Market Overview

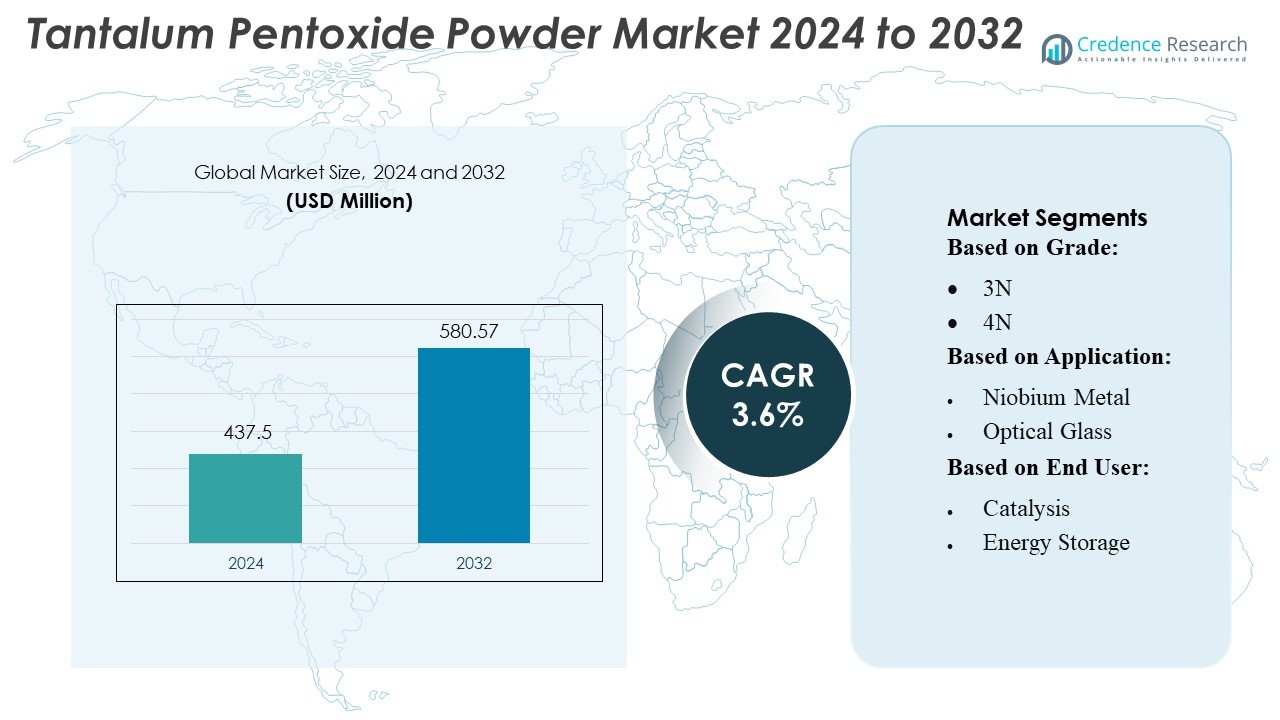

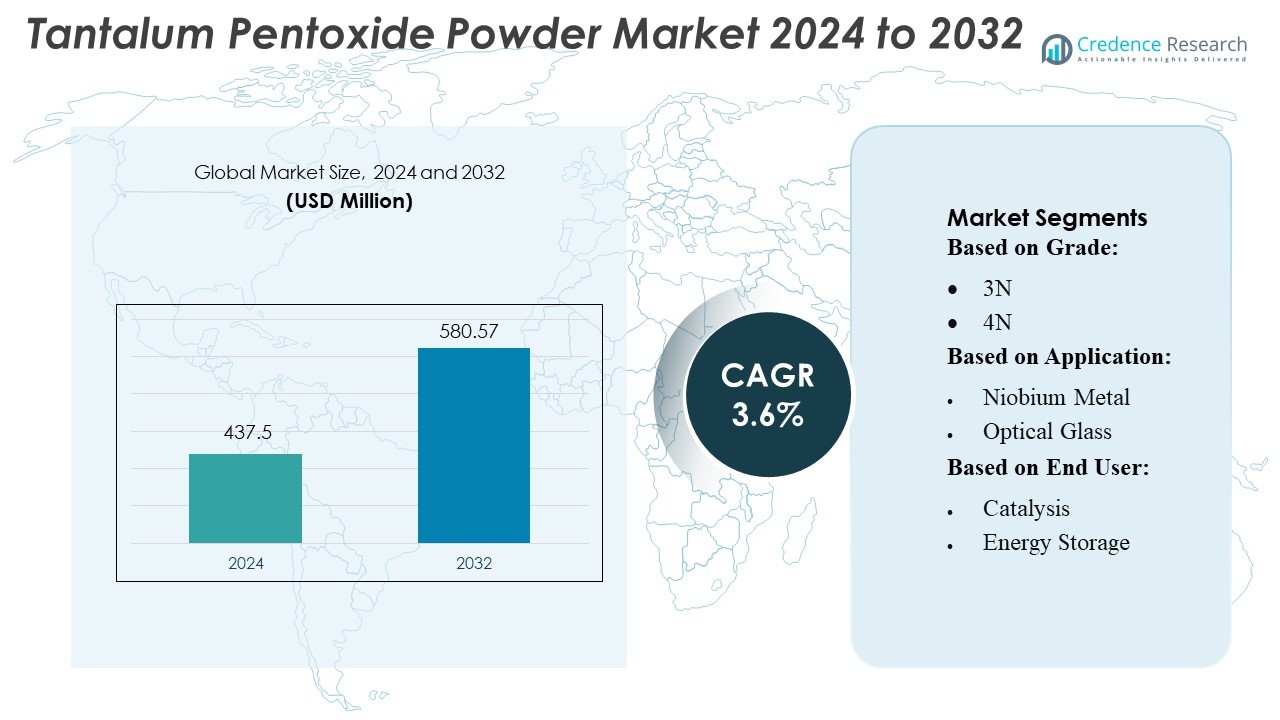

Tantalum Pentoxide Powder Market size was valued USD 437.5 million in 2024 and is anticipated to reach USD 580.57 million by 2032, at a CAGR of 3.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tantalum Pentoxide Powder Market Size 2024 |

USD 437.5 Million |

| Tantalum Pentoxide Powder Market, CAGR |

3.6% |

| Tantalum Pentoxide Powder Market Size 2032 |

USD 580.57 Million |

The tantalum pentoxide (Ta₂O₅) powder market include Global Advanced Metals, Taniobis (JX Nippon Mining & Metals), Mitsui Kinzoku, AMG, Ningxia Orient Tantalum, Taki Chemical, Solikamsk Magnesium Works, and Materion. Among them, Global Advanced Metals leads with a dominant market share of approximately 19.4 %. The industry is highly consolidated, with the top four manufacturers controlling over 50 % of global output. Regionally, Asia-Pacific is the leading market, accounting for about 50 % of global consumption, propelled by strong demand from electronics and semiconductor sectors in countries such as China, Japan, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Tantalum Pentoxide Powder Market was valued at USD 437.5 million in 2024 and is projected to reach USD 580.57 million by 2032, registering a CAGR of 3.6% during the forecast period.

- Rising demand from electronics and semiconductor manufacturing drives market expansion, supported by the material’s high dielectric properties and increasing adoption in capacitors and thin-film applications.

- Asia-Pacific dominates with nearly 50% regional share, driven by strong consumption from China, Japan, and South Korea, while the electronics segment accounts for the largest application share globally.

- The market is highly consolidated, with Global Advanced Metals holding about 19.4% share and the top four players—Taniobis, Mitsui Kinzoku, AMG, and Global Advanced Metals—collectively controlling over 50% of global production.

- Supply constraints, reliance on limited raw material sources, and fluctuating tantalum prices remain key restraints, affecting production stability and long-term procurement strategies for manufacturers.

Market Segmentation Analysis:

By Grade:

The 4N grade segment dominates the Tantalum Pentoxide Powder Market, accounting for an estimated 52–55% share, driven by its high purity level that supports advanced electronic and optical applications. Manufacturers prefer 4N powder for producing high-precision capacitors and optical coatings due to its superior dielectric strength, low impurity profile, and improved thermal stability. The 3N grade follows, mainly serving general industrial applications where cost efficiency outweighs ultra-high purity requirements. Growing adoption of miniaturized electronic components and high-performance optical systems continues to reinforce demand for the 4N segment.

- For instance, Rusal has demonstrated advanced oxide-refining capability through its industrial-scale inert anode technology, where pilot electrolysis cells at the Krasnoyarsk Aluminum Smelter achieved stable production of 1.8 tons of metal per day while eliminating carbon emissions during electrolysis.

By Application:

Capacitors represent the leading application segment, holding roughly 45–48% of the market, driven by the widespread use of tantalum-based capacitors in smartphones, automotive electronics, medical devices, and defense systems. Tantalum pentoxide’s exceptional dielectric properties and stability at high temperatures make it indispensable for manufacturing high-capacitance components with long lifecycle performance. Demand growth is further supported by rising global adoption of EVs and 5G infrastructure. Other applications—such as niobium metal production, optical glass formulation, and alloy manufacturing—gain traction, but none match the volume and technological reliance seen in capacitor fabrication.

- For instance, LightScalpel’s surgical CO₂ laser systems have enabled vaporization of soft-tissue targets with an ablation depth and thermal damage zone typically within 50–100 micrometers, allowing clinicians to remove skin lesions with microscale accuracy and minimal collateral tissue damage.

By End User:

Energy storage emerges as the dominant end-user segment with an estimated 40–43% market share, propelled by increased investment in advanced batteries and high-density electronic systems. Tantalum pentoxide provides high dielectric strength and chemical resilience, enabling improved power efficiency and reliability in energy storage devices. The catalysis segment benefits from the compound’s stability and surface reactivity but remains smaller due to limited high-volume applications. Ceramics and glass industries continue to incorporate tantalum pentoxide for specialized optical and structural materials, while the “Others” segment includes niche uses in research and aerospace components.

Key Growth Drivers

- Rising Demand for High-Performance Capacitors

The growing use of high-capacitance, miniaturized electronic components significantly drives demand for tantalum pentoxide powder. Its superior dielectric constant, thermal stability, and long operational life make it indispensable for manufacturing tantalum capacitors used in smartphones, EV power systems, medical implants, aerospace electronics, and 5G infrastructure. As device manufacturers prioritize compact designs with enhanced reliability, tantalum pentoxide remains a preferred material due to its ability to deliver stable electrical performance in harsh operating environments, ensuring sustained market growth.

- For instance, Höganäs, the world’s largest producer of metal powder, reports a global manufacturing capacity of 500,000 tonnes of powder per year.

- Expansion of Advanced Optical and Ceramic Materials

Tantalum pentoxide plays a critical role in producing advanced optical glasses and high-performance ceramics, driving strong demand across imaging, aerospace, and semiconductor industries. Its high refractive index and excellent transparency make it valuable for precision optical coatings, laser systems, and photonic devices. In ceramics, it enhances thermal resistance and structural strength, supporting applications in high-temperature industrial equipment. The increasing global adoption of high-resolution optics, autonomous systems, and industrial automation technologies further accelerates consumption of high-purity tantalum pentoxide.

- For instance, Domino Printing Sciences PLC, known for its CO₂ laser coders and automation controllers, maintains operations across over 120 countries and employs approximately 3,000 people globally.

- Growing Investment in Energy Storage and Battery Technologies

The rapid evolution of energy storage technologies fuels demand for tantalum pentoxide as manufacturers explore its potential in next-generation solid-state batteries and high-energy-density systems. Its dielectric strength, stable ionic behavior, and resistance to degradation make it suitable for high-performance power devices. As countries expand renewable energy infrastructure and electric mobility accelerates, research on advanced battery chemistries incorporating tantalum pentoxide continues to rise. This trend positions the material as a key en

Key Trends & Opportunities

1. Shift Toward Ultra-High-Purity Grades (4N and Above)

A strong industry trend involves the transition toward ultra-high-purity tantalum pentoxide grades for electronics, photonics, and semiconductor applications. Manufacturers increasingly require powders with extremely low impurity levels to support nanotechnology-driven device fabrication. This shift opens opportunities for material suppliers capable of producing high-consistency, high-purity products using advanced refining and particle-engineering methods. As chip design shrinks to sub-5 nm nodes and optical systems demand tighter tolerances, suppliers that invest in purity enhancement technologies are positioned for long-term competitive advantage.

- For instance, Trumpf, headquartered in Ditzingen, Germany, has developed a new smart factory at this location which measures around 6,000 square meters.

2. Increasing Recycling and Circular Material Recovery

Rising environmental regulations and supply risks associated with tantalum mining drive a growing trend toward recycling and closed-loop material recovery. Technologies enabling efficient extraction of tantalum pentoxide from electronic scrap, capacitor waste, and alloy residues present significant opportunities. Manufacturers adopting recycled tantalum benefit from reduced sourcing volatility and improved sustainability credentials. As global industries emphasize responsible mineral procurement, investment in recycling infrastructure and advanced purification methods becomes a major growth area for market participants.

- For instance, EcoVadis Platinum rating, placing it in the top 1% of over 125,000 companies globally; this rating particularly reflects its use of recycled feedstock in its powder metallurgy processes.

3. Expanding Use in Photonic and Quantum Applications

Tantalum pentoxide’s excellent optical transparency and high refractive index are generating new opportunities in photonics and emerging quantum technologies. It is increasingly used in waveguides, modulators, resonators, and integrated photonic circuits. Advancements in quantum communication and sensing further expand its potential application range. As governments and private companies invest heavily in quantum R&D, demand for high-performance optical materials such as tantalum pentoxide is expected to accelerate, creating new value pools beyond traditional electronics and capacitor markets.

Key Challenges

1. Supply Chain Constraints and Raw Material Dependency

The market faces significant supply risks due to reliance on geographically concentrated tantalum mining regions. Political instability, limited mining capacity, and fluctuating ore availability often disrupt supply chains and increase price volatility. Manufacturers dependent on high-purity tantalum pentoxide face challenges in maintaining consistent procurement volumes. Stringent conflict-mineral regulations also complicate sourcing and compliance efforts. These constraints pressure companies to diversify suppliers, explore recycling, and adopt long-term procurement strategies to ensure stable material flow.

2. High Production Costs and Technical Barriers

Producing high-purity tantalum pentoxide powder involves complex refining, advanced purification, and controlled processing steps that significantly increase manufacturing costs. Achieving consistent particle size, purity, and thermal properties requires specialized equipment and stringent quality control, limiting participation to a small group of advanced material producers. These technical and cost barriers challenge new entrants and restrict large-scale production expansion. Additionally, the high price of tantalum raw material limits adoption in cost-sensitive applications, affecting broader market penetration.

Regional Analysis

North America

North America commands an estimated 28–30% share of the Tantalum Pentoxide Powder Market, driven by strong demand from advanced electronics, aerospace, and defense manufacturing. The U.S. remains the primary consumer due to extensive production of high-performance capacitors, semiconductor components, and optical coatings. The region benefits from established R&D capabilities and stringent quality standards that favor high-purity tantalum pentoxide grades. Growth is further supported by increasing investment in electric vehicles, renewable energy storage, and defense modernization programs. However, dependence on imported tantalum concentrates continues to influence pricing and supply stability.

Europe

Europe holds roughly 22–24% of the global market, supported by its robust optical materials, specialty ceramics, and advanced manufacturing industries. Germany, the U.K., and France lead consumption due to their strong semiconductor fabrication, aerospace engineering, and precision optics sectors. Demand for ultra-high-purity tantalum pentoxide continues to rise as European firms expand photonics and quantum research initiatives. Additionally, the region’s emphasis on sustainable sourcing and circular material recovery boosts adoption of recycled tantalum. Despite its technological capabilities, Europe faces supply constraints caused by limited domestic mineral availability, reinforcing reliance on global suppliers.

Asia-Pacific (APAC)

Asia-Pacific dominates the market with an estimated 38–40% share, driven by expansive electronics production and growing adoption of high-density capacitors across China, Japan, South Korea, and Taiwan. The region’s large semiconductor manufacturing base fuels steady demand for high-purity tantalum pentoxide used in advanced chip fabrication and optical components. Rapid growth in EVs, telecommunications, and consumer electronics further accelerates consumption. APAC’s cost-efficient production environment and rising investments in battery technologies also strengthen its position. However, fluctuating raw material imports and geopolitical risks may create intermittent supply pressures for local manufacturers.

Latin America

Latin America accounts for approximately 4–5% of global demand, with growth primarily concentrated in Brazil and Mexico. The market expands steadily due to increasing use of tantalum pentoxide in automotive electronics, industrial equipment, and specialty glass production. Brazil’s mining activities contribute indirectly to supply chain stability, although most regional manufacturers still depend on imported high-purity powder for advanced applications. Adoption rises as multinational electronics companies expand local assembly operations. However, limited technological infrastructure, slower semiconductor development, and economic fluctuations restrict the region’s ability to capture a larger market share.

Middle East & Africa (MEA)

The Middle East & Africa region holds an estimated 5–6% share, driven mainly by emerging industrial applications and increasing participation in global tantalum supply chains. Countries such as Rwanda and the Democratic Republic of Congo serve as important sources of tantalum ore, indirectly supporting downstream processing industries abroad. Local consumption of tantalum pentoxide remains modest but gradually increases with investments in electronics assembly, energy projects, and specialty material research. Regulatory frameworks promoting responsible mineral sourcing create both opportunities and compliance challenges. Limited processing capabilities, however, constrain regional market expansion.

Market Segmentations:

By Grade:

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Tantalum Pentoxide Powder Market features a diverse set of global material and metal specialists, including CRS Holdings Inc., Rusal, Advanced Technology & Materials Co., Ltd, Sandvik AB, Hoganas AB, Liberty House Group, Rio Tinto Metal Powders, GKN PLC, MolyWorks Materials Corporation, POLEMA, and Advanced Micro Devices. The Tantalum Pentoxide Powder Market remains highly consolidated, with a limited number of advanced material producers focusing on high-purity powder manufacturing, process innovation, and consistent supply security. Companies compete by enhancing refining technologies, optimizing particle-size distribution, and improving chemical purity to serve demanding applications in electronics, optics, and energy storage. Strategic priorities include expanding production capacity, securing stable raw material sources, and adhering to global responsible mineral sourcing standards. Continuous investment in R&D enables manufacturers to develop customized powder grades that support miniaturized capacitors, advanced photonic components, and high-performance ceramics, strengthening competitive differentiation across high-value sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CRS Holdings Inc.

- Rusal

- Advanced Technology & Materials Co., Ltd

- Sandvik AB

- Hoganas AB

- Liberty House Group

- Rio Tinto Metal Powders

- GKN PLC

- MolyWorks Materials Corporation

- POLEMA

- Advanced Micro Devices

Recent Developments

- In May 2025, Oerlikon Metco launched its new MetcoMed brand for medical Additive Manufacturing (AM) with two metal powders: MetcoMed Ti64 G23-C (a titanium alloy) and MetcoMed CoCrMo F75-A (a cobalt-chromium alloy). These materials are designed for creating medical components and implants, and the powders are optimized for use on most Powder Bed Fusion-Laser Beam (PBF-LB) AM platforms.

- In April 2024, Premier African Minerals raised to complete Zulu commissioning. The company will use the proceeds for working capital and to finalize changes to the material flow through the flotation plant of the Zulu lithium and tantalum project, in Zimbabwe, which is in the process of being commissioned.

- In March 2024, SSAB is launching the world’s first emission-free steel powder for commercial deliveries, made of recycled SSAB Zero[®] steel. The product will create opportunities for customers to 3D-print their unique designs in steel produced without fossil carbon dioxide emissions.

Report Coverage

The research report offers an in-depth analysis based on Grade, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as demand for high-performance capacitors rises across consumer electronics and electric vehicles.

- Manufacturers will increasingly adopt ultra-high-purity tantalum pentoxide grades to meet advanced semiconductor and photonics requirements.

- Recycling and circular material recovery will expand as companies prioritize sustainable sourcing and reduced supply-chain risk.

- Energy storage innovations will create new opportunities for tantalum pentoxide in next-generation solid-state and high-density battery technologies.

- Optical and photonic applications will grow rapidly with increasing investment in lasers, sensors, and imaging systems.

- Supply chain diversification will strengthen as industries aim to reduce dependence on conflict-prone tantalum mining regions.

- Material producers will expand R&D efforts to improve powder morphology, purity consistency, and application-specific performance.

- Technological advancements will support wider adoption in advanced ceramics and specialty glass manufacturing.

- Strategic partnerships between material suppliers and electronics manufacturers will accelerate product customization.

- Regulatory emphasis on ethical mineral sourcing will influence procurement strategies and market competitiveness.