Market Overview

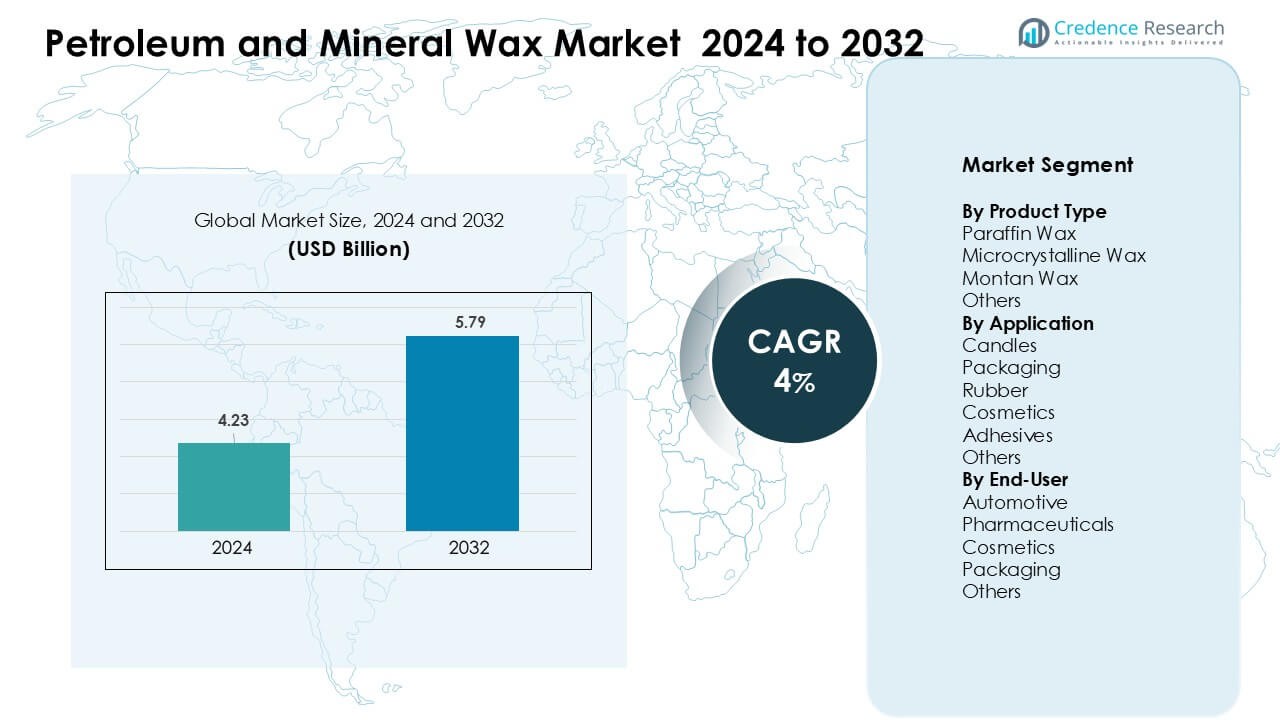

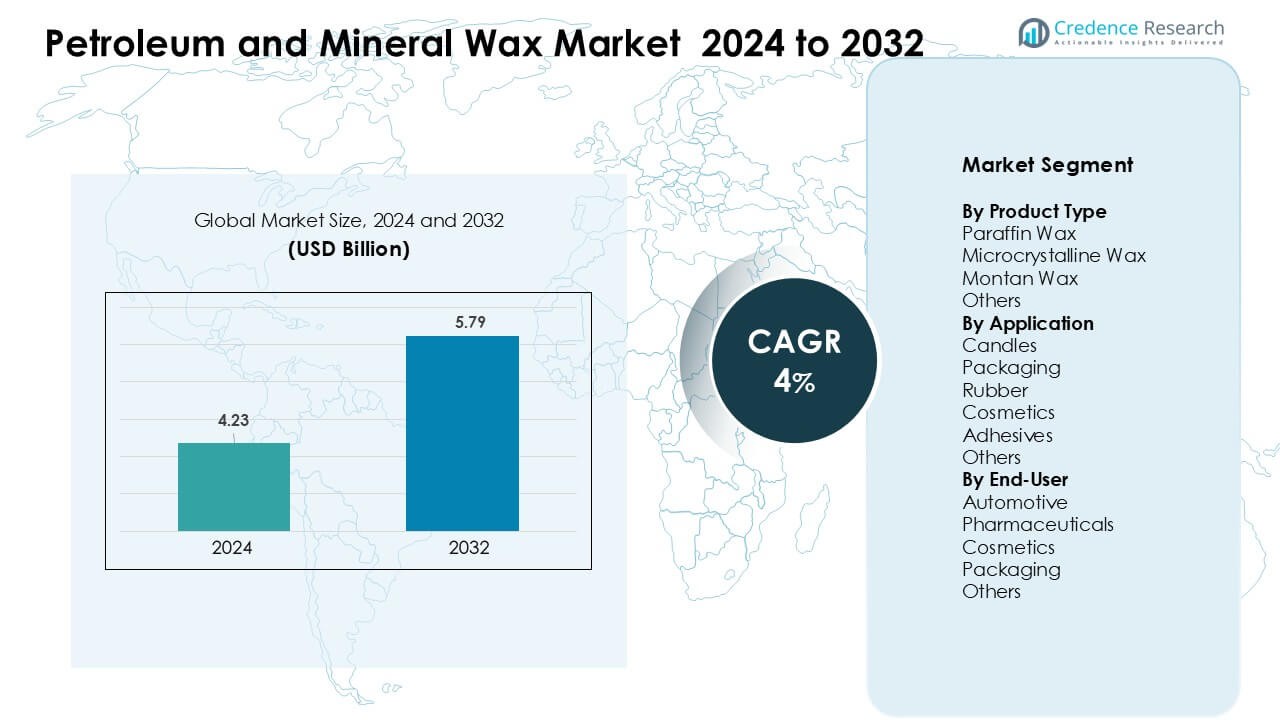

Petroleum and Mineral Wax Market was valued at USD 4.23 billion in 2024 and is anticipated to reach USD 5.79 billion by 2032, growing at a CAGR of 4 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Petroleum and Mineral Wax Market Size 2024 |

USD 4.23 Billion |

| Petroleum and Mineral Wax Market, CAGR |

4% |

| Petroleum and Mineral Wax Market Size 2032 |

USD 5.79 Billion |

The petroleum and mineral wax market is shaped by leading players such as Sasol Limited, HollyFrontier Corporation, Nippon Seiro Co., Ltd., Petro-Canada Lubricants Inc., Petrobras, H&R Group, Sinopec Limited, The International Group, Inc., Royal Dutch Shell plc, and ExxonMobil Corporation. These companies compete through large refining capacities, high-purity wax production, and strong distribution networks that support demand from candles, packaging, cosmetics, pharmaceuticals, and rubber industries. Asia Pacific emerged as the leading region in 2024 with about 38% share, driven by strong manufacturing activity, expanding consumer goods sectors, and rising use of both paraffin and microcrystalline wax across industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The petroleum and mineral wax market reached USD 23 billion in 2024 and is projected to grow at a CAGR of 4% through 2032, driven by strong consumption in candles, packaging, cosmetics, and rubber applications.

- Rising demand from candle manufacturing and moisture-resistant packaging acts as a key growth driver, supported by high usage of paraffin wax, which held about 62% share in the product segment.

- Market trends include growing adoption of high-purity microcrystalline wax in cosmetics and adhesives, along with increased interest in specialty wax grades across pharmaceuticals and automotive industries.

- Competitive activity remains strong as major players enhance refinery integration and invest in advanced purification technologies to supply stable, high-quality waxes across global manufacturing sectors.

- Asia Pacific held the largest regional share at about 38% in 2024, while candles remained the leading application with nearly 41% share, supported by rapid industrial expansion and rising consumer product demand across China, India, and Southeast Asia.

Market Segmentation Analysis:

By Product Type

Paraffin wax held the dominant share in 2024 with about 62%. This lead came from strong use in candles, packaging coatings, and board lamination. The product stays popular due to stable supply, low cost, and broad compatibility with additives. Microcrystalline wax grew in premium cosmetics and adhesives because of its higher viscosity and flexibility. Montan wax stayed niche but useful in polishes and engineering plastics. Demand for refined paraffin grades increased as industries sought better stability, smoothness, and higher melting points.

- For instance, suppliers like IGI Wax offer microcrystalline grades with a melting point range of 60–93 °C (140–200 °F), providing enhanced elasticity and tackiness properties that cosmetics formulators leverage in lip balms, creams, and structural makeup products.

By Application

Candles dominated the application segment in 2024 with nearly 41% share. The segment expanded due to rising demand for decorative and scented candles in home décor and wellness. Paraffin-based blends gave stable burn quality, easy coloring, and cost efficiency, which boosted adoption among large candle manufacturers. Packaging grew due to wax-coated boards and moisture-resistant paper needs across food and industrial uses. Cosmetics and adhesives increased demand for microcrystalline wax because of its binding strength and smooth texture performance.

- For instance, ExxonMobil’s Prowax® 600 series paraffin wax is used in paper coating applications to improve water resistance and grease barriers in food packaging.

By End-User

Packaging led the end-user segment in 2024 with about 36% share. The lead came from steady consumption of wax-coated wrappers, corrugated boards, and barrier papers in food, e-commerce, and logistics. The packaging sector prefers paraffin wax for its moisture resistance and cost advantages. Cosmetics followed due to strong use of microcrystalline wax in balms, creams, and sticks. Automotive and pharmaceuticals showed steady demand for specialty wax blends that aid in lubrication, surface protection, and controlled-release formulations.

Key Growth Drivers

Rising Demand from Candle and Packaging Industries

Growing consumption of candles and packaging materials remains a major driver for the petroleum and mineral wax market. Candle makers continue to favor paraffin wax due to its steady burn profile, strong fragrance retention, and low production cost, which supports large-scale output. Rising home décor trends, aromatherapy use, and holiday-season demand push candle manufacturing volumes higher across global markets. Packaging applications also strengthen demand as wax-coated boards, corrugated sheets, and barrier papers provide moisture resistance and product protection in food, e-commerce, and industrial shipments. Expanding logistics networks and growth in temperature-sensitive goods further increase wax-coated packaging usage. The combined rise of decorative candles and high-performance packaging materials keeps paraffin and microcrystalline wax consumption stable, reinforcing their role as reliable and economical industrial materials.

- For instance, Yankee Candle primarily uses paraffin-based wax blends in many of its jar candle products. The company favors paraffin wax for its reliable burn behavior and strong fragrance compatibility in mass-market candles.

Expansion of Cosmetics, Adhesives, and Rubber Manufacturing

The cosmetics, adhesives, and rubber industries continue to widen their use of various wax grades due to performance benefits and growing product innovation. Microcrystalline wax remains important in lip care, skin creams, and balms because it enhances texture, firmness, and stability while supporting high melting points. Adhesive makers prefer wax additives for improved flexibility, bond strength, and viscosity control in hot-melt systems used in hygiene products, packaging, and woodworking. Rubber manufacturers rely on wax coatings to prevent cracking and ozone degradation in tires and molded components, creating steady long-term demand. As personal care and automotive production expand, the need for specialty waxes grows across diverse applications. The shift toward premium cosmetic formulations and advanced adhesive technologies supports market growth and encourages refineries to produce more refined, high-purity wax grades.

- For instance, microcrystalline wax used in cosmetic formulations typically has a melting point in the range of 60–90 °C, offering thermal stability so that creams, lip balms, and solid products remain stable even in warm climates a key benefit for manufacturers delivering products to diverse markets.

Stable Availability and Cost Advantage Over Alternative Materials

Petroleum and mineral waxes retain a strong position due to their consistent supply, cost efficiency, and well-established industrial acceptance. Refinery operations generate paraffin wax as a steady by-product, ensuring predictable availability for key sectors such as candles, packaging, cosmetics, and pharmaceuticals. Compared with natural waxes like beeswax or carnauba, petroleum-derived options offer lower price volatility, uniform quality, and easier large-scale processing, making them preferred materials for mass production. The waxes also blend effectively with polymers, oils, and additives, supporting wide formulation flexibility across coatings, emulsions, and adhesive systems. Their durability, water resistance, and thermal stability allow manufacturers to maintain performance without relying on higher-priced natural alternatives. This structural cost advantage continues to attract industrial users seeking reliable materials for large-volume production.

Key Trends & Opportunities

Growing Adoption of High-Performance Specialty Waxes

A key trend shaping the petroleum and mineral wax market is the shift toward higher-grade and specialty waxes that deliver better thermal stability, hardness, and gloss. Microcrystalline wax continues to gain traction in cosmetics, adhesives, and rubber applications due to its fine crystalline structure and enhanced binding strength. Industries also seek more refined paraffin grades for superior clarity and consistency in candles and coatings. Investments in upgrading refinery technologies support the development of cleaner, odor-free, and low-oil waxes tailored for premium applications. As manufacturers pursue higher product quality and sustainability compliance, demand for advanced and well-processed wax grades increases across multiple end-use sectors.

- For instance, Sonneborn (IMCD Group) produces microcrystalline waxes with oil content below 1% and controlled needle penetration, supporting elasticity and adhesion in cosmetic sticks.

Opportunities from Pharmaceutical and Automotive Applications

Pharmaceutical and automotive applications present strong growth opportunities for the market as these sectors rely on waxes for specialized technical functions. Pharmaceutical firms use waxes in controlled-release tablets, ointments, and topical formulations due to their stability, hydrophobic nature, and compatibility with active ingredients. Automotive producers utilize wax coatings for corrosion protection, surface finishing, and tire protection, maintaining consistent long-term demand. Growth in global healthcare spending, rising chronic disease management, and expanding vehicle production create new avenues for wax suppliers. Increasing use of microcrystalline and synthetic waxes in premium formulations further enhances market potential in these high-value industries.

- For instance, manufacturers such as IGI Wax supply microcrystalline wax grades with melting points in the 60–93 °C range and with high viscosity and tack properties that support adhesive performance, thermal stability, and elasticity under stress.

Key Challenges

Volatility in Crude Oil Supply and Refinery Output

Crude oil fluctuations remain a major challenge because wax supply depends directly on refinery output and processing patterns. As refineries shift toward producing low-sulfur fuels and lighter petroleum products, the supply of heavy fractions used to produce paraffin and microcrystalline wax may decline. Geopolitical tensions, production cuts, and regulatory pressures contribute to periods of inconsistent wax availability. These supply uncertainties raise procurement risks for packaging, candle manufacturing, and cosmetics companies that rely on stable feedstock quality. Market players must adapt to varying refinery yields and explore diversification strategies, including sourcing from multiple regions or developing alternative wax blends.

Competition from Natural and Synthetic Alternatives

The market faces rising competition from natural waxes such as beeswax, soy wax, and carnauba, as well as synthetic options like polyethylene waxes. Consumer interest in eco-friendly and plant-based materials drives candle and cosmetics manufacturers to test natural wax substitutes. Regulatory pressure for sustainable raw materials also encourages companies to reduce dependency on petroleum-derived waxes. Although natural and synthetic waxes often cost more, they provide advantages in biodegradability, perceived safety, and premium brand positioning. This trend challenges petroleum wax suppliers to innovate, improve purification levels, and highlight performance benefits to maintain competitiveness in evolving markets.

Regional Analysis

North America

North America held about 34% share in the petroleum and mineral wax market in 2024, driven by strong demand from packaging, candles, and cosmetics industries. The region benefits from steady refinery output and widespread use of paraffin wax in household and decorative candles, which remain popular across the U.S. Canada supports growth through packaging and automotive applications that rely on wax coatings for moisture resistance and surface protection. Expanding e-commerce shipments also increase the use of wax-coated corrugated boards. Rising interest in premium cosmetic formulations strengthens demand for microcrystalline wax across major personal care brands.

Europe

Europe accounted for nearly 28% share in 2024 due to high consumption in candles, pharmaceuticals, and industrial coatings. The region has a strong candle manufacturing base in Germany, Poland, and the Netherlands, which drives significant paraffin wax usage. Pharmaceutical companies across France, Italy, and the U.K. rely on refined wax grades for tablet coatings and topical formulations. Demand also rises in rubber and automotive applications due to strict performance standards. Growth in specialty wax imports continues as regional refineries shift toward cleaner fuels, reducing local wax availability and increasing reliance on global suppliers.

Asia Pacific

Asia Pacific led the global market with about 38% share in 2024, supported by strong industrial expansion and high production volumes across packaging, rubber, adhesives, and cosmetics. China remains the largest consumer due to its extensive manufacturing base and strong export-driven packaging demand. India and Southeast Asia show rapid growth in candles, pharmaceuticals, and automotive rubber components, boosting interest in both paraffin and microcrystalline wax. Rising disposable income supports premium cosmetic product adoption, further expanding the use of specialty waxes. Growing refinery upgrades and flexible sourcing strategies strengthen the region’s long-term market outlook.

Latin America

Latin America captured close to 7% share in 2024, driven by steady demand from packaging, rubber goods, and automotive sectors. Brazil and Mexico anchor market growth due to their expanding food packaging industries and large tire manufacturing bases. Wax-coated corrugated boards see higher usage as regional logistics networks expand. Cosmetics and personal care growth in Chile, Colombia, and Argentina supports rising microcrystalline wax demand. Limited local refining capacity increases reliance on imports, encouraging partnerships with global suppliers. Rising industrial investments and consumer-driven product categories continue to offer growth opportunities across key economies.

Middle East & Africa

Middle East & Africa represented roughly 6% share in 2024, supported by refining capacity, industrial development, and growth in consumer goods. Gulf countries benefit from integrated refinery operations that ensure stable paraffin wax availability for export and domestic use. Packaging and rubber industries in South Africa, Nigeria, and Kenya create consistent demand for wax coatings and protective applications. Cosmetics and pharmaceuticals show gradual growth, further expanding the use of refined wax grades. Infrastructure development and rising retail activity support wider use of wax-based materials in construction, automotive, and packaged goods across emerging markets.

Market Segmentations:

By Product Type

- Paraffin Wax

- Microcrystalline Wax

- Montan Wax

- Others

By Application

- Candles

- Packaging

- Rubber

- Cosmetics

- Adhesives

- Others

By End-User

- Automotive

- Pharmaceuticals

- Cosmetics

- Packaging

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the petroleum and mineral wax market features major players such as Sasol Limited, HollyFrontier Corporation, Nippon Seiro Co., Ltd., Petro-Canada Lubricants Inc., Petrobras, H&R Group, Sinopec Limited, The International Group, Inc., Royal Dutch Shell plc, and ExxonMobil Corporation. These companies compete through refinery integration, advanced purification technologies, and broad product portfolios that include paraffin, microcrystalline, and specialty waxes. Leading suppliers focus on consistent quality, high melting point stability, and tailored formulations for candles, packaging, cosmetics, pharmaceuticals, and adhesives. Many players expand global reach through capacity upgrades, supply chain partnerships, and distribution networks that support large-scale industrial demand. Product innovation also strengthens competitiveness as firms develop low-odor, low-oil, and high-purity wax grades to meet rising standards in premium applications. Industry leaders continue investing in upgrading refineries, improving sustainability practices, and building long-term contracts with high-volume consumers to maintain market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sasol Limited

- HollyFrontier Corporation

- Nippon Seiro Co., Ltd.

- Petro-Canada Lubricants Inc.

- Petrobras

- H&R Group

- Sinopec Limited

- The International Group, Inc.

- Royal Dutch Shell plc

- ExxonMobil Corporation

Recent Developments

- In February 2025, Sasol Limited Sasol Chemicals expanded its micronised and paraffin wax portfolio by launching SASOLWAX LC Spray 30 G and LC Spray 30 G-EF, marketed as micronised waxes with a materially lower product carbon footprint. The launch highlights Sasol’s push to decarbonise wax products via Fischer–Tropsch / GTL optimisations and to position lower-PCF waxes for coatings, polishes and specialty applications.

- In January 2025, HollyFrontier Corporation (now HF Sinclair) In Jan 2025 HF Sinclair (owner of the HollyFrontier business and the “Hollywax” brand) completed corporate actions related to HollyFrontier’s debt while continuing to promote and supply its Hollywax™ portfolio (paraffin, microcrystalline, slack and blended waxes) through HollyFrontier Specialty Products signalling ongoing commercial availability and support for customers in candles, packaging, coatings and lubricant feedstocks.

- In September 2024, Nippon Seiro Co., Ltd. Nippon Seiro continued product and sustainability moves in 2024, publicly emphasising development of eco-oriented and specialty waxes (including work on bio-based/rice-derived and advanced emulsions reported in industry coverage), and reaffirming its leadership in high-purity paraffin, microcrystalline and blended waxes for packaging, coatings and industrial uses.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for refined paraffin and microcrystalline wax will rise in premium candles and home décor products.

- Packaging producers will adopt more wax-coated boards to improve moisture resistance in food and e-commerce shipments.

- Cosmetic brands will increase use of high-purity waxes for improved texture, stability, and performance.

- Pharmaceutical applications will expand as waxes support controlled-release and protective formulations.

- Automotive and rubber industries will continue using wax blends for tire protection and surface finishing.

- Refiners will invest in cleaner and low-odor wax grades to meet tightening quality standards.

- Competition from natural and synthetic waxes will drive innovation in petroleum-based alternatives.

- Supply chains will diversify as industries seek more reliable sourcing across regions.

- Asia Pacific will strengthen its leadership due to expanding manufacturing capacity.

- Sustainability goals will encourage producers to optimize refining efficiency and reduce emissions.