Market Overview

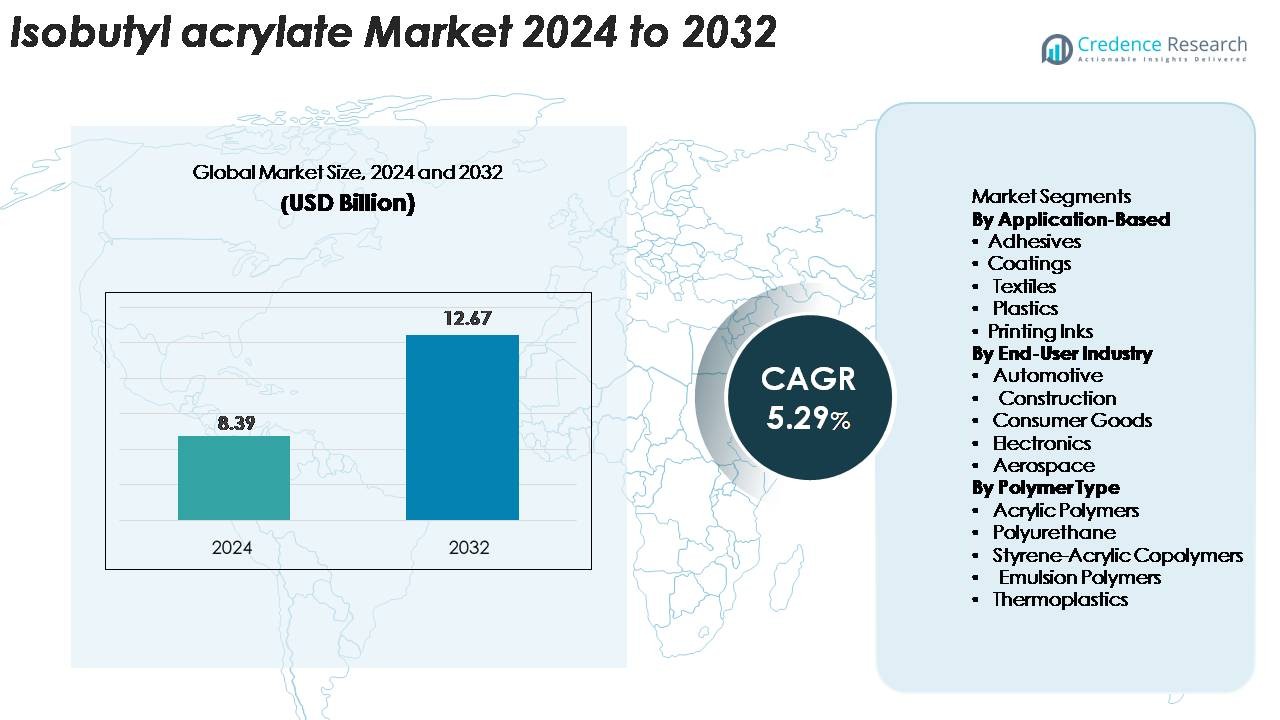

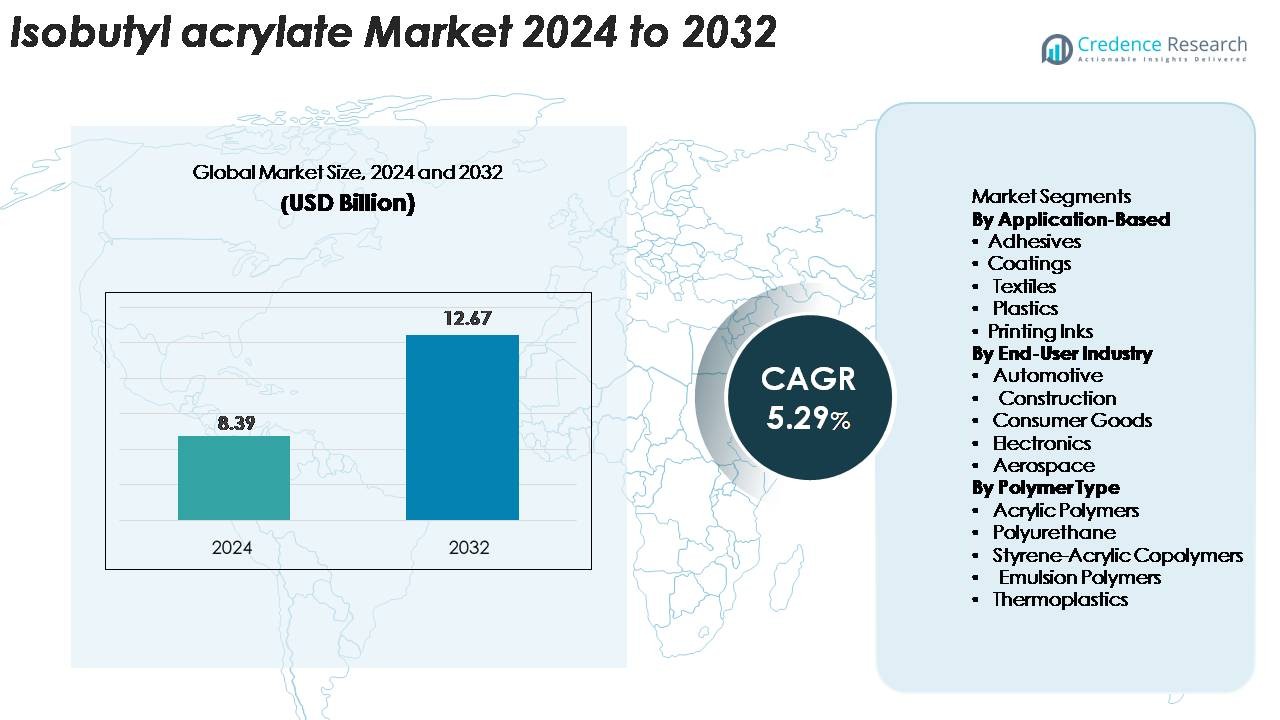

The global isobutyl acrylate market size was valued at USD 8.39 billion in 2024 and is projected to reach USD 12.67 billion by 2032, expanding at a CAGR of 5.29% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Isobutyl Acrylate Market Size 2024 |

USD 8.39 Billion |

| Isobutyl Acrylate Market, CAGR |

5.29% |

| Isobutyl Acrylate Market Size 2032 |

USD 12.67 Billion |

The Isobutyl Acrylate market is driven by key players such as Solventis Limited, Mitsubishi Chemical Corporation, Sigma-Aldrich LLC, OSAKA ORGANIC CHEMICAL INDUSTRY LTD, NIPPON SHOKUBAI Co. Ltd., BASF SE, and BAMM, all of which maintain strong production, distribution, and technology capabilities. These companies focus on high-purity formulations, reliability in supply, and expanding applications across adhesives, coatings, plastics, and specialty chemicals. Asia-Pacific leads the global market with an exact share of around 37%, supported by large-scale chemical manufacturing and high consumption in China and India. North America follows with 30%, while Europe accounts for 27%, reflecting robust industrial and regulatory frameworks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Isobutyl Acrylate market is valued at USD 8.39 billion in 2024 and is projected to reach USD 12.67 billion by 2032, growing at a CAGR of 5.29%.

- Strong demand for advanced adhesives, coatings, and polymer formulations continues to drive market expansion, supported by increasing consumption across construction, automotive, textiles, and electronics industries.

- Key trends include the adoption of low-VOC, high-purity acrylate grades and rising use of isobutyl acrylate in high-performance coatings, with the coatings segment holding the largest share, followed by adhesives and plastics.

- Competitive activity is shaped by major players expanding production capacity, improving product quality, and strengthening global supply chains to meet rising industrial requirements.

- Regionally, Asia-Pacific leads with 37% share, supported by large-scale chemical manufacturing; North America follows with 30%, driven by strong industrial demand; and Europe holds 27%, backed by established specialty chemical producers.

Market Segmentation Analysis:

Application-Based Segment:

In the application-based segmentation, adhesives hold the dominant share, driven by strong demand from packaging, construction, and automotive assembly processes. Isobutyl acrylate enhances flexibility, adhesion strength, and weather resistance, making it a preferred monomer for pressure-sensitive and industrial adhesives. Coatings also contribute significantly as manufacturers adopt high-performance acrylic formulations for architectural and protective finishes. Meanwhile, its use in textiles, plastics, and printing inks continues to grow steadily due to rising requirements for durability, printability, and material compatibility across diverse manufacturing environments.

- For instance, 3M’s VHB acrylic foam tapes demonstrate peel adhesion levels exceeding 160 N/100 mm, showcasing the performance contribution of acrylate-based chemistries.

End-User Industry Segment:

Within the end-user landscape, the automotive industry represents the leading segment, supported by increasing use of high-performance adhesives, coatings, and polymer blends for lightweight vehicle components. Isobutyl acrylate enables improved flexibility, impact resistance, and bonding performance, aligning with OEMs’ shift toward advanced material engineering. Construction follows closely, leveraging the monomer in sealants, paints, and insulation materials. Consumer goods, electronics, and aerospace sectors also expand their consumption, driven by demand for durable, chemically resistant materials in product manufacturing and surface protection applications.

- For instance, 3M’s DP420 structural epoxy adhesive delivers lap shear strengths of up to 30 MPa, demonstrating the bonding performance required for hybrid material assemblies.

Polymer Type Segment:

Among polymer types, acrylic polymers dominate the market as they rely heavily on isobutyl acrylate for enhancing elasticity, adhesion, and environmental resistance. These polymers are widely used in adhesives, coatings, and specialty materials, ensuring consistent demand. Polyurethane and styrene-acrylic copolymers also show strong uptake due to their application in flexible foams, sealants, and industrial coatings. Emulsion polymers and thermoplastics constitute growing segments as manufacturers pursue low-VOC, high-performance solutions for packaging, textiles, and engineering components, reinforcing the material’s relevance across modern polymer systems.

Top of Form

Bottom of Form

Key Growth Drivers

Expanding Demand for High-Performance Adhesives and Sealants

The rising adoption of high-performance adhesives and sealants across automotive, construction, packaging, and consumer goods industries is a major driver of the isobutyl acrylate market. This monomer provides superior flexibility, adhesion strength, and weatherability, making it essential for pressure-sensitive adhesives, industrial tapes, structural bonding, and sealant formulations. As manufacturers transition from mechanical fasteners to adhesive-based joining technologies to enhance aesthetics, reduce weight, and improve performance, demand for isobutyl acrylate continues to grow. In sectors such as EV manufacturing, wind energy, and modern construction, high-strength bonding solutions are increasingly prioritized, further elevating consumption. Additionally, the global shift toward lightweight materials and high-performance coating systems reinforces the need for acrylate-based adhesives and sealants, strengthening market expansion.

- For instance, SikaPower®-830 is engineered for high-performance bonding and features a certified tensile lap-shear strength of 20 MPa (equivalent to 20 N/mm), enabling reliable adhesion in turbine blade assembly and other heavy-load applications.

Growth of the Coatings Industry and Expansion of Construction Projects

Isobutyl acrylate is widely used in acrylic coatings due to its excellent UV resistance, durability, and flexibility, making it a critical component for architectural, industrial, and automotive coatings. The expansion of infrastructure development, urbanization, and refurbishing activities in key markets significantly boosts demand. Rapid construction growth in emerging economies, coupled with stringent regulations encouraging low-VOC, high-performance coatings, supports increased use of acrylate monomers. In industrial settings, anticorrosive and protective coatings rely heavily on isobutyl acrylate for long-term performance. Automotive refinishing, metal coating applications, and high-durability exterior paints further enhance its market prominence. As industries prioritize surface protection, extended material lifespan, and improved environmental compliance, demand for acrylic-based coating ingredients continues to rise, positioning isobutyl acrylate as a growth-enabling monomer.

· For instance, AkzoNobel’s Interpon D powder coatings, which are typically based on polyester (or sometimes fluoropolymer for top-tier products), are tested against rigorous architectural standards like AAMA 2604 which involves several thousand hours of accelerated weathering tests and typically a five-year real-world Florida exposure benchmark for durability.

Rising Use in Polymer Modification and Specialty Chemical Applications

The increasing use of isobutyl acrylate in the production and modification of polymer systems, including acrylic polymers, emulsion polymers, and specialty copolymers, is a significant growth driver. Its ability to enhance elasticity, hydrophobicity, and durability makes it integral in manufacturing specialty plastics, binders, adhesives, and textile finishes. The shift toward advanced polymer engineering—driven by demand for lightweight materials, improved mechanical performance, and tailored chemical properties—supports higher consumption across multiple industrial verticals. Specialty applications such as nonwoven fabrics, pressure-sensitive materials, and engineered plastics rely on acrylate monomers for consistent performance improvements. Moreover, innovations in water-based and low-emission polymer systems encourage manufacturers to prioritize isobutyl acrylate as a key raw material. With increasing investments in high-value polymer technologies, the monomer’s role in specialty chemical production continues to strengthen.

Key Trends & Opportunities

Growing Shift Toward Low-VOC, Eco-Friendly Formulations

A significant trend shaping the isobutyl acrylate market is the rising demand for low-VOC, environmentally compliant materials across adhesives, coatings, and polymer systems. Regulatory bodies in North America, Europe, and parts of Asia enforce strict emission standards, compelling manufacturers to adopt acrylate monomers that support greener formulations. Isobutyl acrylate enables high-performance water-based systems, reducing reliance on solvent-based products while maintaining durability, flexibility, and weather resistance. This shift opens substantial opportunities for suppliers to innovate sustainable product lines targeted at construction, automotive refinishing, protective coatings, and packaging applications. As industries increasingly emphasize environmental stewardship, the monomer’s suitability for eco-efficient formulations strengthens its market attractiveness and long-term demand outlook.

- For instance, AkzoNobel’s Sikkens Autowave 2.0 waterborne refinishing system reduces VOC emissions by up to 85 g/L compared with solvent-based alternatives, illustrating the environmental gains achieved with advanced acrylic chemistry.

Advancements in Specialty Polymers and High-Performance Industrial Materials

Technological advancements in specialty polymers present lucrative opportunities for market expansion. Manufacturers are developing engineered materials with enhanced elasticity, thermal stability, and chemical resistance, relying on isobutyl acrylate as a key building block. The rise of high-performance coatings, next-generation adhesives, and advanced composite materials fuels demand for acrylate monomers that deliver superior functional properties. Growing adoption of performance-enhancing additives in electronics, automotive components, aerospace structures, and industrial machinery reinforces this trend. Furthermore, innovation in emulsion polymerization and copolymer systems expands the scope of applications in textiles, paper coatings, and flexible packaging. The ability of isobutyl acrylate to support structural performance and formulation versatility creates new avenues for specialty chemical development.

- For instance, Arkema’s Sartomer UV-curable acrylate oligomers serve as critical components in advanced formulations engineered to deliver precise mechanical performance.

Increasing Integration in Flexible Packaging and Digital Printing Technologies

The expanding packaging and printing sectors present emerging opportunities, particularly as the market shifts toward flexible, durable, and high-quality labeling materials. Isobutyl acrylate plays a crucial role in producing pressure-sensitive adhesives, acrylic films, and binder systems used in printing inks, enabling enhanced printability, transparency, and adhesion. Growth in e-commerce, food packaging, and barcode labeling accelerates the need for advanced coating and adhesive solutions. Meanwhile, digital printing technologies require polymers with improved gloss, fast setting, and long-lasting performance—attributes supported by acrylate-based formulations. As packaging and printing industries modernize with sustainability-focused and high-speed production processes, isobutyl acrylate usage is expected to expand significantly.

Key Challenges

Volatility in Raw Material Prices and Supply Chain Disruptions

A major challenge for the isobutyl acrylate market is the volatility in raw material prices, particularly propylene and acrylic acid, which are influenced by fluctuations in crude oil markets. Price instability creates cost uncertainties for manufacturers, affecting profitability and production planning. Additionally, global supply chain disruptions—whether due to geopolitical tensions, logistics delays, or shortages of chemical feedstocks—pose operational challenges. These disruptions often lead to extended lead times, increased transportation costs, and constrained availability. Manufacturers must also navigate regulatory barriers and regional compliance requirements, complicating international sourcing strategies. Maintaining consistent product supply at viable costs is a persistent challenge for producers and downstream users.

Environmental and Health Concerns Associated with Acrylate Chemicals

Despite its utility, isobutyl acrylate faces increasing scrutiny due to environmental and health considerations associated with acrylate monomers. Concerns over emissions, toxicity during handling, and potential environmental impact of chemical discharge impose regulatory pressures on producers. Stringent compliance requirements from environmental agencies demand investments in safe production practices, emission control systems, and sustainable formulation technologies. These requirements increase operational costs and limit the use of certain solvent-based or high-VOC applications. Additionally, end-users are shifting toward greener alternatives, compelling manufacturers to innovate and adapt. Balancing compliance, sustainability, and performance expectations remains a complex challenge for stakeholders across the value chain.

Regional Analysis

North America

North America holds a strong position in the Isobutyl Acrylate market, accounting for an estimated 28–30% share, driven by advanced manufacturing capabilities and a robust presence of adhesive, coatings, and plastics producers. The U.S. remains the core contributor due to consistent investments in chemical production and innovation-led industries such as automotive, construction, and electronics. Demand is further supported by stringent quality standards and an established supply chain. Growth in sustainable and high-performance polymers continues to fuel adoption across specialty applications. Canada adds additional momentum with expanding industrial activity and rising consumption of high-value acrylate-based materials.

Europe

Europe commands roughly 26–28% of the global market, supported by its mature chemical industry, strong regulatory framework, and extensive adoption of advanced coatings, inks, and textile chemicals. Germany, France, and the U.K. represent the key hubs, benefiting from technological innovation and large-scale production of specialty polymers. The region’s accelerating demand for eco-friendly and low-VOC formulations reinforces its reliance on isobutyl acrylate in adhesives and construction materials. Additionally, the presence of leading chemical manufacturers enhances product availability and export capacity. Industrial modernization and expansion of automotive and aerospace sectors continue to underpin stable consumption across Europe.

Asia-Pacific (APAC)

Asia-Pacific dominates the global market with the highest share of approximately 35–38%, led by China, India, Japan, and South Korea. Rapid industrialization, rising construction spending, and large-scale manufacturing of coatings, plastics, and adhesives drive the region’s demand. China remains the epicenter due to its expansive chemical production capacity and strong export footprint. India’s fast-growing consumer goods and automotive sectors also contribute significantly. Increasing investments in polymers and industrial infrastructure strengthen regional consumption patterns. The region’s cost-effective production environment and improving regulatory frameworks support sustained expansion, making APAC the fastest-growing market for isobutyl acrylate.

Latin America

Latin America accounts for an estimated 8–10% share, supported by growing demand in construction, packaging, automotive refinishing, and consumer product manufacturing. Brazil and Mexico lead regional consumption due to expanding industrial bases and increasing investments in chemical processing. The shift toward modern coatings and adhesives in infrastructure development fuels market growth. Rising import reliance, combined with gradual development of local polymer manufacturing capabilities, shapes supply dynamics. Although growth is moderate compared with Asia or North America, the region benefits from improving economic stability and rising use of high-performance materials in industrial and commercial applications.

Middle East & Africa (MEA)

The Middle East & Africa region holds a 5–6% market share, driven by rising industrial diversification and infrastructure development initiatives. The UAE, Saudi Arabia, and South Africa are the key markets, supported by increasing adoption of advanced coatings, sealants, and adhesives in construction and automotive sectors. The growing presence of petrochemical facilities enhances feedstock availability, improving local production potential. While the market is still emerging, investments in manufacturing, packaging, and industrial maintenance applications are boosting demand. Continued urbanization, along with expansion of high-end coating technologies, positions MEA as a gradually strengthening market for isobutyl acrylate.

Market Segmentations:

By Application-Based

- Adhesives

- Coatings

- Textiles

- Plastics

- Printing Inks

By End-User Industry

- Automotive

- Construction

- Consumer Goods

- Electronics

- Aerospace

By Polymer Type

- Acrylic Polymers

- Polyurethane

- Styrene-Acrylic Copolymers

- Emulsion Polymers

- Thermoplastics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the isobutyl acrylate market is characterized by the presence of global chemical manufacturers with strong production capabilities, integrated value chains, and established distribution networks. Leading companies focus on expanding capacity, enhancing product quality, and strengthening supply reliability to maintain competitive advantage. Innovation in low-VOC formulations, specialty polymers, and eco-friendly production technologies has become a key strategic priority, driven by rising regulatory pressures and shifting customer preferences. Partnerships, long-term supply agreements, and portfolio diversification into acrylic monomers and specialty chemicals further support market positioning. Regional players increasingly invest in modernization and cost-efficient manufacturing to compete with international suppliers. Additionally, companies are emphasizing backward integration for raw material security and adopting digital tools for operational optimization. Growing demand from adhesives, coatings, and polymer segments continues to fuel competitive activity, prompting manufacturers to enhance technical service capabilities and tailor product offerings to high-growth end-use industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Solventis Limited

- Mitsubishi Chemical Corporation

- Sigma-Aldrich Co. LLC

- OSAKA ORGANIC CHEMICAL INDUSTRY LTD

- NIPPON SHOKUBAI Co. Ltd.

- BASF SE

- BAMM

Recent Developments

- In August 2025, the company OSAKA ORGANIC CHEMICAL INDUSTRY LTD announced a joint-venture agreement in the U.S. (with SHIN‑NAKAMURA CHEMICAL Co., Ltd.) to form Visnex Chemicals Corp., aiming to strengthen sales of specialty acrylic esters including IBA in North America.

- In June 2024, Mitsubishi Chemical Corporation and Technip Energies announced they are licensing an improved ‘OXO M-Process’ technology to minimize the production of isobutyraldehyde as a by-product, thereby increasing efficiency in the production of n-butanol, a key ingredient for paints and coatings.

Report Coverage

The research report offers an in-depth analysis based on Application-based, End-User industry, Polymer type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as demand rises for high-performance adhesives, coatings, and specialty polymers.

- Adoption of low-VOC and eco-friendly formulations will strengthen the role of isobutyl acrylate in sustainable manufacturing.

- Growth in automotive lightweighting and advanced material engineering will drive higher consumption in performance adhesives and coatings.

- Rapid industrialization in Asia-Pacific will reinforce the region’s position as the dominant market.

- Increasing investments in specialty polymers will enhance the monomer’s relevance in engineered materials and advanced composites.

- Digital printing and flexible packaging growth will create new opportunities in high-quality inks and adhesive binders.

- Infrastructure development and building refurbishment will boost demand for durable architectural and industrial coatings.

- Technological improvements in acrylic polymer production will support broader application versatility.

- Supply chain optimization and backward integration will remain strategic priorities for major producers.

- Rising regulatory emphasis on emissions control will accelerate the shift toward water-based and safer chemical formulations.