Market Overview:

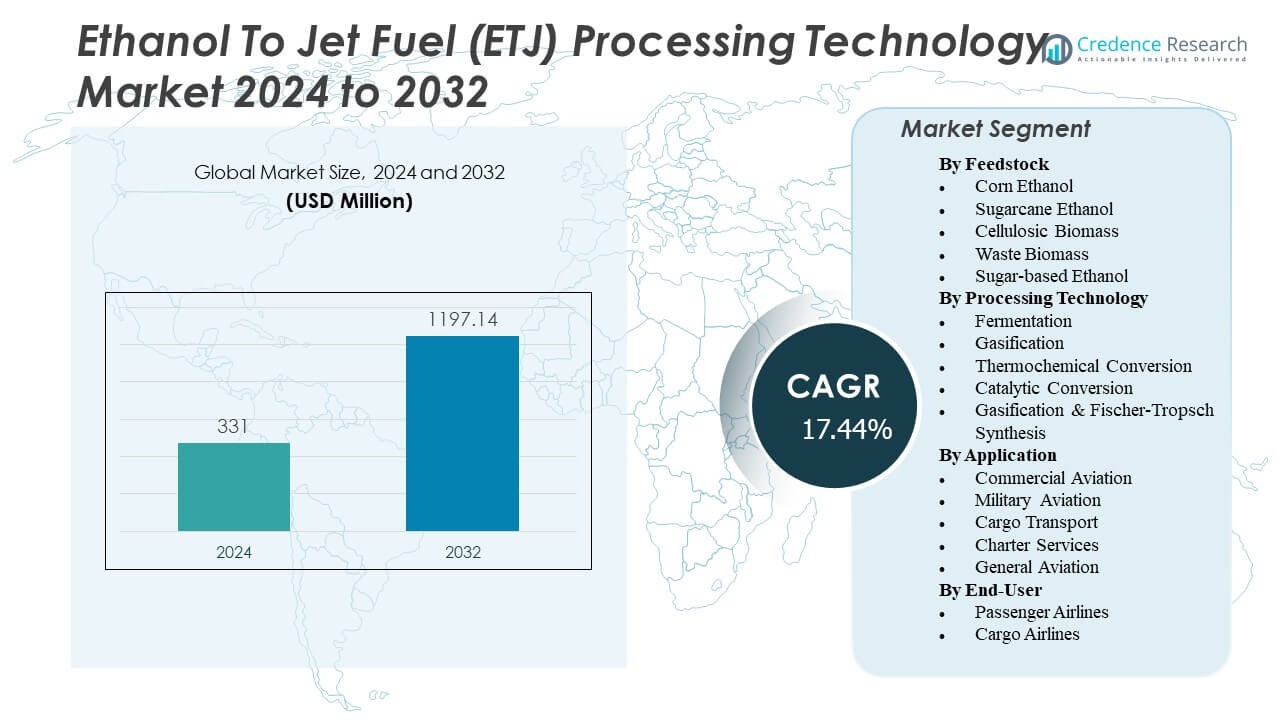

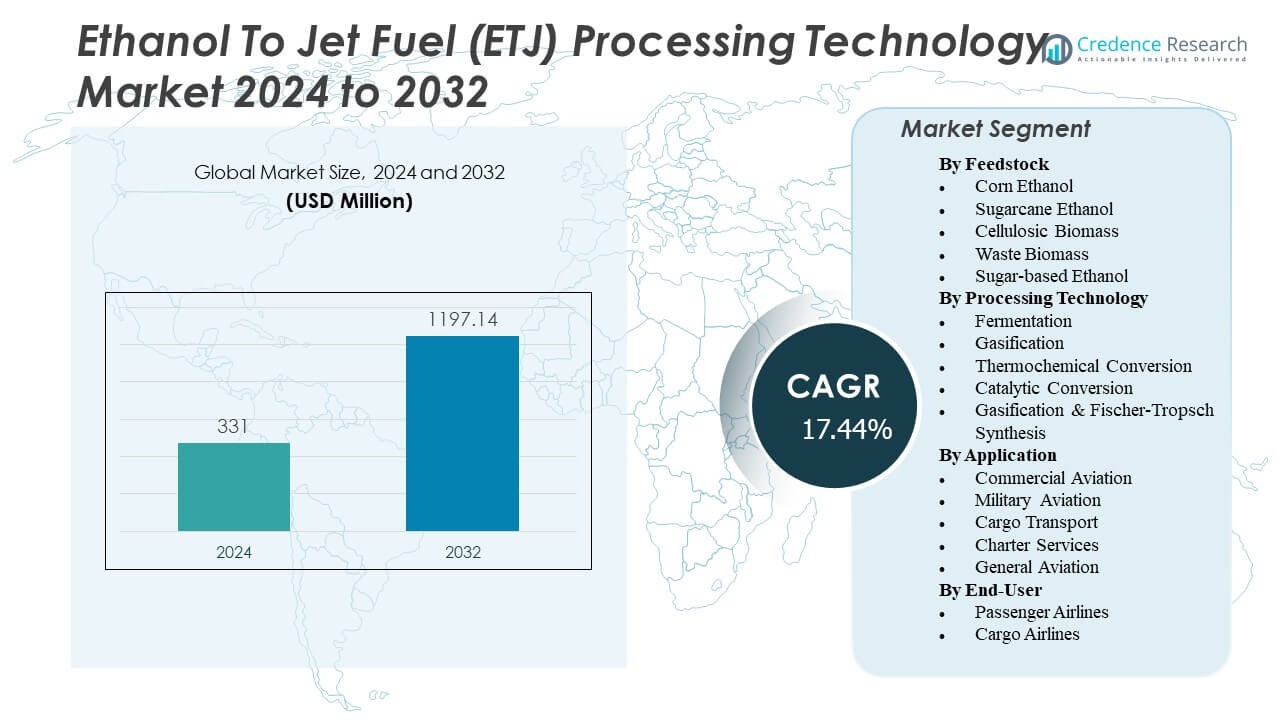

The Ethanol To Jet Fuel (ETJ) Processing Technology Market is projected to grow from USD 331 million in 2024 to an estimated USD 1197.14 million by 2032, with a compound annual growth rate (CAGR) of 17.44% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ethanol To Jet Fuel (ETJ) Processing Technology Market Size 2024 |

USD 331 Million |

| Ethanol To Jet Fuel (ETJ) Processing Technology Market, CAGR |

17.44% |

| Ethanol To Jet Fuel (ETJ) Processing Technology Market Size 2032 |

USD 1197.14 Million |

Rising emphasis on sustainable aviation fuels (SAF) and global carbon reduction goals are driving the demand for ethanol-to-jet technologies. Airlines and fuel producers are investing heavily in renewable pathways to meet emission targets. Advancements in catalytic conversion and alcohol-to-jet (ATJ) processes enhance production efficiency and reduce lifecycle emissions. Supportive policies, government incentives, and collaborations between aviation and energy companies are accelerating technology adoption and commercialization across the aviation sector.

North America leads due to robust ethanol infrastructure, government-backed SAF programs, and early commercialization of ETJ projects. Europe follows, supported by stringent emission reduction mandates and strong R&D funding in renewable aviation fuel. Asia-Pacific emerges as a key growth hub with expanding ethanol production, growing air travel demand, and regional commitments to sustainability. South America and the Middle East are showing increasing interest in diversifying fuel sources, laying groundwork for future ETJ adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Ethanol To Jet Fuel (ETJ) Processing Technology Market is valued at USD 331 million in 2024 and is expected to reach USD 1197.14 million by 2032, growing at a CAGR of 17.44%.

- Rising global demand for sustainable aviation fuels drives investment in ethanol-to-jet conversion technologies.

- Advancements in catalytic and thermochemical processes improve production efficiency and reduce carbon intensity.

- High infrastructure costs and limited feedstock availability restrain large-scale commercial adoption.

- Government incentives and renewable fuel mandates strengthen the deployment of ethanol-based SAF.

- North America leads the market due to strong policy support and established ethanol supply networks.

- Asia-Pacific emerges as a high-potential region with expanding ethanol capacity and increasing aviation demand.

Market Drivers

Rising Global Focus on Decarbonization in Aviation Sector

The aviation industry’s growing commitment to carbon neutrality drives the adoption of ethanol-to-jet fuel technologies. Airlines and manufacturers are investing in renewable fuel pathways to meet international emission reduction goals. Government policies and green fuel mandates further strengthen industry participation. The Ethanol To Jet Fuel (ETJ) Processing Technology Market benefits from increased alignment between energy transition and aviation sustainability. It supports compliance with frameworks like ICAO’s CORSIA and net-zero targets by 2050. Growing airline partnerships with biofuel producers enhance scalability and commercial viability. Sustainable feedstock conversion improves lifecycle emissions, reinforcing adoption. These factors collectively accelerate technology deployment.

Increasing Government Incentives and Funding for Renewable Aviation Fuel Development

Government-backed initiatives play a vital role in expanding ethanol-to-jet production facilities. Several nations offer grants, subsidies, and tax credits to boost SAF output and supply chain efficiency. The U.S. Inflation Reduction Act and EU’s Renewable Energy Directive III strengthen investment flow into biofuel infrastructure. The Ethanol To Jet Fuel (ETJ) Processing Technology Market gains from funding that lowers capital costs and production risks. It attracts interest from aviation fuel refiners seeking diversification. Strategic alliances between bio-refineries and oil companies further strengthen market presence. Public-private collaborations encourage R&D on improved conversion catalysts. These initiatives ensure long-term policy stability and industrial participation.

Technological Innovations Enhancing Conversion Efficiency and Fuel Quality

Continuous technological advancements in catalytic reforming and dehydration processes improve yield efficiency. Research focuses on optimizing ethanol conversion into hydrocarbons with lower emissions and higher fuel stability. The Ethanol To Jet Fuel (ETJ) Processing Technology Market leverages improved process integration to reduce energy intensity. It gains support from advancements in thermochemical and biochemical pathways that enhance cost competitiveness. Engine compatibility tests show improved combustion performance and reduced particulate emissions. These developments encourage investment in pilot-scale and commercial-scale production plants. Research institutions and private players collaborate to scale production economically. Such progress enhances the fuel’s reliability for both commercial and defense aviation.

- For instance, Gevo has publicly reported on its proprietary alcohol-to-jet processes meeting ASTM D7566 jet fuel standards, with demonstration quantities delivered for engine testing. The company converted its Luverne, Minnesota, facility to ethanol-based production and has reached pilot-commercial status, certifying fuel characteristics that comply with industry technical benchmarks.

Strong Commercial and Defense Sector Demand for Sustainable Jet Fuel

Aviation operators are seeking alternative fuels to reduce reliance on fossil-based kerosene. Airlines and defense agencies have begun long-term supply contracts for sustainable aviation fuels. The Ethanol To Jet Fuel (ETJ) Processing Technology Market benefits from these commitments that ensure steady demand growth. It gains traction from commercial airlines aiming for SAF integration in fleet operations. Rising jet fuel consumption due to expanding air travel further boosts the market. Defense aviation’s push for cleaner energy sources complements this growth. Continuous government procurement programs sustain adoption momentum. The combination of energy security and emission control keeps demand robust.

- For instance, the U.S. Air Force partnered with Twelve, launching a pilot program to demonstrate operational viability for CO₂-derived ethanol jet fuel. Initial results in 2021–2022 confirmed ASTM D7566 specification compliance, leading to plans for scale-up and integration in strategic procurement. The Air Force aims to decrease carbon emissions and increase fuel sourcing flexibility for defense applications through operational contracts and ongoing research validation.

Market Trends

Growing Integration of Ethanol-Based SAF Pathways into Existing Refinery Infrastructure

Refineries are reconfiguring their operations to accommodate renewable feedstocks such as ethanol. Integration with existing units reduces infrastructure costs and enables faster commercialization. The Ethanol To Jet Fuel (ETJ) Processing Technology Market benefits from refinery partnerships that streamline supply chains. It allows flexible co-processing of bio-based and petroleum-based inputs to enhance output consistency. Such hybrid refinery models reduce the carbon footprint while maintaining fuel performance standards. Producers leverage modular technologies for smooth adaptation within existing assets. The trend supports global SAF deployment goals and operational continuity. It also positions ethanol-based fuels as a viable large-scale aviation energy source.

- For example, LanzaJet’s Freedom Pines Fuels Plant in Georgia, USA, achieved commercial readiness in 2024 and will produce 10 million gallons of SAF and renewable diesel per year from certified ethanol. Offtake agreements for all fuel produced have been contracted for ten years, as officially noted by LanzaJet.

Advancement of Alcohol-to-Jet (ATJ) Process Technologies Across Key Producers

Companies are adopting advanced ATJ process technologies to convert ethanol into hydrocarbons efficiently. New catalysts and reactor designs improve yield, purity, and production rate. The Ethanol To Jet Fuel (ETJ) Processing Technology Market experiences technological upgrades that lower operational expenses. It benefits from growing investment in pilot and demonstration projects globally. Producers achieve improved process economics with higher carbon efficiency. Technology licensors expand global outreach through partnerships with ethanol suppliers. Industrial collaborations enable large-scale deployment and standardization. Continuous process optimization ensures reliable SAF production under regulatory compliance.

Emergence of Strategic Collaborations and Cross-Sector Partnerships in Fuel Production

Energy companies, ethanol producers, and airlines are forming alliances to develop sustainable aviation fuels. These collaborations ensure reliable feedstock supply, secure offtake agreements, and mutual technological growth. The Ethanol To Jet Fuel (ETJ) Processing Technology Market gains through synergy across fuel ecosystems. It strengthens industrial relationships that reduce logistical and financial barriers. Partnerships also support regional capacity development and technology localization. Many collaborations focus on joint R&D to enhance process efficiency. This trend attracts capital from institutional investors focusing on climate innovation. The network effect accelerates commercial deployment across strategic aviation hubs.

- For instance, Praj Industries (India), IndianOil R&D, and CSIR-IIP formed a strategic partnership in 2024 to build pilot plants for ethanol- and biomass-based sustainable aviation fuel using ATJ technology, with IndianOil also securing ISCC certification for its Panipat refinery’s SAF production.

Increased Private Investment and Venture Funding Toward Sustainable Aviation Startups

Private investors and venture funds are channeling capital into startups focused on ethanol-based SAF. Funding supports early-stage technology validation and scalability testing. The Ethanol To Jet Fuel (ETJ) Processing Technology Market benefits from a growing innovation ecosystem. It supports process development that reduces feedstock dependency and improves conversion efficiency. Financial institutions recognize the commercial potential of low-carbon aviation fuels. Startups bring agility, novel reactor designs, and alternative catalysts to the market. Corporate investors co-finance projects to gain early technological access. The surge in venture capital strengthens the innovation pipeline for long-term market resilience.

Market Challenges Analysis

High Production Costs and Feedstock Supply Constraints Affecting Profitability

The transition toward ethanol-based jet fuel faces cost pressures from feedstock procurement and conversion processes. Supply fluctuations in corn, sugarcane, and cellulosic materials create price volatility. The Ethanol To Jet Fuel (ETJ) Processing Technology Market experiences challenges maintaining cost competitiveness with fossil-based jet fuel. It demands large-scale infrastructure and high energy input for processing. Limited feedstock availability in some regions constrains production expansion. Transportation and storage costs for ethanol further elevate operational expenses. Industry players must optimize process yield and reduce input losses to sustain margins. Scaling up requires consistent feedstock supply and advanced logistic frameworks.

Regulatory Barriers and Certification Complexities Delaying Commercial Adoption

Regulatory frameworks for sustainable aviation fuels remain fragmented across global markets. Producers face long certification timelines and complex compliance documentation. The Ethanol To Jet Fuel (ETJ) Processing Technology Market encounters delays in securing ASTM and regional fuel approvals. It needs consistent policy coordination between aviation and energy agencies. Lack of harmonized standards slows investment and international trade opportunities. Certification testing also demands high capital outlay and rigorous verification. Producers must ensure lifecycle emission compliance to meet global SAF norms. These barriers collectively restrain faster commercialization and broader adoption in emerging markets.

Market Opportunities

Expansion of Commercial Airline Commitments and Long-Term SAF Offtake Agreements

Global airlines are pledging to integrate sustainable aviation fuels into regular operations. These long-term offtake contracts ensure stable demand and revenue visibility. The Ethanol To Jet Fuel (ETJ) Processing Technology Market benefits from such commitments that encourage new plant construction. It gains traction through partnerships between ethanol producers and aviation operators. Airlines use SAF integration to achieve emission reduction targets and brand differentiation. This demand encourages producers to scale facilities and adopt new process technologies. Governments supporting procurement policies also enhance investment confidence. Expanding air travel and carbon-neutral goals create a strong business environment for ETJ technology.

Emergence of Cellulosic Ethanol and Waste Biomass as Next-Generation Feedstocks

R&D on advanced bio-based feedstocks expands the resource base for ethanol-to-jet conversion. The use of agricultural residues, municipal waste, and lignocellulosic biomass offers sustainable alternatives. The Ethanol To Jet Fuel (ETJ) Processing Technology Market benefits from these innovations that reduce land-use impact. It enables fuel producers to access abundant non-food materials for conversion. Emerging technologies improve ethanol yield from waste feedstocks with lower emissions. This transition supports circular economy principles within aviation energy systems. Industry participants investing in cellulosic ethanol plants gain long-term cost stability. Such advancements open new pathways for scalable and eco-friendly fuel production.

Market Segmentation Analysis:

By Feedstock

Corn ethanol dominates due to its large-scale production and established agricultural infrastructure. It remains the preferred feedstock for ethanol-based jet fuel due to consistent supply and mature processing networks. The Ethanol To Jet Fuel (ETJ) Processing Technology Market benefits from technological upgrades that improve corn ethanol yield efficiency. Sugarcane ethanol offers a low-emission alternative, mainly led by Brazil’s strong biofuel ecosystem. Cellulosic and waste biomass segments gain traction for their sustainability and lower carbon footprint. Sugar-based ethanol supports smaller regional producers seeking renewable fuel diversification. The diversification of feedstocks ensures balanced growth and supply resilience.

- For example, POET, the world’s largest bioethanol producer, operates 34 plants across the U.S. with an annual capacity exceeding 3 billion gallons of ethanol. According to the U.S. Grains Council, a typical dry mill ethanol plant adds roughly $2.06 in value per bushel of corn processed through ethanol and coproduct generation, including distillers grains.

By Processing Technology

Fermentation remains the foundation for ethanol generation from starch- and sugar-based feedstocks. Catalytic conversion holds the highest potential due to its ability to transform ethanol into jet-range hydrocarbons efficiently. The Ethanol To Jet Fuel (ETJ) Processing Technology Market advances with thermochemical conversion that enhances reaction efficiency and product stability. Gasification enables syngas production for integrated biofuel synthesis. The Gasification & Fischer-Tropsch Synthesis pathway provides a benchmark for process optimization and alternative route development. Technology advancements reduce costs and improve carbon recovery rates. Each process contributes to building scalable, low-emission aviation fuel systems.

- For example, Velocys reports that its micro-channel FT reactors achieve per-pass CO conversion above 70% and up to 98% overall with recycle, supported by its 2025 technology licensing announcements.

By Application

Commercial aviation leads due to rising airline commitments to sustainable fuel adoption. It accounts for the largest demand share, driven by global net-zero emission targets. The Ethanol To Jet Fuel (ETJ) Processing Technology Market supports military aviation with energy diversification and security benefits. Cargo transport operators integrate sustainable jet fuels into logistics operations for carbon compliance. Charter services gradually adopt renewable fuels to attract environmentally conscious clientele. General aviation remains an emerging user base with potential growth in private aircraft adoption. Expanding flight operations and emission regulations sustain application-level demand.

By End-User

Passenger airlines dominate due to large fleet sizes and global decarbonization mandates. They form long-term offtake agreements with ethanol-to-jet producers to secure fuel supply. The Ethanol To Jet Fuel (ETJ) Processing Technology Market also serves cargo airlines aiming to reduce operational emissions. It supports logistics firms integrating sustainable fuels into global freight networks. Cargo operators explore partnerships with fuel producers to ensure consistent SAF availability. Both segments contribute to the commercialization of renewable aviation fuels. Strong end-user participation accelerates infrastructure development and market maturity.

Segmentation:

By Feedstock

- Corn Ethanol

- Sugarcane Ethanol

- Cellulosic Biomass

- Waste Biomass

- Sugar-based Ethanol

By Processing Technology

- Fermentation

- Gasification

- Thermochemical Conversion

- Catalytic Conversion

- Gasification & Fischer-Tropsch Synthesis

By Application

- Commercial Aviation

- Military Aviation

- Cargo Transport

- Charter Services

- General Aviation

By End-User

- Passenger Airlines

- Cargo Airlines

By Regional

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the leading share of 38% in the Ethanol To Jet Fuel (ETJ) Processing Technology Market due to strong government mandates and established biofuel infrastructure. The United States dominates production, supported by the Department of Energy and Federal Aviation Administration programs promoting sustainable aviation fuels. It benefits from advanced ethanol conversion technologies and consistent feedstock availability. Canada’s renewable energy initiatives further complement regional growth. Growing airline partnerships for long-term SAF offtake contracts strengthen commercial adoption. Investments in refinery retrofits and ethanol integration improve market scalability and cost efficiency across the region.

Europe

Europe accounts for 29% of the global share, driven by stringent emission targets under the EU’s Renewable Energy Directive and ReFuelEU Aviation initiative. Countries like Germany, France, and the Netherlands are expanding ethanol-based SAF production capacity. The Ethanol To Jet Fuel (ETJ) Processing Technology Market in this region benefits from policy-driven demand for low-carbon aviation fuels. It gains support from industrial collaborations between bio-refineries and energy companies. The strong regulatory framework and growing R&D funding stimulate innovation in catalytic conversion processes. Airports in Western Europe are becoming testing grounds for blended ethanol jet fuels, promoting large-scale acceptance.

Asia-Pacific, South America, and Middle East & Africa

Asia-Pacific holds 23% of the market, emerging as a major growth hub led by China, India, and Japan. Expanding ethanol production and rising air traffic fuel regional adoption of ethanol-to-jet conversion technologies. South America represents 6% of the market, driven by Brazil’s robust ethanol industry and government-backed aviation fuel diversification. The Middle East & Africa region holds 4%, focusing on diversifying energy sources to reduce dependence on crude-based fuels. The Ethanol To Jet Fuel (ETJ) Processing Technology Market gains momentum across these regions with public-private investments and regional biofuel mandates. It shows steady potential for long-term industrial development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- LanzaJet (LanzaTech)

- Honeywell UOP

- Gevo Inc.

- Fulcrum BioEnergy

- Vertimass

- Haldor Topsoe

- Neste

- TotalEnergies

- World Energy

- Byogy Renewables

- SkyNRG

- KBR, Inc.

- ExxonMobil

- HIF Global

- Siemens Energy

Competitive Analysis:

The Ethanol To Jet Fuel (ETJ) Processing Technology Market features a moderately consolidated landscape with companies focusing on innovation and strategic alliances. Key participants include LanzaJet Inc., Honeywell UOP, Shell plc, Clariant AG, and Gevo Inc. It demonstrates intense competition centered on process efficiency, carbon reduction capabilities, and cost optimization. Firms invest heavily in pilot plants and commercial-scale facilities to validate ethanol-to-jet conversion pathways. Partnerships between ethanol producers, airlines, and energy firms enhance supply reliability and accelerate certification. Several companies target ASTM-compliant jet fuel approval to secure global market entry. Strategic mergers and technological collaborations continue to strengthen competitive positions and expand SAF production networks worldwide.

Recent Developments:

- In September 2025, LanzaJet made significant progress in the commercial deployment of its Alcohol-to-Jet (ATJ) technology with Project Speedbird in the UK, integrating Technip Energies’ Hummingbird ethanol-to-ethylene technology at its Freedom Pines Fuels demonstration facility in Georgia, USA.

- In September 2025, Gevo Inc. and HAUSH Ltd., a prominent European renewable energy developer, signed an agreement to explore ethanol-to-jet processing opportunities in Europe. Their partnership aims to catalyze local SAF projects, leveraging Gevo’s technology for market expansion and emissions reduction

- In February 2025, Gevo formed a strategic alliance with Axens to accelerate the commercialization of ethanol-to-jet (ETJ) pathway using Axens’ Jetanol technology and Gevo’s next-gen ethanol-to-olefins (ETO) process. The alliance brings together advanced plant integrations and aims to deploy cost-effective, zero-carbon intensity SAF at scale.

Report Coverage:

The research report offers an in-depth analysis based on Feedstock, Processing Technology, Application and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for sustainable aviation fuels will strengthen adoption of ethanol-based jet fuel technologies.

- Advancements in catalytic and thermochemical conversion will improve efficiency and fuel quality.

- Growing airline commitments to carbon neutrality will create long-term offtake opportunities for producers.

- Expanding government incentives and renewable fuel mandates will accelerate global production capacity.

- Increased R&D in cellulosic and waste biomass feedstocks will support lower carbon intensity pathways.

- Strategic collaborations among ethanol producers, refiners, and airlines will enhance supply stability.

- Emerging economies will expand ethanol production infrastructure, supporting regional ETJ deployment.

- Certification and policy harmonization will facilitate international trade in sustainable jet fuels.

- Integration of digital monitoring systems will improve conversion yield and process safety.

- Continued investment in pilot and commercial-scale ETJ plants will ensure long-term market maturity.