Market Overview

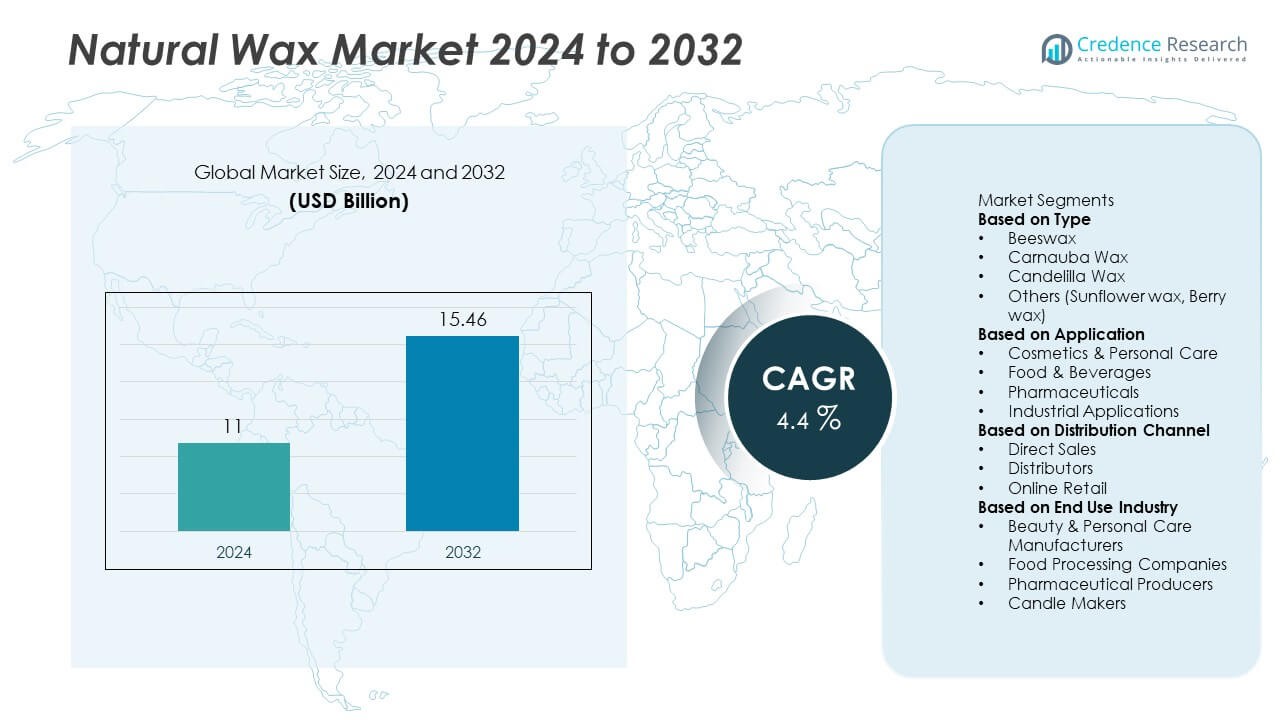

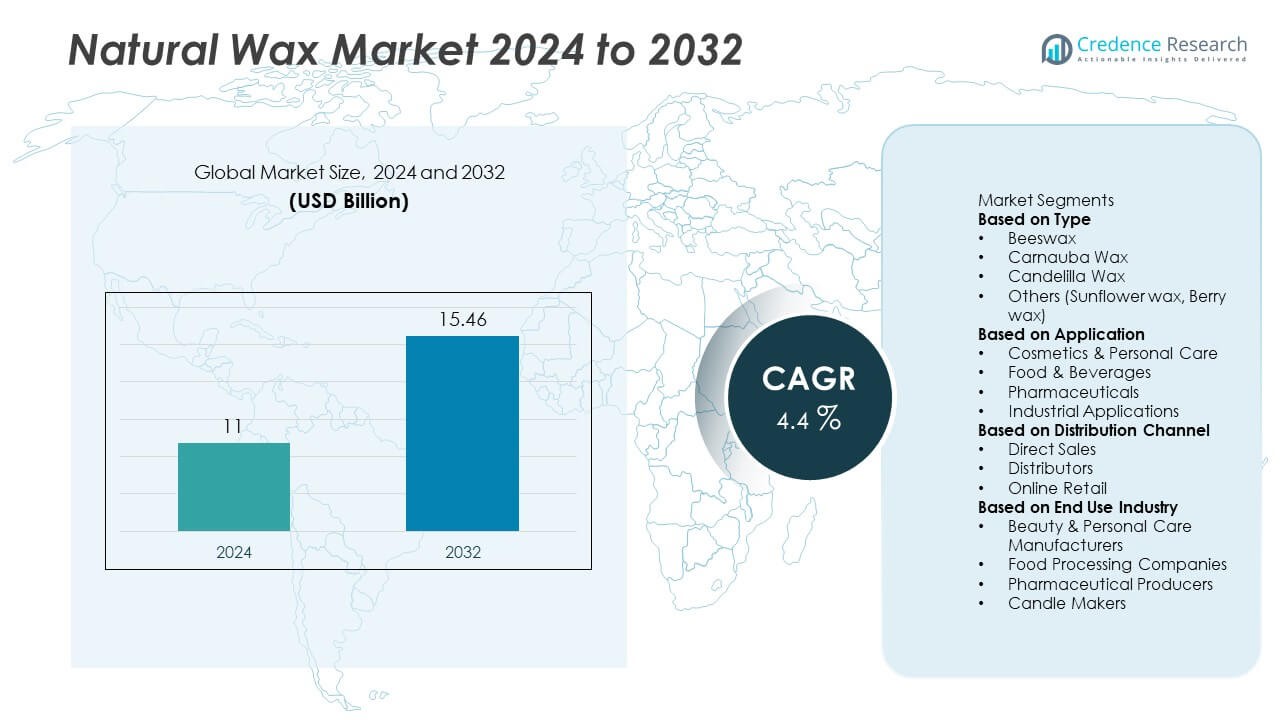

The Natural Wax market was valued at USD 11 billion in 2024 and is projected to reach USD 15.46 billion by 2032, registering a 4.4% CAGR over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Natural Wax Market Size 2024 |

USD 11 Billion |

| Natural Wax Market, CAGR |

4.4% |

| Natural Wax Market Size 2032 |

USD 15.46 Billion |

Top players in the Natural Wax market include Koster Keunen, Strahl & Pitsch, KahlWax, Natural Waxes S.A., The International Group (IGI), Blachford Corporation, Akrochem Corporation, AF Suter, Poth Hille & Co Ltd, and TER Chemicals Distribution Group. These companies strengthen their positions by offering high-purity beeswax, carnauba, candelilla, and specialty plant-based waxes used across cosmetics, food, pharmaceuticals, and industrial applications. Their focus on sustainable sourcing, advanced refining technologies, and custom blends supports strong global demand for natural ingredients. North America leads the market with a 32% share, followed by Europe at 29%, driven by clean-label trends and advanced natural product manufacturing capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Natural Wax market reached USD 11 billion in 2024 and will grow at a 4.4% CAGR through the forecast period.

- Demand rises as cosmetics and personal care brands shift toward clean-label, biodegradable ingredients, supporting strong adoption of beeswax, carnauba, and candelilla wax across premium formulations.

- Key trends include fast growth of plant-based and vegan waxes, while beeswax leads the type segment with a 42% share due to its versatility and strong emulsifying properties.

- Competition intensifies as major players expand refining capabilities, launch high-purity grades, and strengthen sustainable sourcing, though supply variability and higher costs versus synthetic waxes remain restraints.

- North America leads regional demand with a 32% share, followed by Europe at 29% and Asia Pacific at 26%, supported by strong cosmetics manufacturing, clean beauty adoption, and expanding food and pharmaceutical applications.

Market Segmentation Analysis:

By Type

Beeswax holds the dominant position in the type segment with a market share of 42%, driven by its natural purity, strong emulsifying properties, and wide acceptance in premium cosmetic and skincare formulations. Its demand rises as brands shift toward sustainable, chemical-free ingredients. Carnauba and candelilla waxes gain traction for their high melting points and glossy finishes, supporting growth in food coatings and personal care. Other waxes, including sunflower and berry wax, increase usage in vegan formulations. Rising preference for clean-label and bio-based products strengthens beeswax’s leadership across global end-use industries.

- For instance, Koster Keunen has improved its beeswax sourcing technology and processing methods to enhance its purity and sustainability, leading to the creation of the world’s first certified, 100% sustainably-sourced beeswax.

By Application

Cosmetics and personal care lead the application segment with a market share of 39%, supported by strong use in lip care, skin creams, balms, lotions, and natural makeup formulations. Natural waxes offer safe texture enhancement, moisture retention, and stability, making them preferred ingredients for clean beauty brands. The food and beverage segment expands with rising use in coatings, glazing agents, and confectionery polishing. Pharmaceutical applications also grow due to natural excipient needs. Increasing demand for plant-based and hypoallergenic materials helps the cosmetics and personal care segment maintain its dominance.

- For instance, Akrochem Corporation offers various products, including the Akrowax series, which function as release agents and processing aids primarily in the rubber and plastics industries.

By Distribution Channel

Direct sales account for the largest share in the distribution channel segment with a market share of 47%, as major manufacturers supply bulk natural waxes directly to cosmetic, pharmaceutical, and food processing companies. This channel supports better quality control, stable pricing, and long-term supply agreements. Distributors remain essential for small and mid-sized buyers seeking varied wax grades in flexible quantities. Online retail is expanding as artisanal candle makers, DIY formulators, and small brands purchase specialty waxes through e-commerce platforms. Strong demand for consistent supply and custom specifications keeps direct sales in a leading position across global markets.

Key Growth Drivers

Growing Demand for Clean-Label and Natural Ingredients

Demand for clean-label, chemical-free ingredients continues to strengthen the natural wax market. Beauty, skincare, and personal care brands increasingly use beeswax, carnauba, and candelilla wax to replace synthetic petroleum-based alternatives. These waxes offer safe functionality, strong emulsification, and superior texture enhancement, meeting rising consumer expectations for sustainable formulations. Expanding global preference for eco-friendly cosmetics drives manufacturers to adopt plant-based and biodegradable waxes, supporting long-term market growth across premium and mass-market product lines.

- For instance, Strahl & Pitsch is a wax supplier that refines candelilla wax for use in cosmetics and personal care products, where it is known to act as an emulsifier.

Expansion of Natural and Organic Personal Care Products

The rapid expansion of natural and organic beauty products drives steady demand for natural waxes in lip balms, lotions, foundations, and hair-care applications. Brands emphasize plant-derived waxes for improved spreadability, stabilisation, and skin compatibility. Growth in vegan and ethical cosmetic launches boosts interest in carnauba, candelilla, sunflower, and berry wax. Increased consumer focus on transparency, ingredient safety, and sustainability encourages manufacturers to reformulate products with natural waxes, creating strong opportunities across global beauty and personal care segments.

- For instance, Poth Hille & Co Ltd. supplies a wide range of plant-based waxes, such as soy wax, rapeseed wax, and castor wax, which are suitable for use in cosmetics and personal care products.

Rising Use in Food, Pharmaceutical, and Specialty Industrial Applications

Natural waxes gain traction in food coatings, confectionery glazing, pharmaceutical excipients, and specialty industrial uses. Carnauba wax is preferred for fruit coatings and candy polishing due to its hardness and sheen, while beeswax is widely used in capsules, ointments, and controlled-release formulations. Industrial applications expand with rising demand for bio-based coatings, polishes, and lubricants. The need for renewable, non-toxic materials across multiple industries continues to boost natural wax consumption and strengthens long-term growth prospects.

Key Trends & Opportunities

Increasing Shift Toward Vegan and Plant-Based Waxes

A major trend shaping the market is the growing preference for vegan and plant-derived waxes, such as candelilla, carnauba, and sunflower wax. These alternatives replace beeswax in cruelty-free formulations and offer strong hardness, gloss, and stability. Rising adoption by clean beauty brands and natural product manufacturers supports rapid demand growth. The trend opens opportunities for suppliers to develop customized blends tailored to skincare, haircare, and decorative cosmetics, enhancing performance while maintaining eco-friendly profiles.

- For instance, Koster Keunen introduced a candelilla wax blend with improved gloss and stability, meeting the rising demand from vegan and cruelty-free product lines.

Technological Advancements in Extraction and Processing

Improvements in refining, filtration, and purification technologies enhance the quality, consistency, and functionality of natural waxes. Advanced processing techniques help manufacturers achieve higher purity levels and improved sensory attributes suited for premium applications. These advancements support broader usage in pharmaceuticals, high-end cosmetics, and specialty food coatings. Opportunities also emerge as producers develop modified natural waxes with enhanced melting points and improved compatibility with modern formulations, expanding their applications across multiple industries.

- For instance, Rieke Packaging Technologies is known as a global leader in closure and dispensing systems for various markets, including beauty and personal care.

Rising Demand for Sustainable Packaging and Bio-Based Materials

Natural waxes gain relevance in sustainable packaging, coatings, and biodegradable materials. Their water resistance, film-forming properties, and compatibility with paper-based substrates make them suitable for replacing synthetic wax coatings. Growing interest in eco-friendly industrial solutions drives manufacturers to incorporate natural waxes into polishes, sealants, and protective coatings. This trend positions natural waxes as key components in next-generation sustainable materials and supports strong growth in green packaging innovations.

Key Challenges

Supply Variability and Dependency on Natural Sources

Natural wax production depends heavily on agricultural and environmental conditions, creating supply fluctuations that affect pricing and availability. Beeswax relies on healthy bee populations, while plant-based waxes depend on crop yields influenced by climate variations. These uncertainties challenge manufacturers that require consistent quality and stable supply for large-scale formulations. Variability in origin, purity, and processing also creates challenges in maintaining uniform performance across diverse applications.

Higher Costs Compared to Synthetic Alternatives

Natural waxes generally cost more than synthetic petroleum-based options due to limited supply, labor-intensive harvesting, and specialized processing. Higher prices can restrict adoption in cost-sensitive applications such as mass-market cosmetics, industrial coatings, and large-scale manufacturing. Some end users hesitate to shift from inexpensive paraffin wax to premium natural waxes, slowing market penetration. The challenge intensifies as companies balance sustainability goals with budget constraints, especially in competitive product categories.

Regional Analysis

North America

North America holds a market share of 32%, driven by strong demand from cosmetics, personal care, and premium candle manufacturers. The region benefits from high consumer preference for clean-label and natural ingredients, boosting the use of beeswax, soy wax, and plant-derived waxes. Growing interest in organic beauty products strengthens demand across major brands and boutique formulators. Expanding applications in food coatings, pharmaceuticals, and specialty industrial uses also support market growth. Strong retail networks and well-established natural product companies help North America maintain its leadership position.

Europe

Europe accounts for a market share of 29%, supported by stringent sustainability standards and high adoption of natural, vegan, and eco-friendly product formulations. The cosmetics and personal care industries lead consumption, fueled by a strong preference for plant-based ingredients such as carnauba and candelilla wax. The region also uses natural waxes in confectionery coatings, pharmaceuticals, and environmentally safe industrial applications. Rising consumer awareness of clean beauty trends and increasing regulatory pressure against synthetic additives contribute to steady market growth across European countries.

Asia Pacific

Asia Pacific holds a market share of 26%, driven by expanding cosmetics manufacturing, strong demand for natural ingredients, and rapid growth in food processing and pharmaceuticals. Rising disposable incomes and growing interest in organic personal care products strengthen demand for beeswax, carnauba, and rice bran wax. The region also benefits from strong agricultural output, supporting local wax production. Expanding industrial use in coatings, polishes, and biodegradable materials further boosts adoption. Increasing investments in clean-label product development reinforce Asia Pacific’s growing contribution to global market demand.

Latin America

Latin America captures a market share of 8%, supported by abundant natural resources and strong production of carnauba and candelilla wax. These waxes supply both local industries and global markets, strengthening regional competitiveness. Growing demand for natural cosmetics and rising interest in sustainable food coatings drive consumption. Small and mid-sized manufacturers increasingly adopt natural waxes to meet clean-label trends. Expansion in pharmaceutical manufacturing and specialty industrial applications also adds momentum. Market growth remains steady as regional producers enhance refining capabilities and expand export activities.

Middle East & Africa

The Middle East & Africa region holds a market share of 5%, driven by rising demand for natural ingredients in personal care, pharmaceuticals, and specialty industrial applications. Growth in premium skincare and fragrance markets supports increased use of natural waxes such as beeswax and carnauba wax. Local candle-making industries also contribute to consumption. Emerging interest in clean beauty and sustainable materials creates new opportunities for suppliers. Despite limited production capabilities, rising imports and increasing retail availability enable gradual adoption across key markets in the region.

Market Segmentations:

By Type

- Beeswax

- Carnauba Wax

- Candelilla Wax

- Others (Sunflower wax, Berry wax)

By Application

- Cosmetics & Personal Care

- Food & Beverages

- Pharmaceuticals

- Industrial Applications

By Distribution Channel

- Direct Sales

- Distributors

- Online Retail

By End Use Industry

- Beauty & Personal Care Manufacturers

- Food Processing Companies

- Pharmaceutical Producers

- Candle Makers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes major players such as Koster Keunen, Strahl & Pitsch, KahlWax, Natural Waxes S.A., The International Group (IGI), Blachford Corporation, Akrochem Corporation, AF Suter, Poth Hille & Co Ltd, and TER Chemicals Distribution Group. These companies compete by offering a wide range of high-quality natural waxes derived from beeswax, carnauba, candelilla, soy, and specialty plant sources. Their strategies focus on enhancing refining technologies, improving purity levels, and developing customized wax blends for cosmetics, food, pharmaceuticals, and industrial applications. Manufacturers also invest in clean-label and sustainable sourcing practices to meet rising global demand for eco-friendly materials. Partnerships with cosmetic brands, expansions into emerging markets, and advancements in plant-based wax processing strengthen their competitive positions. Continuous innovation in non-synthetic alternatives, improved supply chain transparency, and certification compliance enable these companies to maintain strong market presence in the natural wax sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, TER Chemicals Distribution Group announced publication of its new Sustainable Procurement Policy as part of its wax and specialty chemical distribution operations.

- In January 2025, Koster Keunen announced a strategic partnership with OQEMA Group covering Home & Personal Care, I&I, Food & Feed, and Pharma across Baltics, CEE and SEE.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Distribution Channel, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and clean-label waxes will continue to rise across cosmetics and skincare.

- Plant-based and vegan waxes will gain traction as brands expand cruelty-free product lines.

- Advancements in refining technologies will improve wax purity and expand high-performance applications.

- Food and pharmaceutical sectors will increase adoption of natural waxes for safe coating and formulation needs.

- Sustainable packaging and bio-based material development will drive new industrial uses for natural waxes.

- Growth in premium candle and home fragrance markets will boost demand for high-quality natural wax blends.

- Supply chain transparency and ethical sourcing will become key competitive factors for major producers.

- Emerging markets will adopt natural waxes faster as clean beauty awareness rises.

- Manufacturers will invest more in customized wax blends tailored to specific end-use industries.

- Regulatory support for eco-friendly materials will accelerate the shift away from synthetic wax alternatives.