Market Overview:

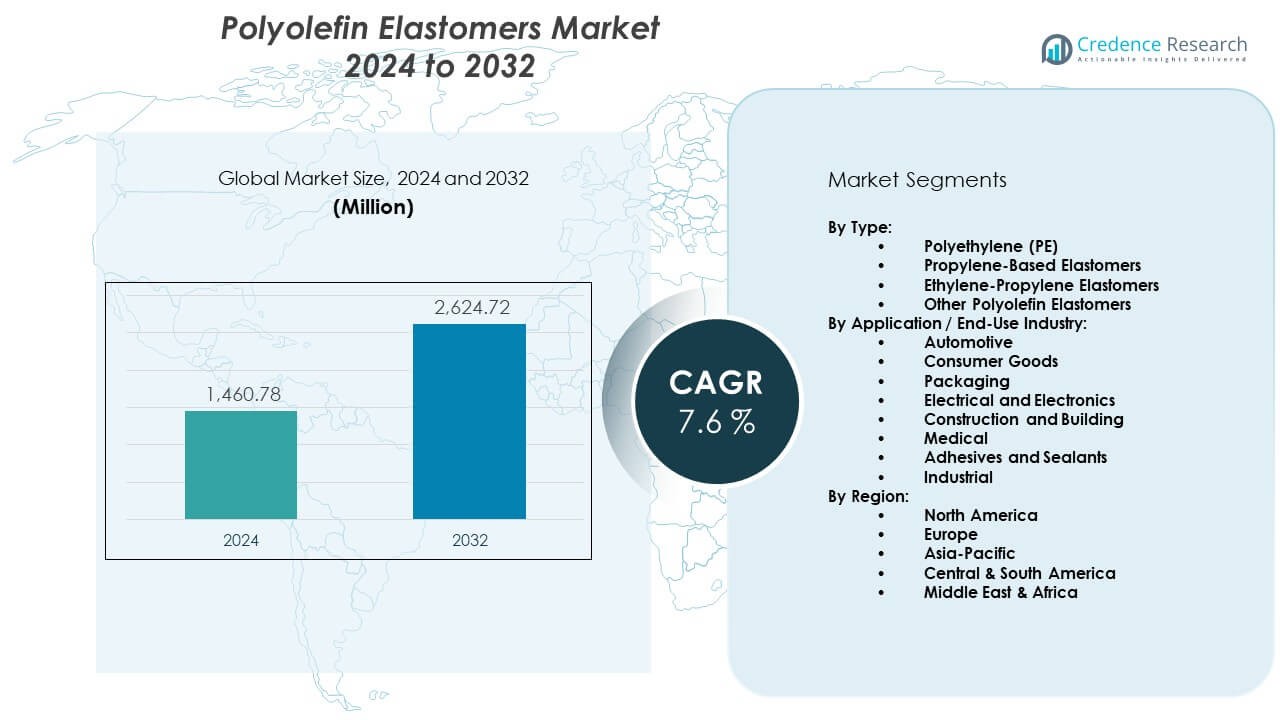

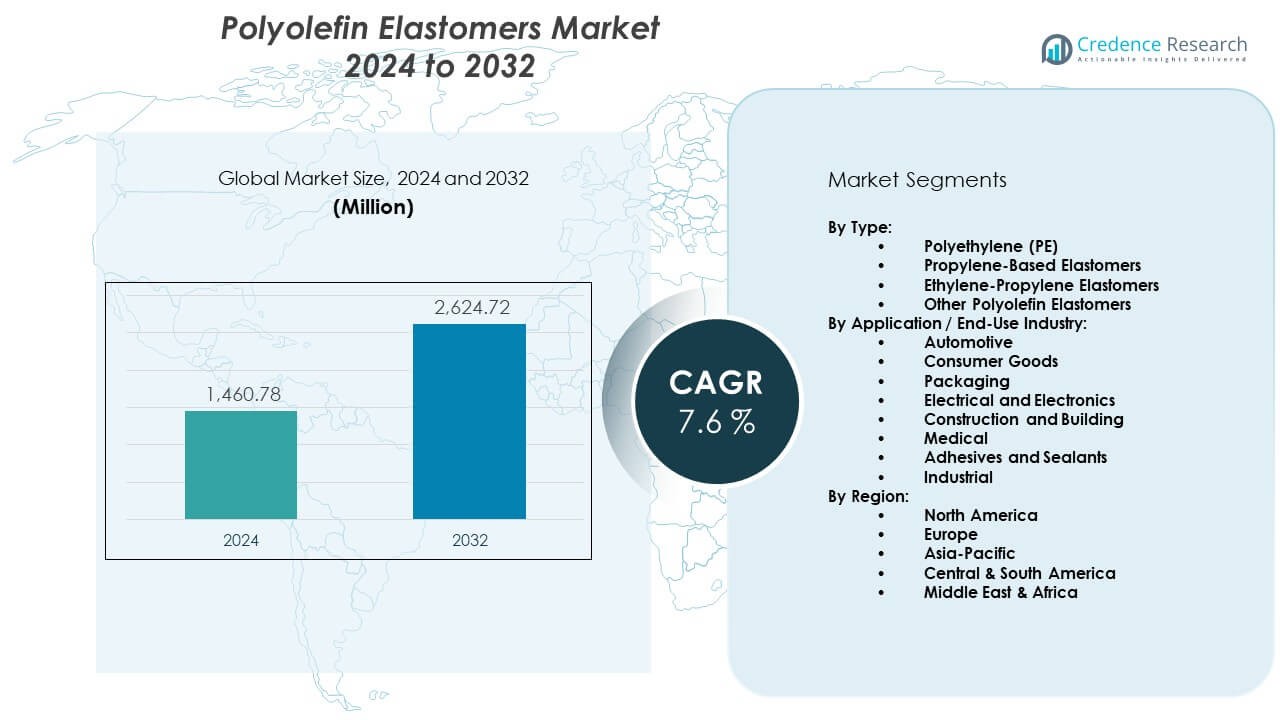

The Polyolefin Elastomers Market is projected to grow from USD 1460.78 million in 2024 to an estimated USD 2624.72 million by 2032, with a compound annual growth rate (CAGR) of 7.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyolefin Elastomers Market Size 2024 |

USD 1460.78 Million |

| Polyolefin Elastomers Market, CAGR |

7.6% |

| Polyolefin Elastomers Market Size 2032 |

USD 2624.72 Million |

Rising interest in lightweight materials drives stronger uptake across transportation and electronics. Producers develop elastomers with better impact strength to support durable components. Packaging companies shift toward flexible film structures that improve product protection. The Polyolefin Elastomers Market gains momentum as brand owners seek sustainable materials with better recyclability. Consumer goods makers use advanced elastomers to enhance stretch, softness, and safety. Industrial buyers adopt these materials to streamline molding processes and reduce production waste.

North America leads due to strong demand from automotive and packaging industries supported by advanced manufacturing capabilities. Europe follows with steady consumption driven by strict sustainability goals and strong polymer innovation. Asia Pacific emerges as the fastest-growing region due to expanding automotive production and rapid growth in flexible packaging. China, India, and Southeast Asia push wider adoption through rising industrial output and higher use of modern polymer blends. Latin America and the Middle East show gradual expansion driven by infrastructure upgrades and a growing consumer base.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Polyolefin Elastomers Market is projected to grow from USD 1460.78 million in 2024 to USD 2624.72 million by 2032, recording a 6% CAGR, driven by rising use in automotive parts, packaging films, and consumer goods.

- North America (38%), Asia-Pacific (30%), and Europe (27%) hold the largest shares due to strong automotive demand, advanced polymer processing, and strict sustainability-driven adoption.

- Asia-Pacific, at 30% share, stands as the fastest-growing region supported by expanding automotive production, rapid industrialization, and strong growth in flexible packaging.

- Packaging accounts for the largest segment share at 34%, driven by demand for flexible films, clarity, and durable protective layers across industries.

- Automotive holds around 27% share, supported by lightweight material needs, improved part durability, and growing electric vehicle production.

Market Drivers:

Market Drivers:

Rising Use of Lightweight Polymers in Automotive and Transportation

Demand grows as automakers replace heavier materials with flexible elastomer grades that support weight reduction. Manufacturers focus on impact-resistant compounds to improve part longevity. Engineers use these polymers to upgrade bumper systems, seals, and trims. The shift toward electric vehicles pushes wider adoption of soft-touch components. Suppliers expand portfolios to meet strict safety and durability needs. The Polyolefin Elastomers Market gains steady traction through rising production volumes. It helps brands improve fuel efficiency targets. The trend strengthens global interest in lightweight design.

- For instance, ExxonMobil reports that its Vistamaxx™ performance polymers improve impact resistance in automotive interiors by up to 20%, enabling lighter assemblies.

Growing Demand for Flexible Packaging Structures Across Industries

Packaging converters increase use of elastomers to improve seal strength and film clarity. Food brands adopt flexible materials to extend product shelf life. Healthcare firms rely on soft films to support sterile packaging needs. Producers upgrade film blends for better tear resistance. It supports consistent performance in demanding logistics cycles. The Polyolefin Elastomers Market grows through rapid expansion in e-commerce shipments. Brand owners look for safer and more appealing packaging formats. Sustainability goals push wider use of recyclable polymer blends.

- For instance, ExxonMobil’s Exceed™ XP films demonstrate puncture resistance exceeding 5 J, which enhances durability for packaged goods. Food brands adopt flexible materials to extend product shelf life.

Strong Shift Toward Sustainable and Recyclable Material Formulations

Manufacturers redesign elastomer grades to reduce environmental footprints. Research teams explore cleaner catalyst systems to support greener production. Packaging firms invest in recyclable structures to meet regulatory needs. It encourages companies to trial mono-material solutions for easier recovery. The Polyolefin Elastomers Market benefits from stronger commitments to circular models. Automotive suppliers test bio-based blends for interior and exterior components. Industrial buyers evaluate low-emission grades to meet compliance norms. Global sustainability frameworks accelerate polymer innovation.

Expanding Role of High-Performance Elastomers in Consumer Goods

Producers develop soft-touch materials to improve comfort and product aesthetics. Consumer brands adopt elastomers to enhance grip and durability. Toy manufacturers use safer grades for flexible parts. Sports equipment firms include advanced compounds to improve performance. It supports stronger demand for customized product features. The Polyolefin Elastomers Market gains value through rising lifestyle-oriented consumption. Electronics brands use elastomers for ergonomic casings. Growth rises as buyers seek products with better tactile feel.

Market Trends:

Innovation in Catalyst Technology to Improve Material Precision and Performance

Producers invest in metallocene catalyst systems to deliver better control over polymer structure. It helps improve softness, elasticity, and clarity for advanced applications. The Polyolefin Elastomers Market observes rising demand for grades with tighter molecular distribution. Packaging converters benefit from improved mechanical balance. Automotive suppliers use precision grades for enhanced molding consistency. Consumer goods manufacturers gain better design flexibility. Research teams test catalysts that reduce defects during production. Innovation accelerates adoption across multiple industries.

- For instance, Mitsui Chemicals’ Tafmer™ metallocene elastomers achieve melt flow rates down to 5 g/10 min, enabling high precision in film and molding applications.

Shift Toward High-Temperature and High-Strength Elastomer Grades

Industrial buyers seek materials that withstand tougher mechanical loads. Producers respond with elastomers designed for elevated thermal conditions. It expands usage across heavy-duty segments. The Polyolefin Elastomers Market gains traction as buyers search for long-lasting materials. Engineers adopt stronger grades to improve end-product stability. Automotive firms test these polymers in demanding environments. Packaging converters use heat-resistant blends for retort applications. Strong performance needs drive continuous material upgrades.

- For instance, LG Chem’s POE grades for industrial parts withstand temperatures near 120°C without losing elasticity.

Rising Integration of Elastomers in Advanced Film and Lamination Technologies

Film manufacturers use elastomer-enhanced structures for better flexibility. It supports higher resistance to puncture during transport cycles. The Polyolefin Elastomers Market grows through expanding multilayer film adoption. Packaging brands invest in smoother sealing surfaces. Healthcare firms test elastomer blends for sensitive medical films. Electronics producers use advanced laminates to protect components. E-commerce growth accelerates need for durable packaging films. Demand rises across logistics and retail supply chains.

Growth in Specialty Applications Driven by Custom Material Engineering

Producers create tailor-made elastomer grades for niche segments. It helps brands adopt unique material functions across products. The Polyolefin Elastomers Market benefits from greater customization requests. Footwear firms use engineered blends for improved cushioning. Cable manufacturers adopt elastomers for flexible jacketing. Medical suppliers test soft-touch materials for safer devices. Industrial designers push demand for differentiated polymer properties. Specialty applications unlock new revenue pathways.

Market Challenges Analysis:

High Production Costs and Limitations in Feedstock Availability

Manufacturers face strong pressure due to volatile raw material supply. Feedstock shortages disrupt production cycles across regions. It raises cost burdens for converters and compounders. The Polyolefin Elastomers Market experiences challenges when supply chains tighten. Producers struggle to balance pricing with customer expectations. Import-dependent regions report higher exposure to global disruptions. Industrial buyers delay procurement when price gaps widen. Competition stiffens as firms seek low-cost alternatives.

Technical Constraints in High-Precision Processing and Product Standardization

Elastomers require strict processing controls to maintain uniform quality. It creates operational difficulty for smaller manufacturers. The Polyolefin Elastomers Market encounters hurdles when precision molding demands rise. Variability in performance limits adoption in safety-critical applications. Converters invest in advanced machinery to improve consistency. Product standardization remains uneven across global markets. Engineers face difficulty ensuring identical results across batches. Technical challenges push firms to upgrade equipment frequently.

Market Opportunities:

Rapid Expansion of Sustainable Alternatives Across Packaging and Consumer Goods

Brands shift toward recyclable materials to meet environmental goals. Producers develop cleaner polymer grades to support regulatory needs. It encourages adoption across flexible packaging and personal care products. The Polyolefin Elastomers Market benefits from rising demand for eco-friendly solutions. Converters explore mono-material designs for easier recovery. Consumer brands promote greener products to enhance market appeal. Growth opportunities rise within regions focusing on circular economies. New formulations help reduce environmental impact.

Growing Adoption of Elastomers in High-Value Industrial and Medical Applications

Medical device makers seek soft-touch materials for improved comfort. Industrial suppliers test elastomers for better vibration control. It supports wider use in tools and safety gear. The Polyolefin Elastomers Market expands through emerging application clusters. Electronics producers include elastomers in ergonomic housings. Robotics designers use flexible polymers for sensitive movement parts. Demand grows as buyers look for advanced performance features. Broader industrial needs open space for long-term innovation.

Market Segmentation Analysis:

By Type

Polyethylene (PE) leads the segment due to strong demand for flexible films, soft-touch components, and high-clarity packaging structures. Propylene-based elastomers follow with wider use in automotive interiors, bumpers, and sealing systems that require improved impact strength. Ethylene-propylene elastomers gain traction for weather-resistant and durable outdoor applications. Other polyolefin elastomers support niche needs where custom performance or specialized processing is required. The Polyolefin Elastomers Market benefits from strong compatibility across molding, extrusion, and blending operations. It supports manufacturers seeking versatile materials with balanced mechanical properties. Type diversification strengthens product innovation across industries.

- For instance, SABIC’s PE-based elastomers achieve dart drop impact strength above 1,500 g, supporting premium packaging uses.

By Application / End-Use Industry

Automotive holds significant share due to rising adoption in trims, gaskets, and lightweight components. Consumer goods rely on elastomers for soft-touch grips, wear resistance, and improved ergonomics. Packaging emerges as a major user due to strong demand for flexible films, sealants, and protective layers. Electrical and electronics firms use elastomers for insulation, cushioning, and component safety. Construction and building applications grow through greater use in roofing membranes and sealants. Medical uses expand due to interest in safer, non-latex alternatives. Adhesives and sealants benefit from improved bonding strength and durability. Industrial users adopt elastomers to support vibration control and reliable mechanical performance.

- For instance, Dow’s ENGAGE™ materials are used in auto weatherseals with compression set improvements of up to 25%. Consumer goods rely on elastomers for soft-touch grips, wear resistance, and better ergonomics.

Segmentation:

By Type:

- Polyethylene (PE)

- Propylene-Based Elastomers

- Ethylene-Propylene Elastomers

- Other Polyolefin Elastomers

By Application / End-Use Industry:

- Automotive

- Consumer Goods

- Packaging

- Electrical and Electronics

- Construction and Building

- Medical

- Adhesives and Sealants

- Industrial

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Polyolefin Elastomers Market, accounting for around 38% due to strong adoption in automotive, packaging, and consumer goods. Demand rises as manufacturers invest in advanced polymer processing and lightweight design. The region benefits from a mature industrial base supported by strong R&D capabilities. It gains steady traction through wider use in high-performance films and molded parts. Automotive suppliers depend on elastomers to improve durability and safety. Packaging companies increase use of flexible structures to meet sustainability goals. The market maintains a stable growth path supported by strong technology development.

Europe

Europe secures about 27% share driven by strict environmental standards and rising demand for recyclable materials. Producers adopt elastomers to comply with evolving circular economy regulations. The Polyolefin Elastomers Market grows through stronger interest in eco-friendly packaging formats. It gains support from automotive manufacturers that prioritize lightweight and low-emission parts. Consumer goods brands rely on high-quality elastomers to improve comfort and product life. Medical and healthcare applications expand with growing need for safer and latex-free materials. Regional innovation centers push steady improvements in polymer performance.

Asia-Pacific

Asia-Pacific captures nearly 30% share and remains the fastest-growing region due to expanding manufacturing capacity and rising consumption across key industries. China, India, and Southeast Asia drive higher demand for automotive parts, construction materials, and flexible packaging. It benefits from rapid industrialization and increasing investments in processing technologies. The Polyolefin Elastomers Market gains strong momentum as regional producers scale polymer production. Electronics manufacturers use elastomers for insulation and shock absorption. Packaging converters boost usage to serve large FMCG and e-commerce sectors. Growth accelerates with improving infrastructure and rising disposable income across developing economies.

Key Player Analysis:

- DowDuPont (US)

- The Dow Chemical Company (US)

- Exxon Mobil Corporation (US)

- Mitsui Chemicals, Inc. (Japan)

- LG Chem (South Korea)

- Mitsubishi Chemical Holding Corporation (Japan)

- Polmann India Ltd (India)

- SABIC (Saudi Arabia)

- LyondellBasell Industries Holdings BV (Netherlands)

- RTP Company (US)

- PolyOne Corporation (US)

Competitive Analysis:

The Polyolefin Elastomers Market features strong competition driven by product quality, processing efficiency, and global supply capabilities. Leading companies invest in advanced catalyst technologies to deliver consistent material performance across industries. Producers expand portfolios to meet rising demand for flexible packaging, automotive components, and consumer goods. It benefits from continuous improvements in mechanical strength, clarity, and recyclability. Key players focus on strategic partnerships to secure feedstock stability and extend regional presence. Innovation centers support development of specialized grades for high-value applications. Competition intensifies as new entrants target niche performance segments. Established firms strengthen distribution networks to maintain leadership positions.

Recent Developments:

- In September 2025, Mitsui Chemicals, Idemitsu Kosan, and Sumitomo Chemical entered into a Memorandum of Understanding (MOU) for integrating Sumitomo Chemical’s polypropylene (PP) and linear low-density polyethylene (LLDPE) businesses in Japan into Prime Polymer Co., Ltd., the joint venture between Mitsui (65% stake) and Idemitsu (35% stake). Following the integration scheduled for April 2026, the shareholding structure will change to Mitsui 52%, Idemitsu 28%, and Sumitomo 20%, with an ambitious goal to generate integration synergies exceeding 8 billion yen through facility consolidation, product line optimization, and productivity improvements, while enhancing capabilities to develop high-performance and environmentally conscious polyolefin products for a sustainable green chemical business.

- In July 2025, ENEOS Corporation and Mitsubishi Chemical Corporation completed their chemical recycling facility for plastic-to-oil conversion business at MCC’s Ibaraki Plant in Kamisu City, Ibaraki Prefecture, marking a significant step forward in advanced plastic recycling technology and demonstrating the companies’ commitment to developing innovative circular economy solutions in specialty materials production.

- In October 2024, ExxonMobil Corporation announced the launch of its Signature Polymers brand, a transformative strategic initiative that unified all polyolefin products under a single portfolio brand as part of a comprehensive repositioning strategy to enhance customer partnership and service. The new brand architecture includes streamlined product naming and portfolio organization, new “PolyView” events to facilitate industry dialogue and market insights sharing, and the introduction of a Signature Polymers Academy focused on delivering training and workshops for customers across key markets, demonstrating ExxonMobil’s commitment to becoming the industry’s most valued global partner through improved service and collaboration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Type and By Application/End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for elastomers will rise with increased adoption in flexible packaging.

- Automotive firms will use more lightweight polymer blends for trims and sealing parts.

- Processing innovation will support higher-quality film and molding performance.

- Material recyclability will become a central focus for producers and converters.

- Medical device makers will expand use of soft-touch and latex-free elastomers.

- Electronics firms will rely on advanced grades for insulation and shock protection.

- New catalyst systems will improve material precision for high-value applications.

- Infrastructure growth in Asia-Pacific will drive regional consumption.

- Global suppliers will expand facilities to secure long-term feedstock stability.

- Specialty elastomers will gain traction for emerging industrial and consumer uses.

Market Drivers:

Market Drivers: