Market Overview

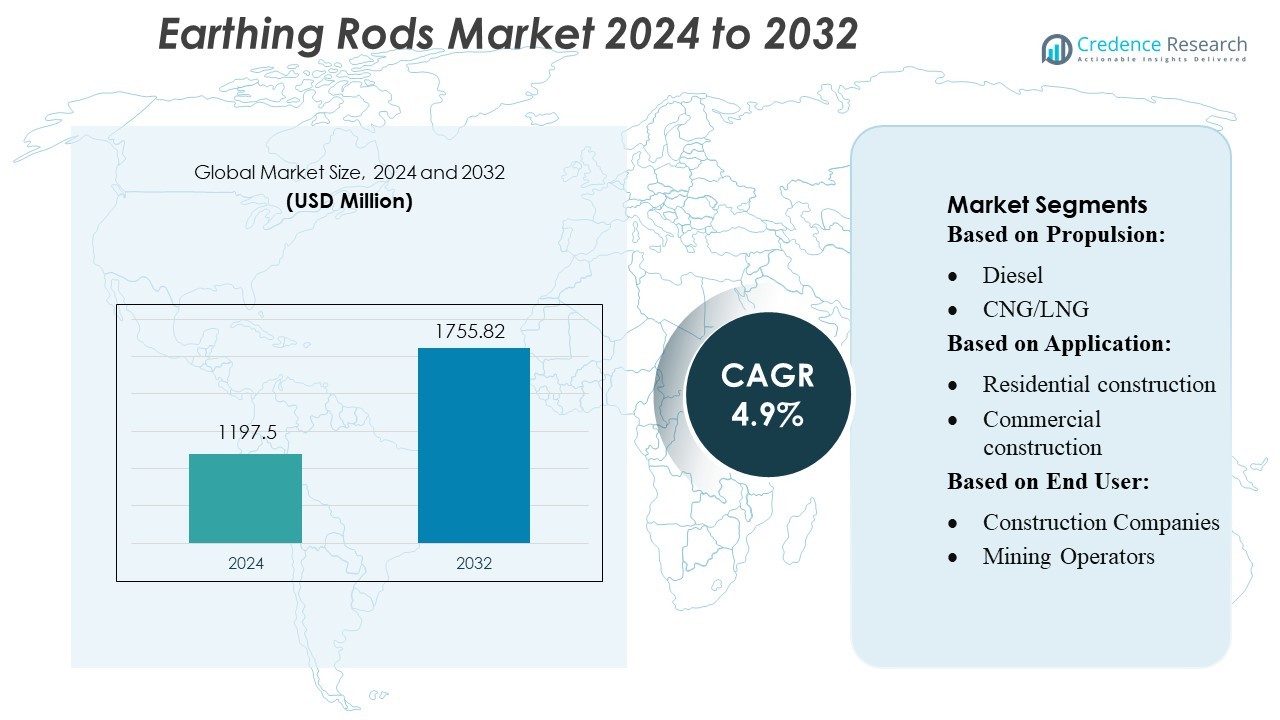

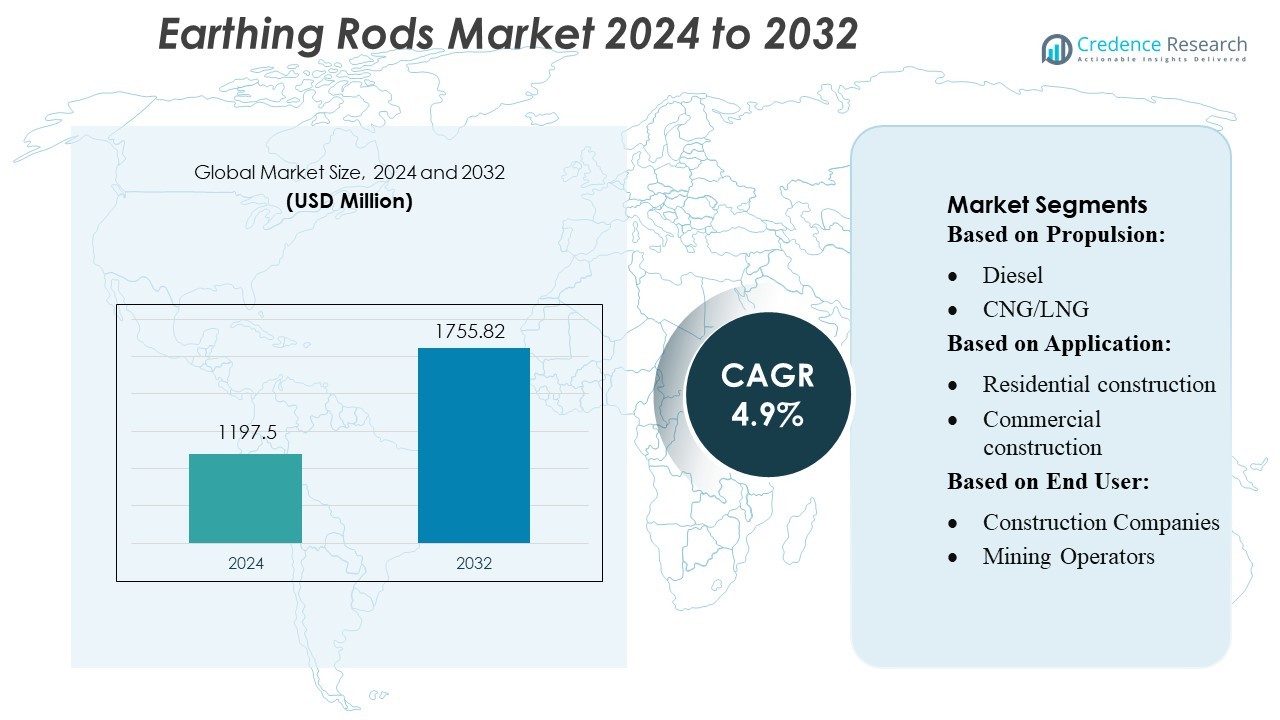

Earthing Rods Market size was valued USD 1197.5 million in 2024 and is anticipated to reach USD 1755.82 million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Earthing Rods Market Size 2024 |

USD 1197.5 Million |

| Earthing Rods Market, CAGR |

4.9% |

| Earthing Rods Market Size 2032 |

USD 1755.82 Million |

The Earthing Rods Market features strong competition among leading manufacturers specializing in grounding solutions, with companies focusing on corrosion-resistant materials, precision engineering, and compliance with global electrical safety standards to strengthen their market positioning. Vendors increasingly invest in advanced copper-bonding technologies and automated production systems to deliver high-performance products for utility, industrial, and commercial applications. Asia-Pacific leads the global market with an estimated 34% share, driven by large-scale infrastructure expansion, rapid industrialization, and extensive electrification initiatives across emerging economies. Continuous growth in renewable energy installations and smart grid development further reinforces the region’s dominance in the earthing rods industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Earthing Rods Market was valued at USD 1197.5 million in 2024 and is projected to reach USD 1755.82 million by 2032, registering a CAGR of 4.9%, supported by steady expansion across construction, utilities, and industrial sectors.

- Growing focus on electrical safety, stricter compliance standards, and rising demand for corrosion-resistant copper-bonded rods strongly drive market adoption across commercial, residential, and industrial applications.

- Key trends include increasing use of automated manufacturing, advanced coating technologies, and higher adoption of durable stainless-steel rods, along with rising investment in grounding solutions for renewable energy systems.

- Competitive intensity strengthens as manufacturers enhance product reliability, expand distribution networks, and diversify portfolios, while price pressure and raw material volatility act as key restraints.

- Asia-Pacific leads the global market with 34% regional share, followed by North America at 28% and Europe at 25%, while copper-bonded rods represent the largest segment with over 40% share due to superior conductivity and durability.

Market Segmentation Analysis:

By Propulsion

The propulsion-based segmentation of the earthing rods market is dominated by the Diesel sub-segment, accounting for over 52% of total demand, driven by its widespread use in off-grid and temporary power systems across construction, mining, and industrial sites. Diesel-powered equipment requires high-reliability grounding to prevent electrical faults and ensure operational safety, sustaining steady demand for robust earthing rods. CNG/LNG applications are growing gradually as industries transition toward lower-emission fuels, while the Electric segment is expanding fastest due to accelerating electrification of construction and industrial machinery but still holds a smaller overall market share.

- For instance, Hyundai Construction Equipment’s R215L Smart X Plus crawler excavator delivers a gross power of 148 hp at 2,000 rpm. Its electric equipment is also advancing.

By Application

Across applications, the Industrial construction segment leads with nearly 40% market share, supported by stringent electrical safety standards, continuous operational loads, and the need for enhanced fault-protection systems in manufacturing and heavy-engineering facilities. Industrial projects typically deploy larger grounding grids and multiple earthing rods, significantly boosting consumption. Mining & quarrying follows due to high-risk electrical environments that require deep-set grounding solutions, while commercial construction maintains steady adoption for building safety compliance. Residential use remains the smallest segment but grows steadily with rising urbanization and the adoption of modern electrical protection systems.

- For instance, Kubota Corporation is pushing innovation with its autonomous fuel-cell tractor concept unveiled at Expo 2025 Osaka Kansai, which delivers the equivalent of 100 horsepower using a solid-polymer fuel cell and hydrogen fuel.

By End User

Among end users, Construction Companies hold the dominant share at approximately 45%, driven by their extensive involvement in large-scale infrastructure, industrial facilities, and commercial building projects that rely on consistent grounding installations. Their recurring project pipelines and regulatory obligations for safe electrical systems support sustained demand. Mining Operators form another major segment as they require durable and corrosion-resistant grounding equipment for high-voltage and hazardous operations. Government & Municipalities contribute steadily through public infrastructure development, while Rental Companies and Industrial Users support demand through equipment leasing and facility-level electrical safety upgrades.

Key Growth Drivers

- Rising Infrastructure Modernization and Grid Resilience Programs

Governments and utilities increasingly invest in modernizing electrical infrastructure to enhance grid reliability and reduce outage risks. These programs demand robust grounding systems to manage fault currents and ensure operational safety across industrial, commercial, and residential networks. Earthing rods witness strong adoption as utilities upgrade transmission lines, deploy smart substations, and expand renewable energy integration. The need for stable grounding in high-load environments and improved lightning protection systems further accelerates market growth across developing and developed regions.

- For instance, Doosan Enerbility recently secured a contract to supply a 380 MW H-class gas turbine, a steam turbine, and heat-supply equipment for the Bundang combined-cycle power plant modernization project, underscoring its role in high-capacity grid projects.

- Expansion of Renewable Energy Installations

The rapid deployment of solar farms, wind parks, and distributed clean-energy infrastructure drives significant demand for high-performance earthing rods. Renewable systems require effective grounding to protect sensitive power electronics, inverters, and control systems from surges and electrical faults. As countries pursue aggressive decarbonization targets and utility-scale renewable projects increase in capacity, the need for advanced, corrosion-resistant earthing solutions grows. This shift accelerates the consumption of copper-bonded and galvanized steel rods designed to deliver long-term reliability in diverse soil conditions.

- For instance, Caterpillar, Inc. has recently launched its Cat® Energy Storage Systems (ESS), with the Cat PGS module rated at 840–1260 kW and offering 448–672 kWh of energy capacity, facilitating seamless integration with solar and wind generation.

- Increasing Industrial Automation and Electrification

Industries are adopting advanced automation, robotics, and high-power machinery, which heighten the need for robust electrical safety and grounding systems. Earthing rods support uninterrupted industrial operations by preventing equipment damage, ensuring voltage stabilization, and mitigating electrical hazards. As manufacturing, oil & gas, mining, and data center sectors expand globally, the use of grounding components grows proportionally. The rising installation of sensitive electronic systems and high-density power distribution networks strengthens demand for durable and compliant earthing rod systems.

Key Trends & Opportunities

- Growing Adoption of Corrosion-Resistant and High-Durability Materials

Technological advancements enable the development of copper-bonded, stainless steel, and composite earthing rods engineered for superior corrosion resistance and longer service life. End users increasingly prefer products with improved conductivity, lower maintenance requirements, and enhanced soil compatibility. Manufacturers also explore micro-alloying and molecular-bonding techniques to strengthen durability. This trend creates opportunities for premium product segments, particularly in regions with aggressive soil conditions and harsh industrial environments where long-term reliability is a priority.

- For instance, J C Bamford Excavators Ltd. (JCB) has significantly enhanced the structural resilience of its excavators: the JS 200/210/220 series uses a reinforced boom and dipper made from high-tensile strength steel.

- Rising Demand for Smart Grounding Systems and Condition Monitoring

Utilities and industries are adopting digital monitoring tools to assess ground resistance, detect faults, and optimize maintenance cycles. Integrated sensors, remote diagnostic features, and IoT-enabled grounding networks are emerging as value-added solutions. These systems present new opportunities for manufacturers to expand beyond hardware and offer software-driven services. As smart grids evolve, demand for intelligent grounding systems capable of providing real-time performance analytics continues to grow, opening new avenues for innovation and differentiation.

- For instance, CNH remotely monitored 46 Case IH Puma tractors using IoT telemetry, significantly reducing downtime by tracking maintenance metrics and failure indicators.

- Increasing Focus on Safety Compliance and Standardization

Stricter regulatory frameworks and global harmonization of electrical safety standards drive the adoption of certified earthing components. Industries prioritize products that meet IEC, IEEE, UL, and regional compliance requirements to ensure operational safety and reduce liability. This trend encourages manufacturers to invest in testing, material optimization, and advanced manufacturing processes. Opportunities grow for suppliers offering certified, high-reliability solutions tailored for mission-critical applications such as power distribution, telecommunication towers, and industrial automation.

Key Challenges

- Fluctuating Metal Prices and Supply Chain Volatility

Copper, steel, and other raw materials used in earthing rod production experience sharp price fluctuations driven by global supply constraints, geopolitical instability, and rising demand from other industries. These uncertainties increase manufacturing costs and pressure profit margins. Additionally, disruptions in global logistics and shortages of high-quality metals hinder consistent production and timely deliveries. Manufacturers must strengthen procurement strategies and diversify sourcing to mitigate volatility and maintain stable pricing.

- Installation Complexity in Harsh Soil Conditions

Implementing earthing systems in rocky, dry, or high-resistivity soils often requires specialized installation techniques and additional components such as chemical electrodes or soil enhancers. These requirements increase project costs and complexity, discouraging adoption in some regions. Inadequate technical expertise and lack of proper site assessment further reduce system performance and longevity. Manufacturers and service providers must enhance training, provide technical support, and develop solutions optimized for challenging geological environments to overcome this barrier.

Regional Analysis

North America

North America holds a significant position in the earthing rods market, accounting for around 28% of global share, driven by large-scale infrastructure upgrades, stringent electrical safety norms, and high adoption of advanced grounding technologies. The U.S. leads demand due to rapid expansion in industrial automation, utility modernization, and renewable energy grid integration. Canada contributes steadily as commercial and residential construction activities expand. The region benefits from strong compliance frameworks such as IEEE and NEC standards, which influence product innovation and quality. Continued investment in grid resilience and EV charging infrastructure supports long-term market growth.

Europe

Europe captures approximately 25% of the global earthing rods market, supported by robust regulatory enforcement, aging grid rehabilitation, and continuous industrial modernization. Germany, France, and the U.K. generate the largest demand, particularly in manufacturing, energy, and transportation sectors. The region’s emphasis on harmonizing electrical safety standards under the EU regulatory framework drives adoption of premium-quality copper-bonded and galvanized steel rods. Sustainability initiatives also encourage the use of corrosion-resistant materials to extend service life. Ongoing investments in smart grids, offshore wind, and grid-connected mobility infrastructure continue to strengthen Europe’s position in the market.

Asia-Pacific

Asia-Pacific leads the global market with around 34% share, driven by rapid urbanization, extensive industrial expansion, and accelerated infrastructure development across China, India, Japan, and Southeast Asia. Massive investments in utilities, transportation corridors, data centers, and telecommunications networks stimulate high-volume demand for grounding solutions. China dominates regional share, while India experiences the fastest growth owing to nationwide electrification programs and rising safety compliance in construction. Increasing adoption of renewable energy projects, especially solar and wind installations, further elevates demand for earthing rods. The region’s large-scale manufacturing capabilities also support competitive pricing and strong export activity.

Latin America

Latin America accounts for roughly 7% of the global market, with demand primarily driven by expanding energy infrastructure, industrial development, and improvements in power distribution systems. Brazil and Mexico represent the largest markets, supported by investments in utility modernization and commercial construction. Rural electrification programs across countries such as Colombia and Peru also fuel market growth. While regulatory frameworks are improving, variations in compliance levels create mixed adoption rates across segments. Nonetheless, increasing renewable energy deployments, particularly in solar, are generating new opportunities for corrosion-resistant grounding products in the region.

Middle East & Africa (MEA)

The Middle East & Africa region holds about 6% of the global earthing rods market, supported by major infrastructure, oil & gas, and utility projects in GCC countries. The UAE and Saudi Arabia dominate regional demand due to continuous investments in mega-projects, smart cities, and high-voltage transmission networks. In Africa, electrification efforts across Nigeria, Kenya, and South Africa are gradually boosting consumption of grounding components. Harsh environmental conditions in many MEA countries increase the demand for durable, corrosion-resistant earthing rods. Growing emphasis on grid reliability and renewable energy expansion further supports market development.

Market Segmentations:

By Propulsion:

By Application:

- Residential construction

- Commercial construction

By End User:

- Construction Companies

- Mining Operators

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Earthing Rods Market features prominent industrial manufacturers such as Hyundai Construction Equipment Co., Ltd., KUBOTA Corporation, Doosan Corporation, Caterpillar, Inc., J C Bamford Excavators Ltd., CNH Industrial America LLC., Komatsu Ltd., Escorts Limited, Hitachi Construction Machinery Co., Ltd., and Deere & Company. The Earthing Rods Market remains highly fragmented, with numerous regional and global manufacturers competing on product quality, material strength, and long-term corrosion resistance. Companies focus on enhancing performance standards by adopting advanced metallurgical processes, precision threading, and improved copper-bonding techniques. Innovation centers on durability, electrical conductivity, and compliance with international safety regulations such as IEC and IEEE standards. Manufacturers increasingly prioritize sustainable production methods and lifecycle-tested materials to meet rising infrastructure and utility sector demands. Strategic partnerships with distributors, geographic expansion into emerging markets, and customized grounding solutions for industrial, commercial, and renewable energy applications continue to define competitive differentiation across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, JCB India plans to introduce a new generation of construction equipment in India, featuring a diverse range of new machines including hydrogen-powered prototypes, fully electric and hybrid models, and enhanced diesel-powered equipment that meets the CEV Stage-V emission standards.

- In July 2025, New Holland Construction introduces W100D Compact Wheel Loader with an all-new operator-centric cab and cab features. Constructed with landscapers, agricultural operators, snow removers and others in mind, the W100D is a dependable powerhouse with a deliberate design to provide productivity and performance in a small class size where there has been scarce choice.

- In January 2025, Volvo CE introduces New Generation Excavators in Southeast Asia to enhance efficiency, productivity and safety of the customers. The New Generation 5 models include: EC210, EC220, EC230, EC300 and EC360 and they will be sold throughout the region starting January 2025.

- In November 2023, Komatsu Ltd. through its subsidiary, Komatsu America Corp. agreed to acquire American Battery Solutions, Inc., a battery manufacturer based in the U.S. The acquisition of American Battery Solutions, Inc. would allow Komatsu Ltd.

Report Coverage

The research report offers an in-depth analysis based on Propulsion, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness rising demand as global infrastructure development accelerates across industrial and utility sectors.

- Adoption of corrosion-resistant and high-conductivity materials will increase to enhance long-term grounding performance.

- Manufacturers will integrate advanced coating and metallurgical technologies to improve product reliability.

- Electrification programs in developing regions will continue to expand market penetration.

- Renewable energy installations will boost consumption of grounding rods designed for high-fault environments.

- Regulatory bodies will strengthen electrical safety standards, increasing compliance-driven product upgrades.

- Smart grid modernization will create new opportunities for premium-quality grounding solutions.

- Custom-engineered earthing rods will gain traction in oil & gas, telecom, and transportation projects.

- Distribution networks will expand as companies target emerging markets with scalable production.

- Sustainability initiatives will drive manufacturers to adopt eco-friendly materials and energy-efficient production processes.