advanced coating technologies, further improving adoption across various high-precision industries.

Asia Pacific

Asia Pacific leads application-driven growth with a market share of 32%, supported by large-scale electronics manufacturing, strong telecommunications expansion, and rising EV production. China, Japan, South Korea, and India drive demand for EMI shielding fibers used in smartphones, 5G equipment, and semiconductor components. The region benefits from cost-effective production capabilities, rapid industrialization, and strong investment in high-performance composites. Growing aerospace activities, expanding automotive supply chains, and increasing focus on lightweight conductive materials further strengthen market growth. Asia Pacific remains a key hub for both consumption and manufacturing of nickel-coated fiber.

Latin America

Latin America holds a market share of 4%, driven by increasing adoption of conductive materials in automotive, electronics assembly, and industrial equipment manufacturing. Brazil and Mexico lead regional demand due to expanding production facilities and growing investments in electrical and communication infrastructure. EMI shielding and composite reinforcement applications gain traction as industries modernize and integrate advanced technologies. While economic fluctuations limit rapid expansion, ongoing development in industrial automation, consumer electronics, and transportation systems supports steady demand across the region.

Middle East & Africa

The Middle East & Africa region captures a market share of 3%, supported by rising adoption of high-performance materials in energy, telecommunications, and industrial sectors. GCC countries drive demand through investments in aerospace programs, defense technologies, and large-scale infrastructure projects. Nickel-coated fiber sees growing use in EMI shielding, sensor protection, and conductive components across developing manufacturing bases. Africa shows increasing demand in telecommunications and industrial equipment upgrades. Although infrastructure limitations and slower industrialization pose challenges, sustained investment in technology and modernization continues to support long-term market growth.

Market Segmentations:

By Fiber Type

- Carbon Fiber

- Glass Fiber

- Polymer Fiber

- Others

By Coating Thickness

- Below 5 Microns

- 5–10 Microns

- 10–20 Microns

- Above 20 Microns

By Application

- Electromagnetic Interference (EMI) Shielding

- Electrostatic Discharge (ESD) Protection

- Conductive Composites

- Others

By End-Use Industry

- Electronics & Telecommunications

- Automotive

- Aerospace & Defense

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape or analysis features major players such as 3M Company, TOHO Tenax Co., Ltd., Mitsui Mining & Smelting Co., Ltd., Conductive Composites Inc., Nippon Carbon Co., Ltd., Specialty Materials, Inc., Hollingsworth & Vose Company, Bekaert, Jiangsu Tianniao High Technology Co., Ltd., and Qingdao Advanced Carbon Materials Co., Ltd. These companies compete by advancing coating technologies, enhancing conductivity, and improving fiber durability for high-performance applications. Manufacturers invest in precision electroplating, nano-coating methods, and stronger adhesion processes to deliver fibers suitable for EMI shielding, conductive composites, and aerospace-grade components. Strategic partnerships with electronics and defense OEMs strengthen market reach, while expansions in production capacity help meet rising global demand. Many players focus on lightweight, high-strength materials to support electric vehicles, telecommunications, and next-generation electronics. Sustainability, cost optimization, and superior electrical performance remain key factors shaping competitive positioning in the Nickel-Coated Fiber market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- 3M Company

- TOHO Tenax Co., Ltd.

- Mitsui Mining & Smelting Co., Ltd.

- Conductive Composites Inc.

- Nippon Carbon Co., Ltd.

- Specialty Materials, Inc.

- Hollingsworth & Vose Company

- Bekaert

- Jiangsu Tianniao High Technology Co., Ltd.

- Qingdao Advanced Carbon Materials Co., Ltd.

Recent Developments

- In September 2025, Specialty Materials, Inc. showcased their Hy-Bor® portfolio of unidirectional boron fiber-carbon fiber prepregs and latest developments at CAMX 2025 in Orlando, collaborating with Toray Advanced Composites for advanced composites.

- In August 2023, the 3M Company participated in a webinar promoting its comprehensive EMI/RFI shielding and grounding solutions, which emphasize conductive fabric and foil tapes for high-frequency electronics. The company utilizes various conductive fillers, including nickel-coated graphite particles, in its advanced shielding designs.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Coating Thickness, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for nickel-coated fibers will rise as industries adopt advanced EMI and ESD protection solutions.

- High-performance composites in aerospace and EV manufacturing will drive wider material integration.

- Precision coating technologies will improve conductivity, durability, and long-term stability.

- 5G expansion and next-generation electronics will increase usage in shielding and circuit protection.

- Electric vehicle battery systems will adopt conductive fibers for enhanced safety and thermal performance.

- Lightweight conductive materials will gain preference over traditional metal-based shielding components.

- Growth in defense and aerospace programs will expand adoption of high-strength conductive fibers.

- Manufacturers will focus on sustainable coating processes to meet environmental regulations.

- Custom fiber grades tailored for extreme environments will see rising demand across industries.

- Asia Pacific and North America will strengthen their positions as leading hubs for production and application expansion.