Market Overview

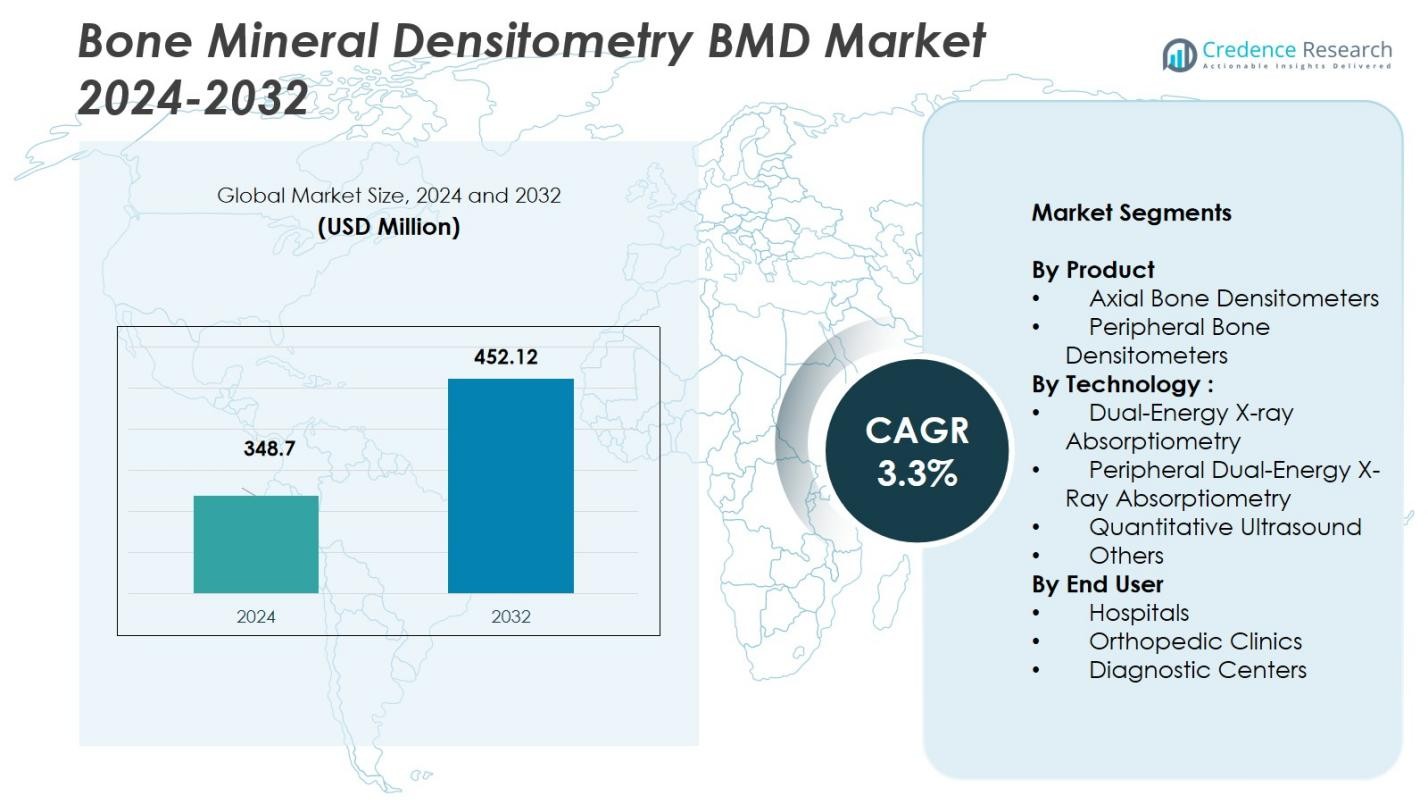

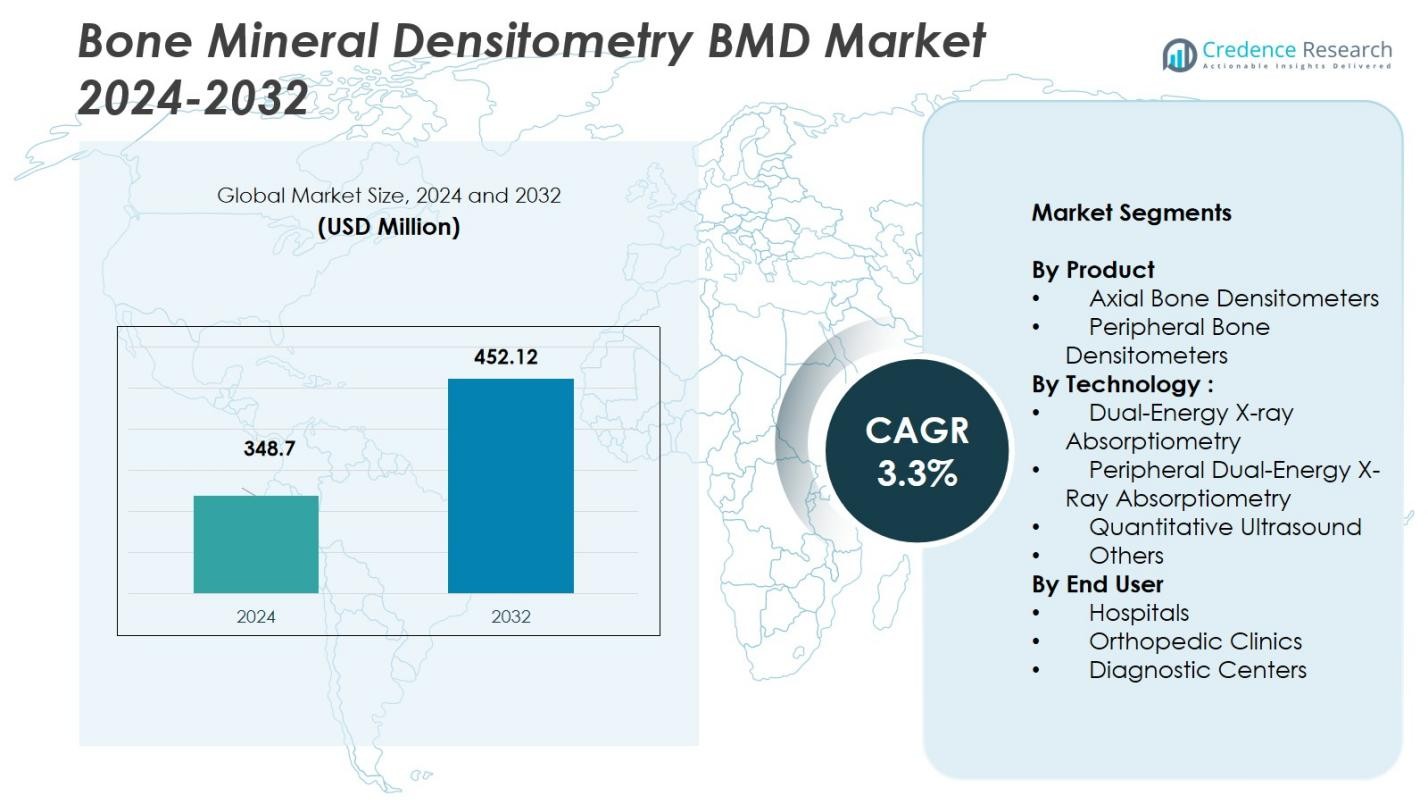

Bone Mineral Densitometry (BMD) Market size was valued at USD 348.7 million in 2024 and is anticipated to reach USD 452.12 million by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Bone Mineral Densitometry (BMD) Market Size 2024 |

USD 348.7 Million |

| Bone Mineral Densitometry (BMD) Market, CAGR |

3.3% |

| Bone Mineral Densitometry (BMD) Market Size 2032 |

USD 452.12 Million |

The Bone Mineral Densitometry (BMD) Market features top players such as GE Healthcare, Hologic Inc., Swissray International Inc., BeamMed Ltd., Osteometer Meditech Inc., Osteosys Co. Ltd., Diagnostic Medical System SA, Medonica Co. Ltd., CooperSurgical Inc., and Hitachi Ltd. These companies leverage strong research and development pipelines, strategic partnerships, and broad global distribution networks to maintain leadership in devices and solutions for bone density assessment. The North American region leads the market with a exact 37.4% share in 2024, followed by Europe with approximately 28%. Their dominance stems from high healthcare infrastructure, reimbursement support, and advanced imaging adoption, thereby establishing a solid foundation for regional advantage.

Market Insights

Market Insights

- The Bone Mineral Densitometry (BMD) Market was valued at USD 348.7 million in 2024 and is expected to reach USD 452.12 million by 2032, growing at a CAGR of 3.3% during the forecast period.

- The market is driven by the rising global prevalence of osteoporosis, increasing aging populations, and the expansion of preventive health initiatives, leading to greater adoption of BMD systems.

- Technological advancements such as AI integration and portable devices are reshaping the market, with a focus on improving diagnostic accuracy and providing more accessible solutions in community and rural settings.

- The Axial Bone Densitometers segment holds the largest market share, accounting for 65%, while the Dual-Energy X-ray Absorptiometry (DEXA) technology dominates with a 72% share.

- North America leads the market with a 37.4% share, followed by Europe at 28%, while Asia Pacific is growing rapidly with a 21% share, driven by increasing healthcare investments and a rising geriatric population.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

In the Bone Mineral Densitometry (BMD) Market, Axial Bone Densitometers hold a dominant 65% share, supported by their superior precision in diagnosing osteoporosis and assessing central skeletal sites such as the hip and spine. Their high clinical reliability and stronger integration with hospital imaging workflows continue to drive adoption. Peripheral Bone Densitometers account for the remaining 35%, benefiting from portability and cost-effectiveness, but their limited diagnostic depth and lower accuracy restrict usage to preliminary screening rather than comprehensive clinical evaluation.

- For instance, Echolight S.p.A. has innovated with radiation-free peripheral densitometers using REMS technology, offering a non-invasive option for early bone health assessment.

By Technology

Dual-Energy X-ray Absorptiometry (DEXA) leads the technology segment with an exact 72% market share, driven by its status as the gold standard for bone density measurement, minimal radiation exposure, and strong acceptance in clinical guidelines worldwide. Its precision in fracture-risk assessment further reinforces dominance. Peripheral DEXA, Quantitative Ultrasound (QUS), and other modalities collectively hold 28%, catering to budget-sensitive settings and point-of-care screening needs, though their reduced accuracy and narrower diagnostic scope limit broader clinical penetration.

- For instance, Hologic’s Horizon DXA system offers high-resolution imaging with low radiation dose and is widely used in hospitals for accurate osteoporosis diagnosis and fracture risk evaluation.

By End User

In the end-user landscape, Hospitals account for an exact 50% share, driven by higher patient inflow, availability of advanced axial DEXA systems, and the need for comprehensive diagnostic capabilities within centralized care environments. Hospitals also benefit from robust reimbursement pathways and structured osteoporosis management programs, strengthening adoption. Orthopedic Clinics represent 30%, supported by specialized musculoskeletal care demand, while Diagnostic Centers hold the remaining 20%, driven by rising standalone imaging services, preventive health screenings, and growing awareness of early osteoporosis detection.

Key Growth Drivers

Rising Prevalence of Osteoporosis and Fracture Risks

The growing global incidence of osteoporosis, driven by aging populations and lifestyle-related bone disorders, significantly accelerates demand for Bone Mineral Densitometry. Increasing fracture rates among adults over 50 have pushed healthcare systems to implement early screening programs and routine bone health assessments. Greater clinical emphasis on fracture prevention, combined with rising awareness of osteoporosis as a major public health concern, reinforces adoption of advanced DEXA systems. As governments and hospitals expand diagnostic capacity, the need for precise bone density evaluation continues to escalate.

- For instance, the International Osteoporosis Foundation reports that osteoporosis affects one in three women and one in five men over 50 worldwide, with the number of affected individuals in the EU rising from 27.5 million in 2010 to a projected 33.9 million by 2025.

Expansion of Screening Programs and Preventive Care

Governments and healthcare organizations are increasingly prioritizing preventive bone health management, leading to broader deployment of bone densitometry equipment across hospitals and diagnostic centers. National screening initiatives for postmenopausal women and high-risk individuals support early detection and intervention. Insurance providers are also improving reimbursement frameworks for DEXA scans, encouraging higher patient participation. The shift toward routine monitoring of chronic conditions such as rheumatoid arthritis and endocrine disorders further boosts utilization of bone density testing in both primary and specialty healthcare settings.

- For instance, National screening initiatives, such as Pharmed Limited’s India Bone Health Initiative, conduct annual BMD testing camps focusing on postmenopausal women and high-risk populations, promoting early detection and osteoporosis awareness.

Technological Advancements Improving Diagnostic Accuracy

Continuous technological innovation in axial and peripheral densitometry systems serves as a major growth catalyst in the BMD market. Advancements such as high-resolution imaging, low-dose radiation, improved calibration algorithms, and increasingly portable systems enhance diagnostic precision and workflow efficiency. Artificial intelligence–enabled bone health analysis is gaining traction, enabling faster interpretation and improved fracture-risk prediction. These innovations allow clinicians to detect bone loss at earlier stages, optimize therapeutic decisions, and streamline patient management, thereby strengthening adoption across hospitals and specialty clinics.

Key Trends & Opportunities

Growing Adoption of Digital and AI-Enhanced Densitometry

The integration of digital platforms and AI-driven analytics into bone densitometry systems presents a significant trend reshaping the market. Advanced software solutions assist radiologists with automated fracture-risk scoring, longitudinal bone tracking, and enhanced reporting accuracy. Cloud-based platforms support remote consultations and data sharing across care teams. This digital ecosystem not only improves workflow but also positions densitometry for broader adoption in telehealth-supported chronic care models, creating new opportunities for vendors offering AI-enabled diagnostic enhancements.

- For instance, GE Healthcare’s Smart DXA platform offers cloud-based data storage and remote access capabilities, facilitating multidisciplinary care and telehealth consultations.

Rising Demand for Portable and Point-of-Care Solutions

Miniaturization and portability of densitometry devices are creating strong opportunities, particularly in community health centers, mobile clinics, and rural healthcare facilities. Portable peripheral devices are increasingly used for rapid osteoporosis screening, outreach campaigns, and home-based assessments for elderly patients. Their ease of use, lower cost, and minimal infrastructure requirements support wider adoption in both developed and emerging markets. As healthcare providers aim to decentralize diagnostics and expand preventive care access, portable BMD systems represent a fast-growing market opportunity.

- For instance, Echolight’s portable peripheral densitometers use radiation-free technology to enable rapid osteoporosis screening in outreach campaigns and home-based elderly assessments, supporting wider accessibility.

Key Challenges

High Equipment Costs and Limited Accessibility in Emerging Regions

The high capital cost of advanced axial DEXA systems remains a significant barrier, particularly for small hospitals and diagnostic centers in low- and middle-income countries. Limited reimbursement in several regions further deters investment in bone densitometry infrastructure. As a result, many patients lack access to accurate osteoporosis screening, delaying fracture prevention efforts. These cost constraints slow market expansion and create disparities in bone health management, making affordability a persistent challenge for industry stakeholders.

Shortage of Skilled Technicians and Interpretation Complexity

The effectiveness of bone densitometry relies heavily on trained technologists capable of performing accurate scans and clinicians skilled in interpreting results. Many regions face workforce shortages, leading to inconsistent scan quality and diagnostic errors. Complexities in interpreting borderline results and distinguishing artifacts from true bone loss add further challenges. Limited training programs and high variability in operator skill affect standardization, particularly in smaller facilities, posing an obstacle to reliable adoption and optimal clinical outcomes.

Regional Analysis

North America

In the North America region, the Bone Mineral Densitometry (BMD) market accounted for 37.4% market share in 2024. Driving factors include well‑developed diagnostic infrastructure, strong reimbursement for bone density screening, and heightened awareness of osteoporosis among aging populations. Leading hospitals adopt advanced axial DEXA systems and integrate bone‑health metrics into fracture‑prevention pathways. Large installed bases and mature imaging ecosystems further reinforce North America’s leadership. Nevertheless, saturation of major markets prompts vendors to explore outpatient and mobile screening solutions to sustain growth.

Europe

In the Europe region, the BMD market held an estimated 28% market share in 2024 (calculated as the residual from available estimates). The region benefits from comprehensive public health programmes targeting osteoporosis, widespread adoption of fracture‑liaison services, and relatively high healthcare spending. Many Western European nations have established preventive screening guidelines for at‑risk populations and early diagnostics. As newer, lower‑cost peripheral systems and portable diagnostics expand in Central and Eastern Europe, growth opportunities emerge despite budget constraints and gradual reimbursement reform.

Asia Pacific

In the Asia Pacific region, the BMD market captured 21% market share in 2024 (derived from remaining regional share after major regions). Rapid growth is spurred by large geriatric populations, rising healthcare expenditure in China and India, and increased diagnostic capacity in urban centres. Emerging middle‑income markets are scaling bone‑density screening as part of broader preventive health initiatives. Though base adoption remains lower than mature markets, rising awareness, improving infrastructure, and cost‑effective device offerings are driving this region’s fast‑growing trajectory.

Latin America

In the Latin America region, the BMD market held 8% market share in 2024. The region is characterized by improving but still modest diagnostic infrastructure, growing urbanization, and increasing interest in preventive bone‑health care. Public and private healthcare providers are expanding imaging services and screening outreach, particularly in Brazil and Mexico. However, limited reimbursement frameworks, lower per‑capita healthcare spending, and uneven device penetration constrain the market. Opportunities lie in mobile diagnostics and lower‑cost peripheral solutions tailored to regional needs.

Middle East & Africa (MEA)

In the Middle East & Africa region, the BMD market represented 5.6% market share in 2024 (to complete the full 100%). Growth is emerging on the back of rising healthcare investment, expansion of private diagnostic chains, and increased awareness of women’s bone health. While infrastructure gaps and cost constraints persist, adoption of portable devices, urban screening programmes, and government incentives are gradually moving the market forward. The region presents a white‑space opportunity for device manufacturers targeting underserved segments and scalable service models.

Market Segmentations:

By Product

- Axial Bone Densitometers

- Peripheral Bone Densitometers

By Technology :

- Dual-Energy X-ray Absorptiometry

- Peripheral Dual-Energy X-Ray Absorptiometry

- Quantitative Ultrasound

- Others

By End User

- Hospitals

- Orthopedic Clinics

- Diagnostic Centers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis in the Bone Mineral Densitometry (BMD) market reveals that leading companies such as GE Healthcare, Hologic, Inc., and Swissray International, Inc. dominate key geographies and technology domains. These firms leverage strong brand recognition, extensive distribution networks, and broad product portfolios covering axial and peripheral densitometers. They continuously invest in next‑generation technologies—such as AI‑enabled analytics and low‑dose DEXA systems—to differentiate their offerings and meet evolving clinical demands. Strategic partnerships, acquisitions, and geographic expansion are frequent, enabling rapid deployment of new systems into emerging markets. Meanwhile, niche players and regional specialists intensify competition by focusing on portable, cost‑effective ultrasound and peripheral devices, challenging traditional market leaders in outpatient and primary‑care screening segments. Overall, competitive rivalry remains intense as vendors vie to address both high‑end hospital settings and growing community‑based diagnostics.

Key Player Analysis

- Osteometer Meditech, Inc.

- CooperSurgical, Inc.

- Swissray International, Inc.

- Diagnostic Medical System SA

- Hitachi Ltd

- Hologic, Inc.

- Osteosys Co. Ltd.

- GE Healthcare

- Medonica Co. Ltd.

- Beammed, Ltd.

Recent Developments

- In July 2025, Entera Bio announced that the U.S. Food & Drug Administration (FDA) gave pivotal agreement on the Phase 3 design for its osteoporosis treatment EB613, with bone mineral density (BMD) set as the primary endpoint.

- In September 2025, Naitive Technologies received 510(k) clearance from the U.S. Food & Drug Administration (FDA) for its OsteoSight software.

- In October 2025, Echolight S.p.A. announced that it will demonstrate its radiation‑free bone density scanning technology (REMS) at the Radiological Society of North America 2025 (RSNA 2025) event in Chicago.

- In June 2025, Medimaps Group launched its “TBS Osteo Next‑Generation” software in the U.S. for advanced bone microarchitecture assessment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Technology, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Increasing global aging population will drive sustained demand for bone mineral densitometry.

- Expansion of preventive health programs will encourage wider screening and earlier diagnosis of osteoporosis.

- Technological advances such as AI integration and cloud‑based analytics will improve diagnostic accuracy and workflow.

- Growth in portable and point‑of‑care densitometry devices will broaden access in community and rural settings.

- Emerging markets will offer high growth potential as healthcare infrastructure and awareness of bone health increase.

- Reimbursement reforms and broader insurance coverage will further support market uptake of densitometry services.

- Collaboration between device manufacturers and software/analytics firms will foster new value‑added solutions.

- Shifts toward outpatient diagnostics and mobile health units will increase deployment of compact BMD solutions.

- Rising demand for performance tracking and longitudinal monitoring of bone health will drive subscription and service models.

- Competitive pressure will intensify, prompting companies to differentiate via lower‑cost systems, bundled services, and strategic acquisitions.

Market Insights

Market Insights