Market Overview

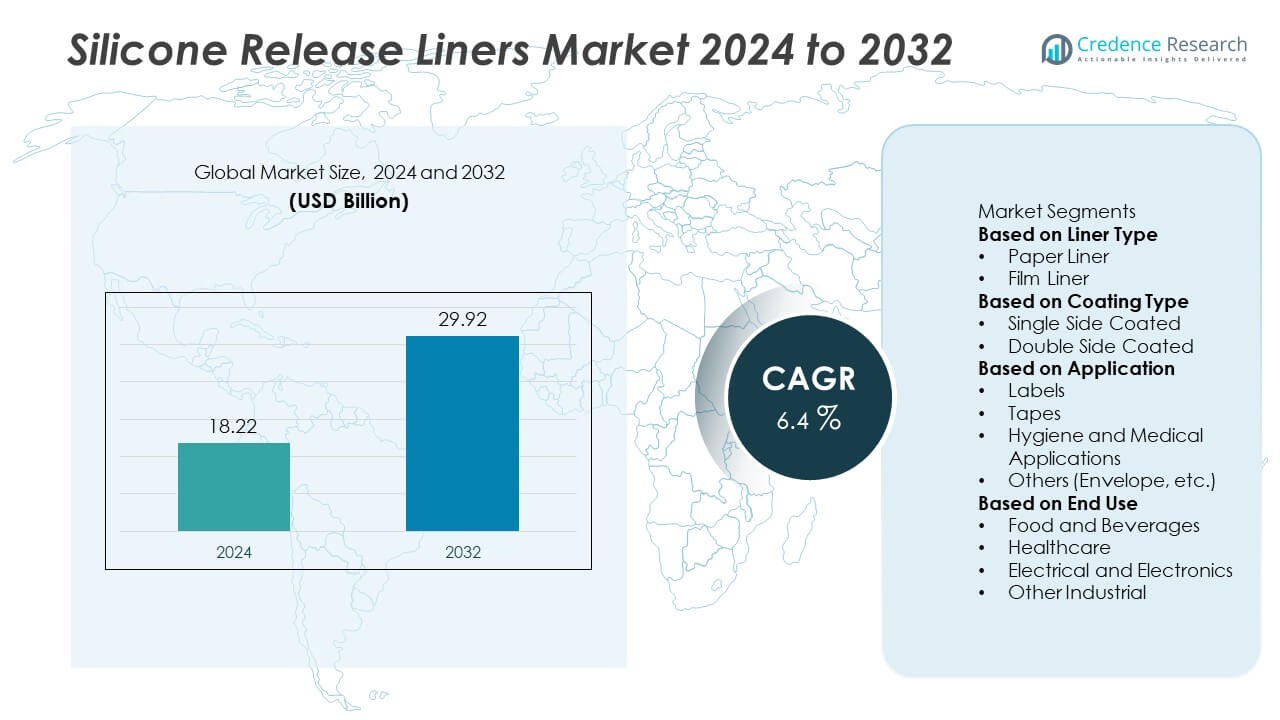

The global Silicone Release Liners Market was valued at USD 18.22 billion in 2024 and is projected to reach USD 29.92 billion by 2032, expanding at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicone Release Liners Market Size 2024 |

USD 18.22 Billion |

| Silicone Release Liners Market , CAGR |

6.4% |

| Silicone Release Liners Market Size 2032 |

USD 29.92 Billion |

The silicone release liners market is led by prominent players such as 3M Company, Mondi plc, Loparex LLC, Avery Dennison Corporation, UPM Raflatac, Lintec Corporation, Gascogne Group, Siliconature S.p.A., Rayven Inc., and Sappi Limited. These companies dominate through innovation in coating technologies, recyclable materials, and customized liner solutions for diverse industrial uses. North America leads the market with a 34.2% share in 2024, supported by strong demand from packaging and hygiene sectors. Europe follows with 29.4% share, driven by sustainability mandates and eco-friendly coatings, while Asia-Pacific holds 27.8% share, emerging as the fastest-growing region due to expanding manufacturing and high consumption of self-adhesive products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global silicone release liners market was valued at USD 18.22 billion in 2024 and is projected to reach USD 29.92 billion by 2032, growing at a CAGR of 6.4%.

- Increasing demand from labeling, packaging, and medical industries is driving market growth, supported by rising use of pressure-sensitive adhesives and sustainable liner materials.

- Key trends include advancements in solvent-free silicone coatings, UV-curing technologies, and adoption of recyclable and bio-based liner materials across end-use industries.

- Leading companies such as 3M Company, Mondi plc, Avery Dennison Corporation, and UPM Raflatac focus on sustainable innovations, strategic acquisitions, and capacity expansion to strengthen their global presence.

- North America leads with 34.2% share, followed by Europe at 29.4% and Asia-Pacific at 27.8%; by liner type, paper liners dominate with 57.6% share, while single-side coated liners account for 63.1% of total demand.

Market Segmentation Analysis:

By Liner Type

The paper liner segment dominates the silicone release liners market with a 57.6% share in 2024. Paper liners are preferred for their cost-effectiveness, recyclability, and compatibility with a wide range of pressure-sensitive adhesives. They are widely used in label manufacturing, tapes, and hygiene applications due to excellent silicone anchorage and easy release properties. The growing demand for sustainable and bio-based paper liners further strengthens their use across industries. Film liners are gaining traction for their superior dimensional stability and moisture resistance, especially in high-performance and electronic applications.

- For instance, 3M Company has reduced its Scope 1 and 2 greenhouse gas (GHG) emissions by 59.1% since 2019, and its Scope 3 emissions by 30.7% since 2021. This contributes to its goal of achieving carbon neutrality by 2050.

By Coating Type

The single-side coated segment leads the market with a 63.1% share in 2024, driven by its widespread application in labels, tapes, and industrial laminations. These liners offer a smooth release surface and cost benefits, making them ideal for high-volume production. The growing use of pressure-sensitive adhesives in packaging and automotive sectors supports the segment’s dominance. Double-side coated liners, however, are expanding steadily due to their superior performance in complex applications such as medical patches and transfer adhesives, where dual release surfaces enhance process flexibility and product efficiency.

- For instance, Avery Dennison Corporation has developed solvent-free UV acrylic adhesives and other advanced adhesive technologies for medical applications, which provide reliable performance and environmental benefits compared to solvent-based alternatives, contributing to enhanced product quality and more sustainable manufacturing.

By Application

The labels segment holds the largest share of 41.3% in 2024, attributed to rising demand from the packaging, logistics, and consumer goods sectors. The increasing use of pressure-sensitive labels in food, beverages, and pharmaceuticals drives strong growth. Advancements in printing technologies and sustainable adhesive systems further boost segment expansion. The tapes segment follows closely, benefiting from the rising use of self-adhesive tapes in construction and electronics. Meanwhile, hygiene and medical applications are witnessing steady growth due to the rising consumption of release liners in wound dressings, sanitary products, and transdermal patches.

Key Growth Drivers

Rising Demand from Label and Packaging Industries

Expanding demand for labels and packaging materials across e-commerce, FMCG, and logistics sectors is a key driver for the silicone release liners market. These liners enable efficient processing and easy handling of pressure-sensitive adhesives used in labels and tapes. Growing emphasis on branding, traceability, and product safety has accelerated label applications across industries. Additionally, the shift toward recyclable and lightweight packaging materials is boosting the need for high-performance release liners with improved coating uniformity and sustainability.

- For instance, UPM Raflatac, a leading supplier of self-adhesive label materials, offers a range of sustainable label solutions and services like the RafCycle program that contribute to the circular economy.

Increasing Adoption in Medical and Hygiene Applications

The growing use of silicone release liners in medical and hygiene products is significantly fueling market growth. Their superior barrier properties, non-stick characteristics, and biocompatibility make them essential in wound care dressings, sanitary products, and transdermal patches. Rising healthcare awareness and hygiene standards, especially in developing economies, are driving higher consumption of disposable medical materials. Manufacturers are focusing on developing hypoallergenic and breathable liner solutions that meet stringent medical-grade safety and performance requirements.

- For instance, Covalon Technologies uses soft silicone adhesive technology in its advanced wound care dressings, such as the CovaWound silicone foam dressings. This silicone adhesive layer does not stick to the wound surface or cause epidermal stripping, contributing to patient comfort and minimal pain upon removal, a key advantage over traditional acrylic adhesives.

Technological Advancements in Coating and Curing Processes

Continuous innovation in coating technologies and UV-curing systems is enhancing liner quality and production efficiency. Advanced silicone formulations now provide better release performance, heat resistance, and durability for diverse substrates. UV and solvent-free coating techniques reduce energy consumption and environmental impact, aligning with global sustainability trends. Manufacturers are adopting precision coating and multi-layer technologies to meet specific end-use requirements across automotive, electronics, and label printing applications, contributing to improved cost efficiency and product reliability.

Key Trends and Opportunities

Shift Toward Sustainable and Recyclable Liner Materials

Sustainability is emerging as a key trend, with increasing demand for recyclable, bio-based, and solvent-free release liners. Paper-based liners made from renewable sources and recyclable film liners are gaining traction among eco-conscious manufacturers. Companies are also investing in closed-loop recycling systems to recover silicone coatings. This shift supports global sustainability commitments and helps reduce waste generated from label and tape production. The adoption of environmentally friendly liners offers strong opportunities for product differentiation and long-term brand positioning.

- For instance, Mondi Group, a global leader in packaging and paper solutions, has developed a range of recyclable paper-based release liners under the EverLiner brand to help customers reduce their carbon footprint.

Rising Integration of Film Liners in High-Performance Applications

Film liners are gaining popularity in high-performance sectors such as electronics, automotive, and medical devices. Their excellent dimensional stability, moisture resistance, and optical clarity make them suitable for precision adhesive applications. The growing demand for durable and clean-release surfaces in graphic films, protective tapes, and display components is fueling segment growth. Film liners are increasingly replacing traditional paper liners in specialized industrial uses, offering opportunities for manufacturers to cater to advanced technical and engineering applications.

- For instance, Lintec Corporation, a major supplier of adhesive materials, produces various adhesive films and tapes for the automotive industry, which are engineered for effective performance under demanding conditions.

Key Challenges

High Production Costs and Raw Material Volatility

The cost of silicone and specialty paper or film substrates significantly impacts production economics. Fluctuating raw material prices, driven by energy costs and supply chain constraints, pose challenges for manufacturers. Additionally, advanced coating technologies and precision curing systems require substantial capital investment. These cost pressures limit the competitiveness of smaller manufacturers, particularly in developing markets. Balancing cost efficiency with high performance and sustainability remains a key challenge for the silicone release liner industry.

Environmental and Recycling Limitations

Despite efforts toward sustainability, recycling silicone-coated liners remains technically challenging due to the complex combination of silicone and substrate materials. Limited recycling infrastructure and high processing costs hinder large-scale recovery efforts. Regulatory pressures on waste management are increasing, particularly in Europe and North America, pushing companies to develop eco-friendly alternatives. Achieving full recyclability while maintaining release performance and durability continues to be a major technological hurdle for market players.

Regional Analysis

North America

North America holds the largest share of the silicone release liners market with 34.2% in 2024. The region’s dominance is driven by strong demand from packaging, labels, and hygiene product manufacturers. The United States leads due to advanced production technologies, high consumption of pressure-sensitive adhesives, and growth in medical applications. Rising demand for sustainable, recyclable liners and increasing use of silicone-coated films in automotive and electronics industries further support expansion. The presence of leading players and strong R&D initiatives ensures steady growth across diverse industrial applications in North America.

Europe

Europe accounts for 29.4% share of the silicone release liners market in 2024, supported by stringent environmental regulations and rapid adoption of sustainable liner materials. The region benefits from high demand in labeling, industrial tapes, and healthcare sectors. Countries such as Germany, France, and the United Kingdom are leading innovation in solvent-free and recyclable silicone coatings. The market is also influenced by strong consumer awareness toward eco-friendly packaging solutions. Growing investment in circular economy initiatives and renewable raw materials continues to drive product development and market expansion across Europe.

Asia-Pacific

Asia-Pacific captures 27.8% share of the global silicone release liners market in 2024 and is the fastest-growing region. Rapid industrialization, urbanization, and the expansion of packaging, medical, and electronics sectors drive market growth. China, Japan, India, and South Korea lead regional demand with increasing production of labels, hygiene products, and adhesive tapes. The region’s growing export-oriented manufacturing and rising investment in high-performance silicone coating technologies strengthen its market position. Cost-effective production, coupled with expanding consumer goods and healthcare markets, ensures strong long-term growth prospects for Asia-Pacific.

Latin America

Latin America holds 5.1% share of the silicone release liners market in 2024, driven by growing demand in packaging, labeling, and construction applications. Brazil and Mexico dominate regional consumption due to expanding manufacturing and e-commerce sectors. The increasing use of self-adhesive materials in logistics and hygiene products supports steady growth. However, limited local production capacity and dependency on imports pose challenges. Ongoing investments in sustainable paper liners and improved distribution networks are expected to enhance regional competitiveness and drive gradual market expansion across Latin America.

Middle East and Africa

The Middle East and Africa region accounts for 3.5% share of the silicone release liners market in 2024. Market growth is supported by increasing use of pressure-sensitive adhesives in construction, packaging, and medical sectors. Gulf countries, led by the UAE and Saudi Arabia, are adopting high-performance liners for industrial and consumer applications. In Africa, rising urbanization and the growth of hygiene and healthcare sectors are driving product demand. Infrastructure development, expanding retail activity, and increasing focus on industrial labeling are expected to support future growth in this emerging regional market.

Market Segmentations:

By Liner Type

By Coating Type

- Single Side Coated

- Double Side Coated

By Application

- Labels

- Tapes

- Hygiene and Medical Applications

- Others (Envelope, etc.)

By End Use

- Food and Beverages

- Healthcare

- Electrical and Electronics

- Other Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the silicone release liners market is defined by major players such as 3M Company, Mondi plc, Loparex LLC, Avery Dennison Corporation, UPM Raflatac, Lintec Corporation, Gascogne Group, Siliconature S.p.A., Rayven Inc., and Sappi Limited. These companies focus on innovation, product diversification, and sustainable production technologies to strengthen their market position. Key strategies include developing recyclable and solvent-free liners, expanding global manufacturing capacities, and enhancing product performance for high-demand sectors such as packaging, medical, and electronics. Strategic mergers, acquisitions, and partnerships help leading players broaden their geographic reach and customer base. Many are also investing in advanced silicone coating technologies and digital process optimization to reduce waste and improve coating precision. Continuous R&D investment and adoption of environmentally responsible materials remain central to gaining a competitive edge in this rapidly evolving and sustainability-driven market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- 3M Company

- Mondi plc

- Loparex LLC

- Avery Dennison Corporation

- UPM Raflatac

- Lintec Corporation

- Gascogne Group

- Siliconature S.p.A.

- Rayven Inc.

- Sappi Limited

Recent Developments

- In November 2024, Loparex LLC released its 2024 ESG Report which underscores its sustainable innovations in engineered release liner solutions (paper & film) and its commitment to renewable energy use and safety initiatives.

- In February 2024, Mondi plc announced that at its Jülich (Germany) and Heerlen (Netherlands) production sites it had improved the circularity of its release‑liner production waste, achieving around 95% of production waste now used as secondary raw material via cooperation with Veyzle, WEPA Group and Soprema.

- In September 2023, Avery Dennison Corporation introduced at Labelexpo Europe 2023 a decorative linerless system as an initial step toward transforming pressure‑sensitive prime materials to liner‑free formats.

Report Coverage

The research report offers an in-depth analysis based on Liner Type, Coating Type, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sustainable and recyclable silicone release liners will continue to grow across industries.

- Advancements in solvent-free and UV-curing coating technologies will enhance production efficiency.

- Expansion in e-commerce and packaging sectors will drive higher adoption of pressure-sensitive labels.

- Medical and hygiene applications will witness steady growth due to rising healthcare standards.

- Film liners will gain traction in high-performance applications like electronics and automotive.

- Manufacturers will invest in eco-friendly materials to meet global sustainability regulations.

- Integration of digital monitoring and precision coating systems will improve product consistency.

- Strategic collaborations and acquisitions will help companies expand their global reach.

- Emerging economies in Asia-Pacific will become major production hubs for release liners.

- Continuous innovation in lightweight and high-durability liners will create new opportunities in specialty applications.